Vox Provides Project Updates Across Gold Royalty Portfolio Assets

Vox Royalty Corp. (NASDAQ:VOXR, TSXV:VOX) announced significant updates from its North American gold royalty projects. The recent pre-feasibility study for Treasury Metals' Goldlund project reported a post-tax NPV of C$336 million and increased average annual production to 90,000 ounces. Alamos achieved major permitting milestones at the Lynn Lake project. Furthermore, Orla Mining announced positive drilling results at the South Railroad project, with ongoing exploration in 2023. These advancements highlight Vox's strategic positioning in Tier 1 mining jurisdictions, bolstering management's confidence in long-term value creation for shareholders.

- Treasury Metals' Goldlund project PFS shows a post-tax net present value of C$336 million and increased annual production to 90,000 ounces.

- Alamos Gold achieved key permitting milestones, including a completed Environmental Impact Assessment for Lynn Lake.

- Orla Mining's South Railroad project reported significant drilling results, indicating resource expansion opportunities.

- None.

Insights

Analyzing...

TORONTO, ON / ACCESSWIRE / March 21, 2023 / Vox Royalty Corp. (TSXV:VOX)(NASDAQ:VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to provide recent North American development and exploration updates from royalty operating partners Treasury Metals Inc. (TSX:TML) ("Treasury"), Alamos Gold Inc. (TSX:AGI) ("Alamos"), and Orla Mining Ltd. (TSX:OLA, NYSE:ORLA) ("Orla"). All amounts are in U.S. dollars unless otherwise indicated.

Spencer Cole, Chief Investment Officer stated: "We are excited to report promising development progress across key Canadian and US development gold royalties, including the release of the Goldlund-Goliath (gold) pre-feasibility study, major permitting milestones at Lynn Lake (gold), and exploration success at South Railroad (gold). Vox's ~

Key Updates

- Treasury announced positive results for its pre-feasibility study ("PFS") over the Goldlund gold project, which is part of the Goliath Gold Complex in Ontario;

- Major permitting milestones were achieved by Alamos at the Lynn Lake gold project, with the completion of an Environmental Impact Assessment ("EIA") and a positive Decision Statement issued by the Minister of Environment and Climate Change Canada; and

- Significant South Railroad gold drilling results were announced by Orla, with continued resource expansion exploration drilling scheduled for 2023 in Nevada.

Goldlund (Pre-Feasibility - Canada) - Positive Results from the Pre-Feasibility Study Released(1)

- Vox holds a

1% net smelter royalty ("NSR") on part of the Goldlund gold project (below 50m shaft collar depth), which is part of the Goliath Gold Complex in Ontario, Canada; - On February 22, 2023, Treasury announced:

- The results of the PFS. Highlights include:

- Post-tax net present value at a

5% discount rate of C$336 million and post-tax internal rate of return of25.4% , using a long-term gold price of$1,750 per ounce and an exchange rate of US$1.00 t o C$1.34 ; - Average annual production increased from 79,000 ounces to 90,000 ounces per year, with peak production increasing from 119,000 ounces to 128,000 ounces (year two), compared to the 2021 Preliminary Economic Assessment ("PEA") for the project;

- Expected total ounces to be produced has increased from 1.065 million ounces to 1.175 million ounces, with increased production in the first nine years of mine life based on Proven and Probable Mineral Reserve of 1.3 million ounces gold (30.3 million tonnes @ 1.3 g/t Au);

- Estimated initial capital of C

$335 million , which includes a30% increase to process plant capacity (compared to the PEA), with life of mine capital of C$552 million including closure costs and salvage values and a post-tax payback period of 2.8 years; - Cash costs of

$820 /oz, All-In Sustaining Costs ("AISC") of$1,008 /oz and annual EBITDA and free cash flows of C$145 million and C$106 million , respectively, over the first five years of production; and - Optimization work to commence to unlock further value towards a Feasibility Study.

- Post-tax net present value at a

- The results of the PFS. Highlights include:

- On February 23, 2023, Treasury announced:

- Treasury President-CEO Jeremy Wyeth stated, "If all goes well with permitting and other studies, mining operations could begin as early as 2026";

- Mining at Goliath is expected to occur in stages from three separate deposits; Goliath, Goldlund and Miller; and

- Open-pit mining is expected to commence at the Goliath deposit with one year of pre-production and two years of production before activity shifts to the northwest to Goldlund for open-pit mining during years 2 - 7.

- Vox Management Summary: The legacy Goldlund royalty was acquired from an Ontario-based prospector in June 2022 and this PFS study confirms Vox's technical due diligence on the potential future value of the Goldlund project. We look forward to Treasury continuing to enhance the value of this royalty asset through the upcoming feasibility study and as the asset progresses towards operations "as early as 2026".

Lynn Lake (MacLellan) (Feasibility - Canada) - Major Permitting Milestones

- Vox holds a

2% gross revenue royalty (post initial capital recovery) on part of the MacLellan deposit at the Lynn Lake gold project; - On March 6, 2023 Alamos announced:

- The federal EIA for the Lynn Lake Gold Project has been completed;

- A positive Decision Statement has been issued by the Minister of Environment and Climate Change Canada;

- An updated Feasibility Study is expected to be completed during the first half of 2023;

- Exploration will remain a key ongoing focus with

$5 million budgeted at the Lynn Lake Project in 2023, which includes 8,000 metres of drilling focused on several advanced regional targets, and potential expansion of Mineral Reserves and Resources; - The continued evaluation and advancement of a pipeline of prospective exploration targets within the 58,000-hectare Lynn Lake Property is also a key area of focus for 2023; and

- John A. McCluskey, President and Chief Executive Officer, said, "Achieving both of these important regulatory milestones for the Lynn Lake Gold Project represents a multi-year, collaborative effort by our team and our commitment to environmental sustainability."

- Vox Management Summary: Alamos management is very optimistic on the opportunity for Lynn Lake to drive significant future growth. The completed EIA and positive decision statement further de-risks Lynn Lake's development pathway. Vox management is excited to note these major permitting milestones for Lynn Lake and looks forward to Alamos continuing to progress the project towards a development decision.

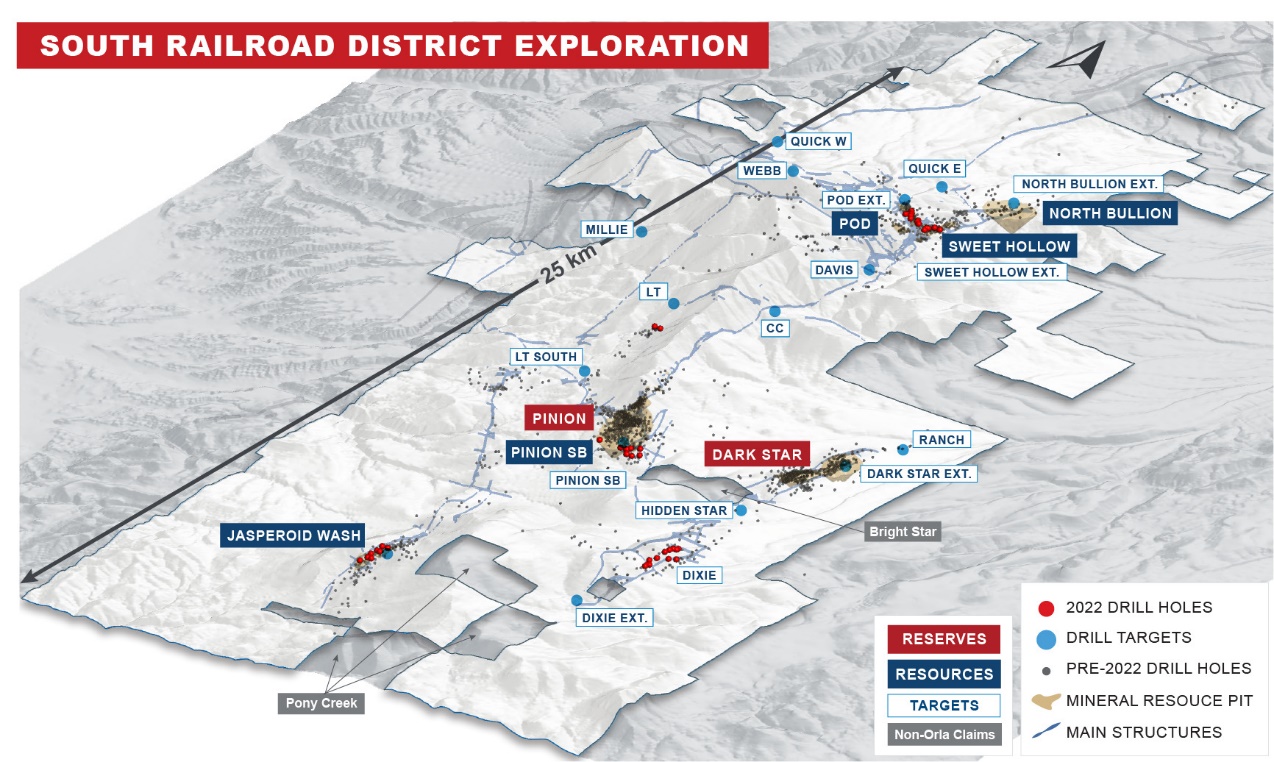

South Railroad (Feasibility - United States) - Significant RC Drill Results

Figure 1: Ongoing South Railroad District Exploration in Nevada's Carlin Trend

(Source: https://orlamining.com/news/orla-mining-drills-significant-gold-intersections-at-multiple-oxide-targets-upon-reactivation-of-exploration-at-south-railroad/)

- Vox holds a

0.633% NSR with advance minimum royalty payments over key portions of the South Railroad gold project, which is located in the prolific Carlin Trend of Nevada; - On February 8, 2023, Orla announced:

- The resumption of exploration activities in mid-2022 resulted in promising drill results from multiple satellite oxide mineralized zones and targets across the 21,000-hectare South Railroad land package, with the following notable reverse circulation ("RC") drilling results from the royalty linked deposits Pinion SB, Jasperoid Wash and POD:

- 0.85 g/t Au over 53.3 m (Oxide), and 1.03 g/t Au over 32.0 m (Oxide) in drillhole PR22-01;

- 4.87 g/t Au over 25.9 m (Transition), incl. 8.52 g/t Au over 13.7m (Oxide) in drillhole POD22-15;

- 1.37 g/t Au over 21.3m (Oxide), and 4.96 g/t Au over 24.4m (Sulphide) in drillhole POD22-09;

- 0.62 g/t Au over 18.3 m (Transition) in drillhole JW22-04;

- 0.29 g/t Au over 38.1 m (Oxide) in drillhole JW22-03;

- In total, 10,573m of drilling (9,796m of RC in 61 holes and 777m of core in 7 holes) were completed at South Railroad in 2022, focused on oxide resource definition and expansion at multiple targets;

- Inferred mineral resource estimates for Pinion SB, POD, Sweet Hollow, and Jasperoid Wash are expected to be updated in the second half of 2023; and

- A

$10 million exploration budget is planned for South Railroad in 2023, which would include approximately 22,400m of drilling (16,500m of RC drilling and 5,900m of core).

- The resumption of exploration activities in mid-2022 resulted in promising drill results from multiple satellite oxide mineralized zones and targets across the 21,000-hectare South Railroad land package, with the following notable reverse circulation ("RC") drilling results from the royalty linked deposits Pinion SB, Jasperoid Wash and POD:

- Vox Management Summary: Given South Railroad is situated along the prolific Carlin Trend in Nevada, ongoing drilling activity provides significant opportunity for future resource expansion and conversion and the discovery of new deposits. Vox management anticipates additional significant permitting, resource expansion and development newsflow from Orla in 2023.

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties and streams spanning eight jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 25 separate transactions to acquire over 50 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Spencer Cole | Kyle Floyd |

Chief Investment Officer | Chief Executive Officer |

+1-345-815-3939 | +1-345-815-3939 |

Cautionary Statements to U.S. Security Holders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, the U.S. Securities Exchange Act of 1934, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Vox Royalty Corp. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator updates provided by management and the potential impact on the Company of such operator updates, statements regarding expectations for the timing of commencement of development, construction at and/or resource production from various mining projects, expectations regarding the size, quality and exploitability of the resources at various mining projects, future operations and work programs of Vox's mining operator partners, the receipt of future royalty payments derived from various royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox, and requirements for and operator ability to receive regulatory approvals.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions, the absence of control over mining operations from which the Company expects to receive royalties from, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined, risks in the marketability of minerals, fluctuations in the price of commodities, fluctuation in foreign exchange rates and interest rates, stock market volatility, as well as those factors discussed in the section entitled "Risk Factors" in the Company's annual information form for the financial year ended December 31, 2022 available at www.sedar.com.

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than

References & Notes:

- Floyd Varley, P. Eng, Maura Kolb, M.Sc., P.Geo., Director of Exploration and Adam Larsen, P. Geo., Exploration Manager, are each considered a "Qualified Person" for the purposes of NI 43-101 and have reviewed and approved the scientific and technical disclosure contained in Treasury's news release on its behalf.

- The PFS referenced above was developed by Ausenco Engineering Canada Inc. with collaboration from SRK Consulting (Canada) Inc., SLR Consulting (Canada) Ltd., Minnow Environmental Inc., WSP Canada Inc. and Stantec Inc.

SOURCE: Vox Royalty Corp.

View source version on accesswire.com:

https://www.accesswire.com/744752/Vox-Provides-Project-Updates-Across-Gold-Royalty-Portfolio-Assets