S&P Global Mobility: August US auto sales trends remain familiar

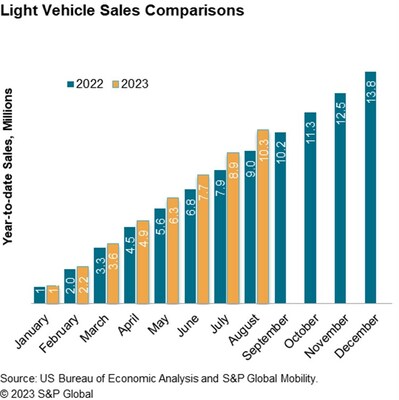

- US light vehicle sales expected to be up 18% YoY in August

- Daily selling rate metric to fall below 50,000 units for the first time since February 2023

New light vehicle sales in August are expected to be up double digits from year-ago, while maintaining pace with July results

While the year-over-year growth in the market will be sustained in August, there are some faint indicators of market softening. The daily selling rate metric, since peaking at 54,500 sales per day in April, has realized a mild downward trend since. With 27 selling days in August, and an estimated volume of 1.34 million units, the daily selling rate metric would fall below 50,000 units for the first time since February 2023. S&P Global Mobility analysts project calendar year 2023 total light vehicle sales of 15.4 million units. Although the daily selling rate has diminished over the past three months, we do not expect this metric to further decline over the remainder of the year.

"New vehicle affordability concerns will not be quick to rectify," reports Chris Hopson, principal analyst at S&P Global Mobility. "Rising interest rates, credit tightening and new vehicle pricing levels slowly decelerating remain pressure points for consumers."

In terms of total dealer-advertised inventories, volumes have stayed relatively static since the beginning of July – at around 2.3 million units, with upward and downward variations of ~100,000 units over the course of a sales month, according to Matt Trommer, associate director of Market Reporting at S&P Global Mobility.

On a year-over-year basis, compared to mid-August 2022, inventories have risen by

Various risk factors beyond the US consumer also remain prevalent in the outlook for the remainder of 2023, including the potential for North American vehicle supply disruptions as union negotiations emerge.

"The greatest threat to the forecast in the near-term surrounds the union negotiations between the United Auto Workers (UAW) in the US and Unifor in

US Light Vehicle Sales | ||||

Aug 23 (Est) | July 23 | Aug 22 | ||

Total Light Vehicle | Units, NSA | 1,340,000 | 1,299,199 | 1,134,265 |

In millions, SAAR | 15.2 | 15.7 | 13.2 | |

Light Truck | In millions, SAAR | 12.1 | 12.6 | 10.4 |

Passenger Car | In millions, SAAR | 3.1 | 3.1 | 2.8 |

Source: S&P Global Mobility (Est), | ||||

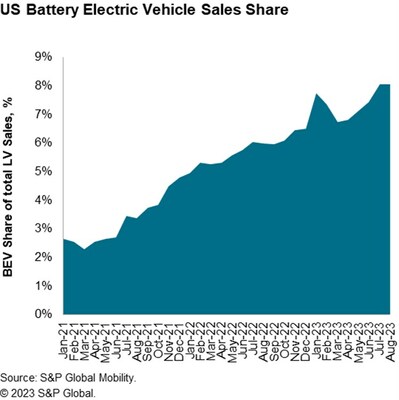

Continued development of battery-electric vehicle (BEV) sales remains a constant assumption for 2023 although some month-to-month volatility is expected. BEV share is expected to

About S&P Global Mobility

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/mobility.

Media Contact:

Michelle Culver

S&P Global Mobility

248.728.7496 or 248.342.6211

Michelle.culver@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility--august-us-auto-sales-trends-remain-familiar-301911105.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility--august-us-auto-sales-trends-remain-familiar-301911105.html

SOURCE S&P Global Mobility