SS&C GlobeOp Forward Redemption Indicator

- None.

- None.

Insights

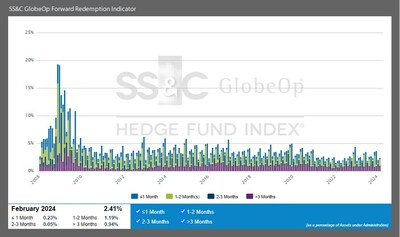

The SS&C GlobeOp Forward Redemption Indicator's rise to 2.41% in February 2024, as reported, is a subtle yet potentially significant signal for investors and market analysts. This uptick, though slight, suggests a marginal increase in the number of investors requesting redemptions from hedge funds. It is essential to contextualize this figure against historical trends to gauge investor sentiment. For instance, the all-time high of 19.27% in November 2008 coincided with the global financial crisis, reflecting extreme investor panic. In contrast, the current level remains relatively low, indicating that while there may be concerns about market conditions, they have not yet triggered a widespread flight from hedge funds.

Moreover, the Forward Redemption Indicator can be a leading indicator of future capital outflows from hedge funds. It is important to monitor this in conjunction with the SS&C GlobeOp Capital Movement Index, which reflects net flows, including subscriptions and redemptions. A disconnect between these two can provide insights into underlying market dynamics. For example, if redemptions are rising but net flows remain positive, it could suggest that new investments are offsetting the redemptions, which would be a positive sign for the hedge fund industry.

When analyzing the SS&C GlobeOp Forward Redemption Indicator, it's important to consider broader market conditions that influence investor behavior. The mentioned elevated equity valuations, interest rates, public debt and market volatility are factors that typically lead to increased investor caution. Hedge funds, known for their risk-adjusted returns, may become more attractive during volatile periods as investors seek to mitigate risk. However, an increase in forward redemption rates could indicate that investors are either rebalancing their portfolios, possibly due to overexposure to risk, or losing confidence in hedge funds' ability to navigate the current economic environment.

Redemption rates slightly higher than the 10-year average could also suggest a shift in the investment landscape. It is crucial to track these changes over time to understand long-term trends in investor confidence and hedge fund performance. An upward trend in redemption rates over several months could signal a more significant shift in investor sentiment, potentially impacting hedge fund strategies and operations.

The SS&C GlobeOp Forward Redemption Indicator serves as a microcosm for the broader economic environment. A rise in redemption requests can reflect broader economic concerns that may affect consumer spending, corporate investment and overall economic growth. Elevated interest rates, often implemented to combat inflation, can have a cooling effect on the economy, which in turn can lead to a reassessment of risk among investors. This reassessment may be reflected in the redemption rates of hedge funds.

Furthermore, the relationship between redemption rates and market volatility is complex. While higher volatility can lead to higher returns for some hedge fund strategies, it can also increase the risk of losses. Investors may react to this risk by increasing redemptions, which can affect liquidity in the markets. It is essential to analyze these economic indicators in conjunction with each other to understand their combined effect on investor behavior and market dynamics.

SS&C GlobeOp Forward Redemption Indicator: February notifications

"SS&C GlobeOp's Forward Redemption Indicator for February 2024 was

The SS&C GlobeOp Forward Redemption Indicator represents the sum of forward redemption notices received from investors in hedge funds administered by SS&C GlobeOp on the SS&C GlobeOp platform, divided by the AuA at the beginning of the month for SS&C GlobeOp fund administration clients on the SS&C GlobeOp platform. Forward redemptions as a percentage of SS&C GlobeOp's assets under administration on the SS&C GlobeOp platform have trended significantly lower since reaching a high of

Published on the 15th business day of the month, the SS&C GlobeOp Forward Redemption Indicator presents a timely and accurate view of the redemption pipeline for investors in hedge funds on the SS&C GlobeOp administration platform. Movements in the Indicator reflect investor confidence in their allocations to hedge funds. Indicator data is based on actual investor redemption notifications received. Unlike subscriptions, redemption notifications are typically received 30-90 days in advance of the redemption date. Investors may, and sometimes do, cancel redemption notices. In addition, the establishment and enforcement of redemption notices may vary from fund to fund.

SS&C GlobeOp Hedge Fund Performance Index

Base | 100 points on 31 December 2005 |

Flash estimate (current month) | |

Year-to-date (YTD) | |

Last 12 month (LTM) | |

Life to date (LTD) | |

*All numbers reported above are gross |

SS&C GlobeOp Capital Movement Index

Base | 100 points on 31 December 2005 |

All time high | 150.77 in September 2013 |

All time low | 99.67 in January 2006 |

12-month high | 130.54 in March 2023 |

12-month low | 124.61 in January 2024 |

Largest monthly change | - 15.21 in January 2009 |

SS&C GlobeOp Forward Redemption Indicator

All time high | |

All time low | |

12-month high | |

12-month low | |

Largest monthly change |

About the SS&C GlobeOp Hedge Fund Index®

The SS&C GlobeOp Hedge Fund Index (the Index) is a family of indices published by SS&C GlobeOp. A unique set of indices by a hedge fund administrator, it offers clients, investors and the overall market a welcome transparency on liquidity, investor sentiment and performance. The Index is based on a significant platform of diverse and representative assets.

The SS&C GlobeOp Capital Movement Index and the SS&C GlobeOp Forward Redemption Indicator provide monthly reports based on actual and anticipated capital movement data independently collected from all hedge fund clients for whom SS&C GlobeOp provides administration services on the SS&C GlobeOp platform.

The SS&C GlobeOp Hedge Fund Performance Index is an asset-weighted benchmark of the aggregate performance of funds for which SS&C GlobeOp provides monthly administration services on the SS&C GlobeOp platform. Flash estimate, interim and final values are provided, in each of three months respectively, following each business month-end.

While individual fund data is anonymized by aggregation, the SS&C GlobeOp Hedge Fund Index data will be based on the same reconciled fund data that SS&C GlobeOp uses to produce fund net asset values (NAV). Funds acquired through the acquisition of Citi Alternative Investor Services are integrated into the index suite starting with the January 2017 reporting periods. SS&C GlobeOp's total assets under administration on the SS&C GlobeOp platform represent approximately

About SS&C Technologies

SS&C is a global provider of services and software for the financial services and healthcare industries. Founded in 1986, SS&C is headquartered in

Additional information about

SS&C (Nasdaq: SSNC) is available at www.ssctech.com.

Follow SS&C on X, LinkedIn and Facebook.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ssc-globeop-forward-redemption-indicator-302075374.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ssc-globeop-forward-redemption-indicator-302075374.html

SOURCE SS&C