VERB Delivers Remarkable 2024 Financial Performance

Verb Technology Company (Nasdaq: VERB) reported significant financial growth in its 2024 Form 10-K filing. The company achieved total revenue of $895,000, marking a 1,321% increase from the previous year. Q4 2024 revenue reached $723,000, representing a 2,393% year-over-year increase and 465% quarter-over-quarter growth.

The company maintains a strong cash position of $13.5 million ($8.5M cash plus $4.9M in liquid investments), with an additional $1.7M added in Q1 2025. This is expected to fund operations into 2028. VERB has become debt-free in Q1 2025 and reports a cash value of $13.40 per common share.

Notable improvements include a reduction in net loss from continuing operations by $4.3M (29%), operating loss reduction of $2.2M (16%), and decreased general and administrative expenses by $0.3M (2%). Revenue growth is primarily attributed to MARKET.live business unit services and the Go Fund Yourself business unit.

Verb Technology Company (Nasdaq: VERB) ha riportato una significativa crescita finanziaria nel suo filing del 2024 Form 10-K. L'azienda ha raggiunto un fatturato totale di $895,000, segnando un aumento del 1,321% rispetto all'anno precedente. I ricavi del Q4 2024 hanno raggiunto $723,000, rappresentando un incremento del 2,393% anno su anno e una crescita del 465% rispetto al trimestre precedente.

L'azienda mantiene una solida posizione di liquidità di $13.5 milioni ($8.5M in contante più $4.9M in investimenti liquidi), con un ulteriore aumento di $1.7M nel Q1 2025. Si prevede che questo finanziamento sosterrà le operazioni fino al 2028. VERB è diventata esente da debiti nel Q1 2025 e riporta un valore di liquidità di $13.40 per azione comune.

Tra i miglioramenti notevoli vi sono una riduzione della perdita netta dalle operazioni continuative di $4.3M (29%), una riduzione della perdita operativa di $2.2M (16%), e una diminuzione delle spese generali e amministrative di $0.3M (2%). La crescita dei ricavi è principalmente attribuita ai servizi dell'unità di business MARKET.live e all'unità di business Go Fund Yourself.

Verb Technology Company (Nasdaq: VERB) reportó un crecimiento financiero significativo en su presentación del Formulario 10-K de 2024. La empresa alcanzó un ingreso total de $895,000, marcando un aumento del 1,321% en comparación con el año anterior. Los ingresos del cuarto trimestre de 2024 llegaron a $723,000, representando un incremento del 2,393% año tras año y un crecimiento del 465% en comparación con el trimestre anterior.

La empresa mantiene una fuerte posición de efectivo de $13.5 millones ($8.5M en efectivo más $4.9M en inversiones líquidas), con $1.7M adicionales añadidos en el primer trimestre de 2025. Se espera que esto financie las operaciones hasta 2028. VERB se ha vuelto libre de deudas en el primer trimestre de 2025 y reporta un valor de efectivo de $13.40 por acción común.

Las mejoras notables incluyen una reducción de la pérdida neta de operaciones continuas de $4.3M (29%), una reducción de la pérdida operativa de $2.2M (16%), y una disminución de los gastos generales y administrativos de $0.3M (2%). El crecimiento de los ingresos se atribuye principalmente a los servicios de la unidad de negocio MARKET.live y a la unidad de negocio Go Fund Yourself.

Verb Technology Company (Nasdaq: VERB)는 2024년 Form 10-K 제출에서 상당한 재무 성장을 보고했습니다. 이 회사는 총 수익 $895,000을 달성하여 전년 대비 1,321% 증가했습니다. 2024년 4분기 수익은 $723,000에 달하며, 이는 전년 대비 2,393% 증가하고 분기 대비 465% 성장한 수치입니다.

회사는 $13.5 million ($8.5M 현금 + $4.9M 유동 투자)의 강력한 현금 위치를 유지하고 있으며, 2025년 1분기에 추가로 $1.7M이 더해졌습니다. 이는 2028년까지 운영 자금을 지원할 것으로 예상됩니다. VERB는 2025년 1분기에 부채가 없어진 상태이며, 보통주당 현금 가치는 $13.40입니다.

주목할 만한 개선 사항으로는 지속 운영에서의 순손실이 $4.3M (29%) 감소하고, 운영 손실이 $2.2M (16%) 감소했으며, 일반 및 관리 비용이 $0.3M (2%) 감소한 것입니다. 수익 성장은 주로 MARKET.live 비즈니스 유닛 서비스와 Go Fund Yourself 비즈니스 유닛에 기인합니다.

Verb Technology Company (Nasdaq: VERB) a rapporté une croissance financière significative dans son dépôt du Formulaire 10-K de 2024. L'entreprise a atteint un revenu total de 895 000 $, marquant une augmentation de 1 321 % par rapport à l'année précédente. Les revenus du quatrième trimestre 2024 ont atteint 723 000 $, représentant une augmentation de 2 393 % d'une année sur l'autre et une croissance de 465 % par rapport au trimestre précédent.

L'entreprise maintient une forte position de liquidités de 13,5 millions de dollars (8,5 millions de dollars en espèces plus 4,9 millions de dollars en investissements liquides), avec un ajout supplémentaire de 1,7 million de dollars au premier trimestre 2025. Cela devrait financer les opérations jusqu'en 2028. VERB est devenue sans dette au premier trimestre 2025 et rapporte une valeur en espèces de 13,40 $ par action ordinaire.

Les améliorations notables incluent une réduction de la perte nette des opérations continues de 4,3 millions de dollars (29 %), une réduction de la perte d'exploitation de 2,2 millions de dollars (16 %) et une diminution des frais généraux et administratifs de 0,3 million de dollars (2 %). La croissance des revenus est principalement attribuée aux services de l'unité commerciale MARKET.live et à l'unité commerciale Go Fund Yourself.

Verb Technology Company (Nasdaq: VERB) berichtete über ein signifikantes finanzielles Wachstum in seiner 2024 Form 10-K Einreichung. Das Unternehmen erzielte einen Gesamtumsatz von $895,000, was einem Anstieg von 1,321% im Vergleich zum Vorjahr entspricht. Der Umsatz im 4. Quartal 2024 belief sich auf $723,000, was einen Anstieg von 2,393% im Jahresvergleich und 465% im Quartalsvergleich darstellt.

Das Unternehmen hält eine starke Liquidität von $13.5 Millionen ($8.5M Bargeld plus $4.9M in liquiden Anlagen), mit zusätzlichen $1.7M, die im 1. Quartal 2025 hinzugefügt wurden. Dies wird voraussichtlich die Betriebe bis 2028 finanzieren. VERB ist im 1. Quartal 2025 schuldenfrei geworden und berichtet einen Bargeldwert von $13.40 pro Stammaktie.

Bemerkenswerte Verbesserungen umfassen eine Reduzierung des Nettoverlusts aus fortgeführten Betrieben um $4.3M (29%), eine Reduzierung des operativen Verlusts um $2.2M (16%) und eine Senkung der allgemeinen und Verwaltungskosten um $0.3M (2%). Das Umsatzwachstum ist hauptsächlich auf die Dienstleistungen der Geschäftseinheit MARKET.live und die Geschäftseinheit Go Fund Yourself zurückzuführen.

- Revenue surged 1,321% year-over-year to $895,000

- Q4 2024 revenue increased 2,393% YoY to $723,000

- Strong cash position of $13.5M with additional $1.7M in Q1 2025

- Net loss reduced by 29% ($4.3M improvement)

- Operating loss decreased by 16% ($2.2M improvement)

- All debt retired in Q1 2025

- Cash runway extended into 2028

- Despite improvements, company still operating at a loss

- General and administrative expenses remain high at $11.2M

- Revenue base still relatively small at $895,000 annually

Insights

VERB's 2024 financial results demonstrate an extraordinary turnaround story with

What's most remarkable is the company's balance sheet transformation. With

The financial improvements extend beyond revenue, with meaningful reductions in net loss (

Despite the impressive percentage gains, absolute revenue remains modest, and the company continues to operate at a loss. However, the trajectory of improvement, substantial liquidity relative to market cap, and accelerating quarterly revenue growth pattern suggest VERB is positioning for a potentially sustainable growth phase following its strategic business unit sale in 2023.

Quadruple Digit % Gains Year-Over-Year and Triple Digit % Gains Quarter-Over-Quarter Reflected in 2024 Form 10-K

Debt-Free and

Increased Growth Projected For Q1 2025

LAS VEGAS and LOS ALAMITOS, Calif., March 25, 2025 (GLOBE NEWSWIRE) -- Verb Technology Company, Inc. (Nasdaq: VERB) ("VERB" or the "Company"), Transforming the Landscape of Social Commerce, Social Telehealth and Social Crowdfunding with MARKET.live; VANITYPrescribed; GoodGirlRx; and the GO FUND YOURSELF TV Show, today filed its Form 10-K reporting financial and operating results for the full year and the quarter ending December 31, 2024.

Summary Financial Results

For the Year Ended December 31, 2024

- Total revenue was

$895 thousand , an increase of$832 thousand , or 1,321% , over the previous year. Represents the greatest amount of revenue generated since the strategic sale of the Company’s direct sales SaaS business unit in June 2023 - Cash Value per common share -

$13.4 (*includes value of highly-liquid professionally managed investments) - *Year-End Cash position

$13.5 million ($8.5 million cash, plus$4.9 million in highly-liquid investments). Does not include$1.7 million cash added in Q1 2025. - Strong Cash Position – expected to fund operations into 2028 and beyond

- Net loss from continuing operations reduced by

$4.3 million , represents an improvement of29% over prior year - Operating loss reduced by

$2.2 million , represents an improvement of16% over prior year - General and Administrative expenses reduced by

$0.3 million , represents an improvement of2% over prior year, indicates enhanced Company financial performance attributable to increases in revenue – not excessive cost cutting measures - All Remaining Debt retired in Q1 2025

Three Months Ended December 31, 2024

- Total Q4 revenue -

$723 thousand , an increase of$694 thousand , or 2,393% , from the prior year comparable quarter - represents an increase of$595 thousand , or465% over Q3. Indicates enormous revenue growth in Q4 attributable to management’s recent operational and marketing changes which are further validated by projected Q1 2025 results.

Results of Operations

Fiscal Year Ended December 31, 2024 Compared to Fiscal Year Ended December 31, 2023

The following is a comparison of the results of our operations for the years ended December 31, 2024 and 2023 (in thousands):

| Years Ended December 31, | ||||||||||||

| 2024 | 2023 | Change | ||||||||||

| Revenue | $ | 895 | $ | 63 | $ | 832 | ||||||

| Costs and expenses | ||||||||||||

| Cost of revenue, exclusive of depreciation and amortization shown separately below | 224 | 19 | 205 | |||||||||

| Depreciation and amortization | 1,077 | 2,331 | (1,254 | ) | ||||||||

| General and administrative | 11,238 | 11,508 | (270 | ) | ||||||||

| Total costs and expenses | 12,539 | 13,858 | (1,319 | ) | ||||||||

| Operating loss from continuing operations | (11,644 | ) | (13,795 | ) | 2,151 | |||||||

| Other income (expense) | ||||||||||||

| Interest income | 692 | - | 692 | |||||||||

| Unrealized loss on short-term investments | (44 | ) | - | (44 | ) | |||||||

| Interest expense | (237 | ) | (1,193 | ) | 956 | |||||||

| Financing costs | (90 | ) | (1,239 | ) | 1,149 | |||||||

| Other income, net | 812 | 1,162 | (350 | ) | ||||||||

| Change in fair value of derivative liability | 1 | 221 | (220 | ) | ||||||||

| Total other income (expense), net | 1,134 | (1,049 | ) | 2,183 | ||||||||

| Net loss from continuing operations | $ | (10,510 | ) | $ | (14,844 | ) | $ | 4,334 | ||||

Revenue

Revenue was

Revenue was

Revenue was

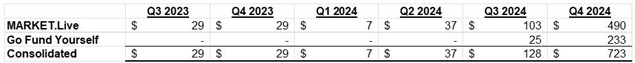

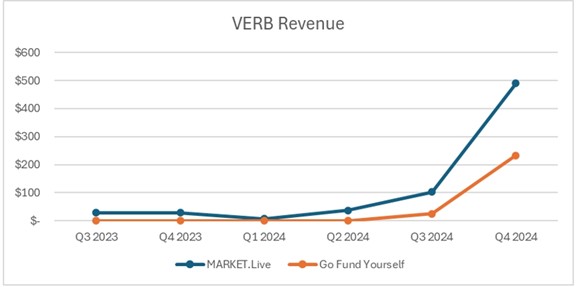

The table below sets forth our quarterly revenues from the quarter ended September 30, 2023 (first quarter following the direct sales SaaS sale) through the quarter ended December 31, 2024, which reflects the trend of revenue over the past six fiscal quarters:

Operating Expenses

Depreciation and amortization expense was

General and administrative expenses including stock compensation expense were

Other Income (Expense), net

Other income (expense), net, was

Liquidity and Capital Resources

Overview

As of December 31, 2024 and 2023, we had the following balances of cash, restricted cash, and highly liquid investments.

| As of December 31, | ||||||||

| 2024 | 2023 | |||||||

| Cash | $ | 7,617 | $ | 4,353 | ||||

| Restricted Cash | 878 | - | ||||||

| Investments: Government-Backed Securities | 3,731 | - | ||||||

| Investments: Corporate Bonds | 1,182 | - | ||||||

| Total | 13,408 | 4,353 | ||||||

Subsequent to December 31, 2024, we received

Conference Call Information

VERB CEO, Rory J. Cutaia will hold a conference call today, March 25, 2025, at 1:00 p.m. Eastern time to discuss the 2024 results and strategic plans for 2025. A telephonic replay of the conference call is available from 4:00 p.m. Eastern time today through April 8, 2025.

VERB Q4 and FY 2024 Earnings Call

Date: Tuesday, March 25, 2025

Time: 1:00 p.m. Eastern time (10:00 a.m. Pacific time)

To access by phone: Please call the conference telephone number 10-15 minutes prior to the start time. An operator will register your name and organization.

Meeting Link: CLICK HERE

Toll Free: 1-877-407-4018

Toll/International: 1-201-689-8471

Telephonic Replay: Available after 4:00 p.m. Eastern time on the same day through Tuesday, April 8, 2025 at 11:59 PM ET

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13752553

About VERB

Verb Technology Company, Inc. (Nasdaq: VERB), is the innovative force behind interactive video-based social commerce. The Company operates three business units, each of which leverages its social commerce technology and video marketing expertise. The Company’s MARKET.live platform is a multi-vendor, livestream social shopping destination at the forefront of the convergence of e-commerce and entertainment, where brands, retailers, creators, and influencers engage their customers, clients, fans, and followers across multiple social media channels simultaneously. GO FUND YOURSELF is a revolutionary interactive social crowd funding platform and TV show for public and private companies seeking broad-based exposure across social media channels for their crowd-funded Regulation CF and Regulation A offerings. The platform combines a ground-breaking interactive TV show with MARKET.live’s back-end capabilities allowing viewers to tap, scan or click on their screen to facilitate an investment, in real time, as they watch companies presenting before the show’s panel of “Titans”. Presenting companies that sell consumer products are able to offer their products directly to viewers during the show in real time through shoppable onscreen icons. VANITYPrescribed.com and GoodGirlRx.com are telehealth portals, intended to redefine telehealth by offering a seamless, digital-first experience that empowers individuals to take control of their healthcare needs. They were designed and developed to disrupt the traditional healthcare model by providing tailored healthcare solutions at affordable, fixed prices – without hidden fees, membership costs, or inflated pharmaceutical markups. GoodGirlRx.com, a partnership with Savannah Chrisley, a well-known lifestyle personality and advocate for health and wellness, offers customers access to convenient, no-hassle telehealth services and pharmaceuticals, including the new weight-loss drugs, with fixed pricing regardless of dosage, breaking away from the industry’s traditional model of excessive pricing and pharmaceutical gatekeeping.

The Company is headquartered in Las Vegas, NV and operates full-service production and creator studios in Los Alamitos, California.

For more information, please visit: www.verb.tech

Follow VERB and MARKET.live here:

VERB on Facebook: https://www.facebook.com/VerbTechCo

VERB on Twitter: https://twitter.com/VerbTech_Co

VERB on LinkedIn: https://www.linkedin.com/company/verb-tech

VERB on YouTube: https://www.youtube.com/channel/UC0eCb_fwQlwEG3ywHDJ4_KQ

Sign up for E-mail Alerts here: https://ir.verb.tech/news-events/email-alerts

FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties and include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance, or achievements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, those identified in our filings with the Securities and Exchange Commission (the “SEC”), including our annual, quarterly and current reports filed with the SEC and the risk factors included in our annual report on Form 10-K filed with the SEC today. Any forward-looking statement made by us herein is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement whether as a result of new information, future developments or otherwise.

Investor Relations Contact: investors@verb.tech

Media Contact: info@verb.tech

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/98fa0d86-9d94-4cfa-97f5-ffd4c89edad9

https://www.globenewswire.com/NewsRoom/AttachmentNg/c013f2c6-3f17-4624-bd9a-60b7c28ab5fe