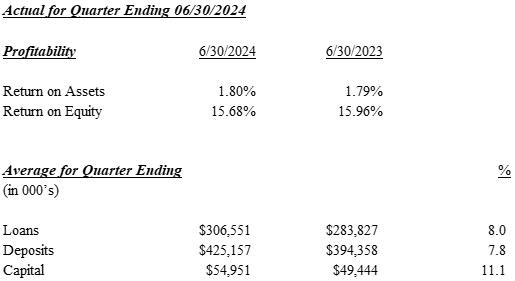

Trinity Bank Reports 2024 2Q Results - Return on Assets 1.80% and Return on Equity 15.68%

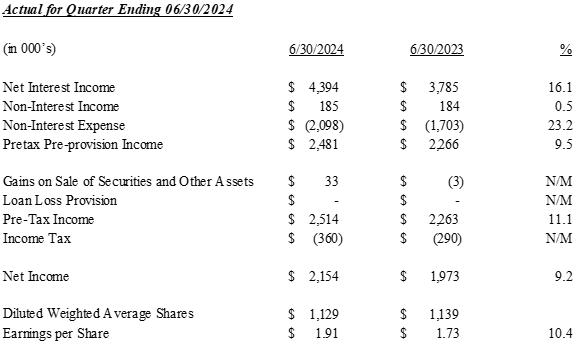

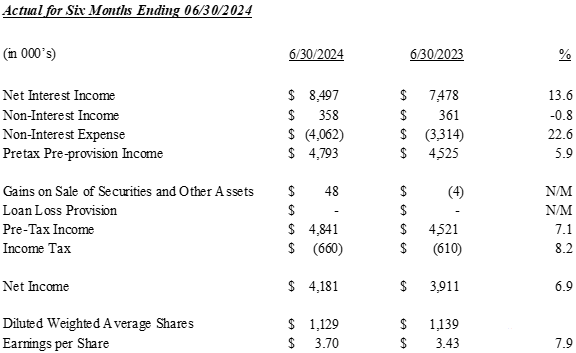

Trinity Bank N.A. (OTC PINK:TYBT) reported strong financial results for Q2 2024 and the first half of the year. Net Income after Taxes for Q2 2024 was $2,154,000 or $1.91 per diluted share, a 10.4% increase from Q2 2023. For the first six months of 2024, Net Income after Taxes reached $4,181,000, up 6.9% from the same period in 2023. Earnings per diluted share for H1 2024 were $3.70, a 7.9% increase year-over-year.

CEO Matt R. Opitz highlighted Q2 2024 as Trinity Bank's best quarter since inception, praising the staff's dedication. Despite challenges like high inflation and an elevated rate environment, the bank reported a positive business climate in North Texas. Trinity Bank maintains strong liquidity and capital positions, ready for continued growth opportunities.

Trinity Bank N.A. (OTC PINK:TYBT) ha riportato risultati finanziari solidi per il Q2 2024 e per il primo semestre dell'anno. Il Reddito Netto dopo le Tasse per il Q2 2024 è stato di $2.154.000, ovvero $1,91 per azione diluita, con un incremento del 10,4% rispetto al Q2 2023. Nel corso dei primi sei mesi del 2024, il Reddito Netto dopo le Tasse ha raggiunto $4.181.000, con un aumento del 6,9% rispetto allo stesso periodo del 2023. Gli Utili per azione diluita per il primo semestre del 2024 sono stati di $3,70, con un incremento del 7,9% anno dopo anno.

Il CEO Matt R. Opitz ha messo in evidenza il Q2 2024 come il migliore trimestre della storia di Trinity Bank, lodando la dedizione del personale. Nonostante le sfide come l'alta inflazione e un contesto di tassi elevati, la banca ha riportato un clima di business positivo nel nord del Texas. Trinity Bank mantiene solide posizioni di liquidità e capitale, pronta per opportunità di crescita continua.

Trinity Bank N.A. (OTC PINK:TYBT) reportó resultados financieros sólidos para el Q2 2024 y la primera mitad del año. Los Ingresos Netos después de Impuestos para el Q2 2024 fueron de $2,154,000 o $1.91 por acción diluida, un aumento del 10.4% en comparación con el Q2 2023. Para los primeros seis meses de 2024, los Ingresos Netos después de Impuestos alcanzaron los $4,181,000, un 6.9% más que en el mismo período de 2023. Las Ganancias por acción diluida para el H1 2024 fueron de $3.70, un aumento del 7.9% año tras año.

El CEO Matt R. Opitz destacó el Q2 2024 como el mejor trimestre de Trinity Bank desde su creación, elogiando la dedicación del personal. A pesar de desafíos como la alta inflación y un entorno de tasas elevadas, el banco reportó un clima empresarial positivo en el norte de Texas. Trinity Bank mantiene sólidas posiciones de liquidez y capital, listas para nuevas oportunidades de crecimiento.

트리니티 뱅크 N.A. (OTC PINK:TYBT)는 2024년 2분기 및 상반기에 대한 강력한 재무 결과를 발표했습니다. 세후 순이익은 2024년 2분기에 $2,154,000 또는 희석주당 $1.91로, 2023년 2분기 대비 10.4% 증가했습니다. 2024년 상반기의 세후 순이익은 $4,181,000에 도달하여, 2023년 같은 기간 대비 6.9% 증가했습니다. 희석주당 순이익은 2024년 상반기에 $3.70로, 전년 대비 7.9% 증가했습니다.

CEO 맷 R. 오피츠는 2024년 2분기를 트리니티 뱅크의 창립 이후 가장 좋은 분기로 강조하며 직원들의 헌신을 칭찬했습니다. 높은 인플레이션과 금리 인상과 같은 도전 과제가 있음에도 불구하고, 은행은 북텍사스에서 긍정적인 비즈니스 환경을 보고했습니다. 트리니티 뱅크는 강력한 유동성 및 자본 위치를 유지하고 있으며, 지속적인 성장 기회를 준비하고 있습니다.

Trinity Bank N.A. (OTC PINK:TYBT) a annoncé de solides résultats financiers pour le Q2 2024 et le premier semestre de l'année. Le Résultat Net après Impôts pour le Q2 2024 s'est établi à 2.154.000 $, soit 1,91 $ par action diluée, ce qui représente une augmentation de 10,4 % par rapport au Q2 2023. Pour les six premiers mois de 2024, le Résultat Net après Impôts a atteint 4.181.000 $, en hausse de 6,9 % par rapport à la même période en 2023. Le Bénéfice par action diluée pour le H1 2024 s'élève à 3,70 $, soit une augmentation de 7,9 % par rapport à l'année précédente.

Le PDG Matt R. Opitz a souligné le Q2 2024 comme le meilleur trimestre de l'histoire de Trinity Bank, louant le dévouement du personnel. Malgré les défis tels que l'inflation élevée et un environnement de taux d'intérêt élevé, la banque a rapporté un climat d'affaires positif dans le nord du Texas. Trinity Bank maintient une position solide en termes de liquidités et de capital, prête pour de futures opportunités de croissance.

Trinity Bank N.A. (OTC PINK:TYBT) berichtete über starkeFinanzergebnisse für das Q2 2024 und das erste Halbjahr des Jahres. Das Nettoergebnis nach Steuern für das Q2 2024 betrug $2.154.000 oder $1,91 pro verwässerter Aktie, was einer Steigerung von 10,4 % im Vergleich zum Q2 2023 entspricht. Für die ersten sechs Monate des Jahres 2024 erreichte das Nettoergebnis nach Steuern $4.181.000, was einem Anstieg von 6,9 % im Vergleich zum Vorjahr entspricht. Die Erträge pro verwässerter Aktie für das erste Halbjahr 2024 betrugen $3,70, was einem Anstieg von 7,9 % im Vergleich zum Vorjahr entspricht.

CEO Matt R. Opitz hob das Q2 2024 als das beste Quartal in der Geschichte von Trinity Bank hervor und lobte das Engagement der Mitarbeiter. Trotz Herausforderungen wie hoher Inflation und eines erhöhten Zinsniveaus berichtete die Bank über ein positives Geschäftsklima in Nordtexas. Trinity Bank hat starke Liquiditäts- und Kapitalpositionen und ist bereit für zukünftige Wachstumschancen.

- Net Income after Taxes increased by 10.4% year-over-year in Q2 2024

- Earnings per diluted share grew by 10.4% to $1.91 in Q2 2024

- H1 2024 Net Income after Taxes up 6.9% compared to H1 2023

- H1 2024 Earnings per diluted share increased by 7.9% to $3.70

- Return on Assets of 1.80% and Return on Equity of 15.68% for Q2 2024

- Strong liquidity and capital position reported by the bank

- None.

Second Quarter Earnings Up

FORT WORTH, TX / ACCESSWIRE / July 25, 2024 / Trinity Bank N.A. (OTC PINK:TYBT) today announced operating results for the three months ending June 30, 2024, and YTD results for the six months ending June 30, 2024.

Results of Operations

Trinity Bank, N.A. reported Net Income after Taxes of

For the first six months of 2024, Net Income after Taxes amounted to

Matt R. Opitz, CEO, stated, "The second quarter represents Trinity Bank's single best quarter of performance since inception. We are pleased with these results and especially proud of our dedicated staff who continues to go above and beyond, constantly providing the type of exceptional customer experiences that make results like these possible."

"Despite the continued effects of high inflation, the elevated rate environment and an upcoming, consequential presidential election, the business climate is good in North Texas and our customers remain cautiously optimistic. Trinity Bank is well positioned, with good liquidity and strong capital, to deal with the effects of our current environment as well as look for opportunities for continued growth."

Trinity Bank, N.A. is a commercial bank that began operations May 28, 2003. For a full financial statement, visit Trinity Bank's website: www.trinitybk.com Regulatory reporting format is also available at www.fdic.gov.

###

For information contact:

Richard Burt

Executive Vice President

Trinity Bank

817-763-9966

This Press Release may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding future financial conditions, results of operations and the Bank's business operations. Such forward-looking statements involve risks, uncertainties and assumptions, including, but not limited to, monetary policy and general economic conditions in Texas and the greater Dallas-Fort Worth metropolitan area, the risks of changes in interest rates on the level and composition of deposits, loan demand and the values of loan collateral, securities and interest rate protection agreements, the actions of competitors and customers, the success of the Bank in implementing its strategic plan, the failure of the assumptions underlying the reserves for loan losses and the estimations of values of collateral and various financial assets and liabilities, that the costs of technological changes are more difficult or expensive than anticipated, the effects of regulatory restrictions imposed on banks generally, any changes in fiscal, monetary or regulatory policies and other uncertainties as discussed in the Bank's Registration Statement on Form SB‑1 filed with the Office of the Comptroller of the Currency. Should one or more of these risks or uncertainties materialize, or should these underlying assumptions prove incorrect, actual outcomes may vary materially from outcomes expected or anticipated by the Bank. A forward-looking statement may include a statement of the assumptions or bases underlying the forward‑looking statement. The Bank believes it has chosen these assumptions or bases in good faith and that they are reasonable. However, the Bank cautions you that assumptions or bases almost always vary from actual results, and the differences between assumptions or bases and actual results can be material. The Bank undertakes no obligation to publicly update or otherwise revise any forward‑looking statements, whether as a result of new information, future events or otherwise, unless the securities laws require the Bank to do so.

| Quarter Ended |

|

|

| Six Months Ending |

| ||||||||||||||||||

| June 30 | % |

|

|

| June 30 | % |

| ||||||||||||||||

BALANCE SHEET SUMMARY |

|

| 2024 |

|

|

| 2023 |

|

| Change |

|

|

| 2024 |

|

|

| 2023 |

|

| Change | |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Interest income |

| $ | 7,107 |

|

| $ | 5,719 |

|

|

| 24.3 | % |

| $ | 14,041 |

|

| $ | 10,982 |

|

|

| 27.9 | % |

Interest expense |

|

| 2,713 |

|

|

| 1,934 |

|

|

| 40.3 | % |

|

| 5,544 |

|

|

| 3,504 |

|

|

| 58.2 | % |

Net Interest Income |

|

| 4,394 |

|

|

| 3,785 |

|

|

| 16.1 | % |

|

| 8,497 |

|

|

| 7,478 |

|

|

| 13.6 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Service charges on deposits |

|

| 64 |

|

|

| 64 |

|

|

| 0.0 | % |

|

| 120 |

|

|

| 123 |

|

|

| -2.4 | % |

Other income |

|

| 121 |

|

|

| 120 |

|

|

| 0.8 | % |

|

| 238 |

|

|

| 238 |

|

|

| 0.0 | % |

Total Non Interest Income |

|

| 185 |

|

|

| 184 |

|

|

| 0.5 | % |

|

| 358 |

|

|

| 361 |

|

|

| -0.8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Salaries and benefits expense |

|

| 1,319 |

|

|

| 1,146 |

|

|

| 15.1 | % |

|

| 2,541 |

|

|

| 2,214 |

|

|

| 14.8 | % |

Occupancy and equipment expense |

|

| 122 |

|

|

| 116 |

|

|

| 5.2 | % |

|

| 244 |

|

|

| 227 |

|

|

| 7.5 | % |

Other expense |

|

| 657 |

|

|

| 441 |

|

|

| 49.0 | % |

|

| 1,277 |

|

|

| 873 |

|

|

| 46.3 | % |

Total Non Interest Expense |

|

| 2,098 |

|

|

| 1,703 |

|

|

| 23.2 | % |

|

| 4,062 |

|

|

| 3,314 |

|

|

| 22.6 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pretax pre-provision income |

|

| 2,481 |

|

|

| 2,266 |

|

|

| 9.5 | % |

|

| 4,793 |

|

|

| 4,525 |

|

|

| 5.9 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gain on sale of Securities |

|

| (4 | ) |

|

| (3 | ) |

|

| N/M |

|

|

| (4 | ) |

|

| (4 | ) |

|

| N/M |

|

Gain on sale of Assets |

|

| 36 |

|

|

| 0 |

|

|

| N/M |

|

|

| 53 |

|

|

| 0 |

|

|

| N/M |

|

Provision for Loan Losses |

|

| 0 |

|

|

| 0 |

|

|

| N/M |

|

|

| 0 |

|

|

| 0 |

|

|

| N/M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earnings before income taxes |

|

| 2,514 |

|

|

| 2,263 |

|

|

| 11.1 | % |

|

| 4,841 |

|

|

| 4,521 |

|

|

| 7.1 | % |

Provision for income taxes |

|

| 360 |

|

|

| 290 |

|

|

| 24.1 | % |

|

| 660 |

|

|

| 610 |

|

|

| 8.2 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Earnings |

| $ | 2,154 |

|

| $ | 1,973 |

|

|

| 9.2 | % |

| $ | 4,181 |

|

| $ | 3,911 |

|

|

| 6.9 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic earnings per share |

|

| 2.00 |

|

|

| 1.81 |

|

|

| 10.3 | % |

|

| 3.87 |

|

|

| 3.59 |

|

|

| 7.9 | % |

Basic weighted average shares |

|

| 1,079 |

|

|

| 1,090 |

|

|

|

|

|

|

| 1,079 |

|

|

| 1,090 |

|

|

|

|

|

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Diluted earnings per share - estimate |

|

| 1.91 |

|

|

| 1.73 |

|

|

| 10.2 | % |

|

| 3.70 |

|

|

| 3.43 |

|

|

| 8.0 | % |

Diluted weighted average shares outstanding |

|

| 1,129 |

|

|

| 1,139 |

|

|

|

|

|

|

| 1,129 |

|

|

| 1,139 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Average for Quarter |

|

|

|

|

|

| Average for Six Months | ||||||||||||||||

| June 30 | % |

|

|

|

| June 30 | % |

| |||||||||||||||

BALANCE SHEET SUMMARY |

|

| 2024 |

|

|

| 2023 |

|

| Change |

|

|

| 2024 |

|

|

| 2023 |

|

| Change | |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total loans |

| $ | 306,551 |

|

| $ | 283,827 |

|

|

| 8.0 | % |

| $ | 304,424 |

|

| $ | 287,647 |

|

|

| 5.8 | % |

Total short term investments |

|

| 25,626 |

|

|

| 16,087 |

|

|

| 59.3 | % |

|

| 31,637 |

|

|

| 19,392 |

|

|

| 63.1 | % |

FRB Stock |

|

| 435 |

|

|

| 429 |

|

|

| 1.4 | % |

|

| 434 |

|

|

| 429 |

|

|

| 1.2 | % |

Total investment securities |

|

| 137,088 |

|

|

| 134,403 |

|

|

| 2.0 | % |

|

| 139,855 |

|

|

| 142,743 |

|

|

| -2.0 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earning assets |

|

| 469,700 |

|

|

| 434,746 |

|

|

| 8.0 | % |

|

| 476,350 |

|

|

| 450,211 |

|

|

| 5.8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total assets |

|

| 477,700 |

|

|

| 441,447 |

|

|

| 8.2 | % |

|

| 483,981 |

|

|

| 437,237 |

|

|

| 10.7 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest bearing deposits |

|

| 131,609 |

|

|

| 140,734 |

|

|

| -6.5 | % |

|

| 129,688 |

|

|

| 136,459 |

|

|

| -5.0 | % |

Interest bearing deposits |

|

| 293,548 |

|

|

| 253,624 |

|

|

| 15.7 | % |

|

| 301,289 |

|

|

| 249,018 |

|

|

| 21.0 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total deposits |

|

| 425,157 |

|

|

| 394,358 |

|

|

| 7.8 | % |

|

| 430,977 |

|

|

| 393,778 |

|

|

| 9.4 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fed Funds Purchased and Repurchase Agreements |

|

| 0 |

|

|

| 55 |

|

|

| N/M |

|

|

| 0 |

|

|

| 28 |

|

|

| N/M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shareholders' equity |

| $ | 54,951 |

|

| $ | 49,444 |

|

|

| 11.1 | % |

| $ | 54,437 |

|

| $ | 49,539 |

|

|

| 9.9 | % |

| Average for Quarter Ending |

| ||||||||||||||||||

| June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30, |

|

| June 30, |

| ||||||

BALANCE SHEET SUMMARY |

| 2024 |

|

| 2024 |

|

| 2023 |

|

| 2023 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total loans |

| $ | 306,551 |

|

| $ | 302,296 |

|

| $ | 297,994 |

|

| $ | 294,238 |

|

| $ | 283,827 |

|

Total short term investments |

|

| 25,626 |

|

|

| 37,649 |

|

|

| 43,172 |

|

|

| 22,128 |

|

|

| 16,087 |

|

FRB Stock |

|

| 435 |

|

|

| 433 |

|

|

| 430 |

|

|

| 430 |

|

|

| 429 |

|

Total investment securities |

|

| 137,088 |

|

|

| 142,623 |

|

|

| 132,086 |

|

|

| 133,257 |

|

|

| 134,403 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earning assets |

|

| 469,700 |

|

|

| 483,001 |

|

|

| 473,682 |

|

|

| 450,053 |

|

|

| 434,746 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total assets |

|

| 477,700 |

|

|

| 490,262 |

|

|

| 481,952 |

|

|

| 458,461 |

|

|

| 441,447 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest bearing deposits |

|

| 131,609 |

|

|

| 127,766 |

|

|

| 138,527 |

|

|

| 137,385 |

|

|

| 140,734 |

|

Interest bearing deposits |

|

| 293,548 |

|

|

| 309,030 |

|

|

| 297,030 |

|

|

| 271,946 |

|

|

| 253,624 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total deposits |

|

| 425,157 |

|

|

| 436,796 |

|

|

| 435,557 |

|

|

| 409,331 |

|

|

| 394,358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fed Funds Purchased and Repurchase Agreements |

|

| 0 |

|

|

| 0 |

|

|

| 261 |

|

|

| 1,076 |

|

|

| 55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shareholders' equity |

| $ | 54,951 |

|

| $ | 53,923 |

|

| $ | 52,263 |

|

| $ | 51,234 |

|

| $ | 49,444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Quarter Ended |

|

|

|

|

| ||||||

| June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30, |

|

| June 30, |

| ||||||

HISTORICAL EARNINGS SUMMARY |

| 2024 |

|

| 2024 |

|

| 2023 |

|

| 2023 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest income |

| $ | 7,107 |

|

| $ | 6,934 |

|

| $ | 6,818 |

|

| $ | 6,258 |

|

| $ | 5,719 |

|

Interest expense |

|

| 2,713 |

|

|

| 2,832 |

|

|

| 2,738 |

|

|

| 2,370 |

|

|

| 1,934 |

|

Net Interest Income |

|

| 4,394 |

|

|

| 4,102 |

|

|

| 4,080 |

|

|

| 3,888 |

|

|

| 3,785 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Service charges on deposits |

|

| 64 |

|

|

| 53 |

|

|

| 55 |

|

|

| 69 |

|

|

| 64 |

|

Other income |

|

| 121 |

|

|

| 121 |

|

|

| 117 |

|

|

| 114 |

|

|

| 120 |

|

Total Non Interest Income |

|

| 185 |

|

|

| 174 |

|

|

| 172 |

|

|

| 183 |

|

|

| 184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Salaries and benefits expense |

|

| 1,319 |

|

|

| 1,223 |

|

|

| 1,314 |

|

|

| 1,171 |

|

|

| 1,146 |

|

Occupancy and equipment expense |

|

| 122 |

|

|

| 122 |

|

|

| 109 |

|

|

| 118 |

|

|

| 116 |

|

Other expense |

|

| 657 |

|

|

| 620 |

|

|

| 509 |

|

|

| 500 |

|

|

| 441 |

|

Total Non Interest Expense |

|

| 2,098 |

|

|

| 1,965 |

|

|

| 1,932 |

|

|

| 1,789 |

|

|

| 1,703 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pretax pre-provision income |

|

| 2,481 |

|

|

| 2,311 |

|

|

| 2,320 |

|

|

| 2,282 |

|

|

| 2,266 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gain on sale of securities |

|

| (4 | ) |

|

| 0 |

|

|

| (36 | ) |

|

| (1 | ) |

|

| (3 | ) |

Gain on sale of Other Assets |

|

| 36 |

|

|

| 17 |

|

|

| 58 |

|

|

| 0 |

|

|

| 0 |

|

Provision for Loan Losses |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earnings before income taxes |

|

| 2,514 |

|

|

| 2,328 |

|

|

| 2,342 |

|

|

| 2,281 |

|

|

| 2,263 |

|

Provision for income taxes |

|

| 360 |

|

|

| 300 |

|

|

| 207 |

|

|

| 313 |

|

|

| 290 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Earnings |

| $ | 2,154 |

|

| $ | 2,028 |

|

| $ | 2,135 |

|

| $ | 1,968 |

|

| $ | 1,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Diluted earnings per share |

| $ | 1.91 |

|

| $ | 1.80 |

|

| $ | 1.88 |

|

| $ | 1.73 |

|

| $ | 1.73 |

|

| Ending Balance |

| ||||||||||||||||||

| June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30, |

|

| June 30, |

| ||||||

HISTORICAL BALANCE SHEET |

| 2024 |

|

| 2024 |

|

| 2023 |

|

| 2023 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total loans |

| $ | 304,810 |

|

| $ | 312,372 |

|

| $ | 297,423 |

|

| $ | 298,506 |

|

| $ | 292,591 |

|

FRB Stock |

|

| 435 |

|

|

| 435 |

|

|

| 430 |

|

|

| 430 |

|

|

| 429 |

|

Total short term investments |

|

| 10,003 |

|

|

| 38,009 |

|

|

| 40,334 |

|

|

| 26,168 |

|

|

| 18,313 |

|

Total investment securities |

|

| 136,331 |

|

|

| 139,598 |

|

|

| 140,403 |

|

|

| 127,035 |

|

|

| 130,603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total earning assets |

|

| 451,579 |

|

|

| 490,414 |

|

|

| 478,590 |

|

|

| 452,139 |

|

|

| 441,507 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Allowance for loan losses |

|

| (5,227 | ) |

|

| (5,225 | ) |

|

| (5,224 | ) |

|

| (5,222 | ) |

|

| (5,344 | ) |

Premises and equipment |

|

| 2,397 |

|

|

| 2,375 |

|

|

| 2,387 |

|

|

| 2,389 |

|

|

| 2,378 |

|

Other Assets |

|

| 14,711 |

|

|

| 8,149 |

|

|

| 10,291 |

|

|

| 10,137 |

|

|

| 10,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total assets |

|

| 463,460 |

|

|

| 495,713 |

|

|

| 486,044 |

|

|

| 459,443 |

|

|

| 448,585 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest bearing deposits |

|

| 128,318 |

|

|

| 130,876 |

|

|

| 130,601 |

|

|

| 135,016 |

|

|

| 141,613 |

|

Interest bearing deposits |

|

| 280,945 |

|

|

| 310,889 |

|

|

| 301,603 |

|

|

| 279,319 |

|

|

| 259,401 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total deposits |

|

| 409,263 |

|

|

| 441,765 |

|

|

| 432,204 |

|

|

| 414,335 |

|

|

| 401,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fed Funds Purchased and Repurchase Agreements |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Other Liabilities |

|

| 2,804 |

|

|

| 2,618 |

|

|

| 2,663 |

|

|

| 3,164 |

|

|

| 2,239 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total liabilities |

|

| 412,067 |

|

|

| 444,383 |

|

|

| 434,867 |

|

|

| 417,499 |

|

|

| 403,253 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shareholders' Equity Actual |

|

| 55,915 |

|

|

| 54,777 |

|

|

| 53,465 |

|

|

| 51,470 |

|

|

| 50,427 |

|

Unrealized Gain/Loss - AFS |

|

| (4,957 | ) |

|

| (3,883 | ) |

|

| (2,718 | ) |

|

| (9,956 | ) |

|

| (5,096 | ) |

Total Equity |

| $ | 50,958 |

|

| $ | 50,894 |

|

| $ | 50,747 |

|

| $ | 41,514 |

|

| $ | 45,331 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Quarter Ending |

|

|

|

|

|

|

|

|

| ||

| June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30, |

|

| June 30, |

| ||||||

NONPERFORMING ASSETS |

| 2024 |

|

| 2024 |

|

| 2023 |

|

| 2023 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Nonaccrual loans |

| $ | 0 |

|

| $ | 0 |

|

| $ | 0 |

|

| $ | 115 |

|

| $ | 143 |

|

Restructured loans |

|

| 552 |

|

|

| 598 |

|

|

| 658 |

|

|

| 0 |

|

|

| 0 |

|

Other real estate & foreclosed assets |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Accruing loans past due 90 days or more |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Total nonperforming assets |

| $ | 552 |

|

| $ | 598 |

|

| $ | 658 |

|

| $ | 115 |

|

| $ | 143 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Accruing loans past due 30-89 days |

| $ | 1,274 |

|

| $ | 0 |

|

| $ | 1 |

|

| $ | 2 |

|

| $ | 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total nonperforming assets as a percentage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of loans and foreclosed assets |

|

| 0.18 | % |

|

| 0.19 | % |

|

| 0.22 | % |

|

| 0.04 | % |

|

| 0.05 | % |

| Quarter Ending |

| ||||||||||||||||||

ALLOWANCE FOR |

| June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30, |

|

| June 30, |

| |||||

LOAN LOSSES |

| 2024 |

|

| 2024 |

|

| 2023 |

|

| 2023 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Balance at beginning of period |

| $ | 5,224 |

|

| $ | 5,224 |

|

| $ | 5,222 |

|

| $ | 5,344 |

|

| $ | 5,344 |

|

Loans charged off |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| (127 | ) |

|

| 0 |

|

Loan recoveries |

|

| 3 |

|

|

| 0 |

|

|

| 2 |

|

|

| 5 |

|

|

| 0 |

|

Net (charge-offs) recoveries |

|

| 0 |

|

|

| 0 |

|

|

| 2 |

|

|

| (122 | ) |

|

| 0 |

|

Provision for loan losses (One time CECL adjustment) |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Balance at end of period |

| $ | 5,227 |

|

| $ | 5,224 |

|

| $ | 5,224 |

|

| $ | 5,222 |

|

| $ | 5,344 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Allowance for loan losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as a percentage of total loans |

|

| 1.71 | % |

|

| 1.67 | % |

|

| 1.76 | % |

|

| 1.75 | % |

|

| 1.83 | % |

Allowance for loan losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as a percentage of nonperforming assets |

|

| 947 | % |

|

| 874 | % |

|

| 794 | % |

|

| 4541 | % |

|

| 3737 | % |

Net charge-offs (recoveries) as a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

percentage of average loans |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.04 | % |

|

| 0.00 | % |

Provision for loan losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as a percentage of average loans |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Quarter Ending | |||||||||||||||||||

| June 30, |

|

| March 31, |

|

| Dec. 31 |

|

| Sept. 30, |

|

| June 30, |

| ||||||

SELECTED RATIOS |

| 2024 |

|

| 2024 |

|

| 2023 |

|

| 2023 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Return on average assets (annualized) |

|

| 1.80 | % |

|

| 1.65 | % |

|

| 1.77 | % |

|

| 1.72 | % |

|

| 1.79 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Return on average equity (annualized) |

|

| 17.42 | % |

|

| 16.03 | % |

|

| 19.87 | % |

|

| 17.36 | % |

|

| 17.74 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Return on average equity (excluding unrealized gain on investments) |

|

| 15.68 | % |

|

| 15.04 | % |

|

| 16.34 | % |

|

| 15.29 | % |

|

| 15.96 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Average shareholders' equity to average assets |

|

| 11.50 | % |

|

| 11.00 | % |

|

| 10.84 | % |

|

| 11.18 | % |

|

| 11.20 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Yield on earning assets (tax equivalent) |

|

| 6.28 | % |

|

| 5.97 | % |

|

| 5.81 | % |

|

| 5.76 | % |

|

| 5.47 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Effective Cost of Funds |

|

| 2.59 | % |

|

| 2.31 | % |

|

| 2.16 | % |

|

| 2.11 | % |

|

| 1.78 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net interest margin (tax equivalent) |

|

| 3.97 | % |

|

| 3.63 | % |

|

| 3.65 | % |

|

| 3.66 | % |

|

| 3.69 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Efficiency ratio (tax equivalent) |

|

| 43.2 | % |

|

| 43.1 | % |

|

| 42.4 | % |

|

| 41.6 | % |

|

| 42.9 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

End of period book value per common share |

| $ | 47.23 |

|

| $ | 47.17 |

|

| $ | 46.73 |

|

| $ | 38.09 |

|

| $ | 41.59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

End of period book value (excluding unrealized gain/loss on investments) |

| $ | 51.82 |

|

| $ | 50.77 |

|

| $ | 49.23 |

|

| $ | 47.22 |

|

| $ | 46.26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

End of period common shares outstanding (in 000's) |

|

| 1,079 |

|

|

| 1,079 |

|

|

| 1,086 |

|

|

| 1,090 |

|

|

| 1,090 |

|

|

| Quarter Ending |

| |||||||||||||||||||||||||||||

|

| June 30, 2024 |

|

| June 30, 2023 |

| ||||||||||||||||||||||||||

YIELD ANALYSIS |

| Average |

|

| Interest |

|

| Yield |

|

| Tax |

|

| Average |

|

| Interest |

|

| Yield |

|

| Tax |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Interest Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Short term investment |

| $ | 25,626 |

|

|

| 356 |

|

|

| 5.56 | % |

|

| 5.56 | % |

| $ | 16,087 |

|

|

| 215 |

|

|

| 5.35 | % |

|

| 5.35 | % |

FRB Stock |

|

| 435 |

|

|

| 6 |

|

|

| 6.00 | % |

|

| 6.00 | % |

|

| 429 |

|

|

| 6 |

|

|

| 6.00 | % |

|

| 6.00 | % |

Taxable securities |

|

| 495 |

|

|

| 6 |

|

|

| 4.85 | % |

|

| 4.85 | % |

|

| 385 |

|

|

| 4 |

|

|

| 4.16 | % |

|

| 4.16 | % |

Tax Free securities |

|

| 136,593 |

|

|

| 1,234 |

|

|

| 3.61 | % |

|

| 4.41 | % |

|

| 133,589 |

|

|

| 832 |

|

|

| 2.49 | % |

|

| 3.15 | % |

Loans |

|

| 306,551 |

|

|

| 5,504 |

|

|

| 7.18 | % |

|

| 7.18 | % |

|

| 283,827 |

|

|

| 4,662 |

|

|

| 6.57 | % |

|

| 6.57 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Interest Earning Assets |

|

| 469,700 |

|

|

| 7,106 |

|

|

| 6.05 | % |

|

| 6.28 | % |

|

| 434,317 |

|

|

| 5,719 |

|

|

| 5.27 | % |

|

| 5.47 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

| 5,791 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5,770 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets |

|

| 7,436 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6,704 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses |

|

| (5,227 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (5,344 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Noninterest Earning Assets |

|

| 8,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7,130 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

| $ | 477,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 441,447 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction and Money Market accounts |

| $ | 190,542 |

|

| $ | 1,522 |

|

|

| 3.20 | % |

|

| 3.20 | % |

| $ | 167,291 |

|

| $ | 1,240 |

|

|

| 2.96 | % |

|

| 2.96 | % |

Certificates and other time deposits |

|

| 103,006 |

|

|

| 1,191 |

|

|

| 4.62 | % |

|

| 4.62 | % |

|

| 86,333 |

|

|

| 694 |

|

|

| 3.22 | % |

|

| 3.22 | % |

Other borrowings |

|

| 0 |

|

|

| 0 |

|

|

| 0.00 | % |

|

| 0.00 | % |

|

| 55 |

|

|

| 0 |

|

|

| 0.00 | % |

|

| 0.00 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Interest Bearing Liabilities |

|

| 293,548 |

|

|

| 2,713 |

|

|

| 3.70 | % |

|

| 3.70 | % |

|

| 253,679 |

|

|

| 1,934 |

|

|

| 3.05 | % |

|

| 3.05 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

|

| 131,609 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 140,734 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other liabilities |

|

| 3,069 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2,541 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

| 49,474 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 44,493 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders Equity |

| $ | 477,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 441,447 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Income and Spread |

| $ | 176,152 |

|

| $ | 4,393 |

|

|

| 2.35 | % |

|

| 2.59 | % |

| $ | 180,638 |

|

| $ | 3,785 |

|

|

| 2.22 | % |

|

| 2.42 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Margin |

|

|

|

|

|

|

|

|

|

| 3.74 | % |

|

| 3.97 | % |

|

|

|

|

|

|

|

|

|

| 3.49 | % |

|

| 3.69 | % |

| June 30 |

|

|

|

|

| June 30 |

|

|

|

| |||||

| 2024 |

|

| % |

|

| 2023 |

|

| % |

| |||||

LOAN PORTFOLIO |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Commercial and industrial |

| $ | 164,397 |

|

|

| 53.93 | % |

| $ | 167,463 |

|

|

| 57.23 | % |

Real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial |

|

| 96,074 |

|

|

| 31.52 | % |

|

| 83,273 |

|

|

| 28.46 | % |

Residential |

|

| 16,263 |

|

|

| 5.34 | % |

|

| 12,731 |

|

|

| 4.35 | % |

Construction and development |

|

| 27,722 |

|

|

| 9.09 | % |

|

| 28,600 |

|

|

| 9.77 | % |

Consumer |

|

| 354 |

|

|

| 0.12 | % |

|

| 524 |

|

|

| 0.18 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total loans |

| $ | 304,810 |

|

|

| 100.00 | % |

| $ | 292,591 |

|

|

| 100.00 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| ||||||

|

| June 30 |

|

|

|

|

|

|

| June 30 |

|

|

|

|

| |

REGULATORY CAPITAL DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier 1 Capital |

| $ | 55,914 |

|

|

|

|

|

| $ | 45,331 |

|

|

|

|

|

Total Capital (Tier 1 + Tier 2) |

| $ | 60,247 |

|

|

|

|

|

| $ | 50,427 |

|

|

|

|

|

Total Risk-Adjusted Assets |

| $ | 345,039 |

|

|

|

|

|

| $ | 332,236 |

|

|

|

|

|

Tier 1 Risk-Based Capital Ratio |

|

| 16.21 | % |

|

|

|

|

|

| 15.18 | % |

|

|

|

|

Total Risk-Based Capital Ratio |

|

| 17.46 | % |

|

|

|

|

|

| 16.43 | % |

|

|

|

|

Tier 1 Leverage Ratio |

|

| 11.70 | % |

|

|

|

|

|

| 11.42 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Time Equivalent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employees (FTE's) |

|

| 29 |

|

|

|

|

|

|

| 27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Stock Price Range |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(For the Three Months Ended): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

| $ | 94.00 |

|

|

|

|

|

| $ | 87.75 |

|

|

|

|

|

Low |

| $ | 86.75 |

|

|

|

|

|

| $ | 85.00 |

|

|

|

|

|

Close |

| $ | 89.75 |

|

|

|

|

|

| $ | 85.00 |

|

|

|

|

|

SOURCE: Trinity Bank, NA (Fort Worth, Texas)

View the original press release on accesswire.com