TrueCar Releases Analysis of March and First Quarter Industry Sales

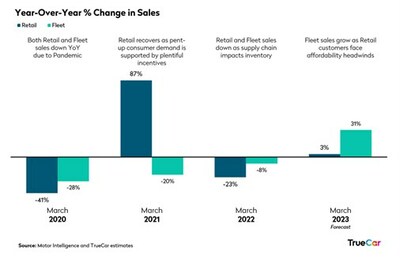

TrueCar, Inc. (NASDAQ: TRUE) reports that total new vehicle sales in March 2023 are expected to reach 1,356,762 units, reflecting a 7% increase year-over-year and a 4% rise from February 2023. The seasonally adjusted annualized rate (SAAR) is projected at 14.7 million, up 8.5% from last year. Fleet sales are anticipated to surge by 31% from March 2022 and 13.5% from February 2023, highlighting a significant recovery. Retail sales are also on the rise, with Nissan expected to lead fleet contributions. New vehicle prices are projected to increase by 5.6% compared to last year while interest rates remain stable at around 6.97% for new and 11% for used vehicles.

- Total industry sales expected to rise 7% YoY in March 2023.

- Fleet sales projected to increase by 31% YoY and 13.5% from February 2023.

- Retail sales anticipated to rise 3% YoY, indicating a recovery.

- Used vehicle sales expected to decline by 3% YoY.

Insights

Analyzing...

Fleet sales are at their highest in three years

"While we're seeing a modest recovery in retail sales, a key focal point this month will be the return of fleet sales," said

"Honda sales are tracking to be their best result in a year and a half," said

Additional March Industry Insights (from

- Total sales for

March 2023 are expected to be up7% from a year ago and up4% fromFebruary 2023 when adjusted for the same number of selling days. - Fleet sales for

March 2023 are expected to be up31% from a year ago and up13.5% fromFebruary 2023 when adjusted for the same number of selling days. - Average transaction price for new vehicles is projected to be up

5.6% from a year ago and even withFebruary 2023 . - Total SAAR is expected to be up

8.5% from a year ago at about 14.7 million units. - Used vehicle sales for

March 2023 are expected to reach 3.4 million, down3% from a year ago and up6% fromFebruary 2023 . - The average interest rate on new vehicles is

6.97% , on par withFebruary 2023 and the average interest rate on used vehicles is11% . - The average loan term on a new vehicle for

March 2023 is about 69 months and the average loan term on a used vehicle is about 70 months. - Quarterly average transaction price is projected to be up

4% from a year ago and about the same as Q4 2022. - Quarterly incentive spend is down

9% from a year ago and up27% from Q4 2022.

Total Unit Sales | |||||||

Manufacturer | YoY % Change | YoY % Change | MoM % Change | MoM % Change | |||

BMW | 32,455 | 30,561 | 26,808 | 6.2 % | 6.2 % | 21.1 % | 7.6 % |

28,745 | 28,764 | 26,624 | -0.1 % | -0.1 % | 8.0 % | -4.0 % | |

Ford | 166,606 | 158,500 | 156,377 | 5.1 % | 5.1 % | 6.5 % | -5.3 % |

225,784 | 204,829 | 185,560 | 10.2 % | 10.2 % | 21.7 % | 8.2 % | |

Honda | 114,503 | 108,075 | 83,247 | 5.9 % | 5.9 % | 37.5 % | 22.3 % |

Hyundai | 75,498 | 63,983 | 61,252 | 18.0 % | 18.0 % | 23.3 % | 9.6 % |

Kia | 69,784 | 59,524 | 60,859 | 17.2 % | 17.2 % | 14.7 % | 1.9 % |

Nissan | 99,089 | 79,665 | 72,393 | 24.4 % | 24.4 % | 36.9 % | 21.7 % |

Stellantis | 135,681 | 143,376 | 119,770 | -5.4 % | -5.4 % | 13.3 % | 0.7 % |

Subaru | 52,541 | 43,322 | 45,790 | 21.3 % | 21.3 % | 14.7 % | 2.0 % |

Tesla | 62,145 | 47,953 | 60,325 | 29.6 % | 29.6 % | 3.0 % | -8.4 % |

Toyota | 170,462 | 195,271 | 157,697 | -12.7 % | -12.7 % | 8.1 % | -3.9 % |

54,387 | 39,262 | 47,381 | 38.5 % | 38.5 % | 14.8 % | 2.0 % | |

Industry | 1,356,762 | 1,264,300 | 1,160,877 | 7.3 % | 7.3 % | 16.9 % | 3.9 % |

Retail Unit Sales | |||||||

Manufacturer | YoY % Change | YoY % Change | MoM % Change | MoM % Change | |||

BMW | 29,496 | 29,977 | 25,052 | -1.6 % | -1.6 % | 17.7 % | 4.7 % |

25,904 | 27,443 | 25,169 | -5.6 % | -5.6 % | 2.9 % | -8.5 % | |

Ford | 119,978 | 118,539 | 109,733 | 1.2 % | 1.2 % | 9.3 % | -2.8 % |

173,276 | 163,021 | 153,473 | 6.3 % | 6.3 % | 12.9 % | 0.4 % | |

Honda | 113,336 | 104,176 | 81,868 | 8.8 % | 8.8 % | 38.4 % | 23.1 % |

Hyundai | 71,675 | 63,319 | 53,035 | 13.2 % | 13.2 % | 35.1 % | 20.1 % |

Kia | 66,530 | 53,572 | 56,870 | 24.2 % | 24.2 % | 17.0 % | 4.0 % |

Nissan | 70,193 | 64,109 | 60,090 | 9.5 % | 9.5 % | 16.8 % | 3.8 % |

Stellantis | 93,641 | 113,098 | 85,170 | -17.2 % | -17.2 % | 9.9 % | -2.3 % |

Subaru | 51,000 | 41,963 | 43,436 | 21.5 % | 21.5 % | 17.4 % | 4.4 % |

Tesla | 55,160 | 47,447 | 52,555 | 16.3 % | 16.3 % | 5.0 % | -6.7 % |

Toyota | 152,631 | 174,182 | 145,354 | -12.4 % | -12.4 % | 5.0 % | -6.7 % |

47,449 | 38,135 | 44,078 | 24.4 % | 24.4 % | 7.6 % | -4.3 % | |

Industry | 1,131,166 | 1,094,894 | 983,735 | 3.3 % | 3.3 % | 15.0 % | 2.2 % |

Fleet Unit Sales | |||||||

Manufacturer | YoY % Change | YoY % Change | MoM % Change | MoM % Change | |||

BMW | 2,959 | 584 | 1,756 | 406.3 % | 406.3 % | 68.5 % | 49.8 % |

2,841 | 1,321 | 1,455 | 115.1 % | 115.1 % | 95.3 % | 73.6 % | |

Ford | 46,628 | 39,961 | 46,644 | 16.7 % | 16.7 % | 0.0 % | -11.1 % |

52,508 | 41,808 | 32,087 | 25.6 % | 25.6 % | 63.6 % | 45.5 % | |

Honda | 1,167 | 3,899 | 1,379 | -70.1 % | -70.1 % | -15.4 % | -24.8 % |

Hyundai | 3,823 | 664 | 8,217 | 475.7 % | 475.7 % | -53.5 % | -58.6 % |

Kia | 3,254 | 5,952 | 3,989 | -45.3 % | -45.3 % | -18.4 % | -27.5 % |

Nissan | 28,896 | 15,556 | 12,303 | 85.8 % | 85.8 % | 134.9 % | 108.8 % |

Stellantis | 42,040 | 30,278 | 34,600 | 38.8 % | 38.8 % | 21.5 % | 8.0 % |

Subaru | 1,541 | 1,359 | 2,354 | 13.4 % | 13.4 % | -34.5 % | -41.8 % |

Tesla | 6,985 | 506 | 7,770 | 1279.4 % | 1279.4 % | -10.1 % | -20.1 % |

Toyota | 17,831 | 21,089 | 12,343 | -15.4 % | -15.4 % | 44.5 % | 28.4 % |

6,938 | 1,127 | 3,303 | 515.9 % | 515.9 % | 110.1 % | 86.7 % | |

Industry | 221,630 | 169,208 | 173,600 | 31.0 % | 31.0 % | 27.7 % | 13.5 % |

Fleet Penetration | |||||

Manufacturer | YoY % Change | MoM % Change | |||

BMW | 9.1 % | 1.9 % | 6.6 % | 376.7 % | 39.2 % |

9.9 % | 4.6 % | 5.5 % | 115.3 % | 80.9 % | |

Ford | 28.0 % | 25.2 % | 29.8 % | 11.0 % | -6.2 % |

23.3 % | 20.4 % | 17.3 % | 13.9 % | 34.5 % | |

Honda | 1.0 % | 3.6 % | 1.7 % | -71.7 % | -38.5 % |

Hyundai | 5.1 % | 1.0 % | 13.4 % | 387.9 % | -62.3 % |

Kia | 4.7 % | 10.0 % | 6.6 % | -53.4 % | -28.9 % |

Nissan | 29.2 % | 19.5 % | 17.0 % | 49.3 % | 71.6 % |

Stellantis | 31.0 % | 21.1 % | 28.9 % | 46.7 % | 7.3 % |

Subaru | 2.9 % | 3.1 % | 5.1 % | -6.5 % | -43.0 % |

Tesla | 11.2 % | 1.1 % | 12.9 % | 964.4 % | -12.7 % |

Toyota | 10.5 % | 10.8 % | 7.8 % | -3.1 % | 33.6 % |

12.8 % | 2.9 % | 7.0 % | 344.6 % | 83.0 % | |

Industry | 16.3 % | 13.4 % | 15.0 % | 22.1 % | 9.2 % |

Total Market Share | |||

Manufacturer | |||

BMW | 2.4 % | 2.4 % | 2.3 % |

2.1 % | 2.3 % | 2.3 % | |

Ford | 12.3 % | 12.5 % | 13.5 % |

16.6 % | 16.2 % | 16.0 % | |

Honda | 8.4 % | 8.5 % | 7.2 % |

Hyundai | 5.6 % | 5.1 % | 5.3 % |

Kia | 5.1 % | 4.7 % | 5.2 % |

Nissan | 7.3 % | 6.3 % | 6.2 % |

Stellantis | 10.0 % | 11.3 % | 10.3 % |

Subaru | 3.9 % | 3.4 % | 3.9 % |

Tesla | 4.6 % | 3.8 % | 5.2 % |

Toyota | 12.6 % | 15.4 % | 13.6 % |

4.0 % | 3.1 % | 4.1 % | |

94.9 % | 95.2 % | 95.1 % | |

Retail Market Share | |||

Manufacturer | |||

BMW | 2.6 % | 2.7 % | 2.5 % |

2.3 % | 2.5 % | 2.6 % | |

Ford | 10.6 % | 10.8 % | 11.2 % |

15.3 % | 14.9 % | 15.6 % | |

Honda | 10.0 % | 9.5 % | 8.3 % |

Hyundai | 6.3 % | 5.8 % | 5.4 % |

Kia | 5.9 % | 4.9 % | 5.8 % |

Nissan | 6.2 % | 5.9 % | 6.1 % |

Stellantis | 8.3 % | 10.3 % | 8.7 % |

Subaru | 4.5 % | 3.8 % | 4.4 % |

Tesla | 4.9 % | 4.3 % | 5.3 % |

Toyota | 13.5 % | 15.9 % | 14.8 % |

4.2 % | 3.5 % | 4.5 % | |

94.6 % | 94.9 % | 95.1 % | |

ATP | |||||

Manufacturer | YOY | MOM | |||

BMW | 4.2 % | -1.8 % | |||

11.5 % | 1.3 % | ||||

Ford | 12.9 % | -2.2 % | |||

5.4 % | 3.5 % | ||||

Honda | 1.8 % | 1.3 % | |||

Hyundai | 0.4 % | -2.2 % | |||

Kia | -1.3 % | 0.2 % | |||

Nissan | 9.3 % | -1.3 % | |||

Stellantis | 4.2 % | 0.2 % | |||

Subaru | 1.4 % | 1.4 % | |||

Toyota | 4.0 % | 0.5 % | |||

5.4 % | 2.2 % | ||||

Industry | 5.6 % | 0.0 % | |||

- | |||||

Incentives | |||||

Manufacturer | YOY | MOM | |||

BMW | 57.0 % | 3.7 % | |||

30.1 % | 4.0 % | ||||

Ford | -24.9 % | 10.4 % | |||

8.1 % | 4.1 % | ||||

Honda | 22.9 % | 5.0 % | |||

Hyundai | 58.1 % | 7.3 % | |||

Kia | -36.1 % | 1.7 % | |||

Nissan | 30.4 % | 6.3 % | |||

Stellantis | 16.7 % | 5.1 % | |||

Subaru | -4.2 % | 0.5 % | |||

Toyota | -19.5 % | 2.1 % | |||

48.8 % | -1.5 % | ||||

Industry | 5.8 % | 4.9 % | |||

Incentives as % of ATP | |||||

Manufacturer | YOY | MOM | |||

BMW | 4.2 % | 2.8 % | 4.0 % | 50.6 % | 5.7 % |

2.9 % | 2.5 % | 2.8 % | 16.6 % | 2.6 % | |

Ford | 2.3 % | 3.4 % | 2.0 % | -33.5 % | 12.9 % |

4.0 % | 3.9 % | 3.9 % | 2.5 % | 0.6 % | |

Honda | 3.5 % | 2.9 % | 3.4 % | 20.7 % | 3.6 % |

Hyundai | 2.8 % | 1.8 % | 2.5 % | 57.5 % | 9.7 % |

Kia | 1.7 % | 2.6 % | 1.6 % | -35.3 % | 1.5 % |

Nissan | 6.1 % | 5.1 % | 5.7 % | 19.3 % | 7.7 % |

Stellantis | 4.7 % | 4.2 % | 4.5 % | 12.0 % | 4.8 % |

Subaru | 2.4 % | 2.5 % | 2.4 % | -5.5 % | -0.9 % |

Toyota | 1.7 % | 2.2 % | 1.7 % | -22.6 % | 1.5 % |

4.6 % | 3.2 % | 4.8 % | 41.2 % | -3.6 % | |

Industry | 3.4 % | 3.4 % | 3.3 % | 0.2 % | 4.9 % |

Revenue | |||||

Manufacturer | YOY | MOM | |||

Industry | 13.4 % | 16.9 % | |||

Quarterly Tables

Total Unit Sales | |||||||

Manufacturer | Q1 2023 | Q1 2022 | Q4 2022 | YoY % Change | YoY % Change | QoQ % Change | QoQ % Change |

BMW | 84,605 | 80,590 | 112,057 | 5.0 % | 5.0 % | -24.5 % | -21.5 % |

78,929 | 73,412 | 87,557 | 7.5 % | 7.5 % | -9.9 % | -6.2 % | |

Ford | 468,053 | 429,174 | 479,769 | 9.1 % | 9.1 % | -2.4 % | 1.5 % |

594,434 | 509,108 | 617,575 | 16.8 % | 16.8 % | -3.7 % | 0.1 % | |

Honda | 282,264 | 266,418 | 255,250 | 5.9 % | 5.9 % | 10.6 % | 15.0 % |

Hyundai | 192,656 | 171,399 | 211,497 | 12.4 % | 12.4 % | -8.9 % | -5.3 % |

Kia | 182,626 | 151,194 | 175,401 | 20.8 % | 20.8 % | 4.1 % | 8.3 % |

Nissan | 231,733 | 201,081 | 191,887 | 15.2 % | 15.2 % | 20.8 % | 25.6 % |

Stellantis | 365,610 | 407,550 | 348,244 | -10.3 % | -10.3 % | 5.0 % | 9.2 % |

Subaru | 142,704 | 132,346 | 155,466 | 7.8 % | 7.8 % | -8.2 % | -4.5 % |

Tesla | 176,345 | 130,133 | 131,574 | 35.5 % | 35.5 % | 34.0 % | 39.4 % |

Toyota | 464,918 | 514,592 | 537,971 | -9.7 % | -9.7 % | -13.6 % | -10.1 % |

145,450 | 114,540 | 142,039 | 27.0 % | 27.0 % | 2.4 % | 6.5 % | |

Industry | 3,584,087 | 3,330,136 | 3,606,847 | 7.6 % | 7.6 % | -0.6 % | 3.3 % |

Retail Unit Sales | |||||||

Manufacturer | Q1 2023 | Q1 2022 | Q4 2022 | YoY % Change | YoY % Change | QoQ % Change | QoQ % Change |

BMW | 76,891 | 78,760 | 103,405 | -2.4 % | -2.4 % | -25.6 % | -22.7 % |

71,128 | 69,571 | 82,703 | 2.2 % | 2.2 % | -14.0 % | -10.6 % | |

Ford | 337,059 | 324,330 | 338,394 | 3.9 % | 3.9 % | -0.4 % | 3.6 % |

456,194 | 402,836 | 499,104 | 13.2 % | 13.2 % | -8.6 % | -4.9 % | |

Honda | 279,387 | 258,857 | 251,092 | 7.9 % | 7.9 % | 11.3 % | 15.7 % |

Hyundai | 182,901 | 169,718 | 188,202 | 7.8 % | 7.8 % | -2.8 % | 1.1 % |

Kia | 174,110 | 137,760 | 163,657 | 26.4 % | 26.4 % | 6.4 % | 10.6 % |

Nissan | 164,156 | 164,170 | 158,021 | 0.0 % | 0.0 % | 3.9 % | 8.0 % |

Stellantis | 252,327 | 330,551 | 249,335 | -23.7 % | -23.7 % | 1.2 % | 5.2 % |

Subaru | 138,519 | 128,432 | 148,694 | 7.9 % | 7.9 % | -6.8 % | -3.1 % |

Tesla | 156,524 | 125,871 | 120,829 | 24.4 % | 24.4 % | 29.5 % | 34.7 % |

Toyota | 416,286 | 458,887 | 486,588 | -9.3 % | -9.3 % | -14.4 % | -11.0 % |

126,895 | 111,084 | 131,712 | 14.2 % | 14.2 % | -3.7 % | 0.2 % | |

Industry | 2,994,652 | 2,896,489 | 3,063,713 | 3.4 % | 3.4 % | -2.3 % | 1.7 % |

Total Market Share | |||

Manufacturer | Q1 2023 | Q1 2022 | Q4 2022 |

BMW | 2.4 % | 2.4 % | 3.1 % |

2.2 % | 2.2 % | 2.4 % | |

Ford | 13.1 % | 12.9 % | 13.3 % |

16.6 % | 15.3 % | 17.1 % | |

Honda | 7.9 % | 8.0 % | 7.1 % |

Hyundai | 5.4 % | 5.1 % | 5.9 % |

Kia | 5.1 % | 4.5 % | 4.9 % |

Nissan | 6.5 % | 6.0 % | 5.3 % |

Stellantis | 10.2 % | 12.2 % | 9.7 % |

Subaru | 4.0 % | 4.0 % | 4.3 % |

Tesla | 4.9 % | 3.9 % | 3.6 % |

Toyota | 13.0 % | 15.5 % | 14.9 % |

4.1 % | 3.4 % | 3.9 % | |

95.2 % | 95.5 % | 95.5 % | |

Retail Market Share | |||

Manufacturer | Q1 2023 | Q1 2022 | Q4 2022 |

BMW | 2.6 % | 2.7 % | 3.4 % |

2.4 % | 2.4 % | 2.7 % | |

Ford | 11.3 % | 11.2 % | 11.0 % |

15.2 % | 13.9 % | 16.3 % | |

Honda | 9.3 % | 8.9 % | 8.2 % |

Hyundai | 6.1 % | 5.9 % | 6.1 % |

Kia | 5.8 % | 4.8 % | 5.3 % |

Nissan | 5.5 % | 5.7 % | 5.2 % |

Stellantis | 8.4 % | 11.4 % | 8.1 % |

Subaru | 4.6 % | 4.4 % | 4.9 % |

Tesla | 5.2 % | 4.3 % | 3.9 % |

Toyota | 13.9 % | 15.8 % | 15.9 % |

4.2 % | 3.8 % | 4.3 % | |

94.6 % | 95.3 % | 95.4 % | |

ATP | ||||||

Manufacturer | Q1 2023 | Q1 2022 | Q4 2022 | YoY % Change | QoQ % Change | |

BMW | 7.8 % | 0.1 % | ||||

7.5 % | 6.9 % | |||||

Ford | 12.7 % | -0.5 % | ||||

2.3 % | -1.2 % | |||||

Honda | 3.5 % | 1.5 % | ||||

Hyundai | 1.8 % | 0.5 % | ||||

Kia | 0.7 % | -1.4 % | ||||

Nissan | 12.3 % | 1.9 % | ||||

Stellantis | 4.3 % | -0.2 % | ||||

Subaru | 0.1 % | -1.9 % | ||||

Toyota | 5.2 % | 4.8 % | ||||

8.4 % | 0.5 % | |||||

Industry | 45,452 | 43,701 | 45,397 | 4.0 % | 0.1 % | |

Incentives | ||||||

Manufacturer | Q1 2023 | Q1 2022 | Q4 2022 | YoY % Change | QoQ % Change | |

BMW | 16.3 % | 69.6 % | ||||

5.7 % | 24.6 % | |||||

Ford | -37.6 % | 6.3 % | ||||

2.4 % | 46.2 % | |||||

Honda | 13.9 % | 32.6 % | ||||

Hyundai | 6.6 % | -2.7 % | ||||

Kia | -52.3 % | 26.4 % | ||||

Nissan | 15.2 % | 46.2 % | ||||

Stellantis | -1.3 % | 42.6 % | ||||

Subaru | -4.7 % | 56.9 % | ||||

Toyota | -30.7 % | 8.8 % | ||||

21.8 % | 42.3 % | |||||

Industry | 1,486 | 1,631 | 1,168 | -8.9 % | 27.2 % | |

- | ||||||

(Note: This industry insight is based solely on

About

For more information, please visit www.truecar.com, and follow us on LinkedIn, Facebook or Twitter.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/truecar-releases-analysis-of-march-and-first-quarter-industry-sales-301785018.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/truecar-releases-analysis-of-march-and-first-quarter-industry-sales-301785018.html

SOURCE TrueCar.com