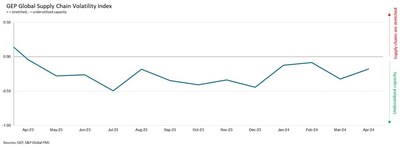

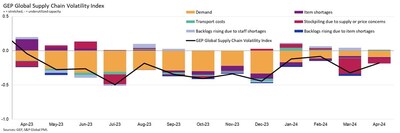

AFTER FOUR YEARS OF WILD SWINGS FROM SHORTAGES TO GLUT, GLOBAL SUPPLY CHAINS ARE NOW IN THE GOLDILOCKS ZONE: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

Global supply chains are currently operating near full capacity, indicating a positive outlook for the manufacturing sector. The GEP Global Supply Chain Volatility Index rose in April, showing increased demand and activity in the Asian market, tightening capacity in North America, and improved conditions in Europe. Global transportation costs have risen slightly, following an increase in oil prices.

- Global supply chains are operating near maximum capacity, signaling a steady outlook for the manufacturing sector.

- Asian factories are experiencing strong demand, leading to increased purchasing activity.

- North American manufacturers are facing tightening capacity, with backlogged work reported, and improved demand for raw materials.

- Improving activity across global supply chains is a result of healthier demand, especially in Asia.

- Transportation costs have risen slightly due to an increase in oil prices.

- European manufacturing sector continues to underperform compared to other regions.

- Global transportation costs have risen slightly, which could impact overall supply chain costs.

Insights

- Global supply chains are operating near maximum capacity, signaling steady outlook for the manufacturing sector

- Asian factories purchase more inputs to meet growing orders, increasing pressure on the region's suppliers

- North American manufacturers report some difficulties meeting orders due to shortages of staff and critical materials

- Global transportation costs rise slightly, following a recent increase in oil prices

Improving activity across global supply chains are a direct result of healthier demand, which has picked up consistently in the year-to-date after considerable weakness in 2023. The Asian market is at the forefront of this trend, with input demand at the region's factories remaining strong. Procurement managers in

The North American market is showing more evidence of tightening capacity, with backlogged work reported by manufacturers, particularly in

Demand conditions were less robust in

"After four years of supply shocks, inflation, stockpiling, and uncertainty, global supply chains are now operating in a Goldilocks zone, a steady state of full capacity, not expanding or contracting too quickly, which is excellent news for global suppliers and business," explained Mike Seitz, vice president, GEP Consulting. "In China, we're seeing a steady pick-up in manufacturing activity, which will encourage Chinese Premier Li Qiang to accelerate efforts to remove barriers imposed by European markets and foster more FDI, especially as the potential for tougher

Interpreting the data:

- Index > 0, supply chain capacity is being stretched. The further above 0, the more stretched supply chains are.

- Index < 0, supply chain capacity is being underutilized. The further below 0, the more underutilized supply chains are.

APRIL 2024 KEY FINDINGS

- DEMAND: Global demand for raw materials, commodities and components remained close to its long-term average in April, highlighting vastly improved conditions in the worldwide manufacturing sector compared with late last year. As was also the case in March,

Asia was the main positive force, with major goods-producing nations such asChina ,India andSouth Korea recording growth.

- INVENTORIES: Inventory drawdowns persisted into April, albeit cooling in strength compared to March. Reports from global businesses of stockpiles rising because of price or supply concerns were among the lowest seen in over four years.

- MATERIAL SHORTAGES: Reports of short supply for items, including semiconductors, foodstuff, chemicals, and metals, remain historically low.

- LABOR SHORTAGES: After rising for the past three months, global reports of backlogged orders rising because of staff shortages fell in April and were broadly aligned with historically typical levels. Regional differences persisted, however, with

North America seeing greater labor shortages than elsewhere.

- TRANSPORTATION: Following recent increases in oil prices, global transportation costs rose for the first time this year in April.

REGIONAL SUPPLY CHAIN VOLATILITY

NORTH AMERICA : Index broadly unchanged at -0.30, versus -0.31 previously. Although indicative of spare capacity, the input demand trend ticked higher in April, while increased backlogs of work were also reported.EUROPE : Index fell to -0.55, from -0.62. April's increase suggests the continent's industrial downturn continued to ease.U.K. : Index decreased to -0.47, from -0.17 asU.K. manufacturers destock sharply instead of ordering from suppliers.ASIA : Index rose to 0.07, from -0.07, signaling the first month of stretched supplier capacity since January.

For more information, visit www.gep.com/volatility.

Note: Full historical data dating back to January 2005 is available for subscription. Please contact economics@spglobal.com.

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, June 13, 2024.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global's PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

- A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

- A value below 0 indicates that supply chain capacity is being underutilized, reducing supply chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

A Supply Chain Volatility Index is also published at a regional level for

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Our customers are the world's best companies, including more than 550 Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic, financial and operational goals. A leader in multiple Gartner Magic Quadrants, GEP's cloud-native software and digital business platforms consistently win awards and recognition from industry analysts, research firms and media outlets, including Gartner, Forrester, IDC, ISG, and Spend Matters. GEP is also regularly ranked a top procurement and supply chain consulting and strategy firm, and a leading managed services provider by ALM, Everest Group, NelsonHall, IDC, ISG and HFS, among others. Headquartered in

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world's leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world's leading organizations plan for tomorrow, today.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without S&P Global's prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the content or information ("Data") contained herein, any errors, inaccuracies, omissions or delays in the Data, or for any actions taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages, arising out of the use of the Data. Purchasing Managers' Index™ and PMI® are either trade marks or registered trade marks of S&P Global Inc or licensed to S&P Global Inc and/or its affiliates.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global. Reproduction of any information, data or material, including ratings ("Content") in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers ("Content Providers") do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.

Media Contacts | |

Derek Creevey | Joe Hayes |

Director, Public Relations | Principal Economist |

GEP | S&P Global Market Intelligence |

Phone: +1 732-382-6565 | Phone: +44-1344-328-099 |

Email: derek.creevey@gep.com | Email: joe.hayes@spglobal.com |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/after-four-years-of-wild-swings-from-shortages-to-glut-global-supply-chains-are-now-in-the-goldilocks-zone-gep-global-supply-chain-volatility-index-302142538.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/after-four-years-of-wild-swings-from-shortages-to-glut-global-supply-chains-are-now-in-the-goldilocks-zone-gep-global-supply-chain-volatility-index-302142538.html

SOURCE GEP

FAQ

What is the GEP Global Supply Chain Volatility Index?

What does a negative Index value indicate?

What regions are experiencing tightening capacity according to the press release?