Spotify Technology S.A. Announces Financial Results for Second Quarter 2021

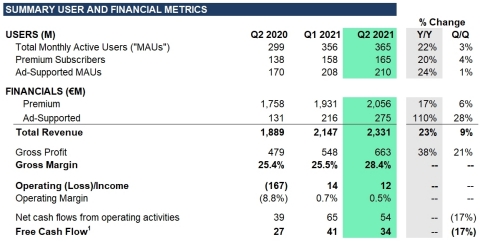

Spotify Technology S.A. (NYSE:SPOT) reported Q2 performance showing 22% Y/Y growth in total Monthly Active Users (MAUs), reaching 365 million, despite falling short of guidance mainly due to disruptions from COVID-19 and technical issues. Revenue grew 23% Y/Y to €2,331 million, bolstered by strong advertising and Premium subscribers, which rose 20% Y/Y to 165 million. Free Cash Flow improved to €34 million, although MAUs showed greater variability. The company remains optimistic despite ongoing challenges.

- Total revenue of €2,331 million grew 23% Y/Y.

- Premium subscribers grew 20% Y/Y, reaching 165 million.

- Free Cash Flow improved to €34 million.

- Gross Margin expanded to 28.4%, exceeding guidance.

- Total MAUs growth of 22% Y/Y fell short of guidance.

- COVID-19 and technical issues caused MAU variability.

Insights

Analyzing...

Spotify Technology S.A. (NYSE:SPOT):

(Graphic: Business Wire)

Dear Shareholders,

Most of our major metrics -- Subscriber growth, Revenue, Gross Margin, and Operating Income -- performed better than expected this quarter. The exception was MAUs, where we fell short of our guidance range. The quarter was led by improving ARPU, decreased churn, a return to per user consumption growth, and significant advertising strength. We did see a second quarter of greater MAU variability mainly due to ongoing COVID-19 headwinds and a temporary issue related to user intake on a third party platform. However, trends improved in the back half of the quarter. Additionally, we generated positive Free Cash Flow of

MONTHLY ACTIVE USERS (“MAUs”)

Total MAUs grew

MAU performance was slower than expected due primarily to lighter user intake during the first half of the quarter. COVID-19 continued to weigh on our performance in several markets, and, in some instances, we paused marketing campaigns due to the severity of the pandemic. Separately, a user sign-up issue associated with a global third party platform created unexpected intake friction, which also impacted MAU growth. This issue has since been resolved.

Overall, we saw a return to better growth patterns in the back half of the quarter. Although we continue to face near-term uncertainty with respect to COVID-19, we remain confident in the underlying health of our user funnel, and our existing user retention activity remains consistent with historical trends.

Global consumption hours continued to grow meaningfully in Q2 on a Y/Y basis. On a per user basis, global consumption levels returned to Y/Y growth in the quarter, led by gains in developed regions such as North America and Europe.

PREMIUM SUBSCRIBERS

Our Premium Subscribers grew

Compared with the last few years, we shortened our mid-year promotional campaign cycle from 6 weeks to 4 weeks, and performance exceeded expectations. Additionally, we added or expanded several major promotional partnerships in the quarter, including a renewal and expansion of our Samsung promotion (offering 3 month trials in 73 markets to all new and existing mobile/speaker/wearable and appliance devices), a renewal and expansion of our Microsoft Gamepass promotion (offering 3 or 4 month trials in 15 markets), a new Epic/Fortnite promotion (3 month trial in 25 markets), a renewal of our Paypal promotion (3 month trial in 10 markets), and a renewal and expansion of our Vivo promotion (3 month trial in Brazil). Additionally, we announced a new promotion with TikTok (3 or 4 month trial across 7 countries in EMEA) which launched in mid July.

Our average monthly Premium churn rate for the quarter was down 23 bps Y/Y and down modestly Q/Q. The Y/Y improvement continues to be driven by the adoption of our higher retention offerings like Duo and Family Plans in addition to growth in high retention regions.

FINANCIAL METRICS

Revenue

Revenue of

Within Premium, average revenue per user (“ARPU”) of

Ad-Supported Revenue outperformed our forecast, driven by strong underlying demand (benefiting sellout and pricing) and aided by favorable comps vs. last year's COVID-19 lows. The strength in Ad-Supported Revenue was led by our Direct and Podcast sales channels, with the latter benefiting from a triple-digit Y/Y gain at existing Spotify studios (The Ringer, Parcast, Spotify Studios, and Gimlet) along with contributions from the Megaphone acquisition, the exclusive licensing of the Joe Rogan Experience, and Higher Ground. Ad Studio grew

We are very pleased with the initial performance of the Spotify Audience Network which launched in the US in April. The rollout allowed us to increase our monetizable podcast inventory in the US by nearly 3x. Additionally, for opted-in podcast publishers we’ve seen a double digit increase in fill rates, a meaningful increase in unique advertisers, and a double digit lift in CPMs. On July 1, we expanded the Spotify Audience Network to include Australia, Canada, and the United Kingdom.

Gross Margin

Gross Margin finished at

Premium Gross Margin was

Operating Expenses

Operating Expenses totaled

Social Charges were approximately

At the end of Q2, our workforce consisted of 7,085 FTEs globally.

Product and Platform

During the quarter, we continued to increase the pace of our innovation efforts. On June 16, we soft-launched Spotify Greenroom, a redesigned version of Betty Lab’s Locker Room app, as part of our entry into the live audio space. This mobile app allows users to join or host live audio rooms, and optionally turn those conversations into podcasts. Additionally, we announced a Creator Fund bringing new exciting content to users and helping those creators get rewarded for the content they create on the platform. We expect to move to a full commercial launch of Spotify Greenroom later this year, with an initial focus on sports, pop culture, music, and entertainment.

During the quarter, we began rolling out our paid subscription platform for podcasters in the US. Additionally, as part of our Spotify Open Access platform strategy, we announced several new partnerships aimed at opening our platform to third-party paywalled content with the goal of becoming the world’s leading audio browser. On May 20, we partnered with Storytel, one of the world’s leading audiobook streaming services, to give Storytel subscribers the ability to enjoy their library of audiobooks on Spotify. On July 27, we announced more than 10 new Spotify Open Access partners -- with more to come -- all of which will be able to activate their subscriber base on Spotify while retaining full control over their content.

We continue to improve our search capability expanding our functionality to include filters and voice search making it quicker and more efficient for users to find content. Additionally, we rolled out a new version of Your Library to all Spotify mobile users that creates a streamlined way for listeners to explore their collection and find saved music and podcasts more easily.

During the quarter, we also advanced our product ubiquity efforts in a number of key areas. We introduced a new miniplayer experience that allows listeners to share, explore, and discover audio from Spotify directly within Facebook, without switching between apps. On the Apple Watch, we rolled out the capability for users to download playlists, albums, and podcasts to their watch. Finally, we expanded our video podcast footprint to Xbox gaming consoles and went live with the Spotify X1 integration to Rogers Communications customers in Canada.

Content

At the end of Q2, we had 2.9 million podcasts on the platform (up from 2.6 million at the end of Q1). The percentage of MAUs that engaged with podcast content on our platform improved modestly relative to Q1. Among MAUs that engaged with podcasts in Q2, consumption trends were strong (up

During the quarter, we announced exclusive licensing deals with Call Her Daddy and Armchair Expert, both of which are now exclusively on Spotify. The Joe Rogan Experience continues to perform above expectations, and The Ringer shows, such as The Bill Simmons Podcast, grew consumption significantly as the NBA headed into the playoffs.

Internationally, we released 100 new Originals & Exclusives (“O&E”) podcasts across markets including 5 adaptations of existing formats. We expanded Your Daily Drive to include Mexico (Ruta Diaria), Argentina (Ruta Diaria), and Brazil (Caminho Diário). The launches included bespoke content from 28 partners across the region, such as notable new organizations like Infobae and La Nación (Argentina), W Radio (Mexico), and 123 Segundos (Brazil), a Spotify original. One of the top podcasts in India, The Ranveer Show, which covers topics like health, spirituality, and lifestyle, also came exclusively to Spotify in June.

In Q2, Olivia Rodrigo’s album, SOUR, set the record for biggest streaming debut for any album on Spotify this year with over 63 million global first day streams. Other major releases in the quarter include BTS single, Butter, Griff’s Album, One Foot In Front Of The Other, and Doja Cat’s album, Planet Her. Spotify also launched a new Fresh Finds marketing program to celebrate Indie artists in the US as well as expanding the playlist via localized editions in 13 territories around the world. Fresh Finds, which first launched in 2016, has playlisted over 25,000 artists and built a reputation among users and in the industry as the go-to destination to discover new Indie acts. In addition, of artists whose first editorial playlist is Fresh Finds, over

Two-Sided Marketplace

We continue to test Discovery Mode with a small set of labels and licensors including major labels, independent labels, and independent artist distributors. Thus far, artists with tracks in Discovery Mode have found over

Sponsored Recommendations (i.e. Marquee) continued to gain traction during the second quarter as we expanded into more international markets including Australia, Ireland, New Zealand, and the UK. We also rolled out new functionality for artist teams using the self-serve platform to target specific audience segments (casual listeners, lapsed listeners, and recently interested listeners) with their campaigns, a functionality previously only available to customers purchasing through our sales team.

Free Cash Flow

Free Cash Flow was

At the end of Q2, we maintained a strong liquidity position with

Q3 & Q4 2021 OUTLOOK

The following forward-looking statements reflect Spotify’s expectations as of July 28, 2021 and are subject to substantial uncertainty. The estimates below utilize the same methodology we’ve used in prior quarters with respect to our guidance and the potential range of outcomes. Given the extraordinary operating circumstances we currently face with respect to the impact of COVID-19, there is a greater likelihood of variances with respect to those ranges than typical quarters.

Q3 2021 Guidance:

- Total MAUs: 377-382 million

- Total Premium Subscribers: 170-174 million

-

Total Revenue:

€2.31 -€2.51 billion - Assumes approximately 60 bps tailwind to growth Y/Y due to movements in foreign exchange rates

-

Gross Margin: 24.4

-26.4% -

Operating Profit/Loss:

€(80) -€0 million

Q4 2021 Guidance:

- Total MAUs: 400-407 million

- Total Premium Subscribers: 177-181 million

-

Total Revenue:

€2.48 -€2.68 billion - Assumes approximately 175 bps tailwind to growth Y/Y due to movements in foreign exchange rates

-

Gross Margin: 24.1

-26.1% -

Operating Profit/Loss:

€(152) -€(72) million

EARNINGS QUESTION & ANSWER SESSION

We will host a live question and answer session starting at 8 a.m. ET today on investors.spotify.com. Daniel Ek, our Founder and CEO, and Paul Vogel, our Chief Financial Officer, will be on hand to answer questions submitted through slido.com using the event code #SpotifyEarningsQ221. Participants also may join using the listen-only conference line by registering through the following site:

Direct Event Registration Portal: http://www.directeventreg.com/registration/event/6039475

We use investors.spotify.com and newsroom.spotify.com websites as well as other social media listed in the “Resources – Social Media” tab of our Investors website to disclose material company information.

Use of Non-IFRS Measures

To supplement our financial information presented in accordance with IFRS, we use the following non-IFRS financial measures: Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect, Ad-Supported revenue excluding foreign exchange effect, Gross margin excluding release of accruals for prior period publishing royalty estimate, Operating expense excluding foreign exchange effect, Operating expense excluding social charge, and Free Cash Flow. Management believes that Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect, Gross margin excluding release of accruals for prior period publishing royalty estimate, Operating expense excluding foreign exchange effect, Operating expense excluding social charge are useful to investors because they present measures that facilitate comparison to our historical performance. However, Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect, Ad-Supported revenue excluding foreign exchange effect, Gross margin excluding release of accruals for prior period publishing royalty estimate, Operating expense excluding foreign exchange effect, Operating expense excluding social charge, should be considered in addition to, not as a substitute for or superior to, Revenue, Premium revenue, Ad-Supported revenue, Gross margin, Operating expense or other financial measures prepared in accordance with IFRS. Management believes that Free Cash Flow is useful to investors because it presents a measure that approximates the amount of cash generated that is available to repay debt obligations, to make investments, and for certain other activities that exclude certain infrequently occurring and/or non-cash items. However, Free Cash Flow should be considered in addition to, not as a substitute for or superior to, net cash flows (used in)/from operating activities or other financial measures prepared in accordance with IFRS. For more information on these non-IFRS financial measures, please see “Reconciliation of IFRS to Non-IFRS Results” table.

Forward Looking Statements

This shareholder letter contains estimates and forward-looking statements. All statements other than statements of historical fact are forward-looking statements. The words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible,” and similar words are intended to identify estimates and forward-looking statements.

Our estimates and forward-looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or may affect our businesses and operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to numerous risks and uncertainties and are made in light of information currently available to us. Many important factors may adversely affect our results as indicated in forward-looking statements. These factors include, but are not limited to: our ability to attract prospective users and to retain existing users; competition for users, user listening time, and advertisers; risks associated with our international expansion and our ability to manage our growth; our ability to predict, recommend, and play content that our users enjoy; our ability to effectively monetize our Service; our ability to generate sufficient revenue to be profitable or to generate positive cash flow and grow on a sustained basis; risks associated with the expansion of our operations to deliver non-music content, including podcasts, including increased business, legal, financial, reputational, and competitive risks; potential disputes or liabilities associated with content made available on our Service; risks relating to the acquisition, investment, and disposition of companies or technologies; our dependence upon third-party licenses for most of the content we stream; our lack of control over the providers of our content and their effect on our access to music and other content; our ability to comply with the many complex license agreements to which we are a party; our ability to accurately estimate the amounts payable under our license agreements; the limitations on our operating flexibility due to the minimum guarantees required under certain of our license agreements; our ability to obtain accurate and comprehensive information about the compositions embodied in sound recordings in order to obtain necessary licenses or perform obligations under our existing license agreements; new copyright legislation and related regulations that may increase the cost and/or difficulty of music licensing; assertions by third parties of infringement or other violations by us of their intellectual property rights; our ability to protect our intellectual property; the dependence of streaming on operating systems, online platforms, hardware, networks, regulations, and standards that we do not control; potential breaches of our security systems or systems of third parties, including as a result of our Work From Anywhere program; interruptions, delays, or discontinuations in service in our systems or systems of third parties; changes in laws or regulations affecting us; risks relating to privacy and protection of user data; our ability to maintain, protect, and enhance our brand; payment-related risks; our ability to hire and retain key personnel, and challenges to productivity and integration as a result of our Work From Anywhere program; our ability to accurately estimate our user metrics and other estimates; risks associated with manipulation of stream counts and user accounts and unauthorized access to our services; tax-related risks; the concentration of voting power among our founders who have and will continue to have substantial control over our business; risks related to our status as a foreign private issuer; international, national or local economic, social or political conditions; risks associated with accounting estimates, currency fluctuations and foreign exchange controls; and the impact of the COVID-19 pandemic on our business and operations, including any adverse impact on advertising sales or subscriber revenue; risks related to our debt, including limitations on our cash flow for operations and our ability to satisfy our obligations under the Exchangeable Notes; our ability to raise the funds necessary to repurchase the Exchangeable Notes for cash, under certain circumstances, or to pay any cash amounts due upon exchange; provisions in the indenture governing the Exchangeable Notes delaying or preventing an otherwise beneficial takeover of us; and any adverse impact on our reported financial condition and results from the accounting methods for the Exchangeable Notes. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from our estimates and forward-looking statements is included in our filings with the U.S. Securities and Exchange Commission (“SEC”), including our Annual Report on Form 20-F filed with the SEC on February 5, 2021, as updated by subsequently filed reports for our interim results on Form 6-K. We undertake no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this shareholder letter.

Rounding

Certain monetary amounts, percentages, and other figures included in this letter have been subject to rounding adjustments. The sum of individual metrics may not always equal total amounts indicated due to rounding.

Interim condensed consolidated statement of operations

(Unaudited)

(in € millions, except share and per share data)

|

|

Three months ended |

|

Six months ended |

|||||||||

|

|

June 30, 2021 |

|

March 31, 2021 |

|

June 30, 2020 |

|

June 30, 2021 |

|

June 30, 2020 |

|||

Revenue |

|

2,331 |

|

|

2,147 |

|

|

1,889 |

|

|

4,478 |

|

3,737 |

Cost of revenue |

|

1,668 |

|

|

1,599 |

|

|

1,410 |

|

|

3,267 |

|

2,786 |

Gross profit |

|

663 |

|

|

548 |

|

|

479 |

|

|

1,211 |

|

951 |

Research and development |

|

255 |

|

|

196 |

|

|

267 |

|

|

451 |

|

429 |

Sales and marketing |

|

279 |

|

|

236 |

|

|

248 |

|

|

515 |

|

479 |

General and administrative |

|

117 |

|

|

102 |

|

|

131 |

|

|

219 |

|

227 |

|

|

651 |

|

|

534 |

|

|

646 |

|

|

1,185 |

|

1,135 |

Operating income/(loss) |

|

12 |

|

|

14 |

|

|

(167) |

|

|

26 |

|

(184) |

Finance income |

|

21 |

|

|

104 |

|

|

6 |

|

|

125 |

|

76 |

Finance costs |

|

(25) |

|

|

(31) |

|

|

(294) |

|

|

(56) |

|

(306) |

Finance income/(costs) - net |

|

(4) |

|

|

73 |

|

|

(288) |

|

|

69 |

|

(230) |

Income/(loss) before tax |

|

8 |

|

|

87 |

|

|

(455) |

|

|

95 |

|

(414) |

Income tax expense/(benefit) |

|

28 |

|

|

64 |

|

|

(99) |

|

|

92 |

|

(59) |

Net (loss)/income attributable to owners of the parent |

|

(20) |

|

|

23 |

|

|

(356) |

|

|

3 |

|

(355) |

(Loss)/earnings per share attributable to owners of the

|

|

|

|

|

|

|

|

|

|

|

|||

Basic |

|

(0.10) |

|

0.12 |

|

(1.91) |

|

0.02 |

|

(1.91) |

|||

Diluted |

|

(0.19) |

|

(0.25) |

|

(1.91) |

|

(0.44) |

|

(1.91) |

|||

Weighted-average ordinary shares outstanding |

|

|

|

|

|

|

|

|

|

|

|||

Basic |

|

191,172,946 |

|

190,565,397 |

|

186,552,877 |

|

190,870,850 |

|

185,799,600 |

|||

Diluted |

|

194,084,446 |

|

191,815,695 |

|

186,552,877 |

|

193,051,280 |

|

185,799,600 |

|||

Condensed consolidated statement of financial position

(Unaudited)

(in € millions)

|

|

June 30, 2021 |

|

December 31, 2020 |

||

Assets |

|

|

|

|

||

Non-current assets |

|

|

|

|

||

Lease right-of-use assets |

|

441 |

|

|

444 |

|

Property and equipment |

|

351 |

|

|

313 |

|

Goodwill |

|

851 |

|

|

736 |

|

Intangible assets |

|

95 |

|

|

97 |

|

Long term investments |

|

1,897 |

|

|

2,277 |

|

Restricted cash and other non-current assets |

|

78 |

|

|

78 |

|

Deferred tax assets |

|

17 |

|

|

15 |

|

|

|

3,730 |

|

|

3,960 |

|

Current assets |

|

|

|

|

||

Trade and other receivables |

|

492 |

|

|

464 |

|

Income tax receivable |

|

6 |

|

|

4 |

|

Short term investments |

|

612 |

|

|

596 |

|

Cash and cash equivalents |

|

2,440 |

|

|

1,151 |

|

Other current assets |

|

201 |

|

|

151 |

|

|

|

3,751 |

|

|

2,366 |

|

Total assets |

|

7,481 |

|

|

6,326 |

|

Equity and liabilities |

|

|

|

|

||

Equity |

|

|

|

|

||

Share capital |

|

— |

|

|

— |

|

Other paid in capital |

|

4,656 |

|

|

4,583 |

|

Treasury shares |

|

(171 |

) |

|

(175 |

) |

Other reserves |

|

1,501 |

|

|

1,687 |

|

Accumulated deficit |

|

(3,287 |

) |

|

(3,290 |

) |

Equity attributable to owners of the parent |

|

2,699 |

|

|

2,805 |

|

Non-current liabilities |

|

|

|

|

||

Exchangeable Notes |

|

1,199 |

|

|

— |

|

Lease liabilities |

|

576 |

|

|

577 |

|

Accrued expenses and other liabilities |

|

36 |

|

|

42 |

|

Provisions |

|

2 |

|

|

2 |

|

|

|

1,813 |

|

|

621 |

|

Current liabilities |

|

|

|

|

||

Trade and other payables |

|

705 |

|

|

638 |

|

Income tax payable |

|

11 |

|

|

9 |

|

Deferred revenue |

|

439 |

|

|

380 |

|

Accrued expenses and other liabilities |

|

1,707 |

|

|

1,748 |

|

Provisions |

|

20 |

|

|

20 |

|

Derivative liabilities |

|

87 |

|

|

105 |

|

|

|

2,969 |

|

|

2,900 |

|

Total liabilities |

|

4,782 |

|

|

3,521 |

|

Total equity and liabilities |

|

7,481 |

|

|

6,326 |

|

Interim condensed consolidated statement of cash flows

(Unaudited)

(in € millions)

|

|

Three months ended |

|

Six months ended |

||||||||||||||

|

|

June 30,

|

|

March 31,

|

|

June 30,

|

|

June 30,

|

|

June 30,

|

||||||||

Operating activities |

|

|

|

|

|

|

|

|

|

|

||||||||

Net (loss)/income |

|

(20 |

) |

|

|

23 |

|

|

|

(356 |

) |

|

|

3 |

|

|

(355 |

) |

Adjustments to reconcile net (loss)/income to net cash flows |

|

|

|

|

|

|

|

|

|

|

||||||||

Depreciation of property and equipment and lease right-of-use assets |

|

23 |

|

|

|

22 |

|

|

|

23 |

|

|

|

45 |

|

|

44 |

|

Amortization of intangible assets |

|

8 |

|

|

|

8 |

|

|

|

5 |

|

|

|

16 |

|

|

10 |

|

Share-based payments expense |

|

68 |

|

|

|

48 |

|

|

|

50 |

|

|

|

116 |

|

|

87 |

|

Finance income |

|

(21 |

) |

|

|

(104 |

) |

|

|

(6 |

) |

|

|

(125 |

) |

|

(76 |

) |

Finance costs |

|

25 |

|

|

|

31 |

|

|

|

294 |

|

|

|

56 |

|

|

306 |

|

Income tax expense/(benefit) |

|

28 |

|

|

|

64 |

|

|

|

(99 |

) |

|

|

92 |

|

|

(59 |

) |

Other |

|

3 |

|

|

|

2 |

|

|

|

2 |

|

|

|

5 |

|

|

6 |

|

Changes in working capital: |

|

|

|

|

|

|

|

|

|

|

||||||||

(Increase)/decrease in trade receivables and other assets |

|

(95 |

) |

|

|

15 |

|

|

|

(39 |

) |

|

|

(80 |

) |

|

(17 |

) |

Increase/(decrease) in trade and other liabilities |

|

30 |

|

|

|

(67 |

) |

|

|

151 |

|

|

|

(37 |

) |

|

88 |

|

Increase in deferred revenue |

|

17 |

|

|

|

37 |

|

|

|

34 |

|

|

|

54 |

|

|

30 |

|

Decrease in provisions |

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

(1 |

) |

Interest paid on lease liabilities |

|

(13 |

) |

|

|

(11 |

) |

|

|

(15 |

) |

|

|

(24 |

) |

|

(30 |

) |

Interest received |

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

3 |

|

Income tax paid |

|

(1 |

) |

|

|

(2 |

) |

|

|

(5 |

) |

|

|

(3 |

) |

|

(6 |

) |

Net cash flows from operating activities |

|

54 |

|

|

|

65 |

|

|

|

39 |

|

|

|

119 |

|

|

30 |

|

Investing activities |

|

|

|

|

|

|

|

|

|

|

||||||||

Business combinations, net of cash acquired |

|

(42 |

) |

|

|

(59 |

) |

|

|

— |

|

|

|

(101 |

) |

|

(137 |

) |

Purchases of property and equipment |

|

(20 |

) |

|

|

(24 |

) |

|

|

(14 |

) |

|

|

(44 |

) |

|

(26 |

) |

Purchases of short term investments |

|

(109 |

) |

|

|

(115 |

) |

|

|

(145 |

) |

|

|

(224 |

) |

|

(643 |

) |

Sales and maturities of short term investments |

|

134 |

|

|

|

90 |

|

|

|

242 |

|

|

|

224 |

|

|

719 |

|

Change in restricted cash |

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

2 |

|

Other |

|

(2 |

) |

|

|

(6 |

) |

|

|

(7 |

) |

|

|

(8 |

) |

|

(21 |

) |

Net cash flows (used in)/from investing activities |

|

(39 |

) |

|

|

(114 |

) |

|

|

78 |

|

|

|

(153 |

) |

|

(106 |

) |

Financing activities |

|

|

|

|

|

|

|

|

|

|

||||||||

Payments of lease liabilities |

|

(8 |

) |

|

|

(8 |

) |

|

|

(6 |

) |

|

|

(16 |

) |

|

(10 |

) |

Proceeds from exercise of stock options |

|

26 |

|

|

|

51 |

|

|

|

101 |

|

|

|

77 |

|

|

178 |

|

Proceeds from issuance of Exchangeable Notes, net of costs |

|

— |

|

|

|

1,223 |

|

|

|

— |

|

|

|

1,223 |

|

|

— |

|

Payments for employee taxes withheld from restricted stock unit releases |

|

(12 |

) |

|

|

(16 |

) |

|

|

(5 |

) |

|

|

(28 |

) |

|

(8 |

) |

Net cash flows from financing activities |

|

6 |

|

|

|

1,250 |

|

|

|

90 |

|

|

|

1,256 |

|

|

167 |

|

Net increase in cash and cash equivalents |

|

21 |

|

|

|

1,201 |

|

|

|

207 |

|

|

|

1,222 |

|

|

91 |

|

Cash and cash equivalents at beginning of the period |

|

2,442 |

|

|

|

1,151 |

|

|

|

951 |

|

|

|

1,151 |

|

|

1,065 |

|

Net exchange (losses)/gains on cash and cash equivalents |

|

(23 |

) |

|

|

90 |

|

|

|

(10 |

) |

|

|

67 |

|

|

(8 |

) |

Cash and cash equivalents at period end |

|

2,440 |

|

|

|

2,442 |

|

|

|

1,148 |

|

|

|

2,440 |

|

|

1,148 |

|

Calculation of basic and diluted (loss)/earnings per share

(Unaudited)

(in € millions, except share and per share data)

|

|

Three months ended |

|

Six months ended |

||||||||||||||

|

|

June 30, 2021 |

|

March 31, 2021 |

|

June 30, 2020 |

|

June 30, 2021 |

|

June 30, 2020 |

||||||||

Basic (loss)/earnings per share |

|

|

|

|

|

|

|

|

|

|

||||||||

Net (loss)/income attributable to owners of the parent |

|

(20 |

) |

|

|

23 |

|

|

|

(356 |

) |

|

|

3 |

|

|

(355 |

) |

Share used in computation: |

|

|

|

|

|

|

|

|

|

|

||||||||

Weighted-average ordinary shares outstanding |

|

191,172,946 |

|

|

|

190,565,397 |

|

|

|

186,552,877 |

|

|

|

190,870,850 |

|

|

185,799,600 |

|

Basic (loss)/earnings per share attributable to

|

|

(0.10 |

) |

|

|

0.12 |

|

|

|

(1.91 |

) |

|

|

0.02 |

|

|

(1.91 |

) |

|

|

|

|

|

|

|

|

|

|

|

||||||||

Diluted loss per share |

|

|

|

|

|

|

|

|

|

|

||||||||

Net (loss)/income attributable to owners of the parent |

|

(20 |

) |

|

|

23 |

|

|

|

(356 |

) |

|

|

3 |

|

|

(355 |

) |

Fair value gains on Exchangeable Notes |

|

(17 |

) |

|

|

(49 |

) |

|

|

— |

|

|

|

(66 |

) |

|

|

|

Fair value gains on dilutive warrants |

|

— |

|

|

|

(22 |

) |

|

|

— |

|

|

|

(21 |

) |

|

— |

|

Net loss used in the computation of diluted

|

|

(37 |

) |

|

|

(48 |

) |

|

|

(356 |

) |

|

|

(84 |

) |

|

(355 |

) |

Shares used in computation: |

|

|

|

|

|

|

|

|

|

|

||||||||

Weighted-average ordinary shares outstanding |

|

191,172,946 |

|

|

|

190,565,397 |

|

|

|

186,552,877 |

|

|

|

190,870,850 |

|

|

185,799,600 |

|

Exchangeable Notes |

|

2,911,500 |

|

|

|

938,150 |

|

|

|

— |

|

|

|

1,919,670 |

|

|

— |

|

Warrants |

|

— |

|

|

|

312,148 |

|

|

|

— |

|

|

|

260,760 |

|

|

— |

|

Diluted weighted-average ordinary shares |

|

194,084,446 |

|

|

|

191,815,695 |

|

|

|

186,552,877 |

|

|

|

193,051,280 |

|

|

185,799,600 |

|

Diluted loss per share attributable to

|

|

(0.19 |

) |

|

|

(0.25 |

) |

|

|

(1.91 |

) |

|

|

(0.44 |

) |

|

(1.91 |

) |

Reconciliation of IFRS to Non-IFRS Results

(Unaudited)

(in € millions, except percentages)

|

|

Three months ended |

|

Six months ended |

||||||||

|

|

June 30, 2021 |

|

June 30, 2020 |

|

June 30, 2021 |

|

June 30, 2020 |

||||

IFRS revenue |

|

2,331 |

|

|

1,889 |

|

|

4,478 |

|

|

3,737 |

|

Foreign exchange effect on 2021 revenue using 2020 rates |

|

(81) |

|

|

|

|

(195) |

|

|

|

||

Revenue excluding foreign exchange effect |

|

2,412 |

|

|

|

|

4,673 |

|

|

|

||

IFRS revenue year-over-year change % |

|

23 |

% |

|

|

|

20 |

% |

|

|

||

Revenue excluding foreign exchange effect year-over-year change % |

|

28 |

% |

|

|

|

25 |

% |

|

|

||

IFRS Premium revenue |

|

2,056 |

|

|

1,758 |

|

|

3,987 |

|

|

3,458 |

|

Foreign exchange effect on 2021 Premium revenue using 2020 rates |

|

(60) |

|

|

|

|

(158) |

|

|

|

||

Premium revenue excluding foreign exchange effect |

|

2,116 |

|

|

|

|

4,145 |

|

|

|

||

IFRS Premium revenue year-over-year change % |

|

17 |

% |

|

|

|

15 |

% |

|

|

||

Premium revenue excluding foreign exchange effect year-over-year change % |

|

20 |

% |

|

|

|

20 |

% |

|

|

||

IFRS Ad-Supported revenue |

|

275 |

|

|

131 |

|

|

491 |

|

|

279 |

|

Foreign exchange effect on 2021 Ad-Supported revenue using 2020 rates |

|

(21) |

|

|

|

|

(37) |

|

|

|

||

Ad-Supported revenue excluding foreign exchange effect |

|

296 |

|

|

|

|

528 |

|

|

|

||

IFRS Ad-Supported revenue year-over-year change % |

|

110 |

% |

|

|

|

76 |

% |

|

|

||

Ad-Supported revenue excluding foreign exchange effect year-over-year change % |

|

126 |

% |

|

|

|

89 |

% |

|

|

||

Gross Margin

(Unaudited)

(in € millions, except percentages)

|

|

Three months ended

|

|

Revenue |

|

2,331 |

|

Cost of revenue |

|

1,668 |

|

IFRS Gross Profit |

|

663 |

|

IFRS Gross Margin |

|

28.4 |

% |

Adjustments: |

|

|

|

Prior period publishing royalty estimate |

|

45 |

|

Non-IFRS Gross Profit |

|

618 |

|

Non-IFRS Gross Margin |

|

26.5 |

% |

Operating Expenses

(Unaudited)

(in € millions, except percentages)

|

Three months ended |

||||||

|

|

June 30, 2021 |

|

June 30, 2020 |

|

||

IFRS Operating Expenses |

|

651 |

|

|

646 |

|

|

Foreign exchange effect on 2021 operating expenses using 2020 rates |

|

(27) |

|

|

|

|

|

Operating Expenses excluding foreign exchange effect |

|

678 |

|

|

|

|

|

IFRS Operating expense year-over-year change % |

|

1 |

% |

|

|

|

|

Operating expenses excluding foreign exchange effect year-over-year change % |

|

5 |

% |

|

|

|

|

Free Cash Flow

(Unaudited)

(in € millions)

|

|

Three months ended |

|

Six months ended |

||||||||||||||

|

|

June 30, 2021 |

|

March 31, 2021 |

|

June 30, 2020 |

|

June 30, 2021 |

|

June 30, 2020 |

||||||||

Net cash flows from operating activities |

|

54 |

|

|

|

65 |

|

|

|

39 |

|

|

|

119 |

|

|

30 |

|

Capital expenditures |

|

(20 |

) |

|

|

(24 |

) |

|

|

(14 |

) |

|

|

(44 |

) |

|

(26 |

) |

Change in restricted cash |

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

2 |

|

Free Cash Flow |

|

34 |

|

|

|

41 |

|

|

|

27 |

|

|

|

75 |

|

|

6 |

|

1Free Cash Flow is a non-IFRS measure. See “Use of Non-IFRS Measures” and “Reconciliation of IFRS to Non-IFRS Results” for additional information.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210728005343/en/