S&P Global Mobility: February 2024 US auto sales to bounce mildly

- None.

- None.

Insights

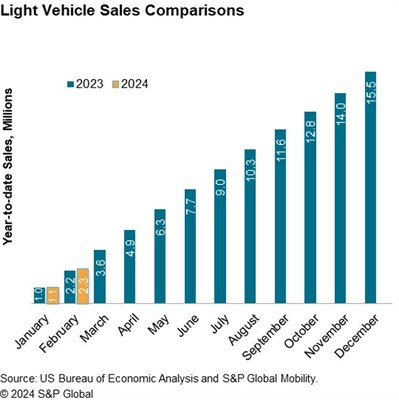

The projection of a moderate rebound in February 2024 U.S. auto sales to a 15.5 million SAAR from a 15.0 million in January indicates a potential stabilization within the automotive industry. While this uptick suggests a positive trend, the underlying volatility and the challenge in gaining sustained momentum point to a cautious optimism among manufacturers and retailers. The 3% year-over-year growth forecast for light vehicle sales reflects a tempered but steady recovery from previous production shutdowns and is indicative of a strategic realignment towards inventory restocking and incentive offerings.

The anticipated growth in light vehicle sales, particularly in light trucks, aligns with consumer preferences and market trends favoring utility and versatility. However, the high interest rate environment and economic uncertainty could dampen consumer spending power and delay a more robust recovery. The nuanced analysis of these factors is essential for stakeholders to navigate the market dynamics and align their strategies accordingly.

The auto industry's financial health is closely tied to unit sales and production levels, which are key indicators for investors. The projected SAAR of 15.5 million units for February 2024, while a slight improvement, still signals a cautious market. Investors should note that despite the positive signs of recovery, the industry is not yet at pre-pandemic sales levels and high interest rates could continue to suppress consumer financing options and thus sales.

The projected calendar-year sales volume of 15.9 million units for 2024, representing a 3% increase from 2023, suggests a conservative growth trajectory. Companies that can efficiently manage production costs, inventory levels and incentive strategies in this environment may be better positioned to capitalize on the gradual market improvement and deliver shareholder value.

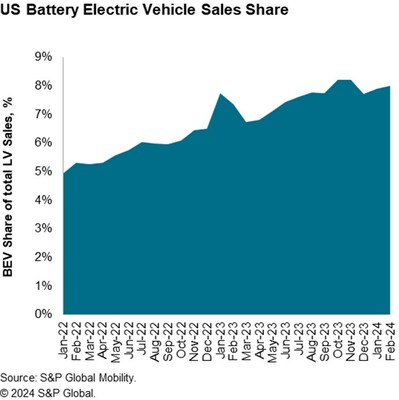

Continued development in the battery-electric vehicle (BEV) market is a significant factor for the industry's future. The February BEV share holding steady at 8.0% indicates that the market is still in an early adoption phase, with room for growth as more models become available. The mention of upcoming models like the Chevrolet Equinox EV, Honda Prologue and Fiat 500e signifies an impending increase in offerings, which could stimulate demand and increase BEV penetration in the market.

Automakers' ability to adapt to the changes in IRA Federal tax credits and how this affects consumer behavior will be crucial. A successful transition could foster a more favorable environment for BEV sales and position early adopters and innovators for long-term growth within the evolving automotive landscape.

S&P Global Mobility projects that February 2024 will realize a slight rebound from the slow January result, but new vehicle sales levels remain tepid.

"We expect that auto sales in February should recover mildly from the January 2024 result, but sustained momentum seems tough to come by, given the current purchase environment facing auto consumers," said Chris Hopson, principal analyst at S&P Global Mobility. "While pricing, inventory and incentive trends are seemingly moving in the correct directions, respectively, to promote new vehicle sales growth, high interest rates and uncertain economic conditions continue to push against any consistent upshift for demand levels."

The S&P Global Mobility US auto outlook for 2024 reflects sustained, but more moderate growth levels for light vehicle sales. We expect production levels to continue to develop, especially early in the year as some automakers look to continue to restock in wake of production shutdowns late in 2023 and decent December 2023 sales volume. The advancing production levels sets the stage for incentives and inventory to continue to develop, potentially enticing new vehicle buyers who remain on the sidelines due to higher interest rates. S&P Global Mobility projects calendar-year 2024 light vehicle sales volume of 15.9 million units, a

Feb 24 (Est) | Jan 24 | Feb 23 | ||

Total Light Vehicle | Units, NSA | 1,220,787 | 1,076,047 | 1,138,756 |

In millions, SAAR | 15.5 | 15.0 | 14.9 | |

Light Truck | In millions, SAAR | 12.4 | 12.0 | 11.9 |

Passenger Car | In millions, SAAR | 3.1 | 3.0 | 3.0 |

Source: S&P Global Mobility (Est), | ||||

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. February BEV share is expected to reach

About S&P Global Mobility

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/mobility.

Media Contact:

Michelle Culver

S&P Global Mobility

248.342.6211

Michelle.culver@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-february-2024-us-auto-sales-to-bounce-mildly-302072658.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-february-2024-us-auto-sales-to-bounce-mildly-302072658.html

SOURCE S&P Global Mobility

FAQ

What is the projected sales pace for U.S. auto sales in February 2024?

What is the expected increase in light vehicle sales volume for 2024 compared to 2023?

Which vehicles are scheduled for market introductions over the first half of 2024?