Tocvan Announces $3.0 Million Non-Brokered Private Placement; Secures $1.8 Million from Institutional Investor; Set to Mobilize Drill Rigs for Gran Pilar Gold Silver Project

Tocvan Ventures announces a $3.0 million non-brokered private placement, including a $1.8 million institutional investment. The offering consists of 6,250,000 units at $0.48 per unit, with each unit including one common share and one warrant exercisable at $0.75 for 36 months. The company plans to mobilize drill rigs at the Gran Pilar Gold Silver Project, with up to 1,250 meters of core drilling before year-end and 2,000 meters of RC drilling planned. The proceeds will support drilling operations, test mine preparations, and permitting of drilling expansion areas. A test mine for Pilar is scheduled for Q2 2025, with estimated costs of US$1.7 million and expected recovery of 800-1,400 gold ounces.

Tocvan Ventures annuncia un collocamento privato non intermediato da 3,0 milioni di dollari, comprensivo di un investimento istituzionale di 1,8 milioni di dollari. L'offerta consiste in 6.250.000 unità a 0,48 dollari ciascuna, con ogni unità che include un'azione comune e un warrant esercitabile a 0,75 dollari per 36 mesi. L'azienda prevede di mobilitare i trapani presso il Gran Pilar Gold Silver Project, con fino a 1.250 metri di perforazioni a carotaggio prima della fine dell'anno e 2.000 metri di perforazione RC programmati. I proventi supporteranno le operazioni di perforazione, i preparativi per la miniera di prova e i permessi per le aree di espansione della perforazione. Una miniera di prova per Pilar è programmata per il secondo trimestre del 2025, con costi stimati di 1,7 milioni di dollari e un recupero previsto di 800-1.400 once d'oro.

Tocvan Ventures anuncia una colocación privada no intermedia de 3,0 millones de dólares, que incluye una inversión institucional de 1,8 millones de dólares. La oferta consiste en 6,250,000 unidades a 0,48 dólares por unidad, donde cada unidad incluye una acción común y una opción de compra que se puede ejercer a 0,75 dólares durante 36 meses. La compañía planea movilizar plataformas de perforación en el Gran Pilar Gold Silver Project, con hasta 1,250 metros de perforación de núcleo antes de fin de año y 2,000 metros de perforación RC planificados. Los ingresos apoyarán las operaciones de perforación, los preparativos para la mina de prueba y la obtención de permisos para las áreas de expansión de perforación. Se programa una mina de prueba para Pilar para el segundo trimestre de 2025, con costos estimados de 1,7 millones de dólares y una recuperación esperada de 800-1,400 onzas de oro.

톡반 벤처스는 300만 달러 규모의 비중개 사모 배치를 발표했으며, 이 중 180만 달러는 기관 투자입니다. 이번 공모는 유닛당 0.48달러에 6,250,000개의 유닛으로 구성되어 있으며, 각 유닛에는 보통주 1주와 36개월 동안 0.75달러에 행사할 수 있는 워런트가 포함되어 있습니다. 이 회사는 그란 필라 골드 실버 프로젝트에서 드릴링 장비를 동원할 계획이며, 연말 이전에 최대 1,250미터의 코어 드릴링과 2,000미터의 RC 드릴링을 계획하고 있습니다. 자금은 드릴링 작업, 테스트 광산 준비 및 드릴링 확장 지역의 허가 지원에 사용됩니다. 필라 테스트 광산은 2025년 2분기로 예정되어 있으며, 예상 비용은 170만 달러이고 금 800-1,400 온스의 회수가 예상됩니다.

Tocvan Ventures annonce une placement privé non-intermédié de 3,0 millions de dollars, incluant un investissement institutionnel de 1,8 million de dollars. L'offre se compose de 6 250 000 unités à 0,48 dollar chacune, chaque unité comprenant une action ordinaire et un bon de souscription exerçable à 0,75 dollar pendant 36 mois. L'entreprise prévoit de mobiliser des équipements de forage au Gran Pilar Gold Silver Project, avec jusqu'à 1 250 mètres de forage à carottes avant la fin de l'année et 2 000 mètres de forage RC prévus. Les recettes serviront à soutenir les opérations de forage, les préparatifs pour la mine de test et l'obtention de permis pour les zones d'expansion de forage. Une mine de test pour Pilar est prévue pour le deuxième trimestre de 2025, avec des coûts estimés à 1,7 million de dollars et une récupération prévue de 800 à 1 400 onces d'or.

Tocvan Ventures kündigt eine nicht vermittelte Privatplatzierung in Höhe von 3,0 Millionen Dollar an, darunter eine institutionelle Investition von 1,8 Millionen Dollar. Das Angebot besteht aus 6.250.000 Einheiten zu je 0,48 Dollar, wobei jede Einheit eine Stammaktie und einen Warrant umfasst, der für 36 Monate zu 0,75 Dollar ausgeübt werden kann. Das Unternehmen plant, Bohranlagen im Gran Pilar Gold Silver Project zu mobilisieren, mit bis zu 1.250 Metern Kernbohrung vor Jahresende und 2.000 Metern RC-Bohrung, die geplant sind. Die Einnahmen unterstützen die Bohroperationen, die Vorbereitungen für die Testmine und die Genehmigungen für die Erweiterungsgebiete der Bohrungen. Eine Testmine für Pilar ist für das zweite Quartal 2025 vorgesehen, mit geschätzten Kosten von 1,7 Millionen Dollar und einer erwarteten Rückgewinnung von 800-1.400 Unzen Gold.

- Secured $1.8 million from institutional investor

- Total private placement of $3.0 million

- Pre-paid drilling agreement with JV partner for Main Zone

- Expected gold recovery of 800-1,400 ounces from test mine

- Test mine facility requires significant capital investment of US$1.7 million

- Conservative recovery rates of 62% based on previous bulk sample

Highlights:

Non-brokered Private Placement with Anchor Investment from Institutional Shareholder

Core Drill Rig Set to Mobilize First Week of December up to 1,250 meters planned before year end

Pre-Paid by Main Zone JV Partner

RC Drill Plan Set to Explore and Expand Northern Corridors

2,000 meters planned for Next Phase

Proceeds will be used to support Drilling, Test Mine Preparations, Permitting of Drilling on Expansion Area

CALGARY, AB / ACCESSWIRE / November 27, 2024 / Tocvan Ventures Corp. (the "Company") (CSE:TOC)(OTCQB:TCVNF)(WKN:TV3/A2PE64), is pleased to announce it has arranged a non-brokered private placement with a lead order from an institutional investor (the "Investor"). The Company has executed a term sheet in connection with a

"We are excited to return to drilling Pilar's Main Zone with an emphasis on building out a robust geological model needed for resource development" commented, CEO Brodie Sutherland. "Partnering with Colibri to complete this round of drilling allows us to advance the project in the most cost-effective way. In the past core drilling has returned some of the best results from Pilar, core drill hole placement across the project will better our understanding and support resource growth. As for plans for RC drilling, the extent of mineralization remains open to the north and east and we look to further define and extend mineralization in those directions for the most immediate increase in resource potential. We have not been idle in our planning and development strategy coupled with ongoing exploration showcasing further expansion potential. A test mine for Pilar is slated for Q2 of next year and we are exploring non-dilutive methods to fully finance the operation. We look forward to sharing the latest results as we advance Pilar towards production."

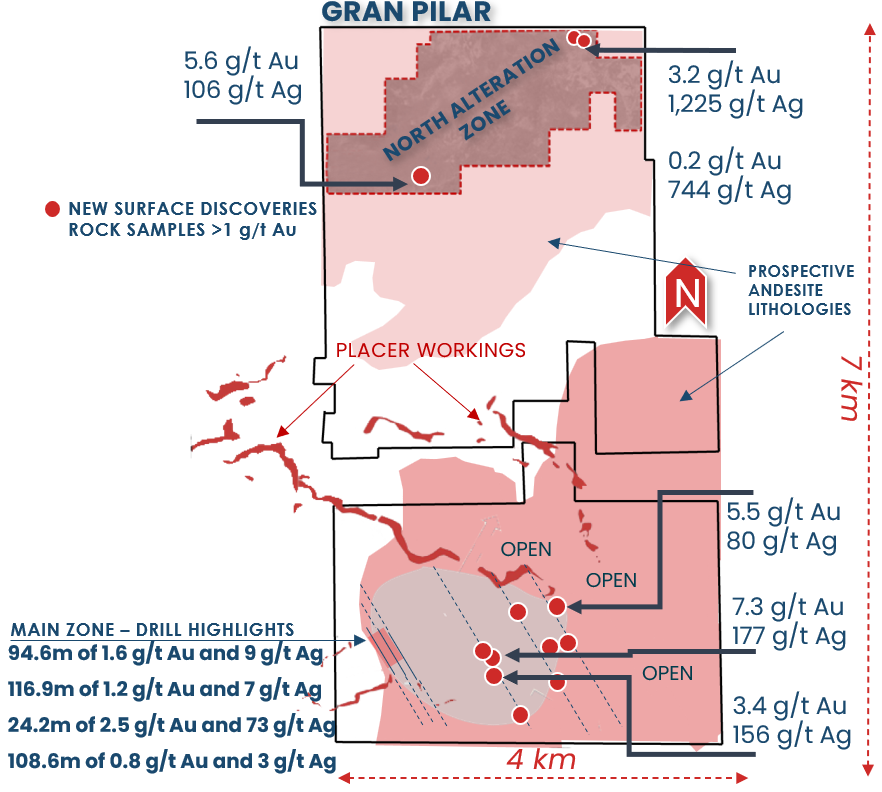

A diamond core drill rig is set to mobilize on or about December 4th, 2024. Core drilling of up to 1,250-meters is budgeted and pre-paid through an existing credit with partial joint venture partner, Colibri Resources (Colibri). Tocvan and Colibri share 51/49 percent interest in the 105-hectare area that contains Pilar's Main Zone, core drilling will be focused on the JV area across the Main Zone to build out a robust geological model needed for resource estimation. Drilling is expected to continue up until the holiday season with wrap up and demobilization planned for on or about December 22nd, 2024. Additionally, RC drilling is expected to begin in early December to test the north and northeast extent of known mineralization. Several areas extending into the

In addition to drilling, the next round of permitting will include extraction and processing of the anticipated 50,000 tonne bulk test mine scheduled for next year. Permitting will also include new exploration initiatives in the expansion area for trenching and drilling across several of the new geochemical target areas with existing road access, making for cost effective evaluation of several new key trends. Ground preparation for the test mine is expected for early Q1/2025, that will include systematic trenching and channel sampling of all open ground for the test mine.

Regarding the test mine parameters, the Company estimates the total cost of the Pilot facility including the extraction and processing of 50,000 tonnes to be approximately US

Use of Proceeds

Proceeds will go towards advancing the Gran Pilar Gold-Silver Project in Sonora, Mexico.

Notes On the Offerings

Closing of the Offerings is subject to several conditions, including receipt of all necessary corporate and regulatory approvals, including the Canadian Securities Exchange (the "Exchange", or the "CSE"). All of the securities issued in connection with the Offerings will be subject to a statutory hold period of four months plus a day from the date of issuance in accordance with applicable securities legislation in Canada as well as the required legend under applicable U.S. securities legislation.

The Units issued to the Investor under the Institutional Offering will be subject to the terms of an escrow agreement. The Company will receive

The Existing Shareholder Exemption and Investment Dealer Exemption

The Non-Brokered Offering is also made available to existing shareholders of the Company who, as of the close of business on November 27, 2024, held common shares of the Company (and who continue to hold such common shares as of the closing date), pursuant to the prospectus exemption set out in Alberta Securities Commission Rule 45-513 - Prospectus Exemption for Distribution to Existing Security Holders and in similar instruments in other jurisdictions in Canada. The existing shareholder exemption limits a shareholder to a maximum investment of

The Company has also made the Non-Brokered Offering available to certain subscribers pursuant to the investment dealer exemption.

In accordance with the requirements of the investment dealer exemption, the Company confirms that there is no material fact or material change about the Company that has not been generally disclosed.

Any participation by insiders of the Company in the Offerings will be on the same terms as arm's-length investors. Depending on market conditions, the gross proceeds of the Offerings could be increased or decreased. The participation of any directors or officers of the Company in the Offerings will constitute a related-party transaction within the meaning of Multilateral Instrument 61-101 (Protection of Minority Security Holders in Special Transactions) and the policies of the Exchange. For any such participation, the Company will be relying upon exemptions from the formal valuation and minority shareholder approval requirements pursuant to sections 5.5(b) and 5.7(1)(a), respectively, of MI 61-101 on the basis that the Company is not listed on a specified stock exchange and, that at the time the Offerings are agreed to, neither the fair market value of the subject matter of, nor the fair market value of the consideration for, the transaction insofar as it involves an interested party (within the meaning of MI 61-101) in the offerings, will exceed 25 percent of the Company's market capitalization calculated in accordance with MI 61-101.

About the Pilar Property

The Pilar Gold-Silver property has returned some of the regions best drill results. Coupled with encouraging gold and silver recovery results from metallurgical test work, Pilar is primed to be a potential near-term producer. Pilar is interpreted as a structurally controlled low-sulphidation epithermal system hosted in andesite rocks. Initially three primary zones of mineralization were identified on the original property from historic surface work and drilling and are referred to as the Main Zone, North Hill and 4-T. Each trend remains open to the southeast and north and new parallel zones have been discovered. Structural features and zones of mineralization within the structures follow an overall NW-SE trend of mineralization. Mineralization extends along a 1.2-km trend, only half of that trend has been drill tested so far. The Company has now expanded its interest in the area by consolidating 22 square-kilometers of highly prospective ground where it has already made significant surface discoveries.

Pilar Drill Highlights:

2022 Phase III Diamond Drilling Highlights include (all lengths are drilled thicknesses):

116.9m @ 1.2 g/t Au, including 10.2m @ 12 g/t Au and 23 g/t Ag

108.9m @ 0.8 g/t Au, including 9.4m @ 7.6 g/t Au and 5 g/t Ag

63.4m @ 0.6 g/t Au and 11 g/t Ag, including 29.9m @ 0.9 g/t Au and 18 g/t Ag

2021 Phase II RC Drilling Highlights include (all lengths are drilled thicknesses):

39.7m @ 1.0 g/t Au, including 1.5m @ 14.6 g/t Au

47.7m @ 0.7 g/t Au including 3m @ 5.6 g/t Au and 22 g/t Ag

29m @ 0.7 g/t Au

35.1m @ 0.7 g/t Au

2020 Phase I RC Drilling Highlights include (all lengths are drilled thicknesses):

94.6m @ 1.6 g/t Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

41.2m @ 1.1 g/t Au, including 3.1m @ 6.0 g/t Au and 12 g/t Ag ;

24.4m @ 2.5 g/t Au and 73 g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

15,000m of Historic Core & RC drilling. Highlights include:

61.0m @ 0.8 g/t Au

21.0m @ 38.3 g/t Au and 38 g/t Ag

13.0m @ 9.6 g/t Au

9.0m @ 10.2 g/t Au and 46 g/t Ag

Pilar Bulk Sample Summary:

62% Recovery of Gold Achieved Over 46-day Leaching PeriodHead Grade Calculated at 1.9 g/t Au and 7 g/t Ag; Extracted Grade Calculated at 1.2 g/t Au and 3 g/t Ag

Bulk Sample Only Included Coarse Fraction of Material (+3/4" to +1/8")

Fine Fraction (-1/8") Indicates Rapid Recovery with Agitated Leach

Agitated Bottle Roll Test Returned Rapid and High Recovery Results:

80% Recovery of Gold and94% Recovery of Silver after Rapid 24-hour Retention Time

Additional Metallurgical Studies:

Gravity Recovery with Agitated Leach Results of Five Composite Samples Returned

95 to

99% Recovery of Gold73 to

97% Recovery of SilverIncludes the Recovery of

99% Au and73% Ag from Drill Core Composite at 120-meter depth.

Based on management's strong belief in the project's potential, the Company is outlining a permitting and operations strategy for a pilot facility at Pilar. The facility would underpin a robust test mine scenario aiming to process up to 50,000 tonnes of material. Timelines and budget are being prepared with expectations to move forward with the development early in 2025. With gold prices hitting all-time highs, the Company believes the onsite test mine will provide key economic parameters and showcase the mineral potential of the area. In 2023, the Company completed an offsite bulk sample that produced important data showcasing the potential to recover both gold and silver through a variety of methods including heap leach, gravity and agitated leach (see August 22, 2023, news release for more details).

About Tocvan Ventures Corp.

Tocvan's advancing gold-silver projects are located in the mine-friendly jurisdiction of Sonora, Mexico. Through ongoing exploration programs, Company is unveiling the high-potential at its Gran Pilar Gold-Silver Project where it holds

Tocvan has approximately 51 million shares outstanding.

Brodie A. Sutherland, CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Cautionary Statement Regarding Forward-Looking Statements

Neither the Canadian Securities Exchange nor its regulation services provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company's business, the Company's formative stage of development and the Company's financial position. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws.

There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

For more information, please contact:

TOCVAN VENTURES CORP.

Brodie A. Sutherland, CEO

1150, 707 - 7 Ave SW

Calgary, Alberta T2P 3H6

+1-403-829-9877

bsutherland@tocvan.ca

The Howard Group

Jeff Walker

VP Howard Group Inc.

+1-403-221-0915

jeff@howardgroupinc.com

SOURCE: Tocvan Ventures Corp

View the original press release on accesswire.com

FAQ

What is the size and price of Tocvan's (TCVNF) private placement announced in November 2024?

How many meters of drilling is planned for Tocvan's (TCVNF) Gran Pilar project in December 2024?