SS&C GlobeOp Forward Redemption Indicator

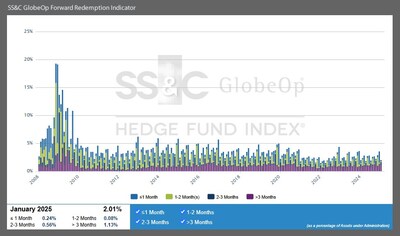

SS&C Technologies (Nasdaq: SSNC) has reported that the SS&C GlobeOp Forward Redemption Indicator for January 2025 was 2.01%, showing a decrease from December's 3.54%. While this figure is slightly above the five-year average of 1.85%, it represents improving market conditions for hedge funds.

The company's Hedge Fund Performance Index showed a flash estimate of -0.10% for the current month, with year-to-date and last 12-month performance both at 8.78%. The Capital Movement Index reached a 12-month high of 125.37 in December 2024, while the Forward Redemption Indicator hit its 12-month high at 3.54% in the same month.

According to Bill Stone, Chairman and CEO, conditions are favorable for attractive risk-adjusted returns and strong hedge fund inflows in 2025, despite increased volatility and persistent inflation in late 2024.

SS&C Technologies (Nasdaq: SSNC) ha comunicato che l'Indicatore di Riscatto Anticipato SS&C GlobeOp per gennaio 2025 è stato 2.01%, mostrando un calo rispetto al 3.54% di dicembre. Sebbene questa cifra sia leggermente superiore alla media quinquennale dell'1.85%, rappresenta un miglioramento delle condizioni di mercato per i fondi hedge.

L'Indice di Performance dei Fondi Hedge dell'azienda ha mostrato una stima preliminare di -0.10% per il mese corrente, con performance da inizio anno e negli ultimi 12 mesi entrambe al 8.78%. L'Indice di Movimento del Capitale ha raggiunto un massimo di 12 mesi di 125.37 nel dicembre 2024, mentre l'Indicatore di Riscatto Anticipato ha raggiunto il suo massimo di 12 mesi al 3.54% nello stesso mese.

Secondo Bill Stone, Presidente e CEO, le condizioni sono favorevoli per rendimenti attraenti aggiustati per il rischio e forti afflussi nei fondi hedge nel 2025, nonostante l'aumentata volatilità e l'inflazione persistente alla fine del 2024.

SS&C Technologies (Nasdaq: SSNC) ha informado que el Indicador de Redención Anticipada SS&C GlobeOp para enero de 2025 fue de 2.01%, mostrando una disminución desde el 3.54% de diciembre. Aunque esta cifra es ligeramente superior al promedio de cinco años del 1.85%, representa una mejora en las condiciones del mercado para los fondos de cobertura.

El Índice de Desempeño de Fondos de Cobertura de la compañía mostró una estimación provisional de -0.10% para el mes actual, con un desempeño acumulado en lo que va del año y en los últimos 12 meses ambos en 8.78%. El Índice de Movimiento de Capital alcanzó un máximo de 12 meses de 125.37 en diciembre de 2024, mientras que el Indicador de Redención Anticipada alcanzó su máximo de 12 meses en 3.54% en el mismo mes.

Según Bill Stone, Presidente y CEO, las condiciones son favorables para obtener rendimientos atractivos ajustados al riesgo y fuertes entradas en fondos de cobertura en 2025, a pesar de la mayor volatilidad y la inflación persistente a finales de 2024.

SS&C 기술(Nasdaq: SSNC)은 2025년 1월 SS&C GlobeOp 환매 지표가 2.01%로 나타났으며, 이는 12월의 3.54%에서 감소한 수치라고 보고했습니다. 이 수치는 5년 평균인 1.85%를 살짝 웃돌지만 헤지펀드의 시장 조건이 개선되고 있음을 나타냅니다.

회사의 헤지펀드 성과 지수는 현재 월에 대한 잠정 추정치를 -0.10%로 보여주며, 올해 초부터 현재까지와 지난 12개월 성과는 모두 8.78%입니다. 자본 이동 지수는 2024년 12월에 125.37의 12개월 최고치를 기록했으며, 같은 달에 환매지표는 3.54%로 12개월 최고치를 기록했습니다.

빌 스톤 회장 겸 CEO에 따르면, 2024년 말의 변동성과 지속적인 인플레이션에도 불구하고 2025년에는 매력적인 위험 조정 수익과 강력한 헤지펀드 유입이 기대됩니다.

SS&C Technologies (Nasdaq: SSNC) a rapporté que l'Indicateur de Rachat Anticipé SS&C GlobeOp pour janvier 2025 était de 2.01%, montrant une diminution par rapport à 3.54% en décembre. Bien que ce chiffre soit légèrement supérieur à la moyenne sur cinq ans de 1.85%, il représente une amélioration des conditions de marché pour les fonds de couverture.

L'Indice de Performance des Fonds de Couverture de la société a montré une estimation préliminaire de -0.10% pour le mois en cours, avec une performance depuis le début de l'année et sur les 12 derniers mois à 8.78% tous les deux. L'Indice de Mouvement des Capitaux a atteint un sommet de 12 mois de 125.37 en décembre 2024, tandis que l'Indicateur de Rachat Anticipé a atteint son sommet de 12 mois à 3.54% au cours du même mois.

Selon Bill Stone, président et PDG, les conditions sont favorables à des rendements attractifs ajustés au risque et à de forts flux entrants dans les fonds de couverture en 2025, malgré une volatilité accrue et une inflation persistante à la fin de 2024.

SS&C Technologies (Nasdaq: SSNC) hat berichtet, dass der SS&C GlobeOp-Vorabauszahlungsindikator für Januar 2025 bei 2.01% lag, was einem Rückgang gegenüber 3.54% im Dezember entspricht. Dieser Wert liegt zwar leicht über dem fünfjährigen Durchschnitt von 1.85%, stellt jedoch eine Verbesserung der Marktbedingungen für Hedgefonds dar.

Der Hedgefonds-Leistungsindex des Unternehmens zeigte für den laufenden Monat eine vorläufige Schätzung von -0.10%, während die Performance seit Jahresbeginn und in den letzten 12 Monaten bei 8.78% liegt. Der Kapitalbewegungsindex erreichte im Dezember 2024 einen 12-Monats-Höchststand von 125.37, während der Vorabauszahlungsindikator im selben Monat mit 3.54% seinen vorherigen 12-Monats-Höchststand erreichte.

Laut Bill Stone, Vorsitzender und CEO, sind die Bedingungen günstig für attraktive risikobereinigte Renditen und starke Zuflüsse in Hedgefonds im Jahr 2025, trotz gestiegener Volatilität und anhaltender Inflation Ende 2024.

- Forward redemption rate decreased from 3.54% to 2.01%

- Strong YTD and LTM hedge fund performance of 8.78%

- Capital Movement Index reached 12-month high of 125.37 in December 2024

- Current month's flash estimate shows -0.10% performance

- January 2025 redemption rate (2.01%) exceeds five-year average (1.85%)

- Increased market volatility and persistent inflation noted

Insights

The January 2025 redemption indicator reveals several significant trends in the hedge fund industry that directly impact SS&C's business outlook. The 2.01% redemption rate, while a marked improvement from December's 3.54%, signals continued stability in SS&C's core fund administration business. This is particularly noteworthy when compared to the historical peak of 19.27% during the 2008 financial crisis.

The data presents two key insights: First, the relatively low redemption rate, despite market volatility and inflation concerns, indicates strong investor confidence in hedge fund strategies. Second, SS&C's platform, which administers approximately 10% of global hedge fund assets, continues to provide robust visibility into industry capital flows.

The 8.78% YTD performance of funds on SS&C's platform, coupled with improving market breadth, suggests potential growth in SS&C's administration fees. The company's position as a leading fund administrator becomes increasingly valuable in volatile markets where accurate, timely redemption processing and reporting are crucial.

Market conditions characterized by increased volatility and persistent inflation typically lead to higher trading volumes and more complex portfolio management requirements. This environment tends to drive demand for SS&C's technology solutions and services, potentially supporting revenue growth across their service offerings.

SS&C GlobeOp Forward Redemption Indicator: January notifications

"SS&C GlobeOp's Forward Redemption Indicator for January 2025 was

The SS&C GlobeOp Forward Redemption Indicator represents the sum of forward redemption notices received from investors in hedge funds administered by SS&C GlobeOp on the SS&C GlobeOp platform, divided by the AuA at the beginning of the month for SS&C GlobeOp fund administration clients on the SS&C GlobeOp platform. Forward redemptions as a percentage of SS&C GlobeOp's assets under administration on the SS&C GlobeOp platform have trended significantly lower since reaching a high of

Published on the 15th business day of the month, the SS&C GlobeOp Forward Redemption Indicator presents a timely and accurate view of the redemption pipeline for investors in hedge funds on the SS&C GlobeOp administration platform. Movements in the Indicator reflect investor confidence in their allocations to hedge funds. Indicator data is based on actual investor redemption notifications received. Unlike subscriptions, redemption notifications are typically received 30-90 days in advance of the redemption date. Investors may, and sometimes do, cancel redemption notices. In addition, the establishment and enforcement of redemption notices may vary from fund to fund.

SS&C GlobeOp Hedge Fund Performance Index

Base | 100 points on 31 December 2005 |

Flash estimate (current month) | - |

Year-to-date (YTD) | |

Last 12 month (LTM) | |

Life to date (LTD) | |

*All numbers reported above are gross |

SS&C GlobeOp Capital Movement Index

Base | 100 points on 31 December 2005 |

All time high | 150.77 in September 2013 |

All time low | 99.67 in January 2006 |

12-month high | 125.37 in December 2024 |

12-month low | 123.64 in April 2024 |

Largest monthly change | - 15.21 in January 2009 |

SS&C GlobeOp Forward Redemption Indicator

All time high | |

All time low | |

12-month high | |

12-month low | |

Largest monthly change |

About the SS&C GlobeOp Hedge Fund Index®

The SS&C GlobeOp Hedge Fund Index (the Index) is a family of indices published by SS&C GlobeOp. A unique set of indices by a hedge fund administrator, it offers clients, investors and the overall market a welcome transparency on liquidity, investor sentiment and performance. The Index is based on a significant platform of diverse and representative assets.

The SS&C GlobeOp Capital Movement Index and the SS&C GlobeOp Forward Redemption Indicator provide monthly reports based on actual and anticipated capital movement data independently collected from all hedge fund clients for whom SS&C GlobeOp provides administration services on the SS&C GlobeOp platform.

The SS&C GlobeOp Hedge Fund Performance Index is an asset-weighted benchmark of the aggregate performance of funds for which SS&C GlobeOp provides monthly administration services on the SS&C GlobeOp platform. Flash estimate, interim and final values are provided, in each of three months respectively, following each business month-end.

While individual fund data is anonymized by aggregation, the SS&C GlobeOp Hedge Fund Index data will be based on the same reconciled fund data that SS&C GlobeOp uses to produce fund net asset values (NAV). Funds acquired through the acquisition of Citi Alternative Investor Services are integrated into the index suite starting with the January 2017 reporting periods. SS&C GlobeOp's total assets under administration on the SS&C GlobeOp platform represent approximately

About SS&C Technologies

SS&C is a global provider of services and software for the financial services and healthcare industries. Founded in 1986, SS&C is headquartered in

Additional information about SS&C (Nasdaq: SSNC) is available at www.ssctech.com.

Follow SS&C on X, LinkedIn and Facebook.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ssc-globeop-forward-redemption-indicator-302359451.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ssc-globeop-forward-redemption-indicator-302359451.html

SOURCE SS&C