Schwab Trading Activity Index™: November Score Rises Modestly Following Fed, Election Decisions

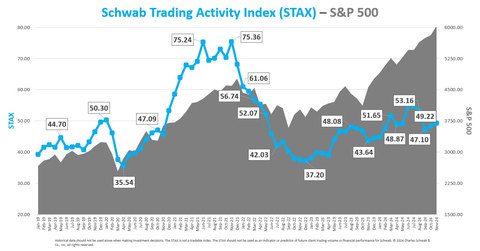

Schwab Trading Activity Index (STAX) rose to 49.22 in November from 48.37 in October, indicating a 'moderate low' trading activity compared to historical averages. More clients were net buyers of equities, particularly in Information Technology, Health Care, and Consumer Staples sectors, while selling was concentrated in Communication Services, Financials, and Consumer Discretionary.

Following the U.S. election results and Fed's interest rate cut announcement, market uncertainty decreased, with all three major U.S. stock indices reaching new all-time highs. The VIX fell 26% to 13.49, while the 10-year Treasury yield closed at 4.172%. Popular buys included NVIDIA, Palantir, and AMD, while Apple, Disney, and Tesla were among the most sold stocks.

L'Indice di Attività di Trading Schwab (STAX) è salito a 49,22 a novembre rispetto a 48,37 di ottobre, indicando un'attività di trading 'moderatamente bassa' rispetto alle medie storiche. Più clienti sono stati acquirenti netti di azioni, in particolare nei settori della Tecnologia dell'Informazione, della Salute e degli Strumenti di Consumo, mentre le vendite si sono concentrate nei Settori dei Servizi di Comunicazione, Finanziari e dei Beni di Consumo Discrezionali.

In seguito ai risultati delle elezioni statunitensi e all'annuncio del taglio dei tassi d'interesse da parte della Fed, l'incertezza di mercato è diminuita, con tutti e tre i principali indici azionari americani che hanno raggiunto nuovi massimi storici. Il VIX è sceso del 26% a 13,49, mentre il rendimento del Treasury a 10 anni ha chiuso al 4,172%. Tra gli acquisti più popolari figurano NVIDIA, Palantir e AMD, mentre Apple, Disney e Tesla sono state tra le azioni più vendute.

El Índice de Actividad de Trading de Schwab (STAX) aumentó a 49.22 en noviembre desde 48.37 en octubre, lo que indica una actividad de trading 'moderadamente baja' en comparación con los promedios históricos. Más clientes fueron compradores netos de acciones, particularmente en los sectores de Tecnología de la Información, Cuidado de la Salud y Bienes de Consumo, mientras que las ventas se concentraron en Servicios de Comunicación, Finanzas y Consumo Discrecional.

Tras los resultados de las elecciones en EE. UU. y el anuncio de recorte de tasas de interés de la Fed, la incertidumbre del mercado disminuyó, con los tres principales índices bursátiles de EE. UU. alcanzando nuevos máximos históricos. El VIX cayó un 26% a 13.49, mientras que el rendimiento del Tesoro a 10 años cerró en 4.172%. Entre las compras populares se incluyeron NVIDIA, Palantir y AMD, mientras que Apple, Disney y Tesla estuvieron entre las acciones más vendidas.

슈왑 거래 활동 지수 (STAX)는 10월의 48.37에서 11월에 49.22로 상승하여 역사적 평균에 비해 '중간 낮음'의 거래 활동을 나타냅니다. 더 많은 고객들이 주식의 순매수자였습니다, 특히 정보 기술, 의료 및 소비자 필수품 분야에서, 반면에 매도는 통신 서비스, 금융 및 소비자 선택 품목에 집중되었습니다.

미국 선거 결과와 연준의 금리 인하 발표 이후, 시장의 불확실성이 감소하였고, 미국의 주요 3개 주식 지수는 모두 새로운 사상 최고치를 기록했습니다. VIX는 13.49로 26% 하락하였고, 10년물 국채 수익률은 4.172%로 마감했습니다. 인기 있는 매수 종목에는 NVIDIA, Palantir, AMD가 포함되었고, 애플, 디즈니, 테슬라는 가장 많이 매도된 주식 중 하나였습니다.

L'Indice d'Activité de Trading Schwab (STAX) a augmenté à 49,22 en novembre contre 48,37 en octobre, ce qui indique une activité de trading 'modérément faible' par rapport aux moyennes historiques. Plus de clients ont été des acheteurs nets d'actions, en particulier dans les secteurs de la technologie de l'information, des soins de santé et des biens de consommation, tandis que les ventes ont été concentrées dans les services de communication, les finances et les biens de consommation discrétionnaires.

Suite aux résultats des élections américaines et à l'annonce de la baisse des taux d'intérêt de la Fed, l'incertitude du marché a diminué, toutes les trois grandes indices boursiers américains atteignant de nouveaux sommets historiques. Le VIX a chuté de 26 % à 13,49, tandis que le rendement des bons du Trésor à 10 ans a clôturé à 4,172 %. Les achats populaires comprenaient NVIDIA, Palantir et AMD, tandis qu'Apple, Disney et Tesla figuraient parmi les actions les plus vendues.

Der Schwab Trading Activity Index (STAX) stieg im November auf 49,22 von 48,37 im Oktober und zeigt eine 'mäßig niedrige' Handelsaktivität im Vergleich zu historischen Durchschnittswerten an. Mehr Kunden waren netto Käufer von Aktien, insbesondere in den Bereichen Informationstechnologie, Gesundheitswesen und Konsumgüter, während die Verkäufe sich auf Kommunikationsdienste, Finanzen und zyklische Konsumgüter konzentrierten.

Nach den Ergebnissen der US-Wahlen und der Ankündigung der Zinssenkung durch die Fed verringerte sich die Marktunsicherheit, wobei alle drei großen US-Aktienindizes neue Allzeithochs erreichten. Der VIX fiel um 26 % auf 13,49, während die Rendite der 10-jährigen Staatsanleihen bei 4,172 % schloss. Beliebte Käufe umfassten NVIDIA, Palantir und AMD, während Apple, Disney und Tesla zu den meistverkauften Aktien gehörten.

- STAX index increased from 48.37 to 49.22, showing improved trading activity

- All three major U.S. stock indices reached new all-time highs

- Market volatility decreased with VIX falling 26%

- Clients were net sellers of equities on a dollar basis

- WTI Crude Oil futures declined 5.27% to $68.00

Insights

The November STAX data reveals significant shifts in retail investor behavior amid key macroeconomic events. The modest increase to 49.22 from 48.37 reflects cautious optimism, with notable sector rotation trends. Investors showed strong preference for Information Technology, Healthcare and Consumer Staples, while reducing exposure to Communication Services, Financials and Consumer Discretionary sectors.

The net selling of individual stocks in favor of ETFs, mutual funds and fixed income suggests a strategic shift toward diversification and risk management. The trading patterns align with improved market sentiment following the Fed's rate cut and reduced election uncertainty, evidenced by the

Particularly interesting is the concentrated buying in AI-related stocks (NVDA, PLTR, AMD) while divesting from traditional tech leaders like AAPL, suggesting retail investors are repositioning for the AI boom while reducing exposure to mature tech companies.

The trading activity data provides valuable insights into retail investor positioning heading into year-end. The preference for fixed income and funds over individual equities, despite the broader market rally, indicates a defensive posture despite improved market conditions. The 10-year Treasury yield's decline to

The selling pressure in financials, particularly Bank of America (BAC), reflects concerns about the impact of rate cuts on banking sector profitability. The shift from consumer discretionary stocks like Ford (F) and Tesla (TSLA) to consumer staples suggests preparation for potential economic slowdown. These positioning changes, combined with the moderate-low STAX reading, indicate cautious optimization rather than bullish conviction.

More Schwab clients net bought equities than net sold, with the most buying in the Information Technology, Health Care, and Consumer Staples sectors. Selling was most pronounced in Communication Services, Financials, and Consumer Discretionary.

Schwab Trading Activity Index vs. S&P 500 (Graphic: Charles Schwab)

The reading for the five-week period ending November 29, 2024, ranks “moderate low” compared to historic averages.

“In November, as the outcome of the

With Fed announcements and elections now in the rear-view, some uncertainty and market volatility may have abated, as reflected by a jump in equities and a fall in the CBOE Volatility Index® (VIX). For much of the STAX period, interest rates and stock prices moved in tandem, but that relationship reversed in the final weeks as rates dropped and stocks continued to rise. All three major

The

The VIX fell by

Popular names bought by Schwab clients during the period included:

- NVIDIA Corp. (NVDA)

- Palantir Technologies Inc. (PLTR)

- Advanced Micro Devices Inc. (AMD)

- Super Micro Computer Inc. (SMCI)

- MicroStrategy Inc. (MSTR)

Names net sold by Schwab clients during the period included:

- Apple Inc. (AAPL)

- Walt Disney Co. (DIS)

- Tesla Inc. (TSLA)

- Bank of America Corp. (BAC)

- Ford Motor Co. (F)

About the STAX

The STAX value is calculated based on a complex proprietary formula. Each month, Schwab pulls a sample from its client base of millions of funded accounts, which includes accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly STAX.

For more information on the Schwab Trading Activity Index, please visit www.schwab.com/investment-research/stax. Additionally, Schwab clients can chart the STAX using the symbol $STAX in either the thinkorswim® or thinkorswim Mobile platforms.

Investing involves risk, including loss of principal. Past performance is no guarantee of future results. Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The STAX is not a tradable index. The STAX should not be used as an indicator or predictor of future client trading volume or financial performance for Schwab.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help individuals create a better tomorrow. We have a history of challenging the status quo in our industry, innovating in ways that benefit investors and the advisors and employers who serve them, and championing our clients’ goals with passion and integrity.

More information is available at aboutschwab.com. Follow us on X, Facebook, YouTube, and LinkedIn.

1224-A2P3

View source version on businesswire.com: https://www.businesswire.com/news/home/20241209563932/en/

At the Company

Margaret Farrell

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com

Source: The Charles Schwab Corporation