S&P Global Market Intelligence Outlook Projects New Trade Patterns in the Aftermath of Russia-Ukraine Conflict

The S&P Global Market Intelligence report forecasts significant trade shifts in 2023 due to the Russia-Ukraine conflict. India emerges as a key trade partner for Russia, with over 100% year-on-year increase in imports since February 2022. The report predicts a 3.5% increase in India's export trade and a 1.3% rise in imports. Global containerized trade is also expected to grow by 3.2% in 2023. However, the International Maritime Organization's new greenhouse gas measures may slow down trade growth and increase logistics costs.

- India's import trade from Russia has more than doubled, reflecting strong bilateral trade relations.

- Forecasts suggest a 3.5% growth in India's export trade and 1.3% growth in imports in 2023.

- Global containerized trade is projected to increase by 3.2% year-on-year in 2023.

- China's economic slowdown adds uncertainty to its import forecasts from Russia.

- New IMO regulations may increase logistics costs and marginally slow global trade growth.

NEW YORK, Nov. 7, 2022 /PRNewswire/ -- In the wake of significant bilateral trade volatility between Russia and nearly all markets due to the war in Ukraine, India has emerged as a strong trade partner of Russia and is expected to remain so in 2023, according to a new S&P Global Market Intelligence report released today. The newly published 2023 Global Trade Outlook is part of S&P Global Market Intelligence's Big Picture 2023 Outlook Report Series.

The new report highlights the anticipated shifts in trade due to the Russia–Ukraine conflict as well as positive outlook for containerized trade in 2023 despite a mere

"The trade value of total imports from Russia has increased in recent months, primarily due to rising oil, gas and coal prices, as well as spikes in Russian imports by several countries. This group is led by India, which noted a greater than

Key highlights from the report include:

- Global shifts in trade: India is forecast to see an acceleration in trade in 2023, thanks to its significant increase in imports from Russia. Its trade value is projected to increase by

3.5% y/y in exports and by1.3% y/y in imports, while its trade volume is projected to grow3.8% y/y and7.3% y/y, respectively. - Mainland China is expected to be the biggest importer from Russia in 2023, followed by Turkey, Belarus and Kazakhstan. However, China's current economic slowdown adds considerable uncertainty to the outlook. Western trading partners will lose their significance in Russia's trade turnover. This trend will become even more visible if Russia cuts gas supplies to Europe in the winter of 2022–23.

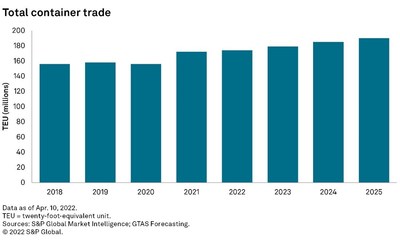

- Containerized trade outlook: S&P Global Market Intelligence's Global Trade Analytics Suite (GTAS) forecasting projects containerized trade to increase by

3.2% y/y in 2023, following a0.7% y/y growth in 2022. - U.S. container imports is forecast to grow

5.9% y/y in 2022 and4.2% y/y in 2023. With U.S. warehouses being full, major carriers started removing capacity on the Asia-US trade lane, although not yet on a massive scale. With no peak season this year, carriers will take out a significant amount of capacity to protect and boost their rates. - With mainland China's containerized exports accounting for more than

50% of its total exports, this type of cargo should face significant long-term impacts from the country's economic challenges, a situation not expected to change anytime soon. - IMO decarbonization goals: Beginning January 1, 2023, the maritime industry, which is highly dependent on fossil fuels, will have to comply with the new short-term greenhouse gas reduction measures implemented by the IMO. This will likely result in higher average increase in maritime logistics costs and a slowdown, albeit marginally, in global trade and economic growth.

To request a copy of the 2023 Global Trade Outlook, please contact pressinquiries.mi@spglobal.com.

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

SungHa Park

S&P Global Market Intelligence

+82 2 6001 3128

sungha.park@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-outlook-projects-new-trade-patterns-in-the-aftermath-of-russiaukraine-conflict-301670329.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-outlook-projects-new-trade-patterns-in-the-aftermath-of-russiaukraine-conflict-301670329.html

SOURCE S&P Global Market Intelligence