Vox Provides Development Updates on Western Australia Gold Royalty Assets

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) has provided updates on its Western Australia gold royalty assets. Key developments include:

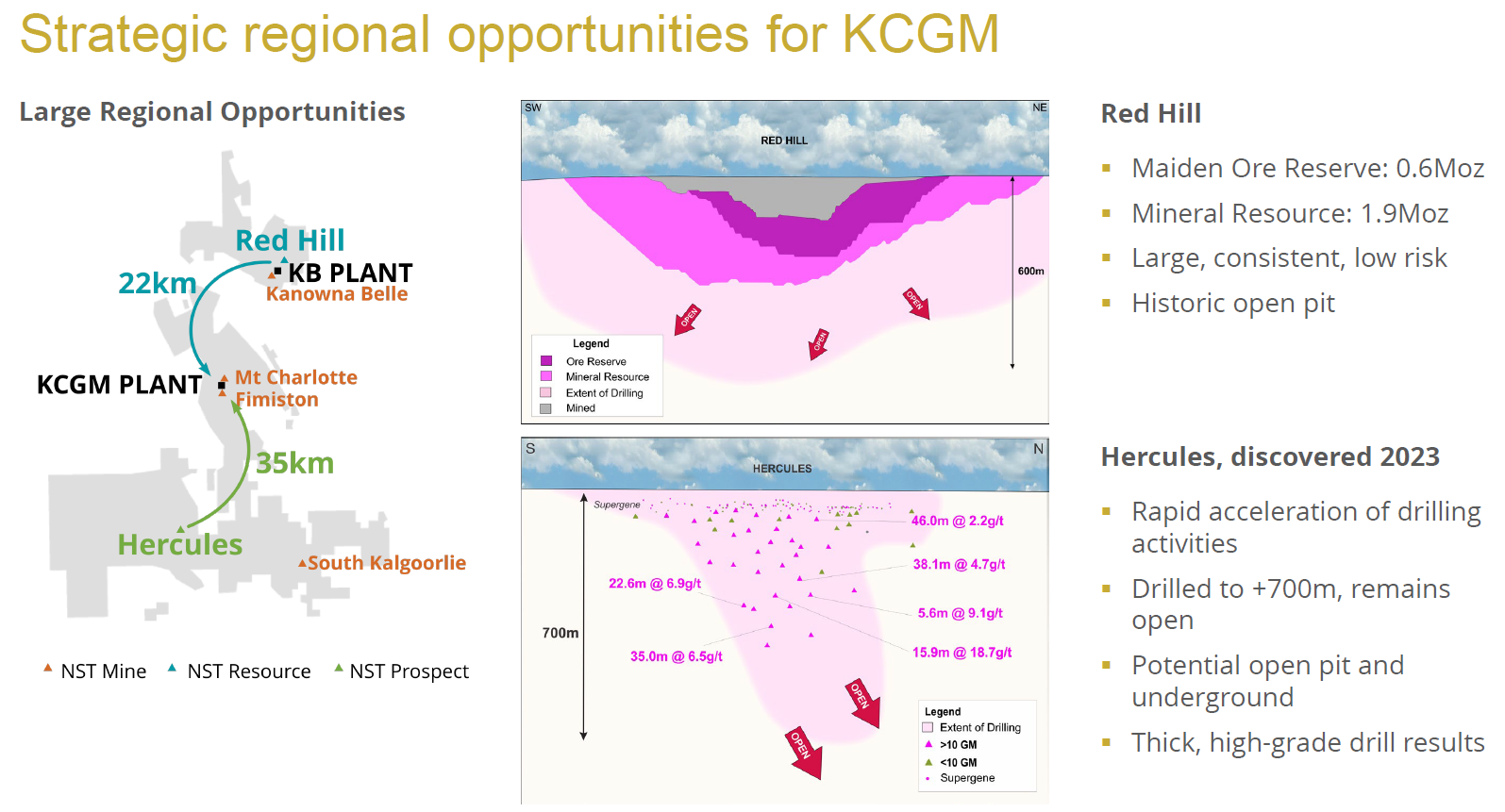

1. Red Hill: Northern Star reaffirmed its strategic value within the A$1.5B expansion of KGCM operations. The 1.9Moz gold resource is classified as 1.0Moz Au Indicated and 0.9Moz Au Inferred.

2. Castle Hill and Kunanalling: Evolution Mining's Mungari expansion is progressing well, with Castle Hill ore prioritized as baseload feed. The mill expansion is on schedule for completion in Q1 2026.

3. West Kundana: Evolution highlighted the Ultrabark deposit on Vox's royalty tenure, indicating potential for further discoveries along the Zuleika shear zone.

These updates support Vox management's previous estimates of potential US$10 million in initial annual revenues from the Red Hill royalty.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ha fornito aggiornamenti riguardanti i suoi asset di royalty in oro dell'Australia Occidentale. Gli sviluppi chiave includono:

1. Red Hill: Northern Star ha ribadito il suo valore strategico all'interno dell'espansione da 1,5 miliardi di dollari australiani delle operazioni KGCM. La risorsa aurea di 1,9 Moz è classificata come 1,0 Moz Au Indicato e 0,9 Moz Au Inferito.

2. Castle Hill e Kunanalling: L'espansione Mungari di Evolution Mining sta progredendo bene, con il minerale di Castle Hill prioritizzato come alimentazione di base. L'espansione del molino è in programma per essere completata nel primo trimestre del 2026.

3. West Kundana: Evolution ha messo in evidenza il deposito Ultrabark nella concessione royalty di Vox, indicando potenziali ulteriori scoperte lungo la zona di taglio Zuleika.

Questi aggiornamenti supportano le stime precedenti della gestione di Vox riguardo a potenziali ricavi annui iniziali di 10 milioni di dollari USA dalla royalty di Red Hill.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ha proporcionado actualizaciones sobre sus activos de regalías de oro en Australia Occidental. Los desarrollos clave incluyen:

1. Red Hill: Northern Star reafirmó su valor estratégico dentro de la expansión de A$1.5 mil millones de las operaciones de KGCM. El recurso de oro de 1.9 Moz se clasifica como 1.0 Moz Au Indicada y 0.9 Moz Au Inferida.

2. Castle Hill y Kunanalling: La expansión Mungari de Evolution Mining avanza bien, con el mineral de Castle Hill priorizado como base de alimentación. La expansión del molino está programada para completarse en el primer trimestre de 2026.

3. West Kundana: Evolution destacó el depósito Ultrabark en el dominio de regalías de Vox, indicando un potencial para más descubrimientos a lo largo de la zona de corte Zuleika.

Estas actualizaciones respaldan las estimaciones previas de la dirección de Vox sobre los ingresos anuales iniciales potenciales de 10 millones de dólares estadounidenses de la regalías de Red Hill.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR)는 서호주 금 로열티 자산에 대한 업데이트를 제공했습니다. 주요 개발 사항은 다음과 같습니다:

1. 레드 힐: Northern Star는 KGCM 작업의 15억 호주 달러 확장 내에서 전략적 가치를 재확인했습니다. 1.9Moz의 금 자원은 1.0Moz Au로 표시되며, 0.9Moz Au는 추정됩니다.

2. 캐슬 힐 및 쿠나날링: Evolution Mining의 Mungari 확장이 순조롭게 진행되고 있으며, 캐슬 힐 광석이 기본 공급으로 우선 순위가 지정되었습니다. 밀 확장은 2026년 1분기 완료될 예정입니다.

3. 웨스트 쿤다나: Evolution은 Vox의 로열티 소유지에 있는 울트라바크 매장을 강조하여, Zuleika 전단에 따라 추가 발견 가능성을 시사했습니다.

이러한 업데이트는 레드 힐 로열티에서 예상되는 1천만 달러의 초기 연간 수익에 대한 Vox 경영진의 이전 추정을 지원합니다.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) a fourni des mises à jour concernant ses actifs de redevances sur l'or en Australie-Occidentale. Les développements clés comprennent :

1. Red Hill : Northern Star a confirmé sa valeur stratégique dans le cadre de l'expansion de 1,5 milliard AUD des opérations KGCM. La ressource en or de 1,9 Moz est classée en tant que 1,0 Moz Au Indiqué et 0,9 Moz Au Inféré.

2. Castle Hill et Kunanalling : L'expansion Mungari d'Evolution Mining progresse bien, avec le minerai de Castle Hill priorisé comme alimentation de base. L'expansion de l'usine est prévue pour être achevée au premier trimestre 2026.

3. West Kundana : Evolution a souligné le dépôt Ultrabark dans le domaine de redevances de Vox, indiquant un potentiel pour de nouvelles découvertes le long de la zone de faille Zuleika.

Ces mises à jour soutiennent les précédentes estimations de la direction de Vox concernant des revenus annuels initiaux potentiels de 10 millions de dollars américains provenant de la redevance de Red Hill.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) hat Aktualisierungen zu seinen Gold-Royalty-Assets in Westaustralien bereitgestellt. Wichtige Entwicklungen umfassen:

1. Red Hill: Northern Star hat seinen strategischen Wert innerhalb der 1,5 Milliarden AUD Erweiterung der KGCM-Betriebe bestätigt. Die Goldressource von 1,9 Moz wird als 1,0 Moz Au angezeigt und 0,9 Moz Au geschätzt.

2. Castle Hill und Kunanalling: Die Mungari-Erweiterung von Evolution Mining schreitet gut voran, wobei das Erz von Castle Hill als Basisladung priorisiert wird. Die Erweiterung der Mühle liegt im Zeitplan für eine Fertigstellung im ersten Quartal 2026.

3. West Kundana: Evolution hob das Ultrabark-Vorkommen im Royalty-Bereich von Vox hervor, was auf das Potenzial weiterer Entdeckungen entlang der Zuleika-Schubzone hindeutet.

Diese Aktualisierungen unterstützen die vorherigen Schätzungen des Vox-Managements von potenziellen anfänglichen jährlichen Einnahmen von 10 Millionen US-Dollar aus der Red Hill-Royalty.

- Red Hill deposit confirmed as a strategic regional opportunity for KCGM expansion, potentially generating US$10 million in initial annual revenues for Vox

- Castle Hill and Kunanalling royalty-linked deposits to provide key baseload ore feed for Mungari mill expansion

- Mungari mill expansion project on schedule and within budget, set for completion in Q1 2026

- Ultrabark deposit highlighted on West Kundana royalty tenure, indicating potential for further discoveries

- None.

Insights

The updates from Northern Star and Evolution Mining on their Western Australian gold projects are positive indicators for Vox Royalty. Northern Star's characterization of Red Hill as a "large, consistent, low risk" opportunity for KCGM suggests strong potential for future royalty revenue. The detailed resource breakdown of

Evolution's progress on the Mungari expansion, with Castle Hill flagged as baseload ore feed, increases the likelihood of near-term royalty generation for Vox. The

Overall, these updates reinforce the quality of Vox's royalty portfolio and suggest a positive outlook for future cash flows from these Western Australian gold assets.

From a financial perspective, the developments at Vox Royalty's Western Australian gold assets are encouraging for potential revenue growth. The Red Hill royalty, with its

The Castle Hill and Kunanalling royalties also show promise, with Evolution Mining's

Investors should note that while these developments are positive, actual royalty revenues depend on mining decisions and production levels, which are still subject to various operational and market factors.

TORONTO, ON / ACCESSWIRE / August 13, 2024 / Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to provide recent development and exploration updates from royalty operating partners, Northern Star Resources Limited ("Northern Star") and Evolution Mining Limited ("Evolution") public disclosures.

Riaan Esterhuizen, Executive Vice President - Australia stated: "We are pleased to share positive updates at key Western Australian gold development royalties: Red Hill, Castle Hill and Kunanalling. Northern Star continues to reaffirm the strategic value and high quality of Red Hill within the context of the A

Key Updates

Northern Star provided additional detailed disclosure on Red Hill's mineral resource estimate and status as a "strategic regional opportunity" for the KCGM operation.

Evolution provided a construction update at Castle Hill and referenced a new gold deposit which is located on Vox's West Kundana royalty tenure.

Red Hill (Development - Western Australia) - Strategic Regional Opportunity for KCGM characterised as "Large, consistent, low risk"

Vox holds an uncapped

4.0% Gross Revenue Royalty over the majority of the Red Hill deposit.On August 5, 2024, Northern Star provided additional detail around its strategy to expand yearly production rates at KGCM to 650koz Au by fiscal year 2026, and 900koz Au by fiscal year 2029. This strategy is underpinned by the ongoing A

$1.5B expansion of the Fimiston Processing Plant, which is expected to see capacity increase from 13Mtpa to 27Mtpa. In a detailed site visit presentation, Northern Star disclosed the following3 (as per Figure 1 below):Red Hill is considered a "large, consistent, low risk" strategic regional opportunity, with ore from this deposit having the potential to be processed at the KCGM plant.

Northern Star stated they will preferentially treat higher-grade open pit ore.

Additionally, Northern Star provided supplementary disclosure and further clarified the previously updated mineral resource estimate at Red Hill, classifying the total 1.9Moz gold resource (49.9Mt @ 1.2g/t Au)4 into:

1.0Moz Au (25.6Mt @ 1.2g/t Au) in the Indicated category, plus

0.9Moz Au (24.3Mt @ 1.1g/t Au) in the Inferred category.

Vox Management Summary: This additional disclosure around Northern Star's expansion at KCGM reinforces our belief that Red Hill has strong potential to be prioritised in the KCGM mine plan to displace lower grade 0.7g/t stockpiles. Vox management looks forward to further news flow as Northern Star continues to execute on the KGCM expansion and further advances the growing Red Hill gold project.

Source: https://www.nsrltd.com/investor-and-media/asx-announcements/2024/august/investor-presentation-kcgm-site-visit

Castle Hill and Kunanalling (Development - Western Australia) - Mungari expansion progressing well, Castle Hill ore to be prioritised as baseload ore feed

On Castle Hill, Vox holds a A

$40 /oz Au royalty (payable up to 75koz Au), plus a milestone payment of A$2M triggered at 140koz Au cumulative production. On Kunanalling, Vox holds an uncapped2% realised production royalty, payable post 75koz Au produced from the Castle Hill royalty tenure.On August 6, 2024, Evolution provided a detailed update on their Mungari mine life extension and mill expansion project5:

The mill expansion is now 13 months into the 30-month build period, on schedule and within budget and scheduled for completion in Q1 2026.

The combined Castle Hill mining hub, which includes deposits covered by both the Castle Hill and Kunanalling royalties, is flagged as "baseload open pit ore feed to mill", with early mining contractor involvement on track. Approximately

80% of the ore volume for the mill expansion is expected to come from open pit sources.Additionally, Evolution stated that the Castle Hill haul road is under construction and progressing, while its broader partnership with ore hauling contractor MLG is also going well.

Vox Management Summary: These recent updates confirm expectations that the Mungari mill expansion project is on schedule to be completed in Q1 2026 and that Vox royalty-linked deposits at Castle Hill and Kunanalling will provide key baseload ore feed.

West Kundana (Exploration - Western Australia) - Ultrabark Deposit

Vox holds a sliding scale

1.5% -2.5% net smelter royalty at West Kundana dependent on the gold price (>AUD$500 /oz gold price,2.5% net smelter royalty rate applies), acquired by Vox for US$40 k in 2020.On August 6, 2024, Evolution's Mungari mine life extension and mill expansion project5 presentation also highlighted the Ultrabark deposit located on Vox's West Kundana royalty tenure

Historical drilling6 at Ultrabark includes (Northern Star, 2017 Kundana Annual Exploration Report, WAMEX):

Exploration at the Ultrabark prospect has occurred in several stages with historic regional percussion and more targeted Reverse Circulation (RC) drilling prior to the 2000's. Significant historic intercepts include

11m @ 3g/t from 22m (WKRC010) and 8m @ 4g/t from 44m (CRC015). The first diamond holes were drilled in 2006 in varying orientations to define the lithologies, mineralisation, veining, and structures, some of which appear to be associated with the observed stockwork mineralisation.The two diamond holes drilled at Ultrabark in 2017 had several intercepts between 0.6g/t and 1g/t of varying thicknesses between 0.4m to 1.5m. Standout intercepts in UBDD17001 include 0.74m @ 19.2g/t from 383.75m and 17m @ 0.9g/t from 407m.

Vox Management Summary: Evolution's recent highlighting of the Ultrabark deposit on the West Kundana royalty tenure indicates the potential for further discoveries along the Zuleika shear zone. Evolution acquired the Kundana project from Northern Star for A

$400M in 2022 and has been actively exploring numerous targets similar to Ultrabark. While the identification of Ultrabark is limited, Vox management is encouraged by how this deposit could evolve through further exploration.

Base Map Source: https://evolutionmining.com.au/storage/2024/08/2756862-Mungari-Site-Visit-Presentation.pdf

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties spanning six jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 30 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Riaan Esterhuizen | Kyle Floyd |

EVP - Australia | Chief Executive Officer |

riaan@voxroyalty.com | info@voxroyalty.com |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator updates provided by management and the potential impact on the Company of such operator updates, statements regarding expectations for the timing of commencement of development, construction at and/or resource production from various mining projects, expectations regarding the size, quality and exploitability of the resources at various mining projects, future operations and work programs of Vox's mining operator partners, the receipt of expected and potential royalty payments derived from various royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox, and requirements for and operator ability to receive regulatory approvals.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty or stream payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox's dividend policy; epidemics, pandemics or other public health crises, including the global outbreak of the novel coronavirus, geopolitical events and other uncertainties, such as the conflict in Ukraine, as well as those factors discussed in the section entitled "Risk Factors" in Vox's annual information form for the financial year ended December 31, 2022 available at www.sedarplus.ca and the SEC's website at www.sec.gov (as part of Vox's Form 40-F).

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than

References & Notes:

Vox estimate of potential illustrative annual royalty revenues based on the following calculation: 4.0Mtpa reserves mined x 1.1g/t reserve grade x

88% recovery (per JORC Appendix C Table 1) x US$200 0/oz gold x4% GRR = US$10M (rounded)Based on Northern Star disclosure it is estimated that approximately

87.5% of Red Hill mineral reserves are covered by the royalty tenure M27/57 ("total of3.5% third party royalty is payable"). Vox management estimates that between65% -85% of mineral resources are covered by royalty tenure, based on Northern Star disclosure.Northern Star - KGCM Site Visit Presentation dated August 5, 2024:

https://www.nsrltd.com/investor-and-media/asx-announcements/2024/august/investor-presentation-kcgm-site-visitNorthern Star - Supplementary Disclosures - ASX Announcements of 5 August 2024:

https://www.nsrltd.com/investor-and-media/asx-announcements/2024/august/supplementary-disclosures-to-announcements-of-5-auThe information in this announcement that relates to Mineral Resource estimations for the Company's Operations is based on information compiled by Jabulani Machukera, a Competent Person who is a Member of the Australasian Institute of Mining and Metallurgy and a full-time employee of Northern Star Resources Limited. Mr Machukera has sufficient experience that is relevant to the styles of mineralisation and type of deposits under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Mr Machukera consents to the inclusion in this announcement of the matters based on this information in the form and context in which it appears.

The information in this announcement that relates to Ore Reserve estimations for the Company's Operations is based on information compiled by Jeff Brown, a Competent Person who is a Member of the Australasian Institute of Mining and Metallurgy and a full-time employee of Northern Star Resources Limited. Mr Brown has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Mr Brown consents to the inclusion in this announcement of the matters based on this information in the form and context in which it appears.

The information in this announcement that relates to Mineral Resource estimations for the KCGM Operations as at 31 March 2021 is based on information compiled by Daniel Howe, a Competent Person who is a Member of the Australasian Institute of Mining and Metallurgy and a full-time employee of Northern Star Resources Limited. Mr Howe has sufficient experience that is relevant to the styles of mineralisation and type of deposits under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Mr Howe consents to the inclusion in this announcement of the matters based on this information in the form and context in which it appears.

The information in the report to which this statement is attached that relates to Mineral Resources for the KCGM Operations as at 30 June 2020 is based upon information compiled by Ms Emma Murray-Hayden, a Competent Person who is a member of The Australasian Institute of Mining and Metallurgy and the Australian Institute of Geoscientists. Emma Murray-Hayden is a full-time employee of Northern Star Resources Ltd. Emma Murray-Hayden has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Emma Murray-Hayden consents to the inclusion in this announcement of statements based on this information in the form and context in which it appears.

The information in this announcement that relates to the current Ore Reserves and Mineral Resources, and production targets of Northern Star has been extracted from the ASX release by Northern Star entitled "Resources, Reserves and Exploration Update" dated 2 May 2024 available at www.nsrltd.com and www.asx.com ("Northern Star Announcement"). Northern Star confirms that it is not aware of any new information or data that materially affects the information included in the Northern Star Announcement other than changes due to normal mining depletion during the four month period to 6 August 2024, and, in relation to the estimates of Northern Star's Ore Reserves and Mineral Resources, that all material assumptions and technical parameters underpinning the estimates in the Northern Star Announcement continue to apply and have not materially changed. Northern Star confirms that the form and context in which the Competent Person's findings are presented have not been materially modified from that announcement.

Rounding is applied in this announcement for the 31 March 2024 Ore Reserves and Mineral Resources figures.

Evolution Mining - Mungari Site Visit - 6 August 2024:

https://evolutionmining.com.au/storage/2024/08/2756862-Mungari-Site-Visit-Presentation.pdfNorthern Star Resources Limited - Northern Star (Kanowna) Pty Limited Annual Report - 7 March 2018

This report was prepared by Caroline Todd and distributed by the Western Australia Department of Mines and Petroleum, available here:

https://wamex.dmp.wa.gov.au/Wamex/Search/ReportDetails?ANumber=116058The Ultrabark prospect is located approximately 2.6km northwest of the Beverly Hills and Barkers North prospects within the Ora Banda domain on the contact between the ultramafic and volcanoclastic and sedimentary rocks of the Spargoville Formation which is part of the Black Flag Group.

SOURCE: Vox Royalty Corp.

View the original press release on accesswire.com

FAQ

What is the current status of the Red Hill gold project in Western Australia?

How much potential revenue could Vox Royalty Corp (VOXR) generate from the Red Hill royalty?

What is the status of Evolution Mining's Mungari expansion project affecting Vox Royalty Corp's (VOXR) Castle Hill and Kunanalling assets?