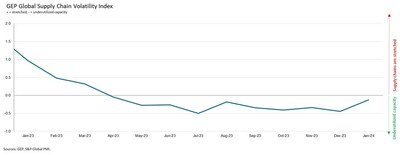

RED SEA ATTACKS DRIVE TRANSPORTATION COSTS TO 15-MONTH HIGH AND SAFETY STOCKPILING INCREASES SLIGHTLY, BUT NO SIGNS OF PANIC SO FAR: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

- None.

- None.

Insights

The observed contraction in excess global supply chain capacity, as reported by the GEP Global Supply Chain Volatility Index, suggests a tightening of supply chains, which historically correlates with increased economic activity. This tightening is significant because it indicates that manufacturers are responding to a pickup in demand, which can lead to higher production levels and potentially more robust economic growth.

Supply chain managers should note the rise in transportation costs due to the Red Sea disruption. This cost increase may squeeze margins or lead to higher prices for end consumers. The shift to stockpiling also indicates a strategic move by businesses to mitigate risks associated with supply disruptions and price volatility. Companies investing in inventory may experience increased carrying costs but can also avoid potential stockouts and production delays.

From a regional perspective, Asia's rebound in factory purchasing activity is particularly noteworthy. Given the region's significant role in global manufacturing, increased activity there could signal a broader upswing in international trade. However, businesses should remain vigilant about supplier pricing strategies to prevent inflationary pressures from eroding the benefits of increased demand.

The incremental rise in the GEP Global Supply Chain Volatility Index implies a potential shift in market sentiment, which could influence investor confidence. The index's movement towards positive territory may suggest that fears of a recession are abating and inflation concerns are diminishing, which can have bullish implications for the stock market.

Investors might view the uptick in Asian supply chain activity as a leading indicator for growth in emerging markets, which could trigger a reallocation of investment portfolios towards sectors and companies poised to benefit from this trend. However, the increased transportation costs highlighted could impact earnings for companies with significant logistics expenses and investors should watch for any related adjustments in upcoming financial disclosures.

Furthermore, the inventory build-up, while a hedge against supply chain risks, could lead to potential overstocking if demand does not meet expectations. Financial analysts would closely monitor inventory turnover ratios in subsequent quarters to assess the efficiency of these stockpiling strategies.

The data from the GEP Global Supply Chain Volatility Index provides insights into the broader economic landscape. A reduction in excess supply chain capacity generally reflects a healthier economic environment, where supply and demand are moving towards equilibrium. This can signal the beginning stages of a recovery phase in the business cycle, particularly if the trend continues.

However, the increase in transportation costs could contribute to inflationary pressures, despite the overall trend toward reduced inflation fears. Economists will be interested in analyzing whether these cost increases are transitory, related to specific events like the Suez Canal disruption, or if they represent a more sustained trend that could influence monetary policy decisions.

Lastly, the stability in labor availability and the low incidence of material shortages suggest that the supply side of the economy is not facing significant constraints, which could facilitate a smoother recovery process. This contrasts with previous periods where labor and material shortages posed critical challenges to economic growth.

- Excess global supply chain capacity shrinks to its lowest level in nine months, showing the first signs of recovery in global manufacturing

- Demand for raw materials, commodities and components, while subdued, also trends higher in January

- Asian supply chains at their busiest in nearly a year as factory purchasing rebounds in region's key markets

Although this is the ninth successive month of excess capacity at global suppliers, the downturn eased to its weakest since last April. The index suggests that underlying trading conditions may be starting to improve as recession and inflation fears fade and businesses prepare for a stronger 2024.

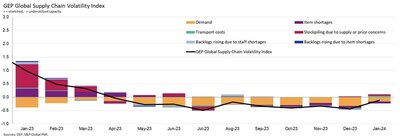

The most noteworthy impact from the Red Sea disruption was to transportation costs, which rose to a 15-month high in January, as commercial ships took the lengthier route around the Cape of Good Hope. There was also a slight pick-up in safety stockpiling, with reports from businesses of inventory building due to supply or price fears at the highest since last June. That said, they were well below the levels seen in 2021-2022 during the post-pandemic supply crunch.

Regionally,

"The world's supply chains got busier in January, and activity at our global manufacturing clients is ticking up," explained Daryl Watkins, senior director, consulting, GEP.

"With input demand trending higher, led by

JANUARY 2024 KEY FINDINGS

- DEMAND: Purchases of raw materials, commodities and components remained subdued, although the decline eased to its weakest since last April, hinting at improving demand.

- INVENTORIES: Reports of safety stockpiling due to supply or price concerns ticked up to a seven-month high in January as disruption through the Suez Canal led some companies to build up inventory buffers.

- MATERIAL SHORTAGES: Global supply conditions remain healthy — reports of item shortages remain among the lowest seen in four years.

- LABOR SHORTAGES: Labor availability remains unproblematic for global suppliers, with reports of backlogs rising due to a lack of staff holding close to historically typical levels.

- TRANSPORTATION: Global transportation costs rose to a 15-month high in January, signalling some contagion from the disruption to shipping through the Suez Canal.

REGIONAL SUPPLY CHAIN VOLATILITY

NORTH AMERICA : Index rose to -0.33, from -0.39, indicating the 10th consecutive month of underutilized supplier capacity.EUROPE : Index rose to -0.63, from -0.92, the lowest level of excess vendor capacity in five months.U.K. : Index rose to -0.62, from -1.05, showing spare capacity atU.K. suppliers almost halving, which is a positive sign after 19 consecutive months of subdued input demand.ASIA : Index rose to 0.14, from -0.42, indicating the strongest pressure on the region's supply chains in almost a year amid improving demand in key exporting nations.

For more information, visit www.gep.com/volatility.

Note: Full historical data dating back to January 2005 is available for subscription. Please contact economics@spglobal.com.

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, March 13, 2024.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global's PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

- A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

- A value below 0 indicates that supply chain capacity is being underutilized, reducing supply chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

A Supply Chain Volatility Index is also published at a regional level for

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Our customers are the world's best companies, including more than 550 Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic, financial and operational goals. A leader in multiple Gartner Magic Quadrants, GEP's cloud-native software and digital business platforms consistently win awards and recognition from industry analysts, research firms and media outlets, including Gartner, Forrester, IDC, ISG, and Spend Matters.

GEP is also regularly ranked a top procurement and supply chain consulting and strategy firm, and a leading managed services provider by ALM, Everest Group, NelsonHall, IDC, ISG and HFS, among others. Headquartered in

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world's leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world's leading organizations plan for tomorrow, today.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without S&P Global's prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the content or information ("Data") contained herein, any errors, inaccuracies, omissions or delays in the Data, or for any actions taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages, arising out of the use of the Data. Purchasing Managers' Index™ and PMI® are either trade marks or registered trade marks of S&P Global Inc or licensed to S&P Global Inc and/or its affiliates.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global. Reproduction of any information, data or material, including ratings ("Content") in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers ("Content Providers") do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.

Media Contacts

Derek Creevey | Joe Hayes |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/red-sea-attacks-drive-transportation-costs-to-15-month-high-and-safety-stockpiling-increases-slightly-but-no-signs-of-panic-so-far-gep-global-supply-chain-volatility-index-302059899.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/red-sea-attacks-drive-transportation-costs-to-15-month-high-and-safety-stockpiling-increases-slightly-but-no-signs-of-panic-so-far-gep-global-supply-chain-volatility-index-302059899.html

SOURCE GEP

FAQ

What is the GEP Global Supply Chain Volatility Index indicating?

Why did transportation costs rise to a 15-month high in January?

Which region's supply chains were at their busiest in nearly a year?