Spark Power Delivers Solid Earnings Growth; Executes Key Strategic Transactions and Resets Balance Sheet

Spark Power Group Inc. announced its financial results for Q4 and full year 2022, showcasing a 2.3% increase in Q4 revenue to $64.5 million. Annual revenue rose 11.3% to $272.3 million. Gross profit margins improved to 24.9%, up 740 bps year-over-year. The company achieved a positive cash flow of $2.9 million in Q4 and reduced total debt by $27.2 million. Key strategic moves include the sale of Bullfrog Power for up to $35 million and a new banking agreement, which supports its “Let’s Grow Better” strategy aimed at profitable growth and cash flow generation.

- None.

- None.

Insights

Analyzing...

Core Business Revenue, Gross Profit Margin, EBITDA and Adjusted EBITDA up in Q4 and Full Year 2022

Positive Free Cash Flow from Operations in Q4 of

Reduced Total Debt by

Closed Sale of Bullfrog Power and Entered into New Banking Agreement

(Spark Power reports in Canadian dollars unless otherwise specified)

OAKVILLE, ON / ACCESSWIRE / March 28, 2023 / Spark Power Group Inc. (TSX:SPG), parent company of Spark Power Corp. ("Spark Power" or the "Company"), has announced its financial results for the three and twelve month periods ended December 31, 2022. The related financial statements and MD&A will be available on Spark Power's website at www.sparkpowercorp.com and on SEDAR at www.sedar.com.

Richard Jackson, President & CEO of Spark Power, commented on the fourth quarter 2022 results, "I am pleased to see the improvement in results in the fourth quarter and for the full year 2022, over the comparative prior periods. Margins continue to improve compared to prior year and our cost-cutting initiatives from earlier in 2022 are taking hold." Mr. Jackson continued, "However, I am most proud of how our team has responded to the significant macro-economic challenges we saw last year. Despite serious headwinds, the team was able to produce these improved results and concurrently make significant strides on our key strategic initiatives to narrow the focus on our core business and evolve our strategic platform. The majority of our integration work has been completed and we are now focused on the implementation of our new 3-year "Let's Grow Better" strategy, which is focused on value creation through profitable growth and free cash flow generation; I am excited by what I see and optimistic for what lies ahead".

"The fourth quarter was highlighted by the strategic divestiture of the Bullfrog Power business unit and a new amended credit facility with our lender. These strategic events helped materially reduce our total debt and reset our balance sheet, paving the way for Spark Power to execute the next stage of our strategy. At the same time, we made good progress on reducing working capital as we focus on positive cash flow generation across the portfolio," said Richard Perri, Executive Vice President & CFO of Spark Power. "Throughout 2023, we will remain hyper-focused on free cash flow generation, including targeted reductions in working capital, continued execution of margin improvement initiatives, further optimization of our cost structure, and completion of the roll out of our enterprise-wide technology and business process integration, Project Darwin," Perri concluded.

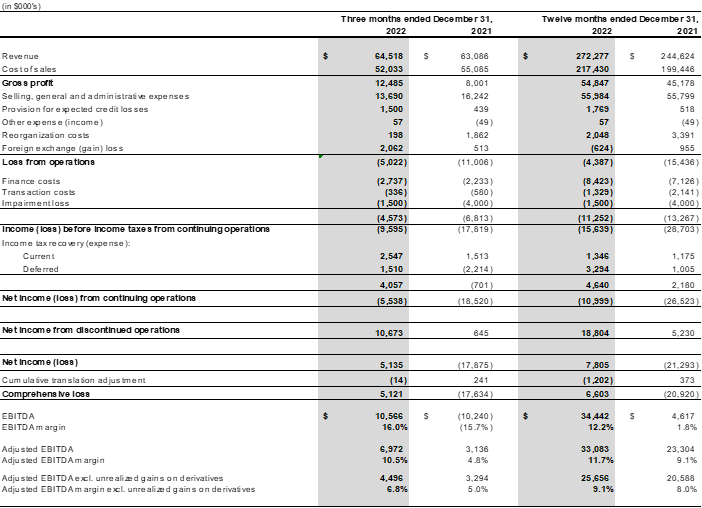

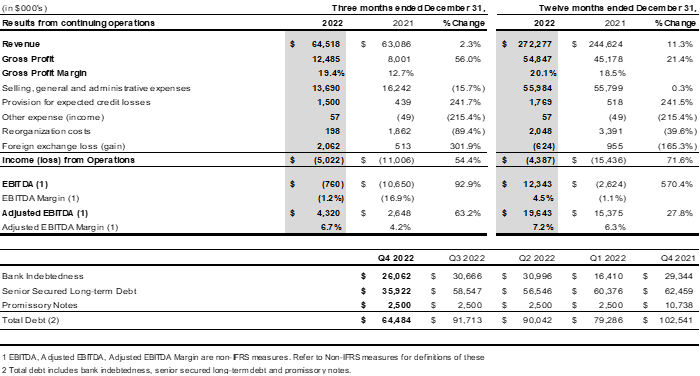

Financial Highlights for Q4 2022 (Continuing Operations)

- Revenue from continuing operations was

$64.5 million in Q4 2022 as compared to$63.1 million in Q4 2021, representing an increase of2.3% year-over-year. The year-over-year growth in the Core business is reflective of solid growth in the Technical Services segment partially offset by lower Renewables segment volume in the Wind segment that included large project work in the prior period. - Gross Profit Margins from continuing operations, excluding depreciation and amortization, were

24.9% in Q4 2022. This represents an increase of 740 bps as compared to Q4 2021 and is a direct result of the ongoing focus on initiatives to improve margin realization. Compared to the prior quarter, margins were impacted by lower volumes, as anticipated due to seasonality; large carry-over projects closed out in the quarter impacting our revenue mix; and to a lesser extent, the migration of our Enterprise Resource Planning system for our US business. - Selling, General and Administration (SG&A) expenses from continuing operations, excluding depreciation and amortization, were

$11.2 million , representing17.3% of revenue. This compares to SG&A of$14.5 million or22.9% of revenue in Q4 2021, with the year-over-year improvement reflecting the benefits of cost actions taken by the Company to streamline overhead costs and the impact of one-time provisions recorded in prior year. - Adjusted EBITDA from continuing operations was

$4.3 million or6.7% of revenue in Q4 2022, excluding unrealized foreign exchange losses of$1.5 million in the quarter. This compares to$2.6 million or4.2% of revenue in Q4 2021. The year-over-year growth in Adjusted EBITDA reflects enhanced gross margin realization and lower SG&A costs. - Significant progress was made through the fourth quarter to substantially reduce Contract Assets and Accounts Receivable by

$18.3 million and generate positive cash flow. In the fourth quarter, cash flow from operations was$2.9 million , up by$1.0 million compared to the prior year and significantly improved compared to the prior quarter and relates to progress made on reducing our speed to invoice and DSO.

Financial Highlights for Fiscal Year 2022 (Continuing Operations)

- Annual Revenue from continuing operations of

$272.3 million in fiscal 2022 as compared to$244.6 million in fiscal 2021, representing an increase of11.3% . The year-over-year growth is reflective of strong growth in our core Technical Services and Renewables segments. - Annual Gross Profit Margins from continuing operations, excluding depreciation and amortization, were

24.9% in fiscal 2022. Gross Profit Margins increased as compared to23.2% in fiscal 2021, primarily related to the impact of favorable revenue mix and the impact of estimate updates in the prior year. - Annual Selling, General and Administration (SG&A) expenses from continuing operations, excluding depreciation and amortization, were

$48.2 million , representing17.7% of revenue. This compares to SG&A of19.7% of revenue in fiscal 2021, with the year-over-year improvement reflecting the benefits of cost actions executed in the year combined with improving operating leverage. - Annual Adjusted EBITDA from continuing operations was

$19.6 million or7.2% of revenue in fiscal 2022, excluding unrealized foreign exchange losses of$0.7 million . This compares to$15.4 million or6.3% of revenue in fiscal 2021. The year-over-year growth in Adjusted EBITDA reflects higher revenues, enhanced gross margin realization and improved operating leverage tied to cost restructuring actions.

Business Highlights for Fiscal Year 2022

- On November 30, 2022, Spark Power announced the closing of the sale of its Bullfrog Power Inc. business unit including its United States business carried on through Bullfrog Solutions USA Inc., and its subsidiary companies. Bullfrog was sold for total all-cash proceeds of up to

$35.0 million , subject to customary adjustments and including an earnout of up to$3.5 million , payable over a maximum of five years. Proceeds from the transaction were used to reduce Spark Power's debt and fund working capital needs. This strategic divestiture supports Spark Power's renewed focus on its core business and contributed to the necessary capital to support the growth strategy of its Technical Services and Renewables segments. - On November 30, 2022 Spark Power finalized the terms of an amended and restated credit facility with its senior lender, Bank of Montreal. The Amended Credit Facility includes the following material terms: extending the Maturity Date of the credit facility to September 30, 2024; extending the Term Loan amortization period and reducing quarterly principal payments to

$1.1 million , effective for the Q4 2022 principal repayment; and decreasing the interest rate margin on facility advances upon adoption of the traditional financial covenants. - In the fourth quarter of 2022, Spark Power continued to see strong demand for its Technical Services and Renewables business in both the Canadian and U.S. markets. This included the company continuing to grow its business with the addition of several new customers in the quarter, including the signing of significant U.S. solar O&M agreements, large scope T&M work in Tech Services and the expansion of its Renewables Operating Centre in Dallas, Texas supporting the monitoring of solar and battery storage assets across North America.

- Spark Power continued to execute its enterprise-wide technology and business process integration, Project Darwin, during the fourth quarter. The focus was on supporting our US Technical Services business through the post go-live phase, and in parallel preparing the US Renewables business for their scheduled go-live on January 1st. This integration, once fully implemented, will bring all operating companies onto one single platform, including common processes and operating protocols. The expected benefits of this integration include improving customer experience, unlocking operational efficiencies in both the field and the back office, and establishing a scalable platform to support the next stage of growth for the Company. The full roll-out remains on track to be completed in 2023.

- At the start of 2023, the Company launched its new three year ‘Let's Grow Better' strategy, focused on creating more sustainable and long-term value for shareholders as a fully integrated platform company. As part of the rollout, significant work has been completed to develop a targeted go-to-market plan with defined customer segments and tailored sales and marketing tactics to enhance gross margins and ultimately drive enhanced free cash flow over the strategic cycle.

Quarterly Conference Call

Management will be hosting an investor conference call and webcast tomorrow, Wednesday, March 29, 2023, at 8:30 a.m. ET to discuss its results for the fourth quarter of 2022. To join by telephone dial: +1-888-506-0062 (toll-free in North America) or +1-973-528-0016 (international), with conference ID: 47051 and entry code: 650247.

The conference call will also be available via webcast and can be accessed through the investor relations section of Spark Power's website at https://sparkpowercorp.com/about-us/investor-relations/. An archived replay of the webcast will be available following the conclusion of the call. Please dial in or log on 10 minutes prior to the start time to provide sufficient time to register for the event.

About Spark Power

Spark Power is a leading independent provider of end-to-end electrical services and operations and maintenance services to the industrial, utility, and renewable asset markets in North America. We work to earn the right to be our customers' Trusted Partner in Power™. Our highly skilled and dedicated people, located in the communities we serve, combined with our knowledge of the power industry, technology expertise, and commitment to safety, ensures we deliver the right solutions that keep our customers' operations up and running today and better equipped for tomorrow. Learn more at www.sparkpowercorp.com.

Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws) which reflect Spark Power's current expectations regarding future events. Forward-looking statements are identified by words such as "believe", "anticipate", "project", "expect", "intend", "plan", "will", "may", "estimate" and other similar expressions. The forward-looking statements in this press release include statements regarding the Company's future performance, expansion and/ or growth, outcomes from integration, and liquidity improvement, including from sale of non-core assets, as well as comments from Messrs. Jackson respecting future market conditions and Messrs. Perri regarding drivers supporting the long-term growth strategy. The forward-looking statements in this news release are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Several factors could cause actual results to differ materially from the results discussed in the forward-looking statements. Such factors include, among others: currency fluctuations; disruptions or changes in the credit or security markets; results of operations; and general developments, market and industry conditions. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, these forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, Spark Power assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

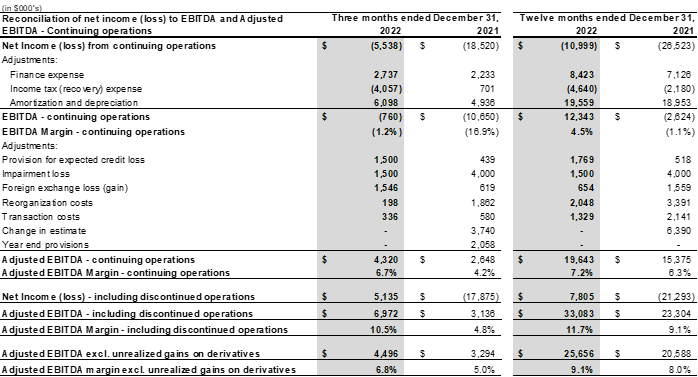

Non-IFRS Measures

The Company prepares and releases unaudited consolidated interim financial statements and audited consolidated annual financial statements prepared in accordance with IFRS. In this and other earnings releases and investor conference calls, as a complement to results provided in accordance with IFRS, the Company also discloses and discusses certain financial measures not recognized under IFRS and that do not have standard meanings prescribed by IFRS. These include "EBITDA", "Adjusted EBITDA", "EBITDA Margin", "Adjusted EBITDA Margin", and "Adjusted Working Capital". These non-IFRS measures are used to provide investors with supplemental measures of Spark Power's operating performance and highlight trends in Spark Power's business that may not otherwise be apparent when relying solely on IFRS measures. Spark also believes that providing such information to securities analysts, investors and other interested parties who frequently use non-IFRS measures in the evaluation of issuers will allow them to better compare Spark Power's performance against others in its industry. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation. For a reconciliation of these non-IFRS measures see the Company's management's discussion and analysis for the three- and twelve- months ended December 31, 2022. The non-IFRS measures should not be construed as alternatives to results prepared in accordance with IFRS.

Selected Consolidated Financial Information:

Reconciliation of Net Income (loss) to EBITDA and Adjusted EBITDA:

The following table is a summary of Spark Power's results from continuing operations for the periods indicated:

Investor and Regulatory Inquiries:

Richard Perri, Executive Vice President & Chief Financial Officer

Richard.perri@sparkpowercorp.com

+1 (416) 388-4546

Media Inquiries:

media@sparkpowercorp.com

+1 (905) 829-3336

SOURCE: Spark Power Group Inc.

View source version on accesswire.com:

https://www.accesswire.com/746373/Spark-Power-Delivers-Solid-Earnings-Growth-Executes-Key-Strategic-Transactions-and-Resets-Balance-Sheet