Solaris Reports In-Pit Mineral Resources Including Higher Grade Mineralization; Over 30,000m Drilling in H2/24 Targeting Open Extensions and Infill to Upgrade Resources; Concurrent District Exploration for Epithermal Gold/Silver and Porphyry Copper Discoveries

Solaris Resources (TSX: SLS; NYSE: SLSR) has reported an In-Pit Mineral Resources Estimate (MRE) for its Warintza Project in Ecuador. Key highlights include:

1. 909 Mt at 0.53% CuEq (Measured & Indicated) and 1,426 Mt at 0.37% CuEq (Inferred) at a 0.25% CuEq cut-off grade.

2. Higher-grade mineralization of 427 Mt at 0.71% CuEq (Measured & Indicated) at a 0.50% CuEq cut-off grade.

3. Ongoing 2024 drill program of 60,000m targeting open extensions and upgrading resources.

4. Concurrent district exploration for epithermal gold/silver and porphyry copper discoveries.

5. Pre-Feasibility Study (PFS) planned for H2/25.

Solaris Resources (TSX: SLS; NYSE: SLSR) ha riportato una stima delle risorse minerarie in situ (MRE) per il suo progetto Warintza in Ecuador. I punti salienti includono:

1. 909 Mt a 0,53% CuEq (Misurate e Indicate) e 1.426 Mt a 0,37% CuEq (Indeterminate) con un grado di taglio di 0,25% CuEq.

2. Mineralizzazione di grado superiore di 427 Mt a 0,71% CuEq (Misurate e Indicate) con un grado di taglio di 0,50% CuEq.

3. Un programma di perforazione per il 2024 di 60.000 m volto a identificare estensioni aperte e aggiornare le risorse.

4. Esplorazione distrettuale in corso per scoperte di oro/argento epithermale e rame porfirico.

5. Studio di Fattibilità Preliminare (PFS) previsto per il secondo semestre del 2025.

Solaris Resources (TSX: SLS; NYSE: SLSR) ha informado sobre una estimación de recursos minerales in situ (MRE) para su proyecto Warintza en Ecuador. Los aspectos más destacados incluyen:

1. 909 Mt a 0.53% CuEq (Medidos e Indicados) y 1.426 Mt a 0.37% CuEq (Inferido) con un grado de corte de 0.25% CuEq.

2. Mineralización de mayor grado de 427 Mt a 0.71% CuEq (Medidos e Indicados) con un grado de corte de 0.50% CuEq.

3. Un programa de perforación para 2024 de 60,000 m que apunta a extensiones abiertas y a la actualización de recursos.

4. Exploración en curso en el distrito para descubrimientos de oro/plata epitermales y cobre porfirico.

5. Estudio de Prefactibilidad (PFS) planeado para la segunda mitad de 2025.

Solaris Resources (TSX: SLS; NYSE: SLSR)는 에콰도르의 Warintza 프로젝트에 대한 지하 광물 자원 추정치(MRE)를 보고했습니다. 주요 내용은 다음과 같습니다:

1. 0.25% CuEq 컷오프 등급에서 909 Mt의 0.53% CuEq (측정 및 지표) 및 1,426 Mt의 0.37% CuEq (추정).

2. 0.50% CuEq 컷오프 등급의 427 Mt의 0.71% CuEq (측정 및 지표)의 고등급 광물화.

3. 열려 있는 연장을 겨냥하고 자원을 업그레이드하기 위한 2024년 60,000m 드릴 프로그램.

4. 에피서말 금/은 및 포르피리 구리 발견을 위한 동시 구역 탐사.

5. 2025년 하반기 예정인 예비타당성 조사(PFS).

Solaris Resources (TSX: SLS; NYSE: SLSR) a annoncé une estimation des ressources minérales en fosse (MRE) pour son projet Warintza en Équateur. Les points clés comprennent :

1. 909 Mt à 0,53% CuEq (Mesuré et Indiqué) et 1.426 Mt à 0,37% CuEq (Inféré) à une teneur de coupure de 0,25% CuEq.

2. Minéralisation de haute teneur de 427 Mt à 0,71% CuEq (Mesuré et Indiqué) à une teneur de coupure de 0,50% CuEq.

3. Un programme de forage de 60 000 m pour 2024 visant les extensions ouvertes et la mise à jour des ressources.

4. Exploration districtale en cours pour des découvertes d'or/argent épithermal et de cuivre porphyrique.

5. Étude de faisabilité préliminaire (PFS) prévue pour le deuxième semestre de 2025.

Solaris Resources (TSX: SLS; NYSE: SLSR) hat eine Schätzung der Mineralressourcen im Scheitelbereich (MRE) für sein Projekt Warintza in Ecuador veröffentlicht. Die wichtigsten Punkte umfassen:

1. 909 Mt bei 0,53% CuEq (Gemessen & angezeigt) und 1.426 Mt bei 0,37% CuEq (geschätzt) mit einem Cut-Off-Gehalt von 0,25% CuEq.

2. Hochgradige Mineralisierung von 427 Mt bei 0,71% CuEq (Gemessen & angezeigt) bei einem Cut-Off-Gehalt von 0,50% CuEq.

3. Ein Bohrprogramm für 2024 über 60.000 m, das sich auf offene Erweiterungen und die Aufwertung von Ressourcen konzentriert.

4. Gleichzeitige Erkundung des Bezirks nach epithermalen Gold-/Silber- und Porphyrkupferentdeckungen.

5. Eine Machbarkeitsstudie (PFS) ist für das zweite Halbjahr 2025 geplant.

- Large mineral resource estimate with 909 Mt at 0.53% CuEq (Measured & Indicated) and 1,426 Mt at 0.37% CuEq (Inferred)

- Higher-grade mineralization of 427 Mt at 0.71% CuEq (Measured & Indicated) at a 0.50% CuEq cut-off grade

- Ongoing 60,000m drill program in 2024 to upgrade and expand resources

- Structural advantages including low elevation, direct connection to Pacific ports, and low-cost hydroelectric power

- Concurrent district exploration targeting epithermal gold/silver and porphyry copper discoveries

- None.

Insights

Solaris Resources' announcement of its In-Pit Mineral Resources Estimate for the Warintza Project is a significant milestone for the company and the mining sector. The details illustrate a robust mineral resource base with 232 million tonnes (Mt) of measured resources at 0.64% copper equivalent (CuEq) and 677 Mt of indicated resources at 0.49% CuEq. These figures provide a strong foundation for the upcoming Pre-Feasibility Study (PFS) in H2/25.

The ongoing drilling program of over 30,000 meters targeting open extensions and resource upgrades is crucial. It aims to convert inferred to measured and indicated categories, enhancing the economic viability and confidence of the project's resource base. The concurrent exploration program targeting epithermal gold/silver and porphyry copper further diversifies the project’s potential and adds value.

Insights: The Warintza Project's location offers structural advantages, including low elevation, direct highway access and low-cost hydroelectric power, which can significantly reduce operational costs. The estimated resources' grade and tonnage suggest a promising yield, which is critical as global copper demand continues to rise, driven by the transition to green energy and electric vehicles.

Conclusion: This announcement positions Solaris Resources favorably within the mining sector, enhancing its attractiveness to investors looking for exposure to copper and precious metals. The comprehensive drilling and exploration strategy underscores the company's commitment to resource expansion and value creation.

The latest mineral resource estimate from Solaris Resources provides a clear indication of the project’s economic potential. The Measured and Indicated resources totaling 909 Mt at 0.53% CuEq, alongside 1,426 Mt at 0.37% CuEq in the inferred category, highlight a substantial resource base that could drive future revenue streams.

Financial Implications: The ongoing drilling and exploration activities are vital in derisking the project and improving the accuracy of future financial projections. The base case assumptions, including copper prices at US$4.00/lb and gold at US$1,850/oz, align with current market trends, offering a realistic foundation for financial modeling. Achieving a favorable Pre-Feasibility Study will be pivotal in securing financing and advancing towards production, potentially increasing the company's market valuation.

Strategic Position: The resource estimate's release should positively impact investor sentiment, reflecting in the stock price as the market assimilates the project's enhanced value proposition. The strategic focus on both copper and precious metals diversifies risk and aligns with industry trends prioritizing multi-metal projects.

Conclusion: Solaris Resources' strong resource base and strategic initiatives position it for significant long-term value creation, making it an attractive opportunity for investors.

The unveiling of Solaris Resources' updated mineral resource estimate is a game-changer for the company, particularly within the highly competitive mining sector. The substantial resources reported provide a solid foundation for future development and market positioning.

Market Context: The global demand for copper is expected to surge due to its essential role in renewable energy infrastructure and electric vehicles. This positions Solaris favorably, as its Warintza Project's robust copper equivalent grades can effectively meet this rising demand. The project's inclusion of gold and silver further enhances its market attractiveness, providing hedges against commodity price volatility.

Competitive Advantage: The Warintza Project's low-cost operational framework, with access to Pacific ports and hydroelectric power, offers Solaris a competitive edge. These factors are important as they directly impact the project's profitability and operational efficiency.

Conclusion: Solaris Resources stands out in the market with a well-rounded resource portfolio and strategic advantages that could lead to substantial investor returns, making it a promising stock to watch.

VANCOUVER, British Columbia, July 22, 2024 (GLOBE NEWSWIRE) -- Solaris Resources Inc. (TSX: SLS; NYSE: SLSR) (“Solaris” or the “Company”) is pleased to report an In-Pit Mineral Resources Estimate (“MRE”) for its Warintza Project (“Warintza” or “the Project”) in southeastern Ecuador. Ongoing mineral resource drilling includes over 30,000m in H2/24 targeting open extensions and upgrading mineral resources to support the Pre-Feasibility Study (“PFS”) in H2/25. Concurrent district exploration programs are targeting complementary discoveries from an expanded portfolio of epithermal gold/silver and porphyry copper targets.

Highlights

- In-Pit Mineral Resources – 232 million tonnes (“Mt”) at

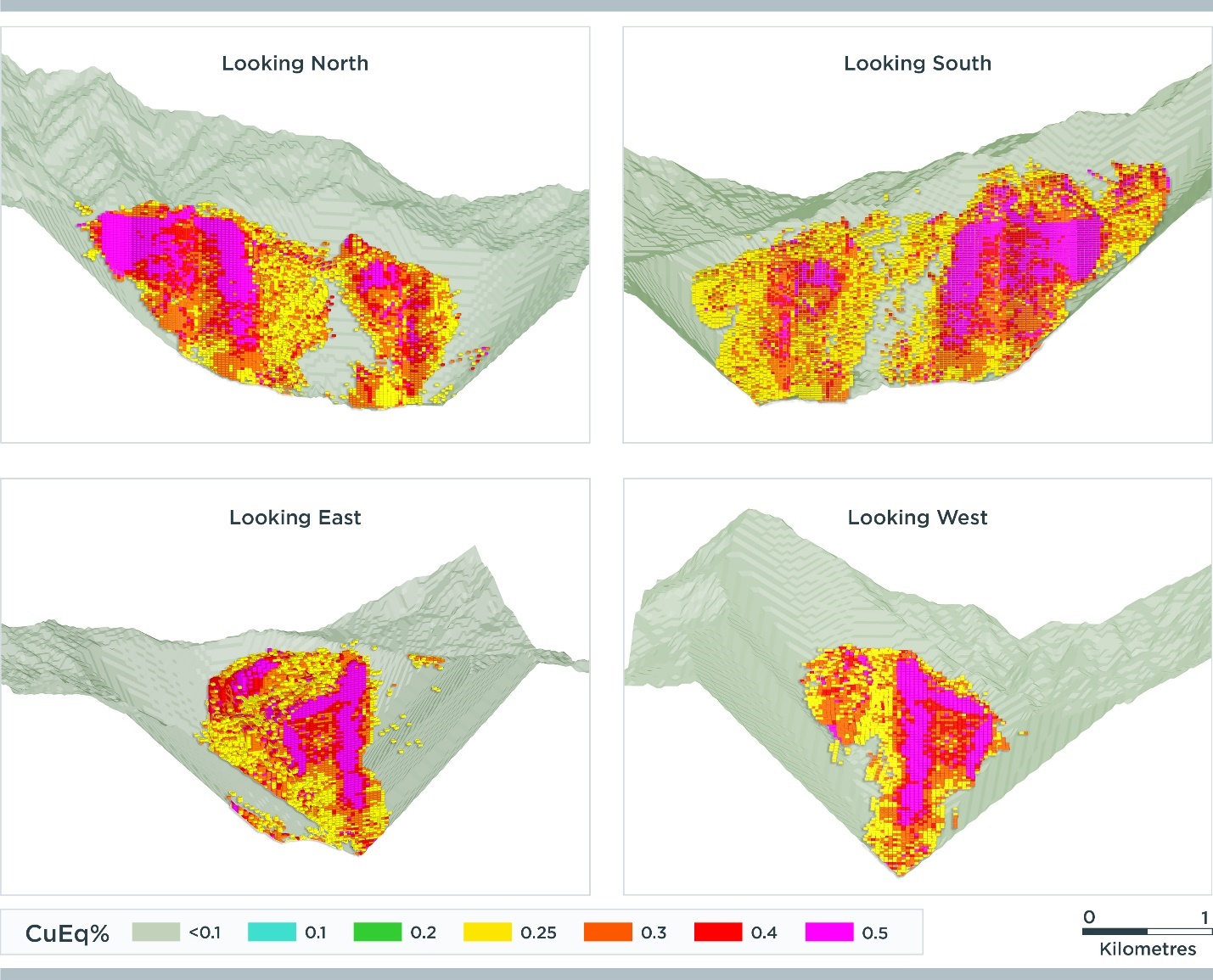

0.64% copper equivalent¹ (“CuEq”) (Measured) and 677 Mt at0.49% CuEq¹ (Indicated) for 909 Mt at0.53% CuEq¹ (Measured & Indicated) and an additional 1,426 Mt at0.37% CuEq¹ (Inferred) at a base case0.25% CuEq¹ cut-off grade - Includes 157 Mt at

0.76% CuEq¹ (Measured) and 269 Mt at0.69% CuEq¹ (Indicated) for 427 Mt at0.71% CuEq¹ (Measured & Indicated) and an additional 177 Mt at0.62% CuEq¹ (Inferred) at a higher cut-off grade of0.50% CuEq¹ which reflects the at or near surface supergene and higher-grade hypogene mineralization (Table 1: Warintza Mineral Resource Estimate Sensitivity and Figure 2) - Structural Advantages – Warintza is set at low elevation within the southeast Ecuador mining district that is serviced by direct connection from highway to Pacific ports, low-cost hydroelectric grid power with further development potential at the adjoining Santiago G8 project, and has seen sweeping socioeconomic improvement from mining exploration, development over the last decade (Figure 1)

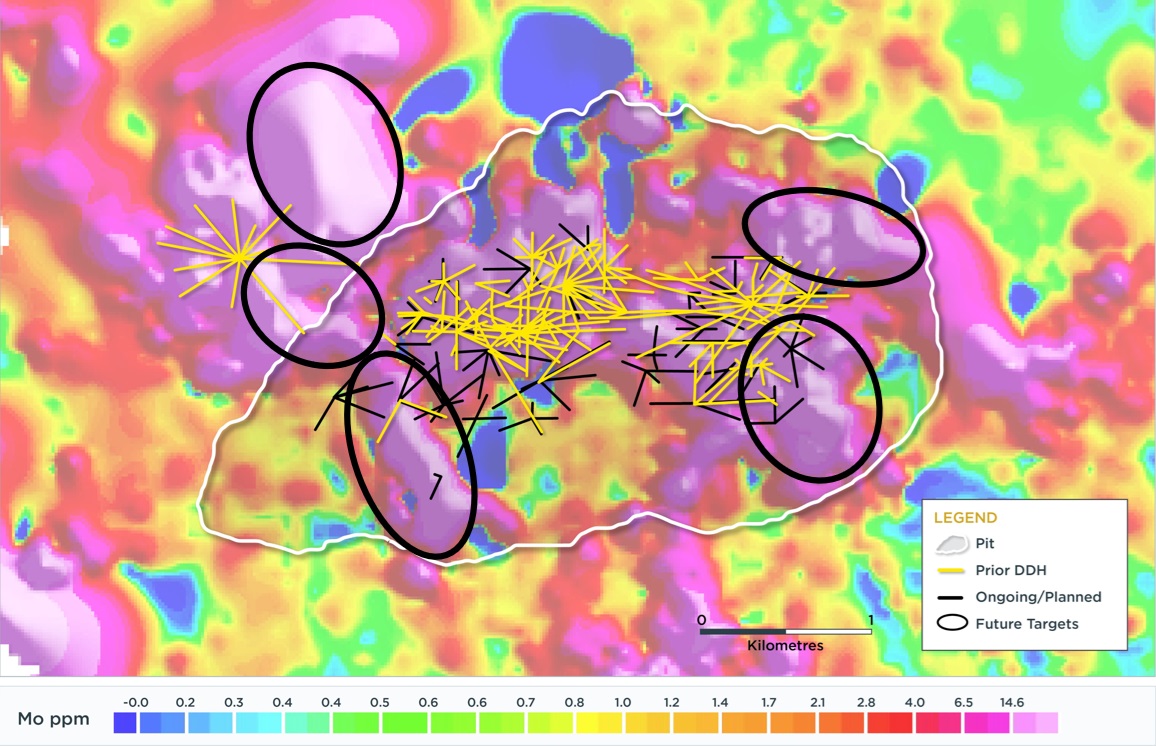

- Resource Drilling Continues – 2024 drill program of 60,000m (over 30,000m in H2/24) in 140 holes from 80 platforms to provide improved drilling coverage targeting open lateral extensions, upgrading mineral resources and converting remaining uncategorized blocks within the pit shell to support the PFS in H2/25; metallurgical, geotechnical and hydrogeological drilling is ongoing (Figure 3)

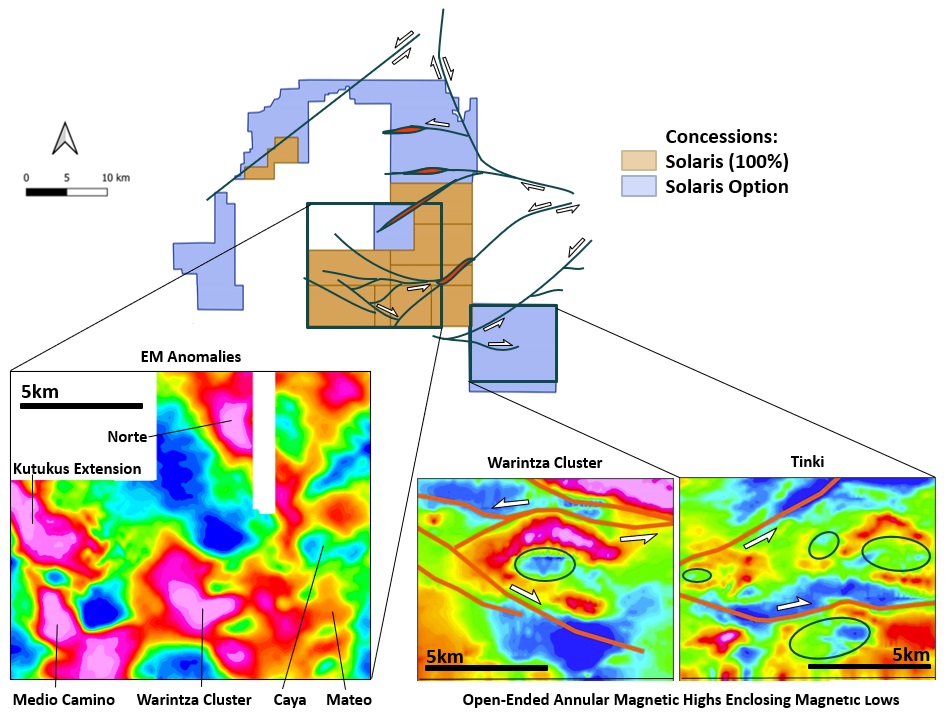

- District Exploration Ongoing – Complementary district exploration efforts are underway with fieldwork targeting epithermal-style gold-silver mineralization south of Caya-Mateo, in an area where recent sampling has returned values between 4 and 12 g/t Au, and field crews also focused on mapping and sampling combined geophysical and geochemical porphyry copper targets (Figure 4)

Mr. Javier Toro, Chief Operating Officer, commented, “We are very pleased to be able to release this standalone MRE which draws on our combined years of experience with open pit copper projects in the Americas. This new MRE provides a solid foundation for future updates and a robust mine plan with a low strip ratio, simple metallurgy and clean concentrates. In support of the PFS, we are doing further technical, infill and extensional drilling into open areas within and adjacent to the pit shell.”

Table 1: Warintza Mineral Resource Estimate Sensitivity

| Cut-off | Category | Tonnage | Grade | ||||

| CuEq (%) | (Mt) | CuEq (%) | Cu (%) | Mo (%) | Au (g/t) | ||

0.15% | Measured | 246 | 0.61 | 0.45 | 0.02 | 0.05 | |

| Indicated | 836 | 0.44 | 0.30 | 0.02 | 0.04 | ||

| M&I | 1,082 | 0.48 | 0.34 | 0.02 | 0.04 | ||

| Inferred | 3,135 | 0.27 | 0.20 | 0.01 | 0.04 | ||

| (Base Case) | Measured | 232 | 0.64 | 0.47 | 0.02 | 0.05 | |

| Indicated | 677 | 0.49 | 0.34 | 0.02 | 0.04 | ||

| M&I | 909 | 0.53 | 0.37 | 0.02 | 0.05 | ||

| Inferred | 1,426 | 0.37 | 0.27 | 0.01 | 0.04 | ||

0.35% | Measured | 207 | 0.68 | 0.50 | 0.03 | 0.06 | |

| Indicated | 497 | 0.56 | 0.40 | 0.02 | 0.05 | ||

| M&I | 704 | 0.60 | 0.43 | 0.02 | 0.05 | ||

| Inferred | 640 | 0.47 | 0.34 | 0.02 | 0.05 | ||

(Higher Grade) | Measured | 157 | 0.76 | 0.56 | 0.03 | 0.06 | |

| Indicated | 269 | 0.69 | 0.50 | 0.03 | 0.05 | ||

| M&I | 427 | 0.71 | 0.52 | 0.03 | 0.06 | ||

| Inferred | 177 | 0.62 | 0.45 | 0.02 | 0.07 | ||

Notes to Table 1:

- The Mineral Resource Estimate was prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014.

- Reasonable prospects for eventual economic extraction assume open-pit mining with conventional flotation processing and were tested using Whittle and Minesight pit optimization software with the following assumptions: metal prices of US

$4.00 /lb Cu, US$20.00 /lb Mo, and US$1,850 /oz Au; operating costs of US$1.50 /t+US$0.02 /t per bench mining, US$5.0 /t milling, US$1.0 /t G&A, and recoveries of90% Cu,85% Mo, and70% Au based on preliminary metallurgical testwork. - Metal price assumptions for copper, molybdenum and gold are based on a discount to the lesser of the 3-year trailing average (in accordance with US Securities and Exchange Commission guidance) and current spot prices for each metal.

- Mineral Resources include grade capping and dilution. Grade was interpolated by ordinary kriging populating a block model with block dimensions of 25m x 25m x 15m.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Copper-equivalent grade calculation for reporting assumes metal prices of US

$4.00 /lb Cu, US$20.00 /lb Mo, and US$1,850 /oz Au, and recoveries of90% Cu,85% Mo, and70% Au based on preliminary metallurgical testwork and includes provisions for downstream selling costs. CuEq formula: CuEq (%) = Cu (%) + 5.604 × Mo (%) + 0.623 × Au (g/t). - The Mineral Resources estimate was prepared by Mario E. Rossi, FAusIMM, RM-SME, Principal Geostatistician of Geosystems International Inc., who is an Independent Qualified Person under NI 43-101. The Mineral Resources estimate is at a base case of

0.25% CuEq¹ cut-off grade and other estimates at varying cut-off grades are included only to demonstrate the sensitivity of the Mineral Resources estimate and are not the QP’s estimate of the Mineral Resources for the property. - In Mr. Rossi’s opinion, there are currently no relevant factors or legal, political, environmental, or other risks that could materially affect the potential development of Mineral Resources.

- All figures are rounded to reflect the relative accuracy of the estimate and therefore may not appear to add precisely.

- The effective date of the mineral resource estimate is July 1, 2024.

Figure 1 – Warintza Location, Access, Infrastructure

Figure 2 – Warintza Mineral Resource Block Model

Note to Figure 2: Mineral Resources cut off at pit outline.

Figure 3 – Warintza Drilling and Future Targets

Figure 4 – Warintza District Exploration

The corresponding Technical Report disclosing the MRE in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) will be prepared by Mr. Rossi and available on the Company’s website at www.solarisresources.com and on SEDAR+ under the Company’s profile at www.sedarplus.ca within 45 days of this news release.

Endnotes

- Copper-equivalence grade calculation for reporting assumes metal prices of US

$4.00 /lb Cu, US$20.00 /lb Mo, and US$1,850 /oz Au, and recoveries of90% Cu,85% Mo, and70% Au based on preliminary metallurgical testwork and includes provisions for downstream selling costs. CuEq formula: CuEq (%) = Cu (%) + 5.604 × Mo (%) + 0.623 × Au (g/t).

Resource Estimation Methodology and Parameters

Measured Mineral Resources were defined where there are at least two drill holes and four composites minimum within 40 and 80m, depending on geologic domain and orientation. Indicated Mineral Resources were defined where there are at least two drill holes and four composites minimum within 60 and 120m, depending on geologic domain and orientation. Variogram models were used to support the assessment of grade continuity. The classification reflects not only drill spacing and drill hole data quality, but also confidence level in the continuity of the grade and the geometry of the deposit. Inferred Mineral Resources were estimated within an envelope of drill hole influence, defined nominally as 200m in the horizontal directions, and 40m in the vertical direction. Mineral Resources include outlier grade restriction and internal dilution. Grade was interpolated by ordinary kriging populating a block model with block dimensions of 25m x 25m x 15m. The Measured, Indicated and Inferred Mineral Resources are classified in a manner that is consistent with the May 10, 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. In Mr. Rossi’s opinion, there are currently no relevant factors or legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources.

Technical Information and Quality Control & Quality Assurance

Sample assay results have been independently monitored through a quality control/quality assurance (“QA/QC”) program that includes the insertion of blind certified reference materials (standards), blanks and field duplicate samples. Logging and sampling are completed at a secure Company facility located on site. The drill core is cut in half on site and samples are securely transported to ALS Labs in Quito. Sample pulps are sent to ALS Labs in Lima, Peru and Vancouver, Canada for analysis. Total copper and molybdenum contents are determined by four-acid digestion with AAS finish. Gold is determined by fire assay of a 30-gram charge. In addition, selected pulp check samples are sent to Bureau Veritas lab in Lima, Peru. Both ALS Labs and Bureau Veritas lab are independent of Solaris. Mr. Rossi verified the data disclosed, including sampling, analytical, and test data underlying the information included in this news release, by personally inspecting the drill core use in the MRE and performing several checks to confirm the accuracy of such data. In addition, Mr. Rossi reviewed the QA/QC reports from the Company’s drill programs and noted that there were no issues that arose which would affect confidence with the assay data. Mr. Rossi considers the sampling method appropriate for the deposit type, adequate security and QA/QC measures were maintained, and samples are representative of the existing mineralization. Mr. Rossi is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein.

Heliborne magnetic, LIDAR and other layers of data quality for Warintza district exploration were validated by a qualified external professional using data validation procedures under high industry standards. The data has been verified by Jorge Fierro, M.Sc., DIC, PG, using data validation and quality assurance procedures under high industry standards.

Qualified Person

The MRE was prepared and the scientific and technical information in this news release was approved by Independent Qualified Person, Mario E. Rossi, FAusIMM, SME, IAMG, Principal Geostatistician of Geosystems International Inc (“GSI”) who is a copper porphyry specialist. Mr. Rossi is a qualified person pursuant to NI 43-101 and is independent of Solaris Resources under Section 1.5 of NI 43-101. Mr. Rossi has over 35 years of experience in mining and geostatistics, mineral resource and reserves estimation, audits and reviews in over 100 mining projects at various stages of development and operation. GSI is an independent, international mining consulting practice offering services specializing in porphyry deposits from exploration through feasibility, mine planning, and production.

The scientific and technical content of the Warintza district exploration targets in this press release has been reviewed and approved by Jorge Fierro, M.Sc., DIC, PG, Vice President Exploration of Solaris who is a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects. Jorge Fierro is a Registered Professional Geologist through the SME (registered member #4279075).

On behalf of the Board of Solaris Resources Inc.

“Daniel Earle”

President & CEO, Director

For Further Information

Jacqueline Wagenaar, VP Investor Relations

Direct: 416-366-5678 Ext. 203

Email: jwagenaar@solarisresources.com

About Solaris Resources Inc.

Solaris is advancing a portfolio of copper and gold assets in the Americas, which includes a world class copper resource with expansion and discovery potential at its Warintza Project in Ecuador; a series of grass roots exploration projects with discovery potential in Peru and Chile; and significant leverage to increasing copper prices through its

Cautionary Notes and Forward-looking Statements

This document contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of the words “will” and “expected” and similar expressions are intended to identify forward-looking statements. These statements include statements that ongoing mineral resource drilling includes over 30,000m in H2/24 targeting open extensions and upgrading mineral resources to support the PFS in H2/25, concurrent district exploration programs are targeting complementary discoveries from an expanded portfolio of epithermal gold/silver and porphyry copper targets, 2024 drill program of 60,000m (over 30,000m in H2/24) in 140 holes from 80 platforms to provide improved drilling coverage targeting open lateral extensions, upgrading mineral resources and converting remaining uncategorized blocks within the pit shell to support the PFS in H2/25; metallurgical, geotechnical and hydrogeological drilling is ongoing, complementary district exploration efforts are underway with fieldwork targeting epithermal-style gold-silver mineralization south of Caya-Mateo, in an area where recent sampling has returned values between 4 and 12 g/t Au, and field crews also focused on mapping and sampling combined geophysical and geochemical porphyry copper targets. Although Solaris believes that the expectations reflected in such forward-looking statements and/or information are reasonable, readers are cautioned that actual results may vary from the forward-looking statements. The Company has based these forward-looking statements and information on the Company’s current expectations and assumptions about future events including assumptions regarding the exploration and regional programs and technical programs. These statements also involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Solaris Management’s Discussion and Analysis, for the year ended December 31, 2023 available at www.sedarplus.ca. Furthermore, the forward-looking statements contained in this news release are made as at the date of this news release and Solaris does not undertake any obligation to publicly update or revise any of these forward-looking statements except as may be required by applicable securities laws.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/b12e12a3-210f-4794-8e49-6933a4b7e2c7

https://www.globenewswire.com/NewsRoom/AttachmentNg/67e7de05-ab10-4cdf-8a28-db2a21f16a64

https://www.globenewswire.com/NewsRoom/AttachmentNg/f3295cba-498a-45ec-bad7-3bacc019469e

https://www.globenewswire.com/NewsRoom/AttachmentNg/0b55465d-27c3-41b3-8e08-3698acc7ad1b

FAQ

What is the Measured & Indicated resource for Solaris Resources' Warintza Project (NYSE: SLSR)?

When is the Pre-Feasibility Study (PFS) for Solaris Resources' Warintza Project (NYSE: SLSR) expected?

What is the size of Solaris Resources' (NYSE: SLSR) 2024 drill program at Warintza?