Travel + Leisure Co. Reports Fourth Quarter and Full-Year 2021 Results

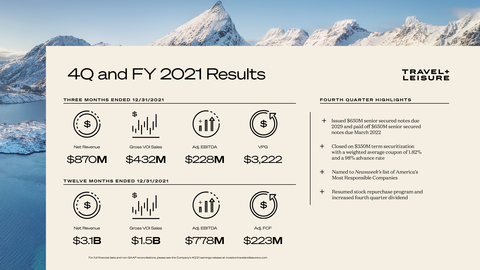

Fourth quarter 2021 highlights:

-

Net income from continuing operations of

$110 million $1.26 $870 million

-

Adjusted EBITDA of

$228 million $1.19

- Resumed stock repurchase program and increased dividend

Full-year 2021 highlights:

-

Net income from continuing operations of

$313 million $3.58 $3.1 billion

-

Adjusted EBITDA of

$778 million $3.65

-

Net cash provided by operating activities of

$568 million $223 million

Outlook:

-

First quarter 2022 adjusted EBITDA is expected to range from

$160 million $170 million

-

The Company will recommend a first quarter 2022 dividend of

$0.40

“The continued recovery in leisure travel and business improvements made at the start of the pandemic helped us deliver full-year adjusted EBITDA and adjusted diluted EPS above our guidance range,” said

“We anticipate that leisure travel will continue to lead the broader travel industry, which will support the 2025 growth plan announced at our Investor Day in September 2021.”

(1) This press release includes adjusted EBITDA, adjusted diluted EPS, adjusted free cash flow, gross VOI sales and adjusted net income/(loss), which are metrics that are not calculated in accordance with Generally Accepted Accounting Principles in the

Business Segment Results

The results of operations during the fourth quarter and full-year of 2021 and 2020 include impacts related to the COVID-19 global pandemic. Refer to Table 8 for a breakout of COVID-19 related impacts.

Vacation Ownership

$ in millions |

Q4 2021 |

Q4 2020 |

% change |

FY 2021 |

FY 2020 |

% change |

Revenue |

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

Vacation Ownership revenue increased

Fourth quarter adjusted EBITDA was

Fourth quarter 2021 results include an adjustment to the COVID-19 related allowance for loan losses, resulting in a

Travel and Membership

$ in millions |

Q4 2021 |

Q4 2020 |

% change |

FY 2021 |

FY 2020 |

% change |

Revenue |

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

Travel and Membership revenue increased

Fourth quarter Adjusted EBITDA increased

Balance Sheet and Liquidity

Net Debt — As of

The Company renewed its

During the quarter, the Company issued

Timeshare Receivables Financing — The Company closed on a

Cash Flow — For the full-year 2021, net cash provided by operating activities was

Share Repurchases — The Company resumed share repurchase activity in the fourth quarter of 2021 and repurchased 0.5 million shares of common stock for

Dividend — The Company paid

Outlook

For the first quarter of 2022, the Company expects adjusted EBITDA to range from

This guidance is presented only on a non-GAAP basis because not all of the information necessary for a quantitative reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measure is available without unreasonable effort, primarily due to uncertainties relating to the occurrence or amount of these adjustments that may arise in the future.

Conference Call Information

Presentation of Financial Information

Financial information discussed in this press release includes non-GAAP measures such as adjusted EBITDA, adjusted diluted EPS, adjusted free cash flow, gross VOI sales and adjusted net income/(loss), which include or exclude certain items, as well as non-GAAP guidance. The Company utilizes non-GAAP measures, defined in Table 9, on a regular basis to assess performance of its reportable segments and allocate resources. These non-GAAP measures differ from reported GAAP results and are intended to illustrate what management believes are relevant period-over-period comparisons and are helpful to investors when considered with GAAP measures as an additional tool for further understanding and assessing the Company’s ongoing operating performance by adjusting for items which in our view do not necessarily reflect ongoing performance. Management also internally uses these measures to assess our operating performance, both absolutely and in comparison to other companies, and in evaluating or making selected compensation decisions. Exclusion of items in the Company’s non-GAAP presentation should not be considered an inference that these items are unusual, infrequent or non-recurring. Full reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures for the reported periods appear in the financial tables section of the press release. See definitions on Table 9 for an explanation of our non-GAAP measures.

About

Forward-Looking Statements

This press release includes “forward-looking statements” as that term is defined by the

Table of Contents

Table Number

- Consolidated Statements of Income/(Loss) (Unaudited)

- Summary Data Sheet

- Operating Statistics

- Revenue by Reportable Segment

- Non-GAAP Measure: Reconciliation of Net Income/(Loss) to Adjusted Net Income/(Loss) to Adjusted EBITDA

- Non-GAAP Measure: Reconciliation of Net VOI Sales to Gross VOI Sales

- Non-GAAP Measure: Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow

- COVID-19 Related Impacts

- Definitions

Table 1 |

|||||||||||||||

Consolidated Statements of Income/(Loss) (Unaudited) (in millions, except per share amounts) |

|||||||||||||||

|

Three Months

|

|

Twelve Months

|

||||||||||||

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

Net revenues |

|

|

|

|

|

|

|

||||||||

Service and membership fees |

$ |

388 |

|

|

$ |

293 |

|

|

$ |

1,502 |

|

|

$ |

1,139 |

|

Net VOI sales |

|

366 |

|

|

|

231 |

|

|

|

1,176 |

|

|

|

505 |

|

Consumer financing |

|

100 |

|

|

|

107 |

|

|

|

404 |

|

|

|

467 |

|

Other |

|

16 |

|

|

|

14 |

|

|

|

52 |

|

|

|

49 |

|

Net revenues |

|

870 |

|

|

|

645 |

|

|

|

3,134 |

|

|

|

2,160 |

|

|

|

|

|

|

|

|

|

||||||||

Expenses |

|

|

|

|

|

|

|

||||||||

Operating |

|

367 |

|

|

|

269 |

|

|

|

1,359 |

|

|

|

1,130 |

|

Cost of vacation ownership interests |

|

52 |

|

|

|

29 |

|

|

|

157 |

|

|

|

2 |

|

Consumer financing interest |

|

18 |

|

|

|

26 |

|

|

|

81 |

|

|

|

101 |

|

General and administrative |

|

110 |

|

|

|

102 |

|

|

|

434 |

|

|

|

398 |

|

Marketing |

|

102 |

|

|

|

82 |

|

|

|

363 |

|

|

|

329 |

|

Depreciation and amortization |

|

31 |

|

|

|

32 |

|

|

|

124 |

|

|

|

126 |

|

COVID-19 related costs |

|

— |

|

|

|

6 |

|

|

|

4 |

|

|

|

88 |

|

Restructuring |

|

— |

|

|

|

12 |

|

|

|

(1 |

) |

|

|

39 |

|

Asset impairments/(recovery) |

|

(5 |

) |

|

|

2 |

|

|

|

(5 |

) |

|

|

52 |

|

Total expenses |

|

675 |

|

|

|

560 |

|

|

|

2,516 |

|

|

|

2,265 |

|

|

|

|

|

|

|

|

|

||||||||

Operating income/(loss) |

|

195 |

|

|

|

85 |

|

|

|

618 |

|

|

|

(105 |

) |

Other (income), net |

|

(4 |

) |

|

|

(3 |

) |

|

|

(6 |

) |

|

|

(14 |

) |

Interest expense |

|

50 |

|

|

|

54 |

|

|

|

198 |

|

|

|

192 |

|

Interest (income) |

|

(1 |

) |

|

|

(1 |

) |

|

|

(3 |

) |

|

|

(7 |

) |

Income/(loss) before income taxes |

|

150 |

|

|

|

35 |

|

|

|

429 |

|

|

|

(276 |

) |

Provision for/(benefit from) income taxes |

|

40 |

|

|

|

31 |

|

|

|

116 |

|

|

|

(23 |

) |

Net income/(loss) from continuing operations |

|

110 |

|

|

|

4 |

|

|

|

313 |

|

|

|

(253 |

) |

Loss on disposal of discontinued business, net of income taxes |

|

(3 |

) |

|

|

(2 |

) |

|

|

(5 |

) |

|

|

(2 |

) |

Net income/(loss) attributable to TNL shareholders |

$ |

107 |

|

|

$ |

2 |

|

|

$ |

308 |

|

|

$ |

(255 |

) |

|

|

|

|

|

|

|

|

||||||||

Basic earnings/(loss) per share |

|

|

|

|

|

|

|

||||||||

Continuing operations |

$ |

1.27 |

|

|

$ |

0.05 |

|

|

$ |

3.62 |

|

|

$ |

(2.95 |

) |

Discontinued operations |

|

(0.04 |

) |

|

|

(0.02 |

) |

|

|

(0.06 |

) |

|

|

(0.02 |

) |

|

$ |

1.23 |

|

|

$ |

0.03 |

|

|

$ |

3.56 |

|

|

$ |

(2.97 |

) |

|

|

|

|

|

|

|

|

||||||||

Diluted earnings/(loss) per share |

|

|

|

|

|

|

|

||||||||

Continuing operations |

$ |

1.26 |

|

|

$ |

0.05 |

|

|

$ |

3.58 |

|

|

$ |

(2.95 |

) |

Discontinued operations |

|

(0.04 |

) |

|

|

(0.02 |

) |

|

|

(0.06 |

) |

|

|

(0.02 |

) |

|

$ |

1.22 |

|

|

$ |

0.03 |

|

|

$ |

3.52 |

|

|

$ |

(2.97 |

) |

|

|

|

|

|

|

|

|

||||||||

Weighted average shares outstanding |

|

|

|

|

|

|

|

||||||||

Basic |

|

86.5 |

|

|

|

86.1 |

|

|

|

86.5 |

|

|

|

86.1 |

|

Diluted |

|

87.4 |

|

|

|

86.6 |

|

|

|

87.3 |

|

|

|

86.1 |

|

Table 2 |

|||||||||||||||||||||

Summary Data Sheet (in millions, except per share amounts, unless otherwise indicated) |

|||||||||||||||||||||

|

Three Months Ended |

|

Twelve Months Ended |

||||||||||||||||||

|

|

2021 |

|

|

|

2020 |

|

|

Change |

|

|

2021 |

|

|

|

2020 |

|

|

Change |

||

Consolidated Results |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Net income/(loss) attributable to TNL shareholders |

$ |

107 |

|

|

$ |

2 |

|

|

NM |

|

|

$ |

308 |

|

|

$ |

(255 |

) |

|

221 |

% |

Diluted earnings/(loss) per share |

$ |

1.22 |

|

|

$ |

0.03 |

|

|

NM |

|

|

$ |

3.52 |

|

|

$ |

(2.97 |

) |

|

219 |

% |

Net income/(loss) from continuing operations |

$ |

110 |

|

|

$ |

4 |

|

|

NM |

|

|

$ |

313 |

|

|

$ |

(253 |

) |

|

224 |

% |

Diluted earnings/(loss) per share from continuing operations |

$ |

1.26 |

|

|

$ |

0.05 |

|

|

NM |

|

|

$ |

3.58 |

|

|

$ |

(2.95 |

) |

|

221 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Net income/(loss) margin |

|

12.3 |

% |

|

|

0.3 |

% |

|

|

|

|

9.8 |

% |

|

|

(11.8 |

) % |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Adjusted Earnings/(Loss) |

|

|

|

|

|

|

|

|

|

|

|||||||||||

Adjusted EBITDA |

$ |

228 |

|

|

$ |

148 |

|

|

54 |

% |

|

$ |

778 |

|

|

$ |

259 |

|

|

200 |

% |

Adjusted net income/(loss) |

$ |

104 |

|

|

$ |

28 |

|

|

271 |

% |

|

$ |

319 |

|

|

$ |

(80 |

) |

|

499 |

% |

Adjusted diluted earnings/(loss) per share |

$ |

1.19 |

|

|

$ |

0.32 |

|

|

272 |

% |

|

$ |

3.65 |

|

|

$ |

(0.94 |

) |

|

488 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Segment Results |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Net Revenues |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Vacation Ownership |

$ |

695 |

|

|

$ |

509 |

|

|

37 |

% |

|

$ |

2,403 |

|

|

$ |

1,625 |

|

|

48 |

% |

Travel and Membership |

|

179 |

|

|

|

141 |

|

|

27 |

% |

|

|

752 |

|

|

|

552 |

|

|

36 |

% |

Corporate and other |

|

(4 |

) |

|

|

(5 |

) |

|

|

|

|

(21 |

) |

|

|

(17 |

) |

|

|

||

Total |

$ |

870 |

|

|

$ |

645 |

|

|

35 |

% |

|

$ |

3,134 |

|

|

$ |

2,160 |

|

|

45 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Vacation Ownership |

$ |

182 |

|

|

$ |

115 |

|

|

58 |

% |

|

$ |

558 |

|

|

$ |

121 |

|

|

361 |

% |

Travel and Membership |

|

64 |

|

|

|

50 |

|

|

28 |

% |

|

|

282 |

|

|

|

191 |

|

|

48 |

% |

Segment Adjusted EBITDA |

|

246 |

|

|

|

165 |

|

|

|

|

|

840 |

|

|

|

312 |

|

|

|

||

Corporate and other |

|

(18 |

) |

|

|

(17 |

) |

|

|

|

|

(62 |

) |

|

|

(53 |

) |

|

|

||

Total Adjusted EBITDA |

$ |

228 |

|

|

$ |

148 |

|

|

54 |

% |

|

$ |

778 |

|

|

$ |

259 |

|

|

200 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Adjusted EBITDA Margin |

|

26.2 |

% |

|

|

22.9 |

% |

|

|

|

|

24.8 |

% |

|

|

12.0 |

% |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Key Operating Statistics |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Vacation Ownership |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Gross VOI sales |

$ |

432 |

|

|

$ |

281 |

|

|

54 |

% |

|

$ |

1,491 |

|

|

$ |

967 |

|

|

54 |

% |

Tours (in thousands) |

|

129 |

|

|

|

85 |

|

|

52 |

% |

|

|

451 |

|

|

|

333 |

|

|

35 |

% |

VPG (in dollars) |

$ |

3,222 |

|

|

$ |

2,938 |

|

|

10 |

% |

|

$ |

3,143 |

|

|

$ |

2,486 |

|

|

26 |

% |

New owner sales, volume mix |

|

25.3 |

% |

|

|

25.3 |

% |

|

|

|

|

28.0 |

% |

|

|

27.3 |

% |

|

|

||

New owner sales, transaction mix |

|

24.7 |

% |

|

|

24.8 |

% |

|

|

|

|

27.8 |

% |

|

|

28.9 |

% |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Travel and Membership |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Transactions (in thousands) |

|

452 |

|

|

|

348 |

|

|

30 |

% |

|

|

1,960 |

|

|

|

1,220 |

|

|

61 |

% |

Revenue per transaction (in dollars) |

$ |

270 |

|

|

$ |

254 |

|

|

6 |

% |

|

$ |

275 |

|

|

$ |

258 |

|

|

7 |

% |

Avg. number of exchange members (in thousands) |

|

3,831 |

|

|

|

3,652 |

|

|

5 |

% |

|

|

3,721 |

|

|

|

3,749 |

|

|

(1 |

) % |

NM is defined as Not Meaningful |

Note: Amounts may not calculate due to rounding. See Table 9 for definitions. For a full reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, refer to Table 5 and Table 6. See "Presentation of Financial Information" and the tables for the definitions and reconciliations of these non-GAAP measures in accordance with GAAP.

|

In connection with the Travel + Leisure brand acquisition we updated the names and composition of our reportable segments to better align with how they are managed. We created the |

Table 3 |

|||||||||||||||||||||

Operating Statistics: Travel and Membership |

|||||||||||||||||||||

The following operating statistics are the significant drivers of the Company's revenues and therefore provide an enhanced understanding of the Company's businesses: (a) |

|||||||||||||||||||||

|

Year |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Full Year |

||||||||||

Gross VOI Sales (in millions) (a) |

2021 |

|

$ |

236 |

|

|

$ |

383 |

|

|

$ |

440 |

|

|

$ |

432 |

|

|

$ |

1,491 |

|

2020 |

|

$ |

413 |

|

|

$ |

18 |

|

|

$ |

256 |

|

|

$ |

281 |

|

|

$ |

967 |

|

|

2019 |

|

$ |

484 |

|

|

$ |

626 |

|

|

$ |

663 |

|

|

$ |

582 |

|

|

$ |

2,355 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Tours (in thousands) |

2021 |

|

|

76 |

|

|

|

117 |

|

|

|

129 |

|

|

|

129 |

|

|

|

451 |

|

2020 |

|

|

162 |

|

|

|

6 |

|

|

|

80 |

|

|

|

85 |

|

|

|

333 |

|

|

2019 |

|

|

192 |

|

|

|

249 |

|

|

|

269 |

|

|

|

234 |

|

|

|

945 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

VPG |

2021 |

|

$ |

2,847 |

|

|

$ |

3,151 |

|

|

$ |

3,233 |

|

|

$ |

3,222 |

|

|

$ |

3,143 |

|

2020 |

|

$ |

2,128 |

|

|

|

NM |

|

|

$ |

3,039 |

|

|

$ |

2,938 |

|

|

$ |

2,486 |

|

|

2019 |

|

$ |

2,405 |

|

|

$ |

2,425 |

|

|

$ |

2,332 |

|

|

$ |

2,373 |

|

|

$ |

2,381 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Provision for Loan Losses (in millions) (b) |

2021 |

|

$ |

(38 |

) |

|

$ |

(33 |

) |

|

$ |

(49 |

) |

|

$ |

(9 |

) |

|

$ |

(129 |

) |

2020 |

|

$ |

(315 |

) |

|

$ |

(30 |

) |

|

$ |

(45 |

) |

|

$ |

(25 |

) |

|

$ |

(415 |

) |

|

2019 |

|

$ |

(109 |

) |

|

$ |

(129 |

) |

|

$ |

(135 |

) |

|

$ |

(106 |

) |

|

$ |

(479 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Provision for Loan Loss as a Percentage of Gross VOI Sales, net of Fee-for-Service sales |

2021 |

|

|

18.1 |

% |

|

|

|

|

|

|

|

|

||||||||

2020 |

|

|

NM |

|

|

|

NM |

|

|

|

18.8 |

% |

|

|

|

|

NM |

|

|||

2019 |

|

|

22.5 |

% |

|

|

21.2 |

% |

|

|

20.3 |

% |

|

|

18.6 |

% |

|

|

20.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Allowance for Loan Losses (in millions) |

2021 |

|

$ |

622 |

|

|

$ |

573 |

|

|

$ |

565 |

|

|

$ |

510 |

|

|

$ |

510 |

|

2020 |

|

$ |

930 |

|

|

$ |

846 |

|

|

$ |

788 |

|

|

$ |

693 |

|

|

$ |

693 |

|

|

2019 |

|

$ |

721 |

|

|

$ |

735 |

|

|

$ |

767 |

|

|

$ |

747 |

|

|

$ |

747 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Gross Vacation Ownership Contract Receivables (in millions) |

2021 |

|

$ |

2,975 |

|

|

$ |

2,892 |

|

|

$ |

2,857 |

|

|

$ |

2,819 |

|

|

$ |

2,819 |

|

2020 |

|

$ |

3,722 |

|

|

$ |

3,461 |

|

|

$ |

3,309 |

|

|

$ |

3,175 |

|

|

$ |

3,175 |

|

|

2019 |

|

$ |

3,741 |

|

|

$ |

3,783 |

|

|

$ |

3,885 |

|

|

$ |

3,867 |

|

|

$ |

3,867 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Allowance for Loan Loss as a Percentage of Gross Vacation Ownership Contract Receivables |

2021 |

|

|

20.9 |

% |

|

|

19.8 |

% |

|

|

19.8 |

% |

|

|

18.1 |

% |

|

|

18.1 |

% |

2020 |

|

|

25.0 |

% |

|

|

24.4 |

% |

|

|

23.8 |

% |

|

|

21.8 |

% |

|

|

21.8 |

% |

|

2019 |

|

|

19.3 |

% |

|

|

19.4 |

% |

|

|

19.7 |

% |

|

|

19.3 |

% |

|

|

19.3 |

% |

|

| Note: Full year amounts and percentages may not compute due to rounding. | |

| NM Not Meaningful | |

(a) |

Includes Gross VOI sales under the Company's Fee-for-Service sales. (See Table 6 for a reconciliation of Net VOI sales to Gross VOI sales). |

(b) |

Represents provision for estimated losses on vacation ownership contract receivables, which is recorded as contra revenue to vacation ownership interest sales on the Consolidated Statements of Income/(Loss). |

(c) |

The percentage was |

(d) |

The percentage was |

(e) |

The percentage was |

(f) |

The percentage was |

(g) |

The percentage was |

| Table 3

(continued) |

||||||||||||||||

Operating Statistics: Travel and Membership |

||||||||||||||||

The following operating statistics are the significant drivers of the Company's revenues and therefore provide an enhanced understanding of the Company's businesses: (a) |

||||||||||||||||

|

Year |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Full Year |

|||||

Transactions (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Exchange |

2021 |

|

|

354 |

|

|

314 |

|

|

256 |

|

|

257 |

|

|

1,182 |

Non-Exchange |

2021 |

|

|

159 |

|

|

210 |

|

|

214 |

|

|

195 |

|

|

778 |

Total Transactions |

2021 |

|

|

513 |

|

|

524 |

|

|

470 |

|

|

452 |

|

|

1,960 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Exchange |

2020 |

|

|

260 |

|

|

72 |

|

|

214 |

|

|

217 |

|

|

762 |

Non-Exchange |

2020 |

|

|

141 |

|

|

44 |

|

|

142 |

|

|

131 |

|

|

458 |

Total Transactions |

2020 |

|

|

401 |

|

|

116 |

|

|

356 |

|

|

348 |

|

|

1,220 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Exchange |

2019 |

|

|

444 |

|

|

377 |

|

|

367 |

|

|

304 |

|

|

1,493 |

Non-Exchange |

2019 |

|

|

52 |

|

|

63 |

|

|

138 |

|

|

153 |

|

|

405 |

Total Transactions |

2019 |

|

|

496 |

|

|

440 |

|

|

505 |

|

|

457 |

|

|

1,898 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Revenue per transaction (in dollars) |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Exchange |

2021 |

|

$ |

292 |

|

$ |

331 |

|

$ |

339 |

|

$ |

335 |

|

$ |

322 |

Non-Exchange |

2021 |

|

$ |

182 |

|

$ |

231 |

|

$ |

214 |

|

$ |

184 |

|

$ |

205 |

Total Revenue per transaction |

2021 |

|

$ |

258 |

|

$ |

291 |

|

$ |

282 |

|

$ |

270 |

|

$ |

275 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Exchange |

2020 |

|

$ |

279 |

|

$ |

540 |

|

$ |

300 |

|

$ |

330 |

|

$ |

324 |

Non-Exchange |

2020 |

|

$ |

164 |

|

$ |

133 |

|

$ |

157 |

|

$ |

128 |

|

$ |

148 |

Total Revenue per transaction |

2020 |

|

$ |

239 |

|

$ |

384 |

|

$ |

243 |

|

$ |

254 |

|

$ |

258 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Exchange |

2019 |

|

$ |

275 |

|

$ |

276 |

|

$ |

276 |

|

$ |

307 |

|

$ |

282 |

Non-Exchange |

2019 |

|

$ |

216 |

|

$ |

185 |

|

$ |

172 |

|

$ |

165 |

|

$ |

177 |

Total Revenue per transaction |

2019 |

|

$ |

269 |

|

$ |

263 |

|

$ |

247 |

|

$ |

259 |

|

$ |

259 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Avg. Number of Exchange Members (in thousands) |

2021 |

|

|

3,576 |

|

|

3,582 |

|

|

3,895 |

|

|

3,831 |

|

|

3,721 |

2020 |

|

|

3,864 |

|

|

3,799 |

|

|

3,680 |

|

|

3,652 |

|

|

3,749 |

|

2019 |

|

|

3,875 |

|

|

3,893 |

|

|

3,895 |

|

|

3,884 |

|

|

3,887 |

|

| Note: Full year amounts and percentages may not compute due to rounding. | |

(a) |

Includes the impact of acquisitions from the acquisition dates forward. |

Table 4 |

||||||||||||||||

Revenue by Reportable Segment (in millions) |

||||||||||||||||

|

|

2021 |

||||||||||||||

|

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Full Year |

||||||

Vacation Ownership |

|

|

|

|

|

|

|

|

|

|

||||||

Net VOI Sales |

|

$ |

172 |

|

$ |

294 |

|

|

$ |

344 |

|

$ |

366 |

|

$ |

1,176 |

Property Management Fees and Reimbursable Revenues |

|

|

157 |

|

|

161 |

|

|

|

171 |

|

|

182 |

|

|

671 |

Consumer Financing |

|

|

98 |

|

|

102 |

|

|

|

103 |

|

|

100 |

|

|

404 |

Other Revenues |

|

|

22 |

|

|

42 |

|

|

|

42 |

|

|

47 |

|

|

152 |

Total Vacation Ownership |

|

|

449 |

|

|

599 |

|

|

|

660 |

|

|

695 |

|

|

2,403 |

|

|

|

|

|

|

|

|

|

|

|

||||||

Travel and Membership |

|

|

|

|

|

|

|

|

|

|

||||||

Transaction Revenues |

|

|

132 |

|

|

153 |

|

|

|

133 |

|

|

122 |

|

|

540 |

Subscription Revenues |

|

|

41 |

|

|

43 |

|

|

|

43 |

|

|

48 |

|

|

176 |

Other Revenues |

|

|

10 |

|

|

8 |

|

|

|

9 |

|

|

9 |

|

|

36 |

|

|

|

183 |

|

|

204 |

|

|

|

185 |

|

|

179 |

|

|

752 |

Total Reportable Segments |

|

$ |

632 |

|

$ |

803 |

|

|

$ |

845 |

|

$ |

874 |

|

$ |

3,155 |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

2020 |

||||||||||||||

|

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Full Year |

||||||

Vacation Ownership |

|

|

|

|

|

|

|

|

|

|

||||||

Net VOI Sales |

|

$ |

90 |

|

$ |

(13 |

) |

|

$ |

196 |

|

$ |

231 |

|

$ |

505 |

Property Management Fees and Reimbursable Revenues |

|

|

170 |

|

|

122 |

|

|

|

146 |

|

|

145 |

|

|

583 |

Consumer Financing |

|

|

127 |

|

|

119 |

|

|

|

115 |

|

|

107 |

|

|

467 |

Other Revenues |

|

|

16 |

|

|

10 |

|

|

|

18 |

|

|

26 |

|

|

70 |

Total Vacation Ownership |

|

|

403 |

|

|

238 |

|

|

|

475 |

|

|

509 |

|

|

1,625 |

|

|

|

|

|

|

|

|

|

|

|

||||||

Travel and Membership |

|

|

|

|

|

|

|

|

|

|

||||||

Transaction Revenues |

|

|

96 |

|

|

44 |

|

|

|

86 |

|

|

88 |

|

|

315 |

Subscription Revenues |

|

|

44 |

|

|

33 |

|

|

|

43 |

|

|

40 |

|

|

160 |

Other Revenues |

|

|

19 |

|

|

29 |

|

|

|

16 |

|

|

13 |

|

|

77 |

|

|

|

159 |

|

|

106 |

|

|

|

145 |

|

|

141 |

|

|

552 |

Total Reportable Segments |

|

$ |

562 |

|

$ |

344 |

|

|

$ |

620 |

|

$ |

650 |

|

$ |

2,177 |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

2019 |

||||||||||||||

|

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Full Year |

||||||

Vacation Ownership |

|

|

|

|

|

|

|

|

|

|

||||||

Net VOI Sales |

|

$ |

375 |

|

$ |

481 |

|

|

$ |

528 |

|

$ |

464 |

|

$ |

1,848 |

Property Management Fees and Reimbursable Revenues |

|

|

163 |

|

|

162 |

|

|

|

170 |

|

|

176 |

|

|

672 |

Consumer Financing |

|

|

125 |

|

|

128 |

|

|

|

132 |

|

|

130 |

|

|

515 |

Other Revenues |

|

|

12 |

|

|

31 |

|

|

|

20 |

|

|

24 |

|

|

87 |

Total Vacation Ownership |

|

|

675 |

|

|

802 |

|

|

|

850 |

|

|

794 |

|

|

3,122 |

|

|

|

|

|

|

|

|

|

|

|

||||||

Travel and Membership |

|

|

|

|

|

|

|

|

|

|

||||||

Transaction Revenues |

|

|

133 |

|

|

116 |

|

|

|

125 |

|

|

118 |

|

|

492 |

Subscription Revenues |

|

|

55 |

|

|

54 |

|

|

|

54 |

|

|

53 |

|

|

216 |

Vacation Rental Revenue |

|

|

38 |

|

|

48 |

|

|

|

60 |

|

|

7 |

|

|

153 |

Other Revenues |

|

|

22 |

|

|

24 |

|

|

|

24 |

|

|

14 |

|

|

83 |

|

|

|

248 |

|

|

242 |

|

|

|

263 |

|

|

192 |

|

|

944 |

Total Reportable Segments |

|

$ |

923 |

|

$ |

1,044 |

|

|

$ |

1,113 |

|

$ |

986 |

|

$ |

4,066 |

Note: Full year amounts may not add across due to rounding. |

||||||||||||||||

Table 5 |

|||||||||||||||||||

Non-GAAP Measure: Reconciliation of Net Income/(Loss) to Adjusted Net Income/(Loss) to Adjusted EBITDA (in millions, except diluted per share amounts) |

|||||||||||||||||||

|

Three Months Ended |

||||||||||||||||||

|

|

2021 |

|

|

EPS |

|

Margin % |

|

|

2020 |

|

|

EPS |

|

Margin % |

||||

Net income attributable to TNL shareholders |

$ |

107 |

|

|

$ |

1.22 |

|

12.3 |

% |

|

$ |

2 |

|

|

$ |

0.03 |

|

0.3 |

% |

Loss on disposal of discontinued business, net of income taxes |

|

(3 |

) |

|

|

|

|

|

|

(2 |

) |

|

|

|

|

||||

Net income from continuing operations |

$ |

110 |

|

|

$ |

1.26 |

|

12.6 |

% |

|

$ |

4 |

|

|

$ |

0.05 |

|

0.6 |

% |

Amortization of acquired intangibles (a) |

|

2 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

||||

Restructuring costs |

|

— |

|

|

|

|

|

|

|

12 |

|

|

|

|

|

||||

COVID-19 related costs (b) |

|

— |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

||||

Legacy items |

|

(2 |

) |

|

|

|

|

|

|

2 |

|

|

|

|

|

||||

Unrealized gain on equity investment (c) |

|

(3 |

) |

|

|

|

|

|

|

— |

|

|

|

|

|

||||

Impairments/(recovery) (d) |

|

(5 |

) |

|

|

|

|

|

|

2 |

|

|

|

|

|

||||

Taxes (e) |

|

2 |

|

|

|

|

|

|

|

— |

|

|

|

|

|

||||

Adjusted net income |

$ |

104 |

|

|

$ |

1.19 |

|

12.0 |

% |

|

$ |

28 |

|

|

$ |

0.32 |

|

4.3 |

% |

Income taxes on adjusted net income |

|

38 |

|

|

|

|

|

|

|

31 |

|

|

|

|

|

||||

Interest expense |

|

50 |

|

|

|

|

|

|

|

54 |

|

|

|

|

|

||||

Depreciation |

|

29 |

|

|

|

|

|

|

|

30 |

|

|

|

|

|

||||

Stock-based compensation expense (f) |

|

8 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

||||

Interest income |

|

(1 |

) |

|

|

|

|

|

|

(1 |

) |

|

|

|

|

||||

Adjusted EBITDA |

$ |

228 |

|

|

|

|

26.2 |

% |

|

$ |

148 |

|

|

|

|

22.9 |

% |

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Diluted Shares Outstanding |

|

87.4 |

|

|

|

|

|

|

|

86.6 |

|

|

|

|

|

||||

Table 5 (continued) |

||||||||||||||||||||

|

Twelve Months Ended |

|||||||||||||||||||

|

|

2021 |

|

|

EPS |

|

Margin % |

|

|

2020 |

|

|

EPS |

|

Margin % |

|||||

Net income/(loss) attributable to TNL shareholders |

$ |

308 |

|

|

$ |

3.52 |

|

9.8 |

% |

|

$ |

(255 |

) |

|

$ |

(2.97 |

) |

|

(11.8 |

) % |

Loss on disposal of discontinued business, net of income taxes |

|

(5 |

) |

|

|

|

|

|

|

(2 |

) |

|

|

|

|

|||||

Net income/(loss) from continuing operations |

$ |

313 |

|

|

$ |

3.58 |

|

10.0 |

% |

|

$ |

(253 |

) |

|

$ |

(2.95 |

) |

|

(11.7 |

) % |

Amortization of acquired intangibles (a) |

|

9 |

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|||||

Legacy items |

|

4 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|||||

COVID-19 related costs (b) |

|

3 |

|

|

|

|

|

|

|

56 |

|

|

|

|

|

|||||

Exchange inventory write-off |

|

— |

|

|

|

|

|

|

|

48 |

|

|

|

|

|

|||||

Restructuring costs |

|

(1 |

) |

|

|

|

|

|

|

39 |

|

|

|

|

|

|||||

Unrealized gain on equity investment (c) |

|

(3 |

) |

|

|

|

|

|

|

— |

|

|

|

|

|

|||||

Impairments/(recovery) (d) |

|

(5 |

) |

|

|

|

|

|

|

57 |

|

|

|

|

|

|||||

Taxes (e) |

|

(1 |

) |

|

|

|

|

|

|

(40 |

) |

|

|

|

|

|||||

Adjusted net income/(loss) |

$ |

319 |

|

|

$ |

3.65 |

|

10.2 |

% |

|

$ |

(80 |

) |

|

$ |

(0.94 |

) |

|

(3.7 |

) % |

Income taxes on adjusted net income/(loss) |

|

117 |

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|||||

Interest expense |

|

198 |

|

|

|

|

|

|

|

192 |

|

|

|

|

|

|||||

Depreciation |

|

115 |

|

|

|

|

|

|

|

117 |

|

|

|

|

|

|||||

Stock-based compensation expense (f) |

|

32 |

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|||||

Interest income |

|

(3 |

) |

|

|

|

|

|

|

(7 |

) |

|

|

|

|

|||||

Adjusted EBITDA |

$ |

778 |

|

|

|

|

24.8 |

% |

|

$ |

259 |

|

|

|

|

12.0 |

% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Diluted Shares Outstanding |

|

87.3 |

|

|

|

|

|

|

|

86.1 |

|

|

|

|

|

|||||

Amounts may not calculate due to rounding. The table above reconciles certain non-GAAP financial measures to their closest GAAP measure. The presentation of these adjustments is intended to permit the comparison of particular adjustments as they appear in the income statement in order to assist investors' understanding of the overall impact of such adjustments. In addition to GAAP financial measures, the Company provides adjusted net income/(loss), adjusted EBITDA, adjusted EBITDA margin, and adjusted diluted EPS to assist our investors in evaluating our ongoing operating performance for the current reporting period and, where provided, over different reporting periods, by adjusting for certain items which in our view do not necessarily reflect ongoing performance. We also internally use these measures to assess our operating performance, both absolutely and in comparison to other companies, and in evaluating or making selected compensation decisions. These supplemental disclosures are in addition to GAAP reported measures. Non-GAAP measures should not be considered a substitute for, nor superior to, financial results and measures determined or calculated in accordance with GAAP. Our presentation of adjusted measures may not be comparable to similarly-titled measures used by other companies. See "Presentation of Financial Information" and table 9 for the definitions of these non-GAAP measures.

(a) |

Amortization of acquisition-related intangible assets is excluded from adjusted net income/(loss) and adjusted EBITDA. |

(b) |

Reflects severance and other employee costs associated with layoffs due to the COVID-19 workforce reduction offset in part by employee retention credits received in connection with the |

(c) |

Represents the unrealized gain associated with Vacasa equity acquired as part of the consideration for the sale of |

(d) |

Includes |

(e) |

The amounts represent the tax effects on the adjustments. In addition, during the three months ended |

(f) |

All stock-based compensation is excluded from adjusted EBITDA. |

| Table 6 | |||||||||||||||||

Non-GAAP Measure: Reconciliation of Net VOI Sales to Gross VOI Sales (in millions) |

|||||||||||||||||

The Company believes gross VOI sales provide an enhanced understanding of the performance of its vacation ownership business because it directly measures the sales volume of this business during a given reporting period. |

|||||||||||||||||

The following table provides a reconciliation of Net VOI sales (see Table 4) to Gross VOI sales (see Table 3): |

|||||||||||||||||

Year |

|

|

|

|

|

|

|

|

|

|

|||||||

2021 |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Full Year |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Net VOI sales |

|

$ |

172 |

|

$ |

294 |

|

|

$ |

344 |

|

$ |

366 |

|

$ |

1,176 |

|

Loan loss provision |

|

|

38 |

|

|

33 |

|

|

|

49 |

|

|

9 |

|

|

129 |

|

Gross VOI sales, net of Fee-for-Service sales |

|

|

210 |

|

|

327 |

|

|

|

393 |

|

|

375 |

|

|

1,305 |

|

Fee-for-Service sales |

|

|

26 |

|

|

56 |

|

|

|

47 |

|

|

57 |

|

|

186 |

|

Gross VOI sales |

|

$ |

236 |

|

$ |

383 |

|

|

$ |

440 |

|

$ |

432 |

|

$ |

1,491 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

2020 |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Net VOI sales |

|

$ |

90 |

|

$ |

(13 |

) |

|

$ |

196 |

|

$ |

231 |

|

$ |

505 |

|

Loan loss provision |

|

|

315 |

|

|

30 |

|

|

|

45 |

|

|

25 |

|

|

415 |

|

Gross VOI sales, net of Fee-for-Service sales |

|

|

405 |

|

|

17 |

|

|

|

241 |

|

|

256 |

|

|

920 |

|

Fee-for-Service sales |

|

|

8 |

|

|

1 |

|

|

|

15 |

|

|

25 |

|

|

47 |

|

Gross VOI sales |

|

$ |

413 |

|

$ |

18 |

|

|

$ |

256 |

|

$ |

281 |

|

$ |

967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2019 |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Net VOI sales |

|

$ |

375 |

|

$ |

481 |

|

|

$ |

528 |

|

$ |

464 |

|

$ |

1,848 |

|

Loan loss provision |

|

|

109 |

|

|

129 |

|

|

|

135 |

|

|

106 |

|

|

479 |

|

Gross VOI sales, net of Fee-for-Service sales |

|

|

484 |

|

|

610 |

|

|

|

663 |

|

|

570 |

|

|

2,327 |

|

Fee-for-Service sales |

|

|

— |

|

|

16 |

|

|

|

— |

|

|

12 |

|

|

28 |

|

Gross VOI sales |

|

$ |

484 |

|

$ |

626 |

|

|

$ |

663 |

|

$ |

582 |

|

$ |

2,355 |

|

Note: Amounts may not add due to rounding. |

|||||||||||||||||

Table 7 |

||||||||

Non-GAAP Measure: Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow (in millions) |

||||||||

|

|

Twelve Months

Ended |

||||||

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

|

|

||||

Net cash provided by operating activities |

|

$ |

568 |

|

|

$ |

374 |

|

Property and equipment additions |

|

|

(57 |

) |

|

|

(69 |

) |

Sum of proceeds and principal payments of non-recourse vacation ownership debt |

|

|

(294 |

) |

|

|

(333 |

) |

Free cash flow |

|

$ |

217 |

|

|

$ |

(28 |

) |

Separation and other adjustments (a) |

|

|

— |

|

|

|

16 |

|

COVID-19 related adjustments (b) |

|

|

6 |

|

|

|

47 |

|

Adjusted free cash flow (c) |

|

$ |

223 |

|

|

$ |

35 |

|

(a) |

Includes cash paid for separation-related activities and transaction costs for acquisitions and divestitures. |

(b) |

Includes cash paid for COVID-19 expenses factored into the calculation of Adjusted EBITDA. |

(c) |

The Company had |

Table 8 |

|

COVID-19 Related Impacts |

(in millions) |

|

The tables below present the COVID-19 related impacts to our results of operations for three and twelve months ended |

Three Months Ended |

|

Vacation Ownership |

|

Travel and Membership |

|

Corporate & Other |

|

Consolidated |

|

Non-GAAP Adjustments |

|

Income Statement Classification |

|||||||||

|

|

|

|

|

|

|

|||||||||||||||

Allowance for loan losses: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Provision |

|

$ |

(44 |

) |

|

$ |

— |

|

|

$ |

— |

|

$ |

(44 |

) |

|

$ |

— |

|

|

Vacation ownership interest sales |

Recoveries |

|

|

16 |

|

|

|

— |

|

|

|

— |

|

|

16 |

|

|

|

— |

|

|

Cost of vacation ownership interests |

Asset impairment recovery |

|

|

— |

|

|

|

(6 |

) |

|

|

— |

|

|

(6 |

) |

|

|

(6 |

) |

|

Asset impairments/(recovery) |

Total COVID-19 |

|

$ |

(28 |

) |

|

$ |

(6 |

) |

|

$ |

— |

|

$ |

(34 |

) |

|

$ |

(6 |

) |

|

|

Twelve Months Ended |

|

Vacation Ownership |

|

Travel and Membership |

|

Corporate & Other |

|

Consolidated |

|

Non-GAAP Adjustments |

|

Income Statement Classification |

|||||||||

|

|

|

|

|

|

|

|||||||||||||||

Allowance for loan losses: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Provision |

|

$ |

(91 |

) |

|

$ |

— |

|

|

$ |

— |

|

$ |

(91 |

) |

|

$ |

— |

|

|

Vacation ownership interest sales |

Recoveries |

|

|

33 |

|

|

|

— |

|

|

|

— |

|

|

33 |

|

|

|

— |

|

|

Cost of vacation ownership interests |

Employee compensation related and other |

|

|

3 |

|

|

|

— |

|

|

|

1 |

|

|

4 |

|

|

|

3 |

|

|

COVID-19 related costs |

Asset impairment recovery |

|

|

— |

|

|

|

(6 |

) |

|

|

— |

|

|

(6 |

) |

|

|

(6 |

) |

|

Asset impairments/(recovery) |

Lease-related |

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

(1 |

) |

|

|

(1 |

) |

|

Restructuring |

Total COVID-19 |

|

$ |

(56 |

) |

|

$ |

(6 |

) |

|

$ |

1 |

|

$ |

(61 |

) |

|

$ |

(4 |

) |

|

|

Table 8 (continued) |

The tables below present the COVID-19 related impacts to our results of operations for three and twelve months ended |

Three Months Ended |

|

Vacation Ownership |

|

Travel and Membership |

|

Corporate & Other |

|

Consolidated |

|

Non-GAAP Adjustments |

|

Income Statement Classification |

|||||||

|

|

|

|

|

|

|

|||||||||||||

Allowance for loan losses: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Provision |

|

$ |

(20 |

) |

|

$ |

— |

|

$ |

— |

|

$ |

(20 |

) |

|

$ |

— |

|

Vacation ownership interest sales |

Recoveries |

|

|

7 |

|

|

|

— |

|

|

— |

|

|

7 |

|

|

|

— |

|

Cost of vacation ownership interests |

Employee compensation related and other |

|

|

3 |

|

|

|

2 |

|

|

2 |

|

|

7 |

|

|

|

6 |

|

COVID-19 related costs |

Asset impairments |

|

|

1 |

|

|

|

— |

|

|

1 |

|

|

2 |

|

|

|

2 |

|

Asset impairments/(recovery) |

Lease-related |

|

|

12 |

|

|

|

— |

|

|

— |

|

|

12 |

|

|

|

12 |

|

Restructuring |

Total COVID-19 |

|

$ |

3 |

|

|

$ |

2 |

|

$ |

3 |

|

$ |

8 |

|

|

$ |

20 |

|

|

Twelve Months Ended |

|

Vacation Ownership |

|

Travel and Membership |

|

Corporate & Other |

|

Consolidated |

|

Non-GAAP Adjustments |

|

Income Statement Classification |

|||||||

|

|

|

|

|

|

|

|||||||||||||

Allowance for loan losses: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Provision |

|

$ |

205 |

|

|

$ |

— |

|

$ |

— |

|

$ |

205 |

|

|

$ |

— |

|

Vacation ownership interest sales |

Recoveries |

|

|

(48 |

) |

|

|

— |

|

|

— |

|

|

(48 |

) |

|

|

— |

|

Cost of vacation ownership interests |

Employee compensation related and other |

|

|

65 |

|

|

|

9 |

|

|

14 |

|

|

88 |

|

|

|

56 |

|

COVID-19 related costs |

Asset impairments |

|

|

21 |

|

|

|

34 |

|

|

1 |

|

|

56 |

|

|

|

56 |

|

Asset impairments/(recovery) and Operating expenses |

Exchange inventory write-off |

|

|

— |

|

|

|

48 |

|

|

— |

|

|

48 |

|

|

|

48 |

|

Operating expenses |

Lease-related |

|

|

14 |

|

|

|

22 |

|

|

— |

|

|

36 |

|

|

|

36 |

|

Restructuring |

Total COVID-19 |

|

$ |

257 |

|

|

$ |

113 |

|

$ |

15 |

|

$ |

385 |

|

|

$ |

196 |

|

|

Table 9 |

Definitions |

Adjusted Diluted Earnings/(Loss) per Share: A non-GAAP measure, defined by the Company as Adjusted net income/(loss) divided by the diluted weighted average number of common shares. |

Adjusted EBITDA: A non-GAAP measure, defined by the Company as net income/(loss) from continuing operations before depreciation and amortization, interest expense (excluding consumer financing interest), early extinguishment of debt, interest income (excluding consumer financing revenues) and income taxes, each of which is presented on the Consolidated Statements of Income. Adjusted EBITDA also excludes stock-based compensation costs, separation and restructuring costs, legacy items, transaction costs for acquisitions and divestitures, impairments, gains and losses on sale/disposition of business, and items that meet the conditions of unusual and/or infrequent. Legacy items include the resolution of and adjustments to certain contingent assets and liabilities related to acquisitions of continuing businesses and dispositions, including the separation of |

Adjusted EBITDA Margin: A non-GAAP measure, represents Adjusted EBITDA as a percentage of revenue. |

Adjusted Free Cash Flow: A non-GAAP measure, defined by the Company as net cash provided by operating activities from continuing operations less property and equipment additions (capital expenditures) plus the sum of proceeds and principal payments of non-recourse vacation ownership debt, while also adding back cash paid for transaction costs for acquisitions and divestitures, separation adjustments associated with the spin-off of |

Adjusted Net Income/(Loss): A non-GAAP measure, defined by the Company as net income/(loss) from continuing operations adjusted to exclude separation and restructuring costs, legacy items, transaction costs for acquisitions and divestitures, amortization of acquisition-related assets, debt modification costs, impairments, gains and losses on sale/disposition of business, and items that meet the conditions of unusual and/or infrequent and the tax effect of such adjustments. Legacy items include the resolution of and adjustments to certain contingent assets and liabilities related to acquisitions of continuing businesses and dispositions, including the separation of |

Average Number of Exchange Members: Represents paid members in our vacation exchange programs who are considered to be in good standing. |

Free Cash Flow (FCF): A non-GAAP measure, defined by TNL as net cash provided by operating activities from continuing operations less property and equipment additions (capital expenditures) plus the sum of proceeds and principal payments of non-recourse vacation ownership debt. TNL believes FCF to be a useful operating performance measure to evaluate the ability of its operations to generate cash for uses other than capital expenditures and, after debt service and other obligations, its ability to grow its business through acquisitions and equity investments, as well as its ability to return cash to shareholders through dividends and share repurchases. A limitation of using FCF versus the GAAP measure of net cash provided by operating activities as a means for evaluating TNL is that FCF does not represent the total cash movement for the period as detailed in the consolidated statement of cash flows. |

Gross Vacation Ownership Interest Sales: A non-GAAP measure, represents sales of vacation ownership interests (VOIs), including sales under the fee-for-service program before the effect of loan loss provisions. We believe that Gross VOI sales provide an enhanced understanding of the performance of our vacation ownership business because it directly measures the sales volume of this business during a given reporting period. |

Leverage Ratio: The Company calculates leverage ratio as net debt divided by Adjusted EBITDA as defined in the credit agreement. |

Net Debt: Net debt equals total debt outstanding, less non-recourse vacation ownership debt and cash and cash equivalents. |

New owner sales, volume mix: Represents VOI sales (tour generated plus telephonic) to first time buyers as a percentage of total VOI sales. |

New owner sales, transactions mix: Represents the number of first time buyer transactions as a percentage of the total number of VOIs sold during the period. |

Tours: Represents the number of tours taken by guests in our efforts to sell VOIs. |

Travel and Membership Revenue per Transaction: Represents transactional revenue divided by transactions, provided in two categories; Exchange, which is primarily RCI, and non-Exchange. |

Travel and Membership Transactions: Represents the number of vacation bookings recognized as revenue during the period, net of cancellations, provided in two categories; Exchange, which is primarily RCI, and non-Exchange. |

Volume Per Guest (VPG): Represents Gross VOI sales (excluding tele-sales upgrades, which are non-tour upgrade sales) divided by the number of tours. The Company has excluded non-tour upgrade sales in the calculation of VPG because non-tour upgrade sales are generated by a different marketing channel. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220223005484/en/

Investors:

Senior Vice President, FP&A and Investor Relations

(407) 626-4050

Christopher.Agnew@travelandleisure.com

Media:

Corporate Communications

(407) 626-5882

Steven.Goldsmith@travelandleisure.com

Source: