S&P Global Market Intelligence 2023 financial institutions outlook says Fed's efforts to tame inflation proves double-edged sword

The 2023 Financial Institutions Industry Outlook report by S&P Global Market Intelligence discusses the impact of rising interest rates on the financial sector. The report indicates that while higher rates benefit bank margins, they also raise concerns about loan losses and a potential recession. Key insights include predicted bank margin increases to 2.77% in 2022 and expectations for credit costs to normalize in 2023. Additionally, inflation will likely affect underwriting profitability in property and casualty insurance, while fintech startups face capital access challenges due to the changing economic landscape.

- Bank margins expected to increase by 27 basis points to 2.77% in 2022 and further to 2.79% in 2023.

- Higher interest rates are projected to support profits for many financial institutions.

- Rising interest rates and inflation have heightened recession fears and potential loan losses for banks.

- Property and casualty insurers may see underwriting profitability decline, impacting the market.

NEW YORK, Oct. 31, 2022 /PRNewswire/ -- Financial institutions have looked forward to the return of a higher interest rate environment for some time, but the swift pace of rate increase by the Federal Reserve has sparked recessionary fears and turmoil in the markets, according to a new S&P Global Market Intelligence report released today. The newly published, 2023 Financial Institutions Industry Outlook, is part of S&P Global Market Intelligence's Big Picture 2023 Outlook Report Series.

The new report finds the return of higher interest rates is welcomed by many financial institutions but brings its share of risks as well. Higher rates and elevated inflation have raised fears of potential recession and the prospect of notably higher loan losses for banks, slower growth for life insurers, risks to downside for the property and casualty insurance space and much greater demands from investors supporting fintech startups. Higher rates are generally positive for U.S. banks and the U.S. life and annuity industry, but elevated inflation threatens banks' credit quality, property and casualty insurers' underwriting profitability and the related market volatility presents challenges to life insurers and has forced fintech startups to shift their focus from growth to achieving profitability.

"U.S. financial institutions waited for the return of higher rates with bated breath after several years of pandemic-era policies pressured investment yields but persistently high inflation and sharp rate hikes by the Fed have proved a double-edged sword," said Nathan Stovall, principal research analyst at S&P Global Market Intelligence. "Higher rates support profits for many financial institutions but the abrupt end to free money could put pressure on their customers and has already reduced access to capital for some startups."

Key highlights from the report include:

- Higher interest rates will push U.S. bank margins notably higher in 2022. S&P Global Market Intelligence expect banks' margins to expand by 27 basis points in 2022 to

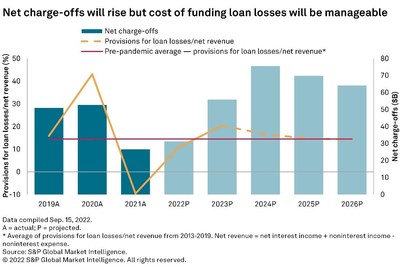

2.77% and then climb modestly higher to2.79% in 2023. - Higher rates and elevated inflation have also raised recessionary fears and the prospect of notably higher loan losses for U.S. banks. Credit costs are expected to normalize in 2023 and prevent earnings from growing from year-ago levels but believe that losses will be manageable.

- Inflationary pressures on some U.S. property and casualty business lines in 2022 will set the stage for continued outsized written premium growth in 2023 even in the context of an economic downturn. In the meantime, S&P Global Market Intelligence expect those pressures will lead to the industry posting a calendar-year combined ratio for 2022 in excess of

100% for the first time since 2017. - Rising interest rates have fueled especially strong expansion in individual fixed deferred and indexed annuities in 2022. But S&P Global Market Intelligence expect overall life, annuity and accident-and-health premiums and considerations to grow at a considerably slower pace in 2023, with a projected rate that is less than half of our 2022 estimate of

6.4% .

To request a copy of the 2023 Financial Institutions Industry Outlook, please contact pressinquiries.mi@spglobal.com.

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Katherine Smith

S&P Global Market Intelligence

+1 781-301-9311

katherine.smith@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-2023-financial-institutions-outlook-says-feds-efforts-to-tame-inflation-proves-double-edged-sword-301663316.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-2023-financial-institutions-outlook-says-feds-efforts-to-tame-inflation-proves-double-edged-sword-301663316.html

SOURCE S&P Global Market Intelligence