Stratasys Mails Proxy Materials for Extraordinary General Meeting and Letter to Shareholders

- Merger with Desktop Metal expected to accelerate growth and generate cost and revenue synergies

- Combined company projected to generate $1.6B+ revenue and $300M+ EBITDA in 2026

- None.

Insights

Analyzing...

Desktop Metal Combination Presents Significant Growth Opportunities and Value Creation for Stratasys Shareholders

Urges Shareholders to Vote “FOR” the Merger-related Proposal

Visit www.NextGenerationAM.com for More Information

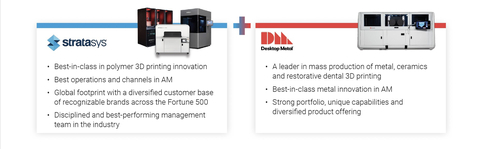

The First Industrial AM Company Covering the Full Manufacturing Lifecycle from Design to Mass Production in Both Polymers and Metal (Graphic: Business Wire)

In connection with the proxy materials, Stratasys is mailing a letter to shareholders, which can be found at www.NextGenerationAM.com along with other materials related to the Stratasys EGM.

The full text of the letter follows:

Your vote is important. Help ensure Stratasys and all stakeholders can realize the value creation opportunity of the Desktop Metal combination and VOTE TODAY “FOR” the Merger-related proposal.

The Stratasys Board of Directors unanimously recommends that Stratasys shareholders vote “FOR” each of the proposals to be considered at the Stratasys Extraordinary General Meeting of Shareholders on September 28, 2023, including the Stratasys Merger-related proposal.

Vote FOR the Desktop Metal Transaction

- Accelerates Stratasys’ mission to lead additive manufacturing (“AM”) into mass production by having a metal manufacturing solution alongside its robust polymer offering.

- Creates strong growth through complementary go-to-market channels to deliver enhanced value to shareholders.

- Establishes an AM powerhouse marked by innovation, operating efficiency and unmatched execution.

- Creates new opportunities in AM for customers, providing broad and complementary products and services and unique technologies that transform customers’ businesses.

Dear Stratasys Shareholder,

This is an exciting time for Stratasys. At the Stratasys Extraordinary General Meeting of Shareholders on September 28, 2023, Stratasys shareholders will have the opportunity to vote on the Stratasys Merger-related proposal, the approval of which is necessary to complete our previously announced merger with Desktop Metal.

Your vote is critical to ensuring Stratasys and its shareholders can realize the significant value creation opportunities of the proposed merger with Desktop Metal.

Together, Stratasys and Desktop Metal will create the first industrial additive manufacturing (“AM”) company covering the full manufacturing lifecycle from design to mass production in both polymers and metal. The compelling strategic combination delivers significant value for shareholders:

-

Creates the first >

$1B - Accelerates Desktop Metal’s complementary portfolio of growth assets with minimal overlap by leveraging Stratasys’ extensive market reach and industry-leading global go-to-market infrastructure and customer support capabilities.

-

Drives powerful synergies with an expected

$50M + in cost synergies and additional$50M - Right-sized post-closing balance sheet provides strong foundation for continued innovation and growth, including through acquisitions.

-

Generates increased growth and profitability with the combined company expected to generate

$1 $300M + of EBITDA in 2026 at base case, for a20% pro forma EBITDA margin. - Positions robust R&D engine for innovations in the near term and beyond, with substantial combined R&D team of 800+ scientists and engineers and 3,400+ active patents and pending patent applications.

The First Industrial AM Company Covering the Full Manufacturing Lifecycle from Design to Mass Production in Both Polymers and Metal

This transaction is about creating value. As a combined company, we believe we will create even greater opportunities for growth and success. With Desktop Metal, we will accelerate our mission to lead the additive manufacturing industry into mass production.

Advancing this mission requires a metal manufacturing solution alongside Stratasys’ robust polymer offering – and Desktop Metal’s metal offering for mass production is expected to double our addressable market for manufacturing in 2027.

Customers and Partners are Excited About the New Opportunities in AM

Together with Desktop Metal, we will create new opportunities in AM. Customers and partners are already excited about the benefits of the broad and complementary products and services and unique technologies the combined company will provide.

“Siemens is using DM as well as Stratasys systems for inhouse parts. We are looking forward to support as well as your combined journey towards the future of AM”

– Karsten Heuser, VP Additive Manufacturing, Siemens

“Very exciting and definitely a great move to drive adoption of AM for industrial use cases… As largest independent full portfolio provider of AM Materials and Solutions, you are our perfect partner!”

– Martin Back, CEO, BASF Forward AM

“By partnering with Stratasys we are able to advance our manufacturing practices beyond what is currently possible and really harness the possibilities of additive manufacturing for production parts”

– David Wilson, President, Toyota Racing Development

“Ford is a pioneer partner of Desktop Metal… Customers are going to love the way 3D printing can customize parts just for them… There are many possibilities here and we’re looking forward to the next iteration of their technology, which is the production system”

– Ken Washington, Former CTO & VP, Research & Advanced Engineering, Ford Motor Company

“As a long-term customer of Stratasys and more recently Desktop Metal, we are very excited about the possibility of what this merger will bring to change the game in the additive manufacturing industry and increase its impact on end use printed parts in aerospace”

– Blake Scholl, CEO, Boom Technology

“This partnership offers an expanded product portfolio, enhanced workflow efficiency, improved material selection, unparalleled support and training, and a commitment to future innovations”

– Rita Acquafredda, President, Global Dental Lab & Prosthetic Solutions, Henry Schein

“We have been using the Desktop Metal binder jet systems in medical applications and are looking forward to all the benefits the merger with Stratasys will bring to the growth of our industry”

– Shri Shetty, CEO, Zeda

“The combination of DM and Stratasys can bring together not only a vast talent pool and advanced technologies, but also the critical support services… that will benefit our labs, our customers and their patients”

– Laura Kelly, CEO, MicroDental Laboratories

The Stratasys Board of Directors unanimously recommends that Stratasys shareholders vote “FOR” each of the proposals to be considered at the Stratasys EGM, including the Stratasys Merger-related proposal.

Whether or not you attend the Meeting, your vote is important. We urge you to participate and vote, regardless of the number of Stratasys ordinary shares you own.

VOTE TODAY to support the Desktop Metal transaction.

Thank you for your support.

The Stratasys Board of Directors

To vote by mail: Complete, date, sign and return the enclosed proxy |

or voting instruction form in the envelope provided. |

|

To submit your vote electronically: Visit www.proxyvote.com |

or call toll-free at the telephone number listed on the enclosed proxy card. |

|

Your voting instructions must be received by 11:59 p.m., Eastern time, on September 27, 2023 |

(the day before the Stratasys EGM) in order for your shares to be voted at the Stratasys EGM. |

|

|

For assistance voting your Stratasys ordinary shares, |

please contact our proxy solicitor: |

|

Morrow Sodali LLC |

509 Madison Avenue, 12th Floor |

|

|

Call toll-free (800) 662-5200 or (203) 658-9400 |

Email: SSYS@info.morrowsodali.com |

Advisors

J.P. Morgan is acting as exclusive financial advisor to Stratasys, and Meitar Law Offices and Wachtell, Lipton, Rosen & Katz are serving as legal counsel.

About Stratasys

Stratasys is leading the global shift to additive manufacturing with innovative 3D printing solutions for industries such as aerospace, automotive, consumer products, healthcare, fashion and education. Through smart and connected 3D printers, polymer materials, a software ecosystem, and parts on demand, Stratasys solutions deliver competitive advantages at every stage in the product value chain. The world’s leading organizations turn to Stratasys to transform product design, bring agility to manufacturing and supply chains, and improve patient care.

To learn more about Stratasys, visit www.stratasys.com, the Stratasys blog, Twitter, LinkedIn, or Facebook. Stratasys reserves the right to utilize any of the foregoing social media platforms, including the Company’s websites, to share material, non-public information pursuant to the SEC’s Regulation FD. To the extent necessary and mandated by applicable law, Stratasys will also include such information in its public disclosure filings.

Stratasys is a registered trademark and the Stratasys signet is a trademark of Stratasys Ltd. and/or its subsidiaries or affiliates. All other trademarks are the property of their respective owners.

Forward-Looking Statements

This document contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the actual results of Stratasys Ltd. and its consolidated subsidiaries (“Stratasys”) may differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements.

Such forward-looking statements include statements relating to the proposed transaction between Stratasys and Desktop Metal, Inc. (“Desktop Metal”), including statements regarding the benefits of the transaction and the anticipated timing of the transaction, and information regarding the businesses of Stratasys and Desktop Metal, including expectations regarding outlook and all underlying assumptions, Stratasys’ and Desktop Metal’s objectives, plans and strategies, information relating to operating trends in markets where Stratasys and Desktop Metal operate, statements that contain projections of results of operations or of financial condition and all other statements other than statements of historical fact that address activities, events or developments that Stratasys or Desktop Metal intends, expects, projects, believes or anticipates will or may occur in the future. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, which may cause Stratasys’ or Desktop Metal’s actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20-F for the year ended December 31, 2022 and Part 1, Item 1A, “Risk Factors” in Desktop Metal’s Annual Report on Form 10-K for the year ended December 31, 2022, each filed with the Securities and Exchange Commission (the “SEC”), and in other filings by Stratasys and Desktop Metal with the SEC. These include, but are not limited to: factors relating to actions taken by or other developments involving Nano Dimension Ltd. (“Nano”), including any future unsolicited tender offer similar to its recently-expired partial tender offer for shares of Stratasys or Nano’s legal challenge to Stratasys’ shareholder rights plan, and actions taken by Stratasys or its shareholders with respect to such actions or developments, the ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, including the possibility that Stratasys or Desktop Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); other risks related to the completion of the proposed transaction and actions related thereto; changes in demand for Stratasys’ or Desktop Metal’s products and services; global market, political and economic conditions, and in the countries in which Stratasys and Desktop Metal operate in particular; government regulations and approvals; the extent of growth of the 3D printing market generally; the global macro-economic environment, including headwinds caused by inflation, rising interest rates, unfavorable currency exchange rates and potential recessionary conditions; the impact of shifts in prices or margins of the products that Stratasys or Desktop Metal sells or services Stratasys or Desktop Metal provides, including due to a shift towards lower margin products or services; the potential adverse impact that recent global interruptions and delays involving freight carriers and other third parties may have on Stratasys’ or Desktop Metal’s supply chain and distribution network and consequently, Stratasys’ or Desktop Metal’s ability to successfully sell both existing and newly-launched 3D printing products; litigation and regulatory proceedings, including any proceedings that may be instituted against Stratasys or Desktop Metal related to the proposed transaction; impacts of rapid technological change in the additive manufacturing industry, which requires Stratasys and Desktop Metal to continue to develop new products and innovations to meet constantly evolving customer demands and which could adversely affect market adoption of Stratasys’ or Desktop Metal’s products; and disruptions of Stratasys’ or Desktop Metal’s information technology systems.

These risks, as well as other risks related to the proposed transaction, are included in the registration statement on Form F-4 and joint proxy statement/prospectus that were filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. While the list of factors presented here is, and the list of factors presented in the registration statement on Form F-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to Stratasys’ and Desktop Metal’s respective periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ and Desktop Metal’s Annual Reports on Form 20-F and Form 10-K, respectively, and Stratasys’ Reports of Foreign Private Issuer on Form 6-K that published its results for the quarter and six months ended June 30, 2023, which it furnished to the SEC on August 9, 2023, and Desktop Metal’s most recent Quarterly Reports on Form 10-Q. The forward-looking statements included in this communication are made only as of the date hereof. Neither Stratasys nor Desktop Metal undertakes any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the

Important Additional Information

In connection with the proposed transaction, Stratasys filed with the SEC a registration statement on Form F-4 that includes a joint proxy statement of Stratasys and Desktop Metal and that also constitutes a prospectus of Stratasys. Each of Stratasys and Desktop Metal may also file other relevant documents with the SEC regarding the proposed transaction. The registration statement was declared effective by the SEC on August 25, 2023. Stratasys filed the definitive proxy statement/prospectus with the SEC on August 28, 2023. The definitive proxy statement/prospectus was mailed to shareholders of Stratasys and Desktop Metal on or around August 28, 2023. Each of Stratasys and Desktop Metal may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that Stratasys or Desktop Metal may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders are able to obtain free copies of the registration statement and definitive joint proxy statement/prospectus and other documents containing important information about Stratasys, Desktop Metal and the proposed transaction through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with, or furnished, to the SEC by Stratasys are available free of charge on Stratasys’ website at https://investors.stratasys.com/sec-filings. Copies of the documents filed with the SEC by Desktop Metal are available free of charge on Desktop Metal’s website at https://ir.desktopmetal.com/sec-filings/all-sec-filings.

Participants in the Solicitation

Stratasys, Desktop Metal and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Stratasys, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Stratasys’ proxy statement for its 2023 Annual General Meeting of Shareholders, which was furnished to the SEC on July 12, 2023, and Stratasys’ Annual Report on Form 20-F for the fiscal year ended December 31, 2022, which was filed with the SEC on March 3, 2023. Information about the directors and executive officers of Desktop Metal, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Desktop Metal’s proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 25, 2023 and Desktop Metal’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 1, 2023. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC regarding the proposed transaction. Investors should read the joint proxy statement/prospectus carefully before making any voting or investment decisions. You may obtain free copies of these documents from Stratasys or Desktop Metal using the sources indicated above.

Use of Non-GAAP Financial Measures

This communication contains certain forward-looking non-GAAP measures, which are based on internal forecasts and represent management’s best judgment. Reconciliation of such measures to the most directly comparable GAAP financial measures cannot be furnished without unreasonable efforts due to inherent difficulty in forecasting the amount and timing of certain adjustments that are necessary for such reconciliations and which may significantly impact our GAAP results. In particular, sufficient information is not available to calculate certain adjustments that are required to prepare a forward-looking statement of revenue, margin and EBITDA in accordance with GAAP for fiscal years 2024 and beyond. Stratasys also believes that such reconciliations would also imply a degree of precision that would be confusing or inappropriate for these forward-looking measures, which are inherently uncertain. All revenue, margin, EBITDA and other P&L references are non-GAAP unless specified otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230905078705/en/

Investor Relations

Yonah Lloyd

CCO / VP Investor Relations

Yonah.Lloyd@stratasys.com

Morrow Sodali

SSYS@info.morrowsodali.com

(800) 662-5200

(203) 658-9400

Ed Trissel / Joseph Sala / Kara Brickman

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

Israel Media

Yonatan Snir

VP Global Marketing

Yonatan.Snir@stratasys.com

Yael Arnon

Scherf Communications

yaela@scherfcom.com

+972527202703

Source: Stratasys Ltd.