S&P Global Mobility: July sales to realize bounce from June impacts

Rhea-AI Summary

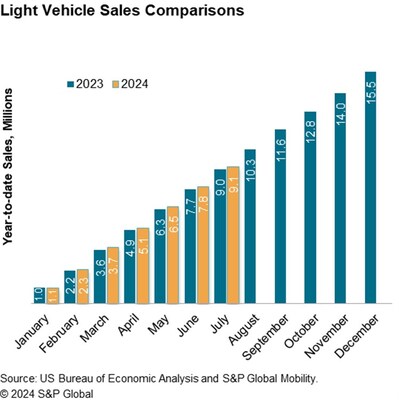

S&P Global Mobility projects new light vehicle sales in July 2024 to reach 1.32 million units, up 1% year-over-year. This translates to an estimated sales pace of 16.4 million units (SAAR), the highest since May 2021. The boost is attributed to delayed purchases from June's dealer management software cyberattack.

Despite one less selling day, July sales are expected to match June's. The two-month average SAAR for June-July aligns with April-May levels, indicating mild progression as rising inventory and incentives alleviate affordability concerns. However, mixed signals persist for H2 2024.

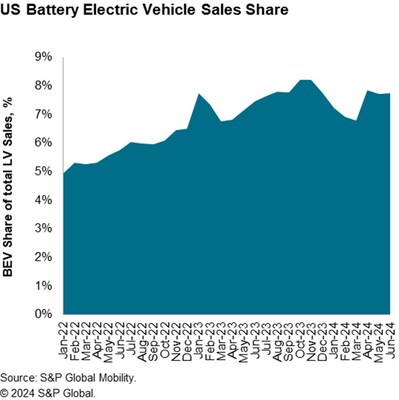

Inventory continues to rise, up 1.8% from May and 57% from last June. Battery-electric vehicle (BEV) share is expected to reach 7.8% in July, with further growth anticipated due to new model releases.

Positive

- New light vehicle sales projected to increase 1% year-over-year in July 2024

- Estimated sales pace of 16.4 million units (SAAR), highest since May 2021

- Inventory levels continue to rise, up 57% compared to last June

- BEV market share expected to reach 7.8% in July, with further growth anticipated

Negative

- Persistent new vehicle affordability concerns

- Some automakers struggling to balance sales, production, inventory, and incentive targets

- North American light vehicle production outlook scaled back for the remainder of the year

News Market Reaction 1 Alert

On the day this news was published, SPGI declined 2.80%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Given the shift of delayed new vehicle purchases which stemmed from the dealer management software cyberattack, the pace of sales in July is expected to realize a notable boost

"As a result of delayed transactions from the June auto dealer cyberattacks, even with one less selling day than June 2024, auto sales volume in July is expected to essentially match the month-prior result," said Chris Hopson, principal analyst at S&P Global Mobility. "When averaged together, the two-month SAAR level of June and July would be very similar to the respective readings of April (15.8M) and May (15.9M), which were progressing mildly as rising inventory and incentive levels continue to help alleviate some new vehicle affordability pinch points. Mixed signals regarding the outlook for the second half of the year remain entrenched though, as new vehicle affordability concerns remain prevalent, and inventories are not expected to advance as strongly as they have done over the past 12 months."

On the supply side of the equation, with pockets of automakers reaching inventory saturation points given the current pace of sales, there are expected to be some interesting dynamics in the short-term production outlook. "Some automakers are struggling to balance their sales, production, inventory and incentive targets as the market returns to more normal dynamics than what occurred from 2020-2023," said Joe Langley, associate director at S&P Global Mobility. "Our North American light vehicle production outlook for the remainder of this year has been scaled back as automakers attempt to manage these factors."

According to Matt Trommer, associate director, S&P Global Mobility, "Analysis of June retail advertised inventory data in the US finds that inventory continues to rise. Available retail advertised inventory at the end of June continued to grow, up

US Light Vehicle Sales | ||||

July 24 (Est) | Jun 24 | July 23 | ||

Total Light Vehicle | Units, NSA | 1,321,000 | 1,321,932 | 1,299.271 |

In millions, SAAR | 16.4 | 15.3 | 15.9 | |

Light Truck | In millions, SAAR | 13.2 | 12.5 | 12.7 |

Passenger Car | In millions, SAAR | 3.2 | 2.8 | 3.2 |

Source: S&P Global Mobility (Est), | ||||

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. July BEV share is expected to reach

About S&P Global Mobility

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/mobility.

Media Contact:

Michelle Culver

S&P Global Mobility

248.728.7496 or 248.342.6211

Michelle.culver@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-july-sales-to-realize-bounce-from-june-impacts-302205415.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-july-sales-to-realize-bounce-from-june-impacts-302205415.html

SOURCE S&P Global Mobility