Americas Gold and Silver Corporation Reports First Quarter 2021 Results and Provides Operational Update

Americas Gold and Silver Corporation (USAS) reported a Q1 2021 revenue of $10.2 million but faced a net loss of $91.8 million, primarily due to a $55.6 million impairment charge and a $23.0 million inventory write-down. The company is transitioning to run-of-mine heap leaching at Relief Canyon to enhance project economics. They anticipate resolving the illegal blockade at Cosalá Operations, with a target to resume full production in Q3 2021. Noteworthy exploration success at the Galena Complex has yielded high-grade mineral intercepts, boosting silver production prospects.

- Exploration success at Galena Complex with several high-grade intercepts, including Hole 55-175A yielding 7,370 g/t silver.

- Transition to run-of-mine heap leaching at Relief Canyon expected to improve project economics and profitability.

- Anticipated resolution of the illegal blockade at Cosalá Operations, with full production expected in Q3 2021.

- Q1 2021 net loss of $91.8 million signifies financial strain.

- Impairment charge of $55.6 million linked to Relief Canyon affects company asset values.

- Operational challenges at Relief Canyon have led to lower than expected gold recovery due to carbonaceous material.

Insights

Analyzing...

Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas” or the “Company”), a growing North American precious metals producer, reports consolidated financial and operational results for the quarter ended March 31, 2021 along with the progress to reopen the Cosalá Operations, continued exploration success at the Galena Complex and an update for Relief Canyon.

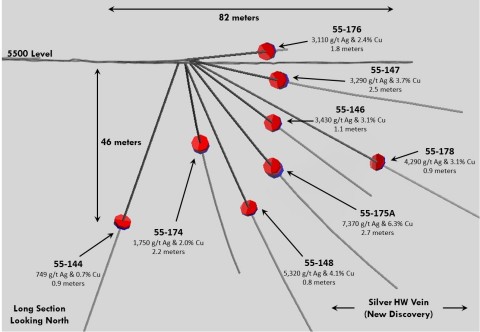

Figure 1: Long Section (Looking North) depicting some significant intercepts from 5500 Level drilling (Graphic: Americas Gold and Silver Corporation)

This earnings release should be read in conjunction with the Company’s Management’s Discussion and Analysis, Financial Statements and Notes to Financial Statements for the corresponding period, which have been posted on the Americas Gold and Silver Corporation SEDAR profile at www.sedar.com, and on its EDGAR profile at www.sec.gov, and which are also available on the Company’s website at www.americas-gold.com. All figures are in U.S. dollars unless otherwise noted.

Highlights

● Revenue of

● Following an extensive review and a challenging ramp-up at Relief Canyon, the operation is proceeding with run-of-mine heap leaching. The Company expects this change will improve overall project economics going forward.

● The Company is confident that a resolution will be reached to reopen the Cosalá Operations with all employees returning to work in the near term with a ramp-up to full production in Q3-2021. Full Mexican government support will ensure the long-term stability of the operation.

● At the Galena Complex, geologists have located and drilled the downdip extension of the prolific Silver Vein. All of the first 8 holes hit high-grade mineralization highlighted by the following:

-

Hole 55-175A: 7,370 g/t silver and

6.3% copper (8,020 g/t silver equivalent [2]) over 2.7 m [3]

including: 30,200 g/t silver and

including: 23,000 g/t silver and

including: 11,500 g/t silver and

-

Hole 55-148: 5,320 g/t silver and

4.1% copper (5,730 g/t silver equivalent) over 0.8 m

including: 10,200 g/t silver and

-

Hole 55-176: 3,110 g/t silver and

2.4% copper (3,350 g/t silver equivalent) over 1.8 m

including: 23,900 g/t silver and

and: 1690 g/t silver and

“Based on our latest discussions with both the state and federal Mexican government, we are on the cusp of a resolution to the illegal blockade at our Cosalá Operations and anticipate our employees will be back to work this quarter,” stated Americas Gold and Silver President & CEO Darren Blasutti. “The restart of the Cosalá Operations and the recent high-grade Silver Vein discovery at the Galena Complex, near existing infrastructure, will increase exposure to silver and cash flow to the Company and our shareholders. At Relief Canyon, following months of study, we have decided to transition to run-of-mine heap leaching to simplify the flowsheet and improve performance. While the ramp-up has been more difficult than the Company envisioned, I believe this change will lead to better economics and enhanced profitability for the operation.”

Relief Canyon

The ramp-up at Relief Canyon has been a challenge and continues to be challenging as documented since the Company first poured gold in February 2020. During this period, the Company and its consultants have performed extensive analyses and implemented a number of procedural changes to address the start-up challenges. As part of this analysis, the Company identified naturally occurring carbonaceous material within the Relief Canyon pit. The identification of this material was not recognized in the feasibility study.

During the first phase of mining (Phase 1 of 5), several adverse impacts affected the operation including the onset of the COVID-19 pandemic and the failure of the Company’s radial stacker. Offsetting these challenges was that the definition of the gold mineralized zones through blasthole sampling reconciled reasonably to the block model. However, during Phase 1, an unknown quantity of carbonaceous material was crushed, stacked and disseminated onto the leach pad resulting in lower-than-expected recovery of the placed gold ore. Following realization of this adverse material, the Company implemented additional measures to the ore control procedure to minimize the impact the carbonaceous material could have on leach pad performance. Additional efforts focussed on improving mining selectivity including the use of a hydraulic excavator operating on split (10 foot) benches when required.

Phase 2 mining, which commenced in late Q4-2020/early Q1-2021, has demonstrated a more structurally complex area than initially interpreted, caused by additional faults and folds. Gold mineralization is strongly influenced by structural controls. The impact of the structural complexity, combined with the increased mining selectivity to reject carbonaceous material, has decreased ore availability in Q1-2021 and into Q2-2021.

As a result of these challenges, the Company began two small run-of-mine test pads in Q1-2021 to evaluate the possibility of simplifying the flowsheet by by-passing the crushing and conveying circuits. Results have been encouraging and the operation has transitioned to this method of ore placement to further demonstrate its applicability with haul trucks now delivering the ore directly from the pit to the leach pad. The Company continues to evaluate options to improve the short-term operational and financial performance of the asset.

Additional improvements in the predictability of the resource model are progressing with incorporation of the latest geological detail from recent pit mapping as well as new data from an extensive re-assaying program of over 10,000 historic exploration pulp samples. Completion of this data compilation and analysis is targeted for late Q3-2021 as part of the Company’s mid-year update of its reserve and resource estimates.

As a result of the differences observed between the modelled (planned) and mined (actual) ore tonnage and the carbonaceous material identified in the early phases of the mine plan, an impairment charge of

Cosalá Operations

The illegal blockade at the Cosalá Operations, which has been in place since February 2020, is nearing a resolution and the Company is confident that the operations will restart this quarter. The expected resolution follows tireless efforts by the Company’s representatives in Mexico in cooperation with various members of as the Mexican federal government, who have sought to properly characterize the nature of the conflict with decision makers (including President Manuel Lopez Obrador) and to establish a framework that will allow for the safe return of the Company’s employees and allow for continuous operation in the long term. The Company understands that a recent positive development in the conflict is the engagement for the first time of state government with its federal counterparts to support a resolution that benefits the people of Cosalá with the peaceful removal of the illegal blockade. Assuming the delivery of agreed conditions and the enforcement of applicable law, the Company eagerly anticipates getting the operation restarted and is targeting full mining operations in Q3-2021.

Upon resolution of the illegal blockade and a re-start of operations, higher silver prices will allow the Company to target the higher-grade silver ores in the Upper Zone of San Rafael and develop the silver-copper EC120 project. Mining these silver-rich areas of the Cosalá Operations is expected to significantly increase silver production to over 2.5 million ounces of silver per annum in the years following the removal of the blockade.

Galena Complex

Initial drilling from the new drill station on the 5500 Level has yielded several high-grade intercepts at depth. Galena geologists discovered a new silver-copper trend south of the prolific Silver Vein. The strike and dip of this new trend matches very well with the strike and dip of the majority of the Silver Vein mined from the 3200 Level to the 4300 Level. Initial interpretations are that this trend is either a southern splay of the Silver Vein or that it is the true Silver Vein at depth.

Initial intercepts from the 5500-level drilling includes:

-

Hole 55-175A: 7,370 g/t silver and

6.3% copper (8,020 g/t silver equivalent) over 2.7 m

including: 30,200 g/t silver and

including: 23,000 g/t silver and

including: 11,500 g/t silver and

-

Hole 55-148: 5,320 g/t silver and

4.1% copper (5,730 g/t silver equivalent) over 0.8 m

including: 10,200 g/t silver and

-

Hole 55-178: 4,290 g/t silver and

3.1% copper (4,610 g/t silver equivalent) over 0.9 m -

Hole 55-146: 3,430 g/t silver and

3.1% copper (3,740 g/t silver equivalent) over 1.1 m

including: 21,800 g/t silver and

and: 844 g/t silver and

-

Hole 55-147: 3,290 g/t silver and

3.7% copper (3,680 g/t silver equivalent) over 2.5 m

including: 5,250 g/t silver and

and: 1,110 g/t silver and

-

Hole 55-174: 1,750 g/t silver and

2.0% copper (1,960 g/t silver equivalent) over 2.2 m

including: 2,770 g/t silver and

-

Hole 55-176: 3,110 g/t silver and

2.4% copper (3,350 g/t silver equivalent) over 1.8 m

including: 23,900 g/t silver and

and: 1,690 g/t silver and

and: 758 g/t silver and

-

Hole 55-144: 749 g/t silver and

0.7% copper (818 g/t silver equivalent) over 0.9 m

East Coeur drilling, which commenced in January 2021, targeting the area between Galena’s historically prolific West Argentine mining front and the Coeur mine continues to provide solid results. Key results from the East Coeur drilling includes:

-

Hole 34-122: 1,170 g/t silver and

1.3% copper (1,310 g/t silver equivalent) over 1.8 m -

Hole 34-125: 1,900 g/t silver and

2.4% copper (2,150 g/t silver equivalent) over 0.4 m -

Hole 34-124: 2,590 g/t silver and

2.7% copper (2,870 g/t silver equivalent) over 0.2 m -

Hole 34-132: 2,360 g/t silver and

3.6% copper (2,730 g/t silver equivalent) over 0.2 m

Geologists drilled an additional hole further east of the current East Coeur drilling which intercepted a new, un-named vein. Additional drilling is planed to further test this area but initial results are encouraging.

-

Hole 34-133: 713 g/t silver and

2.0% copper (914 g/t silver equivalent) over 1.4 m

A full table of drill results can be found at:

https://americas-gold.com/site/assets/files/4297/dr20210516.pdf

The Company expects 2021 to be a transitional year at the Galena Complex for future production with continued exploration drilling supporting production growth toward a 2 million silver ounce per year plan. Longer term and assuming continued exploration success, with the results from the 5500 Level and East Coeur drilling providing a solid initial indication, the Company is confident that the operation will again reach peak historical annual production levels of approximately 5 million ounces per year.

The Company is targeting further mineral resource additions at the Galena Complex from the remainder of Phase 1 drilling through June 2021 with the potential increase exceeding the originally targeted addition of 50 million ounces of silver.

At-The-Market Offering

Americas has entered into an at-the-market offering agreement dated May 17, 2021 (the “ATM Agreement”) with H.C. Wainwright & Co., LLC (the “Lead Agent”) and ROTH Capital Partners, LLC as agents, pursuant to which the Company established an at-the-market equity program (the “ATM Program”). Pursuant to the ATM Program and ATM Agreement, the Company may, at its discretion and from time-to-time during the term of the ATM Agreement, sell, through the Lead Agent, such number of common shares of the Company (“Common Shares”) as would result in aggregate gross proceeds to the Company of up to US

The ATM Program will be made by way of a prospectus supplement dated May 17, 2021 (the “Prospectus Supplement”) to the Company's existing Canadian short form base shelf prospectus dated January 29, 2021 (the “Base Shelf Prospectus”) and U.S. registration statement on Form F-10, as amended (File No. 333-240504) (the “Registration Statement”), dated January 29, 2021. The Registration Statement was declared effective by the United States Securities and Exchange Commission (the “SEC”) on February 1, 2021. The Prospectus Supplement has been filed with the applicable provincial regulatory authorities in Canada and the SEC. The Canadian Prospectus Supplement (together with the related Canadian Base Shelf Prospectus) is available on the SEDAR website maintained by the Canadian Securities Administrators at www.sedar.com. The U.S. Prospectus Supplement (together with the related U.S. Base Shelf Prospectus) is available on the SEC's EDGAR website at www.sec.gov.

This news release does not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these Common Shares in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company owns and operates the Relief Canyon mine in Nevada, USA, the Cosalá Operations in Sinaloa, Mexico and manages the

Technical Information and Qualified Persons

The scientific and technical information relating to the operation of the Company’s material operating mining properties contained herein has been reviewed and approved by Daren Dell, P.Eng., Chief Operating Officer of the Company. The scientific and technical information relating to mineral reserves contained herein has been reviewed and approved by Shawn Wilson, Vice-President, Technical Services of the Company. The scientific and technical information relating to mineral resources and exploration contained herein has been reviewed and approved by Niel de Bruin, Director of Geology of the Company. Each of Messrs. Dell, Wilson, and de Bruin are "qualified persons" for the purposes of NI 43-101.

The Company’s current Annual Information Form and the NI 43-101 Technical Reports for its other material mineral properties, all of which are available on SEDAR at www.sedar.com, and EDGAR at www.sec.gov contain further details regarding mineral reserve and mineral resource estimates, classification and reporting parameters, key assumptions and associated risks for each of the Company’s material mineral properties, including a breakdown by category.

The diamond drilling program used NQ-size core. Americas Gold and Silver’s standard QA/QC practices were utilized to ensure the integrity of the core and sample preparation at the Galena Complex through delivery of the samples to the assay lab. The drill core was stored in a secure facility, photographed, logged and sampled based on lithologic and mineralogical interpretations. Standards of certified reference materials, field duplicates and blanks were inserted as samples shipped with the core samples to the lab.

Analytical work was carried out by American Analytical Services Inc. (“AAS”) located in Osburn, Idaho. AAS is an independent, ISO-17025 accredited laboratory. Sample preparation includes a 30-gram pulp sample analyzed by atomic absorption spectrometry (“AA”) techniques to determine silver, copper, and lead, using aqua regia for pulp digestion. Samples returning values over 514g/t Ag are re-assayed using fire-assay techniques for silver. Additionally, samples returning values over

Duplicate pulp samples were sent out quarterly to ALS Global, an independent, ISO-17025 accredited laboratory based in Reno, Nevada to perform an independent check analysis. A conventional AA technique was used for the analysis of silver, copper and lead at ALS Global with the same industry standard procedures as those used by AAS. The assay results listed in this report did not show any significant contamination during sample preparation or sample bias of analysis.

All mining terms used herein have the meanings set forth in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), as required by Canadian securities regulatory authorities. These standards differ significantly from the requirements of the SEC that are applicable to domestic United States reporting companies. Any mineral reserves and mineral resources reported by the Company in accordance with NI 43-101 may not qualify as such under SEC standards. Accordingly, information contained in this news release may not be comparable to similar information made public by companies subject to the SEC’s reporting and disclosure requirements

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas Gold and Silver’s expectations, intentions, plans, assumptions and beliefs with respect to, among other things, estimated and targeted production rates and results for gold, silver and other precious metals, the expected prices of gold, silver and other precious metals, as well as the related costs, expenses and capital expenditures; the recapitalization plan at the Galena Complex, including the expected production levels and potential additional mineral resources thereat; the expected resolution of the illegal blockade at the Company’s Cosalá Operations and the restart of mining operations, including the expected timing thereof; the Company’s production, development plans and performance expectations at the Relief Canyon Mine and its ability to finance, develop and operate Relief Canyon, including the Company’s determination to proceeding with run-of-mine heap leaching operations and the expected improvement of operations and overall project economics in connection therewith, the timing and conclusions of the data compilation and analysis occurring at Relief Canyon and the potential for reassessment of the remaining carrying value of the Relief Canyon asset; and anticipated offering of Common Shares under the ATM Program and the anticipated use of proceeds from the ATM Program, if any. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas Gold and Silver as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas Gold and Silver to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas Gold and Silver, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreak including the COVID-19 pandemic; the impact of COVID-19 on our workforce, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic; interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to operate the Relief Canyon Project; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions and other factors limiting mine access, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities, labor relations or disruptions, social and political developments and other risks of the mining industry. The potential effects of the COVID-19 pandemic on our business and operations are unknown at this time, including the Company’s ability to manage challenges and restrictions arising from COVID-19 in the communities in which the Company operates and our ability to continue to safely operate and to safely return our business to normal operations. The impact of COVID-19 on the Company is dependent on a number of factors outside of its control and knowledge, including the effectiveness of the measures taken by public health and governmental authorities to combat the spread of the disease, global economic uncertainties and outlook due to the disease, and the evolving restrictions relating to mining activities and to travel in certain jurisdictions in which it operates. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Americas Gold and Silver’s filings with the Canadian Securities Administrators on SEDAR and with the SEC. Americas Gold and Silver does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas Gold and Silver does not give any assurance (1) that Americas Gold and Silver will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward‐looking information concerning Americas Gold and Silver are expressly qualified in their entirety by the cautionary statements above.

1 The Company’s profitability was impacted by non-reoccurring and non-cash charges, specifically

2 Silver equivalent was calculated using metal prices of

3 Meters represent “True Width” which is calculated for significant intercepts only and is based on orientation axis of core across the estimated dip of the vein.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210517005486/en/