Ternium Announces First Quarter of 2025 Results

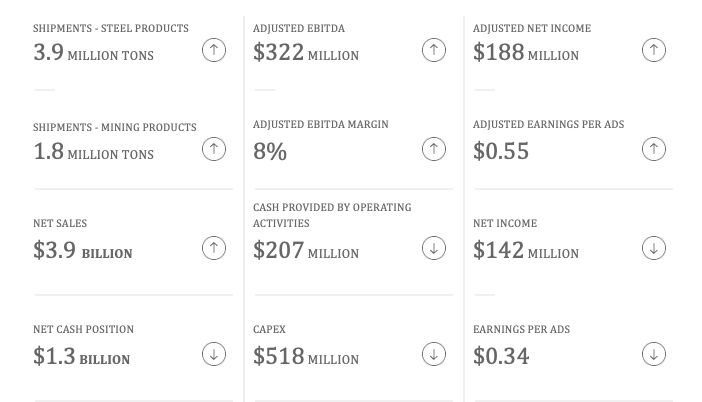

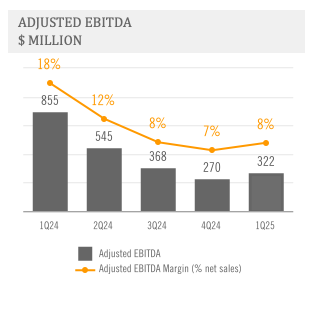

Ternium reported its Q1 2025 financial results, showing mixed performance across regions. The company's Adjusted EBITDA increased sequentially due to improved margins and higher steel and iron ore shipments, despite lower revenue per ton.

Key regional highlights:

- Mexico: Sales decreased both sequentially and year-over-year, affected by U.S. trade policy uncertainty

- Brazil: Shipments rose 9% year-over-year, benefiting from Usiminas' blast furnace ramp-up

- Southern Region: Showed 32% year-over-year growth in steel shipments

- Other Markets: 36% sequential increase, but 14% year-over-year decline

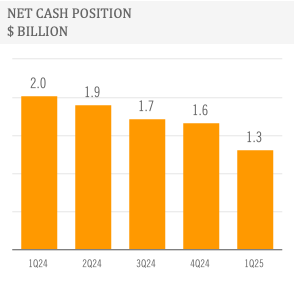

The company reported Net Income of $142 million, with Adjusted Net Income at $188 million after excluding a $45 million provision charge. Ternium maintained a Net Cash position of $1.3 billion, down from $1.6 billion at end-2024. The Pesquería expansion project cost estimate increased to $4.0 billion, with operations expected to begin by Q4 2026.

Ternium ha comunicato i risultati finanziari del primo trimestre 2025, mostrando performance variegate tra le diverse regioni. L’EBITDA rettificato è aumentato rispetto al trimestre precedente grazie a margini migliorati e a un incremento delle spedizioni di acciaio e minerale di ferro, nonostante un calo del ricavo per tonnellata.

Punti salienti regionali:

- Messico: le vendite sono diminuite sia rispetto al trimestre precedente sia su base annua, influenzate dall’incertezza legata alla politica commerciale degli Stati Uniti

- Brasile: le spedizioni sono aumentate del 9% su base annua, beneficiando dell’avvio in aumento dell’altoforno di Usiminas

- Regione Sud: ha registrato una crescita del 32% anno su anno nelle spedizioni di acciaio

- Altri mercati: incremento del 36% rispetto al trimestre precedente, ma calo del 14% anno su anno

L’azienda ha riportato un utile netto di 142 milioni di dollari, con un utile netto rettificato di 188 milioni di dollari escludendo una svalutazione di 45 milioni di dollari. Ternium ha mantenuto una posizione di cassa netta pari a 1,3 miliardi di dollari, in calo rispetto a 1,6 miliardi alla fine del 2024. La stima dei costi per il progetto di espansione di Pesquería è salita a 4,0 miliardi di dollari, con l’avvio delle operazioni previsto entro il quarto trimestre del 2026.

Ternium presentó sus resultados financieros del primer trimestre de 2025, mostrando un desempeño mixto en las distintas regiones. El EBITDA ajustado aumentó secuencialmente debido a márgenes mejorados y mayores envíos de acero y mineral de hierro, a pesar de una disminución en los ingresos por tonelada.

Aspectos destacados regionales:

- México: las ventas disminuyeron tanto secuencialmente como interanualmente, afectadas por la incertidumbre en la política comercial de EE.UU.

- Brasil: los envíos crecieron un 9% interanual, beneficiándose del aumento en la producción del alto horno de Usiminas

- Región Sur: mostró un crecimiento del 32% interanual en envíos de acero

- Otros mercados: aumento del 36% secuencial, pero caída del 14% interanual

La compañía reportó un Ingreso Neto de 142 millones de dólares, con un Ingreso Neto Ajustado de 188 millones de dólares tras excluir un cargo por provisión de 45 millones de dólares. Ternium mantuvo una posición neta de efectivo de 1.300 millones de dólares, descendiendo desde 1.600 millones al cierre de 2024. La estimación del costo del proyecto de expansión en Pesquería aumentó a 4.000 millones de dólares, con operaciones previstas para comenzar en el cuarto trimestre de 2026.

테르니움(Ternium)은 2025년 1분기 재무 실적을 발표하며 지역별로 엇갈린 성과를 보였습니다. 회사의 조정 EBITDA는 마진 개선과 철강 및 철광석 출하량 증가 덕분에 전 분기 대비 상승했으나, 톤당 매출은 감소했습니다.

주요 지역별 하이라이트:

- 멕시코: 미국 무역 정책 불확실성으로 인해 전 분기 및 전년 동기 대비 매출 감소

- 브라질: 우시미나스(Usiminas) 용광로 가동 확대에 힘입어 전년 동기 대비 출하량 9% 증가

- 남부 지역: 철강 출하량이 전년 동기 대비 32% 성장

- 기타 시장: 전 분기 대비 36% 증가했으나, 전년 동기 대비 14% 감소

회사는 순이익 1억 4,200만 달러를 기록했으며, 4,500만 달러의 충당금 비용을 제외한 조정 순이익은 1억 8,800만 달러였습니다. 테르니움은 순현금 13억 달러를 유지했으나, 2024년 말 16억 달러에서 감소했습니다. 페스케리아(Pesquería) 확장 프로젝트 비용 추정치는 40억 달러로 증가했으며, 2026년 4분기까지 운영 시작이 예상됩니다.

Ternium a publié ses résultats financiers du premier trimestre 2025, montrant des performances contrastées selon les régions. L’EBITDA ajusté a augmenté séquentiellement grâce à des marges améliorées et à une hausse des expéditions d’acier et de minerai de fer, malgré une baisse du revenu par tonne.

Points clés par région :

- Mexique : les ventes ont diminué à la fois séquentiellement et en glissement annuel, affectées par l’incertitude de la politique commerciale américaine

- Brésil : les expéditions ont augmenté de 9 % en glissement annuel, bénéficiant de la montée en charge du haut fourneau d’Usiminas

- Région Sud : a affiché une croissance de 32 % des expéditions d’acier en glissement annuel

- Autres marchés : hausse de 36 % séquentiellement, mais baisse de 14 % en glissement annuel

La société a déclaré un bénéfice net de 142 millions de dollars, avec un bénéfice net ajusté de 188 millions de dollars après exclusion d’une charge de provision de 45 millions de dollars. Ternium a maintenu une position nette de trésorerie de 1,3 milliard de dollars, en baisse par rapport à 1,6 milliard fin 2024. L’estimation du coût du projet d’expansion de Pesquería a augmenté à 4,0 milliards de dollars, avec un démarrage des opérations prévu au quatrième trimestre 2026.

Ternium veröffentlichte seine Finanzergebnisse für das erste Quartal 2025 und zeigte dabei eine gemischte Entwicklung in den Regionen. Das bereinigte EBITDA stieg sequenziell aufgrund verbesserter Margen und höherer Stahl- und Eisenerzlieferungen, trotz niedrigerer Erlöse pro Tonne.

Wichtige regionale Highlights:

- Mexiko: Die Umsätze gingen sowohl im Vergleich zum Vorquartal als auch zum Vorjahr zurück, beeinflusst durch Unsicherheiten in der US-Handelspolitik

- Brasilien: Die Lieferungen stiegen im Jahresvergleich um 9%, begünstigt durch die Hochofenhochlauf bei Usiminas

- Südregion: Verzeichnete ein Wachstum der Stahllieferungen von 32% im Jahresvergleich

- Andere Märkte: 36% Anstieg im Vergleich zum Vorquartal, aber 14% Rückgang im Jahresvergleich

Das Unternehmen meldete einen Nettoertrag von 142 Millionen US-Dollar, mit einem bereinigten Nettoertrag von 188 Millionen US-Dollar nach Ausschluss einer Rückstellung von 45 Millionen US-Dollar. Ternium hielt eine Netto-Cash-Position von 1,3 Milliarden US-Dollar, gesunken von 1,6 Milliarden Ende 2024. Die Kostenschätzung für das Erweiterungsprojekt in Pesquería stieg auf 4,0 Milliarden US-Dollar, mit Betriebsbeginn voraussichtlich im vierten Quartal 2026.

- Sequential increase in adjusted EBITDA driven by improved margins and higher shipments

- Net cash position of $1.3B as of March 2025

- Brazil shipments grew 9% YoY due to successful blast furnace ramp-up

- Southern Region reported 32% YoY rise in steel shipments

- Adjusted Net Income of $188M in Q1 2025

- Expected sequential increase in adjusted EBITDA for Q2 2025

- Mexico sales volume decreased both sequentially and YoY due to U.S. trade policy uncertainty

- Pesquería expansion cost increased 16% to $4.0B from previous estimate

- Project completion delayed to Q4 2026

- Net cash position declined from $1.6B to $1.3B quarter-over-quarter

- Steel revenue per ton declined across all regions

- 14% YoY decline in steel shipments in Other Markets, primarily U.S.

- $45M provision charge for ongoing Usiminas litigation

Insights

Ternium shows mixed Q1 results with sequential EBITDA improvement but higher capex budget and delayed expansion timeline, maintaining solid financial position despite challenges.

Ternium's Q1 2025 results present a mixed financial picture with sequential improvement against continued challenges. Adjusted EBITDA increased to

The company's performance reveals geographic disparities - Mexico experienced weakness due to U.S. trade policy uncertainties, while Brazil showed robust

A critical development is the

Despite heavy capital spending of

The company's outlook for Q2 2025 anticipates sequential EBITDA improvement from higher steel prices and stable shipments, suggesting management sees near-term stabilization despite persistent market challenges in Mexico and continuing unfair trade concerns in Brazil.

LUXEMBOURG, LU / ACCESS Newswire / April 29, 2025 / Ternium S.A. (NYSE:TX) today announced its results for the first quarter ended March 31, 2025.

The financial and operational information contained in this press release is based on Ternium S.A.'s operational data and consolidated condensed interim financial statements prepared in accordance with IAS 34 "Interim financial reporting" (IFRS) and presented in U.S. dollars ($) and metric tons. Interim financial figures are unaudited. This press release includes certain non-IFRS alternative performance measures such as Adjusted EBITDA, Cash Operating Income, Adjusted Net Income, Adjusted Equity Holders' Net Income, Adjusted Earnings per ADS, Free Cash Flow and Net Cash. The reconciliation of these figures to the most directly comparable IFRS measures is included in Exhibit I.

First Quarter of 2025 Highlights

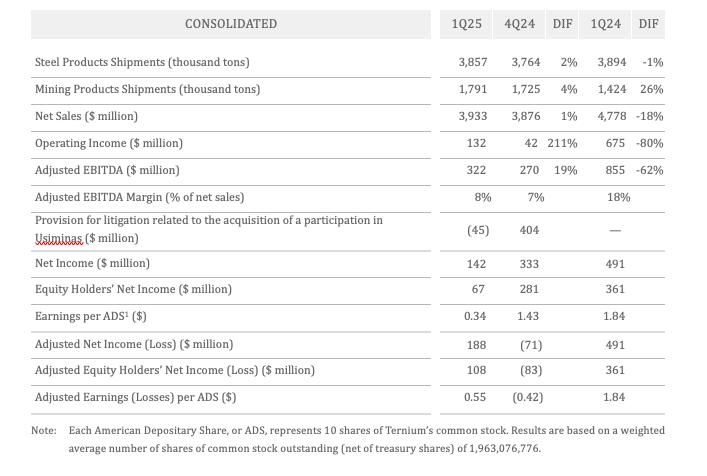

Summary of First Quarter of 2025 Results

First Quarter of 2025 Highlights

In the first quarter of 2025, Ternium reported a sequential increase in adjusted EBITDA driven by improved margins and steel and iron ore shipments. Cost per ton decreased due to the gradual consumption of lower-priced slabs and raw material inventories as well as to improvements in industrial operations efficiency, while a sequentially lower revenue per ton partially offset this cost reduction.

Ternium's sales volume in Mexico decreased both sequentially and year-over-year in the first quarter of 2025. Uncertainty surrounding evolving U.S. trade policies continued to weight on shipments in the first quarter, primarily in the commercial steel market. However, the company's sales to industrial customers remained relatively stable.

Shipments in the Brazilian steel market rose sequentially in the first quarter, rebounding from the seasonal slowdown in the fourth quarter. Year-over-year, sales volumes in Brazil grew by

In the Southern Region, steel sales volumes remained relatively stable in the first quarter of 2025 compared to the fourth quarter of 2024. Year-over-year, the company reported a

In Other Markets, steel shipments rose by

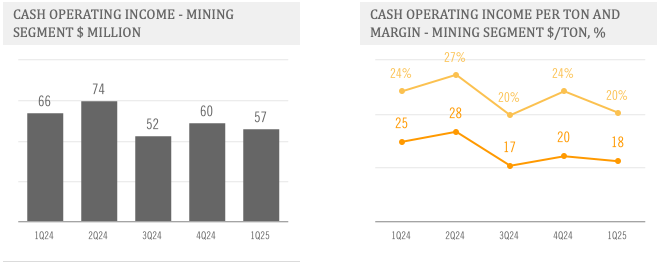

Net income of

Ternium reported a Net Cash position of

Following a review of the project, the company estimates the total cost of its expansion plan in Pesquería to reach

Outlook

Ternium expects a sequential increase in adjusted EBITDA in the second quarter of 2025, driven mainly by higher realized steel prices and slightly lower cost per ton, with relatively stable steel shipments.

In Mexico, the company anticipates volumes in the second quarter to remain subdued due to the unresolved tariff issue, which impacts operational and investment decisions in the steel value chain.

In Brazil, Usiminas anticipates sequentially stable steel shipments in the second quarter of 2025, amid resilient steel demand. The issue of unfair trade practices remains unresolved in this market, with notable year-over-year increases in imports during the first quarter of 2025.

In Argentina, the company expects a sequential increase in shipments in the second quarter of 2025 due to improvements in macroeconomic conditions.

Analysis of First Quarter of 2025 Results

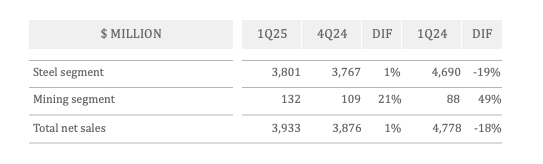

Consolidated Net Sales

Adjusted EBITDA

Adjusted EBITDA in the first quarter of 2025 equals Net Income adjusted to exclude:

Depreciation and amortization;

Income tax results;

Net financial result;

Equity in earnings of non-consolidated companies; and

Provision charge for ongoing litigation related to the acquisition of a participation in Usiminas.

And adjusted to include the proportional EBITDA in Unigal (

Adjusted EBITDA Margin equals Adjusted EBITDA divided by net sales. For more information see Exhibit I - Alternative performance measures - "Adjusted EBITDA".

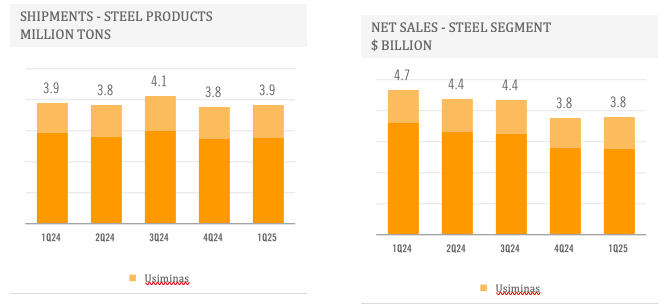

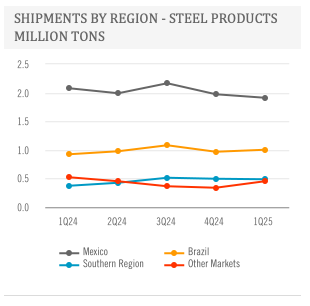

Steel Segment

In the first quarter of 2025, the Steel Segment's shipments and net sales rose slightly compared to the fourth quarter of 2024. Increased sales volumes in Brazil and Other Markets were partially offset by lower sales volumes in Mexico. Realized steel prices edged down slightly on a sequential basis.

Year-over-year, shipments in the Steel Segment remained relatively stable, while net sales declined by

In Mexico, steel shipments had a sequential decline in the first quarter of 2025, reflecting a weaker commercial market. In the case of the industrial market, demand from industrial customers remained relatively stable. Year-over-year, shipments declined in the period, mainly due to a soft commercial market and a slight decrease in sales to industrial customers.

In Brazil, shipments rose sequentially during the first quarter reflecting higher demand for steel products after a seasonally low fourth quarter. Year-over-year, sales volumes increased in the first quarter reflecting the successful ramp up of Usiminas' main blast furnace and a stronger demand for steel products in the country.

In the Southern Region, steel shipments remained relatively stable sequentially in the first quarter. Year-over-year, sales volumes showed a significant rebound in this period, reflecting better activity in the Argentine steel market after a notably weak performance in the same period of 2024.

In Other Markets, sales volumes rose sequentially in the first quarter partly as a result of the sale of steel slabs to third parties. On a year-over-year basis, shipments decreased in the period, largely reflecting lower sales volumes in the U.S. market.

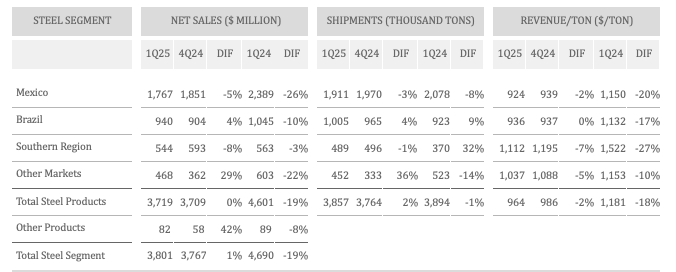

The Steel Segment's Cash Operating Income showed a sequential increase in the first quarter of 2025, driven by higher sales volumes and margins. There was a sequential decrease in raw material and purchased slab costs that were partially offset by lower realized steel prices.

Year-over-year, the decrease in the Steel Segment's Cash Operating Income in the first quarter of 2025 was driven mainly by lower margins. In the period, a

Note: For a reconciliation of the Steel Segment's Cash Operating Income and Cash Operating Income per Ton and Margin to the most directly comparable IFRS measures, see Exhibit I - Alternative performance measures - "Cash Operating Income - Steel Segment".

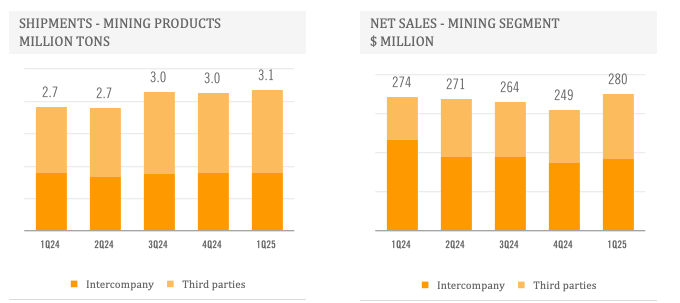

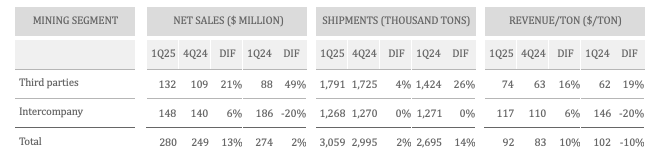

Mining Segment

The Mining Segment's net sales increased sequentially by

In the first quarter of 2025, the Mining Segment's Cash Operating Income decreased sequentially and on a year-over-year basis as a result of lower margins, partially offset by higher sales volumes. Compared to the fourth quarter of 2024, the decrease in margins in the first quarter of 2025 resulted from higher cost per ton, partially offset by higher realized iron ore prices.

Year-over-year, margins contracted due to lower realized iron ore prices, partially offset by a moderate decline in cost per ton.

Note: For a reconciliation of the Mining Segment's Cash Operating Income and Cash Operating Income per Ton and Margin to the most directly comparable IFRS measures, see Exhibit I - Alternative performance measures - "Cash Operating Income - Mining Segment".

Net Financial Results

Net financial results for the first quarter of 2025 recorded a

Ternium Brazil's long local currency position. In addition, Ternium Argentina's divestment of Argentine government bond holdings resulted in a gain of

$ MILLION |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest results |

|

| 14 |

|

|

| 18 |

|

|

| 38 |

|

Net foreign exchange result |

|

| 31 |

|

|

| (72 | ) |

|

| (41 | ) |

Change in fair value of financial assets |

|

| 29 |

|

|

| (3 | ) |

|

| (137 | ) |

Other financial expense, net |

|

| (11 | ) |

|

| (11 | ) |

|

| (22 | ) |

Net financial results |

|

| 63 |

|

|

| (67 | ) |

|

| (163 | ) |

Income Tax Results

Ternium Mexico, Ternium Argentina and Ternium Brasil use the U.S. dollar as their functional currency and are, therefore, affected by deferred tax results.

These results account for the impact of local currency fluctuations against the U.S. dollar, as well as for the effect of local inflation.

$ MILLION |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current income tax expense |

|

| (25 | ) |

|

| (10 | ) |

|

| (126 | ) |

Deferred tax gain (loss) |

|

| 3 |

|

|

| (54 | ) |

|

| 86 |

|

Income tax expense |

|

| (23 | ) |

|

| (64 | ) |

|

| (40 | ) |

Result before income tax |

|

| 165 |

|

|

| 397 |

|

|

| 532 |

|

Effective tax rate |

|

| 14 | % |

|

| 16 | % |

|

| 8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

In the first quarter of 2025, Ternium recorded net income of

adjustment charge of

Adjusted Equity Holder's Net Income was

$ MILLION |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the parent |

|

| 67 |

|

|

| 281 |

|

|

| 361 |

|

Non-controlling interest |

|

| 75 |

|

|

| 52 |

|

|

| 130 |

|

Net Income |

|

| 142 |

|

|

| 333 |

|

|

| 491 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excluding provision charge (reversal) for ongoing litigation related to the acquisition of a participation in Usiminas in 2012 |

|

| 45 |

|

|

| (404 | ) |

|

| - |

|

Adjusted Net Income (Loss) |

|

| 188 |

|

|

| (71 | ) |

|

| 491 |

|

$ per ADS |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

Earnings per ADS |

|

| 0.34 |

|

|

| 1.43 |

|

|

| 1.84 |

|

Adjusted Earnings (Losses) per ADS |

|

| 0.55 |

|

|

| (0.42 | ) |

|

| 1.84 |

|

Cash Flow and Liquidity

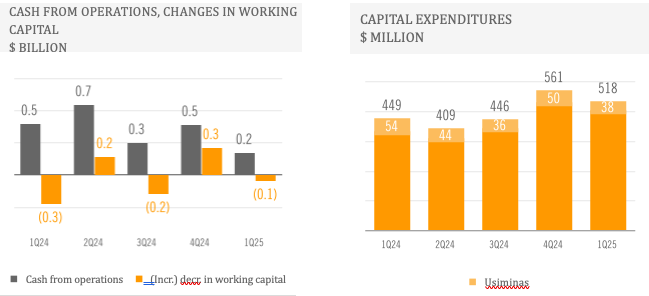

In the first quarter of 2025, cash from operations amounted to

On the other hand, inventories decreased by

Capital expenditures totaled

Ternium's Net Cash position declined by

Conference Call and Webcast

Ternium will host a conference call on April 30, 2025, at 8:30 a.m. ET in which management will discuss first quarter of 2025 results. A webcast link will be available in the Investor Center section of the company's website at www.ternium.com.

Forward Looking Statements

Some of the statements contained in this press release are "forward-looking statements". Forward-looking statements are based on management's current views and assumptions and involve known and unknown risks that could cause actual results, performance or events to differ materially from those expressed or implied by those statements. These risks include but are not limited to risks arising from uncertainties as to gross domestic product, related market demand, global production capacity, tariffs, cyclicality in the industries that purchase steel products, and other factors beyond Ternium's control.

About Ternium

Ternium is a leading steel producer in the Americas, providing advanced steel products to a wide range of manufacturing industries and the construction sector. We invest in low carbon emissions steelmaking technologies to support the energy transition and the mobility of the future. We also support the development of our communities, especially through educational programs in Latin America. More information about Ternium is available at www.ternium.com.

Income Statement

$ MILLION |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

| 3,933 |

|

|

| 3,876 |

|

|

| 4,778 |

|

Cost of sales |

|

| (3,402 | ) |

|

| (3,426 | ) |

|

| (3,675 | ) |

Gross profit |

|

| 531 |

|

|

| 450 |

|

|

| 1,104 |

|

Selling, general and administrative expenses |

|

| (396 | ) |

|

| (373 | ) |

|

| (431 | ) |

Other operating (expense) income, net |

|

| (3 | ) |

|

| (35 | ) |

|

| 2 |

|

Operating income |

|

| 132 |

|

|

| 42 |

|

|

| 675 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expense |

|

| (54 | ) |

|

| (52 | ) |

|

| (45 | ) |

Financial income |

|

| 68 |

|

|

| 71 |

|

|

| 83 |

|

Other financial income (expense), net |

|

| 49 |

|

|

| (86 | ) |

|

| (200 | ) |

Equity in earnings of non-consolidated companies |

|

| 16 |

|

|

| 18 |

|

|

| 20 |

|

Provision (charge) reversal for ongoing litigation related to the acquisition of a participation in Usiminas |

|

| (45 | ) |

|

| 404 |

|

|

| - |

|

Profit before income tax results |

|

| 165 |

|

|

| 397 |

|

|

| 532 |

|

Income tax expense |

|

| (23 | ) |

|

| (64 | ) |

|

| (40 | ) |

Profit for the period |

|

| 142 |

|

|

| 333 |

|

|

| 491 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the parent |

|

| 67 |

|

|

| 281 |

|

|

| 361 |

|

Non-controlling interest |

|

| 75 |

|

|

| 52 |

|

|

| 130 |

|

Profit for the period |

|

| 142 |

|

|

| 333 |

|

|

| 491 |

|

Statement of Financial Position

$ MILLION |

| MARCH 31, 2025 |

|

| DECEMBER 31, 2024 |

| ||

|

|

|

|

|

|

| ||

Property, plant and equipment, net |

|

| 8,803 |

|

|

| 8,381 |

|

Intangible assets, net |

|

| 1,019 |

|

|

| 1,022 |

|

Investments in non-consolidated companies |

|

| 509 |

|

|

| 469 |

|

Other investments |

|

| 0 |

|

|

| 23 |

|

Deferred tax assets |

|

| 1,298 |

|

|

| 1,194 |

|

Receivables, net |

|

| 1,030 |

|

|

| 961 |

|

Total non-current assets |

|

| 12,660 |

|

|

| 12,050 |

|

|

|

|

|

|

|

|

|

|

Receivables, net |

|

| 882 |

|

|

| 902 |

|

Derivative financial instruments |

|

| 8 |

|

|

| 4 |

|

Inventories, net |

|

| 4,591 |

|

|

| 4,751 |

|

Trade receivables, net |

|

| 1,812 |

|

|

| 1,562 |

|

Other investments |

|

| 1,924 |

|

|

| 2,160 |

|

Cash and cash equivalents |

|

| 1,831 |

|

|

| 1,691 |

|

Total current assets |

|

| 11,048 |

|

|

| 11,071 |

|

|

|

|

|

|

|

|

|

|

Non-current assets classified as held for sale |

|

| 8 |

|

|

| 7 |

|

|

|

|

|

|

|

|

|

|

Total assets |

|

| 23,716 |

|

|

| 23,129 |

|

Statement of Financial Position (cont.)

$ MILLION |

| MARCH 31, 2025 |

|

| DECEMBER 31, 2024 |

| ||

|

|

|

|

|

|

| ||

Capital and reserves attributable to the owners of the parent |

|

| 12,108 |

|

|

| 11,968 |

|

Non-controlling interest |

|

| 4,429 |

|

|

| 4,163 |

|

Total equity |

|

| 16,537 |

|

|

| 16,132 |

|

|

|

|

|

|

|

|

|

|

Provisions |

|

| 592 |

|

|

| 553 |

|

Deferred tax liabilities |

|

| 95 |

|

|

| 89 |

|

Non current tax liabilities |

|

| 25 |

|

|

| 21 |

|

Other liabilities |

|

| 783 |

|

|

| 766 |

|

Trade payables |

|

| 1 |

|

|

| 5 |

|

Lease liabilities |

|

| 171 |

|

|

| 164 |

|

Borrowings |

|

| 1,829 |

|

|

| 1,560 |

|

Total non-current liabilities |

|

| 3,496 |

|

|

| 3,158 |

|

|

|

|

|

|

|

|

|

|

Provision for ongoing litigation related to the acquisition of a participation in Usiminas |

|

| 455 |

|

|

| 410 |

|

Current income tax liabilities |

|

| 33 |

|

|

| 107 |

|

Other liabilities |

|

| 670 |

|

|

| 630 |

|

Trade payables |

|

| 1,836 |

|

|

| 1,926 |

|

Derivative financial instruments |

|

| 1 |

|

|

| 50 |

|

Lease liabilities |

|

| 47 |

|

|

| 46 |

|

Borrowings |

|

| 641 |

|

|

| 670 |

|

Total current liabilities |

|

| 3,683 |

|

|

| 3,839 |

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

| 7,179 |

|

|

| 6,997 |

|

|

|

|

|

|

|

|

|

|

Total equity and liabilities |

|

| 23,716 |

|

|

| 23,129 |

|

Statement of Cash Flows

$ MILLION |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Result for the period |

|

| 142 |

|

|

| 333 |

|

|

| 491 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments for: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

| 184 |

|

|

| 189 |

|

|

| 171 |

|

Income tax accruals less payments |

|

| (50 | ) |

|

| 23 |

|

|

| (13 | ) |

Equity in earnings of non-consolidated companies |

|

| (16 | ) |

|

| (18 | ) |

|

| (20 | ) |

Provision charge (reversal) for ongoing litigation related to the acquisition of a participation in Usiminas |

|

| 45 |

|

|

| (404 | ) |

|

| - |

|

Interest accruals less payments / receipts, net |

|

| 9 |

|

|

| (7 | ) |

|

| (2 | ) |

Changes in provisions |

|

| 3 |

|

|

| 10 |

|

|

| (7 | ) |

Changes in working capital |

|

| (55 | ) |

|

| 257 |

|

|

| (266 | ) |

Net foreign exchange results and others |

|

| (56 | ) |

|

| 56 |

|

|

| 120 |

|

Impairment of Las Encinas' mining assets |

|

| - |

|

|

| 32 |

|

|

| - |

|

Net cash provided by operating activities |

|

| 207 |

|

|

| 472 |

|

|

| 475 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures and advances to suppliers for PP&E |

|

| (518 | ) |

|

| (561 | ) |

|

| (449 | ) |

Decrease (increase) in other investments |

|

| 243 |

|

|

| 296 |

|

|

| 0 |

|

Proceeds from the sale of property, plant & equipment |

|

| 1 |

|

|

| 1 |

|

|

| 1 |

|

Dividends received from non-consolidated companies |

|

| 1 |

|

|

| 21 |

|

|

| 1 |

|

Net cash used in investing activities |

|

| (273 | ) |

|

| (243 | ) |

|

| (447 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid in cash to company's shareholders |

|

| - |

|

|

| (177 | ) |

|

| - |

|

Dividends paid in cash to non-controlling interest |

|

| - |

|

|

| (5 | ) |

|

| - |

|

Finance lease payments |

|

| (20 | ) |

|

| (15 | ) |

|

| (18 | ) |

Proceeds from borrowings |

|

| 573 |

|

|

| 272 |

|

|

| 131 |

|

Repayments of borrowings |

|

| (385 | ) |

|

| (139 | ) |

|

| (166 | ) |

Net cash provided by (used in) financing activities |

|

| 167 |

|

|

| (63 | ) |

|

| (53 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents |

|

| 101 |

|

|

| 165 |

|

|

| (24 | ) |

Exhibit I - Alternative Performance Measures

These non-IFRS measures should not be considered in isolation of, or as a substitute for, measures of performance prepared in accordance with IFRS. These non-IFRS measures do not have a standardized meaning under IFRS and, therefore, may not correspond to similar non-IFRS financial measures reported by other companies.

Adjusted EBITDA

$ MILLION |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

| 142 |

|

|

| 333 |

|

|

| 491 |

|

Adjusted to exclude: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

| 184 |

|

|

| 189 |

|

|

| 171 |

|

Income tax results |

|

| 23 |

|

|

| 64 |

|

|

| 40 |

|

Net financial results |

|

| (63 | ) |

|

| 67 |

|

|

| 163 |

|

Equity in earnings of non-consolidated companies |

|

| (16 | ) |

|

| (18 | ) |

|

| (20 | ) |

Provision charge (reversal) for ongoing litigation related to the acquisition of a participation in Usiminas |

|

| 45 |

|

|

| (404 | ) |

|

| - |

|

Impairment of Las Encinas' mining assets |

|

| - |

|

|

| 32 |

|

|

| - |

|

Adjusted to include: |

|

|

|

|

|

|

|

|

|

|

|

|

Proportional EBITDA in Unigal ( |

|

| 6 |

|

|

| 6 |

|

|

| 9 |

|

Adjusted EBITDA |

|

| 322 |

|

|

| 270 |

|

|

| 855 |

|

Divided by: net sales |

|

| 3,933 |

|

|

| 3,876 |

|

|

| 4,778 |

|

Adjusted EBITDA Margin (%) |

|

| 8 | % |

|

| 7 | % |

|

| 18 | % |

Exhibit I - Alternative Performance Measures (cont.)

Cash Operating Income - Steel Segment

$ MILLION |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income - Management View (Note "Segment Information" to Ternium's Financial Statements as of the corresponding dates) |

|

| 244 |

|

|

| 308 |

|

|

| 593 |

|

Plus/Minus differences in cost of sales (IFRS) |

|

| (116 | ) |

|

| (259 | ) |

|

| 59 |

|

Excluding depreciation and amortization |

|

| 142 |

|

|

| 142 |

|

|

| 137 |

|

Including proportional EBITDA in Unigal ( |

|

| 6 |

|

|

| 6 |

|

|

| 9 |

|

Cash Operating Income |

|

| 276 |

|

|

| 197 |

|

|

| 798 |

|

Divided by: steel shipments (thousand tons) |

|

| 3,857 |

|

|

| 3,764 |

|

|

| 3,894 |

|

Cash Operating Income per Ton - Steel |

|

| 72 |

|

|

| 52 |

|

|

| 205 |

|

Divided by: steel net sales |

|

| 3,801 |

|

|

| 3,767 |

|

|

| 4,690 |

|

Cash Operating Income Margin - Steel (%) |

|

| 7 | % |

|

| 5 | % |

|

| 17 | % |

Cash Operating Income - Mining Segment

$ MILLION |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Result - Management View (Note "Segment Information" to Ternium's Financial Statements as of the corresponding dates) |

|

| (2 | ) |

|

| (35 | ) |

|

| (22 | ) |

Plus/minus differences in cost of sales (IFRS) |

|

| 17 |

|

|

| 15 |

|

|

| 54 |

|

Excluding depreciation and amortization |

|

| 42 |

|

|

| 47 |

|

|

| 34 |

|

Impairment of Las Encinas' mining assets |

|

| - |

|

|

| 32 |

|

|

| - |

|

Cash Operating Income |

|

| 57 |

|

|

| 60 |

|

|

| 66 |

|

Divided by: mining shipments (thousand tons) |

|

| 3,059 |

|

|

| 2,995 |

|

|

| 2,695 |

|

Cash Operating Income per Ton - Mining |

|

| 18 |

|

|

| 20 |

|

|

| 25 |

|

Divided by: mining net sales |

|

| 280 |

|

|

| 249 |

|

|

| 274 |

|

Cash Operating Income Margin - Mining (%) |

|

| 20 | % |

|

| 24 | % |

|

| 24 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit I - Alternative Performance Measures (cont.)

Adjusted Net Income

$ MILLION |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

| 142 |

|

|

| 333 |

|

|

| 491 |

|

Excluding provision charge (reversal) for ongoing litigation related to the acquisition of a participation in Usiminas |

|

| 45 |

|

|

| (404 | ) |

|

| - |

|

Adjusted Net Income (Loss) |

|

| 188 |

|

|

| (71 | ) |

|

| 491 |

|

Adjusted Equity Holders' Net Income and Adjusted Earnings per ADS

$ MILLION |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity holders' net income |

|

| 67 |

|

|

| 281 |

|

|

| 361 |

|

Excluding provision charge (reversal) for ongoing litigation related to the acquisition of a participation in Usiminas |

|

| 41 |

|

|

| (364 | ) |

|

| - |

|

Adjusted Equity Holders' Net Income (Loss) |

|

| 108 |

|

|

| (83 | ) |

|

| 361 |

|

Divided by: outstanding shares of common stock, net of treasury shares (expressed in million of ADS equivalent) |

|

| 196 |

|

|

| 196 |

|

|

| 196 |

|

Adjusted Earnings (Losses) per ADS ($) |

|

| 0.55 |

|

|

| (0.42 | ) |

|

| 1.84 |

|

Free Cash Flow

$ MILLION |

|

| 1Q25 |

|

|

| 4Q24 |

|

|

| 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

| 207 |

|

|

| 472 |

|

|

| 475 |

|

Excluding capital expenditures and advances to suppliers for PP&E |

|

| (518 | ) |

|

| (561 | ) |

|

| (449 | ) |

Free Cash Flow |

|

| (311 | ) |

|

| (90 | ) |

|

| 26 |

|

Exhibit I - Alternative Performance Measures (cont.)

Net Cash

$ BILLION |

| MARCH 31, 2025 |

|

| DECEMBER 31, 2024 |

|

| MARCH 31, 2024 |

| |||

|

|

|

|

|

|

|

|

|

| |||

Cash and cash equivalents |

|

| 1.8 |

|

|

| 1.7 |

|

|

| 1.8 |

|

Plus: other investments (current and non-current) |

|

| 1.9 |

|

|

| 2.2 |

|

|

| 2.3 |

|

Less: borrowings (current and non-current) |

|

| (2.5 | ) |

|

| (2.2 | ) |

|

| (2.1 | ) |

Net Cash |

|

| 1.3 |

|

|

| 1.6 |

|

|

| 2.0 |

|

Note: Ternium Argentina's consolidated position of cash and cash equivalents and other investments amounted to

Sebastián Martí

Ternium - Investor Relations

+1 (866) 890 0443

+54 (11) 4018 8389

www.ternium.com

SOURCE: Ternium S.A.

View the original press release on ACCESS Newswire