Tinka Provides Project Update Including Review of Key Geological Controls at Ayawilca

Rhea-AI Summary

Tinka Resources provided an update on its Ayawilca and Silvia projects in Peru. The company aims to advance the Ayawilca zinc-silver-tin project, which has demonstrated strong economic fundamentals in the 2024 Preliminary Economic Assessment (PEA). Recent geological reviews have improved confidence in the resource's geometry and identified new exploration targets.

Key targets for 2024/25 include:

- East Ayawilca: Targeting high-grade zinc.

- West Ayawilca: Extending the zinc zone.

- Silver and Tin zones: Expanding largely untested areas.

Final approvals for drilling at the Silvia Copper-Gold project are expected in the first half of 2025. Notable drill results from 2022-2023 include 38.9m @ 20% zinc and 145m @ 10.9% zinc. The 2024 PEA indicates a 21-year mine life, NPV8% of US$434 million post-tax, and a 25.9% IRR post-tax. Tinka is supported by Buenaventura and Nexa Resources. The company plans to test new targets and advance the Silvia NW copper-gold target in 2025.

Positive

- 2024 PEA shows a 21-year mine life with NPV8% of US$434 million post-tax and a 25.9% IRR post-tax.

- Notable drill results include 38.9m @ 20% zinc and 145m @ 10.9% zinc.

- Improved geological model increases confidence in resource geometry and reduces dilution and mining costs.

- Final approvals for Silvia Copper-Gold project drilling expected in the first half of 2025.

- Tinka is backed by Buenaventura and Nexa Resources, enhancing project credibility.

Negative

- The updated resource did not significantly grow in overall tonnage.

- Final drilling approvals for Silvia NW are still pending, with expected approval in the first half of 2025.

News Market Reaction – TKRFF

On the day this news was published, TKRFF gained 1.87%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESSWIRE / October 16, 2024 / Tinka Resources Limited ("Tinka" or the "Company") (TSXV:TK)(BVL:TK)(OTCQB:TKRFF) is pleased to present an update on activities at the Company's

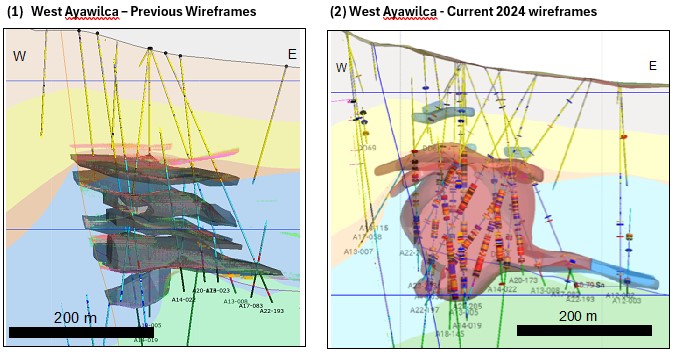

During the second half of 2024, the Company carried out a detailed geological review of the mineralization at Ayawilca, taking into account key findings from the Company's successful 2022-2023 drill program which led to an updated PEA being released in February 2024. This work has led to a significant change in the geological model for the deposit, resulting in an improved level of confidence in the geometry of some of the key areas of the resource and an understanding of the controls to mineralization. The review highlighted a number of exploration targets with significant potential to increase both in size and in the quality of the resource.

Key exploration targets for the 2024/25 exploration season include:

East Ayawilca: the Company will be targeting high-grade zinc mineralization up-dip and along strike of previous wide-spaced drill hole intercepts.

West Ayawilca: the Company will be seeking to extend the West Ayawilca zinc zone (14.5 Mt @

5.1% Zn, 14 g/t Ag &0.2% Pb in Indicated Mineral Resources) to the north.Expanding the Silver and Tin zones, which have been largely untested, especially to depth.

In addition, the Company expects to receive final approvals to launch a maiden drill program at its Silvia Copper-Gold exploration property in the first half of 2025.

Dr. Graham Carman, Tinka's President and CEO, stated:

"Tinka's Ayawilca project is without a doubt one of the largest undeveloped zinc-dominant base metal projects in the Americas and, we believe, one of the most developable, located within a mining region with access to excellent infrastructure and close to a local smelter and port. The Company is advancing the project along the development trajectory, and we have strong local partners who are assisting us in this endeavour."

"On the exploration front, we are confident that there remains considerable upside at Ayawilca over and above that demonstrated within the 2024 PEA. Our greater understanding of the mineralisation at Ayawilca and a reinterpretation of the geological controls on the deposit has led us to update the mineral resource model. Several priority exploration opportunities have been identified with significant potential to improve the economics of the deposit as we progress the project. Our intention is to test one or more of these targets during the next 12 months whilst we continue to derisk the project. Outside of Ayawilca, we will also be looking to advance the highly prospective Silvia NW copper-gold target, which we expect to be fully drill permitted in 2025."

Key highlights of the Ayawilca Project

Ayawilca represents one of the largest undeveloped primary zinc resources in the Americas with over 6,500 million pounds zinc in mineral resources, along with significant silver and tin credits.

Outstanding drill results during the 2022-2023 drill program included:

38.9 metres @

20% zinc incl. 10.4 metres @42.0% zinc in hole A22-202 (news release), and 145 metres @10.9% zinc incl. 29.3 metres @20.2% zinc in hole A23-212 at the South area (news release).44.9 metres @

12.0% zinc incl. 16.1 metres @22.2% zinc in hole A22-200 (news release), and 97.9 metres @8.8% zinc incl. 35.8 metres @19.0% zinc in A23-216 at the West area (news release).

The project benefits from excellent local infrastructure: it is located in a major mining belt with multiple options for road access to the coast, access to a local smelter and/or port facility, and an electrical power grid connection available only 4km from site.

The 2024 PEA showed robust economics with a 21-year mine life, NPV

8% of US$434 million post-tax, a25.9% IRR post-tax and 2.9 year payback period.Tinka is backed by two local mining specialists: Buenaventura, one of Peru's largest mining companies, and Nexa Resources, a Brazilian zinc mining company with two mines and a zinc refinery in Peru, acquired strategic stakes.

Major reinterpretation of geological controls at Ayawilca

The 2022-23 infill drill program at Ayawilca, which used low-angle west-dipping holes, was a huge success with some exceptional zinc drill hole intersections. The program was focused at West and South Ayawilca, which currently represent the most important parts of the Ayawilca zinc zone in both tonnage and grade, and reflect

Figure 1. Two views of the same West Ayawilca cross section showing (1) mineral resource wireframes in 2021, and (2) revised ‘pipe-like' geological model developed for the 2024 PEA following low-angle infill drill holes in 2022-23.

New geological interpretation for East Ayawilca

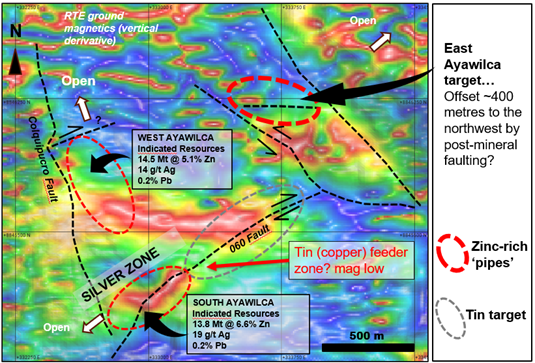

As a result of the modified geological model, Tinka's geological team has carried out a reinterpretation of the geology of the whole Ayawilca deposit (including relogging of key drill holes and revision of geophysical data). In particular, our geologists have developed a new interpretation for the eastern end of the Ayawilca deposit (i.e., East Ayawilca target), where it is now believed that a post-mineral northwest-trending strike-slip fault has offset East Ayawilca some 400 metres to the northwest (see Figure 2). Once movement along this fault is reconstructed, we interpret that the South - Central - East areas may once have been contiguous along the "060 Fault".

The current inferred mineral resource at East Ayawilca is based on a limited number of widely-spaced holes drilled during 2014 and 2015. The East Ayawilca mineral resource wireframes are modelled in a similar fashion to the flat-dipping lense model used previously at West Ayawilca (now outdated). With the new modified geological model (i.e., change to subvertical ‘pipes') we believe there is significant potential for high-grade zinc mineralization up-dip and along strike of previous wide-spaced drill hole intercepts. Drill hole intersections at East Ayawilca include 21 metres @

Other exploration targets at Ayawilca

The West Ayawilca zinc zone (14.5 Mt @

The Silver zone (1.0 Mt @ 111 g/t Ag,

The Tin zone also has significant exploration potential and remains open at depth along the ‘060 Fault' (the probable ‘feeder structure'). A previous drill hole ended in stockwork tin mineralization (16 m @

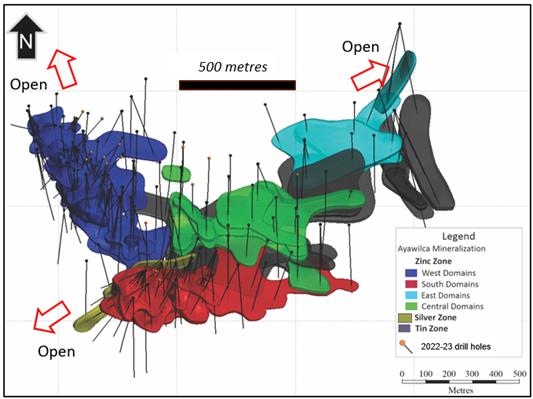

Mineral Resources at Ayawilca

The Ayawilca Project Mineral Resource is summarized in Table 1, as estimated by SLR Consulting (Canada) Ltd dated at January 1, 2024. For the purposes of demonstrating ‘Reasonable Prospects for Eventual Economic Extraction' the Mineral Resources were constrained within underground reporting shapes (i.e., stopes) using an NSR cut-off value of US

Table 1. Mineral Resources estimate for Ayawilca at January 1, 2024

Zinc Zone |

|

Indicated Mineral Resource | 28.3 million tonnes grading |

Inferred Mineral Resource | 31.2 million tonnes grading |

Tin Zone |

|

Indicated Mineral Resource | 1.4 million tonnes grading |

Inferred Mineral Resource | 12.7 million tonnes grading |

Silver Zone |

|

Inferred Mineral Resource | 1.0 million tonnes grading 111.4 g/t Ag, |

Figure 2. Simplified structural interpretation of the Ayawilca deposit over ground magnetics (1st vertical derivative) highlighting known resources and targets. East Ayawilca is interpreted to be offset ~ 400 metres northwards by post-mineral faulting. Similarly, the northern extension of West Ayawilca is interpreted to be cut-off and potentially offset by a cross-fault, open and untested by drilling.

Figure 3. Three-dimensional view of Ayawilca mineral resource wireframes by area dated at January 1, 2024.

Note: The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the results of the PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Silvia Copper-Gold Project

The Silvia Copper-Gold Project consists of 10,906 hectares of granted mining concessions immediately west of the Ayawilca project in the Huanuco region of Peru. Mineralized copper-gold bearing skarn outcrops have been mapped and sampled at several locations within the project area. The Silvia project was acquired from BHP in 2021 for a

At the Silvia NW target, copper-gold bearing skarn mineralization outcrops discontinuously over an area of approximately 4 km2 and is associated with diorite and granodiorite intrusions and dikes (not previously drill tested; see more detailed information here). "Area A", covers an area of around 500 by 100 metres, with surface channel samples of up to

In 2024, Tinka received an approved environmental permit ("DIA") from the Peruvian authorities to drill at Silvia NW. Negotiations are continuing with one key community to reach an access agreement to allow drilling. Once the community agreements are finalized, the Company can then submit a request to the government to initiate drilling activities. Final approval for drilling is expected during the first half of 2025.

Pampahuasi Project

At the Pampahuasi Property, Tinka has been granted two mining concessions totaling 1,200 hectares. Pampahuasi is located in the Department of Huancavelica 300 km southeast of Lima. The area is prospective for epithermal vein gold and silver mineralization. The geology consists of andesite volcanics which have been intruded by a dacite dome complex elongated in a north-south direction. Hydrothermal alteration (silicification and argillic alteration) occurs along the contact and within the dacite for a strike length of ~3km and up to 250 m wide (see more detailed information here). Sheeted quartz veins orientated northeast within the zone of alteration are gold bearing. Higher gold grades come from two areas each with target sizes of around 500 by 200 metres. Channel sampling from the southern part of the Pampahuasi alteration area during 2024 provided the following highlights:

2.0 metres grading 6.7 g/t gold and 6 g/t silver;

4.0 metres grading 2.2 g/t gold and 2 g/t silver;

0.5 metres grading 3.5 g/t gold and 61 g/t silver.

Previous sampling from the northern part of the Pampahuasi area by Tinka included:

3.0 metres grading 3.6 g/t gold and 2 g/t silver;

0.5 metres grading 1.2 g/t gold and 2 g/t silver.

Tinka is reviewing plans for future exploration at Pampahuasi, including potentially undertaking further surface geophysical/geological work, or possibly offering the property for divestment to allow the Company to focus on the Ayawilca and Silvia projects.

Qualified Persons

Technical information related to the PEA contained in this news release was reviewed and approved by Chris Bray, BEng (Mining), MAusIMM (CP), Principal Consultant (Mining Engineering) of SRK Consulting (UK). The Mineral Resources disclosed in this presentation were estimated by Ms. Katharine M. Masun, MSA, M.Sc., P.Geo., Principal Geologist of SLR Consulting (Canada) Ltd. Processing, metallurgical and recovery inputs were reviewed and approved by Mr. Adam Johnston, FAusIMM, CP (Metallurgy) of Transmin Metallurgical Consultants, UK. All are independent of Tinka and are Qualified Persons as defined by National Instrument 43-101.

Dr. Graham Carman, Tinka's President and CEO, prepared and verified the technical contents of this release. Dr. Carman is a Fellow of the Australasian Institute of Mining and Metallurgy, and is a Qualified Person as defined by National Instrument 43-101.

On behalf of the Board, "Graham Carman" | Further Information: Stay up to date by subscribing for news alerts at Contact Tinka and by following Tinka on X, LinkedIn and Facebook. |

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; the Company's expectations regarding the Ayawilca Project PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE: Tinka Resources Ltd.

View the original press release on accesswire.com

FAQ

What are the key exploration targets for Tinka Resources in 2024/25?

What were the notable drill results from Tinka Resources' 2022-2023 program?

What are the financial highlights of the 2024 PEA for Tinka Resources?

When does Tinka Resources expect to receive final approvals for drilling at the Silvia Copper-Gold project?

What is the stock symbol for Tinka Resources?