Volt Lithium Reduces Operating Costs By 64%, Achieving Operational Milestone

- Volt achieves a 64% reduction in operating costs for its DLE technology at the Demonstration Plant in Calgary.

- The company's technological advancements result in improved lithium extraction rates, rising from 90% to 98% between May 2023 and February 2024.

- Volt's DLE process successfully removes 99% of impurities from brine, allowing for cost-effective production of 90% lithium carbonate.

- The company grants 1,200,000 incentive stock options to consultants, aiming to align interests and foster long-term success.

- Scientific and technical information in the press release has been reviewed and approved by qualified persons under NI 43-101 standards.

- None.

CALGARY, Alberta, Feb. 21, 2024 (GLOBE NEWSWIRE) -- Volt Lithium Corp. (TSXV: VLT | OTCQB: VLTLF) ("Volt" or the "Company") is pleased to announce the achievement of another critical milestone on the path to commercializing its proprietary and proven next-generation Direct Lithium Extraction (“DLE”) technology for processing oilfield brines at the Company’s permanent Demonstration Plant in Calgary (the “Demonstration Plant”). As a result of continued DLE technology process improvements, led by Volt’s scientific and engineering teams, the Company has achieved a

“Volt is well on our way to become the low-cost commercial producer of battery-grade lithium from oilfield brines in North America,” commented Alex Wylie, Volt’s President & CEO. “The Volt engineering and technical teams continue to improve operational processes for our proprietary DLE technology that we believe will truly drive commercial success for the Company. As demand for high-quality lithium continues to grow, Volt’s latest achievement positions us to help meet the world’s expanding need for this critical mineral, and to do so in an environmentally sustainable and lower-impact manner.”

DLE Operational Improvements

Volt continues to accelerate process improvements related to its proprietary DLE technology at the Company’s Demonstration Plant. The associated operating cost reductions are highlighted in the table below, showing continuous improvement over three key periods in Volt’s ongoing advancement of its DLE technology, including: 1) May 2023 pilot operations; 2) December 2023 Demonstration Plant operations for the Preliminary Economic Assessment (“PEA"); and 3) Year to Date 2024 process improvements achieved at the Demonstration Plant by the Company’s scientific and engineering teams. Brine used in each of the periods was sourced from the 15-1-111-06W6M well (the “Feedstock Well”) producing from the Keg River formation at Rainbow Lake, and had an initial lithium concentration of 34 mg/L.

The operating costs in Table 1 below reflect Volt’s costs to produce a marketable lithium carbonate of approximately

Table 1: Progression of Operating Cost Reductions for Volt’s DLE Technology

| 34 mg/L | ||||

| May 2023 Pilot | Dec 2023 PEA | Feb 2024 Current | Reduction May 2023 Pilot to Current | |

| $/tonne LCE | $/tonne LCE | $/tonne LCE | % change | |

| Operating Costs1,2 | ||||

| Pre-Treatment and Filtration | 1,880 | 1,165 | 914 | ( |

| DLE3 | 5,121 | 1,905 | 1,051 | ( |

| Concentration and Crystallization | 258 | 290 | 312 | |

| Other4 | 798 | 1,209 | 608 | ( |

| Total | 8,0575 | 4,5696 | 2,885 | (64%) |

1 Based on a commercial operating unit processing 60,000 bbls/d of brine. Represents commercial grade lithium.

2 All amounts in the above table are in USD.

3 Reduction in cost due to the following: 1) process improvements which significantly reduced the reagents required, 2) increasing the concentration of the lithium in the eluate from 65 parts per million (“ppm”) to 1,190ppm and 3) membrane replacements costs being capitalized.

4 Other operating costs include manpower, maintenance materials and external services.

5 As per press release dated May 24, 2023 the Company reported OPEX of

6 This is the estimated equivalent cost using PEA assumptions but based on a lower Li concentration (34 mg/L).

In addition to driving meaningful cost reductions, the impact of Volt’s technological advancements has also resulted in significantly improved lithium extraction results, which rose from

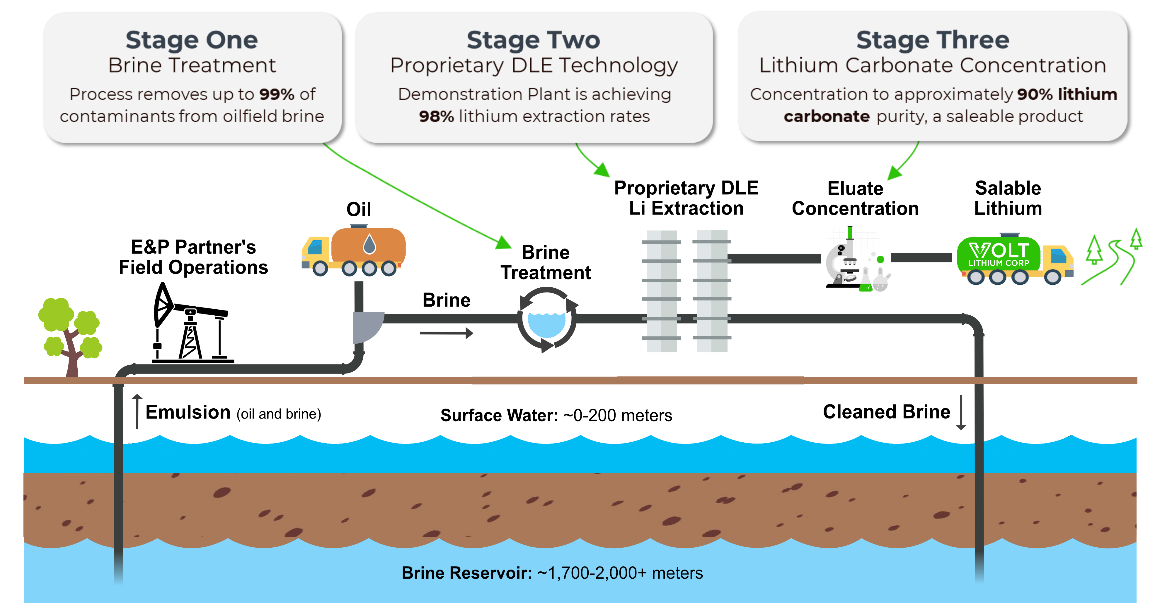

Given Volt’s DLE process is able to successfully remove

Figure 1: Volt Proprietary DLE Process

Option Grant

The Company also announces the grant of an aggregate of 1,200,000 incentive stock options (the "Options") to certain consultants (the "Option Recipients") to purchase common shares (the "Shares") in the capital of the Company pursuant to Volt’s stock option plan (the "Option Plan"). The Options, which vest in equal tranches every six months over an 18-month period, are exercisable at a price of

These grants represent compensation to the Option Recipients for their respective service to the Company and as an incentive mechanism to foster and align the interest of such persons in the long-term success of Volt.

Qualified Person’s Statement

Scientific and technical information contained in this press release has been reviewed and approved by Doug Ashton, P.Eng, and Meghan Klein, P.Eng of Sproule Associates Limited, each of whom are qualified persons within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Mr. Ashton and Ms. Klein consent to the inclusion of the data in the form and context in which it appears.

About Volt

Volt is a lithium development and technology company aiming to be North America’s first commercial producer of lithium hydroxide and lithium carbonates from oilfield brine. Our strategy is to generate value for shareholders by leveraging management’s hydrocarbon experience and existing infrastructure to extract lithium deposits from existing wells, thereby reducing capital costs, lowering risks and supporting the world’s clean energy transition. With four differentiating pillars, and a proprietary Direct Lithium Extraction (“DLE”) technology and process, Volt’s innovative approach to development is focused on allowing the highest lithium recoveries with lowest costs, positioning us well for future commercialization. We are committed to operating efficiently and with transparency across all areas of the business staying sharply focused on creating long-term, sustainable shareholder value. Investors and/or other interested parties may sign up for updates about the Company’s continued progress on its website: https://voltlithium.com/.

Contact Information

For Investor Relations inquiries or further information, please contact:

Alex Wylie, President & CEO

awylie@voltlithium.com

M: +1.403.830.5811

Forward Looking Statements

This news release includes certain “forward-looking statements” and “forward-looking information” within the meaning of applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward-looking statements or information. Statements, other than statements of historical fact, may constitute forward looking information and include, without limitation, statements about the qualification of the FT Units as “flow-through shares” under the Tax Act, which is subject to the risks set out in the Prospectus Supplement; the use of proceeds from the Offering and the Concurrent Private Placement; the ability of the Company to incur qualified Canadian Exploration Expenses with the gross proceeds of the sale of the FT Units; the conduct of the Company’s preliminary economic assessment for the Rainbow Lake project; the Company’s continued exploration of its mineral properties; and general business and economic conditions. With respect to the forward-looking information contained in this news release, the Company has made numerous assumptions. While the Company considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies and may prove to be incorrect. Additionally, there are known and unknown risk factors which could cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein including those known risk factors outlined in the Company’s amended and restated annual information form and the Shelf. All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4402ef8d-4134-459c-90ea-1ad364f322dd

FAQ

What reduction in operating costs did Volt Lithium Corp. achieve for its DLE technology?

How much did the lithium extraction rate improve from May 2023 to February 2024?

What percentage of impurities does Volt's DLE process successfully remove from brine?

How many incentive stock options were granted to consultants by Volt Lithium Corp.?