Spark Power Continues Positive Trajectory With Solid Second Quarter Performance

Spark Power Group Inc. reported record-high quarterly revenue of $72.9 million, a growth of 11.6% year-over-year for Q2 2022. Adjusted EBITDA increased 16.9% to $8.4 million. The company secured new long-term customers in the U.S. Solar market and renewed a major contract in Western Canada. Gross margins improved to 27.5% with lower selling, general, and administration costs, down 6.5% from the prior quarter. Despite a $1.9 million restructuring charge, the management expressed optimism for continued growth in the second half of the year.

- Quarterly revenue increased 11.6% year-over-year to $72.9 million.

- Adjusted EBITDA rose 16.9% to $8.4 million.

- Secured long-term contracts in the U.S. Solar market.

- Renewed contract with largest regulated utility customer in Western Canada.

- Gross margins improved to 27.5%, up 3.8% from the previous quarter.

- Reduction of selling, general, and administration costs by 6.5% from Q1 2022.

- A one-time charge of $1.9 million related to restructuring costs.

Quarterly revenue grows

Adjusted EBITDA up

(Spark Power reports in Canadian dollars unless otherwise specified)

OAKVILLE, ON / ACCESSWIRE / August 11, 2022 / Spark Power Group Inc. (TSX:SPG), parent company of Spark Power Corp. ("Spark Power" or the "Company"), has announced its financial results for its second quarter, the three-and-six months period ended June 30, 2022.

"I am very pleased to see the benefits of our hard work showing up in our financial results. We built on the positive momentum we had coming out of our first quarter, and I am cautiously optimistic that we will continue to see further gains in the second half of the year as the benefits of our revenue mix and integration actions take their full effect," said Richard Jackson, President & CEO of Spark Power. "Furthermore, we continued to strengthen the quality of our revenues with the addition of significant new long-term customers in the U.S. Solar market and the re-signing of a long-standing contract with our largest regulated utility customer in Western Canada - signs that we're seeing positive tailwinds in the market and promising opportunities for sustainable growth. I am very pleased with the overall progress our management team is making as we navigate Spark through the next stages of its maturity," added Jackson.

"Our Q2 results demonstrate the progress we have made on executing our plans to improve margin realization and reset our cost structure. I am particularly pleased with the improvement in profitability from our Technical Services and Renewables segments, in line with our Corporate Update issued in June, and am excited to launch our first go-live on our new ERP platform," said Richard Perri, Executive Vice President & CFO, Spark Power Corp. "These achievements will certainly help to support the advanced discussions we are having with our Lender to amend the terms of our existing credit facility and fuel the execution of the Company's long-term growth strategy," added Perri.

Financial Highlights - Q2 2022

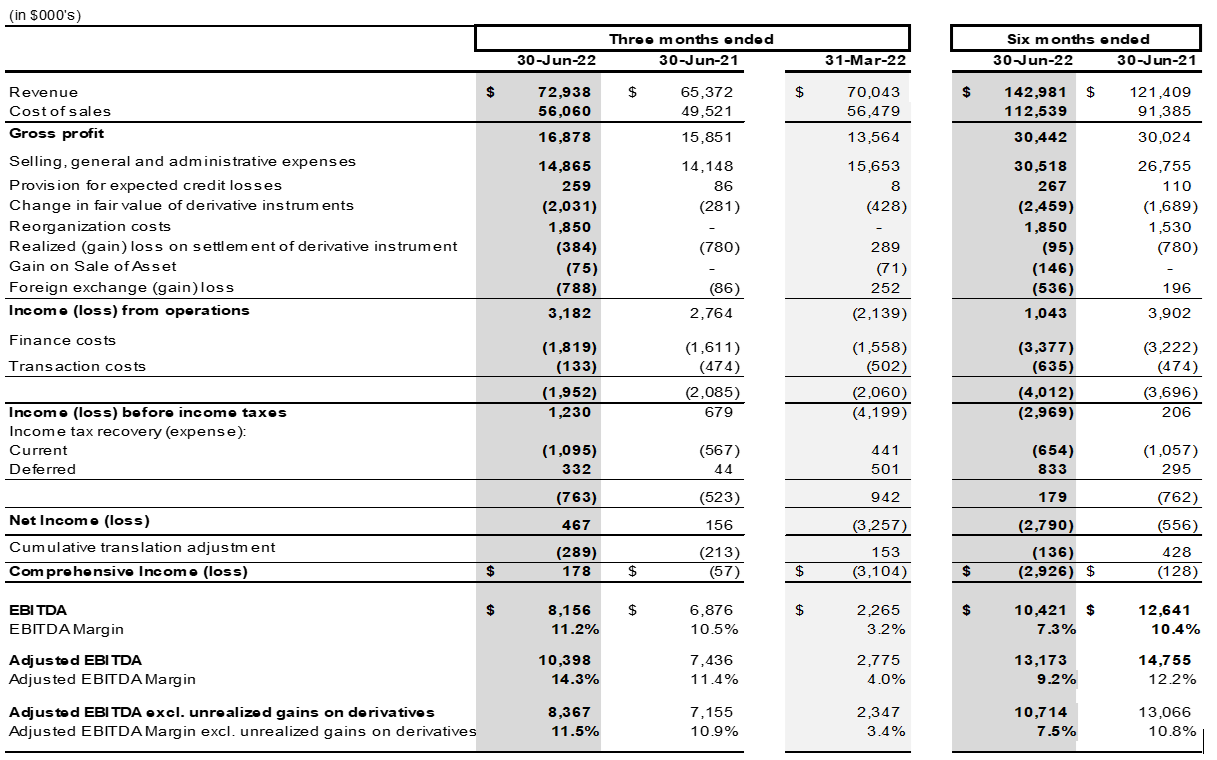

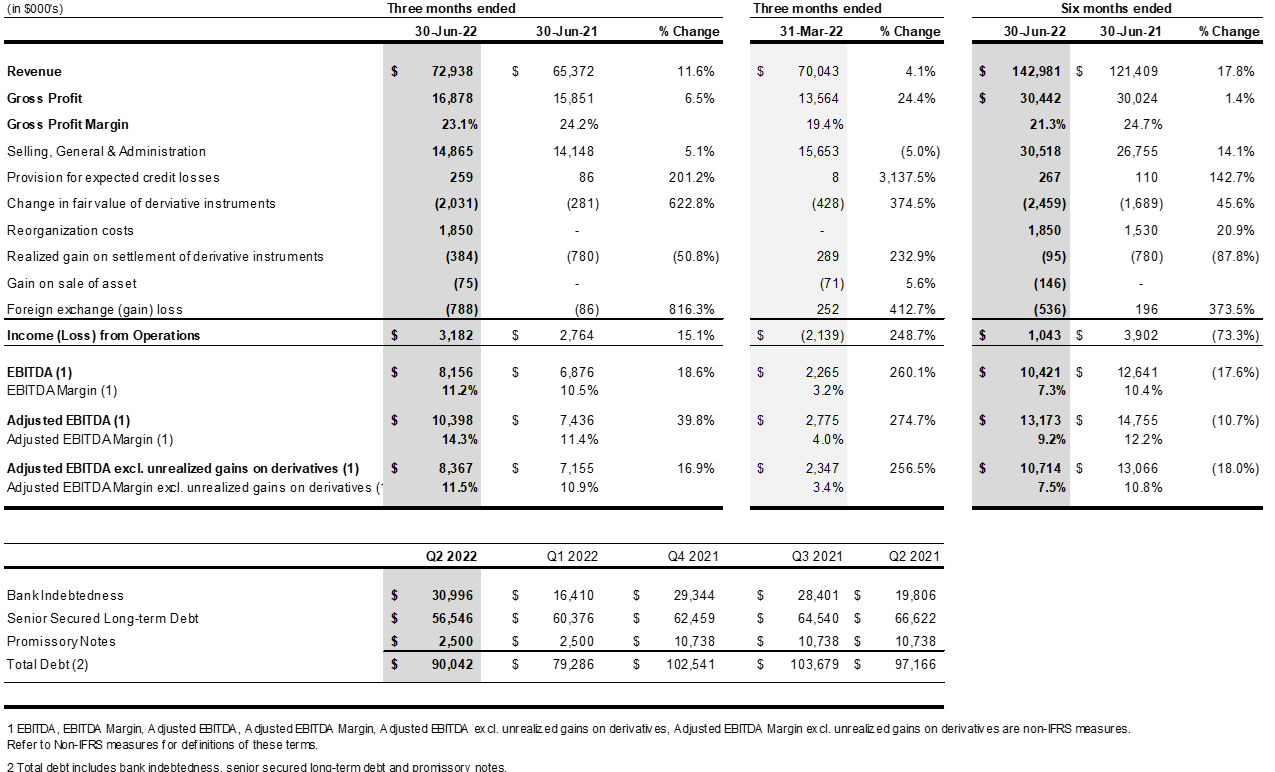

- Revenue of

$72.9 million in Q2 2022, as compared to$65.4 million in Q2 2021 and$70.0 million in Q1 2022, representing increases of11.6% and4.1% respectively. - Gross margins, excluding depreciation and amortization, were

27.5% in Q2 2022, up3.8% from Q1 2022. - Selling, General and Administration costs, excluding depreciation and amortization, were

$12.9 million , down$0.9 million or6.5% from Q1 2022. Selling, General and Administration costs as a percent of revenue were down by1.2% from Q2 2021. $6.1 million of pro-forma annualized Selling, General and Administration cost savings executed through Q2.- Adjusted EBITDA was

$10.4 million or14.3% of revenue in Q2 2022, as compared to$7.4 million or11.4% of revenue in Q2 2021, including unrealized gains on derivatives of$2.0 million in the quarter. Excluding unrealized gains on derivatives, adjusted EBITDA was up16.9% at$8.4 million or11.5% of revenue in Q2 2022 as compared to$7.2 million or10.9% of revenue in Q2 2021. - As part of its previously announced business integration strategy, the Company recorded a one-time charge of

$1.9 million related to restructuring costs.

Business Highlights

- Strong revenue and margin performance in our Technical Services segment, reflecting strong demand in both the Canadian and U.S. markets.

- Secured a multi-year contract renewal with a regulated utility customer in Western Canada, with significant opportunity to expand our presence in the market.

- Continued momentum on the integration of acquired companies under the One Spark operating model - delivering business stability, scalability, and profitability for the long-term.

- Actively executing a comprehensive performance improvement program consisting of targeted initiatives to expand margins and optimize S,G&A.

- Closure and/or consolidation of six branches year-to-date with ongoing reviews of additional underperforming locations in H2 - 2022.

- Finalized the timing of the completion of the founder transition as part of the reduction in S,G&A cost initiatives.

- Launch of additional liquidity improvement measures in Q2 to optimize cash flow.

Quarterly Conference Call

Management is hosting an investor conference call and webcast tomorrow, Friday, August 12 at 8:30 a.m. ET to discuss its financial results in greater detail. To join by telephone dial: +1-877-545-0523 (toll-free in North America) or +1-973-528-0016 (international), with conference ID: 46301 and entry code: 857570.

To listen to a live webcast of the call, please visit the investor relations section of Spark Power's website at https://sparkpowercorp.com/about-us/investor-relations/. An archived replay of the webcast will be available following the conclusion of the call. Please dial in or log on 10 minutes prior to the start time to provide sufficient time to register for the event.

Spark Power's Second Quarter 2022 Interim Unaudited Condensed Consolidated Financial Statements is available on Spark Power's website at www.sparkpowercorp.com, and will be filed on SEDAR at www.sedar.com.

About Spark Power

Spark Power is a leading independent provider of end-to-end electrical services, operations and maintenance services, and energy sustainability solutions to the industrial, commercial, utility, and renewable asset markets in North America. We work to earn the right to be our customers' Trusted Partner in Power™. Our highly skilled and dedicated people, located in the communities we serve, combined with our knowledge of the power industry, technology expertise, and commitment to safety, ensures we deliver the right solutions that keep our customers' operations up and running today and better equipped for tomorrow. Learn more at www.sparkpowercorp.com.

Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws) which reflect Spark Power's current expectations regarding future events. Forward-looking statements are identified by words such as "believe", "anticipate", "project", "expect", "intend", "plan", "will", "may", "estimate" and other similar expressions. The forward-looking statements in this press release include statements regarding the Company's future performance, expansion and/ or growth, outcomes from integration, and liquidity improvement, including from sale of non-core assets, as well as comments from Messrs. Jackson respecting future market conditions and Messrs. Perri regarding drivers supporting the long-term growth strategy. The forward-looking statements in this news release are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Several factors could cause actual results to differ materially from the results discussed in the forward-looking statements. Such factors include, among others: currency fluctuations; disruptions or changes in the credit or security markets; results of operations; and general developments, market and industry conditions. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, these forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, Spark Power assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Non-IFRS Measures

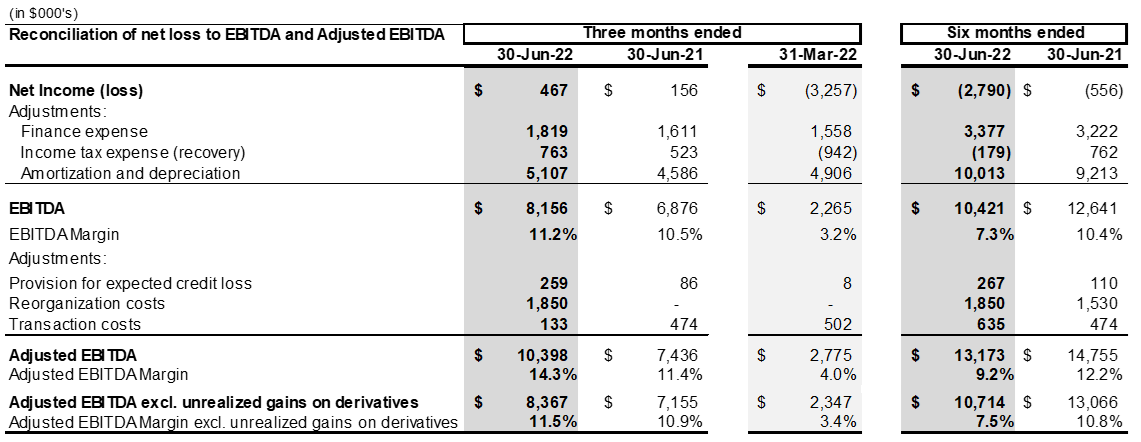

The Company prepares and releases unaudited consolidated interim financial statements and audited consolidated annual financial statements prepared in accordance with IFRS. In this and other earnings releases and investor conference calls, as a complement to results provided in accordance with IFRS, the Company also discloses and discusses certain financial measures not recognized under IFRS and that do not have standard meanings prescribed by IFRS. These include "EBITDA", "Adjusted EBITDA", "Pro-forma Adjusted EBITDA", "EBITDA Margin", "Adjusted EBITDA Margin", "Pro-forma Adjusted EBITDA Margin", "Pro-forma Revenue", "Adjusted Working Capital", and "Adjusted Net and Comprehensive Income (Loss)". These non-IFRS measures are used to provide investors with supplemental measures of Spark Power's operating performance and highlight trends in Spark Power's business that may not otherwise be apparent when relying solely on IFRS measures. Spark also believes that providing such information to securities analysts, investors and other interested parties who frequently use non-IFRS measures in the evaluation of issuers will allow them to better compare Spark Power's performance against others in its industry. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation. For a reconciliation of these non-IFRS measures see the Company's management's discussion and analysis for the three- and six- months ended June 30, 2021. The non-IFRS measures should not be construed as alternatives to results prepared in accordance with IFRS.

Selected Consolidated Financial Information:

Reconciliation of comprehensive income (loss) to EBITDA, Adjusted EBITDA, and Pro-forma Adjusted EBITDA:

The following table is a summary of Spark Power's results for the periods indicated:

Investor and Regulatory Inquiries:

Richard Perri, Executive Vice President & Chief Financial Officer

Richard.perri@sparkpowercorp.com

+1 (905) 829-3336

Media Inquiries:

Bryan Sparks, Manager, Corporate Communications & Brand

media@sparkpowercorp.com

+1 (905) 829-3336

SOURCE: Spark Power Group Inc.

View source version on accesswire.com:

https://www.accesswire.com/711873/Spark-Power-Continues-Positive-Trajectory-With-Solid-Second-Quarter-Performance

FAQ

What were Spark Power's financial results for Q2 2022?

How did Spark Power's revenue perform compared to last year?

What are the highlights of Spark Power's Q2 2022 performance?

How did Spark Power manage its costs in Q2 2022?