Soluna Reports Fourth Quarter and Full Year 2023 Results

Quarterly Adjusted EBITDA tops

Successful business model diversification

Quarterly Gross Profit Best in 4 years at

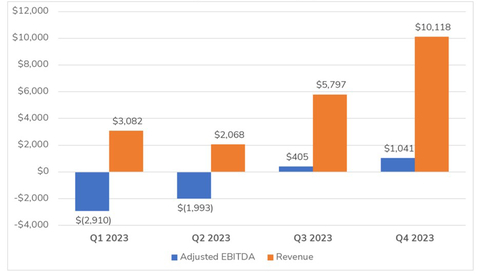

FY 2023 Adjusted EBITDA by Quarter (Photo: Business Wire)

"We are delighted to announce fourth quarter 2023 results, which were the culmination of 18 months of incredible execution by our operating team. We delivered record revenue and project-level profit, a direct result of the ramping up of our flagship Project Dorothy data center, and the new architecture of our business model aimed at revenue diversification," said John Belizaire, CEO of Soluna Holdings.

Fourth Quarter Finance and Operations Highlights:

-

Record Revenue – Revenue ramped to

$10.1 million $5.8 million 75% increase due to the ramp of Project Dorothy. It was the highest quarter in the past 16 quarters.

-

Record Gross Profit – Gross profit grew to

$4.3 million

-

2nd Consecutive Positive EBITDA Quarter – Fourth quarter 2023 Adjusted EBITDA topped

$1.0 million $405 thousand

-

Stronger Balance Sheet – Current Cash & Restricted Cash as of December 31, 2023 was

$9.4 million

-

Substantial Ramp of Flagship in Second Half – During this period, Project Dorothy 1A and 1B generated

$13.7 million 65% of the Company’s total full year revenue.

- Success in Diversification of Model – the Company completed a series of architectural changes to the business to diversify the business across four key areas, now including hosting, mining, ancillary services, and artificial intelligence. This greatly decreases the company’s direct exposure to the volatility of Bitcoin Mining.

Belizaire continued, "2023 involved steering our ship through turbulent waters, while simultaneously rebuilding the ship to sail towards new horizons. 2024 presents numerous opportunities for the Company. I am honored to lead a company with some of the most resilient people in the industry. I am grateful for the patience our shareholders have shown and the support our financial backers have continued to provide."

"While there is more work ahead for our team, we ended 2023 on much better footing. We have proven that our business model – integrating with Renewable Power Plants – works and creates the industry’s greenest, most profitable data centers. It is great to be focused on growth again."

Fiscal Year 2023 Financial Results:

-

The strong fourth quarter results of

$10.1 million 75% increase as compared to the third quarter 2023, had a significant positive impact on our full fiscal year results.

-

Total 2023 revenue was

$21.1 million $7.5 million 26% as compared to 2022 – The decrease was due mainly to the impacts of the strategic realignment of the Company’s business from a primarily Bitcoin mining focus to a more diversified revenue stream that includes hosting, mining and ancillary services. The negative impacts of winding down our less efficient mining activities during the first half of the year were offset in part by the positive impacts of ramping up our hosting and more efficient mining activities during the second half of the year. Ramping up during the second half included the design, permitting, construction and energization of Project Dorothy 1A and 1B, securing hosting clients, and acquiring miners. During this period, Project Dorothy 1A and 1B generated$13.7 million 65% of the Company’s total full year revenue.

-

The total cost of revenue decreased

$20.7 million $36.5 million $15.8 million 128% to75% as a percentage of revenue in 2022 compared to 2023 respectively, primarily driven by closing higher cost facilities, switching to a data hosting model from a proprietary mining model at Project Sophie and energizing the lower cost Project Dorothy site.

FY 2023 Revenue & Cost of Revenue by Project Site |

||||||||||||||||||||||||

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Project Dorothy 1B |

|

|

Project Dorothy 1A |

|

|

Project Sophie |

|

|

Project Marie |

|

|

Other |

|

|

Total |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Cryptocurrency mining revenue |

|

$ |

6,849 |

|

|

$ |

- |

|

|

$ |

2,984 |

|

|

$ |

769 |

|

|

$ |

- |

|

|

$ |

10,602 |

|

Data hosting revenue |

|

|

- |

|

|

|

6,876 |

|

|

|

3,021 |

|

|

|

276 |

|

|

|

23 |

|

|

|

10,196 |

|

Demand response services |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

268 |

|

|

|

268 |

|

Total revenue |

|

$ |

6,849 |

|

|

$ |

6,876 |

|

|

$ |

6,005 |

|

|

$ |

1,045 |

|

|

$ |

291 |

|

|

$ |

21,066 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of cryptocurrency mining, exclusive of depreciation |

|

$ |

3,358 |

|

|

$ |

- |

|

|

|

2,206 |

|

|

|

801 |

|

|

|

- |

|

|

|

6,365 |

|

Cost of data hosting revenue, exclusive of depreciation |

|

|

- |

|

|

|

4,366 |

|

|

|

1,030 |

|

|

|

205 |

|

|

|

- |

|

|

|

5,601 |

|

Cost of revenue- depreciation |

|

|

1,816 |

|

|

|

755 |

|

|

|

1,154 |

|

|

|

136 |

|

|

|

2 |

|

|

|

3,863 |

|

Total cost of revenue |

|

$ |

5,174 |

|

|

$ |

5,121 |

|

|

$ |

4,390 |

|

|

$ |

1,142 |

|

|

$ |

2 |

|

|

$ |

15,829 |

|

FY 2022 Revenue & Cost of Revenue by Project Site |

||||||||||||||||||||||||

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Project Dorothy 1B |

|

|

Project Dorothy 1A |

|

|

Project Sophie |

|

|

Project Marie |

|

|

Other |

|

|

Total |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Cryptocurrency mining revenue |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

13,221 |

|

|

$ |

10,028 |

|

|

$ |

1,160 |

|

|

$ |

24,409 |

|

Data hosting revenue |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4,131 |

|

|

|

7 |

|

|

|

4,138 |

|

Demand response services |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Total revenue |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

13,221 |

|

|

$ |

14,159 |

|

|

$ |

1,167 |

|

|

$ |

28,547 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of cryptocurrency mining, exclusive of depreciation |

|

$ |

54 |

|

|

$ |

- |

|

|

|

7,471 |

|

|

|

6,048 |

|

|

|

653 |

|

|

|

14,226 |

|

Cost of data hosting revenue, exclusive of depreciation |

|

|

- |

|

|

|

54 |

|

|

|

- |

|

|

|

3,518 |

|

|

|

- |

|

|

|

3,572 |

|

Cost of revenue- depreciation |

|

|

- |

|

|

|

- |

|

|

|

10,597 |

|

|

|

7,813 |

|

|

|

298 |

|

|

|

18,708 |

|

Total cost of revenue |

|

$ |

54 |

|

|

$ |

54 |

|

|

$ |

18,068 |

|

|

$ |

17,379 |

|

|

$ |

951 |

|

|

$ |

36,506 |

|

-

General and administrative expenses, excluding depreciation and amortization, for the year ended on December 31, 2023, decreased by

$3.8 million 20% – to$15.4 million $19.2 million $3.7 million

-

Salary and wages decreased by approximately

$1.4 million

-

Legal fees decreased by approximately

$1.1 million

-

Consulting and professional services decreased by

$1.6 million

-

Adjusted EBITDA improved to

$(3.5) million $(4.6) million 157% or$0.6 million $1.0 million $0.4 million

The audited financial statements and 10K are available online.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the

Non GAAP Measures

In addition to figures prepared in accordance with GAAP, Soluna from time to time presents alternative non-GAAP performance measures, e.g., EBITDA, adjusted EBITDA, adjusted net profit/loss, adjusted earnings per share, free cash flow, both on a company basis and on a project-level basis. Project level measures may not take into account a full allocation of corporate expenses. These measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP. Alternative performance measures are not subject to GAAP or any other generally accepted accounting principle. Other companies may define these terms in different ways. See our annual report on Form 10-K for the year ended December 31, 2023 for an explanation of how management uses these measures in evaluating its operations.

About Soluna Holdings, Inc (SLNH)

Soluna is on a mission to make renewable energy a global superpower using computing as a catalyst. The company designs, develops and operates digital infrastructure that transforms surplus renewable energy into global computing resources. Soluna’s pioneering data centers are strategically co-located with wind, solar, or hydroelectric power plants to support high-performance computing applications including Bitcoin Mining, Generative AI, and other compute intensive applications. Soluna’s proprietary software MaestroOS(™) helps energize a greener grid while delivering cost-effective and sustainable computing solutions, and superior returns. To learn more visit solunacomputing.com. Follow us on X (formerly Twitter) at @SolunaHoldings.

Soluna Holdings, Inc. and Subsidiaries Consolidated Balance Sheets As of December 31, 2023 and December 31, 2022 |

||||||||

(Dollars in thousands, except per share) |

||||||||

|

|

December 31, |

|

|

December 31, |

|

||

|

|

2023 |

|

|

2022 |

|

||

Assets |

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

Cash |

|

$ |

6,368 |

|

|

$ |

1,136 |

|

Restricted cash |

|

|

2,999 |

|

|

|

685 |

|

Accounts receivable |

|

|

2,948 |

|

|

|

320 |

|

Notes receivable |

|

|

446 |

|

|

|

219 |

|

Prepaid expenses and other current assets |

|

|

1,416 |

|

|

|

1,107 |

|

Equipment held for sale |

|

|

107 |

|

|

|

295 |

|

Total Current Assets |

|

|

14,284 |

|

|

|

3,762 |

|

Restricted cash, noncurrent |

|

|

1,000 |

|

|

|

- |

|

Other assets |

|

|

2,954 |

|

|

|

1,150 |

|

Deposits and credits on equipment |

|

|

1,028 |

|

|

|

1,175 |

|

Property, plant and equipment, net |

|

|

44,572 |

|

|

|

42,209 |

|

Intangible assets, net |

|

|

27,007 |

|

|

|

36,432 |

|

Operating lease right-of-use assets |

|

|

431 |

|

|

|

233 |

|

Total Assets |

|

$ |

91,276 |

|

|

$ |

84,961 |

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,099 |

|

|

$ |

3,548 |

|

Accrued liabilities |

|

|

4,906 |

|

|

|

2,721 |

|

Line of credit |

|

|

- |

|

|

|

350 |

|

Convertible notes payable |

|

|

8,474 |

|

|

|

11,737 |

|

Current portion of debt |

|

|

10,864 |

|

|

|

10,546 |

|

Income tax payable |

|

|

24 |

|

|

|

- |

|

Deferred revenue |

|

|

- |

|

|

|

453 |

|

Customer deposits-current |

|

|

1,588 |

|

|

|

- |

|

Operating lease liability |

|

|

220 |

|

|

|

161 |

|

Total Current Liabilities |

|

|

28,175 |

|

|

|

29,516 |

|

|

|

|

|

|

|

|

|

|

Other liabilities |

|

|

499 |

|

|

|

203 |

|

Customer deposits- long-term |

|

|

1,248 |

|

|

|

- |

|

Operating lease liability |

|

|

216 |

|

|

|

84 |

|

Deferred tax liability, net |

|

|

7,779 |

|

|

|

8,886 |

|

Total Liabilities |

|

|

37,917 |

|

|

|

38,689 |

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies (Note 14) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

3 |

|

Series B Preferred Stock, par value |

|

|

— |

|

|

|

— |

|

Common stock, par value |

|

|

3 |

|

|

|

1 |

|

Additional paid-in capital |

|

|

291,276 |

|

|

|

277,429 |

|

Accumulated deficit |

|

|

(250,970 |

) |

|

|

(221,769 |

) |

Common stock in treasury, at cost, 40,741 shares at December 31, 2023 and December 31, 2022(1) |

|

|

(13,798 |

) |

|

|

(13,798 |

) |

Total Soluna Holdings, Inc. Stockholders’ Equity |

|

|

26,514 |

|

|

|

41,866 |

|

Non-Controlling Interest |

|

|

26,845 |

|

|

|

4,406 |

|

Total Stockholders’ Equity |

|

|

53,359 |

|

|

|

46,272 |

|

Total Liabilities and Stockholders’ Equity |

|

$ |

91,276 |

|

|

$ |

84,961 |

|

(1) |

Prior period results have been adjusted to reflect the Reverse Stock Split of the Common Stock at a ratio of 1-for-25 that became effective October 13, 2023. See Note 2, “Accounting Policies,” for details. |

Soluna Holdings, Inc. and Subsidiaries Consolidated Statements of Operations For the Years Ended December 31, 2023 and 2022 |

||||||||

(Dollars in thousands, except per share) |

||||||||

|

|

Year Ended |

|

|||||

|

|

December 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

|

|

|

|

|

|

|

||

Cryptocurrency mining revenue |

|

$ |

10,602 |

|

|

$ |

24,409 |

|

Data hosting revenue |

|

|

10,196 |

|

|

|

4,138 |

|

Demand response services |

|

|

268 |

|

|

|

- |

|

Total revenue |

|

|

21,066 |

|

|

|

28,547 |

|

Operating costs: |

|

|

|

|

|

|

|

|

Cost of cryptocurrency mining revenue, exclusive of depreciation |

|

|

6,365 |

|

|

|

14,226 |

|

Cost of data hosting revenue, exclusive of depreciation |

|

|

5,601 |

|

|

|

3,572 |

|

Costs of revenue-depreciation |

|

|

3,863 |

|

|

|

18,708 |

|

Total costs of revenue |

|

|

15,829 |

|

|

|

36,506 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

General and administrative expenses, exclusive of depreciation and amortization |

|

|

15,390 |

|

|

|

19,203 |

|

Depreciation and amortization associated with general and administrative expenses |

|

|

9,513 |

|

|

|

9,506 |

|

Total general and administrative expenses |

|

|

24,903 |

|

|

|

28,709 |

|

Impairment on equity investment |

|

|

- |

|

|

|

750 |

|

Impairment on fixed assets |

|

|

575 |

|

|

|

47,372 |

|

Operating loss |

|

|

(20,241 |

) |

|

|

(84,790 |

) |

Interest expense |

|

|

(2,748 |

) |

|

|

(8,375 |

) |

Loss on debt extinguishment and revaluation, net |

|

|

(3,904 |

) |

|

|

(11,130 |

) |

Loss on sale of fixed assets |

|

|

(398 |

) |

|

|

(4,089 |

) |

Other (expense) income, net |

|

|

(1,479 |

) |

|

|

22 |

|

Loss before income taxes from continuing operations |

|

|

(28,770 |

) |

|

|

(108,362 |

) |

Income tax benefit from continuing operations |

|

|

1,067 |

|

|

|

1,346 |

|

Net loss from continuing operations |

|

|

(27,703 |

) |

|

|

(107,016 |

) |

Income before income taxes from discontinued operations (including gain on sale of MTI Instruments of |

|

|

- |

|

|

|

7,851 |

|

Income tax benefit from discontinued operations |

|

|

- |

|

|

|

70 |

|

Net income from discontinued operations |

|

|

- |

|

|

|

7,921 |

|

Net loss |

|

|

(27,703 |

) |

|

|

(99,095 |

) |

(Less) Net income (loss) attributable to non-controlling interest |

|

|

1,498 |

|

|

|

(380 |

) |

Net loss attributable to Soluna Holdings, Inc. |

|

$ |

(29,201 |

) |

|

$ |

(98,715 |

) |

|

|

|

|

|

|

|

|

|

Basic and Diluted (loss) earnings per common share (1): |

|

|

|

|

|

|

|

|

Net loss from continuing operations attributable to Soluna Holdings, Inc. per share (Basic & Diluted) |

|

$ |

(27.79 |

) |

|

$ |

(187.63 |

) |

Net income from discontinued operations per share (Basic & Diluted) |

|

$ |

- |

|

|

$ |

13.22 |

|

Basic & Diluted loss per share |

|

$ |

(27.79 |

) |

|

$ |

(174.41 |

) |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding (Basic and Diluted) |

|

|

1,313,718 |

|

|

|

599,301 |

|

(1) |

Prior period results have been adjusted to reflect the Reverse Stock Split of the Common Stock at a ratio of 1-for-25 that became effective October 13, 2023. See Note 2, “Accounting Policies,” for details. |

|

|

Soluna Holdings, Inc. and Subsidiaries Consolidated Statements of Cash Flows For the Year Ended December 31, 2023 and 2022 (Dollars in thousands) |

||||||||

|

|

Year Ended December 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Operating Activities |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(27,703 |

) |

|

$ |

(99,095 |

) |

Net income from discontinued operations (including gain on sale of MTI Instruments of |

|

|

- |

|

|

|

(7,921 |

) |

Net loss from continuing operations |

|

|

(27,703 |

) |

|

|

(107,016 |

) |

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation expense |

|

|

3,894 |

|

|

|

18,731 |

|

Amortization expense |

|

|

9,483 |

|

|

|

9,483 |

|

Stock-based compensation |

|

|

4,225 |

|

|

|

3,673 |

|

Consultant stock compensation |

|

|

87 |

|

|

|

179 |

|

Deferred income taxes |

|

|

(1,107 |

) |

|

|

(1,388 |

) |

Impairment on fixed assets |

|

|

575 |

|

|

|

47,372 |

|

Amortization of operating lease asset |

|

|

238 |

|

|

|

202 |

|

Impairment on equity investment |

|

|

- |

|

|

|

750 |

|

Loss on debt extinguishment and revaluation, net |

|

|

3,904 |

|

|

|

11,130 |

|

Amortization on deferred financing costs and discount on notes |

|

|

753 |

|

|

|

6,538 |

|

Loss on sale of fixed assets |

|

|

398 |

|

|

|

4,089 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(2,620 |

) |

|

|

211 |

|

Prepaid expenses and other current assets |

|

|

(306 |

) |

|

|

146 |

|

Other long-term assets |

|

|

(304 |

) |

|

|

(29 |

) |

Accounts payable |

|

|

(862 |

) |

|

|

553 |

|

Deferred revenue |

|

|

(453 |

) |

|

|

137 |

|

Customer deposits |

|

|

2,836 |

|

|

|

- |

|

Operating lease liabilities |

|

|

(234 |

) |

|

|

(197 |

) |

Other liabilities |

|

|

320 |

|

|

|

(308 |

) |

Accrued liabilities |

|

|

3,889 |

|

|

|

(374 |

) |

Net cash used in provided by operating activities |

|

|

(2,987 |

) |

|

|

(6,118 |

) |

Net cash provided by operating activities- discontinued operations |

|

|

- |

|

|

|

369 |

|

Investing Activities |

|

|

|

|

|

|

|

|

Purchases of property, plant, and equipment |

|

|

(12,705 |

) |

|

|

(63,684 |

) |

Purchases of intangible assets |

|

|

(58 |

) |

|

|

(76 |

) |

Proceeds from disposal on property, plant, and equipment |

|

|

2,286 |

|

|

|

2,605 |

|

Deposits of equipment, net |

|

|

147 |

|

|

|

6,441 |

|

Net cash used in investing activities |

|

|

(10,330 |

) |

|

|

(54,714 |

) |

Net cash provided by investing activities- discontinued operations |

|

|

- |

|

|

|

9,084 |

|

Financing Activities |

|

|

|

|

|

|

|

|

Proceeds from preferred offerings |

|

|

- |

|

|

|

16,658 |

|

Proceeds from common stock offering |

|

|

817 |

|

|

|

2,858 |

|

Proceeds from notes and debt issuance |

|

|

3,100 |

|

|

|

30,543 |

|

Costs of preferred offering |

|

|

- |

|

|

|

(1,910 |

) |

Costs of common stock offering |

|

|

(10 |

) |

|

|

(504 |

) |

Costs of notes and short-term debt issuance |

|

|

(1,057 |

) |

|

|

(2,078 |

) |

Cash dividend distribution on preferred stock |

|

|

- |

|

|

|

(3,852 |

) |

Payments on NYDIG loans and line of credit |

|

|

(350 |

) |

|

|

(4,491 |

) |

Contributions from non-controlling interest |

|

|

20,365 |

|

|

|

4,786 |

|

Distributions for non-controlling interest |

|

|

(1,002 |

) |

|

|

- |

|

Proceeds from stock option exercises |

|

|

- |

|

|

|

153 |

|

Proceeds from common stock warrant exercises |

|

|

- |

|

|

|

779 |

|

Net cash provided by financing activities |

|

|

21,863 |

|

|

|

42,942 |

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash & restricted cash-continuing operations |

|

|

8,546 |

|

|

|

(17,890 |

) |

Increase in cash & restricted cash- discontinued operations |

|

|

- |

|

|

|

9,453 |

|

Cash & restricted cash – beginning of period |

|

|

1,821 |

|

|

|

10,258 |

|

Cash & restricted cash – end of period |

|

$ |

10,367 |

|

|

$ |

1,821 |

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosure of Cash Flow Information |

|

|

|

|

|

|

|

|

Interest paid on NYDIG loans and line of credit |

|

|

6 |

|

|

|

1,311 |

|

Interest paid on Navitas loan |

|

|

204 |

|

|

|

- |

|

Interest paid on convertible noteholder default |

|

|

617 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Noncash investing and financing activities: |

|

|

|

|

|

|

|

|

Notes converted to common stock |

|

|

6,013 |

|

|

|

3,295 |

|

Noncash disposal of NYDIG collateralized equipment |

|

|

3,137 |

|

|

|

- |

|

Noncash non-controlling interest contribution |

|

|

2,095 |

|

|

|

- |

|

Interest and penalty settled through repossession of collateralized equipment |

|

|

1,773 |

|

|

|

- |

|

Warrant consideration in relation to convertible notes and debt |

|

|

1,637 |

|

|

|

14,602 |

|

Non-controlling interest membership distribution accrual |

|

|

517 |

|

|

|

- |

|

Noncash activity right-of use assets obtained in exchange for lease obligations |

|

|

403 |

|

|

|

20 |

|

Promissory note conversion to common or preferred shares |

|

|

845 |

|

|

|

15,236 |

|

Noncash proceed on sale of equipment |

|

|

240 |

|

|

|

210 |

|

Series B preferred dividend prefunded warrant and common stock issuance |

|

|

656 |

|

|

|

- |

|

Noncash equipment financing |

|

|

- |

|

|

|

4,620 |

|

Proceed receivable from sale of MTI Instruments |

|

|

- |

|

|

|

295 |

|

Non-GAAP Measures

In addition to financial measures calculated in accordance with

We believe Adjusted EBITDA can be an important financial measure because it allows management, investors, and the Board to evaluate and compare our operating results, including our return on capital and operating efficiencies, from period-to-period by making such adjustments. Non-GAAP financial measures are subject to material limitations as they are not in accordance with, or a substitute for, measurements prepared in accordance with

Adjusted EBITDA is provided in addition to and should not be considered to be a substitute for, or superior to net income, the comparable measure calculated in accordance with

Reconciliations of Adjusted EBITDA to net income from continuing operations, the most comparable

(Dollars in thousands) |

|

Years Ended December 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

|

|

|

|

|

|

|

||

Net loss from continuing operations |

|

$ |

(27,703 |

) |

|

$ |

(107,016 |

) |

Interest expense |

|

|

2,748 |

|

|

|

8,375 |

|

Income tax (benefit) expense |

|

|

(1,067 |

) |

|

|

(1,346 |

) |

Depreciation and amortization |

|

|

13,376 |

|

|

|

28,214 |

|

EBITDA |

|

|

(12,646 |

) |

|

|

(71,773 |

) |

|

|

|

|

|

|

|

|

|

Adjustments: Non-cash items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation costs |

|

|

4,312 |

|

|

|

3,852 |

|

Loss on sale of fixed assets |

|

|

398 |

|

|

|

4,089 |

|

Loss on debt extinguishment and revaluation, net |

|

|

3,904 |

|

|

|

11,130 |

|

Impairment of equity investment |

|

|

- |

|

|

|

750 |

|

Impairment on fixed assets |

|

|

575 |

|

|

|

47,372 |

|

Adjusted EBITDA |

|

$ |

(3,457 |

) |

|

$ |

(4,580 |

) |

Stock based compensation costs represented approximately

The following table represents the Adjusted EBITDA activity between each three-month period for the year ended December 31, 2023.

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Three months ended March 31, 2023 |

|

|

Three months ended June 30, 2023 |

|

|

Three months ended September 30, 2023 |

|

|

Three months ended December 31, 2023 |

|

|

Year ended December 31, 2023 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net loss from continuing operations |

|

$ |

(7,432 |

) |

|

$ |

(9,257 |

) |

|

$ |

(6,016 |

) |

|

$ |

(4,998 |

) |

|

$ |

(27,703 |

) |

Interest expense, net |

|

|

1,374 |

|

|

|

486 |

|

|

|

495 |

|

|

|

393 |

|

|

|

2,748 |

|

Income tax (benefit) expense from continuing operations |

|

|

(547 |

) |

|

|

(547 |

) |

|

|

569 |

|

|

|

(542 |

) |

|

|

(1,067 |

) |

Depreciation and amortization |

|

|

3,002 |

|

|

|

2,918 |

|

|

|

3,579 |

|

|

|

3,877 |

|

|

|

13,376 |

|

EBITDA |

|

|

(3,603 |

) |

|

|

(6,400 |

) |

|

|

(1,373 |

) |

|

|

(1,270 |

) |

|

|

(12,646 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments: Non-cash items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation costs |

|

|

879 |

|

|

|

2,232 |

|

|

|

595 |

|

|

|

606 |

|

|

|

4,312 |

|

Loss (gain) on sale of fixed assets |

|

|

78 |

|

|

|

(48 |

) |

|

|

373 |

|

|

|

(5 |

) |

|

|

398 |

|

Impairment on fixed assets |

|

|

209 |

|

|

|

169 |

|

|

|

41 |

|

|

|

156 |

|

|

|

575 |

|

Loss on debt extinguishment and revaluation, net |

|

|

(473 |

) |

|

|

2,054 |

|

|

|

769 |

|

|

|

1,554 |

|

|

|

3,904 |

|

Adjusted EBITDA |

|

$ |

(2,910 |

) |

|

$ |

(1,993 |

) |

|

$ |

405 |

|

|

$ |

1,041 |

|

|

$ |

(3,457 |

) |

|

|

The following table represents the Adjusted EBITDA activity between each three-month period for the year ended December 31, 2022.

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Three months ended March 31, 2022 |

|

|

Three months ended June 30, 2022 |

|

|

Three months ended September 30, 2022 |

|

|

Three months ended December 31, 2022 |

|

|

Year ended December 31, 2022 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net loss from continuing operations |

|

$ |

(9,132 |

) |

|

$ |

(14,104 |

) |

|

$ |

(56,143 |

) |

|

$ |

(27,637 |

) |

|

$ |

(107,016 |

) |

Interest expense, net |

|

|

2,880 |

|

|

|

3,305 |

|

|

|

1,671 |

|

|

|

519 |

|

|

|

8,375 |

|

Income tax benefit from continuing operations |

|

|

(547 |

) |

|

|

(251 |

) |

|

|

(547 |

) |

|

|

(1 |

) |

|

|

(1,346 |

) |

Depreciation and amortization |

|

|

6,697 |

|

|

|

7,914 |

|

|

|

8,388 |

|

|

|

5,215 |

|

|

|

28,214 |

|

EBITDA |

|

|

(102 |

) |

|

|

(3,136 |

) |

|

|

(46,631 |

) |

|

|

(21,904 |

) |

|

|

(71,773 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments: Non-cash items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation costs |

|

|

955 |

|

|

|

1,064 |

|

|

|

890 |

|

|

|

943 |

|

|

|

3,852 |

|

Loss on sale of fixed assets |

|

|

- |

|

|

|

1,618 |

|

|

|

988 |

|

|

|

1,483 |

|

|

|

4,089 |

|

Impairment on fixed assets |

|

|

- |

|

|

|

750 |

|

|

|

28,086 |

|

|

|

18,536 |

|

|

|

47,372 |

|

Loss (gain) on debt extinguishment and revaluation, net |

|

|

- |

|

|

|

- |

|

|

|

12,317 |

|

|

|

(1,187 |

) |

|

|

11,130 |

|

Impairment on equity investment |

|

|

- |

|

|

|

- |

|

|

|

750 |

|

|

|

- |

|

|

|

750 |

|

Adjusted EBITDA |

|

$ |

853 |

|

|

$ |

296 |

|

|

$ |

(3,600 |

) |

|

$ |

(2,129 |

) |

|

$ |

(4,580 |

) |

View source version on businesswire.com: https://www.businesswire.com/news/home/20240402401707/en/

David Michaels

Chief Financial Officer

Soluna Holdings, Inc.

David@soluna.io

Source: Soluna Holdings, Inc.