S&P Global Market Intelligence Global Bank Ranking Reveals World's Largest Banks Unscathed by COVID-19 Pandemic

The latest Global Bank Ranking by S&P Global Market Intelligence shows that the largest banks in the Asia Pacific have maintained their dominance in 2020 despite the COVID-19 pandemic. The top five banks, including Industrial & Commercial Bank of China and Mitsubishi UFJ Financial Group, remain unchanged. China's banks benefited from a quicker economic recovery, with assets increasing by 17.66% to $30.458 trillion. Notably, JPMorgan Chase regained its position as the sixth-largest bank, while HSBC dropped to eighth.

- China's banks saw a 17.66% increase in assets, totaling $30.458 trillion.

- JPMorgan Chase reported a 26% increase in assets, reclaiming the sixth position.

- BNP Paribas advanced to the seventh position with a 26.8% asset increase.

- HSBC Holdings PLC dropped to the eighth position with assets of $2.984 trillion.

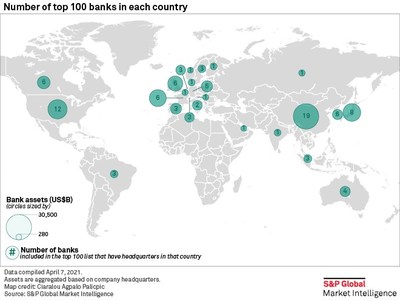

NEW YORK, April 21, 2021 /PRNewswire/ -- Largest banks in Asia Pacific continue to dominate the world's biggest banks in 2020, according to the latest Global Bank Ranking published by S&P Global Market Intelligence, an annual ranking of the 100 largest banks in the world in terms of total assets.

The top five institutions in the ranking, which include Industrial & Commercial Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd., Bank of China Ltd., and Japan's Mitsubishi UFJ Financial Group Inc., remained unchanged from the year before.

"China's banks benefitted from a much swifter economic recovery from the COVID-19 downturn than experienced by other geographies in 2020," said Nathan Stovall, Principal Analyst at S&P Global Market Intelligence. "China's economy returned to pre-pandemic levels by the fourth quarter of last year, while other major developed economies have still not achieved that feat."

"The pace of future vaccinations and efforts to control the COVID-19 in 2021 will play a major role in shaping the operating environment for respective banks across the globe. Banks operating in economies that are poised to reopen sooner will have a leg up on other institutions that remain embattled by the pandemic," Stovall added.

Driven by strong credit growth, China continues to house the greatest number of top 100 banks, with 19 institutions collectively holding assets worth

Among the most notable movements this year, U.S.-based JPMorgan Chase & Co. reclaimed its place as the world's sixth-largest financial institution, overtaking U.K.-based HSBC Holdings PLC after reporting a

French BNP Paribas SA advanced two spots to become the world's No. 7 after posting a

This year's ranking includes two newcomers to the list: U.S.-based State Street Corp. which took the No. 94 spot with

Regional rankings from the Global Bank Ranking series will also be available in the coming weeks:

- Top 50 U.S.

- Top 50 Europe

- Top 50 Asia-Pacific

- Top 50 Latin America & Caribbean

- Top 30 Africa and the Middle East

To access the Top 100 list, or any of the regional bank rankings, please contact pressinquiries.mi@spglobal.com.

Note to Editors

Company assets were adjusted on a best-efforts basis for pending mergers, acquisitions and divestitures, as well as M&A deals that closed after the end of the reporting period through March 31. Assets reported by non-U.S. dollar filers were converted to dollars using period-end exchange rates. Total assets were taken on an "as-reported" basis and no adjustments are made to account for differing accounting standards.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities around the world use this essential intelligence to make business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), the world's foremost provider of credit ratings, benchmarks and analytics in the global capital and commodity markets, offering ESG solutions, deep data and insights on critical business factors. S&P Global has been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Vivian Liu

S&P Global Market Intelligence

P. +852 91791132

E. Vivian.Liu@spglobal.com

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/sp-global-market-intelligence-global-bank-ranking-reveals-worlds-largest-banks-unscathed-by-covid-19-pandemic-301273132.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/sp-global-market-intelligence-global-bank-ranking-reveals-worlds-largest-banks-unscathed-by-covid-19-pandemic-301273132.html

SOURCE S&P Global Market Intelligence

FAQ

What is the S&P Global Market Intelligence Global Bank Ranking for 2020?

Which banks are the top five in the Global Bank Ranking?

How much did JPMorgan Chase's assets increase in 2020?

What was the asset growth percentage for BNP Paribas in 2020?