SoFi Technologies Reports Fourth Quarter and Fiscal Year 2021 Results

SoFi Technologies, Inc. reported record financial results for Q4 and FY 2021, achieving $286 million in GAAP revenue (up 67% YoY) and $280 million in adjusted revenue (up 54% YoY). The company added 523,000 new members in Q4, totaling 3.5 million members, while achieving positive adjusted EBITDA of $5 million. Despite a net loss of $111 million for Q4, SoFi expects continued growth with guidance of $280-$285 million in adjusted revenue for Q1 2022, reflecting a 30%-32% YoY increase.

- Record Q4 GAAP revenue of $286 million, up 67% YoY.

- Positive adjusted EBITDA for six consecutive quarters, totaling $30 million for FY 2021.

- 523,000 new member additions in Q4, totaling 3.5 million members, up 87% YoY.

- Expecting $1.57 billion in adjusted revenue for FY 2022, a 55% increase.

- Net loss of $111 million in Q4, a 34% increase from the prior year.

- Loss per share of $0.15 in Q4, compared to $1.85 in the previous year.

- Impact of student loan payment moratorium extension, estimated to reduce revenue by $30-$35 million in Q1 2022.

Insights

Analyzing...

Record GAAP and Adjusted Revenue for Fourth Quarter and Full Year 2021

Fourth Quarter

Fourth Quarter Adjusted EBITDA of

Record 523,000 Quarterly New Member Adds Up

Record 906,000 Quarterly New Product Adds Up

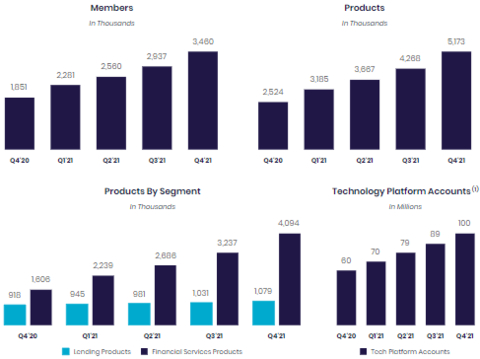

Note: For additional information on our company metrics, see Table 5 in the “Financial Tables” herein. (Graphic: Business Wire)

“We hit new highs across our key financial and operating metrics in the fourth quarter, finishing 2021 with record annual results,” said

Consolidated Results Summary

|

|

Three Months Ended |

|

% Change |

|

Year Ended |

|

% Change |

||||||||||||||

($ in thousands) |

|

|

2021 |

|

|

|

2020 |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

||||

Consolidated – GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Total net revenue |

|

$ |

285,608 |

|

|

$ |

171,491 |

|

|

67 |

% |

|

$ |

984,872 |

|

|

$ |

565,532 |

|

|

74 |

% |

Net loss |

|

|

(111,012 |

) |

|

|

(82,616 |

) |

|

34 |

% |

|

|

(483,937 |

) |

|

|

(224,053 |

) |

|

116 |

% |

Loss per share – basic and diluted |

|

$ |

(0.15 |

) |

|

$ |

(1.85 |

) |

|

|

|

$ |

(1.00 |

) |

|

$ |

(4.30 |

) |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Consolidated – Non-GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Adjusted net revenue(1) |

|

$ |

279,876 |

|

|

$ |

182,019 |

|

|

54 |

% |

|

$ |

1,010,325 |

|

|

$ |

621,207 |

|

|

63 |

% |

Adjusted EBITDA(1) |

|

|

4,593 |

|

|

|

11,817 |

|

|

(61 |

) % |

|

|

30,221 |

|

|

|

(44,576 |

) |

|

n/a |

|

___________________

(1) |

Adjusted net revenue and adjusted EBITDA are non-GAAP financial measures. For more information and reconciliations to the most comparable GAAP measures, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein. |

Noto continued: “As important, we also reached all-time highs in members added, products added and engagement as well. We finished 2021 with approximately 3.5 million total SoFi members, up

Noto concluded: “Today, SoFi is in its strongest position ever to differentiate our offerings and ensure that we're delivering for our members and enhancing their experience with each new product they adopt. Our new bank charter will be a game changer for us in differentiating our SoFi Checking and Savings offering in the marketplace, and improving our pricing and selection across Lending. Acquiring Technisys, a leading cloud-native, digital multi-product core banking platform, will be a critical next step in our continued efforts to vertically integrate SoFi’s businesses to further accelerate the pace of innovation of our best-of-breed financial products. We expect Technisys to be a growth multiplier for both SoFi and Galileo, in addition to realizing its own enormous growth opportunities, which are further strengthened in partnership with Galileo. We think we are well on our way to building the AWS of fintech. We have the right strategy, offering, leadership, liquidity and people to achieve our long-term strategic goal to be the digital one-stop shop for our members for all of the major financial decisions in their lives, and all of the moments in between. Having just celebrated my fourth anniversary as CEO of SoFi in February, I could not be more excited about what’s ahead, and I feel like we are just getting started.”

Consolidated Results

Total GAAP net revenue of

SoFi recorded a GAAP net loss of

Member and Product Growth

SoFi added a record number of both members and products in absolute terms for the quarter and year.

The five nationally televised NFL regular season games at

These brand-building strategies, coupled with referral and cross-buy campaigns such as Refer the App, the SoFi Money Referral program, the SoFi Money-Personal Loan bundle, and SoFi’s unique rewards program, drove record new member and product additions. SoFi added approximately 523,000 new members in the fourth quarter – a record in absolute number terms and up

Total products added in the fourth quarter of approximately 906,000 were

(1) |

Beginning in the fourth quarter of 2021, the Company included SoFi accounts on the Galileo platform-as-a-service in its total Technology Platform accounts metric to better align with presentation of Technology Platform segment revenue. The Company recast the total accounts as of |

In the Financial Services segment, total products increased by

Lending products rose

With the rapid growth in Financial Services products, SoFi finished 2021 with nearly four times as many of these high-frequency, low acquisition cost, “top-of-funnel” products as low-frequency, high lifetime value (LTV), “bottom-of-funnel” Lending products. With these “top-of-funnel” offerings driving product growth, total company fourth quarter cross-buy volume — the term for when existing SoFi members acquire an additional SoFi product — more than tripled year-over-year, to SoFi’s highest absolute number of cross-bought products ever.

Technology Platform enabled accounts increased by

Lending Segment Results

Lending segment GAAP and adjusted net revenues were

Lending segment contribution profit of

Lending – Segment Results of Operations |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Three Months Ended

|

|

|

|

Year Ended

|

|

|

||||||||||||||

($ in thousands) |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

||

Total net revenue – Lending |

|

$ |

213,764 |

|

|

$ |

148,992 |

|

|

43 |

% |

|

$ |

738,323 |

|

|

$ |

480,866 |

|

|

54 |

% |

Servicing rights – change in valuation inputs or assumptions |

|

|

(9,273 |

) |

|

|

1,127 |

|

|

(923 |

)% |

2,651 |

|

|

|

17,459 |

|

|

(85 |

) % |

||

Residual interests classified as debt – change in valuation inputs or assumptions |

|

|

3,541 |

|

|

|

9,401 |

|

|

(62 |

) % |

|

|

22,802 |

|

|

|

38,216 |

|

|

(40 |

) % |

Directly attributable expenses |

|

|

(102,967 |

) |

|

|

(74,316 |

) |

|

39 |

% |

|

|

(364,169 |

) |

|

|

(294,812 |

) |

|

24 |

% |

Contribution Profit |

|

$ |

105,065 |

|

|

$ |

85,204 |

|

|

23 |

% |

|

$ |

399,607 |

|

|

$ |

241,729 |

|

|

65 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Adjusted net revenue – Lending(1) |

|

$ |

208,032 |

|

|

$ |

159,520 |

|

|

30 |

% |

|

$ |

763,776 |

|

|

$ |

536,541 |

|

|

42 |

% |

_________________

| (1) | Adjusted net revenue – Lending represents a non-GAAP financial measure. For more information and a reconciliation to the most comparable GAAP measure, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein. |

Fourth quarter Lending segment total origination volume increased

Record personal loan originations of more than

In the fourth quarter, student loans benefited from accelerating demand ahead of the January federal student loan payment moratorium deadline and anticipated rate increases in 2022. Student loan originations of nearly

Lending – Originations and Average Balances |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Three Months Ended

|

|

% Change |

|

Year Ended

|

|

% Change |

||||||||||

|

|

2021 |

|

2020 |

|

|

2021 |

|

2020 |

|

||||||||

Origination volume ($ in thousands, during period) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Home loans |

|

$ |

657,304 |

|

$ |

672,724 |

|

(2 |

) % |

|

$ |

2,978,222 |

|

$ |

2,183,521 |

|

36 |

% |

Personal loans |

|

|

1,646,289 |

|

|

613,774 |

|

168 |

% |

|

|

5,386,934 |

|

|

2,580,757 |

|

109 |

% |

Student loans |

|

|

1,461,405 |

|

|

970,543 |

|

51 |

% |

|

|

4,293,526 |

|

|

4,928,880 |

|

(13 |

) % |

Total |

|

$ |

3,764,998 |

|

$ |

2,257,041 |

|

67 |

% |

|

$ |

12,658,682 |

|

$ |

9,693,158 |

|

31 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Average loan balance ($, as of period end)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Home loans |

|

$ |

286,991 |

|

$ |

291,382 |

|

(2 |

) % |

|

|

|

|

|

|

|||

Personal loans |

|

|

22,820 |

|

|

21,789 |

|

5 |

% |

|

|

|

|

|

|

|||

Student loans |

|

|

50,549 |

|

|

54,319 |

|

(7 |

) % |

|

|

|

|

|

|

|||

_________________

(1) |

Within each loan product category, average loan balance is defined as the total unpaid principal balance of the loans divided by the number of loans that have a balance greater than zero dollars as of the reporting date. Average loan balance includes loans on the balance sheet and transferred loans with which SoFi has a continuing involvement through its servicing agreements. |

|

|

|

|

|

|||

Lending – Products |

|

2021 |

|

2020 |

|

% Change |

|

Home loans |

|

23,035 |

|

13,977 |

|

65 |

% |

Personal loans |

|

610,348 |

|

501,045 |

|

22 |

% |

Student loans |

|

445,569 |

|

402,623 |

|

11 |

% |

Total lending products |

|

1,078,952 |

|

917,645 |

|

18 |

% |

Technology Platform Segment Results

SoFi's Technology Platform segment consists primarily of

|

|

|

|

|

||

Technology Platform |

|

2021 |

|

2020 |

|

% Change |

Total accounts |

|

99,660,657 |

|

59,735,210 |

|

67 % |

Technology Platform segment net revenue of

Technology Platform – Segment Results of Operations |

|

|

|

|

|

|

||||||||||||||||

|

|

Three Months Ended

|

|

|

|

Year Ended

|

|

|

||||||||||||||

($ in thousands) |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

||

Total net revenue |

|

$ |

53,299 |

|

|

$ |

37,482 |

|

|

42 |

% |

|

$ |

194,886 |

|

|

$ |

96,316 |

|

|

102 |

% |

Directly attributable expenses |

|

|

(33,291 |

) |

|

|

(20,676 |

) |

|

61 |

% |

|

|

(130,439 |

) |

|

|

(42,427 |

) |

|

207 |

% |

Contribution Profit |

|

$ |

20,008 |

|

|

$ |

16,806 |

|

|

19 |

% |

|

$ |

64,447 |

|

|

$ |

53,889 |

|

|

20 |

% |

Financial Services Segment Results

Fourth quarter 2021 net revenue of nearly

Financial Services – Segment Results of Operations |

|

|

|

|

|

|

||||||||||||||||

|

|

Three Months Ended

|

|

|

|

Year Ended

|

|

|

||||||||||||||

($ in thousands) |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

||

Total net revenue |

|

$ |

21,956 |

|

|

$ |

4,051 |

|

|

442 |

% |

|

$ |

58,078 |

|

|

$ |

11,870 |

|

|

389 |

% |

Directly attributable expenses |

|

|

(57,145 |

) |

|

|

(40,804 |

) |

|

40 |

% |

|

|

(192,996 |

) |

|

|

(143,966 |

) |

|

34 |

% |

Contribution loss |

|

$ |

(35,189 |

) |

|

$ |

(36,753 |

) |

|

(4 |

) % |

|

$ |

(134,918 |

) |

|

$ |

(132,096 |

) |

|

2 |

% |

By continuously innovating for members with new and relevant offerings, features and rewards, SoFi added approximately 2.5 million Financial Services products in 2021, bringing the total to approximately 4.1 million. Triple-digit growth in

SoFi Invest expanded member selection in both cryptocurrencies and retail IPOs in 2021. Two new crypto coin additions in the fourth quarter brought the full-year total added to 25, and the year-end total of 30 placed SoFi among the selection leaders in the space. SoFi Invest also brought two regular-way IPOs to members in the fourth quarter — as the primary retail channel for Rivian, the largest IPO since Facebook in 2012, and

|

|

|

|

|

||

Financial Services – Products |

|

2021 |

|

2020 |

|

% Change |

Money |

|

1,436,955 |

|

645,502 |

|

123 % |

Invest |

|

1,595,143 |

|

531,541 |

|

200 % |

Credit Card |

|

91,216 |

|

6,445 |

|

n/m |

Referred loans |

|

7,659 |

|

— |

|

n/m |

Relay |

|

930,181 |

|

408,735 |

|

128 % |

At Work |

|

33,091 |

|

13,687 |

|

142 % |

Total products |

|

4,094,245 |

|

1,605,910 |

|

155 % |

Subsequent Events

National Bank Charter Approval

A key element of SoFi’s long-term strategy has been to secure a national bank charter. In

Management's view is that operating as a bank holding company can enhance SoFi’s overall profitability. Management believes that moving from a reliance on third-party bank holding companies by operating under a national bank charter will allow SoFi to provide current and prospective members broader and more competitive options across their financial services needs, including deposit accounts and loan products, while lowering the overall cost to fund loans (by utilizing members’ deposits held at

Technisys Acquisition

On

Management believes the acquisition of Technisys will provide a critical strategic asset, as both an attractive business, and an innovative technology advancing SoFi’s effort to build the AWS of Fintech and its ambition to provide best-of-breed products on a one-stop shop platform that meets all of its members’ financial needs. In management's view, combining Technisys’ Cyberbank platform with Galileo will create one of the most modern full-stack offerings available with multi-product capabilities — including deposit, checking, lending, credit cards and investing as well as future products — all surfaced through industry-leading APIs. In addition, it is believed that the growth opportunities of both Galileo and Technisys will expand meaningfully as a result of gaining access to each company's large installed client base. SoFi expects to also be able to leverage this next-generation technology stack to continue building its best-of-breed products and services by integrating Technisys’ leading, cloud-native, multi-product digital banking core with Galileo’s cloud-based platform-as-a-service capabilities.

Following the close of the acquisition, Technisys will continue to operate as an independent subsidiary of

Guidance and Outlook

For note, management expects the incremental net interest income revenue from

Over the last several quarters, SoFi’s unique, diversified business model has proven to be an increasingly powerful competitive advantage. Even as SoFi continues to invest and scale, the expectation is for that strength and momentum to continue.

SoFi’s guidance for the first quarter of 2022 incorporates the negative impact of the unexpected extension of the federal student loan payment moratorium to

Had the moratorium expired in January, management estimates that first quarter 2022 adjusted revenue would have been in the range of

For the full year 2022, management expects to grow adjusted net revenue

-

First, management assumes the moratorium on federal student loan payments expires as currently contemplated on

May 1, 2022 and student loan refinance origination volume normalizes to pre-Covid levels partway through the second quarter, and remains at those levels from that point through the remainder of 2022.

-

Second, management assumes that

SoFi Bank will begin contributing to SoFi’s results more meaningfully in the second quarter of 2022, rather than in the first quarter, whenSoFi Bank was opened. BecauseSoFi Bank was initially capitalized with cash from the balance sheet, not loans, SoFi will not begin to realize the lower cost of capital benefits ofSoFi Bank until it can originate and fund loans inSoFi Bank . Management believes it will take until the second quarter of 2022 to build the appropriate loan balances to see more than a nominal impact.

-

Third, management assumes that Technisys revenue growth will be

20% to25% for full-year 2022, and will begin contributing to SoFi's results following the close of the transaction.

-

Fourth, management expects the core SoFi business (excluding the impact of Technisys) to deliver incremental adjusted EBITDA margins of

30% in 2022, consistent with previously articulated plans to continue investing to drive sustainable long-term growth. Management expects Technisys to contribute a minimal amount to adjusted EBITDA in 2022, primarily because 2021 was a year of significant investment for Technisys. Over time, management expects the Technisys business to be additive to consolidated incremental adjusted EBITDA margins.

Management currently forecasts Stock-Based Compensation expense of

Earnings Webcast

SoFi’s executive management team will host a live audio webcast beginning at

Cautionary Statement Regarding Forward-Looking Statements

Certain of the statements above are forward-looking and as such are not historical facts. This includes, without limitation, statements regarding the financial position, business strategy and the plans and objectives of management for our future operations. These forward-looking statements are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. Words such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intend”, “may”, "opportunity", "future", "strategy", “might”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “strive”, “suggests”, “would”, “will be”, “will continue”, “will likely result” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Factors that could cause actual results to differ materially from those contemplated by these forward-looking statements include: (i) the effect of and uncertainties related to the COVID-19 pandemic (including any government responses thereto); (ii) our ability to achieve and maintain profitability and continued growth across our three businesses in the future; (iii) the impact on our business of the regulatory environment and complexities with compliance related to such environment, including any further extension of the student loan payment moratorium and our expectations regarding the return to pre-pandemic student loan demand levels; (iv) our ability to realize the benefits of becoming a bank holding company and operating

These forward-looking statements are based on information available as of the date hereof and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

Non-GAAP Financial Measures

This press release presents information about our adjusted net revenue and adjusted EBITDA, which are non-GAAP financial measures provided as supplements to the results provided in accordance with accounting principles generally accepted in

Forward-looking non-GAAP financial measures are presented without reconciliations of such forward-looking non-GAAP measures because the GAAP financial measures are not accessible on a forward-looking basis and reconciling information is not available without unreasonable effort due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments reflected in our reconciliation of historic non-GAAP financial measures, the amounts of which, based on historical experience, could be material.

About SoFi

SoFi's mission is to help our members achieve financial independence to realize their ambitions. Our products for borrowing, saving, spending, investing and protecting give our approximately three and a half million members fast access to tools to get their money right. SoFi membership comes with the key essentials for getting ahead, including career advisors and connection to a thriving community of like-minded, ambitious people. SoFi is also the naming rights partner of

Availability of Other Information About SoFi

Investors and others should note that we communicate with our investors and the public using our website (www.sofi.com), the investor relations website (https://investors.sofi.com), and on social media (Twitter and LinkedIn), including but not limited to investor presentations and investor fact sheets,

FINANCIAL TABLES

1. Consolidated Statements of Operations and Comprehensive Loss

2. Reconciliation of GAAP to Non-GAAP Financial Measures

3. Consolidated Balance Sheets

4. Consolidated Statements of Cash Flows

5. Company Metrics

6. Segment Financials

Table 1 |

||||||||||||||||

Consolidated Statements of Operations and Comprehensive Loss (In Thousands, Except for Share and Per Share Data) |

||||||||||||||||

|

|

|

|

|

||||||||||||

|

|

Three Months Ended |

|

Year Ended |

||||||||||||

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

Interest income |

|

|

|

|

|

|

|

|||||||||

Loans |

$ |

91,119 |

|

|

$ |

85,622 |

|

|

$ |

337,862 |

|

|

$ |

330,353 |

|

|

Securitizations |

|

2,849 |

|

|

|

5,133 |

|

|

|

14,109 |

|

|

|

24,031 |

|

|

Related party notes |

|

— |

|

|

|

480 |

|

|

|

211 |

|

|

|

3,189 |

|

|

Other |

|

815 |

|

|

|

838 |

|

|

|

2,838 |

|

|

|

5,964 |

|

|

Total interest income |

|

94,783 |

|

|

|

92,073 |

|

|

|

355,020 |

|

|

|

363,537 |

|

|

Interest expense |

|

|

|

|

|

|

|

|||||||||

Securitizations and warehouses |

|

15,067 |

|

|

|

33,669 |

|

|

|

90,485 |

|

|

|

155,150 |

|

|

Corporate borrowings |

|

2,593 |

|

|

|

19,125 |

|

|

|

10,345 |

|

|

|

27,974 |

|

|

Other |

|

546 |

|

|

|

456 |

|

|

|

1,946 |

|

|

|

2,482 |

|

|

Total interest expense |

|

18,206 |

|

|

|

53,250 |

|

|

|

102,776 |

|

|

|

185,606 |

|

|

Net interest income |

|

76,577 |

|

|

|

38,823 |

|

|

|

252,244 |

|

|

|

177,931 |

|

|

Noninterest income |

|

|

|

|

|

|

|

|||||||||

Loan origination and sales |

|

135,415 |

|

|

|

100,241 |

|

|

|

497,626 |

|

|

|

371,323 |

|

|

Securitizations |

|

(8,249 |

) |

|

|

(7,249 |

) |

|

|

(14,862 |

) |

|

|

(70,251 |

) |

|

Servicing |

|

9,594 |

|

|

|

(1,128 |

) |

|

|

(2,281 |

) |

|

|

(19,426 |

) |

|

Technology platform fees |

|

51,287 |

|

|

|

38,521 |

|

|

|

191,847 |

|

|

|

90,128 |

|

|

Other |

|

20,984 |

|

|

|

2,283 |

|

|

|

60,298 |

|

|

|

15,827 |

|

|

Total noninterest income |

|

209,031 |

|

|

|

132,668 |

|

|

|

732,628 |

|

|

|

387,601 |

|

|

Total net revenue |

|

285,608 |

|

|

|

171,491 |

|

|

|

984,872 |

|

|

|

565,532 |

|

|

Noninterest expense |

|

|

|

|

|

|

|

|||||||||

Technology and product development |

|

66,316 |

|

|

|

57,767 |

|

|

|

276,087 |

|

|

|

201,199 |

|

|

Sales and marketing |

|

129,705 |

|

|

|

72,182 |

|

|

|

426,875 |

|

|

|

276,577 |

|

|

Cost of operations |

|

69,195 |

|

|

|

53,010 |

|

|

|

256,980 |

|

|

|

178,896 |

|

|

General and administrative |

|

125,160 |

|

|

|

76,097 |

|

|

|

498,534 |

|

|

|

237,381 |

|

|

Provision for credit losses |

|

4,686 |

|

|

|

— |

|

|

|

7,573 |

|

|

|

— |

|

|

Total noninterest expense |

|

395,062 |

|

|

|

259,056 |

|

|

|

1,466,049 |

|

|

|

894,053 |

|

|

Loss before income taxes |

|

(109,454 |

) |

|

|

(87,565 |

) |

|

|

(481,177 |

) |

|

|

(328,521 |

) |

|

Income tax (expense) benefit |

|

(1,558 |

) |

|

|

4,949 |

|

|

|

(2,760 |

) |

|

|

104,468 |

|

|

Net loss |

$ |

(111,012 |

) |

|

$ |

(82,616 |

) |

|

$ |

(483,937 |

) |

|

$ |

(224,053 |

) |

|

Other comprehensive loss |

|

|

|

|

|

|

|

|||||||||

Unrealized losses on available-for-sale securities, net |

|

(1,201 |

) |

|

|

— |

|

|

|

(1,351 |

) |

|

|

— |

|

|

Foreign currency translation adjustments, net |

|

188 |

|

|

|

(126 |

) |

|

|

46 |

|

|

|

(145 |

) |

|

Total other comprehensive loss |

|

(1,013 |

) |

|

|

(126 |

) |

|

|

(1,305 |

) |

|

|

(145 |

) |

|

Comprehensive loss |

$ |

(112,025 |

) |

|

$ |

(82,742 |

) |

|

$ |

(485,242 |

) |

|

$ |

(224,198 |

) |

|

Loss per share |

|

|

|

|

|

|

|

|||||||||

Loss per share – basic |

$ |

(0.15 |

) |

|

$ |

(1.85 |

) |

|

$ |

(1.00 |

) |

|

$ |

(4.30 |

) |

|

Loss per share – diluted |

$ |

(0.15 |

) |

|

$ |

(1.85 |

) |

|

$ |

(1.00 |

) |

|

$ |

(4.30 |

) |

|

Weighted average common stock outstanding – basic |

|

814,507,200 |

|

|

|

78,480,471 |

|

|

|

526,730,261 |

|

|

|

73,851,108 |

|

|

Weighted average common stock outstanding – diluted |

|

814,507,200 |

|

|

|

78,480,471 |

|

|

|

526,730,261 |

|

|

|

73,851,108 |

|

|

Table 2 |

Non-GAAP Financial Measures |

Reconciliation of Adjusted Net Revenue

Adjusted net revenue is defined as total net revenue, adjusted to exclude the fair value changes in servicing rights and residual interests classified as debt due to valuation inputs and assumptions changes, which relate only to our Lending segment. For our consolidated results and for the Lending segment, we reconcile adjusted net revenue to total net revenue, the most directly comparable GAAP measure, as presented for the periods indicated below:

|

|

Three Months Ended |

|

Year Ended |

|||||||||

($ in thousands) |

|

|

2021 |

|

|

2020 |

|

2021 |

|

2020 |

|||

Total net revenue |

|

$ |

285,608 |

|

|

$ |

171,491 |

|

$ |

984,872 |

|

$ |

565,532 |

Servicing rights – change in valuation inputs or assumptions(1) |

|

|

(9,273 |

) |

|

|

1,127 |

|

|

2,651 |

|

|

17,459 |

Residual interests classified as debt – change in valuation inputs or assumptions(2) |

|

|

3,541 |

|

|

|

9,401 |

|

|

22,802 |

|

|

38,216 |

Adjusted net revenue |

|

$ |

279,876 |

|

|

$ |

182,019 |

|

$ |

1,010,325 |

|

$ |

621,207 |

|

|

Three Months Ended |

|

Year Ended |

|||||||||

($ in thousands) |

|

|

2021 |

|

|

2020 |

|

2021 |

|

2020 |

|||

Total net revenue – Lending |

|

$ |

213,764 |

|

|

$ |

148,992 |

|

$ |

738,323 |

|

$ |

480,866 |

Servicing rights – change in valuation inputs or assumptions(1) |

|

|

(9,273 |

) |

|

|

1,127 |

|

|

2,651 |

|

|

17,459 |

Residual interests classified as debt – change in valuation inputs or assumptions(2) |

|

|

3,541 |

|

|

|

9,401 |

|

|

22,802 |

|

|

38,216 |

Adjusted net revenue – Lending |

|

$ |

208,032 |

|

|

$ |

159,520 |

|

$ |

763,776 |

|

$ |

536,541 |

___________________

(1) |

Reflects changes in fair value inputs and assumptions on servicing rights, including conditional prepayment and default rates and discount rates. These assumptions are highly sensitive to market interest rate changes and are not indicative of our performance or results of operations. Moreover, these non-cash charges are unrealized during the period and, therefore, have no impact on our cash flows from operations. As such, these positive and negative changes are adjusted out of total net revenue to provide management and financial users with better visibility into the net revenue available to finance our operations and our overall performance. |

|

(2) |

Reflects changes in fair value inputs and assumptions on residual interests classified as debt, including conditional prepayment and default rates and discount rates. When third parties finance our consolidated securitization variable interest entities (“VIEs”) by purchasing residual interests, we receive proceeds at the time of the closing of the securitization and, thereafter, pass along contractual cash flows to the residual interest owner. These residual debt obligations are measured at fair value on a recurring basis, but they have no impact on our initial financing proceeds, our future obligations to the residual interest owner (because future residual interest claims are limited to contractual securitization collateral cash flows), or the general operations of our business. As such, these positive and negative non-cash changes in fair value attributable to assumption changes are adjusted out of total net revenue to provide management and financial users with better visibility into the net revenue available to finance our operations. |

Reconciliation of Adjusted EBITDA

Adjusted EBITDA is defined as net income (loss), adjusted to exclude: (i) corporate borrowing-based interest expense (our adjusted EBITDA measure is not adjusted for warehouse or securitization-based interest expense, nor deposit interest expense and finance lease liability interest expense, as discussed further below), (ii) income tax expense (benefit), (iii) depreciation and amortization, (iv) share-based expense (inclusive of equity-based payments to non-employees), (v) transaction-related expenses, (vi) fair value changes in warrant liabilities, and (vii) fair value changes in each of servicing rights and residual interests classified as debt due to valuation assumptions. We reconcile adjusted EBITDA to net loss, the most directly comparable GAAP measure, for the periods indicated below:

|

|

Three Months Ended |

|

Year Ended |

||||||||||||

($ in thousands) |

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

Net loss |

|

$ |

(111,012 |

) |

|

$ |

(82,616 |

) |

|

$ |

(483,937 |

) |

|

$ |

(224,053 |

) |

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

||||||||

Interest expense – corporate borrowings(1) |

|

|

2,593 |

|

|

|

19,125 |

|

|

|

10,345 |

|

|

|

27,974 |

|

Income tax expense (benefit)(2) |

|

|

1,558 |

|

|

|

(4,949 |

) |

|

|

2,760 |

|

|

|

(104,468 |

) |

Depreciation and amortization(3) |

|

|

26,527 |

|

|

|

25,486 |

|

|

|

101,568 |

|

|

|

69,832 |

|

Share-based expense |

|

|

77,082 |

|

|

|

30,089 |

|

|

|

239,371 |

|

|

|

100,778 |

|

Transaction-related expense(4) |

|

|

2,753 |

|

|

|

— |

|

|

|

27,333 |

|

|

|

9,161 |

|

Fair value changes in warrant liabilities(5) |

|

|

10,824 |

|

|

|

14,154 |

|

|

|

107,328 |

|

|

|

20,525 |

|

Servicing rights – change in valuation inputs or assumptions(6) |

|

|

(9,273 |

) |

|

|

1,127 |

|

|

|

2,651 |

|

|

|

17,459 |

|

Residual interests classified as debt – change in valuation inputs or assumptions(7) |

|

|

3,541 |

|

|

|

9,401 |

|

|

|

22,802 |

|

|

|

38,216 |

|

Total adjustments |

|

|

115,605 |

|

|

|

94,433 |

|

|

|

514,158 |

|

|

|

179,477 |

|

Adjusted EBITDA |

|

$ |

4,593 |

|

|

$ |

11,817 |

|

|

$ |

30,221 |

|

|

$ |

(44,576 |

) |

___________________

(1) |

Our adjusted EBITDA measure adjusts for corporate borrowing-based interest expense, as these expenses are a function of our capital structure. Corporate borrowing-based interest expense primarily included (i) interest on our revolving credit facility, (ii) amortization of debt discount and debt issuance costs on our convertible notes, and (iii) interest on the seller note issued in connection with our acquisition of Galileo. Our adjusted EBITDA measure does not adjust for interest expense on warehouse facilities and securitization debt, which are recorded within interest expense—securitizations and warehouses in the consolidated statements of operations and comprehensive income (loss), as these interest expenses are direct operating expenses driven by loan origination and sales activity. Additionally, our adjusted EBITDA measure does not adjust for interest expense on |

|

(2) |

Our income tax expense positions in 2021 and 2019 were primarily a function of |

|

(3) |

Depreciation and amortization expense for 2021 increased compared to 2020 primarily due to the amortization of intangible assets recognized during the second quarter of 2020 associated with the Galileo and 8 Limited acquisitions, amortization of purchased and internally-developed software, and depreciation related to |

|

(4) |

Transaction-related expenses during 2021 included a |

|

(5) |

Our adjusted EBITDA measure excludes the non-cash fair value changes in warrants accounted for as liabilities, which were measured at fair value through earnings. The amounts in 2019 and 2020, as well as a portion of 2021, related to changes in the fair value of Series H warrants issued by Social Finance in 2019 in connection with certain redeemable preferred stock issuances. We did not measure the Series H warrants at fair value subsequent to |

|

(6) |

Reflects changes in fair value inputs and assumptions, including market servicing costs, conditional prepayment and default rates and discount rates. This non-cash change is unrealized during the period and, therefore, has no impact on our cash flows from operations. As such, these positive and negative changes in fair value attributable to assumption changes are adjusted out of net loss to provide management and financial users with better visibility into the earnings available to finance our operations. |

|

(7) |

Reflects changes in fair value inputs and assumptions, including conditional prepayment and default rates and discount rates. When third parties finance our consolidated VIEs through purchasing residual interests, we receive proceeds at the time of the securitization close and, thereafter, pass along contractual cash flows to the residual interest owner. These obligations are measured at fair value on a recurring basis, which has no impact on our initial financing proceeds, our future obligations to the residual interest owner (because future residual interest claims are limited to contractual securitization collateral cash flows), or the general operations of our business. As such, these positive and negative non-cash changes in fair value attributable to assumption changes are adjusted out of net loss to provide management and financial users with better visibility into the earnings available to finance our operations. |

Table 3 |

||||||||

Consolidated Balance Sheets (In Thousands, Except for Share Data) |

||||||||

|

|

|||||||

|

|

2021 |

|

|

|

2020 |

|

|

Assets |

|

|

|

|||||

Cash and cash equivalents |

$ |

494,711 |

|

|

$ |

872,582 |

|

|

Restricted cash and restricted cash equivalents |

|

273,726 |

|

|

|

450,846 |

|

|

Investments in available-for-sale securities (amortized cost of |

|

194,907 |

|

|

|

— |

|

|

Loans, less allowance for credit losses on loans at amortized cost of |

|

6,068,884 |

|

|

|

4,879,303 |

|

|

Servicing rights |

|

168,259 |

|

|

|

149,597 |

|

|

Securitization investments |

|

374,688 |

|

|

|

496,935 |

|

|

Equity method investments |

|

19,739 |

|

|

|

107,534 |

|

|

Property, equipment and software |

|

111,873 |

|

|

|

81,489 |

|

|

|

|

898,527 |

|

|

|

899,270 |

|

|

Intangible assets |

|

284,579 |

|

|

|

355,086 |

|

|

Operating lease right-of-use assets |

|

115,191 |

|

|

|

116,858 |

|

|

Related party notes receivable |

|

— |

|

|

|

17,923 |

|

|

Other assets, less allowance for credit losses of |

|

171,242 |

|

|

|

136,076 |

|

|

Total assets |

$ |

9,176,326 |

|

|

$ |

8,563,499 |

|

|

Liabilities, temporary equity and permanent equity (deficit) |

|

|

|

|||||

Liabilities: |

|

|

|

|||||

Accounts payable, accruals and other liabilities |

$ |

298,164 |

|

|

$ |

452,909 |

|

|

Operating lease liabilities |

|

138,794 |

|

|

|

139,796 |

|

|

Debt |

|

3,947,983 |

|

|

|

4,798,925 |

|

|

Residual interests classified as debt |

|

93,682 |

|

|

|

118,298 |

|

|

Total liabilities |

|

4,478,623 |

|

|

|

5,509,928 |

|

|

Commitments, guarantees, concentrations and contingencies |

|

|

|

|||||

Temporary equity: |

|

|

|

|||||

Redeemable preferred stock, |

|

320,374 |

|

|

|

3,173,686 |

|

|

Permanent equity (deficit): |

|

|

|

|||||

Common stock, |

|

83 |

|

|

|

— |

|

|

Additional paid-in capital |

|

5,561,831 |

|

|

|

579,228 |

|

|

Accumulated other comprehensive loss |

|

(1,471 |

) |

|

|

(166 |

) |

|

Accumulated deficit |

|

(1,183,114 |

) |

|

|

(699,177 |

) |

|

Total permanent equity (deficit) |

|

4,377,329 |

|

|

|

(120,115 |

) |

|

Total liabilities, temporary equity and permanent equity (deficit) |

$ |

9,176,326 |

|

|

$ |

8,563,499 |

|

|

Table 4 |

||||||||

Consolidated Statements of Cash Flows (In Thousands) |

||||||||

|

|

|

||||||

|

|

Year Ended |

||||||

|

|

|

2021 |

|

|

|

2020 |

|

Operating activities |

|

|

|

|||||

Net loss |

$ |

(483,937 |

) |

|

$ |

(224,053 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|||||

Depreciation and amortization |

|

101,568 |

|

|

|

69,832 |

|

|

Deferred debt issuance and discount expense |

|

18,292 |

|

|

|

28,310 |

|

|

Share-based compensation expense |

|

239,011 |

|

|

|

99,870 |

|

|

Equity-based payments to non-employees |

|

360 |

|

|

|

908 |

|

|

Deferred income taxes |

|

1,204 |

|

|

|

(104,504 |

) |

|

Equity method investment earnings |

|

261 |

|

|

|

(4,314 |

) |

|

Accretion of seller note interest expense |

|

— |

|

|

|

6,002 |

|

|

Fair value changes in residual interests classified as debt |

|

22,802 |

|

|

|

38,216 |

|

|

Fair value changes in securitization investments |

|

(6,538 |

) |

|

|

(13,919 |

) |

|

Fair value changes in warrant liabilities |

|

107,328 |

|

|

|

20,525 |

|

|

Fair value adjustment to related party notes receivable |

|

(169 |

) |

|

|

319 |

|

|

Other |

|

(5,085 |

) |

|

|

803 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|||||

Originations and purchases of loans |

|

(13,500,706 |

) |

|

|

(10,406,813 |

) |

|

Proceeds from sales and repayments of loans |

|

12,202,525 |

|

|

|

9,949,805 |

|

|

Other changes in loans |

|

(10,148 |

) |

|

|

(58,743 |

) |

|

Servicing assets |

|

(18,662 |

) |

|

|

52,021 |

|

|

Related party notes receivable interest income |

|

1,399 |

|

|

|

1,121 |

|

|

Other assets |

|

(10,700 |

) |

|

|

(29,883 |

) |

|

Accounts payable, accruals and other liabilities |

|

(9,022 |

) |

|

|

95,161 |

|

|

Net cash used in operating activities |

$ |

(1,350,217 |

) |

|

$ |

(479,336 |

) |

|

Investing activities |

|

|

|

|||||

Purchases of property, equipment, software and intangible assets |

$ |

(52,261 |

) |

|

$ |

(24,549 |

) |

|

Related party notes receivable issuances |

|

— |

|

|

|

(7,643 |

) |

|

Proceeds from repayment of related party notes receivable |

|

16,693 |

|

|

|

— |

|

|

Purchases of available-for-sale investments |

|

(246,372 |

) |

|

|

— |

|

|

Proceeds from sales of available-for-sale investments |

|

52,742 |

|

|

|

— |

|

|

Proceeds from maturities of available-for-sale investments |

|

4,799 |

|

|

|

— |

|

|

Purchases of non-securitization investments |

|

(22,000 |

) |

|

|

(145 |

) |

|

Proceeds from non-securitization investments |

|

109,534 |

|

|

|

974 |

|

|

Proceeds from securitization investments |

|

247,058 |

|

|

|

322,704 |

|

|

Acquisition of business, net of cash acquired |

|

— |

|

|

|

(32,392 |

) |

|

Net cash provided by investing activities |

$ |

110,193 |

|

|

$ |

258,949 |

|

|

Consolidated Statements of Cash Flows (Continued) (In Thousands) |

||||||||

|

|

|

||||||

|

|

Year Ended |

||||||

|

|

|

2021 |

|

|

|

2020 |

|

Financing activities |

|

|

|

|||||

Proceeds from debt issuances |

$ |

9,521,314 |

|

|

$ |

10,234,378 |

|

|

Repayment of debt |

|

(10,429,176 |

) |

|

|

(9,708,991 |

) |

|

Payment of debt issuance costs |

|

(9,465 |

) |

|

|

(16,443 |

) |

|

Purchase of capped calls |

|

(113,760 |

) |

|

|

— |

|

|

Taxes paid related to net share settlement of share-based awards |

|

(42,644 |

) |

|

|

(31,259 |

) |

|

Purchases of common stock |

|

(526 |

) |

|

|

(40 |

) |

|

Redemptions of redeemable common and preferred stock |

|

(282,859 |

) |

|

|

— |

|

|

Proceeds from Business Combination and |

|

1,989,851 |

|

|

|

— |

|

|

Payment of costs directly attributable to the issuance of common stock in connection with Business Combination and |

|

(26,951 |

) |

|

|

— |

|

|

Proceeds from stock option exercises |

|

25,154 |

|

|

|

3,781 |

|

|

Proceeds from warrant exercises |

|

95,047 |

|

|

|

— |

|

|

Payment of redeemable preferred stock dividends |

|

(40,426 |

) |

|

|

(40,536 |

) |

|

Payment of deferred equity costs |

|

(56 |

) |

|

|

— |

|

|

Finance lease principal payments |

|

(516 |

) |

|

|

(489 |

) |

|

Note receivable principal repayments from stockholder |

|

— |

|

|

|

43,513 |

|

|

Proceeds from common stock issuances |

|

— |

|

|

|

369,840 |

|

|

Net cash provided by financing activities |

$ |

684,987 |

|

|

$ |

853,754 |

|

|

Effect of exchange rates on cash and cash equivalents |

|

46 |

|

|

|

(145 |

) |

|

Net (decrease) increase in cash, cash equivalents, restricted cash and restricted cash equivalents |

|

(554,991 |

) |

|

|

633,222 |

|

|

Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of period |

|

1,323,428 |

|

|

|

690,206 |

|

|

Cash, cash equivalents, restricted cash and restricted cash equivalents at end of period |

$ |

768,437 |

|

|

$ |

1,323,428 |

|

|

|

|

|

|

|||||

Reconciliation to amounts on consolidated balance sheets (as of period end) |

|

|

|

|||||

Cash and cash equivalents |

$ |

494,711 |

|

|

$ |

872,582 |

|

|

Restricted cash and restricted cash equivalents |

|

273,726 |

|

|

|

450,846 |

|

|

Total cash, cash equivalents, restricted cash and restricted cash equivalents |

$ |

768,437 |

|

|

$ |

1,323,428 |

|

|

|

|

|

|

|||||

Consolidated Statements of Cash Flows (Continued) (In Thousands) |

||||||

|

|

|

||||

|

|

Year Ended |

||||

|

|

2021 |

|

2020 |

||

Supplemental cash flow information |

|

|

|

|||

Interest paid |

$ |

94,795 |

|

$ |

129,131 |

|

Income taxes paid, net |

|

1,759 |

|

|

529 |

|

|

|

|

|

|||

Supplemental non-cash investing and financing activities |

|

|

|

|||

Securitization investments acquired via loan transfers |

$ |

118,274 |

|

$ |

151,768 |

|

Non-cash property, equipment, software and intangible asset additions |

|

1,930 |

|

|

358 |

|

Available-for-sale investments securities purchased but unpaid |

|

7,457 |

|

|

— |

|

Share-based compensation capitalized related to internally-developed software |

|

7,776 |

|

|

— |

|

Third party warrants acquired with earnings initially deferred |

|

964 |

|

|

— |

|

Deferred debt issuance costs accrued but unpaid |

|

925 |

|

|

1,600 |

|

Costs directly attributable to the issuance of common stock paid in 2020 |

|

588 |

|

|

— |

|

Reduction to temporary equity associated with purchase price adjustments |

|

743 |

|

|

— |

|

Conversion of temporary equity into permanent equity in conjunction with the Business Combination |

|

2,702,569 |

|

|

— |

|

Deconsolidation of residual interests classified as debt |

|

— |

|

|

101,718 |

|

Deconsolidation of securitization debt |

|

— |

|

|

770,918 |

|

Seller note issued in acquisition |

|

— |

|

|

243,998 |

|

Redeemable preferred stock issued in acquisition |

|

— |

|

|

814,156 |

|

Common stock options assumed in acquisition |

|

— |

|

|

32,197 |

|

Issuance of common stock in acquisition |

|

— |

|

|

15,565 |

|

Finance lease right-of-use assets acquired |

|

— |

|

|

15,100 |

|

Property, equipment and software acquired in acquisition |

|

— |

|

|

2,026 |

|

Debt assumed in acquisition |

|

— |

|

|

5,832 |

|

Accrued but unpaid deferred equity costs |

|

— |

|

|

56 |

|

Redeemed but unpaid common stock |

|

— |

|

|

526 |

|

Redeemed but unpaid redeemable preferred stock |

|

— |

|

|

132,859 |

|

Table 5 |

|||||||||||||||

Company Metrics |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Members |

3,460,298 |

|

2,937,379 |

|

2,560,492 |

|

2,281,092 |

|

1,850,871 |

|

1,500,576 |

|

1,204,475 |

|

1,086,409 |

Total Products |

5,173,197 |

|

4,267,665 |

|

3,667,121 |

|

3,184,554 |

|

2,523,555 |

|

2,052,933 |

|

1,645,044 |

|

1,442,481 |

Total Products — Lending segment |

1,078,952 |

|

1,030,882 |

|

981,440 |

|

945,227 |

|

917,645 |

|

892,934 |

|

861,970 |

|

841,615 |

Total Products — Financial Services segment |

4,094,245 |

|

3,236,783 |

|

2,685,681 |

|

2,239,327 |

|

1,605,910 |

|

1,159,999 |

|

783,074 |

|

600,866 |

Total Accounts — Technology Platform segment(1) |

99,660,657 |

|

88,811,022 |

|

78,902,156 |

|

69,572,680 |

|

59,735,210 |

|

49,276,594 |

|

35,988,090 |

|

— |

___________________

(1) |

Beginning in the fourth quarter of 2021, the Company included SoFi accounts on the Galileo platform-as-a-service in its total Technology Platform accounts metric to better align with presentation of Technology Platform segment revenue. The Company recast the total accounts as of |

Members

We refer to our customers as “members”. We define a member as someone who has had a lending relationship with us through origination and/or servicing, opened a financial services account, linked an external account to our platform, or signed up for our credit score monitoring service. Once someone becomes a member, they are always considered a member unless they violate our terms of service, given that our members have continuous access to our certified financial planners, our career advice services, our member events, our content, educational material, news, tools and calculators at no cost to the member. We view members as an indication not only of the size and a measurement of growth of our business, but also as a measure of the significant value of the data we have collected over time.

Products

Total products refers to the aggregate number of lending and financial services products that our members have selected on our platform since our inception through the reporting date, whether or not the members are still registered for such products. In our Lending segment, total products refers to the number of home loans, personal loans and student loans that have been originated through our platform through the reporting date, whether or not such loans have been paid off. If a member has multiple loan products of the same loan product type, such as two personal loans, that is counted as a single product. However, if a member has multiple loan products across loan product types, such as one personal loan and one home loan, that is counted as two products. In our Financial Services segment, total products refers to the number of

Technology Platform Total Accounts

In our Technology Platform segment, total accounts refers to the number of open accounts at Galileo as of the reporting date, excluding SoFi accounts. We exclude SoFi accounts because revenue generated by Galileo from the SoFi relationship is eliminated in consolidation. No information is reported prior to our acquisition of Galileo on

Table 6 |

||||||||||||||||||||||||||||||||

Segment Financials |

||||||||||||||||||||||||||||||||

|

|

Quarter Ended |

||||||||||||||||||||||||||||||

($ in thousands) |

|

|

|

|

|

2021 |

|

2021 |

|

2020 |

|

|

|

2020 |

|

2020 |

||||||||||||||||

Lending |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Total interest income |

|

$ |

91,999 |

|

|

$ |

91,579 |

|

|

$ |

83,035 |

|

|

$ |

81,547 |

|

|

$ |

90,753 |

|

|

$ |

86,468 |

|

|

$ |

83,985 |

|

|

$ |

93,177 |

|

Total interest expense |

|

|

(14,753 |

) |

|

|

(19,322 |

) |

|

|

(26,213 |

) |

|

|

(29,770 |

) |

|

|

(33,626 |

) |

|

|

(34,246 |

) |

|

|

(39,650 |

) |

|

|

(47,516 |

) |

Total noninterest income (loss) |

|

|

136,518 |

|

|

|

138,034 |

|

|

|

109,469 |

|

|

|

96,200 |

|

|

|

91,865 |

|

|

|

109,890 |

|

|

|

51,549 |

|

|

|

28,217 |

|

Total net revenue |

|

|

213,764 |

|

|

|

210,291 |

|

|

|

166,291 |

|

|

|

147,977 |

|

|

|

148,992 |

|

|

|

162,112 |

|

|

|

95,884 |

|

|

|

73,878 |

|

Adjusted net revenue(1) |

|

|

208,032 |

|

|

|

215,475 |

|

|

|

172,232 |

|

|

|

168,037 |

|

|

|

159,520 |

|

|

|

178,084 |

|

|

|

117,182 |

|

|

|

81,755 |

|

Contribution profit (loss) |

|

|

105,065 |

|

|

|

117,668 |

|

|

|

89,188 |

|

|

|

87,686 |

|

|

|

85,204 |

|

|

|

103,011 |

|

|

|

49,419 |

|

|

|

4,095 |

|

Technology Platform |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Total interest income (expense) |

|

$ |

— |

|

|

$ |

39 |

|

|

$ |

(32 |

) |

|

$ |

(36 |

) |

|

$ |

(42 |

) |

|

$ |

(47 |

) |

|

$ |

(18 |

) |

|

$ |

— |

|

Total noninterest income |

|

|

53,299 |

|

|

|

50,186 |

|

|

|

45,329 |

|

|

|

46,101 |

|

|

|

37,524 |

|

|

|

38,865 |

|

|

|

19,037 |

|

|

|

997 |

|

Total net revenue(2) |

|

|

53,299 |

|

|

|

50,225 |

|

|

|

45,297 |

|

|

|

46,065 |

|

|

|

37,482 |

|

|

|

38,818 |

|

|

|

19,019 |

|

|

|

997 |

|

Contribution profit |

|

|

20,008 |

|

|

|

15,741 |

|

|

|

13,013 |

|

|

|

15,685 |

|

|

|

16,806 |

|

|

|

23,986 |

|

|

|

12,100 |

|

|

|

997 |

|

Financial Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Total interest income |

|

$ |

2,523 |

|

|

$ |

1,651 |

|

|

$ |

893 |

|

|

$ |

540 |

|

|

$ |

378 |

|

|

$ |

365 |

|

|

$ |

316 |

|

|

$ |

1,737 |

|

Total interest expense |

|

|

(738 |

) |

|

|

(442 |

) |

|

|

(351 |

) |

|

|

(311 |

) |

|

|

(290 |

) |

|

|

(267 |

) |

|

|

(233 |

) |

|

|

(1,522 |

) |

Total noninterest income |

|

|

20,171 |

|

|

|

11,411 |

|

|

|

16,497 |

|

|

|

6,234 |

|

|

|

3,963 |

|

|

|

3,139 |

|

|

|

2,345 |

|

|

|

1,939 |

|

Total net revenue |

|

|

21,956 |

|

|

|

12,620 |

|

|

|

17,039 |

|

|

|

6,463 |

|

|

|

4,051 |

|

|

|

3,237 |

|

|

|

2,428 |

|

|

|

2,154 |

|

Contribution loss(2) |

|

|

(35,189 |

) |

|

|

(39,465 |

) |

|

|

(24,745 |

) |

|

|

(35,519 |

) |

|

|

(36,753 |

) |

|

|

(37,467 |

) |

|

|

(30,893 |

) |

|

|

(26,983 |

) |

Other(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Total interest income |

|

$ |

261 |

|

|

$ |

371 |

|

|

$ |

180 |

|

|

$ |

441 |

|

|

$ |

942 |

|

|

$ |

1,284 |

|

|

$ |

1,764 |

|

|

$ |

2,368 |

|

Total interest expense |

|

|

(2,715 |

) |

|

|

(1,501 |

) |

|

|

(1,500 |

) |

|

|

(5,131 |

) |

|

|

(19,292 |

) |

|

|

(4,345 |

) |

|

|

(3,417 |

) |

|

|

(1,095 |

) |

Total noninterest income (loss) |

|

|

(957 |

) |

|

|

— |

|

|

|

3,967 |

|

|

|

169 |

|

|

|

(684 |

) |

|

|

(319 |

) |

|

|

(726 |

) |

|

|

— |

|

Total net revenue (loss)(2) |

|

|

(3,411 |

) |

|

|

(1,130 |

) |

|

|

2,647 |

|

|

|

(4,521 |

) |

|

|

(19,034 |

) |

|

|

(3,380 |

) |

|

|

(2,379 |

) |

|

|

1,273 |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Total interest income |

|

$ |

94,783 |

|

|

$ |

93,601 |

|

|

$ |

84,108 |

|

|

$ |

82,528 |

|

|

$ |

92,073 |

|

|

$ |

88,117 |

|

|

$ |

86,065 |

|

|

$ |

97,282 |

|

Total interest expense |

|

|

(18,206 |

) |

|

|

(21,226 |

) |

|

|

(28,096 |

) |

|

|

(35,248 |

) |

|

|

(53,250 |

) |

|

|

(38,905 |

) |

|

|

(43,318 |

) |

|

|

(50,133 |

) |

Total noninterest income (loss) |

|

|

209,031 |

|

|

|

199,631 |

|

|

|

175,262 |

|

|

|

148,704 |

|

|

|

132,668 |

|

|

|

151,575 |

|

|

|

72,205 |

|

|

|

31,153 |

|

Total net revenue |

|

|

285,608 |

|

|

|

272,006 |

|

|

|

231,274 |

|

|

|

195,984 |

|

|

|

171,491 |

|

|

|

200,787 |

|

|

|

114,952 |

|

|

|

78,302 |

|

Adjusted net revenue(1) |

|

|

279,876 |

|

|

|

277,190 |

|

|

|

237,215 |

|

|

|

216,044 |

|

|

|

182,019 |

|

|

|

216,759 |

|

|

|

136,250 |

|

|

|

86,179 |

|

Net income (loss) |

|

|

(111,012 |

) |

|

|

(30,047 |

) |

|

|

(165,314 |

) |

|

|

(177,564 |

) |

|

|

(82,616 |

) |

|

|

(42,878 |

) |

|

|

7,808 |

|

|

|

(106,367 |

) |

Adjusted EBITDA(1) |

|

|

4,593 |

|

|

|

10,256 |

|

|

|

11,240 |

|

|

|

4,132 |

|

|

|

11,817 |

|

|

|

33,509 |

|

|

|

(23,750 |

) |

|

|

(66,152 |

) |

___________________

(1) |

Adjusted net revenue and adjusted EBITDA are non-GAAP financial measures. For additional information on these measures and reconciliations to the most directly comparable GAAP measures, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein. |

|

(2) |

Technology Platform segment total net revenue includes intercompany technology platform fees earned by Galileo from SoFi, which is a Galileo client, of |

|

(3) |

“Other” primarily includes total net revenue associated with corporate functions and non-recurring gains from non-securitization investing activities that are not directly related to a reportable segment. |

SOFI-F

View source version on businesswire.com: https://www.businesswire.com/news/home/20220301006130/en/

Investors:

SoFi Investor Relations

aprochniak@sofi.com

Media:

SoFi Media Relations

rrosenzweig@sofi.com

Source: