Theralase(R) Release's 1Q2024 Financial Statements

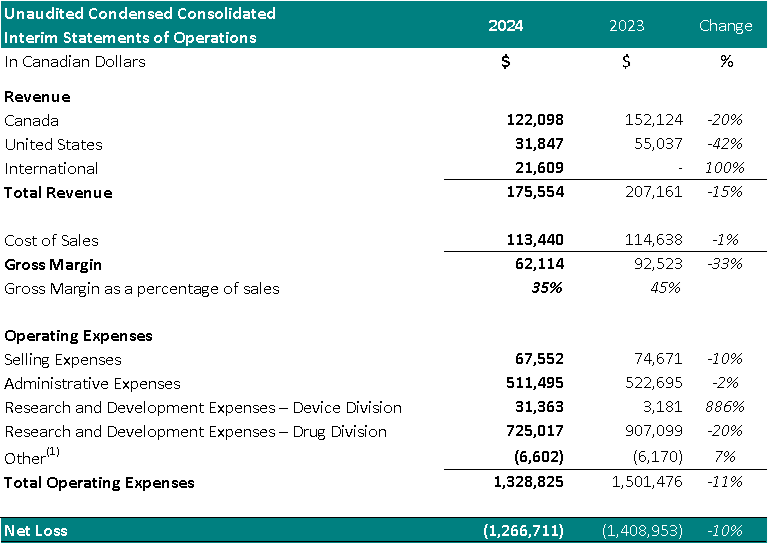

Theralase Technologies, a clinical-stage pharmaceutical company, released its unaudited interim consolidated 1Q2024 financial statements. Key highlights include a 15% YoY revenue decline, with a gross margin of $62,114, down from $92,523 in 2023. Costs and expenses saw varied changes, with a notable 20% decrease in Drug Division R&D expenses to $725,017 and an 886% increase in Device Division R&D expenses to $31,363. Net loss reduced by 10% to $1,266,711.

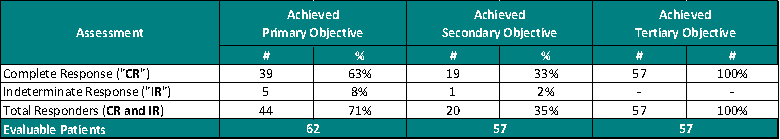

Operationally, Theralase closed a $750,200 private placement and made significant progress in Study II, treating 68 patients, with a 63% complete response rate. Key updates on clinical data and Break Through Designation (BTD) submission to the FDA were also shared. The company aims for full patient enrollment in Study II by 2024 end, data lock by mid-2026, and FDA/Health Canada approval by late 2026.

- Net loss decreased by 10% YoY to $1,266,711.

- R&D expenses in the Drug Division decreased by 20% to $725,017.

- Study II demonstrated a 63% complete response rate.

- Closed a $750,200 non-brokered private placement.

- Progress in Break Through Designation submission to the FDA.

- Total revenue decreased by 15% YoY.

- Gross margin dropped from $92,523 to $62,114 due to increased material costs.

- Device Division R&D expenses increased by 886% to $31,363.

- Gross margin as a percentage of sales decreased from 45% to 35%.

TORONTO, ON / ACCESSWIRE / May 30, 2024 / Theralase® Technologies Inc. (" Theralase® " or the " Company ") ( TSXV:TLT )( OTCQB:TLTFF ), a clinical stage pharmaceutical company dedicated to the research and development of light and/or radiation activated Photo Dynamic Compounds (" PDCs ") for the safe and effective destruction of various cancers, bacteria and viruses has released the Company's unaudited interim consolidated 1Q2024 financial statements (" Financial Statements ").

Theralase® will be hosting a conference call on Thursday June 6 th , 2024 at 11:00 am ET , which will include a presentation of the financial and operational results for the fiscal quarter ending March 31 st , 2024. Questions are welcome; to ensure we have time to review and answer them during the call, please send them in advance to mperraton@theralase.com .

Zoom Meeting Link: https://us02web.zoom.us/j/89087760875

Conference Call in: 1-647-558-0588 (Canada) / 1-646-558-8656 (US) - not required for those attending by Zoom.

An archived version will be available on the website following the conference call.

Financial Summary:

For the three-month period ended March 31 st :

1 Other represents foreign exchange, interest accretion on lease liabilities and / or interest income

Financial Highlights

For the three-month period ended March 31 st , 2024;

- Total revenue decreased

15% , year over year. - Cost of sales was

$113,440 (65% of revenue) resulting in a gross margin of$62,114 (35% of revenue). In comparison, the cost of sales for the same period in 2023 was$114,638 (55% of revenue) resulting in a gross margin of$92,523 (45% of revenue). The gross margin decrease as a percentage of sales, year over year, is attributed to an increase in material costs. - Selling expenses decreased to

$67,552 , from$74,671 for the same period in 2023, a10% decrease. The decrease is a result of reduced spending in commissions (26% ), and travel (74% ). - Administrative expenses decreased to

$511,495 from$522,695 for the same period in 2023, a2% decrease. The decrease is a result of reduced spending on general and administrative expenses (43% ), insurance costs (8% ) and stock based compensation (10% ). - Stock based compensation expense decreased

10% in 2024, due to the cumulative effect of accounting for the vesting of stock options granted in the current and previous years. - Net research and development expenses for the Drug Division decreased to

$725,017 from$907,099 for the same period in 2023, a20% decrease. The decrease is primarily attributed to a decrease in costs for Study II patient enrollment and treatment. - Net research and development expenses for the Device Division increased to

$31,363 from$3,181 for the same period in 2022, an886% increase. The increase is attributed to development of a new software program for the TLC-2000 Cool Laser Therapy system. - Net loss was

$1,266,711 , which included$220,919 of net non-cash expenses (i.e.: amortization, stock-based compensation expense and foreign exchange gain/loss). This compared to a net loss in 2023 of$1,408,953 , a10% year over year reduction, which included$244,787 of net non-cash expenses. The Drug Division represented$1,011,762 of this loss (80% ) in 2024. The decrease in net loss is primarily attributed to decreased spending on research and development expenses in Study II.

Operational Highlights:

Non-Brokered Private Placement

On April 24, 2024, the Company closed a non-brokered private placement of units. On closing, the Company issued an aggregate of 4,167,778 units at a price of

In 2024, the Company plans to secure funding through various equity and debt instruments to allow the Company the ability to become base shelf eligible. This will allow the Company sufficient funding to complete enrollment into Study II by year end, data lock in mid 2026 and position the Company for FDA and Health Canada approval by the end of 2026, subject to achieving FDA Priority Review."

Study II Update

On February 8 th , 2024, Dr. Michael Jewett joined the Company in the role of an independent consultant, to assist the Company in the accruement of patients into Study II. Under the terms of the consulting agreement, Dr. Jewett will be responsible for working with existing clinical study sites and helping to onboard new clinical study sites to assist Theralase® to complete enrollment and provide the primary study treatment to all 100 patients in Study II, by December 31, 2024.

To date, Study II has provided the primary study treatment for 68 patients, with new patients being enrolled in 2Q2024.

Theralase® is working to add up to 5 new CSSs in 2024, as well as increase enrollment at the existing 10 CSSs to complete Study II accruement by the end of 2024.

All patients received the primary Study Procedure (n=68).

Approximately

Of the 33 patients who received the maintenance Study Procedure, 25 were CR prior to treatment, 4 were IR and 4 were No Response (" NR ") (positive cystoscopy and positive urine cytology).

In conclusion, the primary Study Procedure provides a

An advisory board meeting was completed on April 12, 2024 during the Canadian Urologic Association (" CUA ") Bladder Cancer Forum 2024 located in Toronto, Ontario and provided an update to all Canadian PIs of the Study II interim clinical data and an opportunity to discuss patient enrollment.

An advisory board meeting was completed on May 4 th , 2024 during the 2024 American Urology Association (" AUA ") meeting in San Antonio, Texas and provided an update to all attendees of the Study II interim clinical data and an opportunity to discuss patient enrollment.

Break Through Designation Update

The Company submitted a pre-Break Through Designation (" BTD ") submission to the FDA in July 2023 and based on the FDA's feedback, the Company is currently working with the Clinical Study Sites (" CSSs "), a biostatistics organization and a regulatory organization to update the pre-BTD with clinical data clarifications identified by the FDA. The Company plans to resubmit the pre-BTD submission to the FDA in 2Q2024/3Q2024 for FDA review of these clarifications. Once the pre-BTD submission has been accepted by the FDA, the Company will compile a BTD submission for review by the FDA in support of the grant of a BTD approval.

Theralase® has commenced receiving clinical data from the CSSs with a number of patients showing a duration of their CR beyond 450 days, with some patients demonstrating CR for up to 3 years, post the primary Study Procedure.

Additional clinical data is required, prior to a pre-BTD submission to the FDA.

Study II Preliminary Clinical Data :

Performance to Primary, Secondary and Tertiary Objectives

For the primary objective,

For the secondary objective,

For the tertiary objective, no patients have been diagnosed with a Serious Adverse Event ("SAE") directly related to the Study Drug or Study Device.

Note: One patient is currently under investigation for their secondary objective performance, as they demonstrated a CR, potentially recurred and demonstrated a CR once again.

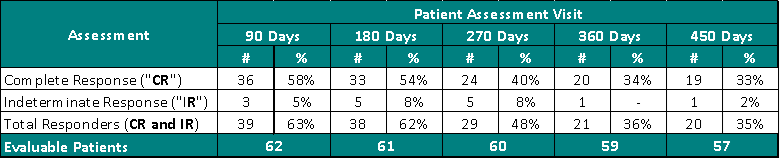

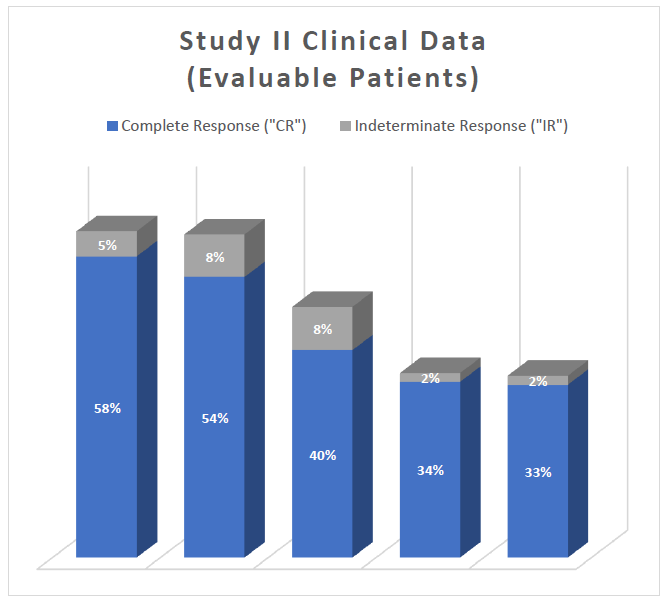

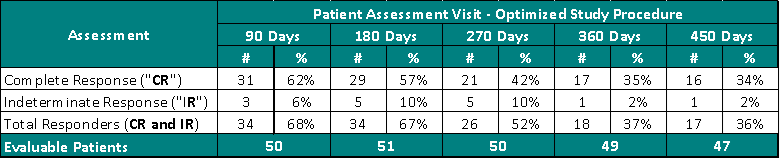

Clinical Data Based on Assessment Visit:

The interim clinical data demonstrates that at the 90 Day Assessment,

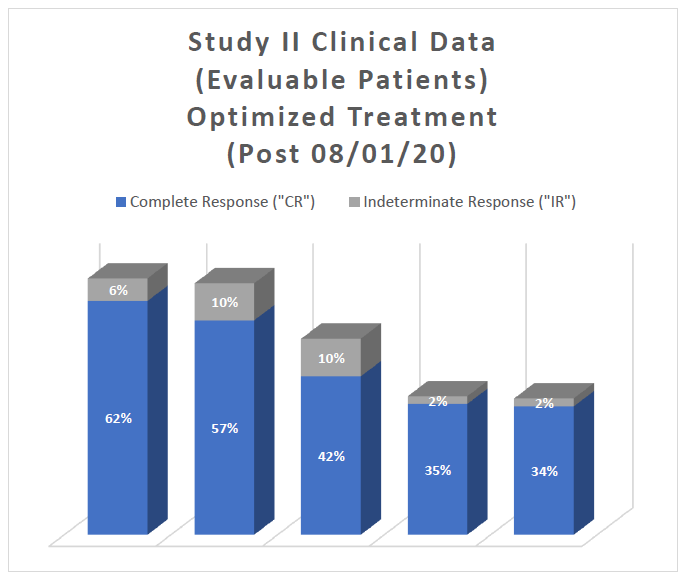

Study II Clinical Data Based on Assessment Visit for Patients Treated with the Optimized Study Procedure (Post August 1, 2020):

The above interim clinical data demonstrates that for patients who received the Optimized Study Procedure at the 90 Day Assessment visit,

Note:

- For patients to be included in the statistical clinical analysis they must be enrolled in Study II, provided the primary Study Procedure and evaluated by a PI at the 90 day assessment visit (cystoscopy and urine cytology)

- One patient passed away prior to their 90 day assessment and is therefore not included in the efficacy statistical analysis, only in the safety statistical analysis; therefore, there are 68 patients that have been statistically analyzed for efficacy.

- Evaluable Patients are defined as patients who have been evaluated by a PI and thus excludes a patient's clinical data at specific assessment days, if that clinical data is pending.

- Six patients have been enrolled and provided the primary Study Procedure but, have not been evaluated at their 90 day assessment; therefore, 62 patients are considered Evaluable Patients at 90 days, with 57 patients considered Evaluable Patients at 450 days.

- The data analysis presented above should be read with caution, as the clinical data is interim in its presentation, as Study II is ongoing and new clinical data collected may or may not continue to support the current trends, with clinical data still pending.

- For patients who have been removed from Study II by the PI or have elected to discontinue from the clinical study their Last Observation Carried Forward (" LOCF ") has been used in this statistical analysis.

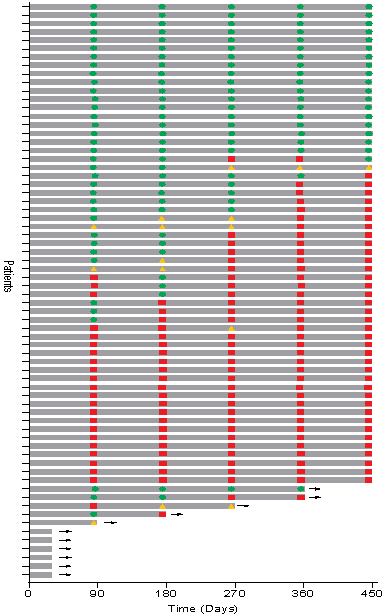

Patient Response Chart:

The Swimmer's plot below is a graphical representation of the interim clinical results (n=68) graphically demonstrating a patient's response to a treatment over time. As can be seen in the plot, clinical data is still pending for patients, who have demonstrated a CR and continue to demonstrate a duration of that response.

Swimmer's Plot:

The Swimmer's Plot illustrates:

- 19 Evaluable Patients achieved CR initially and at the 450 days assessment and thus achieved the primary and secondary objectives of Study II for all patients assessed up to 450 days (19/57 =

33% ). - 39 Evaluable Patients that achieved CR on at least one assessment date and thus achieved the primary objective of Study II (39/62 =

63% )

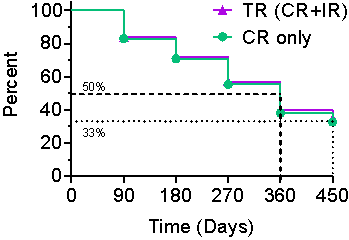

Kaplan-Meier Curve

The Kaplan-Meier (" KM ") Curve represents the interim cumulative incidence of clinical events, including the treatment efficacy, occurring over prespecified time in Study II.

According to the interim clinical data in the KM curve:

- >

80% of patients remained in Study II after 90 days, following the initial Study Procedure. 35% of Total Response patients have a duration of response ≥ 450 days.33% of Complete Response patients have a duration of response ≥ 450 days.

Serious Adverse Events

For 68 patients treated in Study II, there have been 13 Serious Adverse Events (" SAEs ") reported:

- 2 - Grade 2 (resolved within 1 and 1 days, respectively)

- 7 - Grade 3 (resolved within 1, 2, 3, 4, 4, 82 and unknown days, respectively)

- 3 - Grade 4 (resolved within 3, 6 and 8 days, respectively)

- 1 - Grade 5

Theralase® believes all SAEs reported to date are unrelated to the Study II Drug or Study II Device, as reviewed and confirmed by an independent Data Safety Monitoring Board (" DSMB ").

Note: A SAE is defined as any untoward medical occurrence that at any dose: Is serious or life-threatening, requires inpatient hospitalization or prolongation of existing hospitalization, results in persistent or significant disability/incapacity, is a congenital anomaly/birth defect or results in death.

Dr. Arkady Mandel, M.D., Ph.D., D.Sc., Chief Scientific Officer of Theralase® stated, "The interim clinical data of Study II to date has proven to be world-class. Study II has demonstrated an ability to destroy urothelial cell carcinoma in a patient's bladder for a total response of

About Study II:

Study II utilizes the therapeutic dose of the patented Study II Drug ( " Ruvidar TM " or " TLD-1433 ") (0.70 mg/cm 2 ) activated by the proprietary Study II Device ( TLC-3200 Medical Laser System or " TLC-3200 "). Study II is focused on enrolling and treating approximately 100 BCG-Unresponsive NMIBC Carcinoma In-Situ (" CIS ") patients in up to 15 Clinical Study Sites (" CSS ") located in Canada and the United States.

About Ruvidar TM :

Ruvidar TM is a peer reviewed, patented PDC currently under investigation in Study II.

About Theralase® Technologies Inc.:

Theralase® is a clinical stage pharmaceutical company dedicated to the research and development of light activated compounds, their associated drug formulations and the light and/or radiation systems that activate them, with a primary objective of efficacy and a secondary objective of safety in the destruction of various cancers, bacteria and viruses.

Additional information is available at www.theralase.com and www.sedarplus.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements:

This news release contains "forward-looking statements" within the meaning of applicable Canadian securities laws. Such statements include; but, are not limited to statements regarding the Company's proposed development plans with respect to Photo Dynamic Compounds and their drug formulations. Forward looking statements may be identified by the use of the words " may , " should ", " will ", " anticipates ", " believes ", " plans ", " expects ", " estimate ", " potential for " and similar expressions; including, statements related to the current expectations of Company's management for future research, development and commercialization of the Company's Photo Dynamic Compounds and their drug formulations, preclinical research, clinical studies and regulatory approvals.

These statements involve significant risks, uncertainties and assumptions; including, the ability of the Company to: adequately fund and secure the requisite regulatory approvals to commercially market a treatment for bladder cancer in a timely fashion and implement its commercialization strategy. Other risks include: the ability of the Company to successfully complete its Phase II BCG-Unresponsive NMIBC CIS clinical study , access to sufficient capital to fund the Company's operations may not be available or may not be available on terms that are commercially favorable to the Company, the Company's drug formulations may not be effective against the diseases tested in its clinical studies, the Company's fails to comply with the term of license agreements with third parties and as a result loses the right to use key intellectual property in its business, the Company's ability to protect its intellectual property, the timing and success of submission, acceptance and approval of regulatory filings. Many of these factors that will determine actual results are beyond the Company's ability to control or predict.

Readers should not unduly rely on these forward- looking statements, which are not a guarantee of future performance. There can be no assurance that forward looking statements will prove to be accurate as such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results or future events to differ materially from the forward-looking statements.

Although the forward-looking statements contained in the press release are based upon what management currently believes to be reasonable assumptions, the Company cannot assure prospective investors that actual results, performance or achievements will be consistent with these forward-looking statements.

All forward-looking statements are made as of the date hereof and are subject to change. Except as required by law, the Company assumes no obligation to update such statements.

For investor information on the Company, please feel to reach out Investor Inquiries - Theralase Technologies .

For More Information:

1.866.THE.LASE (843-5273)

416.699.LASE (5273)

www.theralase.com

Kristina Hachey, CPA

Chief Financial Officer

khachey@theralase.com

SOURCE: Theralase Technologies Inc.

View the original press release on accesswire.com