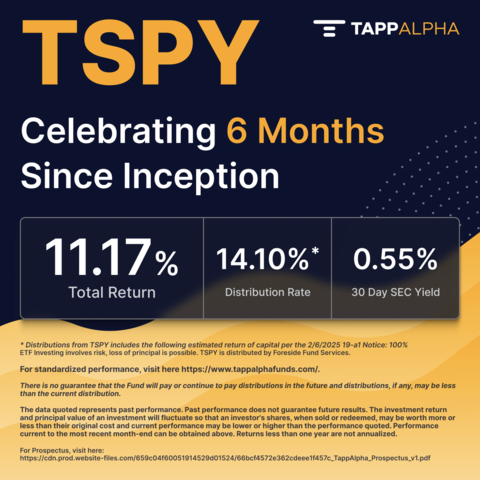

TappAlpha Celebrates TSPY’s Six-Month Anniversary with Strong Performance and Consistent Monthly Distributions

The return of capital for this most recent distribution was estimated to be

Since its launch on August 15, 2024, TSPY has delivered a total return of

With

To learn more about TappAlpha and TSPY, visit TappAlphaFunds.com.

About TappAlpha

Founded in 2023, TappAlpha is a

Disclosures

For prospectus, click here: TSPY Prospectus

Return of Capital (ROC) refers to a portion of a distribution that an ETF, mutual fund, or other investment may pay to investors that comes from the original principal (or initial investment) rather than from earnings, profits, or capital gains. The return of capital for this most recent distribution was estimated to be

Investing involves risk. Principal loss is possible. The Fund’s shares will change in value, and you could lose money by investing in the Fund. The Fund may not achieve its investment objectives. The Fund invests in options contracts that are based on the value of the Index, including SPX and XSP options. This subjects the Fund to certain of the same risks as if it owned shares of companies that comprised the Index, even though it does not own shares of companies in the Index. The Fund will have exposure to declines in the Index. The Fund is subject to potential losses if the Index loses value, which may not be offset by income received by the Fund. By virtue of the Fund’s investments in options contracts that are based on the value of the Index, the Fund may also be subject to an indirect investment risk, an index trading risk, and an S&P 500 Index Risk. To the extent that the Fund invests in other ETFs or investment companies, the value of an investment in the Fund is based on the performance of the underlying funds in which the Fund invests and the allocation of its assets among those ETFs or investment companies. The Fund may incur high portfolio turnover to manage the Fund’s investment exposure. The Fund is classified as “non-diversified” under the 1940 Act. As a result, the Fund is only limited as to the percentage of its assets which may be invested in the securities of any one issuer by the diversification requirements imposed by the Internal Revenue Code of 1986, as amended (the “Code”). A decline in the value of an investment in a single issuer could cause a Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio. For more information about the risks of investing in this Fund, please see the prospectus. The SPDR® S&P 500® ETF Trust. The SPDR® S&P 500® ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index (the “Index”).

The S&P 500® Index. The S&P 500® Index is a widely recognized benchmark index that tracks the performance of 500 of the largest

As of the date of this prospectus, the Fund has no operating history and currently has fewer assets than larger funds. Like other new funds, large inflows and outflows may impact the Fund’s market exposure for limited periods of time. This impact may be positive or negative, depending on the direction of market movement during the period affected. The Fund may incur high portfolio turnover to manage the Fund’s investment exposure. Additionally, active market trading of the Fund’s Shares may cause more frequent creation or redemption activities that could, in certain circumstances, increase the number of portfolio transactions. High levels of portfolio transactions increase brokerage and other transaction costs and may result in increased taxable capital gains. Each of these factors could have a negative impact on the performance of the Fund. The Distribution Rate is the annual rate an investor would receive if the most recent fund distribution remained the same going forward. The Distribution Rate represents a single distribution from the Fund and is not a representation of the Fund's total return. The Distribution Rate is calculated by multiplying the most recent distribution by 12 in order to annualize it, and then dividing by the Fund's NAV. 30-day SEC Yield is based on a formula mandated by the Securities and Exchange Commission (SEC) that calculates a fund's hypothetical annualized income, as a percentage of its assets. A security's income, for the purposes of this calculation, is based on the current market yield to maturity (in the case of bonds) or projected dividend yield (for stocks) of the fund's holdings over a trailing 30-day period. This hypothetical income will differ (at times, significantly) from the fund's actual experience; as a result, income distributions from the fund may be higher or lower than implied by the SEC yield. A final determination of the tax character of distributions paid by the Funds will not be known until the completion of the Funds’ fiscal year and there can be no assurance as to the portions of each Fund’s distributions that will constitute return of capital and/or dividend income. The final determination of the tax character of distributions paid by the Funds in 2024 will be reported to shareholders in January 2025 on Form 1099-DIV. You could lose money by investing in the Fund and the Fund may not achieve its investment objectives. ETFs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s shares may trade at a premium or discount to its net asset value, an active secondary trading market may not develop or be maintained, or trading may and the risk of experiencing significant price fluctuations due to intraday trading volatility, which is not as prominent with mutual funds that are priced only at the end of the trading day

Investing in securities involves risk including the loss of principal. Distributed by Foreside Fund Services, LLC, Member FINRA.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250218774484/en/

For media inquiries:

Gregory FCA for TappAlpha

TappAlpha@gregoryfca.com

Source: TappAlpha