Rupert Resources Reports Further Drilling Results From Ikkari and Provides Update on Other Activities

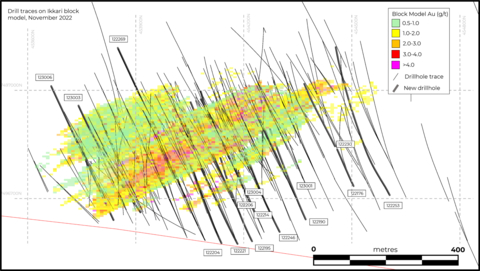

Figure 1. Location of new drilling at Ikkari. Block model displayed as per

In

Highlights from infill drilling results (figure 1) aimed at further upgrading areas of inferred resources at Ikkari include:

- #122190 – 52.6m of 2.3g/t from 515m in the east adding confidence to the inferred resources at this depth

- #122206 – 25.3m of 3.2g/t Au from 291m and 141m of 3.6g/t Au from 322m (figure 2a) in the central portion of the deposit. The intercept extends to 100m below the open pit considered by the PEA, confirming the continuity of high-grade mineralisation.

- #122214 – 15.4m of 5.4g/t Au from 341m, 35m of 1.9g/t Au from 370m and 15m of 3.3g/t Au from 448m also in the centre of the deposit

- #122221 – 27m of 2.9g/t Au from 452m in the west of the deposit

- #123001 – 27m of 3.7g/t Au from 128m and 22m of 2.3g/t Au from 234m in the east of the deposit

Significant results to date, outside of the current block model include:

- #123003 – 6m of 74.1g/t from 361m including 1m of 445g/t, suggesting high-grade mineralisation potential in the west

-

#122269 – 14m of 1.5g/t from 816m, including 1m at 11.2g/t (figure 2b), 230m below the deepest intercept on this section and a 160m step-out west from the closest hole at a similar depth (#121036: 44m of 1.0g/t from 797m including 12m of 2.4g/t from 823m, see press release dated

September 13, 2021 )

2022-2023 exploration program

The 2022/2023 work program commenced in

The results reported today continue to show the consistent mineralisation over broad widths that is a unique characteristic of the Ikkari deposit. Since the initial inferred resource was defined in

Recent regional exploration has focussed to the east of the Ikkari and Heinä discoveries along structures subparallel to the main regional ENE structural trend (figure 4) focussing on a series of base of till anomalies coincident with geophysical features of interest. Whilst drilling to date remains limited, results at Koppelo (figures 3 & 4), located 7km east northeast of Ikkari have yielded 3.1m of 5.3g/t Au from 21m in #122161 and 3m of 3.3g/t Au in #122162. Mineralisation in these holes is associated with albitised quartzites, similar in appearance to those present within the Ikkari deposit, and again provides supporting evidence of

Project updates

Appointment of Study Manager

Work is commencing on the Pre-feasibility Study for the Ikkari project and the Company has hired an experienced Study Manager,

Following the award of the Options, there are 6,092,575 share options outstanding under the Plan, representing

Pahtavaara mine environmental bond

Following submission of a revised long term closure plan for the

The Company’s proposed closure plan considered three options varying from a low CO2 emission design through to the use of 30cm of moraine cover sourced from the mine site and similar to the historic closure permit. The company is in the third year of trials to show the efficacy of direct seeding of the tailings facility, which makes up

Preliminary Economic Assessment Ikkari Project NI 43-101 amended and restated.

After the filing of the NI 43-101 on

Figures & tables

Figures and tables featured in the Appendix at end of release, include:

- Figure 1. Location of new drilling at Ikkari

- Figures 2a and 2b. Cross sections showing new drilling at Ikkari

-

Figure 3. Gold discoveries made by

Rupert Resources in Central Lapland - Figure 4. Plan map of Koppelo Drilling

- Table 1. Collar locations of new drill holes at both Ikkari and Koppelo

- Table 2. New Intercepts from new drilling at Ikkari

Geological interpretation

Ikkari was discovered using systematic regional exploration that initially focused on geochemical sampling of the bedrock/till interface through glacial till deposits of 5m to 40m thickness. No outcrop is present, and topography is dominated by low-lying swamp areas.

The Ikkari deposit occurs within rocks that have been regionally mapped as 2.05-2.15 billion years (“Ga”) old Savukoski group greenschist-metamorphosed mafic-ultramafic volcanic rocks, part of the Central Lapland Greenstone Belt (“CLGB”). Gold mineralisation is largely confined to the structurally modified unconformity at a significant domain boundary. Younger sedimentary lithologies are complexly interleaved, with intensely altered ultramafic rocks, and the mineralized zone is bounded to the north by a steeply N-dipping cataclastic zone. In general, alteration and structure appear to be sub-vertical, with lithologies generally dipping ~70 degrees north.

The main mineralized zone is strongly altered and characterised by intense veining and foliation that frequently overprint original textures. An early phase of finely laminated grey ankerite/dolomite veins is overprinted by stockwork-like irregular siderite ± quartz ± chlorite ± sulphide veins. These vein arrays are often deformed with shear-related boudinage and in situ brecciation. Magnetite and/or haematite are common, in association with pyrite. Hydrothermal alteration commonly comprises quartz-dolomite-chlorite-magnetite (±haematite). Gold is hosted by disseminated and vein-related pyrite. Multi-phase breccias are well developed within the mineralised zone, with early silicified cataclastic phases overprinted by late, carbonate- iron-oxide- rich, hydrothermal breccias which display a subvertical control. All breccias frequently host disseminated pyrite, and are often associated with bonanza gold grades, particularly where magnetite or haematite is prevalent. In the sedimentary lithologies, albite alteration is intense and pervasive, with pyrite-magnetite (± gold) hosted in veinlets in brittle fracture zones.

Review by Qualified Person, Quality Control and Reports

Dr

Samples are prepared by ALS Finland in Sodankylä and assayed in ALS laboratories in

Base of till samples are prepared in ALS Sodankylä by dry-sieving method prep-41 and assayed for gold by fire assay with ICP-AES finish. Multi-elements are assayed in ALS laboratories in either of

About

Neither the TSX Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Exchange) accepts responsibility for the adequacy or accuracy of this release.

1Cautionary Note Regarding Forward Looking Statements

This press release contains statements which, other than statements of historical fact constitute “forward-looking statements” within the meaning of applicable securities laws, including statements with respect to: results of exploration activities and mineral resources. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, are intended to identify such forward-looking statements. Investors are cautioned that forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the general risks of the mining industry, as well as those risk factors discussed or referred to in the Company's annual Management's Discussion and Analysis for the year ended

2

The Mineral Resource estimate included in the Preliminary Economic Assessment (“Study” or “PEA” is reported according to the clarification criteria set out in the

The results of the PEA will be set forth in an independent technical report prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) which will be filed on SEDAR under the Company’s profile within 45 days of the date of this news release.

Readers are cautioned that the PEA is preliminary in nature and is intended to provide an initial assessment of the project’s economic potential and development options. The PEA mine schedule and economic assessment includes numerous assumptions and is based on both Indicated and Inferred Mineral Resources. Inferred Resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA results will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Additional exploration will be required to potentially upgrade the classification of the Inferred Mineral Resources to be considered in future advanced studies.

The Mineral Resource estimate for the Project is reported in accordance with National Instrument 43-101 (“NI 43-101”) and has been estimated using the

The effective date of the 2022 Mineral Resource Estimate for Ikkari is

The effective date of the 2022 Mineral Resource Estimate for Pahtavaara is

The effective date of the 2022 Mineral Resource Estimate for Heinä Central is

APPENDIX

Table 1. Collar locations of new drill holes

Hole ID |

Prospect |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

EOH (m) |

122176 |

Ikkari |

454504.6 |

7496735.5 |

232.5 |

334.9 |

-62.5 |

218.8* |

122190 |

Ikkari |

454371.7 |

7496642.6 |

232.7 |

336.8 |

-54.6 |

641.6 |

122195 |

Ikkari |

454222.8 |

7496582.0 |

229.6 |

335.0 |

-59.9 |

821.8 |

122204 |

Ikkari |

454137.9 |

7496576.7 |

227.0 |

334.1 |

-60.8 |

682.6 |

122206 |

Ikkari |

454177.8 |

7496685.3 |

225.8 |

334.4 |

-55.0 |

540.8 |

122214 |

Ikkari |

454230.8 |

7496660.3 |

227.6 |

334.7 |

-55.1 |

550.3 |

122221 |

Ikkari |

454182.5 |

7496574.8 |

228.3 |

335.0 |

-50.0 |

482.2 |

122230 |

Ikkari |

454453.2 |

7496845.4 |

226.7 |

334.4 |

-50.3 |

297.4 |

122246 |

Ikkari |

454299.4 |

7496608.0 |

232.0 |

334.6 |

-57.4 |

469.3* |

122253 |

Ikkari |

454605.0 |

7496710.0 |

236.0 |

332.4 |

-61.9 |

818.8 |

122269 |

Ikkari |

453849.5 |

7497119.0 |

224.7 |

155.0 |

-65.0 |

886.8 |

123001 |

Ikkari |

454304.2 |

7496786.6 |

226.0 |

335.0 |

-54.0 |

281.7 |

123003 |

Ikkari |

453740.3 |

7496959.0 |

225.9 |

156.9 |

-55.1 |

554.6 |

123004 |

Ikkari |

454212.9 |

7496697.6 |

226.6 |

335.0 |

-55.0 |

252.0 |

123006 |

Ikkari |

453664.5 |

7497013.1 |

227.9 |

155.0 |

-50.0 |

639.0 |

121101 |

Koppelo |

459292.3 |

7499145.6 |

131.5 |

159.3 |

-50.3 |

131.5 |

121102 |

Koppelo |

459278.9 |

7499182.3 |

218.2 |

160.2 |

-49.7 |

122.8 |

121106 |

Koppelo |

459999.0 |

7499534.1 |

228.4 |

161.9 |

-50.1 |

197.3 |

121110 |

Koppelo |

459797.0 |

7499459.7 |

227.2 |

159.2 |

-50.5 |

200.3 |

121111 |

Koppelo |

459521.9 |

7499847.5 |

216.9 |

339.1 |

-44.5 |

138.1 |

122003 |

Koppelo |

459629.1 |

7498997.1 |

214.6 |

158.0 |

-49.3 |

251.3 |

122006 |

Koppelo |

459719.9 |

7499076.8 |

216.1 |

337.6 |

-51.3 |

199.9 |

122009 |

Koppelo |

460137.5 |

7499621.1 |

224.5 |

158.6 |

-50.5 |

204.0 |

122159 |

Koppelo |

460120.2 |

7499667.8 |

224.2 |

160.0 |

-50.0 |

71.6 |

122161 |

Koppelo |

460153.9 |

7499576.4 |

225.1 |

158.2 |

-49.6 |

152.4 |

122162 |

Koppelo |

460101.7 |

7499718.5 |

224.8 |

164.6 |

-50.6 |

166.9 |

122163 |

Koppelo |

460235.8 |

7499560.2 |

222.7 |

159.1 |

-50.2 |

152.6 |

122164 |

Koppelo |

460239.6 |

7499450.9 |

221.7 |

159.7 |

-49.9 |

275.2 |

122165 |

Koppelo |

460072.0 |

7499657.7 |

225.4 |

158.7 |

-50.1 |

158.7 |

122257 |

Koppelo |

459476.3 |

7500051.8 |

217.2 |

159.5 |

-49.9 |

176.4 |

122258 |

Koppelo |

459984.8 |

7499866.2 |

219.7 |

159.7 |

-55.5 |

248.1 |

122259 |

Koppelo |

460642.2 |

7499618.0 |

215.6 |

198.9 |

-55.1 |

188.1 |

*Hole abandoned earlier than planned depth due to technical problems |

|||||||

Table 2. New Intercepts from Ikkari

Hole ID |

|

From (m) |

To (m) |

Interval (m) |

(g/t) |

122176 |

|

|

|

|

NSI |

122190 |

|

515.0 |

567.6 |

52.6 |

2.3 |

|

Including |

515.0 |

518.0 |

3.0 |

7.7 |

|

Including |

535.0 |

536.0 |

1.0 |

12.3 |

|

Including |

555.0 |

558.0 |

3.0 |

7.2 |

122195 |

|

454.0 |

456.0 |

2.0 |

14.7 |

|

|

532.5 |

546.0 |

13.6 |

1.7 |

|

Including |

532.5 |

533.0 |

0.5 |

11.2 |

|

Including |

542.0 |

543.0 |

1.0 |

10.1 |

|

|

617.0 |

628.0 |

11.0 |

2.2 |

122204 |

|

284.0 |

309.0 |

25.0 |

0.9 |

|

|

336.0 |

371.0 |

35.0 |

0.9 |

|

Including |

341.0 |

342.0 |

1.0 |

9.5 |

|

|

421.0 |

434.5 |

13.5 |

2.0 |

|

|

449.0 |

469.0 |

20.0 |

2.2 |

|

|

475.0 |

503.0 |

28.0 |

1.4 |

|

Including |

502.0 |

503.0 |

1.0 |

14.0 |

122206 |

|

291.0 |

316.3 |

25.3 |

3.2 |

|

|

322.0 |

463.0 |

141.0 |

3.6 |

|

Including |

360.0 |

362.0 |

2.0 |

24.1 |

|

Including |

390.0 |

392.0 |

2.0 |

19.1 |

|

Including |

401.0 |

402.0 |

1.0 |

10.1 |

|

Including |

425.0 |

429.0 |

4.0 |

10.5 |

122214 |

|

223.0 |

232.5 |

9.5 |

3.0 |

|

|

321.0 |

329.0 |

8.0 |

4.2 |

|

|

341.0 |

346.4 |

5.4 |

15.4 |

|

Including |

343.6 |

345.0 |

1.4 |

46.5 |

|

|

370.0 |

405.0 |

35.0 |

1.9 |

|

Including |

375.0 |

377.0 |

2.0 |

9.4 |

|

Including |

386.0 |

388.0 |

2.0 |

9.9 |

|

|

422.0 |

432.0 |

10.0 |

2.5 |

|

|

448.0 |

463.0 |

15.0 |

3.3 |

|

Including |

450.0 |

451.0 |

1.0 |

10.7 |

|

Including |

462.0 |

463.0 |

1.0 |

15.2 |

122221 |

|

452.0 |

479.0 |

27.0 |

2.9 |

|

Including |

471.0 |

473.0 |

2.0 |

14.3 |

122246 |

|

|

|

|

NSI |

122253 |

|

232.0 |

234.0 |

2.0 |

32.6 |

|

Including |

232.0 |

233.0 |

1.0 |

64.7 |

|

|

313.0 |

324.0 |

11.0 |

1.9 |

|

Including |

319.0 |

321.0 |

2.0 |

7.9 |

122269 |

|

399.0 |

426.0 |

27.0 |

1.1 |

|

Including |

411.0 |

413.0 |

2.0 |

7.5 |

|

|

816.0 |

830.0 |

14.0 |

1.5 |

|

Including |

827.0 |

828.0 |

1.0 |

11.2 |

123001 |

|

128.0 |

155.0 |

27.0 |

3.7 |

|

Including |

130.0 |

131.0 |

1.0 |

64.2 |

|

|

191.0 |

206.0 |

15.0 |

2.6 |

|

Including |

205.0 |

206.0 |

1.0 |

26.0 |

|

|

234.0 |

256.0 |

22.0 |

2.3 |

|

Including |

255.0 |

256.0 |

1.0 |

11.7 |

|

|

262.0 |

270.0 |

8.0 |

2.7 |

|

Including |

267.0 |

268.0 |

1.0 |

13.2 |

123003 |

|

201.0 |

213.0 |

12.0 |

2.1 |

|

|

361.0 |

367.0 |

6.0 |

74.1 |

|

Including |

364.0 |

365.0 |

1.0 |

438 |

|

|

480.0 |

489.0 |

9.0 |

3.8 |

|

Including |

483.0 |

484.0 |

1.0 |

21.0 |

123004 |

|

|

|

|

NSI |

123006 |

|

167.0 |

169.0 |

2.0 |

13.5 |

|

Including |

168.0 |

169.0 |

1.0 |

25.6 |

|

|

556.0 |

558.0 |

2.0 |

17.0 |

|

|

579.0 |

602.0 |

23.0 |

0.9 |

|

Including |

579.0 |

584.0 |

5.0 |

2.3 |

No upper cut-off grade has been applied. 0.4g/t Au lower cut-off applied, a maximum of 5m internal dilution has been allowed when calculating intercepts and only intercepts with gram-meters greater than 20gm are presented here. Italic intervals indicate intercepts including within the wider intercept. Unless specified, true widths cannot be accurately determined from the information available. Bold intervals referred to in text of release. Refer to https://rupertresources.com/news/ for details of previously released drilling intercepts. EOH– End of Hole. NSI – No significant intercept.

Table 3. New Intercepts from Koppelo Target

Hole ID |

|

From (m) |

To (m) |

Interval (m) |

(g/t) |

121101 |

|

28.3 |

30.2 |

1.9 |

1.1 |

121102 |

|

29.0 |

41.0 |

12.0 |

0.5 |

|

Including |

39.6 |

41.0 |

1.4 |

1.8 |

121106 |

|

12.8 |

13 |

0.2 |

NSI |

121110 |

|

40.0 |

41.0 |

1.0 |

0.6 |

|

|

108.0 |

109.0 |

1.0 |

0.4 |

121111 |

|

|

|

|

NSI |

122003 |

|

|

|

|

NSI |

122006 |

|

|

|

|

NSI |

122009 |

|

15.0 |

19.0 |

4.0 |

0.5 |

|

|

41.0 |

42.0 |

1.0 |

1.0 |

|

|

61.0 |

62.0 |

1.0 |

0.7 |

|

|

125.0 |

126.0 |

1.0 |

0.9 |

122159 |

|

17.0 |

18.0 |

1.0 |

0.4 |

|

|

27.0 |

28.0 |

1.0 |

0.6 |

|

|

39.0 |

45.0 |

6.0 |

1.3 |

|

Including |

39.0 |

41.0 |

2.0 |

3.6 |

|

|

61.0 |

62.0 |

1.0 |

0.6 |

122161 |

|

12.0 |

13.0 |

1.0 |

3.0 |

|

|

21.0 |

24.1 |

3.1 |

5.3 |

|

Including |

23.0 |

24.1 |

1.1 |

10.6 |

|

|

48.0 |

51.0 |

3.0 |

0.4 |

|

Including |

48.8 |

49.7 |

|

No recovery |

122162 |

|

34.0 |

37.0 |

3.0 |

3.3 |

|

Including |

35.0 |

36.0 |

1.0 |

8.1 |

|

|

48.0 |

50.0 |

2.0 |

0.9 |

|

|

80.0 |

81.0 |

1.0 |

2.9 |

|

|

98.0 |

99.0 |

1.0 |

3.3 |

|

|

157.0 |

158.0 |

1.0 |

0.5 |

|

|

163.0 |

164.0 |

1.0 |

0.5 |

122163 |

|

|

|

|

NSI |

122164 |

|

|

|

|

NSI |

122165 |

|

46.0 |

48.0 |

2.0 |

1.8 |

|

|

55.0 |

56.0 |

1.0 |

0.6 |

|

|

62.0 |

63.0 |

1.0 |

0.4 |

|

|

129.0 |

130.0 |

1.0 |

0.8 |

|

|

147.0 |

150.0 |

3.0 |

0.8 |

122257 |

|

170.0 |

171.0 |

1.0 |

0.5 |

122258 |

|

118.0 |

120.0 |

2.0 |

1.4 |

|

|

130.0 |

138.0 |

8.0 |

1.7 |

|

|

152.0 |

157.0 |

5.0 |

1.0 |

122259 |

|

|

|

|

NSI |

No upper cut-off grade has been applied. 0.4g/t Au lower cut-off applied, a maximum of 3m internal dilution has been allowed when calculating intercepts. All intercepts greater than 0.5m are shown here. Italic intervals indicate intercepts including within the wider intercept. Unless specified, true widths cannot be accurately determined from the information available. Bold intervals referred to in text of release. Refer to https://rupertresources.com/news/ for details of previously released drilling intercepts. EOH– End of Hole. NSI – No significant intercept.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230321005638/en/

For further information:

Chief Executive Officer

jwithall@rupertresources.com

Head of Corporate Development

tcredland@rupertresources.com

Tel: +1 416-304-9004 Web: http://rupertresources.com/

Source: