The Trade Desk Unveils the Sellers and Publishers Report – a Biannual Review of Open Internet Trends

The Trade Desk (Nasdaq: TTD) has released The Sellers and Publishers Report, a biannual review of advertising trends on the open internet. The report highlights that the top 500 digital publishers represent around 50% of the open internet's ad revenue, valued for their ad quality and reach. Consumers now spend 61% of their online time on the open internet, a significant shift from 2014. This change is driven by increased streaming TV and digital audio consumption, now nearly 5 hours daily for the average American. The report also indicates a decline in ad spending on platforms like Google and Facebook, which accounted for less than half of digital ad spending in 2022. The report features the top 100 advertising publishers, assessed on various criteria, in collaboration with Sincera.

- Top 500 digital publishers account for 50% of open internet ad revenue.

- Consumers spend 61% of online time on the open internet.

- Significant rise in streaming TV and digital audio consumption to nearly 5 hours daily.

- Ad spending on Google and Facebook has declined below 50% for the first time in a decade.

- Report showcases the top 100 open internet publishers, valued by advertisers.

- No mention of specific financial performance or revenue impact for The Trade Desk.

- Potential risk of over-reliance on a select group of top publishers.

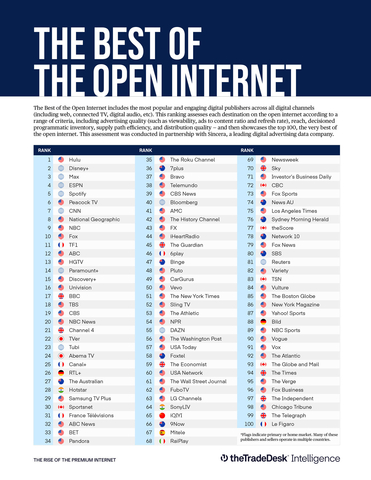

New Report Highlights the Rise of the Premium Internet and Includes a List of the Top 100 Open Internet Publishers as Valued by Advertisers

The Best of the Open Internet (Graphic: Business Wire)

According to the report, consumers now spend 61 percent of their online time on the open internet, compared to 39 percent within Big Tech walled gardens. This represents a reversal since 2014, when the majority of online consumer time was spent within walled gardens. This shift is the result, in part, of the rapid advance in streaming TV and digital audio, which now collectively account for almost 5 hours of daily consumption for the average American.

“The open internet is at a tipping point. In 2022, Facebook and Google accounted for less than half of all digital advertising spending for the first time in a decade, a trend that accelerated in 2023. That comes as consumers now spend the majority of their time outside these Big Tech walled gardens — increasingly preferring the best of the open internet. This includes the latest

In order to showcase the value of the very best of the open internet, the report showcases the leading 100 advertising publishers from around the world including streaming services, audio and podcast platforms, as well as popular news, lifestyle and sports destinations. The list was compiled based on a range of criteria important to advertisers, and was conducted in partnership with Sincera, a leading digital advertising data company.

To read The Sellers and Publishers Report: The Rise of the Premium Internet and view the Best of the Open Internet list, please visit The Trade Desk website here.

About The Trade Desk

The Trade Desk™ is a technology company that empowers buyers of advertising. Through its self-service, cloud-based platform, ad buyers can create, manage, and optimize digital advertising campaigns across ad formats and devices. Integrations with major data, inventory, and publisher partners ensure maximum reach and decisioning capabilities, and enterprise APIs enable custom development on top of the platform. Headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20240529378674/en/

The Trade Desk

PR@thetradedesk.com

Source: The Trade Desk