Upstart Announces Preliminary Unaudited Q2’22 Financial Results

1. Data is for lending partners’ originations made via the Upstart platform as of

Second Quarter 2022 Preliminary Unaudited Financial Results:

-

Revenue is expected to be approximately

$228 million $295 $305 million -

Contribution margin is expected to be approximately

47% , previously guided at approximately45% -

Net Income (loss) is expected to be in the range of (

$31 $27) million , previously guided at ($4 $0 million

“Inflation and recession fears have driven interest rates up and put banks and capital markets on cautious footing,” said

“During the second quarter, we improved our unit economics and oriented ourselves toward continued positive cash flow even at lower loan origination volumes. With a low fixed cost base, we expect to continue adding to our almost

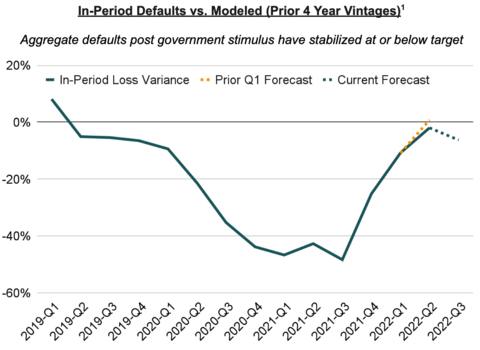

“For loans purchased by non-bank institutions, all vintages from 2018 thorough 2020 delivered significant excess returns, while our 2021 vintage is within 100 basis points of our loss expectations. Lastly, we believe our models are well calibrated to economic conditions and are currently targeting returns in excess of 10 percent.”

Conference Call:

Upstart will host a conference call and live webcast

Live webcast. The live webcast will be accessible on Upstart’s investor relations website, ir.upstart.com, and an archived webcast of the conference call will be available after the conference call.

Conference Call Dial In. To access the live conference call in

Financial Disclosure Advisory

Upstart has not yet completed its reporting process for its second quarter 2022 ended

About Upstart

Upstart is a leading AI lending marketplace partnering with banks and credit unions to expand access to affordable credit. By leveraging Upstart’s AI platform, Upstart-powered banks and credit unions can have higher approval rates and lower loss rates for every race, ethnicity, age, and gender, while simultaneously delivering the exceptional digital-first lending experience their customers demand. More than two-thirds of Upstart loans are approved instantly and are fully automated. Upstart was founded by ex-Googlers in 2012 and is based in

Forward-Looking Statements

This press release contains forward-looking statements. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "anticipate", "estimate", "expect", "project", "plan", "intend", “target”, “aim”, "believe", "may", "will", "should", “becoming”, “could”, "can have", "likely" and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. Forward-looking statements give our current expectations and projections relating to our financial condition; macroeconomic factors; plans; objectives; product development; growth opportunities; assumptions; risks; future performance; default rates on loans; business; any investments; and results of operations, including revenue, contribution margin and net income (loss). Neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. The forward-looking statements included in this press release relate only to events as of the date hereof. Upstart undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. More information about factors that could affect our results of operations and risks and uncertainties are provided in our public filings with the

About Non-GAAP Financial Measures

In addition to our results determined in accordance with generally accepted accounting principles in

We believe non-GAAP information is useful in evaluating the operating results, ongoing operations, and for internal planning and forecasting purposes. We also believe that non-GAAP financial measures provide consistency and comparability with past financial performance and assist investors with comparing Upstart to other companies, some of which use similar non-GAAP financial measures to supplement their GAAP results. Non-GAAP financial measures are presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP and may be different from similarly titled non-GAAP financial measures used by other companies.

Reconciliation tables of the most comparable GAAP financial measures to the non-GAAP financial measure used in this press release are included below.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited, Preliminary) |

|

| Three Months Ended |

|

Operating Margin |

(12) % |

| Sales and marketing, net of borrower acquisition costs(1) | 4 % |

| Customer operations, net of borrower verification and servicing costs(2) | 3 % |

| Engineering and product development | 22 % |

| General, administrative, and other | 18 % |

| Interest income and fair value adjustments, net | 12 % |

Contribution Margin |

47 % |

_________

-

Borrower acquisition costs are expected to be

36% of Revenue from fees, net for the three months endedJune 30, 2022 . Borrower acquisition costs consist of our sales and marketing expenses adjusted to exclude costs not directly attributable to attracting a new borrower, such as payroll-related expenses for our business development and marketing teams, as well as other operational, brand awareness and marketing activities. -

Borrower verification and servicing costs are expected to be

17% of Revenue from fees, net for the three months endedJune 30, 2022 . Borrower verification and servicing costs consist of payroll and other personnel-related expenses for personnel engaged in loan onboarding, verification and servicing, as well as servicing system costs. It excludes payroll and personnel-related expenses and stock-based compensation for certain members of our customer operations team whose work is not directly attributable to onboarding and servicing loans.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220707005843/en/

Investors

Vice President, Investor Relations

ir@upstart.com

Press

press@upstart.com

Source: