DAT: Uncertainty looms despite a steady January for truckload freight

DAT Freight & Analytics reports increased spot truckload freight volumes in January 2024, driven by post-holiday inventory replenishment, pre-tariff import acceleration, and weather-related demand for flexible capacity. The DAT Truckload Volume Index (TVI) showed growth across all equipment types: van up 6% to 277, reefer up 7% to 237, and flatbed up 8% to 256.

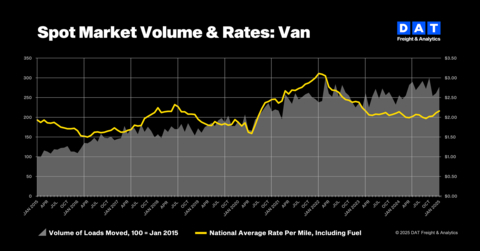

National average spot rates saw modest increases: van rates rose 4 cents to $2.16/mile, reefer rates increased 8 cents to $2.55, and flatbed rates gained 5 cents to $2.44. Contract rates remained stable with slight increases. The van New Rate Differential (NRD) has been positive for four consecutive months, indicating a tightening market despite business volatility.

DAT Freight & Analytics riporta un aumento dei volumi di carico spot per camion a gennaio 2024, sostenuto dal ripristino delle scorte post-festive, dall'accelerazione delle importazioni prima dei dazi e dalla domanda legata alle condizioni meteorologiche per capacità flessibili. L'Indice di Volume per Carico Completo DAT (TVI) ha mostrato una crescita in tutti i tipi di attrezzature: i furgoni sono aumentati del 6% a 277, i refrigerati del 7% a 237 e i pianali del 8% a 256.

Le tariffe medie nazionali per i carichi spot hanno registrato modestissimi aumenti: le tariffe per i furgoni sono aumentate di 4 centesimi a $2.16/miglia, quelle per i refrigerati sono aumentate di 8 centesimi a $2.55, e quelle per i pianali hanno guadagnato 5 centesimi a $2.44. Le tariffe contrattuali sono rimaste stabili con lievi aumenti. Il Differenziale di Nuova Tariffa (NRD) per i furgoni è stato positivo per quattro mesi consecutivi, indicando un mercato in restrizione nonostante la volatilità degli affari.

DAT Freight & Analytics informa sobre un aumento en los volúmenes de carga spot de camiones en enero de 2024, impulsado por la reposición de inventarios después de las festividades, la aceleración de importaciones antes de los aranceles y la demanda relacionada con el clima para capacidad flexible. El Índice de Volumen de Carga Completa de DAT (TVI) mostró crecimiento en todos los tipos de equipos: las furgonetas aumentaron un 6% a 277, los refrigerados un 7% a 237, y los de plataforma un 8% a 256.

Las tarifas spot promedio nacionales vieron aumentos modestos: las tarifas de las furgonetas subieron 4 centavos a $2.16/milla, las tarifas de los refrigerados aumentaron 8 centavos a $2.55, y las tarifas de los de plataforma ganaron 5 centavos a $2.44. Las tarifas contractuales se mantuvieron estables con ligeros incrementos. El Diferencial de Nueva Tarifa (NRD) para las furgonetas ha sido positivo durante cuatro meses consecutivos, lo que indica un mercado más ajustado a pesar de la volatilidad de los negocios.

DAT Freight & Analytics는 2024년 1월에 휴일 이후 재고 보충, 관세 이전의 수입 가속화, 날씨 관련 유연한 용량 수요로 인해 스팟 트럭 적재량이 증가했다고 보고했습니다. DAT 트럭 적재량 지수 (TVI)는 모든 장비 유형에서 성장을 보였습니다: 밴은 6% 증가하여 277, 냉장차는 7% 증가하여 237, 평판차는 8% 증가하여 256에 도달했습니다.

전국 평균 스팟 요금은 소폭 증가했습니다: 밴 요금은 4센트 상승하여 $2.16/마일, 냉장차 요금은 8센트 상승하여 $2.55, 평판차 요금은 5센트 상승하여 $2.44에 도달했습니다. 계약 요금은 약간의 증가와 함께 안정세를 유지했습니다. 밴의 신규 요금 차이(NRD)는 4개월 연속 긍정적이어서 비즈니스 변동성에도 불구하고 시장이 타이트해지고 있음을 나타냅니다.

DAT Freight & Analytics rapporte une augmentation des volumes de fret spot pour camions en janvier 2024, stimulée par le réapprovisionnement des stocks après les vacances, l'accélération des importations avant les droits de douane et la demande liée aux conditions météorologiques pour une capacité flexible. L'Indice de Volume de Fret Complet DAT (TVI) a montré une croissance dans tous les types d'équipements : les fourgons ont augmenté de 6 % à 277, les réfrigérateurs de 7 % à 237, et les plateformes de 8 % à 256.

Les tarifs moyens nationaux spot ont connu des augmentations modestes : les tarifs des fourgons ont augmenté de 4 cents à 2,16 $/mile, les tarifs des réfrigérateurs ont augmenté de 8 cents à 2,55 $, et les tarifs des plateformes ont gagné 5 cents à 2,44 $. Les tarifs contractuels sont restés stables avec de légères augmentations. Le Différentiel de Nouveau Tarif (NRD) pour les fourgons a été positif pendant quatre mois consécutifs, indiquant un marché en tension malgré la volatilité des affaires.

DAT Freight & Analytics berichtet über einen Anstieg der Spot-Lkw-Ladungsvolumina im Januar 2024, der durch die Auffüllung der Bestände nach den Feiertagen, die Beschleunigung der Importe vor den Zöllen und die wetterbedingte Nachfrage nach flexibler Kapazität angetrieben wurde. Der DAT Truckload Volume Index (TVI) zeigte in allen Gerätetypen ein Wachstum: Der Van stieg um 6% auf 277, der Kühlwagen um 7% auf 237 und der Flachbettwagen um 8% auf 256.

Die nationalen Durchschnittspreise für Spot-Ladungen verzeichneten moderate Anstiege: Die Van-Preise stiegen um 4 Cent auf $2.16/meile, die Kühlwagenpreise erhöhten sich um 8 Cent auf $2.55, und die Flachbettpreise gewannen 5 Cent auf $2.44. Die Vertragspreise blieben stabil mit leichten Zuwächsen. Der neue Preisdifferential (NRD) für Vans war vier Monate in Folge positiv, was auf einen angespannten Markt trotz der Geschäftswachstumsvolatilität hinweist.

- TVI increased across all equipment types (van +6%, reefer +7%, flatbed +8%)

- Van TVI showed positive year-over-year growth for 10 consecutive months

- Spot rates increased across all segments (van +$0.04, reefer +$0.08, flatbed +$0.05)

- Contract and spot rate differential at lowest since March 2022, indicating market equilibrium

- Contract reefer rates down $0.10 year-over-year

- Higher fuel costs impacting operations (diesel up $0.14 to $3.63/gallon)

- Market uncertainty due to tariffs and weather disruptions

Insights

The January freight market data reveals several critical insights for ROP investors, particularly regarding its DAT Freight & Analytics division. The 6-8% increase in the Truckload Volume Index across all equipment types, coupled with the tenth consecutive month of year-over-year growth in van volumes, demonstrates resilient demand despite economic uncertainties.

The narrowing spread between contract and spot rates, reaching its tightest level since March 2022, signals a market achieving equilibrium - a historically positive indicator for technology platforms like DAT that generate revenue from both spot and contract transactions. The positive New Rate Differential (NRD) of 1.4% for four consecutive months suggests a gradual market tightening, which typically leads to increased platform utilization as shippers seek optimal pricing and capacity.

Three key factors warrant attention: First, the strategic timing of import acceleration ahead of potential tariffs indicates proactive inventory management by shippers, potentially leading to increased platform activity. Second, weather-driven disruptions are pushing more shippers toward spot market solutions, enhancing the value proposition of DAT's marketplace technology. Third, the sustained positive year-over-year volume growth across all equipment types suggests structural market changes that favor digital freight matching platforms.

The data suggests DAT's market position remains strong within ROP's portfolio, as balanced market conditions typically support steady transaction volumes and sustained subscription revenue. The convergence of spot and contract rates, combined with increased volume, indicates healthy market dynamics that should support stable platform monetization in the near term.

DAT: Uncertainty looms despite a steady January for truckload freight (Graphic: DAT Freight & Analytics)

A measure of van, refrigerated (“reefer”), and flatbed loads moved in a month, the DAT Truckload Volume Index (TVI) increased for all three equipment types:

-

Van TVI: 277, up

6% -

Reefer TVI: 237, up

7% -

Flatbed TVI: 256, up

8%

The TVI was higher for all three equipment types year over year. The van TVI was up

Spot rates rose modestly

National average spot rates rose but did not keep pace with demand.

January’s average van rate increased

Linehaul rates, which subtract an amount equal to an average fuel surcharge, increased modestly. The van linehaul rate averaged

On-highway diesel fuel averaged

“January was a month of mixed indicators, with shippers rebalancing inventories as they typically do while responding to the uncertainty of tariffs, higher fuel costs, and unusually bad weather,” said Ken Adamo, DAT Chief of Analytics.

Contract rates reflect a market in equilibrium

Rates for freight moving under long-term contracts held firm last month:

-

Contract van rate:

$2.41 2 cents and down3 cents year over year -

Contract reefer rate:

$2.76 2 cents and 10 lower year over year -

Contract flatbed rate:

$3.07 1 cent and down1 cent year over year

Contract and spot van and reefer rates tightened for the fifth consecutive month, and the margin was the lowest since March 2022.

The DAT iQ New Rate Differential (NRD), which measures changes in the contract market by comparing rates entering the market to those exiting, was

“The van NRD has been positive for four straight months and trending higher for almost two years,” Adamo said. “It may not feel like it, given last month’s business and trade volatility, but spot and contract freight data reflected a market in equilibrium in January.”

About the DAT Truckload Volume Index

The DAT Truckload Volume Index reflects the change in the number of loads with a pickup date during that month. A baseline of 100 equals the number of loads moved in January 2015, as recorded in DAT RateView, a truckload pricing database and analysis tool with rates paid on an average of 3 million loads per month.

DAT benchmark spot rates are derived from invoice data for hauls of 250 miles or more with a pickup date during the month reported. Linehaul rates subtract an amount equal to an average fuel surcharge.

About DAT Freight & Analytics

DAT Freight & Analytics operates both the largest truckload freight marketplace and truckload freight data analytics service in

Founded in 1978, DAT is a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000. DAT is headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20250213288354/en/

DAT Contact

Georgia Jablon

PR@dat.com / georgia.jablon@dat.com

Source: DAT Freight & Analytics

FAQ

What were the key changes in DAT's truckload volume index for January 2024?

How did spot rates change in January 2024 according to DAT?

What was the average diesel fuel price in January 2024?

How did contract rates perform compared to the previous year?