Automotive Brand Loyalty Rates Show Positive Shift, according to S&P Global Mobility

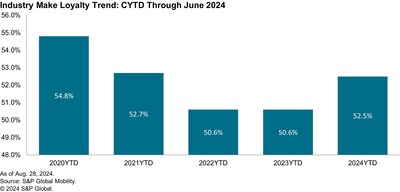

S&P Global Mobility reports a positive shift in automotive brand loyalty rates for the first half of 2024. The industry's brand loyalty rate stands at 52.5%, a 1.9 percentage point increase from 2023, marking the first year-over-year rise since 2020. More than half of all brands saw improvements of 1 percentage point or better, with mainstream and luxury brands increasing by 1.9 and 1.4 percentage points, respectively.

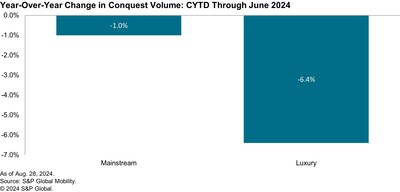

Key factors contributing to this growth include increased inventory levels and a strong pipeline of return-to-market households. However, the rise in brand loyalty has adversely affected conquest volume, with luxury brands experiencing a 6.4% decline and mainstream brands dropping 1% compared to the first half of 2023.

Tesla continues to lead in brand loyalty with a rate of 67.8%, while General Motors tops multi-brand manufacturers at 67.7%. The Lincoln Nautilus currently leads in model loyalty at 46.7%.

S&P Global Mobility riporta un cambiamento positivo nei tassi di fedeltà al marchio automobilistico per la prima metà del 2024. Il tasso di fedeltà del settore si attesta al 52,5%, con un aumento di 1,9 punti percentuali rispetto al 2023, segnando il primo aumento anno su anno dal 2020. Più della metà di tutti i marchi ha visto miglioramenti di 1 punto percentuale o più, con i marchi mainstream e di lusso in crescita rispettivamente di 1,9 e 1,4 punti percentuali.

I fattori chiave che contribuiscono a questa crescita includono livelli di inventario aumentati e un forte bacino di famiglie che tornano sul mercato. Tuttavia, l'aumento della fedeltà al marchio ha avuto un impatto negativo sul volume di conquista, con i marchi di lusso che hanno registrato un calo del 6,4% e i marchi mainstream che sono diminuiti dell'1% rispetto alla prima metà del 2023.

Tesla continua a guidare nella fedeltà al marchio con un tasso del 67,8%, mentre General Motors è al vertice tra i produttori multi-marchio con il 67,7%. La Lincoln Nautilus attualmente guida nella fedeltà al modello con il 46,7%.

S&P Global Mobility informa de un cambio positivo en las tasas de lealtad a las marcas automotrices para la primera mitad de 2024. La tasa de lealtad del sector se sitúa en un 52.5%, un aumento de 1.9 puntos porcentuales en comparación con 2023, marcando el primer aumento interanual desde 2020. Más de la mitad de todas las marcas experimentaron mejoras de 1 punto porcentual o más, con las marcas convencionales y de lujo aumentando en 1.9 y 1.4 puntos porcentuales, respectivamente.

Los factores clave que contribuyen a este crecimiento incluyen niveles de inventario aumentados y un sólido grupo de hogares regresando al mercado. Sin embargo, el aumento de la lealtad a la marca ha afectado negativamente el volumen de conquista, con las marcas de lujo experimentando una disminución del 6.4% y las marcas convencionales cayendo un 1% en comparación con la primera mitad de 2023.

Tesla sigue liderando en lealtad a la marca con una tasa del 67.8%, mientras que General Motors encabeza a los fabricantes de múltiples marcas con un 67.7%. La Lincoln Nautilus actualmente lidera en lealtad al modelo con un 46.7%.

S&P Global Mobility는 2024년 상반기 자동차 브랜드 충성도 비율에서 긍정적인 변화가 있음을 보고했습니다. 업계의 브랜드 충성도 비율은 52.5%로, 2023년 대비 1.9포인트 상승하여 2020년 이후 처음으로 연간 증가세를 보였습니다. 모든 브랜드의 절반 이상이 1포인트 이상의 개선을 보였으며, 주류 브랜드와 럭셔리 브랜드는 각각 1.9포인트와 1.4포인트 상승했습니다.

이 성장에 기여하는 주요 요인으로는 재고 수준 증가와 시장 복귀 가구의 강력한 파이프라인이 있습니다. 그러나 브랜드 충성도 상승은 정복량에 부정적인 영향을 미쳤으며, 럭셔리 브랜드는 6.4% 감소하고 주류 브랜드는 1% 감소했습니다, 2023년 상반기와 비교하여.

테슬라는 67.8%의 비율로 브랜드 충성도에서 계속 선두를 달리고 있으며, 제너럴 모터스는 67.7%로 다브랜드 제조업체 중에서 선두입니다. 링컨 나틸러스는 현재 모델 충성도에서 46.7%로 선두를 차지하고 있습니다.

S&P Global Mobility rapporte un changement positif dans les taux de fidélité des marques automobiles pour la première moitié de 2024. Le taux de fidélité de l'industrie s'établit à 52,5%, soit une augmentation de 1,9 point de pourcentage par rapport à 2023, marquant la première hausse d'une année sur l'autre depuis 2020. Plus de la moitié de toutes les marques ont connu des améliorations d'un point de pourcentage ou plus, les marques grand public et de luxe augmentant respectivement de 1,9 et 1,4 point de pourcentage.

Les facteurs clés contribuant à cette croissance incluent des niveaux de stock accrus et un solide pipeline de ménages revenant sur le marché. Cependant, l'augmentation de la fidélité à la marque a également eu un impact négatif sur le volume de conquête, les marques de luxe enregistrant une baisse de 6,4 % et les marques grand public une diminution de 1 % par rapport à la première moitié de 2023.

Tesla continue de mener en matière de fidélité à la marque avec un taux de 67,8 %, tandis que General Motors est en tête des fabricants multi-marques avec 67,7 %. La Lincoln Nautilus est actuellement en tête en matière de fidélité au modèle avec 46,7 %.

S&P Global Mobility berichtet von einer positiven Veränderung der Markenloyalitätsraten in der Automobilbranche für die erste Hälfte des Jahres 2024. Die Markenloyalitätsrate der Branche liegt bei 52,5%, was einen Anstieg von 1,9 Prozentpunkten im Vergleich zu 2023 darstellt und den ersten Anstieg im Jahresvergleich seit 2020 markiert. Mehr als die Hälfte aller Marken verzeichnete Verbesserungen von 1 Prozentpunkt oder mehr, wobei die Mainstream- und Luxusmarken um 1,9 bzw. 1,4 Prozentpunkte zulegten.

Wesentliche Faktoren, die zu diesem Wachstum beitragen, sind erhöhte Lagerbestände und eine starke Pipeline von Haushalten, die zurück auf den Markt kommen. Dennoch hat der Anstieg der Markenloyalität negativ Auswirkungen auf das Eroberungsvolumen gehabt, wobei Luxusmarken einen Rückgang von 6,4 % und Mainstreammarken von 1 % im Vergleich zur ersten Hälfte des Jahres 2023 verzeichnen.

Tesla führt weiterhin in der Markenloyalität mit einem Wert von 67,8 %, während General Motors bei den Multi-Marken-Herstellern mit 67,7 % an der Spitze steht. Der Lincoln Nautilus führt derzeit bei der Modellloyalität mit 46,7 %.

- None.

- None.

The industry's brand loyalty rate through June stands at

More than half of all brands in the industry saw a year-over-year increase of 1 percentage point (PP) or better. This group included both mainstream and luxury brands, which saw increases of 1.9 PPs and 1.4 PPs, respectively. Growing inventory levels and a strong pipeline of return-to-market households were the primary factors in loyalty gains for the first half of 2024.

"Last year we saw a big jump in the number of households returning to market for a new vehicle, but the inventory was lacking," said Vince Palomarez, associate director, Loyalty product management at S&P Global Mobility. "This year, return-to-market volume remains consistent; however, inventory levels are up more than

Conquest trends adversely affected

The increase in brand loyalty adversely affected conquest volume, as both sectors experienced year-over-year declines in the first half compared to the same period last year. The Luxury brands, which experienced an

"The positive jump in loyalty came at the expense of conquests," said Tom Libby, associate director for loyalty solutions and industry analysis at S&P Global Mobility. "Past years have shown that increases in both loyalty and conquests are possible if the pool of return-to-market rises as well. The first half of 2024 showed little to no change in return to market, so either loyalty or conquest were going to be affected."

Among individual brands, Tesla continues its run as the leader in brand loyalty with a rate of

"Tesla has historically been a brand with strong loyal ties among their consumer base, despite a limited product portfolio," said Palomarez. "Changes in BEV prioritization among other OEMs, along with Tesla's directive to cut pricing when needed, has kept households from defecting."

Additional mid-year highlights:

- General Motors leads all multi-brand manufacturers in manufacturer loyalty for the first half of 2024, at

67.7% - Jaguar, Land Rover, and

Lincoln are among the highest year-over-year gainers in brand loyalty, each improving rates by more than 6 PPs - The Lincoln Nautilus is the current leader in model loyalty at

46.7%

About S&P Global Mobility

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/mobility.

Media Contact:

Michelle Culver

S&P Global Mobility

248.728.7496 or 248.342.6211

Michelle.culver@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/automotive-brand-loyalty-rates-show-positive-shift-according-to-sp-global-mobility-302233332.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/automotive-brand-loyalty-rates-show-positive-shift-according-to-sp-global-mobility-302233332.html

SOURCE S&P Global Mobility

FAQ

What was the automotive industry's brand loyalty rate in the first half of 2024?

How did the increase in brand loyalty affect conquest volume in 2024?

Which brand had the highest loyalty rate in the first half of 2024?

What factors contributed to the increase in brand loyalty rates in 2024?