Rupert Resources Completes Pre-Feasibility for Ikkari Confirming a High-Margin Project Net Present Value of USD1.7 Billion and IRR of 38%

Rupert Resources has completed a Pre-feasibility study for its 100% owned Ikkari Project in Northern Finland, revealing compelling project economics. The study confirms a Probable Mineral Reserve of 52Mt at 2.1g/t Au for 3.5Moz Au, representing an 85% resource conversion.

Key financial highlights include an after-tax Net Present Value of $1.7 billion with an IRR of 38% and 2.2-year payback at $2,150/oz gold price. The project features lowest quartile all-in sustaining costs of $918/oz over its 20-year life of mine, with even lower costs of $717/oz during the first 10 years.

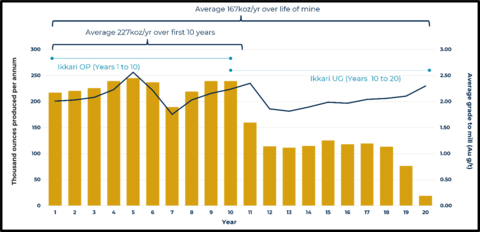

The project requires an initial capital investment of $575 million and will operate as an open-pit mine for the first 10 years, producing an average of 227koz gold annually, before transitioning to underground operations for years 10-20. First gold pour is targeted for 2030, following Environmental Impact Assessment submission and Definitive Feasibility Study initiation in H2 2025.

Rupert Resources ha completato uno studio di pre-fattibilità per il suo progetto Ikkari, di cui detiene il 100%, situato nel nord della Finlandia, rivelando economie di progetto convincenti. Lo studio conferma una Riserva Mineraria Probabile di 52Mt a 2,1g/t Au per 3,5Moz Au, rappresentando una conversione delle risorse dell'85%.

I principali punti finanziari includono un Valore Attuale Netto dopo le tasse di 1,7 miliardi di dollari con un TIR del 38% e un periodo di recupero di 2,2 anni a un prezzo dell'oro di 2.150 dollari/oz. Il progetto presenta costi sostenibili all-in nel quartile più basso di 918 dollari/oz durante la sua vita mineraria di 20 anni, con costi ancora più bassi di 717 dollari/oz nei primi 10 anni.

Il progetto richiede un investimento iniziale di 575 milioni di dollari e opererà come una miniera a cielo aperto nei primi 10 anni, producendo una media di 227koz di oro all'anno, prima di passare a operazioni sotterranee per gli anni 10-20. Il primo versamento di oro è previsto per il 2030, a seguito della presentazione della Valutazione di Impatto Ambientale e dell'avvio dello Studio di Fattibilità Definitivo nel secondo semestre del 2025.

Rupert Resources ha completado un estudio de pre-factibilidad para su Proyecto Ikkari, de propiedad 100%, ubicado en el norte de Finlandia, revelando economías de proyecto convincentes. El estudio confirma una Reserva Mineral Probable de 52Mt a 2.1g/t Au para 3.5Moz Au, que representa una conversión de recursos del 85%.

Los aspectos financieros clave incluyen un Valor Presente Neto después de impuestos de 1.7 mil millones de dólares con una TIR del 38% y un período de recuperación de 2.2 años a un precio del oro de 2,150 dólares/oz. El proyecto presenta costos sostenibles totales en el cuartil más bajo de 918 dólares/oz durante su vida útil de 20 años, con costos aún más bajos de 717 dólares/oz durante los primeros 10 años.

El proyecto requiere una inversión de capital inicial de 575 millones de dólares y funcionará como una mina a cielo abierto durante los primeros 10 años, produciendo un promedio de 227koz de oro anualmente, antes de pasar a operaciones subterráneas para los años 10-20. Se espera que el primer vertido de oro se realice en 2030, tras la presentación de la Evaluación de Impacto Ambiental y el inicio del Estudio de Factibilidad Definitivo en la segunda mitad de 2025.

루퍼트 리소스는 핀란드 북부에 위치한 100% 소유의 이카리 프로젝트에 대한 사전 타당성 조사를 완료하고 매력적인 프로젝트 경제성을 밝혔습니다. 이 연구는 3.5Moz Au에 대해 2.1g/t Au의 52Mt의 가능성 있는 광물 매장량을 확인하며, 이는 85%의 자원 전환율을 나타냅니다.

주요 재무 하이라이트는 17억 달러의 세후 순 현재 가치를 포함하며, 내부 수익률(IRR)은 38%이고, 금 가격이 2,150달러/oz일 때 2.2년의 회수 기간을 보입니다. 이 프로젝트는 20년의 광산 생애 동안 918달러/oz의 최하위 사분위 총 유지 비용을 특징으로 하며, 첫 10년 동안은 717달러/oz로 더 낮은 비용을 기록합니다.

이 프로젝트는 5억 7,500만 달러의 초기 자본 투자를 필요로 하며, 첫 10년 동안은 노천 광산으로 운영되며 연평균 227koz의 금을 생산한 후, 10-20년 동안 지하 작업으로 전환됩니다. 첫 금 주조는 2030년으로 목표하고 있으며, 환경 영향 평가 제출 및 2025년 하반기 확정 타당성 조사 시작에 이어 진행됩니다.

Rupert Resources a achevé une étude de préfaisabilité pour son projet Ikkari, entièrement détenu, situé dans le nord de la Finlande, révélant des économies de projet convaincantes. L'étude confirme une Réserve Minérale Probable de 52Mt à 2,1g/t Au pour 3,5Moz Au, représentant une conversion des ressources de 85 %.

Les principaux points financiers incluent une Valeur Actuelle Nette après impôts de 1,7 milliard de dollars avec un Taux de Rendement Interne (TRI) de 38 % et un délai de récupération de 2,2 ans à un prix de l'or de 2 150 dollars/oz. Le projet présente des coûts totaux de soutien dans le premier quartile de 918 dollars/oz sur sa durée de vie minière de 20 ans, avec des coûts encore plus bas de 717 dollars/oz au cours des 10 premières années.

Le projet nécessite un investissement initial de 575 millions de dollars et fonctionnera comme une mine à ciel ouvert pendant les 10 premières années, produisant en moyenne 227koz d'or par an, avant de passer aux opérations souterraines pour les années 10 à 20. Le premier coulage d'or est prévu pour 2030, après la soumission de l'Évaluation de l'Impact Environnemental et le lancement de l'Étude de Faisabilité Définitive au second semestre 2025.

Rupert Resources hat eine Machbarkeitsstudie für das zu 100 % im Besitz befindliche Ikkari-Projekt im Norden Finnlands abgeschlossen, die überzeugende Wirtschaftlichkeit des Projekts aufzeigt. Die Studie bestätigt eine Wahrscheinliche Mineralreserve von 52Mt bei 2,1g/t Au für 3,5Moz Au, was eine Ressourcenumwandlung von 85 % darstellt.

Die wichtigsten finanziellen Highlights umfassen einen nach Steuern berechneten Nettogegenwartswert von 1,7 Milliarden US-Dollar mit einer internen Rendite (IRR) von 38 % und einer Amortisationszeit von 2,2 Jahren bei einem Goldpreis von 2.150 US-Dollar/oz. Das Projekt weist die niedrigsten quartile Gesamtkosten von 918 US-Dollar/oz über eine Lebensdauer von 20 Jahren auf, mit noch niedrigeren Kosten von 717 US-Dollar/oz in den ersten 10 Jahren.

Das Projekt erfordert eine anfängliche Investition von 575 Millionen US-Dollar und wird in den ersten 10 Jahren als Tagebau betrieben, wobei jährlich durchschnittlich 227koz Gold produziert wird, bevor es in den Jahren 10-20 zu unterirdischen Betrieben wechselt. Der erste Goldguss ist für 2030 angestrebt, nach der Einreichung der Umweltverträglichkeitsprüfung und dem Beginn der endgültigen Machbarkeitsstudie im zweiten Halbjahr 2025.

- High-grade Probable Mineral Reserve of 3.5Moz Au with 85% conversion rate

- Strong NPV of $1.7B with 38% IRR at $2,150/oz gold

- Low AISC of $918/oz LOM, dropping to $717/oz in first 10 years

- 20-year mine life with high annual production of 227koz in first 10 years

- Project located in mining-friendly Finland with access to 100% renewable power

- Significant initial capital requirement of $575M

- Production not starting until 2030

- Additional $571M required in sustaining capital over LOM

Figure 1: Gold production per annum over LOM and average grade (Au g/t) of mill feed

{All figures are in US$ unless otherwise noted}

PFS HIGHLIGHTS

-

Maiden Mineral Reserve declared for the Ikkari Project with Probable Mineral Reserve of 52Mt at 2.1g/t Au for 3.5Moz Au representing an

85% Mineral Resource to Mineral Reserve conversion. -

All weather project economics with leverage to higher gold prices: After-tax Net Present Value (

5% discount) (“NPV”) of$1.7 billion 38% and payback after 2.2 years, assuming long term market consensus gold price of$2,150 $2.5 billion 49% and 1.7 year payback at$2,650 -

High margin production profile: Expected lowest quartile all-in sustaining cost (“AISC”) of

$918 $717 - Long life: 20-year life of mine (“LOM”) comprising an open-pit operation for the first 10 years with average annual production of 227koz per annum, transitioning to an underground operation (years 10 - 20).

-

Manageable initial capital requirement of

$575 million -

100% Contained within Rupert Property: All project infrastructure contained within Rupert’s100% owned exploration licences. Access road, power line and discharge pipeline permitted though separate auxiliary permitting process and do not require siting on mining or exploration permits held by Rupert Resources. - First gold pour targeted in 2030 based on Environmental Impact Assessment (“EIA”) submission and Definitive Feasibility Study (“DFS”) initiation in H2 2025, a 24-month permitting timeline and a 2½ year construction period.

Graham Crew, Chief Executive Officer of Rupert Resources said “The results of today’s study and declaration of 3.5Moz Probable Mineral Reserve confirm Ikkari’s ability to translate robust project fundamentals into compelling project value. The PFS confirms Ikkari’s potential for lowest quartile costs combined with manageable initial capital requirements in a Tier 1 jurisdiction for mining. Work on the Definitive Feasibility Study and Environmental Impact Assessment are already underway and we look forward to publishing results from our 2025 winter exploration campaign in due course.”

Financial model after-tax project value and returns at range of gold prices

Gold price (USD / troy ounce) |

NPV ($m)* |

IRR (%) |

Payback (Years) |

1700 (Reserve price) |

950 |

|

3.1 |

2150 (base case & LT consensus) |

1,700 |

|

2.2 |

2650 |

2,500 |

|

1.7 |

3000 (high case) |

3,100 |

|

1.4 |

*NPV rounded to 2 significant figures at all gold prices

Financial Model Assumptions

Assumption |

Unit |

Value |

Gold Price (unless stated otherwise) |

USD / Troy Ounce |

2150 |

Discount rate |

% |

5 |

Exchange rate |

EUR : USD |

1 : 1.05 |

Corporate tax rate |

% |

20 |

State and landowner royalties1 |

% |

0.75 |

1

PFS Summary

Ikkari is a grassroots discovery made in 2020 by Rupert and completion of the PFS represents a major milestone for the company as it advances the Ikkari Project towards production. The PFS builds on the 4.09Moz Indicated Mineral Resource delivered in November 2023 and enables the Company to declare a maiden Probable Mineral Reserve for the project of 52Mt at 2.1g/t Au for 3.5Moz. Following the successful completion the PFS, Rupert will progress to a Definitive Feasibility Study for the project and expects to submit its EIA in H2 2025.

The Ikkari PFS envisages a staged mine design to minimise waste stripping and enable early production from high grade areas in the open pit. The open pit will produce ore for 10 years before transitioning to a long hole open stope (“LHOS”) underground mine from year 10 for the remainder of the 20-year LOM. Both the grade and the low strip ratio in the open pit are key drivers of a lowest quartile ASIC operation set out in the PFS.

Production Summary |

|||

Years 1 to 10 |

LOM (20 years) |

||

Milled tonnes (Mt) |

35 |

52 |

|

Mill tonnes per annum (Mt/year) |

3.5 |

2.6 |

|

Average processed gold grade (g/t Au) |

2.1 |

2.1 |

|

Average metallurgical recovery (%) |

95.8 |

95.8 |

|

Average annual gold production (koz) |

227 |

167 |

|

Saleable gold (koz) |

2,270 |

3,340 |

|

1Total Cash Cost ($/saleable oz) |

603 |

747 |

|

Sustaining capital ($/saleable oz) |

115 |

171 |

|

2All in Sustaining Cost (AISC) ($/saleable oz) |

717 |

918 |

|

Total initial capital including contingency ($ M) |

575 |

||

1Cash cost includes selling expenses

2As per the World Gold guidance (Gold All in Sustaining Costs | Gold AISC | World Gold Council) available at www.gold.org/gold-standards/non-gaap-metrics-guide, the objective of the AISC metric is to provide stakeholders (i.e. management, shareholders, governments, local communities, etc.) with transparent and comparable metrics that reflect as close as possible the full cost of producing and selling an ounce of gold, and which are fully and transparently reconcilable back to amounts reported under Generally Accepted Accounting Principles (“GAAP”) as published by the Financial Accounting Standards Board (“FASB”) or the International Accounting Standards Board (“IASB” also referred to as “IFRS”). AISC is a non-GAAP metric.

Project economics

Life of Mine |

Years |

20 |

Net Present Value* ^ |

US $m |

1,700 |

Internal Rate of Return (unlevered)* |

% |

38 |

Payback |

Years |

2.2 |

Capital Expenditure (Initial) |

US $m |

575 |

Capital Expenditure (Sustaining) |

US $m |

571 |

Gross Revenue^ |

US $m |

7,200 |

Operating Cost^ |

US $m |

2,400 |

Free Cash Flow (after tax)^ |

US $m |

2,800 |

*Modelled using

Operating cost estimate

Operating cost |

Unit |

Yrs 1 to 10 |

LOM |

OP mining unit cost |

$/t material mined |

4.11 |

|

OP Strip ratio |

Waste : Ore ratio |

3.72 |

|

OP mining unit cost |

$/t ore mined |

17.21 |

|

UG mining unit cost |

$/t ore mined |

46.0 |

|

Mining |

$/t ore milled |

19.6 |

26.1 |

Processing |

$/t ore milled |

11.9 |

13.4 |

Co-Disposal Storage |

$/t ore milled |

2.5 |

2.0 |

Water Management & Treatment |

$/t ore milled |

1.9 |

2.3 |

Site G&A |

$/t ore milled |

2.2 |

3.0 |

Total Operating Costs |

$/t ore milled |

38.1 |

46.8 |

1Excludes capitalized pre-strip tonnage and cost

2Strip ratio is inclusive of capitalized pre-strip tonnage

Capital cost estimates (All USD millions)

Area |

Initial Capital |

Sustaining Capital |

Mining |

45 |

212 |

Co-Disposal Storage |

34 |

24 |

Surface Infrastructure |

72 |

3 |

Concentrator & Filtration Plant |

190 |

2 |

Closure |

0 |

151 |

Water Management and Treatment |

136 |

118 |

Electrical Engineering |

17 |

2 |

Indirect |

15 |

0 |

Contingency |

66 |

59 |

Total Capital |

575 |

571 |

Ikkari Mineral Reserve

Category |

Mining Method |

Cut-off |

Tonnage |

Grade |

Gold Content |

|

Au (g/t) |

(Mt) |

Au (g/t) |

Kg |

Ounces |

||

Proven |

- |

- |

- |

- |

- |

- |

Probable |

Open Pit |

0.34 |

35.7 |

2.2 |

79 920 |

2 486 000 |

Underground |

1.04 |

16.3 |

1.9 |

32 370 |

1 007 000 |

|

Total |

|

52.0 |

2.1 |

112 290 |

3 492 000 |

|

Notes:

- Tonnages are rounded to the nearest 100,000 and ounces are rounded to the nearest 1,000.

- Mineral Reserves were estimated using the CIM Best Practices Guidelines (as defined below) and classified using the CIM Definition Standards (as defined below)

- The Qualified Person within the meaning of NI 43-101 (“Qualified Person” or “QP”) for the Mineral Reserve Estimate is Mr. Timothy Daffern, Technical Director with WSP. The effective date of the estimate is November 25, 2024.

-

Mineral Reserves are based on a gold price of

US /oz and fixed metallurgical recovery of$1,700 95.0% - Open pit Mineral Reserves are converted from Indicated Mineral Resources only through the process of pit optimisation, mine design, schedule and are supported by a positive cash flow analysis.

- Mine design was constrained by a minimum 20m offset to the project boundary

-

Open pit Mineral Reserves include

4% dilution and4% mining losses applied in the production schedule. - Underground Mineral Reserves are stated using a 1.04 g/t stope cut-off grade. Underground Mineral Reserves are generated through the generation of optimised stopes, design of long hole open stoping, schedule and are supported by a positive cash flow analysis.

-

Underground Mineral Reserves account for planned dilution of

15% , unplanned dilution of6% , secondary dilution of3% and with mining losses of4% . - Mineral Reserves are defined at the point where ore is delivered to the plant. All figures are rounded to reflect the relative accuracy of the estimates.

- Totals may not sum due to rounding.

Ikkari Mineral Resource (inclusive of Mineral Reserves)

Resource Category |

Mining Method |

Cut-off |

Tonnage (t) |

Grade |

Gold Content |

|

Au (g/t) |

Au (g/t) |

Kg |

Ounces |

|||

Indicated |

Open Pit |

0.4 |

37 308 000 |

2.21 |

82 400 |

2 649 000 |

Underground |

0.9 |

21 122 000 |

2.12 |

44 700 |

1 437 000 |

|

Total Indicated |

|

58 430 000 |

2.18 |

127 100 |

4 087 000 |

|

Inferred |

Open Pit |

0.4 |

1 271 000 |

0.81 |

1 000 |

33 000 |

Underground |

0.9 |

2 305 000 |

1.39 |

3 200 |

103 000 |

|

Total Inferred |

|

3 576 000 |

1.18 |

4 200 |

136 000 |

|

Notes:

- Mineral Resource Estimates are reported in-situ and inclusive of Mineral Reserves.

- Mineral Resources were estimated using the CIM Best Practices Guidelines and classified using the CIM Definition Standards.

- Tonnage and ounces are rounded to the nearest 1 000.

- g/t = grams per tonne, ounces are reported as troy ounces.

- Totals may not add up correctly due to rounding.

-

The QP for this Mineral Resource estimate is Mr. Brian Thomas, P.Geo., an independent QP, within the meaning of NI 43-101 and an employee of WSP Canada Inc. based in

Sudbury, Ontario, Canada - The effective date of this Mineral Resource estimate is October 24, 2023

-

Cut-off grade defined by Gold Price,

$170 095% , Open Pit Mining Costs$2.9 $29 $11.30 $4.8 0.75% . - Open pit Mineral Resources constrained within a Whittle Optimized open pit shell using the above assumptions with a 26m offset to the property boundary enforced.

- Underground Mineral Resources constrained within the estimation domains to meet the Reasonable Prospects for Eventual Economic Extraction (“RPEEE”) criteria for underground mining.

Mining

The PFS considers extraction of the 3.5Moz Probable Mineral Reserve over a 20 year mine plan with an initial 10 years of mining from open pit with a strip ratio of 3.7 inclusive of pre-stripping. Underground mine development will commence in year 6, with mining by the LHOS method commencing in year 10 through to year 20 (Figures 3 and 4).

Open pit mining will be performed using a conventional truck and shovel configuration with drilling and blasting on 10m benches and the open pit extending to a depth of 300m below surface. The PFS financial model assumes contractor mining except blasting where costs were estimated from first principles. Two stages are planned to maximise early revenue by delaying some waste mining whilst accessing the high-grade ore early in the mining schedule. Open pit operations commence in Year -1, with pre-stripping of the unconsolidated overburden. The open pit operations are planned to produce 3.5Mtpa of ore and cease in Year 11 after with mining transitioning to the underground portion of the deposit.

Underground mining utilises LHOS with a combination of paste and waste rock backfill. Access to the underground mine consists of two declines: one from surface to the east of the open pit with development commencing in year 6 ahead of stoping in year 10. Stopes are planned on 30 m vertical intervals and 15 m intervals between stopes. A primary-secondary stope sequence is planned to enable the underground operations to produce at 2.0 Mtpa to a maximum depth of 540m below surface, 240m below the base of the open pit.

Ikkari open pit strip ratio by stages:

Open Pit Stage |

Strip Ratio (Waste : Ore) |

1 |

2.6 : 1 |

2 |

4.6 : 1 |

Total |

3.7 : 1 |

Note: Strip ratio is inclusive of pre-strip

Processing

Metallurgical test work has confirmed that the expected recovery can be achieved using a conventional flow sheet consisting of crushing and grinding to 100 µm followed by gravity concentration, and intensive leach of the gravity concentrate with carbon-in-leach of the gravity tails. Based on the metallurgical test work results and the proposed flowsheet, the overall projected metallurgical gold recovery is estimated as

Gold will be recovered via electrowinning and poured into doré bars. Tailings from the CIL circuit will be detoxed using a SO2/Air cyanide destruction circuit and pumped to the filtration plant. Tailings will be thickened in a high-rate thickener and feed three horizontal pressure filters prior to reclamation into co-disposal facility.

Co-disposal waste rock and tailings facility

The mining waste and filtered process tailings are to be co-disposed at one location to the north of the plant. This co-disposal facility has a designed capacity of 91.5 Mm³ which includes a

The design allows for phased development during construction and the first few years of LOM. The average side slope of the facility is 1:3, which includes of operational benching. The waste and filtered tailings are to be continuously placed in layers of varying depths depending on the strip ratio and surface area of the facility as it rises. Both the waste and filtered tailings require compaction during deposition.

Water management, treatment and discharge pipeline

Contact water and process water are to be treated in two separate treatment plants. Contact water including run-off and seepage from the co-disposal facility will be collected to the raw water pond, treated, then stored in the treated water pond before being discharged to the Kitinen River via a 37 km pipeline to minimise environmental impact and provide operational flexibility.

Where possible both groundwater and surface water will be intercepted before contact with the Ikkari Project area to minimise volumes requiring treatment as contact water. This will be achieved through a series of ex-pit watering wells, surface berms and channels.

Process water will be treated and re-cycled back to the process plant via the second water treatment plant significantly reducing raw water requirements. Where necessary, treated contact water will be utilised to top-up process plant requirements.

Project Infrastructure

Surface infrastructure to the Ikkari mine (i.e. process plant, filter plant, maintenance workshops, administration, water treatment plant) will be principally located on a gently undulating hill to east of the proposed open pit. (Figure 6). A network of roads is planned within the site, including the ROM haul road to the ore stockpile and primary crusher, a waste haul road and filtered tailings haul roads. A designated main access road is routed through the plant site accessing the administration building, process plant, workshops, stores and filtration plant. A network of lighter access roads will be provided to access the remaining surface assets.

All project infrastructure is contained within Rupert Resources

Access, regional infrastructure and power

Ikkari is well supported by existing infrastructure and is accessed by tarmac and a 5km gravel road from the towns of Kittilä (50km west) and Sodankylä (40km east), both of which provide support services and labour to two existing mines in the area (Kittila, Agnico Eagle and Kevitsa, Boliden). A 220kV power transformer substation is located 9km from Ikkari that can be used as a connection point to the national grid for a 110 kV power line to the Ikkari minesite. A power surplus is envisaged in Lapland towards the end of the decade and the project has access to

Stakeholder Engagement

Rupert Resources is based in the town of Sodankylä (population of around 8,000, located 40km from Ikkari) where mining is already a significant contributor to the local economy. The Company is in its fifth year of community engagement specifically on the Ikkari Project and is encouraged by local support for the Ikkari Project.

As part of the EIA process, Rupert has established a steering committee where authorities and local stakeholders can give their feedback and comments on the Ikkari Project. Small group discussions have been held twice in 2023 and 2024 and are planned to continue in 2025. Topics addressed by the small groups have included: reindeer herding, inhabitants, municipality and livelihoods, recreational use and nature protection.

In total Rupert Resources has logged 51 public events since 2016 and Rupert personnel discussed the project with 1,763 individuals in 2024 alone. These extensive efforts led to the Rupert team achieving the highest possible AAA Standard for community engagement following an external audit by Towards Sustainable Mining –

Next steps, permitting and timeline

The Company plans to submit an EIA for the Ikkari Project by the end of 2025 and based on the positive the results of the PFS, a Definitive Feasibility Study will also be initiated within the same time period. Geotechnical, metallurgical and environmental studies are already underway to support this study.

Several potential optimisations covering water treatment and closure were noted during the development of the PFS however these could not be fully investigated within the scope of this study. These will be interrogated further during optimisation work ahead of the DFS to ensure the optimal project is considered.

Based on an estimated 24 month environmental permitting period and 30 month required for construction, the first gold pour for Ikkari is now targeted for 2030. (Figure 7)

Study team

The PFS study team was led by WSP, a global provider of consulting and engineering services for mining projects. WSP was supported by Piteau (hydrogeological studies), Grinding Solutions Ltd (metallurgy), Paterson & Cook (paste), Mine Environmental Management (tailings and waste) and Envineer Oy (environmental studies).

Review by Qualified Person and Ikkari Technical Report

The Ikkari Technical Report was prepared and executed by WSP in accordance with NI 43-101. The Qualified Persons for the Ikkari Technical Report are Mr. Timothy Daffern B. Eng. (Mining). C. Eng. (

Mr. Daffern has read, reviewed and supervised, to the extent necessary, all aspects of the PFS to observe compliance to the requirements of NI 43-101 and has reviewed and approved the scientific and technical information related to the PFS in this press release.

This Mineral Resource estimate reflected in the Ikkari Technical Report has been prepared in accordance with NI 43-101. The methodology used to determine the Mineral Resource estimate is consistent with the CIM Estimation of Mineral Resource and Mineral Reserves Best Practices Guidelines (November 2019) (the “CIM Best Practices Guidelines”). The Mineral Resource estimate was classified following the CIM Definition Standards.

The QP for the Mineral Resource estimate reflected in the Ikkari Technical report is Mr. Brian Thomas, P.Geo., an independent QP, within the meaning of NI 43-101 and an employee of WSP based in

The Mineral Reserves reflected in the Ikkari Technical Report were estimated in accordance with the CIM Best Practice Guidelines. The disclosure of the Reserve Estimate uses the NI 43-101 guidelines and has excluded the use of Inferred Mineral Resources. The QP for this Mineral Reserve estimate is Mr. Timothy Daffern, B.Eng., C.Eng., ACSM., QMR, FAusIMM, FIMMM, M.CIM., M.SME (

Mr. Craig Hartshorne, a Chartered Geologist and a Fellow of the Geological Society of

The NI-43-101 has been filed on SEDAR+ under the Company’s profile and is also available on the Company’s website: www.rupertresources.com

About Rupert Resources

Rupert Resources is a gold exploration and development company listed on the Toronto Stock Exchange. The Company is focused on making and advancing discoveries of scale and quality with high margin and low environmental impact potential. The Company’s principal focus is Ikkari, a new high-quality, multi-million ounce gold discovery in

Cautionary Note Regarding Forward Looking Statements

This press release contains statements which, other than statements of historical fact constitute “forward-looking information” within the meaning of applicable securities laws, including statements with respect to: results of exploration and development activities and mineral resources. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, are intended to identify such forward-looking statements. Forward-looking statements included in this press release include, but are not limited to, statements relating to: the Mineral Resource and Mineral Reserve estimates; plans and expectations regarding future exploration programs; plans and expectations regarding future project development; the progression of the EIA and Definitive Feasibility Study on the timeline contemplated herein, if at all; operating and cost estimates; future gold prices; the LOM; the achievement of commercial production at Ikkari on the timeline contemplated herein, if at all; and the Company’s plans for future advancement of the Ikkari Project. Investors are cautioned that forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the general risks of the mining industry, as well as those risk factors discussed or referred to in the Company's annual Management's Discussion and Analysis for the year ended February 29, 2024, available on the Company’s website at www.rupertresources.com and on SEDAR+ at www.sedarplus.ca. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company does not intend, and does not assume any obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Cautionary Note Regarding Mineral Resources and Mineral Reserves

Unless otherwise indicated, the scientific and technical disclosure included in this press release, including all Mineral Resource and Mineral Reserve estimates contained in such technical disclosure, has been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014 (the “CIM Definition Standards”). Readers are cautioned that Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all, or any part, of Mineral Resources will be converted into Mineral Reserves. Inferred Mineral Resources are Mineral Resources for which quantity and grade or quality are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. Inferred Mineral Resources are based on limited information and have a great amount of uncertainty as to their existence and as to their economic and legal feasibility, although it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250218078462/en/

Graham Crew

Chief Executive Officer

gcrew@rupertresources.com

Thomas Credland

Head of Corporate Development

tcredland@rupertresources.com

Rupert Resources Ltd

82 Richmond Street East, Suite 203,

Web: http://rupertresources.com/

Source: Rupert Resources Ltd