Texas Instruments signs preliminary agreement to receive up to $1.6 billion in CHIPS and Science Act proposed funding for semiconductor manufacturing in Texas and Utah

Rhea-AI Summary

Texas Instruments (TI) has signed a preliminary agreement with the U.S. Department of Commerce for up to $1.6 billion in proposed direct funding under the CHIPS and Science Act. This funding will support three 300mm semiconductor wafer fabs under construction in Texas and Utah. Additionally, TI expects to receive an estimated $6 billion to $8 billion from the U.S. Department of Treasury's Investment Tax Credit for qualified U.S. manufacturing investments.

The company plans to invest more than $18 billion through 2029 as part of its broader manufacturing investment. This will create over 2,000 new TI jobs and thousands of indirect jobs. The new fabs will produce semiconductors in 28nm to 130nm technology nodes, important for TI's analog and embedded processing products.

Positive

- Potential receipt of up to $1.6 billion in CHIPS Act funding

- Expected $6-8 billion in Investment Tax Credits

- Investment of over $18 billion through 2029 in manufacturing

- Creation of 2,000+ new jobs and thousands of indirect jobs

- Expansion of 300mm manufacturing operations in the U.S.

- Plan to grow internal manufacturing to more than 95% by 2030

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, TXN declined 0.69%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

NEWS HIGHLIGHTS:

- The

U.S. Department of Commerce has proposed up to$1.6 billion Texas andUtah . - TI expects to receive an estimated

$6 billion $8 billion U.S. Department of Treasury's Investment Tax Credit for qualifiedU.S. manufacturing investments. - The company also expects to receive

$10 million

"The historic CHIPS Act is enabling more semiconductor manufacturing capacity in the

Building geopolitically dependable capacity for analog and embedded processing chips

Since its founding more than 90 years ago, TI has been advancing technology, pioneering the transition from vacuum tubes to transistors and then to integrated circuits. Today, TI is the largest

The proposed direct funding under the CHIPS Act would support TI's investment of more than

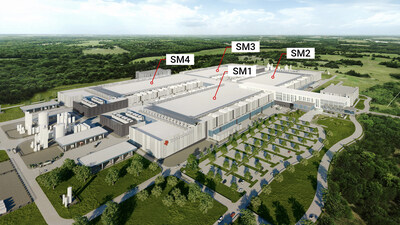

- Construct and build the SM1 cleanroom and complete pilot line for first production;

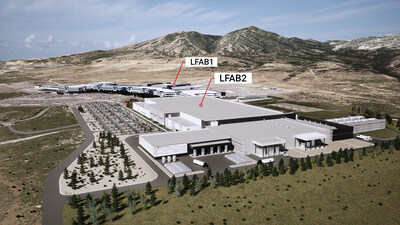

- Construct and build the LFAB2 cleanroom for first production; and

- Construct the SM2 shell.

These connected, multi-fab sites benefit from shared infrastructure, talent and technology sharing, and a strong network of suppliers and community partners. They will produce semiconductors in 28nm to 130nm technology nodes, which provide the optimal cost, performance, power, precision and voltage levels required for TI's broad portfolio of analog and embedded processing products.

"With this proposed investment from the Biden-Harris Administration in TI, a global leader of production for current-generation and mature-node chips, we would help secure the supply chain for these foundational semiconductors that are used in every sector of the

Building a stronger workforce

With a long history of supporting its employees to build long-term, successful careers, TI is also investing in building its future workforce. TI will create more than 2,000 company jobs across its three new fabs in

"We are proud to work with Texas Instruments as they build new semiconductor fabs in

"By investing in semiconductor manufacturing, we are helping secure this vulnerable supply chain, boosting our national security and global competitiveness, and creating new jobs for Texans," said

In order to build a future-ready workforce, TI is enhancing the skills of current employees, expanding internships and creating pipeline programs with a focus on building electronic and mechanical skills. TI has robust engagements with 40 community colleges, high schools and military institutions across the

"

"This proposed CHIPS funding will further support Texas Instruments' investment in its new semiconductor fab in

Building sustainable manufacturing

TI has a long-standing commitment to responsible, sustainable manufacturing and environmental stewardship. As part of this commitment, TI continually invests in its fabrication processes and equipment to reduce energy, material and water consumption, and greenhouse gas (GHG) emissions.

The company's 300mm wafer fabs will be entirely powered by renewable electricity. Additionally, all of TI's new 300mm fabs are designed to meet LEED Gold standards for structural efficiency and sustainability. TI's 300mm manufacturing facilities bring advantages in reducing waste and improving water and energy consumption per chip.

TI semiconductors are and will increasingly play a critical role in helping reduce the impact on the environment, helping customers create smaller, more efficient and cost-effective technology solutions that in turn drive continued innovation in electrification and the expanded usage of renewable energy.

Learn more:

- TI CHIPS Act press kit (includes images, video b-roll, fact sheet)

- TI

Sherman, TX , press kit - TI

Lehi, UT , press kit

Notice regarding forward-looking statements

This release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as TI or its management "believes," "expects," "anticipates," "foresees," "forecasts," "estimates" or other words or phrases of similar import. Similarly, statements herein that describe TI's business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in forward-looking statements.

See Item 1A of TI's most recent Form 10-K for a detailed discussion of risk factors that could cause results to differ materially from the forward-looking statements. The forward-looking statements included in this release are made only as of the date of this release, and we undertake no obligation to update the forward-looking statements to reflect subsequent events or circumstances. If we do update any forward-looking statement, you should not infer that we will make additional updates with respect to that statement or any other forward-looking statement.

About Texas Instruments

Texas Instruments Incorporated (Nasdaq: TXN) is a global semiconductor company that designs, manufactures, and sells analog and embedded processing chips for markets such as industrial, automotive, personal electronics, communications equipment and enterprise systems. At our core, we have a passion to create a better world by making electronics more affordable through semiconductors. This passion is alive today as each generation of innovation builds upon the last to make our technology more reliable, more affordable and lower power, making it possible for semiconductors to go into electronics everywhere. Learn more at TI.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/texas-instruments-signs-preliminary-agreement-to-receive-up-to-1-6-billion-in-chips-and-science-act-proposed-funding-for-semiconductor-manufacturing-in-texas-and-utah-302224237.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/texas-instruments-signs-preliminary-agreement-to-receive-up-to-1-6-billion-in-chips-and-science-act-proposed-funding-for-semiconductor-manufacturing-in-texas-and-utah-302224237.html

SOURCE Texas Instruments