Uranium Royalty Acquires Existing Royalty on Cameco's Advanced Stage Millennium and Cree Extension Uranium Projects

Uranium Royalty Corp (NASDAQ: UROY) has acquired a royalty on the Millennium and Cree Extension Uranium Projects in Saskatchewan for $6 million. The acquired royalty is a 10% net profit interest on a 20.6955% participating interest in the Projects. The Millennium Project, operated by Cameco, contains Indicated Resources of 75.9 million pounds U3O8 at 2.39% grade and Inferred Resources of 29.0 Mlbs U3O8 at 3.19% grade. The project previously had an Environmental Impact Statement application in 2009 proposing production of 150,000-200,000 tonnes of ore annually with a 10-year mine life. The acquisition provides URC exposure to 12,800 hectares in the Athabasca Basin.

Uranium Royalty Corp (NASDAQ: UROY) ha acquisito una royalty sui progetti di uranio Millennium e Cree Extension in Saskatchewan per 6 milioni di dollari. La royalty acquisita rappresenta un interesse netto del 10% su un interesse partecipativo del 20,6955% nei progetti. Il progetto Millennium, gestito da Cameco, contiene risorse indicate pari a 75,9 milioni di libbre di U3O8 con un grado del 2,39% e risorse inferite di 29,0 milioni di libbre di U3O8 con un grado del 3,19%. In passato, il progetto aveva presentato una domanda di dichiarazione di impatto ambientale nel 2009, proponendo una produzione annuale di 150.000-200.000 tonnellate di minerale con una vita mineraria di 10 anni. L'acquisizione fornisce a URC l'esposizione a 12.800 ettari nel Bacino di Athabasca.

Uranium Royalty Corp (NASDAQ: UROY) ha adquirido una regalía sobre los Proyectos de Uranio Millennium y Cree Extension en Saskatchewan por 6 millones de dólares. La regalía adquirida es un interés neto del 10% sobre un interés de participación del 20,6955% en los proyectos. El Proyecto Millennium, operado por Cameco, contiene recursos indicados de 75,9 millones de libras de U3O8 con un grado del 2,39% y recursos inferidos de 29,0 millones de libras de U3O8 con un grado del 3,19%. El proyecto había presentado previamente una solicitud de declaración de impacto ambiental en 2009 proponiendo una producción de 150,000-200,000 toneladas de mineral anualmente con una vida útil de la mina de 10 años. La adquisición proporciona a URC exposición a 12,800 hectáreas en la Cuenca de Athabasca.

우라늄 로열티 Corp (NASDAQ: UROY)는 사스카츄완의 밀레니엄 및 크리 익스텐션 우라늄 프로젝트에 대해 600만 달러에 로열티를 인수했습니다. 인수한 로열티는 프로젝트에 대한 20.6955%의 참여 지분에 대한 10% 순이익 이자입니다. 카메코가 운영하는 밀레니엄 프로젝트는 2.39% 등급의 7590만 파운드 U3O8의 지표 자원과 3.19% 등급의 290만 파운드 U3O8의 추정 자원을 포함하고 있습니다. 이 프로젝트는 2009년에 연간 15만-20만 톤의 광석 생산을 제안하는 환경 영향 보고서 신청서를 제출한 바 있으며, 10년의 광산 운영 수명을 예상하고 있습니다. 이번 인수는 URC에 아타바스카 분지 내 12800헥타르에 대한 노출을 제공합니다.

Uranium Royalty Corp (NASDAQ: UROY) a acquis une redevance sur les projets d'uranium Millennium et Cree Extension en Saskatchewan pour 6 millions de dollars. La redevance acquise représente un intérêt net de 10% sur un intérêt de participation de 20,6955% dans les projets. Le projet Millennium, exploité par Cameco, contient des ressources indiquées de 75,9 millions de livres d'U3O8 avec une teneur de 2,39% et des ressources présumées de 29,0 millions de livres d'U3O8 avec une teneur de 3,19%. Le projet avait précédemment soumis une demande d'évaluation des impacts environnementaux en 2009, proposant une production annuelle de 150 000 à 200 000 tonnes de minerai avec une durée de vie de la mine de 10 ans. L'acquisition offre à URC une exposition de 12 800 hectares dans le bassin d'Athabasca.

Uranium Royalty Corp (NASDAQ: UROY) hat eine Royalty über die Uranprojekte Millennium und Cree Extension in Saskatchewan für 6 Millionen Dollar erworben. Die erworbene Royalty ist ein 10%iges Netto-profitinteresse an einem 20,6955%igen Beteiligungsanteil an den Projekten. Das Millennium-Projekt, das von Cameco betrieben wird, enthält angezeigte Ressourcen von 75,9 Millionen Pfund U3O8 mit einem Gehalt von 2,39% und geschätzte Ressourcen von 29,0 Millionen Pfund U3O8 mit einem Gehalt von 3,19%. Das Projekt hatte zuvor 2009 einen Antrag auf Umweltverträglichkeitsprüfung eingereicht, der eine Produktion von jährlich 150.000-200.000 Tonnen Erze mit einer Lebensdauer der Mine von 10 Jahren vorschlug. Der Erwerb bietet URC Zugriff auf 12.800 Hektar im Athabasca-Becken.

- Acquisition of royalty on one of the largest undeveloped uranium projects globally

- High-grade uranium resources: 75.9M lbs indicated (2.39% U3O8) and 29.0M lbs inferred (3.19% U3O8)

- Project located in premier mining jurisdiction near existing mill infrastructure

- Partnership with established operator Cameco

- Previous development work and EIS submission completed

- Royalty only becomes payable after recovery of all qualifying preproduction expenditures

- Previous EIS application was withdrawn in 2014 due to market conditions

- $6 million cash expenditure for acquisition

Insights

This

The 10% NPI structure on a

Having Cameco as operator adds significant credibility and technical expertise to the project's development potential. The proximity to existing infrastructure (Key Lake Mill) could materially reduce development costs and accelerate potential production timelines.

This acquisition strengthens UROY's portfolio at a important time in the uranium market cycle. With uranium prices reaching multi-year highs and growing nuclear energy adoption globally, securing royalties on high-grade deposits in tier-1 jurisdictions like Saskatchewan's Athabasca Basin is strategically valuable.

The

DESIGNATED NEWS RELEASE

Highlights:

- The acquired royalty is a net profit interest (NPI) of

10% on an approximate20.6955% participating interest in the Projects. The royalty becomes payable after recovery of all qualifying preproduction expenditures incurred after the establishment of the royalty. - The Millennium Project hosts an Indicated Mineral Resource of 75.9 million pounds U3O8 at an average grade of

2.39% U3O8 and an Inferred Resource of 29.0 Mlbs U3O8 at an average grade of3.19% U3O8, which places it among the largest undeveloped uranium projects globally. (1) - Cameco Corporation Inc. ("Cameco"), the operator of the Projects, submitted an Environmental Impact Statement ("EIS") application in 2009 for the project, anticipated to produce 150,000 to 200,000 tonnes of ore per year with a submitted potential mine life of 10 years.(2)

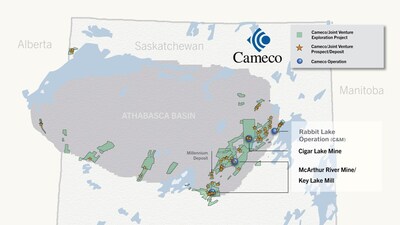

- The acquisition of the royalty on these two Projects provides URC exposure to approximately 12,800 hectares of ground in the highly prospective

Athabasca Basin, with well-respected operators, and in one of the top mining jurisdictions in the world.

Note 1: Resource estimates are on a |

Scott Melbye, Chief Executive Officer of URC stated: "We are very excited to acquire this significant royalty on the Millennium and Cree Extension Projects. Cameco has previously completed substantial development work on the Millennium project and it remains one of the largest undeveloped projects in Cameco's portfolio. It represents an important potential contributor to the future global production pipeline. The transaction is another example of our ability to leverage the URC team's experience and networks to source and execute accretive uranium royalty transactions."

The Millennium Project

The Millennium Project is an advanced stage, conventional uranium project located 36 km northwest of Cameco's Key Lake Mill in

Cameco has disclosed that the Millennium Project hosts estimated resources of 1.4 million tonnes at an average grade of

Cameco has disclosed that it submitted a draft EIS submission for the project in 2009, which submission included anticipated production of 150,000 to 200,000 tonnes of ore per year with a submitted potential mine life of 10 years. Cameco chose to pull the EIS application on May 15, 2014, due to market conditions at the time.

The Cree Extension Project

The Cree Extension Project is an Exploration stage project located 36 km northwest of Cameco's Key Lake Mill. The project is a joint venture among Cameco, Orano Canada Inc., and JCU. The land is located west of Denison's Wheeler River project and southwest of Cameco's McArthur River project.

The Millennium and Cree Extension Royalty

The royalty is a

About Uranium Royalty Corp.

Uranium Royalty Corp. is the world's only publicly traded uranium-focused royalty and streaming company. URC provides investors with uranium commodity price exposure through strategic acquisitions in uranium interests, including royalties, streams, debt and equity in uranium companies, as well as through holdings of physical uranium. The Company is well positioned as a capital provider to an industry needing massive investments in global productive capacity to meet the growing need for uranium as fuel for carbon-free nuclear energy. URC has deep industry knowledge and expertise to identify and evaluate investment opportunities in the uranium industry. The Company's management and the Board include individuals with decades of combined experience in the uranium and nuclear energy sectors, including specific expertise in mine finance, project identification and evaluation, mine development and uranium sales and trading.

Website: www.UraniumRoyalty.com

Note on Technical Disclosure

Darcy Hirsekorn, the Company's Chief Technical Officer, has supervised the preparation of and reviewed the technical information contained in this presentation. He holds a B.Sc. in Geology from the University of

Unless otherwise indicated, the scientific and technical information herein regarding the Millennium Project has been derived from Cameco's website at www.cameco.com and its Annual Information Form for the year ended December 31, 2023, a copy of which is available under its profile on SEDAR+.

As a royalty holder, the Company has limited, if any, access to the properties subject to its interests. The Company generally relies on publicly available information regarding these properties and related operations and generally has no ability to independently verify such information. In addition, such publicly available information may relate to a larger property area than that covered by the Company's interests.

Unless otherwise indicated, the technical and scientific disclosure contained or referenced herein has been prepared in accordance with NI 43-101, which differs significantly from the requirements of the

Forward Looking Statements

Certain statements in this news release may constitute "forward-looking information" and "forward looking statements", as defined under applicable securities laws, including those regarding the disclosed expectations of the operator of the Projects, including expectations regarding the Projects and the Company's business plans. Forward-looking information includes statements that address or discuss activities, events, or developments that the Company expects or anticipates may occur in the future. When used in this news release, words such as "estimates", "expects", "plans", "anticipates", "will", "believes", "intends" "should", "could", "may" and other similar terminology are intended to identify such forward-looking information. Statements constituting forward-looking information reflect the current expectations and beliefs of the Company's management. These statements involve significant uncertainties, known and unknown risks, uncertainties, and other factors and, therefore, actual results, performance or achievements of the Company and its industry may be materially different from those implied by such forward-looking statements. They should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from such forward-looking information, including, without limitation, risks inherent to royalty companies, uranium price volatility, risks related to the operators of the projects underlying the Company's existing and proposed interests and those other risks described in filings with Canadian securities regulators and the

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/uranium-royalty-acquires-existing-royalty-on-camecos-advanced-stage-millennium-and-cree-extension-uranium-projects-302288366.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/uranium-royalty-acquires-existing-royalty-on-camecos-advanced-stage-millennium-and-cree-extension-uranium-projects-302288366.html

SOURCE Uranium Royalty Corp.