Trinity Bank reports 2024 3rd Quarter Earnings - Return on Assets of 1.73%

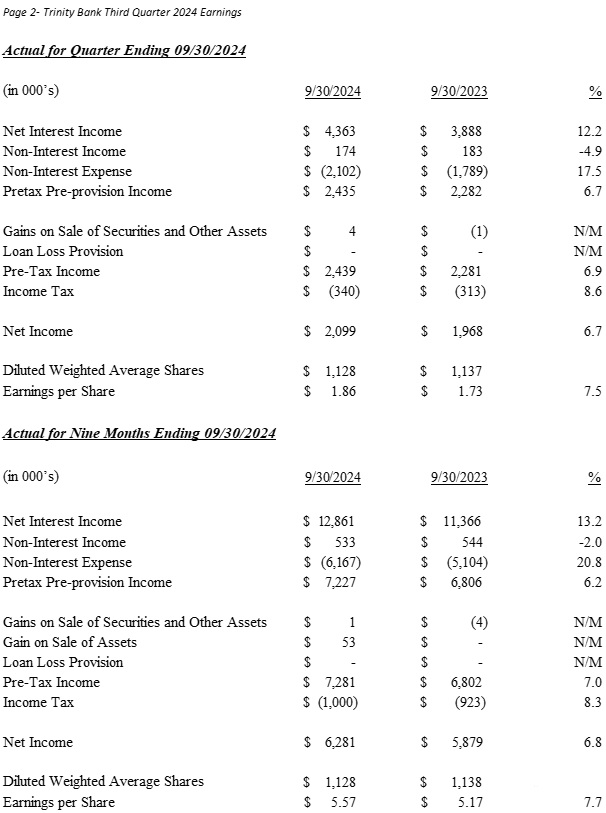

Trinity Bank (OTC PINK:TYBT) reported Q3 2024 net income of $2,099,000, up 6.66% from Q3 2023. Earnings per diluted share reached $1.86, a 7.51% increase. For the first nine months of 2024, net income was $6,281,000, up 6.84% year-over-year. The bank's return on assets was 1.73% and return on equity 14.77%. Total deposits increased 4.8% to $429,139,000, while total loans reached $300,487,000. The bank announced its 26th semi-annual dividend of $0.93 per share, payable October 31, 2024.

Trinity Bank (OTC PINK:TYBT) ha riportato un reddito netto per il terzo trimestre del 2024 di $2.099.000, in aumento del 6,66% rispetto al terzo trimestre del 2023. L'utile per azione diluita ha raggiunto $1,86, registrando un aumento del 7,51%. Nei primi nove mesi del 2024, il reddito netto è stato di $6.281.000, con un incremento del 6,84% rispetto all'anno precedente. Il rendimento degli attivi della banca è stato dell'1,73% e il rendimento del capitale del 14,77%. Le disponibilità totali sono aumentate del 4,8%, raggiungendo $429.139.000, mentre i prestiti totali hanno raggiunto $300.487.000. La banca ha annunciato il suo 26° dividendo semestrale di $0,93 per azione, pagabile il 31 ottobre 2024.

Trinity Bank (OTC PINK:TYBT) reportó un ingreso neto para el tercer trimestre de 2024 de $2,099,000, un aumento del 6.66% en comparación con el tercer trimestre de 2023. La ganancia por acción diluida alcanzó $1.86, un incremento del 7.51%. En los primeros nueve meses de 2024, el ingreso neto fue de $6,281,000, un aumento del 6.84% interanual. El retorno sobre activos del banco fue del 1.73% y el retorno sobre el patrimonio del 14.77%. Los depósitos totales aumentaron un 4.8% hasta alcanzar $429,139,000, mientras que los préstamos totales alcanzaron $300,487,000. El banco anunció su 26º dividendo semestral de $0.93 por acción, que se pagará el 31 de octubre de 2024.

트리니티 뱅크 (OTC PINK:TYBT)는 2024년 3분기 순이익이 $2,099,000으로 2023년 3분기 대비 6.66% 증가했다고 보고했습니다. 희석 주당 수익은 $1.86에 도달하며 7.51% 증가했습니다. 2024년 첫 9개월 동안 순이익은 $6,281,000으로 전년 대비 6.84% 증가했습니다. 은행의 자산 수익률은 1.73%, 자기자본 수익률은 14.77%였습니다. 총 예금은 4.8% 증가하여 $429,139,000에 이르렀고, 총 대출은 $300,487,000에 도달했습니다. 은행은 주당 $0.93의 26번째 반기 배당금을 발표했으며, 2024년 10월 31일에 지급됩니다.

Trinity Bank (OTC PINK:TYBT) a déclaré un revenu net de $2.099.000 pour le troisième trimestre 2024, soit une augmentation de 6,66 % par rapport au troisième trimestre 2023. Le bénéfice par action diluée s'est élevé à 1,86 $, en hausse de 7,51 %. Pour les neuf premiers mois de 2024, le revenu net était de $6.281.000, en hausse de 6,84 % par rapport à l'année précédente. Le rendement des actifs de la banque était de 1,73 % et le rendement des capitaux propres de 14,77 %. Les dépôts totaux ont augmenté de 4,8 % pour atteindre 429.139.000 $, tandis que les prêts totaux ont atteint 300.487.000 $. La banque a annoncé son 26ème dividende semestriel de 0,93 $ par action, payable le 31 octobre 2024.

Trinity Bank (OTC PINK:TYBT) meldete für das 3. Quartal 2024 ein Nettoeinkommen von 2.099.000 $, was einem Anstieg von 6,66 % gegenüber dem 3. Quartal 2023 entspricht. Der Gewinn pro verwässerter Aktie erreichte $1,86, was einem Anstieg von 7,51 % entspricht. Für die ersten neun Monate des Jahres 2024 betrug das Nettoeinkommen 6.281.000 $, was einem Anstieg von 6,84 % im Vergleich zum Vorjahr entspricht. Die Gesamtrendite auf das Vermögen der Bank betrug 1,73 % und die Eigenkapitalrendite 14,77 %. Die Gesamteinlagen stiegen um 4,8 % auf 429.139.000 $ und die Gesamtdarlehen erreichten 300.487.000 $. Die Bank kündigte ihre 26. halbjährliche Dividende von 0,93 $ pro Aktie an, die am 31. Oktober 2024 zahlbar ist.

- None.

- None.

TRINITY BANK REPORTS 2024 3RD QUARTER NET INCOME OF

3RD QUARTER RETURN ON ASSETS

3RD QUARTER RETURN ON EQUITY

FORT WORTH, TX / ACCESSWIRE / October 29, 2024 / Trinity Bank N.A. (OTC PINK:TYBT) today announced operating results for the third quarter and the nine months ending September 30, 2024.

Results of Operation

For the third quarter 2024, Trinity Bank, N.A. reported Net Income after Taxes of

For the first nine months of 2024, Net Income after Taxes was

COO Richard Burt stated, "Trinity Bank continues to produce consistent earnings and growth despite the uncertainty that continues in our economy. We are on pace to have the best year in our 21-year history. In addition, we are proud to announce, Trinity Bank will distribute its 26th semi-annual dividend of $.93 per share on October 31, 2024."

"As we have seen in past presidential election years, our customers and prospects have taken a cautious approach to their business and decisions. Backlogs remain strong and they have chosen to produce cash reserves and paydown debt. We have also seen an uptick in mergers and acquisitions activity over the past few quarters as customers are leery of future tax changes. Regardless of the election uncertainty, we are pleased with both our customers' and the bank's performance and are well positioned to take advantage of opportunities for continued growth."

Page 3 - Trinity Bank third quarter 2024 earnings

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Quarter Ended |

|

| Nine Months Ending |

|

| |||||||||||||||||||

| September 30 |

|

| % |

|

| September 30 |

|

| % |

|

| |||||||||||||

EARNINGS SUMMARY |

| 2024 |

|

| 2023 |

|

| Change |

|

| 2024 |

|

| 2023 |

|

| Change |

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Interest income |

| $ | 7,112 |

|

| $ | 6,258 |

|

|

| 13.6 | % |

| $ | 21,153 |

|

| $ | 17,240 |

|

|

| 22.7 | % |

|

Interest expense |

|

| 2,749 |

|

|

| 2,370 |

|

|

| 16.0 | % |

|

| 8,292 |

|

|

| 5,874 |

|

|

| 41.2 | % |

|

Net Interest Income |

|

| 4,363 |

|

|

| 3,888 |

|

|

| 12.2 | % |

|

| 12,861 |

|

|

| 11,366 |

|

|

| 13.2 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Service charges on deposits |

|

| 65 |

|

|

| 69 |

|

|

| -6.2 | % |

|

| 186 |

|

|

| 192 |

|

|

| -3.1 | % |

|

Other income |

|

| 109 |

|

|

| 114 |

|

|

| -4.1 | % |

|

| 347 |

|

|

| 352 |

|

|

| -1.3 | % |

|

Total Non Interest Income |

|

| 174 |

|

|

| 183 |

|

|

| -4.9 | % |

|

| 533 |

|

|

| 544 |

|

|

| -2.0 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Salaries and benefits expense |

|

| 1,368 |

|

|

| 1,171 |

|

|

| 16.8 | % |

|

| 3,910 |

|

|

| 3,385 |

|

|

| 15.5 | % |

|

Occupancy and equipment expense |

|

| 133 |

|

|

| 118 |

|

|

| 12.9 | % |

|

| 377 |

|

|

| 345 |

|

|

| 9.4 | % |

|

Other expense |

|

| 601 |

|

|

| 500 |

|

|

| 20.1 | % |

|

| 1,880 |

|

|

| 1,374 |

|

|

| 36.8 | % |

|

Total Non Interest Expense |

|

| 2,102 |

|

|

| 1,789 |

|

|

| 17.5 | % |

|

| 6,167 |

|

|

| 5,104 |

|

|

| 20.8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pretax pre-provision income |

|

| 2,435 |

|

|

| 2,282 |

|

|

| 6.7 | % |

|

| 7,227 |

|

|

| 6,806 |

|

|

| 6.2 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gain on sale of Securities |

|

| 4 |

|

|

| (1 | ) |

|

| N/M |

|

|

| 1 |

|

|

| (4 | ) |

|

| N/M |

|

|

Gain on sale of Assets |

|

| 0 |

|

|

| 0 |

|

|

| N/M |

|

|

| 53 |

|

|

| 0 |

|

|

| N/M |

|

|

Provision for Loan Losses |

|

| 0 |

|

|

| 0 |

|

|

| N/M |

|

|

| 0 |

|

|

| 0 |

|

|

| N/M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earnings before income taxes |

|

| 2,439 |

|

|

| 2,281 |

|

|

| 6.9 | % |

|

| 7,281 |

|

|

| 6,802 |

|

|

| 7.0 | % |

|

Provision for income taxes |

|

| 340 |

|

|

| 313 |

|

|

| 8.6 | % |

|

| 1,000 |

|

|

| 923 |

|

|

| 8.3 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Earnings |

| $ | 2,099 |

|

| $ | 1,968 |

|

|

| 6.7 | % |

| $ | 6,281 |

|

| $ | 5,879 |

|

|

| 6.8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic earnings per share |

|

| 1.95 |

|

|

| 1.81 |

|

|

| 7.7 | % |

|

| 5.83 |

|

|

| 5.40 |

|

|

| 7.9 | % |

|

Basic weighted average shares |

|

| 1,078 |

|

|

| 1,088 |

|

|

|

|

|

|

| 1,078 |

|

|

| 1,089 |

|

|

|

|

|

|

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Diluted earnings per share - estimate |

|

| 1.86 |

|

|

| 1.73 |

|

|

| 7.5 | % |

|

| 5.57 |

|

|

| 5.17 |

|

|

| 7.7 | % |

|

Diluted weighted average shares outstanding |

|

| 1,128 |

|

|

| 1,137 |

|

|

|

|

|

|

| 1,128 |

|

|

| 1,138 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Average for Quarter |

|

|

|

|

|

| Average for Nine Months | |||||||||||||||||

| September 30 | % |

|

|

|

| September 30 | % |

|

| |||||||||||||||

BALANCE SHEET SUMMARY |

|

| 2024 |

|

|

| 2023 |

|

| Change |

|

|

| 2024 |

|

|

| 2023 |

|

| Change |

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total loans |

| $ | 300,487 |

|

| $ | 294,238 |

|

|

| 2.1 | % |

| $ | 303,102 |

|

| $ | 283,465 |

|

|

| 6.9 | % |

|

Total short term investments |

|

| 38,112 |

|

|

| 22,128 |

|

|

| 72.2 | % |

|

| 33,811 |

|

|

| 20,314 |

|

|

| 66.4 | % |

|

FRB Stock |

|

| 437 |

|

|

| 430 |

|

|

| 1.6 | % |

|

| 435 |

|

|

| 429 |

|

|

| 1.4 | % |

|

Total investment securities |

|

| 137,751 |

|

|

| 133,257 |

|

|

| 3.4 | % |

|

| 139,148 |

|

|

| 134,353 |

|

|

| 3.6 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earning assets |

|

| 476,787 |

|

|

| 450,053 |

|

|

| 5.9 | % |

|

| 476,496 |

|

|

| 438,561 |

|

|

| 8.6 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total assets |

|

| 485,034 |

|

|

| 458,461 |

|

|

| 5.8 | % |

|

| 484,335 |

|

|

| 446,613 |

|

|

| 8.4 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest bearing deposits |

|

| 131,659 |

|

|

| 137,385 |

|

|

| -4.2 | % |

|

| 130,350 |

|

|

| 141,614 |

|

|

| -8.0 | % |

|

Interest bearing deposits |

|

| 297,480 |

|

|

| 271,946 |

|

|

| 9.4 | % |

|

| 300,010 |

|

|

| 257,406 |

|

|

| 16.6 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total deposits |

|

| 429,139 |

|

|

| 409,331 |

|

|

| 4.8 | % |

|

| 430,360 |

|

|

| 399,020 |

|

|

| 7.9 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fed Funds Purchased and Repurchase Agreements |

|

| 0 |

|

|

| 1,076 |

|

|

| N/M |

|

|

| 0 |

|

|

| 381 |

|

|

| N/M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shareholders' equity |

| $ | 56,857 |

|

| $ | 51,234 |

|

|

| 11.0 | % |

| $ | 55,249 |

|

| $ | 50,110 |

|

|

| 10.3 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Average for Quarter Ending |

|

|

|

| |||||||||||||||

| Sep 30, |

|

| June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30, |

| ||||||

BALANCE SHEET SUMMARY |

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2023 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total loans |

| $ | 300,487 |

|

| $ | 306,551 |

|

| $ | 302,296 |

|

| $ | 297,994 |

|

| $ | 294,238 |

|

Total short term investments |

|

| 38,112 |

|

|

| 25,626 |

|

|

| 37,649 |

|

|

| 43,172 |

|

|

| 22,128 |

|

FRB Stock |

|

| 437 |

|

|

| 435 |

|

|

| 433 |

|

|

| 430 |

|

|

| 430 |

|

Total investment securities |

|

| 137,751 |

|

|

| 137,088 |

|

|

| 142,623 |

|

|

| 132,086 |

|

|

| 133,257 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earning assets |

|

| 476,787 |

|

|

| 469,700 |

|

|

| 483,001 |

|

|

| 473,682 |

|

|

| 450,053 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total assets |

|

| 485,034 |

|

|

| 477,700 |

|

|

| 490,262 |

|

|

| 481,952 |

|

|

| 458,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest bearing deposits |

|

| 131,659 |

|

|

| 131,609 |

|

|

| 127,766 |

|

|

| 138,527 |

|

|

| 137,385 |

|

Interest bearing deposits |

|

| 297,480 |

|

|

| 293,548 |

|

|

| 309,030 |

|

|

| 297,030 |

|

|

| 271,946 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total deposits |

|

| 429,139 |

|

|

| 425,157 |

|

|

| 436,796 |

|

|

| 435,557 |

|

|

| 409,331 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fed Funds Purchased and Repurchase Agreements |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 261 |

|

|

| 1,076 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shareholders' equity |

| $ | 56,857 |

|

| $ | 54,951 |

|

| $ | 53,923 |

|

| $ | 52,263 |

|

| $ | 51,234 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Quarter Ended |

|

| |||||||||||||||||

| Sep 30, | June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30 |

| ||||||||

HISTORICAL EARNINGS SUMMARY |

|

| 2024 |

|

|

| 2024 |

|

|

| 2024 |

|

|

| 2023 |

|

|

| 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest income |

| $ | 7,112 |

|

| $ | 7,107 |

|

| $ | 6,934 |

|

| $ | 6,818 |

|

| $ | 6,258 |

|

Interest expense |

|

| 2,749 |

|

|

| 2,713 |

|

|

| 2,832 |

|

|

| 2,738 |

|

|

| 2,370 |

|

Net Interest Income |

|

| 4,363 |

|

|

| 4,394 |

|

|

| 4,102 |

|

|

| 4,080 |

|

|

| 3,888 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Service charges on deposits |

|

| 65 |

|

|

| 64 |

|

|

| 53 |

|

|

| 55 |

|

|

| 69 |

|

Other income |

|

| 109 |

|

|

| 121 |

|

|

| 121 |

|

|

| 117 |

|

|

| 114 |

|

Total Non Interest Income |

|

| 174 |

|

|

| 185 |

|

|

| 174 |

|

|

| 172 |

|

|

| 183 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Salaries and benefits expense |

|

| 1,368 |

|

|

| 1,319 |

|

|

| 1,223 |

|

|

| 1,314 |

|

|

| 1,171 |

|

Occupancy and equipment expense |

|

| 133 |

|

|

| 122 |

|

|

| 122 |

|

|

| 109 |

|

|

| 118 |

|

Other expense |

|

| 601 |

|

|

| 657 |

|

|

| 620 |

|

|

| 509 |

|

|

| 500 |

|

Total Non Interest Expense |

|

| 2,102 |

|

|

| 2,098 |

|

|

| 1,965 |

|

|

| 1,932 |

|

|

| 1,789 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pretax pre-provision income |

|

| 2,435 |

|

|

| 2,481 |

|

|

| 2,311 |

|

|

| 2,320 |

|

|

| 2,282 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gain on sale of securities |

|

| 4 |

|

|

| (4 | ) |

|

| 0 |

|

|

| (36 | ) |

|

| (1 | ) |

Gain on sale of Other Assets |

|

| 0 |

|

|

| 36 |

|

|

| 17 |

|

|

| 58 |

|

|

| 0 |

|

Provision for Loan Losses |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earnings before income taxes |

|

| 2,439 |

|

|

| 2,514 |

|

|

| 2,328 |

|

|

| 2,342 |

|

|

| 2,281 |

|

Provision for income taxes |

|

| 340 |

|

|

| 360 |

|

|

| 300 |

|

|

| 207 |

|

|

| 313 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Earnings |

| $ | 2,099 |

|

| $ | 2,154 |

|

| $ | 2,028 |

|

| $ | 2,135 |

|

| $ | 1,968 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Diluted earnings per share |

| $ | 1.86 |

|

| $ | 1.91 |

|

| $ | 1.80 |

|

| $ | 1.88 |

|

| $ | 1.73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Ending Balance |

| ||||||||||||||||||

| Sept. 30, |

|

| June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30, |

| ||||||

HISTORICAL BALANCE SHEET |

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2023 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total loans |

| $ | 296,906 |

|

| $ | 304,810 |

|

| $ | 312,372 |

|

| $ | 297,423 |

|

| $ | 298,506 |

|

FRB Stock |

|

| 438 |

|

|

| 435 |

|

|

| 435 |

|

|

| 430 |

|

|

| 430 |

|

Total short term investments |

|

| 59,576 |

|

|

| 10,003 |

|

|

| 38,009 |

|

|

| 40,334 |

|

|

| 26,168 |

|

Total investment securities |

|

| 137,510 |

|

|

| 136,331 |

|

|

| 139,598 |

|

|

| 140,403 |

|

|

| 127,035 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total earning assets |

|

| 494,430 |

|

|

| 451,579 |

|

|

| 490,414 |

|

|

| 478,590 |

|

|

| 452,139 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Allowance for loan losses |

|

| (5,230 | ) |

|

| (5,227 | ) |

|

| (5,225 | ) |

|

| (5,224 | ) |

|

| (5,222 | ) |

Premises and equipment |

|

| 2,393 |

|

|

| 2,397 |

|

|

| 2,375 |

|

|

| 2,387 |

|

|

| 2,389 |

|

Other Assets |

|

| 9,739 |

|

|

| 14,711 |

|

|

| 8,149 |

|

|

| 10,291 |

|

|

| 10,137 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total assets |

|

| 501,332 |

|

|

| 463,460 |

|

|

| 495,713 |

|

|

| 486,044 |

|

|

| 459,443 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest bearing deposits |

|

| 137,594 |

|

|

| 128,318 |

|

|

| 130,876 |

|

|

| 130,601 |

|

|

| 135,016 |

|

Interest bearing deposits |

|

| 305,010 |

|

|

| 280,945 |

|

|

| 310,889 |

|

|

| 301,603 |

|

|

| 279,319 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total deposits |

|

| 442,604 |

|

|

| 409,263 |

|

|

| 441,765 |

|

|

| 432,204 |

|

|

| 414,335 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fed Funds Purchased and Repurchase Agreements |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Other Liabilities |

|

| 2,901 |

|

|

| 2,804 |

|

|

| 2,618 |

|

|

| 2,663 |

|

|

| 3,164 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total liabilities |

|

| 445,505 |

|

|

| 412,067 |

|

|

| 444,383 |

|

|

| 434,867 |

|

|

| 417,499 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shareholders' Equity Actual |

|

| 57,976 |

|

|

| 55,915 |

|

|

| 54,777 |

|

|

| 53,465 |

|

|

| 51,470 |

|

Unrealized Gain/Loss - AFS |

|

| (2,149 | ) |

|

| (4,957 | ) |

|

| (3,883 | ) |

|

| (2,718 | ) |

|

| (9,956 | ) |

Total Equity |

| $ | 55,827 |

|

| $ | 50,958 |

|

| $ | 50,894 |

|

| $ | 50,747 |

|

| $ | 41,514 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Quarter Ending |

| ||||||||||||||||||

| Sept. 30, |

|

| June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30, |

| ||||||

NONPERFORMING ASSETS |

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2023 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Nonaccrual loans |

| $ | 0 |

|

| $ | 0 |

|

| $ | 0 |

|

| $ | 0 |

|

| $ | 115 |

|

Restructured loans |

|

| 505 |

|

|

| 552 |

|

|

| 598 |

|

|

| 658 |

|

|

| 0 |

|

Other real estate & foreclosed assets |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Accruing loans past due 90 days or more |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Total nonperforming assets |

| $ | 505 |

|

| $ | 552 |

|

| $ | 598 |

|

| $ | 658 |

|

| $ | 115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Accruing loans past due 30-89 days |

| $ | 39 |

|

| $ | 1,274 |

|

| $ | 0 |

|

| $ | 1 |

|

| $ | 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total nonperforming assets as a percentage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of loans and foreclosed assets |

|

| 0.17 | % |

|

| 0.18 | % |

|

| 0.19 | % |

|

| 0.22 | % |

|

| 0.04 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Quarter Ending |

|

|

|

| |||||||||||||||

ALLOWANCE FOR |

| Sept. 30, |

|

| June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30, |

| |||||

LOAN LOSSES |

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2023 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Balance at beginning of period |

| $ | 5,224 |

|

| $ | 5,224 |

|

| $ | 5,224 |

|

| $ | 5,222 |

|

| $ | 5,344 |

|

Loans charged off |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| (127 | ) |

Loan recoveries |

|

| 6 |

|

|

| 3 |

|

|

| 0 |

|

|

| 2 |

|

|

| 5 |

|

Net (charge-offs) recoveries |

|

| 6 |

|

|

| 3 |

|

|

| 0 |

|

|

| 2 |

|

|

| (122 | ) |

Provision for loan losses |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Balance at end of period |

| $ | 5,230 |

|

| $ | 5,227 |

|

| $ | 5,224 |

|

| $ | 5,224 |

|

| $ | 5,222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Allowance for loan losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as a percentage of total loans |

|

| 1.76 | % |

|

| 1.71 | % |

|

| 1.67 | % |

|

| 1.76 | % |

|

| 1.75 | % |

Allowance for loan losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as a percentage of nonperforming assets |

|

| 1036 | % |

|

| 947 | % |

|

| 874 | % |

|

| 794 | % |

|

| 4541 | % |

Net charge-offs (recoveries) as a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

percentage of average loans |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.04 | % |

Provision for loan losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as a percentage of average loans |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Quarter Ending |

|

|

|

| |||||||||||||||

| Sept. 30, |

|

| June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30, |

| ||||||

SELECTED RATIOS |

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2023 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Return on average assets (annualized) |

|

| 1.73 | % |

|

| 1.80 | % |

|

| 1.65 | % |

|

| 1.77 | % |

|

| 1.72 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Return on average equity (annualized) |

|

| 15.91 | % |

|

| 17.42 | % |

|

| 16.03 | % |

|

| 19.87 | % |

|

| 17.36 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Return on average equity (excluding unrealized gain on investments) |

|

| 14.77 | % |

|

| 15.68 | % |

|

| 15.04 | % |

|

| 16.34 | % |

|

| 15.29 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Average shareholders' equity to average assets |

|

| 11.72 | % |

|

| 11.50 | % |

|

| 11.00 | % |

|

| 10.84 | % |

|

| 11.18 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Yield on earning assets (tax equivalent) |

|

| 6.20 | % |

|

| 6.28 | % |

|

| 5.97 | % |

|

| 5.81 | % |

|

| 5.76 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Effective Cost of Funds |

|

| 2.50 | % |

|

| 2.59 | % |

|

| 2.31 | % |

|

| 2.16 | % |

|

| 2.11 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net interest margin (tax equivalent) |

|

| 3.89 | % |

|

| 3.97 | % |

|

| 3.63 | % |

|

| 3.65 | % |

|

| 3.66 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Efficiency ratio (tax equivalent) |

|

| 43.7 | % |

|

| 43.2 | % |

|

| 43.1 | % |

|

| 42.4 | % |

|

| 41.6 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

End of period book value per common share |

| $ | 51.79 |

|

| $ | 47.23 |

|

| $ | 47.17 |

|

| $ | 46.73 |

|

| $ | 38.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

End of period book value (excluding unrealized gain/loss on investments) |

| $ | 53.78 |

|

| $ | 51.82 |

|

| $ | 50.77 |

|

| $ | 49.23 |

|

| $ | 47.22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

End of period common shares outstanding (in 000's) |

|

| 1,078 |

|

|

| 1,079 |

|

|

| 1,079 |

|

|

| 1,086 |

|

|

| 1,090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Quarter Ending |

| ||||||||||||||||||||||||||||||

| September 30, 2024 |

|

| September 30, 2023 |

| |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

|

|

|

|

|

|

|

|

| Tax |

|

|

|

|

|

|

|

|

|

|

| Tax |

| |||||||||

| Average |

|

|

|

|

|

|

|

| Equivalent |

|

| Average |

|

|

|

|

|

|

|

| Equivalent |

| |||||||||

YIELD ANALYSIS |

| Balance |

|

| Interest |

|

| Yield |

|

| Yield |

|

| Balance |

|

| Interest |

|

| Yield |

|

| Yield |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Interest Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Short term investment |

| $ | 38,112 |

|

| $ | 525 |

|

|

| 5.51 | % |

|

| 5.51 | % |

| $ | 22,128 |

|

| $ | 301 |

|

|

| 5.44 | % |

|

| 5.44 | % |

FRB Stock |

|

| 437 |

|

|

| 7 |

|

|

| 6.00 | % |

|

| 6.00 | % |

|

| 430 |

|

|

| 6 |

|

|

| 6.00 | % |

|

| 6.00 | % |

Taxable securities |

|

| 2,098 |

|

|

| 26 |

|

|

| 4.96 | % |

|

| 4.96 | % |

|

| 2,337 |

|

|

| 31 |

|

|

| 5.31 | % |

|

| 5.31 | % |

Tax Free securities |

|

| 135,653 |

|

|

| 1,029 |

|

|

| 3.03 | % |

|

| 3.84 | % |

|

| 130,920 |

|

|

| 847 |

|

|

| 2.59 | % |

|

| 3.28 | % |

Loans |

|

| 300,487 |

|

|

| 5,525 |

|

|

| 7.35 | % |

|

| 7.35 | % |

|

| 294,238 |

|

|

| 5,073 |

|

|

| 6.90 | % |

|

| 6.90 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Interest Earning Assets |

|

| 476,787 |

|

|

| 7,112 |

|

|

| 5.97 | % |

|

| 6.20 | % |

|

| 450,053 |

|

|

| 6,258 |

|

|

| 5.56 | % |

|

| 5.76 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

| 5,874 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6,197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets |

|

| 7,602 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7,433 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses |

|

| (5,229 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (5,222 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Noninterest Earning Assets |

|

| 8,247 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8,408 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Assets |

| $ | 485,034 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 458,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction and Money Market accounts |

| $ | 191,291 |

|

| $ | 1,515 |

|

|

| 3.17 | % |

|

| 3.17 | % |

| $ | 178,729 |

|

| $ | 1,494 |

|

|

| 3.34 | % |

|

| 3.34 | % |

Certificates and other time deposits |

|

| 106,189 |

|

|

| 1,233 |

|

|

| 4.64 | % |

|

| 4.64 | % |

|

| 93,217 |

|

|

| 861 |

|

|

| 3.69 | % |

|

| 3.69 | % |

Other borrowings |

|

| 0 |

|

|

| 0 |

|

|

| 0.00 | % |

|

| 0.00 | % |

|

| 1,076 |

|

|

| 15 |

|

|

| 5.58 | % |

|

| 0.00 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Interest Bearing Liabilities |

|

| 297,480 |

|

|

| 2,748 |

|

|

| 3.70 | % |

|

| 3.70 | % |

|

| 273,022 |

|

|

| 2,370 |

|

|

| 3.47 | % |

|

| 3.47 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

|

| 131,659 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 137,385 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other liabilities |

|

| 3,106 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2,703 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

| 52,789 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 45,351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Liabilities and Shareholders Equity |

| $ | 485,034 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 458,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Interest Income and Spread |

| $ | 179,307 |

|

| $ | 4,364 |

|

|

| 2.27 | % |

|

| 2.50 | % |

| $ | 177,031 |

|

| $ | 3,888 |

|

|

| 2.09 | % |

|

| 2.29 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Interest Margin |

|

|

|

|

|

|

|

|

|

| 3.66 | % |

|

| 3.89 | % |

|

|

|

|

|

|

|

|

|

| 3.46 | % |

|

| 3.66 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| September 30 |

|

|

|

|

| September 30 |

|

|

|

| |||||

| 2024 |

|

| % |

|

| 2023 |

|

| % |

| |||||

LOAN PORTFOLIO |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Commercial and industrial |

| $ | 162,143 |

|

|

| 54.61 | % |

| $ | 166,903 |

|

|

| 55.91 | % |

Real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial |

|

| 95,116 |

|

|

| 32.04 | % |

|

| 83,846 |

|

|

| 28.09 | % |

Residential |

|

| 14,608 |

|

|

| 4.92 | % |

|

| 21,044 |

|

|

| 7.05 | % |

Construction and development |

|

| 24,704 |

|

|

| 8.32 | % |

|

| 26,470 |

|

|

| 8.87 | % |

Consumer |

|

| 335 |

|

|

| 0.11 | % |

|

| 243 |

|

|

| 0.08 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total loans |

| $ | 296,906 |

|

|

| 100.00 | % |

| $ | 298,506 |

|

|

| 100.00 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| September 30 |

|

|

|

| September 30 |

|

|

| |||||||

|

| 2024 |

|

|

|

|

|

|

| 2023 |

|

|

|

|

| |

REGULATORY CAPITAL DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier 1 Capital |

| $ | 57,977 |

|

|

|

|

|

| $ | 51,470 |

|

|

|

|

|

Total Capital (Tier 1 + Tier 2) |

| $ | 62,176 |

|

|

|

|

|

| $ | 55,671 |

|

|

|

|

|

Total Risk-Adjusted Assets |

| $ | 334,591 |

|

|

|

|

|

| $ | 334,784 |

|

|

|

|

|

Tier 1 Risk-Based Capital Ratio |

|

| 17.33 | % |

|

|

|

|

|

| 15.37 | % |

|

|

|

|

Total Risk-Based Capital Ratio |

|

| 18.58 | % |

|

|

|

|

|

| 16.63 | % |

|

|

|

|

Tier 1 Leverage Ratio |

|

| 11.95 | % |

|

|

|

|

|

| 11.23 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Time Equivalent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employees (FTE's) |

|

| 28 |

|

|

|

|

|

|

| 27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Stock Price Range |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(For the Three Months Ended): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

| $ | 90.00 |

|

|

|

|

|

| $ | 85.00 |

|

|

|

|

|

Low |

| $ | 80.00 |

|

|

|

|

|

| $ | 84.00 |

|

|

|

|

|

Close |

| $ | 87.00 |

|

|

|

|

|

| $ | 85.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Trinity Bank, N.A. is a commercial bank that began operations May 28, 2003. For a full financial statement, visit Trinity Bank's website: www.trinitybk.com Regulatory reporting format is also available at www.fdic.gov.

###

For information contact:

Richard Burt

Executive Vice President

Trinity Bank

817-763-9966

This Press Release may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding future financial conditions, results of operations and the Bank's business operations. Such forward-looking statements involve risks, uncertainties and assumptions, including, but not limited to, monetary policy and general economic conditions in Texas and the greater Dallas-Fort Worth metropolitan area, the risks of changes in interest rates on the level and composition of deposits, loan demand and the values of loan collateral, securities and interest rate protection agreements, the actions of competitors and customers, the success of the Bank in implementing its strategic plan, the failure of the assumptions underlying the reserves for loan losses and the estimations of values of collateral and various financial assets and liabilities, that the costs of technological changes are more difficult or expensive than anticipated, the effects of regulatory restrictions imposed on banks generally, any changes in fiscal, monetary or regulatory policies and other uncertainties as discussed in the Bank's Registration Statement on Form SB‑1 filed with the Office of the Comptroller of the Currency. Should one or more of these risks or uncertainties materialize, or should these underlying assumptions prove incorrect, actual outcomes may vary materially from outcomes expected or anticipated by the Bank. A forward-looking statement may include a statement of the assumptions or bases underlying the forward‑looking statement. The Bank believes it has chosen these assumptions or bases in good faith and that they are reasonable. However, the Bank cautions you that assumptions or bases almost always vary from actual results, and the differences between assumptions or bases and actual results can be material. The Bank undertakes no obligation to publicly update or otherwise revise any forward‑looking statements, whether as a result of new information, future events or otherwise, unless the securities laws require the Bank to do so.

SOURCE: Trinity Bank, NA (Fort Worth, Texas)

View the original press release on accesswire.com