Vaccinex Reports Third Quarter 2024 Financial Results and Provides Corporate Update

Vaccinex (VCNX) reported Q3 2024 financial results and provided updates on its Alzheimer's disease program. The company reported final data from its SIGNAL-AD clinical trial, showing that pepinemab treatment slowed cognitive decline in patients with early signs of cognitive deficits. Cash and equivalents were $2.9 million as of September 30, 2024. The company recently completed a private placement raising $2.15 million and received approximately $6.2 million from warrant exercises. Q3 net loss was $5.7 million or $(2.83) per share. The company is currently facing Nasdaq listing compliance issues and has submitted a plan to maintain its listing.

Vaccinex (VCNX) ha riportato i risultati finanziari del terzo trimestre 2024 e fornito aggiornamenti sul suo programma per la malattia di Alzheimer. L'azienda ha reso noti i dati finali del suo trial clinico SIGNAL-AD, mostrando che il trattamento con pepinemab ha rallentato il declino cognitivo nei pazienti con segni precoci di deficit cognitivo. Le disponibilità liquide e equivalenti ammontano a 2,9 milioni di dollari al 30 settembre 2024. Recentemente, l'azienda ha completato un collocamento privato che ha raccolto 2,15 milioni di dollari e ha ricevuto circa 6,2 milioni di dollari dall'esercizio di warrant. La perdita netta per il terzo trimestre è stata di 5,7 milioni di dollari, ovvero $(2,83) per azione. Attualmente, l'azienda sta affrontando problemi di conformità con le quotazioni Nasdaq e ha presentato un piano per mantenere la propria quotazione.

Vaccinex (VCNX) informó los resultados financieros del tercer trimestre de 2024 y proporcionó actualizaciones sobre su programa para la enfermedad de Alzheimer. La compañía presentó datos finales de su ensayo clínico SIGNAL-AD, mostrando que el tratamiento con pepinemab desaceleró el deterioro cognitivo en pacientes con signos tempranos de déficit cognitivo. El efectivo y equivalentes ascendían a 2,9 millones de dólares al 30 de septiembre de 2024. Recientemente, la compañía completó una colocación privada que recaudó 2,15 millones de dólares y recibió aproximadamente 6,2 millones de dólares por la ejecución de warrants. La pérdida neta del tercer trimestre fue de 5,7 millones de dólares, o $(2,83) por acción. Actualmente, la empresa enfrenta problemas de cumplimiento de cotización en Nasdaq y ha presentado un plan para mantener su listado.

Vaccinex (VCNX)는 2024년 3분기 재무 결과를 보고하고 알츠하이머병 프로그램에 대한 업데이트를 제공했습니다. 이 회사는 SIGNAL-AD 임상 시험의 최종 데이터를 발표하였으며, pepinemab 치료가 인지 결핍의 초기 징후가 있는 환자에서 인지 저하를 늦춘 것을 보여주었습니다. 2024년 9월 30일 기준으로 현금 및 현금성 자산은 290만 달러였습니다. 최근 회사는 215만 달러을 모금하는 사모 배정을 완료했으며, 약 620만 달러를 워런트 행사로 받았습니다. 3분기 순손실은 570만 달러 또는 주당 $(2.83)였습니다. 현재 회사는 나스닥 상장 준수 문제에 직면해 있으며 상장을 유지하기 위한 계획을 제출했습니다.

Vaccinex (VCNX) a publié les résultats financiers du troisième trimestre 2024 et a fourni des mises à jour sur son programme concernant la maladie d'Alzheimer. La société a rendu publics les données finales de son essai clinique SIGNAL-AD, montrant que le traitement au pepinemab a ralenti le déclin cognitif chez des patients présentant des signes précoces de déficits cognitifs. À la date du 30 septembre 2024, la société disposait de 2,9 millions de dollars en liquidités et équivalents. Récemment, l'entreprise a finalisé un placement privé ayant permis de lever 2,15 millions de dollars et a reçu environ 6,2 millions de dollars grâce à l'exercice de warrants. La perte nette au troisième trimestre s'est élevée à 5,7 millions de dollars, soit $(2,83) par action. Actuellement, l'entreprise fait face à des problèmes de conformité liés à son inscription au Nasdaq et a soumis un plan pour maintenir cette inscription.

Vaccinex (VCNX) hat die Finanzzahlen für das dritte Quartal 2024 veröffentlicht und Updates zu seinem Alzheimer-Programm bereitgestellt. Das Unternehmen hat die endgültigen Daten aus seiner SIGNAL-AD-Studie präsentiert, die zeigen, dass die Behandlung mit Pepinemab den kognitiven Rückgang bei Patienten mit frühen Anzeichen von kognitiven Defiziten verlangsamte. Die liquiden Mittel und Äquivalente beliefen sich zum 30. September 2024 auf 2,9 Millionen Dollar. Das Unternehmen hat kürzlich eine Privatplatzierung abgeschlossen, bei der 2,15 Millionen Dollar gesammelt wurden, und erhielt etwa 6,2 Millionen Dollar aus der Ausübung von Warrants. Der Nettoverlust im dritten Quartal betrug 5,7 Millionen Dollar oder $(2,83) pro Aktie. Das Unternehmen sieht sich derzeit mit Problemen bezüglich der Einhaltung der Nasdaq-Listung konfrontiert und hat einen Plan zur Aufrechterhaltung der Listung eingereicht.

- Successful completion of financing rounds raising $8.35 million combined

- Clinical trial data shows pepinemab slowing cognitive decline in Alzheimer's patients

- Positive biomarker responses in SIGNAL-AD trial

- Increased net loss to $5.7 million in Q3 2024 from $4.9 million in Q3 2023

- Low cash position of $2.9 million as of September 30, 2024

- Risk of Nasdaq delisting due to non-compliance with stockholders' equity requirements

Insights

The Q3 results reveal significant financial challenges for VCNX. With only

The Alzheimer's trial data shows promise but lacks statistical significance in key areas. While pursuing partnership opportunities could provide a lifeline, the company's weak financial position may impact negotiating leverage. Investors should note the significant risks, including potential NASDAQ delisting and ongoing capital needs.

The SIGNAL-AD trial results demonstrate potential efficacy through biomarker improvements in GFAP and p-tau 217, important indicators of disease progression. The cognitive benefit trends across multiple measures (CDR-SB, iADRS, ADAS-Cog13) in early-stage patients (MMSE 22-26) are particularly noteworthy. The replication of benefits seen in Huntington's disease patients strengthens the therapeutic hypothesis.

However, the study's segmentation reduced group sizes, impacting statistical significance. While the mechanism of action appears sound, larger confirmatory trials would be needed for regulatory approval. The parallel findings in both Alzheimer's and Huntington's suggest broader neurodegenerative disease applications, potentially attracting partnership interest despite the current financial constraints.

Actively Exploring Partnership for Alzheimer’s Development

Supplementary Financing Concluded in Q4

ROCHESTER, N.Y., Nov. 18, 2024 (GLOBE NEWSWIRE) -- Vaccinex, Inc. (Nasdaq: VCNX), a clinical-stage biotechnology company pioneering a differentiated approach to treating neurodegenerative disease and cancer through the inhibition of Semaphorin 4D (SEMA4D), today announced financial results for the third quarter ended September 30, 2024 and provided a corporate update on its key program for Alzheimer’s disease.

Treatment with pepinemab believed to slow cognitive decline due to Alzheimer’s disease:

Vaccinex reported final data from its SIGNAL-AD clinical trial at the Alzheimer’s Association International Conference in Philadelphia on July 31, 2024 and at the Clinical Trials on Alzheimer’s Disease Conference in Madrid, Spain on October 31, 2024. The study enrolled participants with Mild Cognitive Impairment (MCI) or Mild Dementia. Key findings included:

- Treatment with Vaccinex’s pepinemab antibody to SEMA4D slowed expression of key biomarkers of disease progression, including blood levels of glial fibrillary acidic protein (GFAP) released by reactive astrocytes in brain, and phosphorylated tau peptide (p-tau 217), a byproduct of formation of toxic “tau tangles” in neurons. Changes in these biomarkers occur early in disease and reflect disease processes that are believed to lead to neuronal damage that compromises brain activity and cognition.

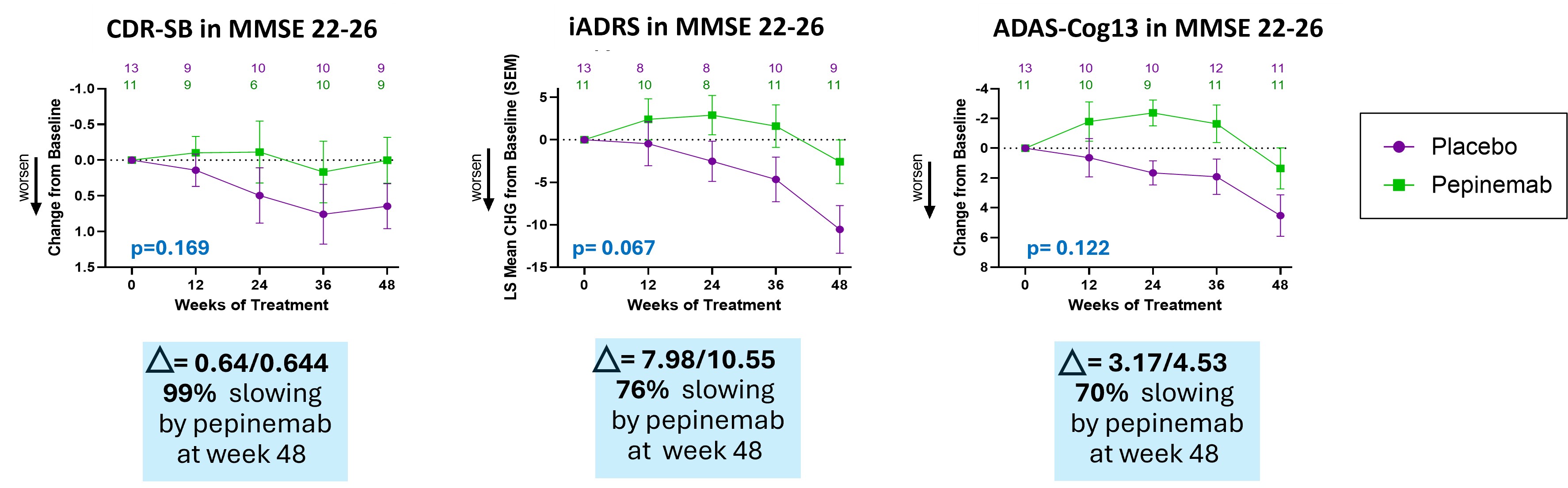

- Treatment with pepinemab after cognitive deficits become evident shows a consistent trend of slowing cognitive decline as determined by multiple established cognitive measures, CDR-SB, iADRS and ADAS-Cog13. This study was designed to test treatment effects at different stages of disease within the span of MCI and Mild Dementia. We found that biomarker and cognitive responses segregate among these groups, which had the effect of reducing group size and statistical significance. Nevertheless, the magnitude of cognitive improvement in patients who showed early signs of cognitive deficits (MMSE 22-26) was noteworthy.

Pepinemab treatment appears to slow cognitive decline improvement in patients who showed early signs of cognitive deficits (MMSE 22-26)

Treatment with pepinemab shows a consistent trend of slowing cognitive decline as determined by multiple established cognitive measures, CDR-SB, iADRS and ADAS-Cog13. Percent slowing is calculated using the formula: % slowing = ((Change with pepinemab – Change with placebo) / Change with placebo) * 100.

- These observations replicate and extend previous evidence of cognitive benefit in a larger prior study of pepinemab treatment in patients with Huntington’s disease, another neurodegenerative disease that is also characterized by astrocyte activation and neuroinflammation preceding cognitive decline. A statistically significant slowing of cognitive decline was observed for a randomized group of 180 patients in that study with a p-value of 0.007, improving even further (p=0.0025) in the subset of patients with early signs of cognitive deficits.

- The Company is encouraged by these similar findings in two different devastating neurodegenerative diseases that have parallel pathology and is actively pursuing partnering discussions to more rapidly advance further development.

- The SIGNAL-AD study was funded in part by investments from the Alzheimer’s Drug Discovery Foundation (ADDF) and by a grant from the Alzheimer’s Association.

Treatment with pepinemab enhances immune activity in HPV-negative and PD-L1 low head and neck cancer (HNSCC), overcoming limitations of immune checkpoint therapy in these patient populations.

At the Society for Immunotherapy of Cancer’s Annual Meeting (SITC) on November 8, 2024, Vaccinex scientists presented data from the Phase 2 KEYNOTE-B84 study (NCT04815720) for treatment of recurrent and metastatic disease in patients with poorly immunogenic, HPV-negative, head and neck cancer (HNSCC). The presentation also reviewed data from an independent study evaluating neoadjuvant treatment of resectable HNSCC (NCT03690986). The two studies showed that pepinemab in combination with KEYTRUDA® appears to induce mature lymphoid aggregates that correlate with clinical benefit in HPV-negative and PD-L1 low patients who otherwise show limited response to immunotherapy.

Financial Results for the Quarter Ended September 30, 2024:

Cash and Cash Equivalents and Marketable Securities. Cash and cash equivalents and marketable securities on September 30, 2024, were

On November 13, 2024, the Company entered into a securities purchase agreement pursuant to which the Company issued and sold to the purchasers named therein an aggregate of (i) 76,909 shares of the Company’s common stock at a price of

On September 17, 2024, the Company entered into inducement letter agreements with holders of existing warrants to purchase up to an aggregate of 1,067,492 shares of the Company’s common stock, par value

Research and Development Expenses. Research and development expenses for the quarter ended September 30, 2024, were

General and Administrative Expenses. General and administrative expenses for the quarter ended September 30, 2024, were

Comprehensive loss/Net loss per share. The Comprehensive Loss and Net loss per share for the quarter ended September 30, 2024, were

Total Stockholders’ Equity. On October 7, 2024, the Company received a letter from the Nasdaq Listing Staff stating that the Company had not regained compliance with the continued listing standards related to Stockholders’ Equity and that, as a result, unless the Company timely requested an appeal of this determination to a Nasdaq Hearings Panel, Nasdaq would move to suspend trading of the Company’s common stock and to have the Company’s securities delisted from the Nasdaq Capital Market. The Company timely appealed the determination, which automatically stayed any suspension or delisting action pending the Hearings Panel’s decision and the expiration of any additional extension period granted by the Hearings Panel following the hearing. Nasdaq required the Company to submit a plan by November 15, 2024, describing how it would regain compliance with the Equity Standard through calendar year 2025. The Company submitted the required plan om November 15, 2024, and, while the Company is confident that its plan is promising and feasible, the Company cannot provide assurances that Nasdaq will accept the plan and that the Hearings Panel will grant the Company’s request for continued listing or that the Company will be able to demonstrate compliance with the Stockholders’ Equity Standard or the Alternative Standards within any additional compliance period that may be granted by the Hearings Panel.

For further details on Vaccinex’s financials, please refer to its Form 10K filed April 1, 2024, with the SEC, and subsequently filed Quarterly Reports on Form 10-Q.

About Pepinemab

Pepinemab is a humanized IgG4 monoclonal antibody designed to block SEMA4D, which can trigger collapse of the actin cytoskeleton and loss of homeostatic functions of astrocytes and other glial cells in the brain and dendritic cells in immune tissue. Over 600 patients have been enrolled in randomized clinical trials of pepinemab in different indications and pepinemab appears to be well-tolerated with a favorable safety profile.

About Vaccinex Inc.

Vaccinex, Inc. is pioneering a differentiated approach to treating slowly progressive neurodegenerative diseases and cancer through the inhibition of semaphorin 4D (SEMA4D). The Company’s lead drug candidate, pepinemab, blocks SEMA4D, a potent biological effector that it believes triggers damaging inflammation in chronic diseases of the brain and prevents immune infiltration into tumors. Pepinemab was studied as a monotherapy in the Phase 1/2a SIGNAL-AD study in Alzheimer’s Disease, with ongoing exploration of potential Phase 3 development in Huntington’s disease. In oncology, pepinemab is being evaluated in combination with KEYTRUDA® in the Phase 1b/2 KEYNOTE-B84 study in recurrent or metastatic head and neck cancer (HNSCC) and in combination with BAVENCIO® in a Phase 1b/2 study in patients with metastatic pancreatic adenocarcinoma (PDAC). The oncology clinical program also includes several investigator-sponsored studies in solid tumors including breast cancer and melanoma.

Vaccinex has global commercial and development rights to pepinemab and is the sponsor of the KEYNOTE-B84 study which is being performed in collaboration with Merck Sharp & Dohme Corp, a subsidiary of Merck and Co, Inc. Kenilworth, NJ, USA. Additional information about the study is available at: clinicaltrials.gov.

KEYTRUDA is a registered trademark of Merck Sharp & Dohme Corp., a subsidiary of Merck & Co. Inc., Kenilworth, NJ, USA. BAVENCIO®/avelumab is provided by Merck KGaA, Darmstadt, Germany, previously as part of an alliance between the healthcare business of Merck KGaA, Darmstadt, Germany and Pfizer.

Forward Looking Statements

To the extent that statements contained in this letter are not descriptions of historical facts regarding Vaccinex, Inc. (“Vaccinex,” “we,” “us,” or “our”), they are forward-looking statements reflecting management’s current beliefs and expectations. Such statements include, but are not limited to, statements about the use and potential benefits of pepinemab treatment in patients with AD and HD; the potential and prospects for continuing late stage development of pepinemab, including as part of a prospective partnership; the continued listing of the Company’s common stock on Nasdaq, including any extensions granted by the Nasdaq Hearings Panel; other statements identified by words such as “believe,” “being,” “will,” “appear,” “expect,” “ongoing,” “potential,” “promising,” “indicate,” “suggest,” “apparent”, and similar expressions or their negatives (as well as other words and expressions referencing future events, conditions, or circumstances). Forward-looking statements involve substantial risks and uncertainties that could cause the outcome of our research and pre-clinical development programs, clinical development programs, future results, performance, or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, uncertainties inherent in the execution, cost and completion of preclinical studies and clinical trials, risks related to reliance on third parties, that interim and preliminary data may not be predictive of final results and does not ensure success in later clinical trials, uncertainties related to regulatory approval, risks related to our dependence on our lead product candidate pepinemab, the possible delisting of our common stock from Nasdaq if the Company is unable to regain and sustain compliance with the Nasdaq listing standards, and other matters that could affect our development plans or the commercial potential of our product candidates. Except as required by law, the Company assumes no obligation to update these forward-looking statements. For a further discussion of these and other factors that could cause future results to differ materially from any forward-looking statement, see the section titled “Risk Factors” in our periodic reports filed with the Securities and Exchange Commission and the other risks and uncertainties described in the Company’s annual year-end Form 10-K and subsequent filings with the SEC.

Investor Contact

Elizabeth Evans, PhD

Chief Operating Officer, Vaccinex, Inc.

(585) 271-2700

eevans@vaccinex.com

| Condensed Balance Sheets (Unaudited) (in thousands, except share and per share data) | ||||||||

| As of September 30, 2024 | As of December 31, 2023 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 2,906 | $ | 1,535 | ||||

| Accounts receivable | 985 | 961 | ||||||

| Prepaid expenses and other current assets | 852 | 853 | ||||||

| Derivative asset | 14 | - | ||||||

| Total current assets | 4,757 | 3,349 | ||||||

| Property and equipment, net | 82 | 136 | ||||||

| Operating lease right-of-use asset | 15 | 146 | ||||||

| TOTAL ASSETS | $ | 4,854 | $ | 3,631 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 4,865 | $ | 2,039 | ||||

| Accrued expenses | 1,200 | 1,242 | ||||||

| Deferred revenue | 51 | 63 | ||||||

| Current portion of long-term debt | 44 | 75 | ||||||

| Operating lease liability | 15 | 146 | ||||||

| Warrant liability | - | 2,351 | ||||||

| Total current liabilities | 6,175 | 5,916 | ||||||

| Long-term debt | - | 26 | ||||||

| TOTAL LIABILITIES | 6,175 | 5,942 | ||||||

| Commitments and contingencies (Note 6) | ||||||||

| Stockholders’ equity (deficit): | ||||||||

| Convertible preferred stock (Series A), par value of | 1,522 | - | ||||||

| Common stock, par value of | 1 | - | ||||||

| Additional paid-in capital | 352,354 | 337,627 | ||||||

| Treasury stock, at cost; 5 shares of common stock as of September 30, 2024, and December 31, 2023, respectively | (11 | ) | (11 | ) | ||||

| Accumulated deficit | (355,187 | ) | (339,927 | ) | ||||

| TOTAL STOCKHOLDERS’ EQUITY/(DEFICIT) | (1,321 | ) | (2,311 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 4,854 | $ | 3,631 | ||||

| VACCINEX, INC. Condensed Statements of Operations and Comprehensive Loss (Unaudited) (in thousands, except share and per share data) | ||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | $ | 52 | $ | 20 | $ | 388 | $ | 570 | ||||||||

| Costs and expenses: | ||||||||||||||||

| Research and development | 3,165 | 4,355 | 10,412 | 13,217 | ||||||||||||

| General and administrative | 1,439 | 1,499 | 5,324 | 5,250 | ||||||||||||

| Total costs and expenses | 4,604 | 5,854 | 15,736 | 18,467 | ||||||||||||

| Loss from operations | (4,552 | ) | (5,834 | ) | (15,348 | ) | (17,897 | ) | ||||||||

| Interest expense | - | - | - | (1 | ) | |||||||||||

| Loss on settlement of warrants | (1,106 | ) | - | (1,106 | ) | - | ||||||||||

| Financing costs - warrant liabilities | - | - | (28 | ) | - | |||||||||||

| Change in fair value of warrant liabilities | (71 | ) | - | 1,291 | - | |||||||||||

| Change in fair value of derivative asset | - | - | (81 | ) | - | |||||||||||

| Other income (expense), net | (3 | ) | 922 | 12 | 964 | |||||||||||

| Loss before provision for income taxes | (5,732 | ) | (4,912 | ) | (15,260 | ) | (16,934 | ) | ||||||||

| Provision for income taxes | - | - | - | - | ||||||||||||

| Net loss attributable to Vaccinex, Inc. common stockholders | $ | (5,732 | ) | $ | (4,912 | ) | $ | (15,260 | ) | $ | (16,934 | ) | ||||

| Comprehensive loss | $ | (5,732 | ) | $ | (4,912 | ) | $ | (15,260 | ) | $ | (16,934 | ) | ||||

| Net loss per share attributable to Vaccinex, Inc. common stockholders, basic and diluted | $ | (2.83 | ) | $ | (15.25 | ) | $ | (8.85 | ) | $ | (59.95 | ) | ||||

| Weighted-average shares used in computing net loss per share attributable to Vaccinex, Inc. common stockholders, basic and diluted | 2,026,920 | 322,153 | 1,724,088 | 282,467 | ||||||||||||

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/551b0bc4-4495-4a65-aa21-a96daddf079e