S&P Global Market Intelligence 2023 Outlook Sees Energy Transition Picking Up Pace and Helping Key Metals Markets Overcome Economic Headwinds as Burgeoning Demand Outstrips Supply

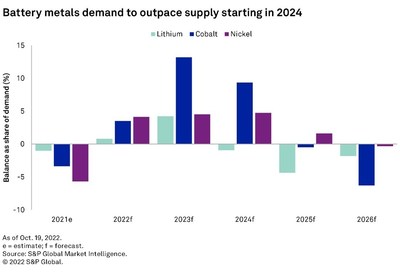

S&P Global Market Intelligence's 2023 Electric, Natural Gas and Water Utilities Outlook predicts a challenging yet promising future for commodities prices, particularly in metals like copper and lithium. The report highlights that the Inflation Reduction Act will boost U.S. renewable energy capacity by 150GW, driving demand for key materials amid a projected drop in commodity prices for 2023. As electric vehicle demand grows nearly 30% annually, supply is expected to lag behind consumption, leading to potential shortages by 2024, impacting investors and utility sectors significantly.

- Inflation Reduction Act expected to add 150GW of renewable energy capacity in the U.S.

- Increasing global demand for electric vehicles projected to rise almost 30% annually through 2026.

- Average commodity prices in 2023 expected to drop 7% for copper and up to 33% for lithium compared to 2022.

- Potential 10%-20% decrease in global exploration budgets for 2023 as investors pull back.

NEW YORK, Nov. 4, 2022 /PRNewswire/ -- Commodities prices for key metals will be battered by the storms buffeting the global economy through much of 2023 but are well positioned to rise through the clouds in the longer term as the energy transition continues apace, according to a new S&P Global Market Intelligence report released today. The newly published 2023 Electric, Natural Gas and Water Utilities Outlook is part of S&P Global Market Intelligence's Big Picture 2023 Outlook Report series.

With the recently passed Inflation Reduction Act set to increase U.S. renewable energy generation capacity by around 150GW in the coming years and electric vehicle demand set to increase almost

"The Inflation Reduction Act is providing a rosy outlook for renewable energy development in the U.S., while the energy transition taking place across much of the globe will see demand for the key raw materials such as lithium, nickel and copper start to exceed supply in the years ahead," said Richard Sansom, Research Director at S&P Global Commodity Insights.

Key findings of the report include:

- The Inflation Reduction Act (IRA) is expected to drive the addition of 150GW of additional renewable energy capacity in the U.S. in coming years, providing for support for wind, solar and storage projects.

- The IRA has come at a time when regulators are facing a challenging confluence of events, with utilities in the midst of a prolonged period of aggressive capital spending on infrastructure, the lingering impacts of the COVID-19 pandemic, more frequent and severe weather events, the war in Ukraine, and rising interest rates and inflation combining to drive historical levels of rate case activity.

- Federal legislation designed to support decarbonization initiatives is expected to attract substantial interest from utility investors in the coming years, but regulatory support, in the form of adequate returns on equity and ample cost recovery opportunities, is necessary to ensure that capital continues to flow to the sector.

- With global economic conditions taking center stage, 2023 industrial commodities prices covered by S&P Global Market Intelligence's Commodities Briefing Service are set to average lower than in 2022, with a year-over-year drop ranging from

7% for copper to33% for lithium. - Growing energy transition and electric vehicle demand for key battery and materials means consumption will outstrip the mining industry's ability to ramp up supply, resulting in commodity deficits as early as 2024. Addressing ESG concerns while allowing development of new mines crucial to those efforts, will require accommodations among all stakeholders.

- High metals prices entering 2022 contributed to global exploration budgets rising

16% for the year, but investors have since shied away from mining companies as metals prices retreated; should this trend continue, S&P Global Market Intelligence expect a10% -20% decrease in the global exploration budget for 2023.

To request a copy of the 2023 Electric, Natural Gas and Water Utilities Industry Outlook, please contact pressinquiries.mi@spglobal.com.

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Amanda Oey

S&P Global Market Intelligence

+1 212-438-1904

amanda.oey@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-2023-outlook-sees-energy-transition-picking-up-pace-and-helping-key-metals-markets-overcome-economic-headwinds-as-burgeoning-demand-outstrips-supply-301668176.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-2023-outlook-sees-energy-transition-picking-up-pace-and-helping-key-metals-markets-overcome-economic-headwinds-as-burgeoning-demand-outstrips-supply-301668176.html

SOURCE S&P Global Market Intelligence