Village Farms International Reports Fourth Quarter and Year End 2021 Financial Results: Fourth Quarter Consolidated EPS of $0.03 Per Share, Net Income of $2.1 Million and Consolidated Adjusted EBITDA(1) of $5.3 Million

Village Farms International reported its financial results for Q4 and the year ended December 31, 2021. The company achieved a 50% year-over-year increase in net sales to $120.8 million and a remarkable 89% rise in adjusted EBITDA to $29.3 million. This marks the 13th consecutive quarter of positive adjusted EBITDA, driven largely by its Canadian cannabis operations, particularly the top-selling Pure Sunfarms brand. The firm expects continued growth and profitability in 2022, bolstered by strategic acquisitions and expanding production capacity.

- 50% year-over-year increase in net sales to $120.8 million.

- 89% increase in adjusted EBITDA to $29.3 million.

- Canadian cannabis operations contributed to sustained growth, with Pure Sunfarms remaining a top brand.

- Achieved 42% gross margin, at the top end of the target range.

- Net loss of $9.1 million compared to a net income of $11.6 million in the prior year.

- Selling, general, and administrative expenses increased 143% to $46.4 million.

- Canadian Cannabis Generates 13th Consecutive Quarter of Positive Adjusted EBITDA, Pure Sunfarms Remains Top-Selling Brand of Dried Flower in Ontario, Alberta and BC

- U.S. Cannabis 2 and Village Farms Fresh (Produce) Each Generate Positive Adjusted EBITDA

VANCOUVER, BC, March 1, 2022 /PRNewswire/ - Village Farms International, Inc. ("Village Farms" or the "Company") (NASDAQ: VFF) today announced its financial results for the three months and year ended December 31, 2021. All figures are in U.S. dollars unless otherwise indicated.

Management Commentary

"In the fourth quarter, we once again saw strong year-over-year growth in sales and adjusted EBITDA, with positive adjusted EBITDA contributions from each of our Canadian Cannabis, US Cannabis and Village Farms Fresh (Produce) businesses for the second consecutive quarter," said Michael DeGiglio, CEO, Village Farms. "Our results were driven by the continued strong performance of our Canadian cannabis operations, with Pure Sunfarms' leading market share in the dried flower category and successful new product introductions, as well as the first partial quarter contribution of Rose LifeScience in Quebec, driving a

"The performance of our Canadian cannabis operations throughout 2021 contributed to a year that saw Village Farms overall deliver growth in revenue and adjusted EBITDA of

1. | Adjusted EBITDA is a non-GAAP measure. See "Non-GAAP Measures" for a definition and reconciliation of Adjusted EBITDA to net income (loss), the nearest comparable measurement under GAAP. |

2. | U.S. Cannabis segment refers to our U.S.-based CBD, cannabinoid and hemp businesses. |

Fourth Quarter Highlights

With the acquisitions of Balanced Health and Rose LifeScience in 2021, we now organize our operating segments into Canadian Cannabis (Pure Sunfarms; Rose LifeScience); U.S. Cannabis (Balanced Health and VF Hemp); Village Farms Fresh (Produce) and VF Clean Energy. For Consolidated Results see below.

Cannabis

- Total cannabis sales (Canadian and US) increased

168% year-over-year to$34.4 million , and represented47% of total consolidated sales, increasing from27% for the fourth quarter of 2020; and, - Total cannabis adjusted EBITDA increased

183% year-over-year to$6.8 million .

Canadian Cannabis (Pure Sunfarms and Rose LifeScience)

- Canadian Cannabis achieved strong year-over-growth in total net sales and retail branded sales, while generating margins at the high end of the Company's stated target range:

50% year-over-year increase in total net sales and118% year-over-year increase in Retail Branded Sales;42% gross margin, above the Company's stated target range of 30 to40% ;99% year-over-year increase in adjusted EBITDA, marking the 13th consecutive quarter of positive adjusted EBITDA;- Pure Sunfarms remained the top-selling brand* of dried flower products in key markets:

- In Ontario (by kilograms sold and dollars sold) for the fourth quarter 2021 and for the period since Retail Branded sales launch in October 2019;

- In Alberta** for the fourth quarter 2021 and monthly since October 2020 (by dollars sold);

- In British Columbia** for the fourth quarter 2021 and monthly since October 2020 (by dollars sold);

- Pure Sunfarms launched 23 new SKUs across four product categories; and,

- Village Farms acquired

70% ownership of privately-held, Québec-based, Rose LifeScience, adding a substantial presence in the Province of Québec as a cannabis supplier, producer and commercialization expert.

*Based on OCS market data for the quarter ended December 31, 2021. |

** Market share performance data cited has been calculated by Pure Sunfarms from sales information provided by Buddi retail store data from over 300 retailers across Alberta and British Columbia as of December 31, 2021. |

*** Market share performance and data cited has been calculated by Pure Sunfarms from sales information provided by OCS as of December 31, 2021. |

Canadian Cannabis (Pure Sunfarms and Rose LifeScience) Financial Summary for the Three Months and Year Ended December 31, 2021 and December 31, 2020 (Before Village Farms' Proportionate Share)

(millions except % metrics) | Three Months Ended December 31, | ||||

2021 | 2020 | Change of C$ | |||

C$ | US$ | C$ | US$ | ||

Total Gross Sales 1 | + | ||||

Total Net Sales | + | ||||

Gross Margin 2 | + | ||||

SG&A | - | ||||

Share-based compensation | N/A | ||||

Net income | + | ||||

Adjusted EBITDA 3 | + | ||||

Adjusted EBITDA Margin 3 | + | ||||

(millions except % metrics) | Year Ended December 31, | ||||

2021 | 2020 | Change of C$ | |||

C$ | US$ | C$ | US$ | ||

Total Gross Sales 1 | + | ||||

Total Net Sales | + | ||||

Gross Margin 2 | - | ||||

SG&A | - | ||||

Share-based compensation | N/A | ||||

Net income 4 | - | ||||

Adjusted EBITDA 3 | + | ||||

Adjusted EBITDA Margin 3 | + | ||||

1. | Total Gross Sales for Canadian Cannabis includes excise taxes which are excluded to derive Total Net Sales. |

2. | Gross margin for the three months ended December 31, 2021 excludes the (C |

3. | Adjusted EBITDA and Adjusted EBITDA Margin are not recognized earnings measures and do not have a standard meaning prescribed in by GAAP. See "Non-GAAP Measures" below. |

4. | Net income includes C |

Canadian Cannabis (Pure Sunfarms) Sales Composition by Product Group

Three months ended | Year ended December 31, | |||

Channel | 2021 | 2020 | 2021 | 2020 |

Retail, Flower | ||||

Retail, Cannabis Derivatives | ||||

Wholesale, Flower and Trim | ||||

U.S. Cannabis (Balanced Health Botanicals and VF Hemp)

- Net sales of

$7.5 million for the three months ended December 31, 2021; - Gross margin of

71% for the fourth quarter of 2021; - Adjusted EBITDA of

$1.9 million for the fourth quarter of 2021; and, - Expanded its product portfolio with the launch of its innovative Synergy Collection, developed to enhance the multitude of benefits offered by the hemp plant and other ingredients beyond CBD alone.

Village Farms Fresh (Produce)

- Continued improved financial results with an

11% year-over-year increase in sales and positive Adjusted EBITDA of$1.1 million for the three months ended December 31, 2021.

Village Farms' Consolidated Financial Summary for the Three Months and Year Ended December 31, 2021 and December 31, 2020 and Corporate Highlights

($US millions except per share | Three Months Ended December 31, | Year Ended December 31, | ||||

2021 | 2020 | Change | 2021 | 2020 | Change | |

Sales1 | + | + | ||||

Produce | + | + | ||||

Canadian Cannabis | N/A | |||||

U.S. Cannabis | N/A | N/A | ||||

Clean Energy | N/A | - | ||||

Net Income (Loss)1 | - | ( | - | |||

Income (Loss) Per Share1 | - | ( | - | |||

Adjusted EBITDA1, 2 | ( | N/A | + | |||

Produce | ( | + | ( | - | ||

Canadian Cannabis | + | + | ||||

U.S. Cannabis | N/A | N/A | ||||

Clean Energy | ( | N/A | ( | ( | + | |

Corporate | ( | ( | - | ( | ( | - |

1. | Sales, Net Income, Income (Loss) per share and Adjusted EBITDA includes results from Pure Sunfarms, Balanced Health and Rose LifeScience pursuant to the Company's statutory reporting requirements. |

2. | Adjusted EBITDA is not a recognized earnings measure and does not have a standard meaning prescribed by GAAP. For a definition of Adjusted EBITDA and reconciliation to net income see "Non-GAAP Measures" below. |

Our Response to the Ongoing Coronavirus Pandemic

In March 2020, the World Health Organization declared the outbreak of the COVID-19 virus a global pandemic. This outbreak continues to cause major disruptions to businesses and markets worldwide as the virus continues to spread. Several countries as well as certain states and cities within the United States and Canada have enacted temporary closures of businesses, issued quarantine or shelter-in-place orders and taken other restrictive measures. In response to the COVID-19 pandemic, the Company implemented safety protocols and procedures to protect its employees, its subcontractors, and its customers. These protocols take into consideration guidance from state and local government agencies as well as the Centers for Disease Control and Prevention and other public health authorities.

In April 2020, the Government of Canada announced the Canada Emergency Wage Subsidy ("CEWS") to help Canadian businesses to keep employees on the payroll in response to the challenges posed by the COVID-19 pandemic. During 2021 and 2020, Pure Sunfarms determined that it met the employer eligibility criteria and applied for the CEWS and received C

As of February 25, 2022, all of the Company's operations are operating normally, however, the extent to which COVID-19 and the related global economic crisis affect the Company's business, results of operations and financial condition, will depend on future developments that are highly uncertain and cannot be predicted, including the scope and duration of the pandemic and any recovery period, future actions taken by governmental authorities, central banks and other third parties (including new financial regulation and other regulatory reform) in response to the pandemic, and the effects on our produce, clients, vendors and employees. Village Farms continues to service its customers amid uncertainty and disruption linked to COVID-19 and is actively managing its business to respond to the impact.

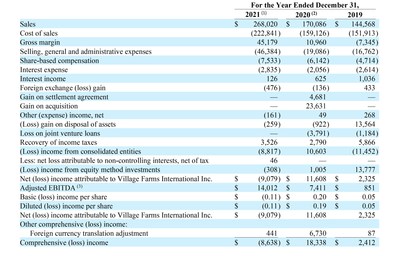

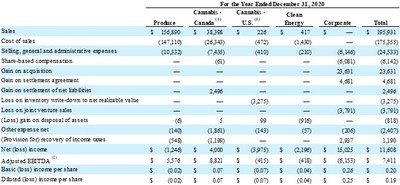

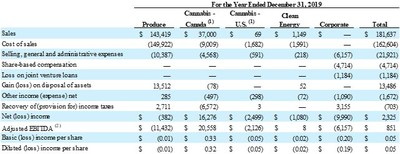

Summary Statutory Results

(in thousands of U.S. Dollars unless otherwise indicated)

1. | For the year ended December 31, 2021, Pure Sunfarms is fully consolidated in the financial results of the Company. For the period August 16, 2021 to December 31, 2021, Balanced Health is fully consolidated in the financial results of the Company. For the period November 15, 2021 to December 31,2021, Village Farms' share of Rose LifeScience's financial results are fully consolidated in the financial results of the Company with the minority non-controlling interest presented in net loss attributable to non-controlling interests, net of tax. |

2. | For the period January 1, 2020 to November 1, 2020, Village Farms' share of Pure Sunfarms earnings are reflected in equity in earnings of unconsolidated entities. For the period of November 2, 2020 to December 31, 2020, Pure Sunfarms is fully consolidated in the financial results of the Company. |

3. | Adjusted EBITDA is not a recognized earnings measure and does not have a standardized meaning prescribed by GAAP. Therefore, Adjusted EBITDA may not be comparable to similar measures presented by other issuers. See "Non-GAAP Measures" for a definition and reconciliation of Adjusted EBITDA to net income (loss), the nearest comparable measurement under GAAP. Management believes that Adjusted EBITDA is a useful supplemental measure in evaluating the performance of the Company. Adjusted EBITDA includes the Company's majority non-controlling interest in Pure Sunfarms through November 1, 2020 and |

Discussion of Financial Results

A discussion of our consolidated results for the years ended December 31, 2021 and 2020 is included below. The consolidated results include all four of our operating segments, produce, cannabis-Canada, cannabis-U.S. and clean energy, along with all public company expenses. The remaining

Under "Cannabis Segment Results - Canada", we also present a discussion of the operating results of Pure Sunfarms, before any allocation to Village Farms, which were not consolidated in our financial results for the period of January 1, 2020 to November 1, 2020 and were only consolidated in our results for the year ended December 31, 2021 and the period November 2, 2020 to December 31, 2020. As a result of the Pure Sunfarms Acquisition, Pure Sunfarms recognized an increase in the fair value of its inventory on-hand on the acquisition date, resulting in a

Under "Cannabis Segment Results – U.S.", we present a discussion of the operating results of Balanced Health for the period of August 16, 2021 to December 31, 2021, which were consolidated in the Company's financial results for the year ended December 31, 2021. We also present VF Hemp which is a joint venture and their results are included in "(Losses) Income from Equity Method Investments" for the year ended December 31, 2021.

CONSOLIDATED RESULTS

Year Ended December 31, 2021 Compared to Year Ended December 31, 2020

Sales

Sales for the year ended December 31, 2021 increased

The average selling price for all tomato pounds sold decreased (

Cost of Sales

Cost of sales for the year ended December 31, 2021 increased

The increase from Canadian cannabis cost of sales was primarily due to the inclusion of twelve months of costs for Pure Sunfarms in 2021 as compared to costs for the period of November 2, 2020 to December 31, 2020, along with the post-acquisition costs from Rose LifeScience from November 15, 2021 through December 31, 2021. The increase in year-over-year produce supply partner costs was due to higher volumes of tomatoes, peppers and cucumbers which also drove higher freight costs and the increase from U.S. cannabis cost of sales was due to the inclusion of the cost of sales of Balanced Health from its acquisition date of August 16, 2021. The reduction in our own produce production costs was driven by lower costs at our Texas facilities, primarily due to a decrease in the cost per pound produced as facility management's cost saving efforts were realized in 2021 despite supply chain issues that worsened during the pandemic.

Gross Margin

Gross margin for the year ended December 31, 2021 increased

Selling, General and Administrative Expenses

Selling, general and administrative expenses for the year ended December 31, 2021 increased

Share-Based Compensation

Share-based compensation expenses for the year ended December 31, 2021 was

Gain on Settlement Agreement

On March 2, 2020, pursuant to the settlement agreement with Emerald, Emerald transferred to the Company

Gain on Acquisition

On November 2, 2020, the Company consummated the Pure Sunfarms Acquisition, pursuant to which the Company acquired 36,958,500 Common Shares of Pure Sunfarms owned by Emerald and increased the Company's ownership of Pure Sunfarms to

Loss on Disposal of Assets

The Company recognized a loss on disposal of assets of (

Loss on Joint Venture Loans

The Company recognized a loss on joint venture loans of (

(Losses) Income from Equity Method Investments

Our share of losses from our equity method investments for the year ended December 31, 2021 was (

Net Loss Attributable to Non-controlling Interests, Net of Tax

For the year ended December 31, 2021, the net loss attributable to non-controlling interests, net of tax was

Net (Loss) Income Attributable to Village Farms International Inc.

Net (loss) for the year ended December 31, 2021 was (

Adjusted EBITDA

Adjusted EBITDA for the year ended December 31, 2021 increased

CANNABIS SEGMENT RESULTS – CANADA

The Canadian cannabis segment currently consists of Pure Sunfarms and Rose LifeScience. Pure Sunfarms' comparative analysis are based on the consolidated results of Pure Sunfarms for the years ended December 31, 2021 and 2020 and the three month periods ending December 31, 2021 and 2020 and September 30, 2021, not accounting for the percentage owned by Village Farms. The Canadian cannabis segment also includes the operating results of Rose LifeScience from November 15, 2021 to December 31, 2021, which are consolidated in our results for the year ended December 31, 2021 with the minority interest presented in Net Income (Loss) Attributable to Non-controlling Interests, Net of Tax. See "Non-GAAP Measures - Reconciliation of U.S. GAAP Results to Proportionate Results" for a presentation of the Canadian cannabis segment's proportionate results for years ended December 30, 2021 and December 31, 2020.

Year Ended December 31, 2021 Compared to Year Ended December 31, 2020

Sales

Canadian cannabis net sales for the years ended December 31, 2021 and 2020 was

For the year ended December 31, 2021,

On a combined basis, the net average selling price of branded flower and pre-roll formats did not change from 2020 to 2021, due primarily to a greater volume of pre-roll sales in 2021 which has a higher selling price than flower. Excluding pre-roll formats, the average net selling price of branded flower decreased by (

Cost of Sales

Cost of sales for the years ended December 31, 2021 and 2020 was

Gross Margin

Gross margin for the year ended December 31, 2021 increased

Selling, General and Administrative Expenses

Selling, general and administrative expenses for the year ended December 31, 2021 increased

Share-Based Compensation

Share-based compensation for the years ended December 31, 2021 and 2020 were

Net Income

Net income for the years ended December 31, 2021 and 2020 was

Adjusted EBITDA

Adjusted EBITDA was

Three Months Ended December 31, 2021 Compared to Three Months Ended December 31, 2020

Sales

Canadian cannabis net sales for the three months ended December 31, 2021 were

Cost of Sales

Canadian cannabis cost of sales for the three months ended December 31, 2021 was

Gross Margin

Gross margin for the three months ended December 31, 2021 was

Selling, General and Administrative Expenses

Canadian cannabis selling, general and administrative expenses for the three months ended December 31, 2021 were

Share-Based Compensation

Share-based compensation expenses for the three months ended December 31, 2021 were

Net Income

Canadian cannabis net income for the three months ended December 31, 2021 was

Adjusted EBITDA

Adjusted EBITDA for the three months ended December 31, 2021 and 2020 was

Three Months Ended December 31, 2021 Compared to Three Months Ended September 30, 2021

Sales

Canadian cannabis net sales for the three months ended December 31, 2021 were

Cost of Sales

Canadian cannabis cost of sales for the three months ended December 31, 2021 was

Gross Margin

Gross margin for the three months ended December 31, 2021 was

Selling, General and Administrative Expenses

Canadian cannabis selling, general and administrative expenses for the three months ended December 31, 2021 were

Share-Based Compensation

Share-based compensation expenses for the three months ended December 31, 2021 were

Net Income

Canadian cannabis net income for the three months ended December 31, 2021 was

Adjusted EBITDA

Adjusted EBITDA for the three months ended December 31, 2021 and September 30, 2021 was

CANNABIS SEGMENT RESULTS – UNITED STATES

The U.S. cannabis segment currently consists of Balanced Health and VF Hemp. For the year ended December 30, 2021, U.S. cannabis financial results are based on the consolidated results of Balanced Health from the closing date of the acquisition of August 16, 2021, as the results of Balanced Health from August 16, 2021 through December 31, 2021 are consolidated in the Company's results. VF Hemp is a joint venture, and its results are included in "Equity in Earnings of Unconsolidated Entities" for the year ended December 31, 2021.

Sales

U.S. cannabis net sales for the period of August 16, 2021 to December 31, 2021 were

Cost of Sales

U.S. cannabis cost of sales for the period of August 16, 2021 to December 31, 2021 were

Gross Margin

U.S. cannabis gross margin for the period of August 16, 2021 to December 31, 2021 was

Selling, General and Administrative Expenses

U.S. cannabis selling general and administrative expenses for the period of August 16, 2021 to December 31, 2021 was

Share-Based Compensation

U.S. cannabis share-based compensation for the period of August 16, 2021 to December 31 2021 was

Net Income

U.S. cannabis net income for the period of August 16, 2021 to December 31, 2021 was

Adjusted EBITDA

U.S. cannabis adjusted EBITDA for the period of August 16, 2021 to December 31, 2021 was

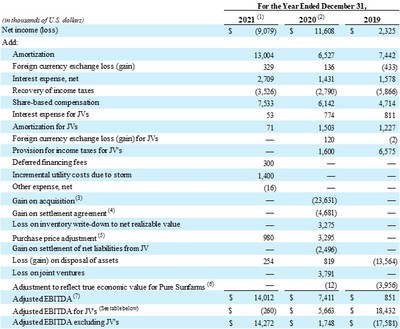

Non-GAAP Measures

References in this MD&A to "Adjusted EBITDA" are to earnings (including the equity earnings of the joint ventures, Pure Sunfarms and VFH) before interest, taxes, depreciation, and amortization ("EBITDA"), as further adjusted to exclude foreign currency exchange gains and losses on translation of long-term debt, unrealized gains on the changes in the value of derivative instruments, share-based compensation, gains and losses on asset sales and the other adjustments set forth in the table below. Adjusted EBITDA is a measure of operating performance that is not recognized under GAAP and does not have a standardized meaning prescribed by GAAP. Therefore, Adjusted EBITDA may not be comparable to similar measures presented by other issuers. Investors are cautioned that Adjusted EBITDA should not be construed as an alternative to net income or loss determined in accordance with GAAP as an indicator of our performance. Management believes that Adjusted EBITDA is an important measure in evaluating the historical performance of the Company because it excludes non-recurring and other items that do not reflect our business performance.

We also present Adjusted EBITDA, earnings per share and diluted earnings per share on a proportionate segment basis. Each of the components of Adjusted EBITDA, on a proportionate segment basis (which include our proportionate share of the joint ventures, Pure Sunfarms and VF Hemp, which were accounted for as equity method investments, as well as the proportionate share of Rose LifeScience, in respect of which we have a

Reconciliation of Consolidated Net Income to Adjusted EBITDA

1. | For the year ended December 31, 2021, Pure Sunfarms is fully consolidated in the financial results of the Company. For the period August 16, 2021 to December 31, 2021, Balanced Health is fully consolidated in the financial results of the Company. For the period November 15, 2021 to December 31,2021, Village Farms' share of Rose LifeScience's financial results are fully consolidated in the financial results of the Company. |

2. | For the period January 1, 2020 to November 1, 2020, Village Farms' share of Pure Sunfarms earnings is reflected in income from equity method investments. For the period of November 2, 2020 to December 31, 2020, Pure Sunfarms is fully consolidated in the financial results of the Company. |

3. | See "Results of Operations – Consolidated Results – Gain on Acquisition" above. |

4. | See "Results of Operations – Consolidated Results – Gain on Settlement Agreement" above. |

5. | The purchase price adjustment primarily reflects the non-cash accounting charge resulting from the revaluation of Pure Sunfarms' inventory to fair value at the acquisition date. |

6. | The GAAP treatment of our equity earning of Pure Sunfarms is different than under IFRS. Under GAAP, the Emerald shares held in escrow are not considered issued until paid for pursuant to the GAAP concept of 'hypothetical liquidation'. As a result, under GAAP, our ownership percentage for March through November of 2019 was higher than its economic interest of |

7. | Adjusted EBITDA is not a recognized earnings measure and does not have a standardized meaning prescribed by GAAP. Therefore, Adjusted EBITDA may not be comparable to similar measures presented by other issuers. Management believes that Adjusted EBITDA is a useful supplemental measure in evaluating the performance of the Company because it excludes non-recurring and other items that do not reflect our business performance. Adjusted EBITDA includes the Company's majority non-controlling interest in Pure Sunfarms through November 1, 2020 and |

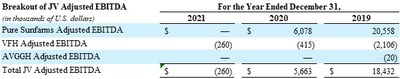

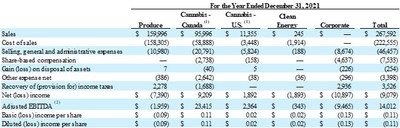

Reconciliation of U.S. GAAP Results to Proportionate Results

The following tables are a reconciliation of the GAAP results to the proportionate results (which include our proportionate share of the equity method joint ventures of Pure Sunfarms, VF Hemp and AVGGH and

1. | The adjusted consolidated financial results have been adjusted to include our share of revenues and expenses from Pure Sunfarms, Rose LifeScience and VF Hemp on a proportionate accounting basis, on which management bases its operating decisions and performance evaluation. GAAP does not allow for the inclusion of the joint ventures on a proportionate basis. These results include additional non-GAAP measures such as Adjusted EBITDA. The adjusted results are not generally accepted measures of financial performance under GAAP. Our method of calculating these financial performance measures may differ from other companies and accordingly, they may not be comparable to measures used by other companies. |

2. | Adjusted EBITDA is not a recognized earnings measure and does not have a standardized meaning prescribed by GAAP. Therefore, Adjusted EBITDA may not be comparable to similar measures presented by other issuers. Management believes that Adjusted EBITDA is a useful supplemental measure in evaluating the performance of the Company because it excludes non-recurring and other items that do not reflect our business performance. Consolidated Adjusted EBITDA includes our majority non-controlling interest Pure Sunfarms, our |

This press release is intended to be read in conjunction with the Company's Consolidated Financial Statements ("Financial Statements") and Management's Discussion & Analysis ("MD&A") for the three and year ended December 31, 2021 in the Company Form 10-K, which will be filed on EDGAR (www.sec.gov/edgar.shtml) and SEDAR (www.sedar.com) and will be available at www.villagefarms.com.

Conference Call

Village Farms' management team will host a conference call today, Tuesday, March 1, 2022 at 8:30 a.m. ET, to discuss its financial results. Participants can access the conference call by telephone by dialing (416) 764-8659 or (888) 664-6392, or via the Internet at: https://bit.ly/3rku2Cl.

For those unable to participate in the conference call at the scheduled time, it will be archived for replay both by telephone and via the Internet beginning approximately one hour following completion of the call. To access the archived conference call by telephone, dial (416) 764-8677 or (888) 390-0541 and enter the passcode 003174 followed by the pound (#) key. The telephone replay will be available until Tuesday, March 8, 2022 at midnight (ET). The conference call will also be available on Village Farms' web site at http://villagefarms.com/investor-relations/investor-calls.

About Village Farms International, Inc.

Village Farms leverages decades of experience as a large-scale, Controlled Environment Agriculture-based, vertically integrated supplier for high-value, high-growth plant-based Consumer Packaged Goods opportunities, with a strong foundation as a leading fresh produce supplier to grocery and large-format retailers throughout the US and Canada, and new high-growth opportunities in the cannabis and CBD categories in North America and selected markets internationally.

In Canada, the Company's wholly-owned Canadian subsidiary, Pure Sunfarms, is one of the single largest cannabis operations in the world, the lowest-cost greenhouse producer and one of Canada's best-selling brands. The Company also owns

In the US, wholly-owned Balanced Health Botanicals is one of the leading CBD brands and e-commerce platforms in the country. Subject to compliance with all applicable US federal and state laws and stock exchange rules, Village Farms plans to enter the US high-THC cannabis market via multiple strategies, leveraging one of the largest greenhouse operations in the country (more than 5.5 million square feet in West Texas), as well as the operational and product expertise gained through Pure Sunfarms' cannabis success in Canada.

Internationally, Village Farms is targeting selected, nascent, legal cannabis and CBD opportunities with significant medium- and long-term potential, with an initial focus on the Asia-Pacific region and Europe.

Cautionary Statement Regarding Forward-Looking Information

This Press Release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and is subject to the safe harbor created by those sections. This Annual Report on Form 10-K also contains "forward-looking information" within the meaning of applicable Canadian securities law. We refer to such forward-looking statements and forward-looking information collectively as "forward-looking statements". Forward-looking statements may relate to the Company's future outlook or financial position and anticipated events or results and may include statements regarding the financial position, business strategy, budgets, expansion plans, litigation, projected production, projected costs, capital expenditures, financial results, taxes, plans and objectives of or involving the Company. Particularly, statements regarding future results, performance, achievements, prospects or opportunities for the Company, the greenhouse vegetable industry or the cannabis industry are forward-looking statements. In some cases, forward-looking information can be identified by such terms as "outlook", "may", "might", "will", "could", "should", "would", "occur", "expect", "plan", "anticipate", "believe", "intend", "try", "estimate", "predict", "potential", "continue", "likely", "schedule", "objectives", or the negative or grammatical variation thereof or other similar expressions concerning matters that are not historical facts. The forward-looking statements in this report are subject to risks that may include, but are not limited to: our limited operating history, including that of our Pure Sunfarms Corp.("Pure Sunfarms") and our start-up operations of growing hemp in the United States ("VF Hemp"); the legal status of Pure Sunfarms cannabis business; risks relating to obtaining additional financing, including our dependence upon credit facilities; potential difficulties in achieving and/or maintaining profitability; variability of product pricing; risks inherent in the cannabis, hemp and agricultural businesses; the ability of Pure Sunfarms to cultivate and distribute cannabis in Canada; existing and new governmental regulations, including risks related to regulatory compliance and licenses (e.g., Pure Sunfarms ability to obtain licenses for its Delta 2 greenhouse facility as well as additional licenses under the Canadian act respecting cannabis to amend to the Controlled Drugs and Substances Act, the Criminal Code and other Acts, S.C. 2018, c. 16 (Canada) (the "Cannabis Act") for its Delta 3 greenhouse facility), and changes in our regulatory requirements; risks relating to conversion of our greenhouses to cannabis production for Pure Sunfarms; risks related to rules and regulations at the U.S. federal (Food and Drug Administration ("FDA") and United States Department of Agriculture ("USDA")), state and municipal levels with respect to produce and hemp; retail consolidation, technological advances and other forms of competition; transportation disruptions; product liability and other potential litigation; retention of key executives; labor issues; uninsured and underinsured losses; vulnerability to rising energy costs; environmental, health and safety risks, foreign exchange exposure, risks associated with cross-border trade; difficulties in managing our growth; restrictive covenants under our credit facilities; natural catastrophes; the ongoing and developing COVID-19 pandemic; and tax risks.

The Company has based these forward-looking statements on factors and assumptions about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs. Although the forward-looking statements contained in this report are based upon assumptions that management believes are reasonable based on information currently available to management, there can be no assurance that actual results will be consistent with these forward-looking statements. Forward-looking statements necessarily involve known and unknown risks and uncertainties, many of which are beyond the Company's control, that may cause the Company's or the industry's actual results, performance, achievements, prospects and opportunities in future periods to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, the factors contained in the Company's filings with securities regulators, including this Annual Report on Form 10-K. In particular, we caution you that our forward-looking statements are subject to the ongoing and developing circumstances related to the COVID-19 pandemic, which may have a material adverse effect on our business, operations and future financial results.

When relying on forward-looking statements to make decisions, the Company cautions readers not to place undue reliance on these statements, as forward-looking statements involve significant risks and uncertainties and should not be read as guarantees of future results, performance, achievements, prospects and opportunities. The forward-looking statements made in this report relate only to events or information as of the date on which the statements are made in this report. Except as required by law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Village Farms International, Inc. | ||||||

Consolidated Statements of Financial Position | ||||||

(In thousands of United States dollars) | ||||||

(Unaudited) | ||||||

December 31, 2021 | December 31, 2020 | |||||

ASSETS | ||||||

Current assets | ||||||

Cash and cash equivalents | $ | 53,417 | $ | 21,640 | ||

Restricted cash | 5,250 | 4,039 | ||||

Trade receivables | 34,360 | 23,222 | ||||

Inventories | 68,677 | 46,599 | ||||

Other receivables | 616 | 145 | ||||

Income tax receivable | 2,430 | 18 | ||||

Prepaid expenses and deposits | 10,209 | 6,145 | ||||

Total current assets | 174,959 | 101,808 | ||||

Non-current assets | ||||||

Property, plant and equipment | 215,704 | 187,020 | ||||

Investment in in minority interests | 2,109 | 1,226 | ||||

Note receivable - joint venture | 3,256 | 3,545 | ||||

Goodwill | 117,533 | 24,027 | ||||

Intangibles | 26,394 | 17,311 | ||||

Deferred tax asset | 16,766 | 13,312 | ||||

Right-of-use assets | 7,609 | 3,832 | ||||

Other assets | 2,581 | 1,950 | ||||

Total assets | $ | 566,911 | $ | 354,031 | ||

LIABILITIES | ||||||

Current liabilities | ||||||

Line of credit | $ | 7,760 | $ | 2,000 | ||

Trade payables | 22,597 | 15,064 | ||||

Current maturities of long-term debt | 11,416 | 10,166 | ||||

Note payable | — | 15,314 | ||||

Accrued liabilities | 14,168 | 10,367 | ||||

Accrued sales taxes | 3,899 | 12,071 | ||||

Accrued loyalty program | 2,098 | — | ||||

Income tax payable | — | 4,523 | ||||

Lease liabilities - current | 962 | 1,134 | ||||

Other current liabilities | 1,413 | 1,641 | ||||

Total current liabilities | 64,313 | 72,280 | ||||

Non-current liabilities | ||||||

Long-term debt | 50,419 | 53,913 | ||||

Deferred tax liability | 18,657 | 18,059 | ||||

Lease liabilities - non-current | 6,711 | 2,863 | ||||

Other liabilities | 1,973 | 1,633 | ||||

Total liabilities | 142,073 | 148,748 | ||||

Commitments and contingencies | ||||||

MEZZANINE EQUITY | ||||||

Redeemable non-controlling interests | 16,433 | — | ||||

SHAREHOLDERS' EQUITY | ||||||

Common stock | 365,561 | 145,668 | ||||

Additional paid in capital | 9,369 | 17,502 | ||||

Accumulated other comprehensive loss | 6,696 | 6,255 | ||||

Retained earnings | 26,779 | 35,858 | ||||

Total shareholders' equity | 408,405 | 205,283 | ||||

Total liabilities and shareholders' equity | $ | 566,911 | $ | 354,031 | ||

Village Farms International, Inc. | ||||||||||||

Consolidated Statements of Income (Loss) and Comprehensive Income (Loss) | ||||||||||||

(In thousands of United States dollars, except per share data, unless otherwise noted) | ||||||||||||

(Unaudited) | ||||||||||||

Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||

2021 | 2020 | 2021 | 2020 | |||||||||

Sales | $ | 72,808 | $ | 47,364 | $ | 268,020 | $ | 170,086 | ||||

Cost of sales | (52,950) | (46,317) | (222,841) | (159,126) | ||||||||

Gross margin | 19,858 | 1,047 | 45,179 | 10,960 | ||||||||

Selling, general and administrative expenses | (16,135) | (6,410) | (46,384) | (19,086) | ||||||||

Share-based compensation | (1,828) | (4,813) | (7,533) | (6,142) | ||||||||

Interest expense | (876) | (783) | (2,835) | (2,056) | ||||||||

Interest income | 27 | 48 | 126 | 625 | ||||||||

Foreign exchange gain (loss) | 159 | 744 | (476) | (136) | ||||||||

Gain on settlement agreement | — | — | — | 4,681 | ||||||||

Gain on acquisition | — | 23,631 | — | 23,631 | ||||||||

Other income (expense) | 193 | (43) | (161) | 49 | ||||||||

Loss on joint venture loans | — | (3,791) | — | (3,791) | ||||||||

Loss on disposal of assets | (219) | (916) | (259) | (922) | ||||||||

Income (loss) before taxes and (loss) income from equity method investments | 1,179 | 8,714 | (12,343) | 7,813 | ||||||||

Recovery of income taxes | 983 | 2,183 | 3,526 | 2,790 | ||||||||

(Loss) income from equity method investments | (133) | (3,880) | (308) | 1,005 | ||||||||

Income (loss) including non-controlling interests | $ | 2,029 | $ | 7,017 | $ | (9,125) | $ | 11,608 | ||||

Less: net loss attributable to non-controlling interests, net of tax | $ | 46 | — | $ | 46 | — | ||||||

Net income (loss) attributable to Village Farms International, Inc. shareholders | $ | 2,075 | $ | 7,017 | $ | (9,079) | $ | 11,608 | ||||

Basic income (loss) per share | $ | 0.03 | $ | 0.12 | $ | (0.11) | $ | 0.20 | ||||

Diluted income (loss) per share | $ | 0.03 | $ | 0.11 | $ | (0.11) | $ | 0.19 | ||||

Weighted average number of common shares used in the computation of net income (loss) per share (in thousands): | ||||||||||||

Basic | 82,161 | 58,526 | 82,161 | 58,526 | ||||||||

Diluted | 82,161 | 61,490 | 82,161 | 61,490 | ||||||||

Net income (loss) attributable to Village Farms International, Inc. shareholders | $ | 2,075 | $ | 7,017 | $ | (9,079) | $ | 11,608 | ||||

Other comprehensive income (loss): | ||||||||||||

Foreign currency translation adjustment | 233 | 6,771 | 441 | 6,730 | ||||||||

Comprehensive income (loss) | $ | 2,308 | $ | 13,788 | $ | (8,638) | $ | 18,338 | ||||

Village Farms International, Inc. | ||||||

Consolidated Statements of Cash Flows | ||||||

(In thousands of United States dollars) | ||||||

(Unaudited) | ||||||

Twelve Months Ended | ||||||

2021 | 2020 | |||||

Cash flows provided by (used in) operating activities: | ||||||

Net income (loss) attributable to Village Farms International, Inc. shareholders | $ | (9,079) | $ | 11,608 | ||

Adjustments to reconcile net (loss) income to net cash (used in) provided by operating activities: | ||||||

Depreciation and amortization | 12,709 | 6,825 | ||||

Amortization of deferred charges | 300 | 115 | ||||

Share of loss (income) from joint ventures | 308 | (1,005) | ||||

Loss on joint venture loans | - | 3,791 | ||||

Interest expense | 2,835 | 2,056 | ||||

Interest income | (126) | (625) | ||||

Interest paid on long-term debt | (3,306) | (1,295) | ||||

Gain on settlement agreement | — | (4,681) | ||||

(Gain) loss on disposal of assets | (259) | 922 | ||||

Gain on acquisition of Pure Sunfarms | — | (23,631) | ||||

Interest paid on finance lease | — | (4) | ||||

Share-based compensation | 7,533 | 6,142 | ||||

Deferred income taxes | (2,866) | (6,462) | ||||

Non-cash lease expense | (1,351) | (1,150) | ||||

Other | 366 | — | ||||

Changes in non-cash working capital items | (46,631) | 13,072 | ||||

Net cash (used in) provided by operating activities | (39,567) | 5,678 | ||||

Cash flows used in investing activities: | ||||||

Purchases of property, plant and equipment, net of rebate | (21,656) | (3,419) | ||||

Acquisitions, net | (40,685) | (34,603) | ||||

Advances to joint ventures | (20) | (177) | ||||

Purchases of intangibles | — | (92) | ||||

Investment in joint ventures | — | (11,713) | ||||

Investment in minority interests | (1,109) | (1,226) | ||||

Net cash used in investing activities | (63,470) | (51,230) | ||||

Cash flows provided by financing activities: | ||||||

Proceeds from borrowings | 19,669 | 10,619 | ||||

Repayments on borrowings | (9,454) | (6,292) | ||||

Proceeds from issuance of common stock and warrants | 135,000 | 57,212 | ||||

Issuance costs | (7,511) | (3,293) | ||||

Note payable paid to Emerald Health | (15,498) | — | ||||

Proceeds from exercise of stock options | 199 | 425 | ||||

Proceeds from exercise of warrants | 18,495 | — | ||||

Share repurchases | (5,000) | — | ||||

Payments on capital lease obligations | (17) | (63) | ||||

Net cash provided by financing activities | 135,883 | 58,608 | ||||

Effect of exchange rate changes on cash and cash equivalents | 142 | 634 | ||||

Net increase in cash and cash equivalents | 32,988 | 13,690 | ||||

Cash and cash equivalents, beginning of period | 25,679 | 11,989 | ||||

Cash and cash equivalents, end of period | $ | 58,667 | $ | 25,679 | ||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/village-farms-international-reports-fourth-quarter-and-year-end-2021-financial-results-fourth-quarter-consolidated-eps-of-0-03-per-share-net-income-of-2-1-million-and-consolidated-adjusted-ebitda1-of-5-3-million-301492454.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/village-farms-international-reports-fourth-quarter-and-year-end-2021-financial-results-fourth-quarter-consolidated-eps-of-0-03-per-share-net-income-of-2-1-million-and-consolidated-adjusted-ebitda1-of-5-3-million-301492454.html

SOURCE Village Farms International, Inc.

FAQ

What were Village Farms' Q4 2021 financial results?

Is Village Farms profitable in its cannabis operations?

What is the outlook for Village Farms in 2022?

How did the acquisition of Rose LifeScience affect Village Farms?