CORRECTING and REPLACING Omdia: Global Smartphone Shipments Rebound with 7.1% Growth in 2024, Amid Industry Recovery

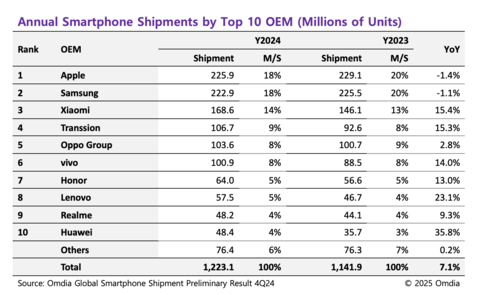

Annual Smartphone Shipments by Top 10 OEM (Graphic: Business Wire)

The updated release reads:

OMDIA: GLOBAL SMARTPHONE SHIPMENTS REBOUND WITH

According to the latest Omdia smartphone preliminary shipment report, global shipments reached 328.0 million units in 4Q24 marking a

Apple led global smartphone shipments in 4Q24, as is typical for the fourth quarter, following the launch of the new iPhone 16 series. The iPhone 16 lineup, released in the third quarter, drove shipments to 77.1 million. While the iPhone 16 series outperformed its predecessor in quarterly shipments, Apple overall shipments still marked a decline from the previous year – down 1 million from 78.1 million in 4Q23. For the full year of 2024, Apple shipped 225.9 million units, down

“Apple is facing difficulties in

Samsung recorded 51.9 million units in 4Q24, bringing its 2024 total to 222.9 million units, a

Xiaomi has exceeded expectations throughout 2024, maintaining strong global growth with 168.6 million unit shipments, an increase of over 20 million smartphones (

Transsion Holding, whose brands include Infinix, iTel and Tecno, saw shipments stabilize in 2024 following rapid expansion in 2023. While the company was unable to maintain its high growth, resulting in fluctuating year-on-year growth, Transsion has succeeded in achieving more sustainable growth. Combined shipments of all three brands total 106.7 million units in 2024, up

Vivo experienced steady growth throughout 2024, finishing the year with a total of 100.9 million shipments. This is 12 million more (

Zaker Li, Omdia Principal Smartphone Analyst said, “vivo has demonstrated remarkable resilience against ongoing intense market competition in 2024. While other brands have focused on aggressive market expansion strategy, vivo opted to focus more strategically on specific markets. It continues to lead in both the

Oppo Group, which includes both the Oppo and OnePlus brand, faced challenges throughout most of 2024. Despite this, the company has experienced strong growth in the second half of the year. Oppo Group recorded a

Honor, Lenovo, and Huawei all achieved double-digit growth, far outpacing the overall market growth rate. This growth was powered by Chinese OEMs' expansion into overseas markets, a recovery in demand for budget smartphones, and the resurgence of smartphone demand in

Concluding the analysis, Hong noted: “Looking back on 2024, it’s clear that the smartphone industry has recovered from the shipment volume decline seen in 2023. With the global smartphone market reaching 1,223.1 million units in 2024, this represents a strong

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250203664882/en/

Fasiha Khan- fasiha.khan@omdia.com

Source: Omdia