Skeena Provides Exploration Update and 2024 Outlook

VANCOUVER, BC / ACCESSWIRE / February 8, 2024 / Skeena Resources Limited (TSX:SKE )(NYSE:SKE ) ("Skeena" or the "Company") is pleased to announce all drilling results from the 2023 exploration drilling program at the Eskay Creek Gold-Silver Project ("Eskay Creek" or the "Project") in the Golden Triangle of northwest British Columbia. This release also provides an outlook for Skeena's 2024 exploration programs. Analytical results are detailed below as well as on the Company's website .

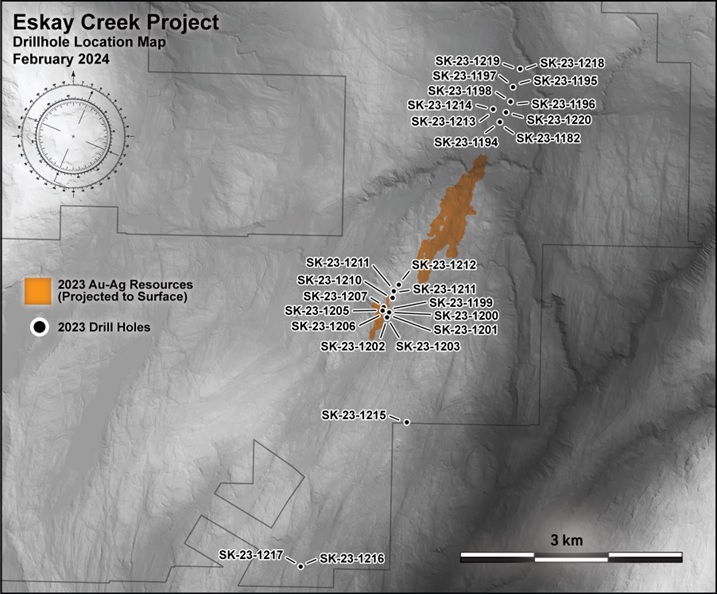

Near Mine Exploratory Drilling

A total of 13 surface drillholes were completed in 2023 with the aim of following up on drill intersections discovered during the 2022 exploratory programs. Drilling in the vicinity surrounding the 22 Zone yielded new occurrences of footwall gold-silver mineralization highlighted by SK-23-1203, which intersected 19.87 g/t Au, 59.1 g/t Ag over 2.95 metres including 64.80 g/t Au, 132.0 g/t Ag over 0.85 metres and a second high grade interval averaging 21.10 g/t Au, 15.4 g/t Ag over 1.50 metres . Additional mineralization was identified 200 metres north of the 22 Zone by SK-23-1200 grading 0.63 g/t Au, 86.1 g/t Ag over 14.50 metres and 1.37 g/t Au, 7.6 g/t Ag over 5.00 metres . These new intersections are not expected to materially affect the existing open-pit Resources and Reserves in the 22 Zone.

Regional Eskay Deeps Program

Discovery of new mineralization in 2022 at Eskay Deeps by exploratory drillhole SK-22-1081 ( 3.79 g/t Au, 59.4 g/t Ag over 32.19 metres ), prompted the 2023 Eskay Deeps Phase I exploration program. Completed in Q4 2023, the Phase I Deeps program was designed to test for additional high-grade Contact Mudstone mineralization in the down-dip extension of the Eskay Rift ~1,000 metres north of the current Eskay Creek Reserves. Targeting was supported by geological modelling and geophysical data, focusing on areas that were inadequately explored by previous operators. In total, 8 drillholes and 2 wedge branches were completed totalling 13,787 metres. To date, the Company has only tested an area of Contact Mudstone measuring 350 metres by 1,000 metres downdip of the main deposit with wide drill spacings in excess of 100 metres. Considerable exploration potential still exists in the Eskay Deeps as many prehistoric and modern day mineralized rift systems typically extend for tens of kilometres.

All 2023 drillholes intersected anomalous trace mineralization in the Contact Mudstone. Additionally, 120 metres below the Contact Mudstone and hosted by footwall rhyolite breccias, 2023 drillhole SK-23-1182 intersected 3.92 g/t Au, 5.2 g/t Ag over 5.38 metres . SK-23-1182 is 50 metres from the discovery drillhole SK-22-1081, indicating that the mineralized hydrothermal system was still active in this area. Feeder zones similar to this typically have a high-grade expression at the Contact Mudstone, which is yet to be encountered in this area.

By testing Eskay Deeps at widely spaced (>100 metre) hole spacings, a wealth of new information was collected from the 2023 program which has yielded a refined interpretation of the Eskay Creek Rift Model at depth. The Rift Model will be further analyzed once combined with Skeena's proposed 2024 seismic survey.

2024 Seismic Survey

The Company is aiming to perform a surface based seismic survey in Summer 2024. It has been proven by previous operators that more conventional geophysical methods such as electromagnetics and induced polarization are unable to directly discern the Eskay Creek gold-silver mineralization. However, the Company is investigating the potential for a seismic survey to indirectly target mineralization by better defining the rift and Contact Mudstone at depth that is critical for hosting Eskay Creek style deposits. Additional Eskay Deeps drilling will be driven by the results of the seismic survey.

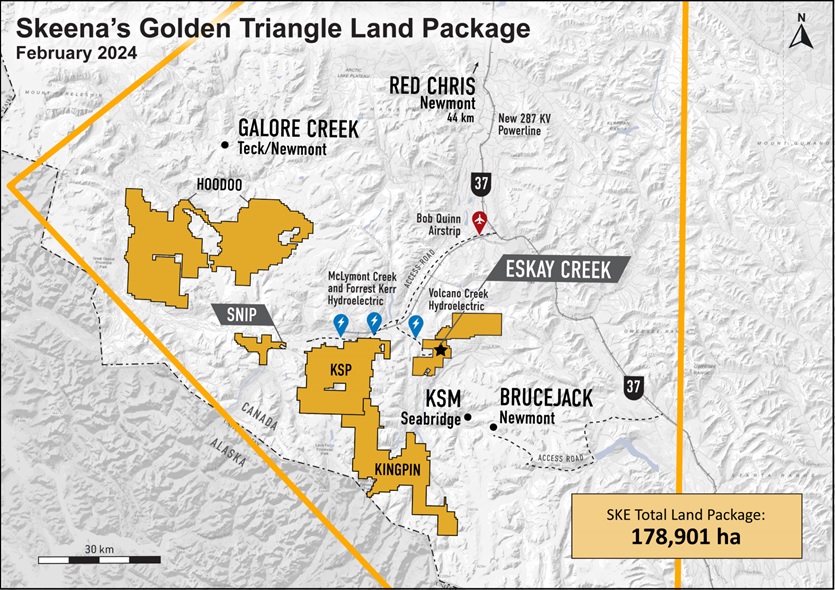

2024 Regional Exploration Plans

During H1 2024, Skeena will be finalizing a large airborne magnetics survey and data compilation for the new 74,633 hectare Hoodoo Project which was staked in October 2023. Remarkably, this ground was unclaimed mineral tenure with virtually no historical exploration despite possessing very high prospectivity for alkalic porphyry deposits. Alkalic gold-copper porphyry deposits in the cordillera of British Columbia typically rank as the higher-grade end members such as Galore Creek and New Afton. These specific deposits are attractive exploration targets based on their atypically high gold tenor.

An accelerated exploration model will be employed in H2 2024 that judiciously ranks and ultimately culminates in drilling targets on the KSP and Hoodoo properties. The successes of the 2023 field program in discovering new gold-copper mineralization and increasing the geological understanding of the KSP and Hoodoo properties warrants augmented exploration in these areas. Overall, 14,000 metres has been budgeted for this regional program.

About Skeena

Skeena Resources Limited is a Canadian mining exploration and development company focused on revitalizing the Eskay Creek and Snip Projects, two past-producing mines located in Tahltan Territory in the Golden Triangle of Northwest British Columbia, Canada. The Company released a Definitive Feasibility Study for Eskay Creek in November 2023 which highlights an after-tax NPV5% of C

On behalf of the Board of Directors of Skeena Resources Limited,

| Walter Coles | Randy Reichert | |

| Executive Chairman | President & CEO |

Contact Information

Investor Inquiries: info@skeenaresources.com

Office Phone: +1 604 684 8725

Company Website: www.skeenaresources.com

Qualified Persons

Exploration activities at the Eskay Creek Project are administered on site by the Company's Exploration Managers, John Tyler, P.Geo., Raegan Markel, P.Geo. and Vice President of Exploration, Adrian Newton, P.Geo. In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Paul Geddes, P.Geo., Senior Vice President, Exploration & Resource Development, is the Qualified Person for the Company and has prepared, validated, and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting activities on its projects.

Cautionary note regarding forward-looking statements

Certain statements and information contained or incorporated by reference in this press release constitute "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and United States securities legislation (collectively, "forward-looking statements"). These statements relate to future events or our future performance. The use of words such as "anticipates", "believes", "proposes", "contemplates", "generates", "progressing towards", "in search of", "targets", "is projected", "plans to", "is planned", "considers", "estimates", "expects", "is expected", "often", "likely", "potential" and similar expressions, or statements that certain actions, events or results "may", "might", "will", "could", or "would" be taken, achieved, or occur, may identify forward-looking statements. All statements other than statements of historical fact are forward-looking statements. Such forward-looking statements are based on material factors and/or assumptions which include, but are not limited to, the estimation of Mineral Resources and Mineral Reserves, the realization of Mineral Resource and Mineral reserve estimates, metal prices, exchange rates, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory and shareholder approvals, environmental risks, title disputes and the assumptions set forth herein and in the Company's MD&A for the year ended December 31, 2022, its most recently filed interim MD&A, and the Company's Annual Information Form ("AIF") dated March 22, 2023. Such forward-looking statements represent the Company's management expectations, estimates and projections regarding future events or circumstances on the date the statements are made, and are necessarily based on several estimates and assumptions that, while considered reasonable by the Company as of the date hereof, are not guarantees of future performance. Actual events and results may differ materially from those described herein, and are subject to significant operational, business, economic, and regulatory risks and uncertainties. The risks and uncertainties that may affect the forward-looking statements in this news release include, among others: the inherent risks involved in exploration and development of mineral properties, including permitting and other government approvals; changes in economic conditions, including changes in the price of gold, silver and other key variables; changes in mine plans, significant legal developments adversely impacting shareholder rights plan generally and other factors, including accidents, equipment breakdown, bad weather and other project execution delays, many of which are beyond the control of the Company; political developments; social unrest; environmental risks and unanticipated reclamation expenses; technological developments; and other risk factors identified in the Company's MD&A for the year ended December 31, 2022, its most recently filed interim MD&A, the AIF dated March 22, 2023, the Company's short form base shelf prospectus dated January 31, 2023, and in the Company's other periodic filings with securities and regulatory authorities in Canada and the United States that are available on SEDAR+ at www.sedarplus.ca or on EDGAR at www.sec.gov .

Readers should not place undue reliance on such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and the Company does not undertake any obligations to update and/or revise any forward-looking statements except as required by applicable securities laws.

Cautionary note to U.S. Investors concerning estimates of Mineral Reserves and Mineral Resources

Skeena's Mineral Reserves and Mineral Resources included or incorporated by reference herein have been estimated in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") as required by Canadian securities regulatory authorities, which differ from the requirements of U.S. securities laws. The terms "Mineral Reserve", "Proven Mineral Reserve", "Probable Mineral Reserve", "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") "CIM Definition Standards - For Mineral Resources and Mineral Reserves" adopted by the CIM Council (as amended, the "CIM Definition Standards"). These standards differ significantly from the mineral property disclosure requirements of the U.S. Securities and Exchange Commission in Regulation S-K Subpart 1300 (the "SEC Modernization Rules"). Skeena is not currently subject to the SEC Modernization Rules. Accordingly, Skeena's disclosure of mineralization and other technical information may differ significantly from the information that would be disclosed had Skeena prepared the information under the SEC Modernization Rules.

In addition, investors are cautioned not to assume that any part, or all of, Skeena's mineral deposits categorized as "Inferred Mineral Resources" or "Indicated Mineral Resources" will ever be converted into Mineral Reserves. "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and a great amount of uncertainty as to their economic and legal feasibility. Accordingly, investors are cautioned not to assume that any "Inferred Mineral Resources" that Skeena reports are or will be economically or legally mineable. Under Canadian securities laws, estimates of "Inferred Mineral Resources" may not form the basis of feasibility or prefeasibility studies, except for a Preliminary Economic Assessment as defined under NI 43-101.

For these reasons, the Mineral Reserve and Mineral Resource estimates and related information presented herein may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.

Table 1: Eskay Creek Project 2023 Exploratory Drilling Length-Weighted Drillhole Composites:

Hole-ID | From (m) | To (m) | Sample Length (m) | Au (g/t) | Ag (g/t) |

|---|---|---|---|---|---|

| SK-23-1182 | 1019.22 | 1024.60 | 5.38 | 3.92 | 5.21 |

| SK-23-1182 | 1045.30 | 1046.50 | 1.20 | 0.95 | 51.70 |

| SK-23-1182 | 1050.00 | 1051.50 | 1.50 | 1.85 | 1.80 |

| SK-23-1182 | 1084.50 | 1086.00 | 1.50 | 1.88 | 1.60 |

| SK-23-1182 | 1144.30 | 1148.90 | 4.60 | 0.77 | 12.54 |

| SK-23-1194 | NSA | ||||

| SK-23-1195 | 1592.50 | 1594.00 | 1.50 | 1.17 | 0.50 |

| SK-23-1196 | 1439.37 | 1440.85 | 1.48 | 0.79 | 11.90 |

| SK-23-1196 | 1442.00 | 1443.28 | 1.28 | 1.30 | 17.10 |

| SK-23-1196 | 1452.21 | 1453.50 | 1.29 | 0.78 | 4.70 |

| SK-23-1197 | TDNR | ||||

| SK-23-1198 | NSA | ||||

| SK-23-1199 | NSA | ||||

| SK-23-1200 | 60.00 | 61.40 | 1.40 | 0.47 | 19.90 |

| SK-23-1200 | 63.77 | 65.00 | 1.23 | 0.34 | 88.50 |

| SK-23-1200 | 69.00 | 83.50 | 14.50 | 0.63 | 86.10 |

| SK-23-1200 | 88.40 | 89.30 | 0.90 | 0.71 | 10.70 |

| SK-23-1200 | 92.00 | 93.00 | 1.00 | 0.85 | 72.70 |

| SK-23-1200 | 123.00 | 128.00 | 5.00 | 1.37 | 7.55 |

| SK-23-1201 | 157.00 | 158.50 | 1.50 | 0.88 | 12.10 |

| SK-23-1202 | 89.00 | 90.00 | 1.00 | 0.64 | 5.30 |

| SK-23-1202 | 111.00 | 112.50 | 1.50 | 0.68 | 1.30 |

| SK-23-1203 | 92.55 | 95.50 | 2.95 | 19.87 | 59.05 |

| INCLUDING | 92.55 | 93.40 | 0.85 | 64.80 | 132.00 |

| SK-23-1203 | 102.50 | 104.00 | 1.50 | 0.62 | 13.10 |

| SK-23-1203 | 151.50 | 153.00 | 1.50 | 0.65 | 4.70 |

| SK-23-1203 | 154.50 | 157.50 | 3.00 | 1.08 | 3.75 |

| SK-23-1203 | 162.00 | 163.50 | 1.50 | 21.10 | 15.40 |

| SK-23-1203 | 171.06 | 171.56 | 0.50 | 1.70 | 17.00 |

| SK-23-1203 | 176.00 | 177.00 | 1.00 | 0.67 | 30.40 |

| SK-23-1203 | 181.50 | 183.00 | 1.50 | 0.53 | 15.80 |

| SK-23-1203 | 195.00 | 196.50 | 1.50 | 1.75 | 34.10 |

| SK-23-1203 | 198.00 | 201.00 | 3.00 | 1.21 | 11.80 |

| SK-23-1204 | NSA | ||||

| SK-23-1205 | 72.00 | 74.50 | 2.50 | 0.60 | 366.20 |

| SK-23-1205 | 76.00 | 76.50 | 0.50 | 1.42 | 5.00 |

| SK-23-1205 | 92.00 | 93.50 | 1.50 | 0.31 | 38.00 |

| SK-23-1205 | 105.00 | 107.22 | 2.22 | 0.70 | 108.84 |

| SK-23-1205 | 111.50 | 113.00 | 1.50 | 0.23 | 192.00 |

| SK-23-1206 | 159.60 | 164.00 | 4.40 | 0.22 | 87.94 |

| SK-23-1206 | 166.20 | 168.00 | 1.80 | 0.36 | 61.52 |

| SK-23-1206 | 169.00 | 170.10 | 1.10 | 0.45 | 30.60 |

| SK-23-1207 | 39.70 | 42.20 | 2.50 | 0.86 | 0.50 |

| SK-23-1207 | 81.70 | 84.00 | 2.30 | 3.52 | 55.20 |

| SK-23-1208 | NSA | ||||

| SK-23-1209 | 132.00 | 133.50 | 1.50 | 0.68 | 43.00 |

| SK-23-1209 | 134.50 | 135.18 | 0.68 | 0.97 | 11.60 |

| SK-23-1209 | 161.00 | 165.50 | 4.50 | 0.81 | 5.40 |

| SK-23-1209 | 190.00 | 192.00 | 2.00 | 0.65 | 36.65 |

| SK-23-1210 | 35.50 | 37.00 | 1.50 | 0.94 | 4.20 |

| SK-23-1210 | 73.50 | 76.50 | 3.00 | 0.12 | 106.80 |

| SK-23-1210 | 103.50 | 105.00 | 1.50 | 0.28 | 33.10 |

| SK-23-1211 | NSA | ||||

| SK-23-1212 | NSA | ||||

| SK-23-1213 | NSA | ||||

| SK-23-1214 | NSA | ||||

| SK-23-1215 | NSA | ||||

| SK-23-1216 | ABANDONED | ||||

| SK-23-1217 | NSA | ||||

| SK-23-1218 | ABANDONED | ||||

| SK-23-1219 | TDNR | ||||

| SK-23-1220 | NSA |

True widths and zone geometries cannot be definitively determined at this time. Grade-capping of individual assays has not been applied to the Au and Ag assays informing the length-weighted composites. Samples below detection limit were nulled to a value of zero. NSA - No Significant Assays. TDNR - Target Depth Not Reached.

Table 2: Mine Grid Drillhole Locations and Orientations:

| Hole-ID | Easting (m) | Northing (m) | Elevation (m) | Length (m) | Azimuth (°) | Dip (°) |

|---|---|---|---|---|---|---|

| SK-23-1182 | 9979.5 | 11939.6 | 813.5 | 1166.5 | 337.0 | -90.0 |

| SK-23-1194 | 9979.5 | 11939.6 | 813.5 | 1306.7 | 337.0 | -90.0 |

| SK-23-1195 | 9953.9 | 12438.7 | 769.0 | 1649.2 | 287.2 | -87.6 |

| SK-23-1196 | 9988.5 | 12258.7 | 793.0 | 1513.0 | 262.1 | -88.0 |

| SK-23-1197 | 9949.3 | 12449.3 | 770.3 | 1601.6 | 272.9 | -79.2 |

| SK-23-1198 | 9988.2 | 12259.5 | 793.3 | 1327.0 | 276.7 | -81.0 |

| SK-23-1199 | 9660.8 | 8961.2 | 1121.5 | 153.0 | 22.0 | -44.5 |

| SK-23-1200 | 9661.9 | 8960.0 | 1121.5 | 165.0 | 22.2 | -45.1 |

| SK-23-1201 | 9661.0 | 8958.2 | 1121.5 | 201.0 | 117.0 | -69.7 |

| SK-23-1202 | 9666.8 | 8902.2 | 1115.1 | 151.3 | 136.7 | -50.0 |

| SK-23-1203 | 9664.7 | 8899.9 | 1115.1 | 228.0 | 167.4 | -50.3 |

| SK-23-1204 | 9667.3 | 8904.6 | 1115.1 | 108.1 | 97.0 | -49.9 |

| SK-23-1205 | 9582.9 | 8945.8 | 1137.4 | 125.0 | 97.2 | -55.0 |

| SK-23-1206 | 9581.8 | 8943.4 | 1137.4 | 184.2 | 147.4 | -50.1 |

| SK-23-1207 | 9581.3 | 8992.3 | 1139.0 | 120.7 | 96.9 | -49.9 |

| SK-23-1208 | 9579.1 | 8995.6 | 1139.2 | 224.5 | 52.0 | -70.0 |

| SK-23-1209 | 9668.6 | 8903.9 | 1115.1 | 210.3 | 96.9 | -49.8 |

| SK-23-1210 | 9628.1 | 9171.1 | 1147.5 | 124.5 | 126.8 | -55.0 |

| SK-23-1211 | 9614.7 | 9235.7 | 1142.0 | 199.0 | 247.4 | -50.0 |

| SK-23-1212 | 9632.1 | 9347.2 | 1145.6 | 153.2 | 257.1 | -44.7 |

| SK-23-1213 | 9827.4 | 12059.6 | 825.2 | 1003.0 | 188.9 | -87.9 |

| SK-23-1214 | 9826.8 | 12060.5 | 825.2 | 1430.3 | 212.6 | -79.6 |

| SK-23-1215 | 10502.3 | 7697.6 | 1042.6 | 120.9 | 247.1 | -44.8 |

| SK-23-1216 | 9990.8 | 5307.3 | 1006.2 | 24.9 | 66.9 | -44.8 |

| SK-23-1217 | 9990.8 | 5307.3 | 1006.2 | 250.8 | 66.0 | -44.9 |

| SK-23-1218 | 9934.7 | 12711.4 | 780.8 | 23.0 | 282.0 | -86.0 |

| SK-23-1219 | 9935.1 | 12712.3 | 780.8 | 1739.3 | 264.8 | -86.0 |

| SK-23-1220 | 9998.9 | 12094.1 | 810.9 | 1050.2 | 277.7 | -84.1 |

SOURCE: Skeena Resources Limited

View the original press release on accesswire.com