SUIC’s Investments and Participates in the Pre-IPO Financing of Sinoway International, Joining Other Backers In Anticipation of IPO In 2022-2023, Targeting Hundreds Of Millions to Billions Investment Returns

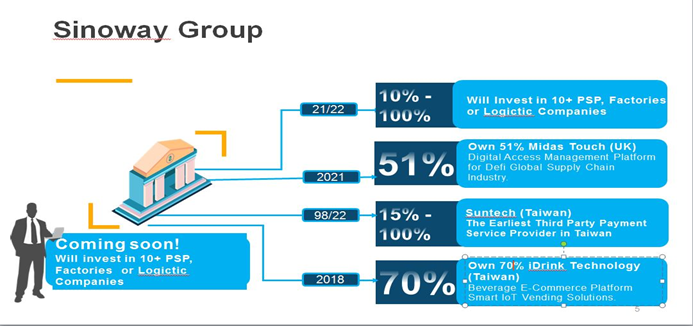

Sino United Worldwide Consolidated Ltd. (SUIC) has made a strategic investment in Sinoway International as it prepares for its IPO in 2022/2023, expecting substantial returns. A Convertible Loan Agreement allows SUIC a potential of 25 million shares upon conversion. The IPO is projected to achieve a valuation of at least 20 times its PE, potentially exceeding tens of billions. SUIC aims to expand its business network across multiple countries, bolstered by partnerships with merchants.

- Investment in Sinoway International with potential returns in hundreds of millions.

- Convertible Loan Agreement allows for 25 million shares after conversion.

- Expected IPO valuation of at least 20 times PE, potentially in the tens of billions.

- Expansion into over 40 countries planned for 2022 and 2023.

- None.

Insights

Analyzing...

NEW YORK, NY / ACCESSWIRE / August 16, 2021 / Sino United Worldwide Consolidated Ltd. (OTC PINK:SUIC), SUIC has invested in the Sinoway International in anticipation of its upcoming IPO plans in 2022/ 2023, expecting to bring in hundreds of millions in expected investment returns.

SUIC and Sinoway International Corporation ("Sinoway") signed a Convertible Loan Agreement for a potential of 25 Million shares equity ownership after conversion of Sinoway's common stock. Not only will SUIC benefit from the IPO of Sinoway, but will also develop their common businesses worldwide, partnering with more merchants and expanding its distribution networks that will benefit shareholders of both companies.

SUIC and Sinoway are expecting to command an IPO valuation at least 20 times of their PE, which is upwards of tens of billion dollars.

"SUIC is assisting Sinoway International in raising new capital to expand its business, network of integrations and partnerships. The fund raising net proceeds will be used for our common growth initiatives." said Yanru Zhou, CEO of SUIC.

SUIC Midas Touch is now finalizing and identifying the 10 PSP's to invest in or to partner with this year through 2022, with over two million merchants that will bring a sales turnover of

Phase 1 expansion will cover United States, Canada; Australia, New Zealand and 8 other countries in Southeast Asia, while Phase 2 expansion will cover South Asia and the Middle East countries, to cover a total of more than 40 countries in 2022 and 2023.

About Sino United Worldwide Consolidated Ltd., USA.

The Sino United Worldwide Consolidated Ltd. provides research and development, venture financing for and investing in private enterprises and the public sector that develop products and services adopting core capabilities of the Internet of Things, cloud computing, mobile payment, Big Data, Blockchain, and Artificial Intelligence, to enhance and streamline existing processes, and establish new and exciting business models that will create revolutionary products and services. Shareholders of SUIC will be exposed to the diverse application of advanced services in various parts of the economy. Additionally, existing and potential customers can benefit from this company's diversified portfolio of technologies. As one of the pioneering publicly traded technology companies, SUIC will help build tech-enabled businesses of the future. To learn more, please visit www.sinounitedco.com.

Forward-Looking Statement

Certain the information set forth herein contains "forward-looking information", including "future-oriented financial information"; and "financial outlook" under applicable securities laws (collectively referred to herein as forward-looking statements). Except for statements of historical fact, the information contained herein constitutes forward-looking statements and includes, but is not limited to, the (i) projected financial performance of the Company; (ii) completion of, and the use of proceeds from, the sale of shares being offered hereunder; (iii) the expected development of the Company's business, projects, and joint ventures; (iv) execution of the Company's vision and growth strategy, including with respect to future M&A activity and global growth; (v) sources and availability of third-party financing for the Company's projects; (vi) completion of the Company's projects that are currently underway, in development, or otherwise under consideration; (vi) renewal of the Company's current agreements; and (vii) future liquidity, working capital, and capital requirements. Forward-looking statements are provided to allow potential investors the opportunity to understand management's beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment.

These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

Although forward-looking statements contained herein are based upon what management of the Company believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management's estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

Contacts

Sino United Worldwide Consolidated Ltd.

New Release Department

929-391-2550

SOURCE: Sino United Worldwide Consolidated Ltd.

View source version on accesswire.com:

https://www.accesswire.com/659873/SUICs-Investments-and-Participates-in-the-Pre-IPO-Financing-of-Sinoway-International-Joining-Other-Backers-In-Anticipation-of-IPO-In-2022-2023-Targeting-Hundreds-Of-Millions-to-Billions-Investment-Returns