TrueCar Releases Analysis of February Industry Sales

TrueCar forecasts total new vehicle sales of 1,117,400 units for February 2023, marking a 5.6% year-over-year increase and a 4.8% rise from January.

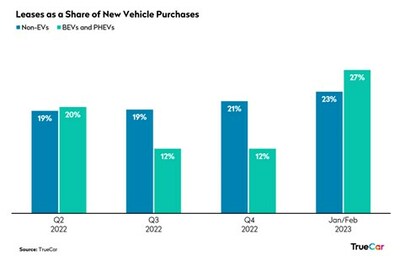

U.S. retail vehicle deliveries are expected at 928,386 units, up 1% from last year. Fleet sales are projected to surge by 33%, while average transaction prices for new vehicles are anticipated to rise by 5%. Despite the increases, the seasonally adjusted annualized rate (SAAR) for total light vehicle sales is estimated at 14.5 million, a 3.8% decline from February 2022. Increased leasing of electric vehicles is attributed to new tax credits, countering high interest rates and prices.

- Total new vehicle sales projected at 1,117,400 units, up 5.6% year-over-year.

- U.S. retail deliveries expected at 928,386 units, marking a 1% increase.

- Fleet sales anticipated to rise by 33%, enhancing revenue potential.

- Average transaction prices projected to increase by 5%.

- SAAR for total light vehicle sales expected to decline by 3.8% to 14.5 million.

- Used vehicle sales projected to drop by 8% year-over-year.

- Average new vehicle interest rates remain high at 6.9%.

Insights

Analyzing...

Electric vehicle leases spike in response to government tax credits

"Consumers and manufacturers alike are employing strategies to address affordability challenges," said

"Over the last month we've seen OEMs respond to Tesla's steep price reductions by increasing traditional incentives, keeping in line with how OEMs typically act to promote vehicles and increase demand," said

Additional February Industry Insights (from

- Total sales for

February 2023 are expected to be up5.6% from a year ago and up4.8% fromJanuary 2023 when adjusted for the same number of selling days. - Fleet sales for

February 2023 are expected to be up33% from a year ago and up16% fromJanuary 2023 when adjusted for the same number of selling days. - Average transaction price for new vehicles is projected to be up

5% from a year ago and about even withJanuary 2023 . - Total SAAR is expected to be down

3.8% from a year ago at about 14.5 million units. - Used vehicle sales for

February 2023 are expected to reach 2.8 million, down8% from a year ago and up5% fromJanuary 2023 . - The average interest rate on new vehicles is

6.9% compared toJanuary 2023 at7% and the average interest rate on used vehicles is10.5% . - The average loan term on a new vehicle for

February 2023 is 69 months and the average loan term on a used vehicle is about 70 months.

Total Unit Sales | |||||||

Manufacturer | YoY % Change | YoY % Change | MoM % Change | MoM % Change | |||

BMW | 24,611 | 26,074 | 25,571 | -5.6 % | -5.6 % | -3.8 % | -3.8 % |

21,874 | 19,237 | 23,560 | 13.7 % | 13.7 % | -7.2 % | -7.2 % | |

Ford | 162,296 | 128,229 | 145,070 | 26.6 % | 26.6 % | 11.9 % | 11.9 % |

184,632 | 161,705 | 183,090 | 14.2 % | 14.2 % | 0.8 % | 0.8 % | |

Honda | 87,526 | 84,394 | 84,514 | 3.7 % | 3.7 % | 3.6 % | 3.6 % |

Hyundai | 59,997 | 55,906 | 55,906 | 7.3 % | 7.3 % | 7.3 % | 7.3 % |

Kia | 56,142 | 49,182 | 51,983 | 14.2 % | 14.2 % | 8.0 % | 8.0 % |

Nissan | 63,622 | 61,674 | 60,251 | 3.2 % | 3.2 % | 5.6 % | 5.6 % |

Stellantis | 111,261 | 136,580 | 108,538 | -18.5 % | -18.5 % | 2.5 % | 2.5 % |

Subaru | 44,877 | 44,866 | 44,373 | 0.0 % | 0.0 % | 1.1 % | 1.1 % |

Tesla | 51,478 | 42,742 | 53,875 | 20.4 % | 20.4 % | -4.4 % | -4.4 % |

Toyota | 154,961 | 160,645 | 136,759 | -3.5 % | -3.5 % | 13.3 % | 13.3 % |

44,912 | 36,355 | 44,086 | 23.5 % | 23.5 % | 1.9 % | 1.9 % | |

Industry | 1,117,400 | 1,058,243 | 1,065,720 | 5.6 % | 5.6 % | 4.8 % | 4.8 % |

Retail Unit Sales | |||||||

Manufacturer | YoY % Change | YoY % Change | MoM % Change | MoM % Change | |||

BMW | 22,155 | 25,575 | 23,917 | -13.4 % | -13.4 % | -7.4 % | -7.4 % |

19,520 | 18,355 | 22,304 | 6.3 % | 6.3 % | -12.5 % | -12.5 % | |

Ford | 116,666 | 95,896 | 102,232 | 21.7 % | 21.7 % | 14.1 % | 14.1 % |

139,763 | 129,069 | 151,662 | 8.3 % | 8.3 % | -7.8 % | -7.8 % | |

Honda | 85,921 | 81,318 | 83,130 | 5.7 % | 5.7 % | 3.4 % | 3.4 % |

Hyundai | 56,284 | 55,344 | 48,421 | 1.7 % | 1.7 % | 16.2 % | 16.2 % |

Kia | 52,968 | 44,264 | 48,580 | 19.7 % | 19.7 % | 9.0 % | 9.0 % |

Nissan | 54,975 | 49,519 | 50,111 | 11.0 % | 11.0 % | 9.7 % | 9.7 % |

Stellantis | 73,159 | 108,737 | 76,215 | -32.7 % | -32.7 % | -4.0 % | -4.0 % |

Subaru | 43,419 | 43,459 | 42,123 | -0.1 % | -0.1 % | 3.1 % | 3.1 % |

Tesla | 45,066 | 42,291 | 46,960 | 6.6 % | 6.6 % | -4.0 % | -4.0 % |

Toyota | 137,684 | 143,332 | 126,423 | -3.9 % | -3.9 % | 8.9 % | 8.9 % |

39,257 | 35,270 | 40,939 | 11.3 % | 11.3 % | -4.1 % | -4.1 % | |

Industry | 928,386 | 918,918 | 903,204 | 1.0 % | 1.0 % | 2.8 % | 2.8 % |

Fleet Unit Sales | |||||||

Manufacturer | YoY % Change | YoY % Change | MoM % Change | MoM % Change | |||

BMW | 2,456 | 499 | 1,654 | 391.9 % | 391.9 % | 48.5 % | 48.5 % |

2,354 | 882 | 1,256 | 167.0 % | 167.0 % | 87.5 % | 87.5 % | |

Ford | 45,630 | 32,333 | 42,838 | 41.1 % | 41.1 % | 6.5 % | 6.5 % |

44,869 | 32,636 | 31,428 | 37.5 % | 37.5 % | 42.8 % | 42.8 % | |

Honda | 1,605 | 3,076 | 1,384 | -47.8 % | -47.8 % | 15.9 % | 15.9 % |

Hyundai | 3,713 | 562 | 7,485 | 561.2 % | 561.2 % | -50.4 % | -50.4 % |

Kia | 3,174 | 4,918 | 3,403 | -35.5 % | -35.5 % | -6.7 % | -6.7 % |

Nissan | 8,647 | 12,155 | 10,140 | -28.9 % | -28.9 % | -14.7 % | -14.7 % |

Stellantis | 38,102 | 27,843 | 32,323 | 36.8 % | 36.8 % | 17.9 % | 17.9 % |

Subaru | 1,458 | 1,407 | 2,250 | 3.6 % | 3.6 % | -35.2 % | -35.2 % |

Tesla | 6,412 | 451 | 6,915 | 1320.6 % | 1320.6 % | -7.3 % | -7.3 % |

Toyota | 17,277 | 17,313 | 10,336 | -0.2 % | -0.2 % | 67.1 % | 67.1 % |

5,655 | 1,085 | 3,147 | 421.4 % | 421.4 % | 79.7 % | 79.7 % | |

Industry | 185,048 | 139,127 | 158,974 | 33.0 % | 33.0 % | 16.4 % | 16.4 % |

Fleet Penetration | |||||

Manufacturer | YoY % Change | MoM % Change | |||

BMW | 10.0 % | 1.9 % | 6.5 % | 421.1 % | 54.3 % |

10.8 % | 4.6 % | 5.3 % | 134.8 % | 101.9 % | |

Ford | 28.1 % | 25.2 % | 29.5 % | 11.5 % | -4.8 % |

24.3 % | 20.2 % | 17.2 % | 20.4 % | 41.6 % | |

Honda | 1.8 % | 3.6 % | 1.6 % | -49.7 % | 12.0 % |

Hyundai | 6.2 % | 1.0 % | 13.4 % | 516.1 % | -53.8 % |

Kia | 5.7 % | 10.0 % | 6.5 % | -43.5 % | -13.6 % |

Nissan | 13.6 % | 19.7 % | 16.8 % | -31.0 % | -19.2 % |

Stellantis | 34.2 % | 20.4 % | 29.8 % | 68.0 % | 15.0 % |

Subaru | 3.2 % | 3.1 % | 5.1 % | 3.6 % | -35.9 % |

Tesla | 12.5 % | 1.1 % | 12.8 % | 1079.5 % | -3.0 % |

Toyota | 11.1 % | 10.8 % | 7.6 % | 3.5 % | 47.5 % |

12.6 % | 3.0 % | 7.1 % | 322.0 % | 76.4 % | |

Industry | 16.6 % | 13.1 % | 14.9 % | 26.0 % | 11.0 % |

Total Market Share | |||

Manufacturer | |||

BMW | 2.2 % | 2.5 % | 2.4 % |

2.0 % | 1.8 % | 2.2 % | |

Ford | 14.5 % | 12.1 % | 13.6 % |

16.5 % | 15.3 % | 17.2 % | |

Honda | 7.8 % | 8.0 % | 7.9 % |

Hyundai | 5.4 % | 5.3 % | 5.2 % |

Kia | 5.0 % | 4.6 % | 4.9 % |

Nissan | 5.7 % | 5.8 % | 5.7 % |

Stellantis | 10.0 % | 12.9 % | 10.2 % |

Subaru | 4.0 % | 4.2 % | 4.2 % |

Tesla | 4.6 % | 4.0 % | 5.1 % |

Toyota | 13.9 % | 15.2 % | 12.8 % |

4.0 % | 3.4 % | 4.1 % | |

95.6 % | 95.2 % | 95.5 % | |

Retail Market Share | |||

Manufacturer | |||

BMW | 2.4 % | 2.8 % | 2.6 % |

2.1 % | 2.0 % | 2.5 % | |

Ford | 12.6 % | 10.4 % | 11.3 % |

15.1 % | 14.0 % | 16.8 % | |

Honda | 9.3 % | 8.8 % | 9.2 % |

Hyundai | 6.1 % | 6.0 % | 5.4 % |

Kia | 5.7 % | 4.8 % | 5.4 % |

Nissan | 5.9 % | 5.4 % | 5.5 % |

Stellantis | 7.9 % | 11.8 % | 8.4 % |

Subaru | 4.7 % | 4.7 % | 4.7 % |

Tesla | 4.9 % | 4.6 % | 5.2 % |

Toyota | 14.8 % | 15.6 % | 14.0 % |

4.2 % | 3.8 % | 4.5 % | |

95.5 % | 94.9 % | 95.6 % | |

ATP | |||||

Manufacturer | YOY | MOM | |||

BMW | 11.3 % | 0.8 % | |||

4.5 % | -0.3 % | ||||

Ford | 12.7 % | -0.9 % | |||

0.2 % | -0.5 % | ||||

Honda | 1.5 % | 2.1 % | |||

Hyundai | 0.7 % | 1.2 % | |||

Kia | 0.5 % | 0.9 % | |||

Nissan | 14.8 % | 2.9 % | |||

Stellantis | 5.2 % | 0.7 % | |||

Subaru | -0.7 % | -2.7 % | |||

Toyota | 4.4 % | 1.9 % | |||

1.3 % | -1.3 % | ||||

Industry | 5.2 % | 0.2 % | |||

Incentives | |||||

Manufacturer | YOY | MOM | |||

BMW | -7.9 % | -7.6 % | |||

-8.9 % | 11.0 % | ||||

Ford | -26.2 % | 14.4 % | |||

-3.8 % | -3.9 % | ||||

Honda | 2.7 % | -10.9 % | |||

Hyundai | -7.9 % | 2.2 % | |||

Kia | -44.8 % | -0.5 % | |||

Nissan | 11.5 % | 7.5 % | |||

Stellantis | -12.6 % | 9.7 % | |||

Subaru | 14.8 % | 7.2 % | |||

Toyota | -36.1 % | -1.0 % | |||

5.0 % | 6.8 % | ||||

Industry | -8.1 % | 9.0 % | |||

- | |||||

Incentives as % of ATP | |||||

Manufacturer | YOY | MOM | |||

BMW | 3.4 % | 4.2 % | 3.7 % | -17.3 % | -8.3 % |

2.6 % | 3.0 % | 2.4 % | -12.8 % | 11.3 % | |

Ford | 2.3 % | 3.6 % | 2.0 % | -34.5 % | 15.4 % |

3.7 % | 3.8 % | 3.8 % | -4.1 % | -3.4 % | |

Honda | 3.1 % | 3.1 % | 3.6 % | 1.1 % | -12.7 % |

Hyundai | 2.3 % | 2.5 % | 2.3 % | -8.5 % | 1.0 % |

Kia | 2.0 % | 3.6 % | 2.0 % | -45.0 % | -1.4 % |

Nissan | 5.1 % | 5.3 % | 4.9 % | -2.9 % | 4.4 % |

Stellantis | 4.0 % | 4.9 % | 3.7 % | -16.9 % | 8.9 % |

Subaru | 2.9 % | 2.5 % | 2.6 % | 15.7 % | 10.1 % |

Toyota | 1.6 % | 2.6 % | 1.6 % | -38.8 % | -2.9 % |

4.1 % | 3.9 % | 3.7 % | 3.7 % | 8.3 % | |

Industry | 3.3 % | 3.8 % | 3.1 % | -12.7 % | 8.9 % |

Revenue | |||||

Manufacturer | YOY | MOM | |||

Industry | 11.1 % | 5.0 % | |||

(Note: This industry insight is based solely on

About

For more information, please visit www.truecar.com, and follow us on LinkedIn, Facebook or Twitter.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/truecar-releases-analysis-of-february-industry-sales-301755221.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/truecar-releases-analysis-of-february-industry-sales-301755221.html

SOURCE TrueCar.com