UTMD Reports Year 2024 and Fourth Quarter Financial Performance

Utah Medical Products (NASDAQ:UTMD) reported significant declines in its 2024 financial performance, with revenues down 19%, net income down 17%, and EPS down 13% compared to 2023. The company's stock price declined 27%, which enabled UTMD to repurchase over 8% of its shares.

The $9.3 million decline in annual revenues was primarily attributed to three factors: a 69% decline ($5.9M) in PendoTECH OEM sales, a 20% reduction ($2.1M) in OUS distributor sales (excluding Filshie), and a 12% decrease ($1.5M) in worldwide Filshie device sales.

Despite lower sales, profit margins remained relatively stable. The company maintained its gross profit margin at 59.0% in 2024 (vs 59.8% in 2023) through manufacturing personnel reductions and closing the second production shift in Utah. The balance sheet remained strong with $83.0 million in cash and investments as of December 31, 2024, though down from $92.9 million in 2023.

Utah Medical Products (NASDAQ:UTMD) ha riportato significativi cali nelle sue performance finanziarie del 2024, con ricavi diminuiti del 19%, reddito netto diminuito del 17% e utili per azione ridotti del 13% rispetto al 2023. Il prezzo delle azioni della società è calato del 27%, il che ha permesso ad UTMD di riacquistare oltre l'8% delle proprie azioni.

La diminuzione annuale dei ricavi di 9,3 milioni di dollari è stata attribuita principalmente a tre fattori: un calo del 69% (5,9 milioni di dollari) nelle vendite OEM di PendoTECH, una riduzione del 20% (2,1 milioni di dollari) nelle vendite degli distributori OUS (escludendo Filshie), e una diminuzione del 12% (1,5 milioni di dollari) nelle vendite globali dei dispositivi Filshie.

Nonostante le vendite più basse, i margini di profitto sono rimasti relativamente stabili. L'azienda ha mantenuto il proprio margine di profitto lordo al 59,0% nel 2024 (rispetto al 59,8% nel 2023) attraverso riduzioni del personale di produzione e la chiusura del secondo turno produttivo in Utah. Il bilancio è rimasto solido con 83,0 milioni di dollari in contante e investimenti al 31 dicembre 2024, anche se in calo rispetto ai 92,9 milioni di dollari del 2023.

Utah Medical Products (NASDAQ:UTMD) reportó caídas significativas en su desempeño financiero de 2024, con ingresos disminuidos en un 19%, ingresos netos reducidos en un 17% y EPS disminuido en un 13% en comparación con 2023. El precio de las acciones de la compañía cayó un 27%, lo que le permitió a UTMD recomprar más del 8% de sus acciones.

La disminución de ingresos anuales de 9.3 millones de dólares se atribuyó principalmente a tres factores: una caída del 69% (5.9 millones de dólares) en las ventas OEM de PendoTECH, una reducción del 20% (2.1 millones de dólares) en las ventas de distribuidores OUS (excluyendo Filshie) y una disminución del 12% (1.5 millones de dólares) en las ventas de dispositivos Filshie a nivel mundial.

A pesar de las menores ventas, los márgenes de ganancia se mantuvieron relativamente estables. La compañía mantuvo su margen de ganancia bruta en 59.0% en 2024 (vs 59.8% en 2023) a través de reducciones de personal de fabricación y el cierre del segundo turno de producción en Utah. El balance general se mantuvo sólido con 83.0 millones de dólares en efectivo e inversiones al 31 de diciembre de 2024, aunque en descenso desde los 92.9 millones de dólares en 2023.

유타 의료 제품 (NASDAQ:UTMD)는 2024년 재무 성과에서 19%의 수익 감소, 17%의 순이익 감소 및 2023년 대비 13%의 주당순이익(EPS) 감소를 보고했습니다. 회사의 주가는 27% 하락했으며, 이는 UTMD가 8% 이상의 자사주를 재매입할 수 있게 했습니다.

9.3백만 달러의 연간 수익 감소는 세 가지 요인에 주로 기인했습니다: PendoTECH OEM 판매의 69% 감소(5.9백만 달러), OUS 유통업체 판매의 20% 감소(2.1백만 달러, Filshie 제외) 및 전 세계 Filshie 장치 판매의 12% 감소(1.5백만 달러)입니다.

판매가 감소했음에도 불구하고 이윤 마진은 상대적으로 안정적으로 유지되었습니다. 회사는 유타에서 두 번째 생산 근무조를 폐쇄하고 생산 인력을 줄여 2024년 총 매출 총이익률을 59.0%(2023년 59.8% 대비)로 유지했습니다. 2024년 12월 31일 기준으로 현금 및 투자액이 8300만 달러로 유지되었으며, 이는 2023년 9290만 달러에서 감소한 수치입니다.

Utah Medical Products (NASDAQ:UTMD) a signalé des baisses significatives de ses performances financières de 2024, avec des revenus en baisse de 19%, un revenu net en baisse de 17% et un BPA en baisse de 13% par rapport à 2023. Le prix de l'action de l'entreprise a chuté de 27%, ce qui a permis à UTMD de racheter plus de 8% de ses actions.

La baisse des revenus annuels de 9,3 millions de dollars a été principalement attribuée à trois facteurs : une baisse de 69% (5,9 millions de dollars) des ventes OEM de PendoTECH, une réduction de 20% (2,1 millions de dollars) des ventes des distributeurs OUS (hors Filshie) et une diminution de 12% (1,5 million de dollars) des ventes mondiales des dispositifs Filshie.

Malgré des ventes plus faibles, les marges bénéficiaires sont restées relativement stables. L'entreprise a maintenu sa marge brute à 59,0% en 2024 (contre 59,8% en 2023) à travers des réductions de personnel de production et la fermeture du deuxième poste de production dans l'Utah. Le bilan est resté solide avec 83,0 millions de dollars en liquidités et investissements au 31 décembre 2024, bien que cela soit en baisse par rapport à 92,9 millions de dollars en 2023.

Utah Medical Products (NASDAQ:UTMD) meldete erhebliche Rückgänge in seiner finanziellen Leistung für 2024, wobei die Einnahmen um 19%, der Nettogewinn um 17% und das EPS um 13% im Vergleich zu 2023 sanken. Der Aktienkurs des Unternehmens fiel um 27%, was es UTMD ermöglichte, über 8% seiner Aktien zurückzukaufen.

Der Rückgang der jährlichen Einnahmen um 9,3 Millionen Dollar wurde hauptsächlich auf drei Faktoren zurückgeführt: einen Rückgang von 69% (5,9 Millionen Dollar) bei den OEM-Verkäufen von PendoTECH, eine Reduzierung von 20% (2,1 Millionen Dollar) bei den Verkäufen von OUS-Distributoren (ohne Filshie) und einen Rückgang von 12% (1,5 Millionen Dollar) bei den weltweiten Verkäufen von Filshie-Geräten.

Trotz der geringeren Verkäufe blieben die Gewinnmargen relativ stabil. Das Unternehmen hielt seine Bruttomarge 2024 bei 59,0% (vs 59,8% in 2023) durch Personalabbau in der Fertigung und die Schließung der zweiten Produktionsschicht in Utah. Die Bilanz blieb stark mit 83,0 Millionen Dollar in bar und Investitionen zum 31. Dezember 2024, obwohl dies ein Rückgang von 92,9 Millionen Dollar in 2023 war.

- Maintained strong profit margins despite revenue decline (GP margin 59.0%)

- Strong balance sheet with $83.0M cash and investments, no debt

- Strategic 8% share repurchase during market weakness

- Reduced manufacturing costs through operational efficiency measures

- Revenue declined 19% to $40.9M in 2024

- Net income decreased 17% year-over-year

- EPS dropped 13% compared to 2023

- Stock price declined 27% during the year

- PendoTECH OEM sales dropped 69% ($5.9M decline)

- Worldwide Filshie device sales decreased 12% ($1.5M decline)

Insights

UTMD's 2024 results reveal a complex financial picture that requires careful analysis. The 19% revenue decline to

- A 69% drop in PendoTECH OEM sales (

$5.9 million reduction) - Reduced OUS distributor sales, particularly in China

- 12% decline in worldwide Filshie device sales

Despite these headwinds, UTMD demonstrated remarkable operational resilience. The company maintained a robust 59% gross profit margin through strategic cost management, including production shift consolidation. The completion of CSI IIA amortization (

The company's capital allocation strategy was particularly noteworthy. UTMD leveraged the 27% stock price decline to repurchase 8% of outstanding shares, while maintaining strong liquidity with

Looking ahead to 2025, management projects another decline in revenues, albeit at a lower rate. Key factors include:

- Expected

$2 million reduction in PendoTECH sales - Slightly higher China distributor orders

- Potential recovery in OUS distributor and Filshie device sales pending regulatory approvals

The company's strong balance sheet, consistent margins and strategic capital deployment position it well to navigate continued market challenges while maintaining operational efficiency.

SALT LAKE CITY, UT / ACCESS Newswire / January 28, 2025 / With Revenues

Currencies in this release are denoted as $ or USD = U.S. Dollars; AUD = Australia Dollars; £ or GBP = UK Pound Sterling; C$ or CAD = Canadian Dollars; and € or EUR = Euros. Currency amounts throughout this report are in thousands, except per share amounts and where noted.

Overview of Results

A summary comparison of 4Q and calendar year 2024 income statement category declines relative to the same periods of 2023 follows:

2024 to 2023 Comparison |

|

| 4Q |

| Year | |||

Revenues (Sales): |

|

| (26 | %) |

|

| (19 | %) |

Gross Profit (GP): |

|

| (25 | %) |

|

| (20 | %) |

Operating Income (OI): |

|

| (26 | %) |

|

| (19 | %) |

Income Before Tax (EBT): Net Income (NI): |

|

| (28 | %) |

|

| (16 | %) |

Earnings Per Share (EPS): |

|

| (27 | %) |

|

| (13 | %) |

Despite the lower sales, profit margins in 4Q and year 2024 held up well compared to 4Q and year 2023, for reasons described later in this report:

| 4Q 2024 (Oct - Dec) |

|

| 4Q 2023 (Oct-Dec) |

|

| 2024 (Jan-Dec) |

|

| 2023 (Jan-Dec) |

| |||||

Gross Profit Margin (GP/ sales): |

|

| 58.1 | % |

|

| 57.6 | % |

|

| 59.0 | % |

|

| 59.8 | % |

Operating Income Margin (OI/ sales): |

|

| 32.0 | % |

|

| 32.0 | % |

|

| 33.2 | % |

|

| 33.4 | % |

Income Before Tax Margin (EBT/ sales): |

|

| 39.5 | % |

|

| 40.7 | % |

|

| 41.1 | % |

|

| 40.0 | % |

Net Income Margin (NI/ sales): |

|

| 31.7 | % |

|

| 34.8 | % |

|

| 33.9 | % |

|

| 33.1 | % |

Because revenue results for any given three-month period in comparison with a previous three-month period are not indicative of comparative results for the year as a whole, investors should focus on the annual results described later in this release. Focusing on the causes of the

Revenue Category: |

| 2024 Sales [million $] |

|

| 2023 Sales [million $] |

|

| Decline [million $] |

|

| Portion of |

| ||||

|

|

| 2.7 |

|

|

| 8.6 |

|

|

| (5.9 | ) |

|

| 64 | % |

2. OUS Distributors (excluding Filshie) |

|

| 8.7 |

|

|

| 10.8 |

|

|

| (2.1 | ) |

|

| 22 | % |

3. WW Filshie |

|

| 10.8 |

|

|

| 12.3 |

|

|

| (1.5 | ) |

|

| 16 | % |

Total Above: |

|

| 22.2 |

|

|

| 31.7 |

|

|

| (9.5 | ) |

|

| 102 | % |

Above % of Total Below: |

|

| 54 | % |

|

| 63 | % |

|

| 102 | % |

|

|

|

|

Total Consolidated WW Revenues: |

|

| 40.9 |

|

|

| 50.2 |

|

|

| (9.3 | ) |

|

| 100 | % |

The OUS (Outside the U.S.) Distributor category (item 2 above) included UTMD's China distributor for blood pressure monitoring kits for which 2024 shipments were

The decline in WW Filshie device revenues (item 3 above) can be divided into three parts:

Filshie Device Sales |

| 2024 Sales |

|

| 2023 Sales |

|

| Revenue Decline [million $] |

|

| 2024 Revenue Decline from 2023 |

| ||||

Domestic Direct (to U.S. medical facilities) |

|

| 4.0 |

|

|

| 4.8 |

|

|

| (0.8 | ) |

|

| (15 | %) |

OUS Direct (to medical facilities outside the U.S.) |

|

| 5.3 |

|

|

| 5.8 |

|

|

| (0.5 | ) |

|

| ( 9 | %) |

OUS distributors |

|

| 1.5 |

|

|

| 1.7 |

|

|

| (0.2 | ) |

|

| (14 | %) |

Total Filshie Revenues: |

|

| 10.8 |

|

|

| 12.3 |

|

|

| (1.5 | ) |

|

| (12 | %) |

OUS Direct Filshie revenues were sales by UTMD subsidiaries directly to medical facilities in the UK, France, Ireland, Canada, Australia and New Zealand. Foreign currency exchange (FX) rate changes had a minimally positive impact on 2024 USD revenues compared to 2023.

Despite additional cost-of-living adjustments for employees in 2024 and continued inflation in raw material costs, UTMD was nevertheless able to maintain its GP margin in 2024 by reducing manufacturing personnel, including closing down the second production shift in Utah. The

UTMD's Operating Income margin was essentially the same in both years, despite retaining its critical mass of sales and marketing (S&M), product development (R&D) and general and administrative (G&A) resources at a higher cost. This occurred because the final 2023

On the other hand, non-operating income was lower as a result of a new excise tax levied on share repurchases in the U.S. and the fact that UTMD Ltd in Ireland did not enjoy the previous significant 2023 income from renting unused warehouse space in 2024. EPS benefited from UTMD repurchasing over

UTMD's December 31, 2024 Balance Sheet, in the continued absence of debt, remained strong. After using over

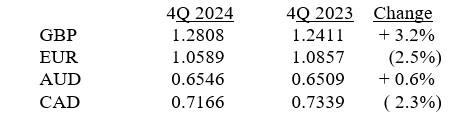

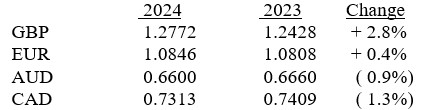

Foreign currency exchange (FX) rates for Balance Sheet purposes are the applicable rates at the end of each reporting period. The FX rates from the applicable foreign currency to USD for assets and liabilities at the end of calendar year 2024 compared to the end of 2023 and the end of 3Q 2024 follow:

|

| 12-31-24 |

| 12-31-23 |

| Change |

|

| 9-30-24 |

| Change |

| |

GBP |

|

| 1.25209 |

| 1.27386 |

| (1.7 | %) |

| 1.33958 |

| (6.5 | %) |

EUR |

|

| 1.03505 |

| 1.10593 |

| (6.4 | %) |

| 1.11429 |

| (7.1 | %) |

AUD |

|

| 0.61834 |

| 0.68248 |

| (9.4 | %) |

| 0.69312 |

| (10.8 | %) |

CAD |

|

| 0.69428 |

| 0.75733 |

| (8.3 | %) |

| 0.73987 |

| (6.2 | %) |

Revenues (sales) - 4Q 2024

Total consolidated 4Q 2024 UTMD worldwide (WW) sales were

Domestic U.S. sales in 4Q 2024 were

OUS sales in 4Q 2024 were

The combined weighted-average positive FX impact on 4Q 2024 foreign currency sales was less than

OUS sales invoiced in foreign currencies are to direct end-users in Ireland, the UK, France, Canada, Australia and New Zealand, and to OUS distributors of devices manufactured by UTMD subsidiaries in Ireland and the UK. Direct to end-user OUS sales in USD terms in 4Q 2024 which were

Sales -2024 Year

Total consolidated 2024 UTMD WW USD-denominated sales were

Looking forward to 2025 in those three revenue categories, even though PendoTECH sales were

OUS USD-denominated sales in 2024 were

Sales invoiced in foreign currencies, which were

The combined weighted-average favorable FX impact on 2024 foreign currency OUS sales was

Domestic U.S. sales in 2024 were

Looking forward to 2025, in summary, UTMD expects total WW consolidated revenues are likely to be lower again, in the low to mid-single percentage digits relative to 2024. UTMD's Form SEC 10-K 2024 annual report to be filed in March will provide management's projected 2025 financial performance.

Gross Profit (GP)

GP results from subtracting the costs of manufacturing, quality assurance and receiving materials from suppliers. With an

Operating Income (OI)

OI results from subtracting Operating Expenses (OE) from GP. For the year 2024, OI was

OE are comprised of Sales and Marketing (S&M) expenses, G&A expenses and Product Development (R&D) expenses. The following table summarizes OE in 4Q and year 2024 compared to the same periods in 2023 by OE category:

OE Category |

| 4Q 2024 |

| % of |

|

| 4Q 2023 |

| % of |

|

| 2024 |

| % of |

|

| 2023 |

| % of | |||||

S&M: |

| $ | 505 |

|

| 5.5 |

| $ | 475 |

|

| 3.9 |

| $ | 1,901 |

|

| 4.6 |

| $ | 1,685 |

|

| 3.4 |

G&A: |

|

| 1,767 |

|

| 19.3 |

|

| 2,533 |

|

| 20.5 |

|

| 7,835 |

|

| 19.2 |

|

| 11,016 |

|

| 21.9 |

R&D: |

|

| 121 |

|

| 1.3 |

|

| 146 |

|

| 1.2 |

|

| 813 |

|

| 2.0 |

|

| 560 |

|

| 1.1 |

Total OE: |

|

| 2,393 |

|

| 26.1 |

|

| 3,154 |

|

| 25.6 |

|

| 10,549 |

|

| 25.8 |

|

| 13,261 |

|

| 26.4 |

The following table summarizes "constant currency" OE in 4Q and year 2024 by OE category:

OE Category |

| 4Q 2024 |

|

| 2024 | ||

S&M: |

| $ | 505 |

|

| $ | 1,899 |

G&A: |

|

| 1,749 |

|

|

| 7,765 |

R&D: |

|

| 121 |

|

|

| 813 |

Total OE: |

|

| 2,375 |

|

|

| 10,477 |

The FX rate change impact on OE in both periods was minor. A stronger GBP increased the Femcare IIA amortization expense included in G&A expense in USD terms by

S&M expenses increased in 2024 primarily as a result of cost-of-living salary increases, and an increase in U.S. medical benefits. Constant currency S&M expenses were the same in the 4Q, and

With the exception of salary increases in all departments, the major changes in OE were in the G&A expense category. The main two G&A expense changes were in litigation expense and in the amortization of the

Litigation expenses in 2024 were

A division of G&A expenses by location follows:

G&A Exp Category |

| 4Q 2024 |

| % of |

| 4Q 2023 |

| % of |

| 2024 |

| % of |

| 2023 |

| % of | ||||||||

IIA Amort - UK: |

| $ | 509 |

|

| 5.6 |

| $ | 493 |

|

| 4 |

| $ | 2,031 |

|

| 5 |

| $ | 1,977 |

|

| 3.9 |

IIA Amort- CSI: |

|

| - |

|

| - |

|

| 368 |

|

| 3 |

|

| - |

|

| - |

|

| 3,684 |

|

| 7.3 |

UK: |

|

| 175 |

|

|

|

|

| 179 |

|

|

|

|

| 724 |

|

|

|

|

| 678 |

|

|

|

US: |

|

| 949 |

|

|

|

|

| 1,339 |

|

|

|

|

| 4,477 |

|

|

|

|

| 4,091 |

|

|

|

IRE: |

|

| 91 |

|

|

|

|

| 95 |

|

|

|

|

| 364 |

|

|

|

|

| 322 |

|

|

|

AUS: |

|

| 17 |

|

|

|

|

| 28 |

|

|

|

|

| 115 |

|

|

|

|

| 134 |

|

|

|

CAN: |

|

| 26 |

|

|

|

|

| 31 |

|

|

|

|

| 124 |

|

|

|

|

| 130 |

|

|

|

Total G&A: |

|

| 1,767 |

|

| 19.3 |

|

| 2,533 |

|

| 20.5 |

|

| 7,835 |

|

| 19.2 |

|

| 11,016 |

|

| 21.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Although the GBP-denominated IIA Amort-UK expense was the same in both years' periods, the USD increase was due to a stronger GBP FX rate. Looking forward, the approximate

Income Before Tax (EBT)

EBT results from subtracting net non‑operating expense (NOE) or adding net non-operating income (NOI) from or to, as applicable, OI. Consolidated 2024 EBT was

NOE/NOI includes the combination of 1) expenses from loan interest and bank fees; 2) U.S. excise taxes on share repurchases; 3) expenses or income from losses or gains from remeasuring the value of EUR cash bank balances in the UK, and GBP cash balances in Ireland, in USD terms; and 4) income from rent of underutilized property, investment income and royalties received from licensing the Company's technology. Negative NOE is NOI. Net NOI in 2024 was

EBITDA is a non-US GAAP metric that measures profitability performance without factoring in effects of financing, accounting decisions regarding non-cash expenses, capital expenditures or tax environments. Consolidated EBT excluding the remeasured bank balance currency gain or loss, interest expense, noncash effects of depreciation, amortization of intangible assets and stock option expense ("adjusted consolidated EBITDA") were

UTMD's adjusted consolidated EBITDA as a percentage of sales was

Management believes that this operating performance metric provides meaningful supplemental information to both management and investors and confirms UTMD's ongoing excellent financial performance.

UTMD's non-US GAAP adjusted consolidated EBITDA is the sum of the elements in the following table, each element of which is a US GAAP number:

|

| 4Q 2024 |

|

|

| 4Q 2023 |

|

|

| 2024 |

|

|

| 2023 | |

EBT |

| $ | 3,614 |

|

| $ | 5,017 |

|

| $ | 16,802 |

|

| $ | 20,089 |

Depreciation Expense |

|

| 201 |

|

|

| 158 |

|

|

| 730 |

|

|

| 624 |

Femcare IIA Amortization Expense |

|

| 509 |

|

|

| 493 |

|

|

| 2,030 |

|

|

| 1,977 |

CSI IIA Amortization Expense |

|

|

|

|

|

| 368 |

|

|

|

|

|

|

| 3,684 |

Other Non-Cash Amortization Expense |

|

| 8 |

|

|

| 7 |

|

|

| 35 |

|

|

| 31 |

Stock Option Compensation Expense Interest Expense |

|

| 72 |

|

|

| 73 |

|

|

| 256 |

|

|

| 225 |

Remeasured Foreign Currency Balances |

|

| 1 |

|

|

| (1 | ) |

|

| (1 | ) |

|

| 5 |

UTMD non-US GAAP EBITDA: |

| $ | 4,405 |

|

| $ | 6,115 |

|

| $ | 19,852 |

|

| $ | 26,635 |

Net Income (NI)

NI for the year 2024 of

Earnings per share (EPS).

Despite

The number of shares used for calculating 4Q 2024 and year 2024 EPS were higher than the December 31, 2024 outstanding shares balance of 3,335,156 because of a time-weighted calculation of average outstanding shares plus dilution from unexercised employee options. Outstanding shares at the end of calendar year 2024 of 3,335,156 compared to 3,629,525 at the end of 2023, a decline of

The number of shares added as a dilution factor for the year 2024 was zero compared to 8,303 in 2023. The number of shares added as a dilution factor for 4Q 2024 was zero compared to 2,539 in 4Q 2023. The number of shares added as dilution factors in 2024 was zero because the average exercise price was higher than the applicable period-ending market price. In November 2024, 24,600 non-qualified option shares were awarded to 47 employees and one new outside director at an exercise price of

UTMD paid

No shares were repurchased in 2023. In 2024, the following quarterly repurchases were made:

|

| # Shares Repurchased |

| Average Cost/ Share |

| Total Cost [$K] | ||

1Q 2024 |

| 43,108 |

| $ | 69.37 |

| $ | 2,990 |

2Q 2024 |

| 95,107 |

| $ | 67.33 |

|

| 6,403 |

3Q 2024 |

| 58,377 |

| $ | 66.22 |

|

| 3,866 |

4Q 2024 |

| 105,369 |

| $ | 63.67 |

|

| 6,709 |

|

| 301,961 |

| $ | 66.13 |

| $ | 19,968 |

The Company retains the strong desire and financial ability for repurchasing its shares at a price it believes is attractive for remaining stockholders. UTMD's closing share price at the end of 2024 was

Balance Sheet

Please see the December 31, 2024 Balance Sheet at the end of this report. At the end of 2024, UTMD's cash and investments at

Financial ratios as of December 31, 2024 which may be of interest to stockholders follow:

1) Current Ratio = 25.6

2) Days in Trade Receivables (based on 4Q 2024 sales activity) = 40.3

3) Average Inventory Turns in 2024 (based on 2024 CGS) = 1.8

4) 2024 ROE (before dividends) =

Investors are cautioned that this press release contains forward looking statements and that actual events may differ from those projected. Risk factors that could cause results to differ materially from those projected include global economic conditions, market acceptance of UTMD's products, regulatory approvals of products, regulatory intervention in current operations, government intervention in healthcare in general, tax reforms, the Company's ability to efficiently manufacture, market and sell products, cybersecurity and foreign currency exchange rates, among other factors that have been and will be outlined in UTMD's public disclosure filings with the SEC. UTMD's 2024 SEC Form 10-K will be filed on or before March 29, 2025, and can be accessed on www.utahmed.com.

Utah Medical Products, Inc., with particular interest in health care for women and their babies, develops, manufactures and markets a broad range of disposable and reusable specialty medical devices recognized by clinicians in over one hundred countries around the world as the standard for obtaining optimal long-term outcomes for their patients. For more information about Utah Medical Products, Inc., visit UTMD's website at www.utahmed.com.

Utah Medical Products, Inc.

INCOME STATEMENT, Fourth Quarter (three months ended December 31)

(in thousands except earnings per share):

|

| 4Q 2024 |

|

|

| 4Q 2023 |

|

| Percent |

| ||

Net Sales |

| $ | 9,157 |

|

| $ | 12,333 |

|

|

| (25.8 | %) |

Gross Profit |

|

| 5,323 |

|

|

| 7,098 |

|

|

| (25.0 | %) |

Operating Income |

|

| 2,930 |

|

|

| 3,944 |

|

|

| (25.7 | %) |

Income Before Tax |

|

| 3,614 |

|

|

| 5,017 |

|

|

| (28.0 | %) |

Net Income |

|

| 2,902 |

|

|

| 4,287 |

|

|

| (32.3 | %) |

Diluted EPS |

| $ | 0.857 |

|

| $ | 1.180 |

|

|

| (27.4 | %) |

Shares Outstanding (diluted) |

|

| 3,388 |

|

|

| 3,632 |

|

|

|

|

|

INCOME STATEMENT, Twelve Months (Calendar Year ended December 31)

(in thousands except earnings per share):

| 2024 |

|

| 2023 |

|

| Percent Change |

| ||||

Net Sales |

| $ | 40,903 |

|

| $ | 50,224 |

|

|

| (18.6 | %) |

Gross Profit |

|

| 24,143 |

|

|

| 30,038 |

|

|

| (19.6 | %) |

Operating Income |

|

| 13,594 |

|

|

| 16,777 |

|

|

| (19.0 | %) |

Income Before Tax |

|

| 16,802 |

|

|

| 20,089 |

|

|

| (16.4 | %) |

Net Income |

|

| 13,874 |

|

|

| 16,635 |

|

|

| (16.6 | %) |

Diluted EPS |

| $ | 3.961 |

|

| $ | 4.574 |

|

|

| (13.4 | %) |

Shares Outstanding (diluted) |

|

| 3,503 |

|

|

| 3,637 |

|

|

|

|

|

BALANCE SHEET

(in thousands) |

| DEC 31, 2024 |

|

| SEP 30, 2024 |

|

| DEC 31, 2023 | |||

Assets |

|

|

|

|

|

|

|

| |||

Cash & Investments |

| $ | 82,976 |

|

| $ | 88,452 |

|

| $ | 92,868 |

Accounts & Other Receivables, Net |

|

| 4,095 |

|

|

| 3,720 |

|

|

| 3,391 |

Inventories |

|

| 8,812 |

|

|

| 9,107 |

|

|

| 9,582 |

Other Current Assets |

|

| 448 |

|

|

| 377 |

|

|

| 428 |

Total Current Assets |

|

| 96,331 |

|

|

| 101,656 |

|

|

| 106,269 |

Property & Equipment, Net |

|

| 9,762 |

|

|

| 10,419 |

|

|

| 10,552 |

Intangible Assets, Net |

|

| 16,445 |

|

|

| 17,619 |

|

|

| 18,637 |

Total Assets |

| $ | 122,538 |

|

| $ | 129,694 |

|

| $ | 135,458 |

Liabilities & Stockholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

Accounts Payable |

| $ | 696 |

|

| $ | 999 |

|

| $ | 769 |

REPAT Tax Payable |

|

| 698 |

|

|

| 558 |

|

|

| 558 |

Other Accrued Liabilities |

|

| 2,363 |

|

|

| 1,878 |

|

|

| 3,383 |

Total Current Liabilities |

| $ | 3,757 |

|

| $ | 3,435 |

|

| $ | 4,710 |

Deferred Tax Liability - Intangible Assets |

|

| 604 |

|

|

| 779 |

|

|

| 1,120 |

Long Term Lease Liability Long Term REPAT Tax Payable |

|

| 282- |

|

|

| 299698 |

|

|

| 295698 |

Deferred Revenue and Income Taxes |

|

| 468 |

|

|

| 286 |

|

|

| 322 |

Stockholders' Equity |

|

| 117,427 |

|

|

| 124,197 |

|

|

| 128,313 |

Total Liabilities & Stockholders' Equity |

| $ | 122,538 |

|

| $ | 129,694 |

|

| $ | 135,458 |

CONTACT: Brian Koopman (801) 566-1200

SOURCE: Utah Medical Products, Inc.

View the original press release on ACCESS Newswire