Strategy Analytics: Qualcomm Dominates the Baseband Market with 800+ Million Shipments in 2021

iPhone and Android Design-wins Fuel Qualcomm's Growth

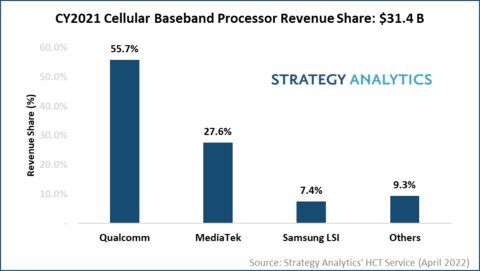

CY 2021 Cellular Baseband Processor Revenue Share:

According to this Strategy Analytics' Handset Component Technologies (HCT) research report, "Baseband Market Share Tracker Q4 2021: Qualcomm and MediaTek Together Capture 95 Percent Share in 5G", Qualcomm, MediaTek, Samsung LSI, Unisoc and Intel captured the top-five revenue share rankings in the baseband market in 2021.

- Qualcomm led the baseband market with a 56 percent revenue share, followed by MediaTek with 28 percent and Samsung LSI with 7 percent.

-

MediaTek, Qualcomm and Unisoc gained market share while Intel,

HiSilicon and Samsung LSI lost share. - 5G baseband revenues grew 71 percent year-over-year, accounting for 66 percent of total baseband revenue in 2021.

-

Cellular IoT baseband vendors ASR Microelectronics, Nordic Semiconductor,

Sequans and Sony (Altair) gained significant traction despite wafer constraints. ASR Microelectronics posted almost four-fold shipment growth.

Sravan Kundojjala, author of the report and Director of Handset Component Technologies service at Strategy Analytics, commented, "Qualcomm shipped 800+ million basebands in 2021 and ranked number one in both units’ revenue terms. The iPhone 13 lineup featured the X60 modem, helping Qualcomm gain volume. In addition, the company established itself as the market leader in the premium and high tier Android devices with its Snapdragon 8 and 7 series of chips. Qualcomm also gained significant traction in non-handset segments such as automotive, IoT, cellular tablets, fixed wireless access and other applications with its diverse portfolio of baseband chips."

Mr. Kundojjala continued, "MediaTek more than tripled its 5G baseband shipments in 2021, thanks to its design-wins at Samsung and Chinese OEMs. The company also focused on the mid-range and low-end LTE market and gained market share over Qualcomm in smartphones. Unisoc, on the other hand, regained LTE share with the help of an improved product portfolio and design wins at tier-one smartphone OEMs. Strategy Analytics believes that Unisoc has the potential to gain further LTE share as the company has a proven track record in capturing share in mature technologies."

According to

Source:

#SA_Components

About Strategy Analytics

For more information about Strategy Analytics

Service

Service

View source version on businesswire.com: https://www.businesswire.com/news/home/20220412005085/en/

Report:

European:

US:

Source: Strategy Analytics