Riot Platforms Reports First Quarter 2024 Financial Results, Current Operational and Financial Highlights

Riot Platforms, Inc. reported impressive financial results for the first quarter of 2024, with total revenue of $79.3 million, net income of $211.8 million, and earnings per share of $0.82. The Company also achieved significant milestones like energizing the new Corsicana Facility, which will be the largest Bitcoin mining facility globally once fully developed. Riot anticipates increasing its self-mining hash rate capacity to 31 EH/s by the end of the year. Despite challenges like decreased Bitcoin production and increased mining costs, Riot's strong financial position with $692.5 million in working capital and industry-leading growth prospects make it a key player in the Bitcoin mining industry.

Riot Platforms, Inc. reported record-high quarterly results with total revenue of $79.3 million, net income of $211.8 million, and earnings per share of $0.82, showcasing impressive financial performance.

The energization of the new Corsicana Facility, expected to be the world's largest Bitcoin mining facility, positions Riot for significant growth and expansion in the industry.

Riot's plans to increase its self-mining hash rate capacity to 31 EH/s by the end of 2024 demonstrate a clear growth pipeline and strong foundation for future scaling in the Bitcoin mining business.

The Company's working capital of $692.5 million, including $688.5 million in cash and 8,490 unencumbered Bitcoins, highlights Riot's robust financial position and ability to drive continued growth.

Riot Platforms, Inc. experienced a decrease in Bitcoin production during the quarter, mining 1,364 Bitcoins compared to 2,115 Bitcoins in the same period last year, attributed to the significant increase in Bitcoin network difficulty.

The average cost to mine Bitcoin increased to $23,034 per Bitcoin, up from $9,438 per Bitcoin in the same period last year, driven by a higher global network hash rate, impacting mining profitability.

Engineering revenue declined to $4.7 million from $16.1 million in the same period last year, reflecting challenges like decreased material receipts due to supply chain constraints and increased competition.

Selling, general and administrative expenses rose to $57.7 million, primarily due to higher stock compensation expenses, legal fees, and other costs related to ongoing growth, impacting overall operational costs.

Insights

Riot Reports

CASTLE ROCK, Colo., May 01, 2024 (GLOBE NEWSWIRE) -- Riot Platforms, Inc. (NASDAQ: RIOT) (“Riot” or “the Company”), an industry leader in vertically integrated Bitcoin mining, reported financial results for the three-month period ended March 31, 2024. The unaudited financial statements and accompanying presentation materials are available on Riot’s website.

“I am excited to present results for Riot for the first quarter of 2024, during which we achieved a number of significant milestones which further solidify our growth path,” said Jason Les, CEO of Riot. “This quarter, Riot reported net income of

“Last month, Riot also announced the energization of our Corsicana Facility, which we believe will be the largest dedicated Bitcoin mining facility in the world once fully developed. Miners deployed at our Corsicana Facility are already hashing, and we remain on track to increase our self-mining hash rate capacity to 31 EH/s by the end of the year, which will nearly triple our existing hash rate capacity. With up to 1 GW of total capacity when fully developed, the Corsicana Facility provides Riot with a clear growth pipeline unrivalled in our industry and gives us a strong foundation upon which we will continue scaling our Bitcoin mining business in the future.”

First Quarter 2024 Financial and Operational Highlights

Key financial and operational highlights for the first quarter include:

- Total revenue of

$79.3 million , as compared to$73.2 million for the same three-month period in 2023. The increase was primarily driven by a131% increase in Bitcoin prices as compared to the same three-month period in 2023, partially offset by lower Bitcoin production. - Produced 1,364 Bitcoin during the quarter, which represented a decrease of

36% from the 2,115 Bitcoin mined during the three months ended March 31, 2023, due primarily to the significant increase in the Bitcoin network difficulty, which has more than doubled since January 2023. - The average cost to mine Bitcoin was

$23,034 in the quarter, as compared to$9,438 per Bitcoin for the same three-month period in 2023. The increase was primarily driven by an increase of89% in global network hash rate as compared to the same three-month period in 2023. - Earned

$5.1 million in power curtailment credits during the quarter, as compared to$3.1 million in power curtailment credits earned for the same three-month period in 2023. - Following the termination of the legacy Data Center Hosting business, reportable segments have changed to reflect the two primary business segments of Riot: Bitcoin Mining and Engineering.

- Bitcoin Mining revenue of

$74.6 million for the quarter, as compared to$48.0 million for the same three-month period in 2023, primarily driven by higher average Bitcoin prices. - Engineering revenue of

$4.7 million for the quarter, as compared to$16.1 million for the same three-month period in 2023. - Maintained industry-leading financial position, with

$692.5 million in working capital, including$688.5 million in cash on hand, and 8,490 in unencumbered Bitcoin (equating to$605.6 million assuming a market price for one Bitcoin on March 31, 2024 of approximately$71,333) , all of which were produced by the Company’s self-mining operations, as of March 31, 2024.

First Quarter 2024 Financial Results

Total revenue for the three-month period ended March 31, 2024 was

Bitcoin Mining revenue in excess of Bitcoin Mining cost of revenue for the quarter was

Engineering cost of revenue in excess of Engineering revenue for the quarter was

Power curtailment credits received totaled approximately

If power credits were directly allocated to Bitcoin Mining cost of revenue, Bitcoin Mining cost of revenue would have decreased by

Selling, general and administrative expenses during the quarter totaled

Net income for the quarter was

Non-GAAP Adjusted EBITDA for the quarter was

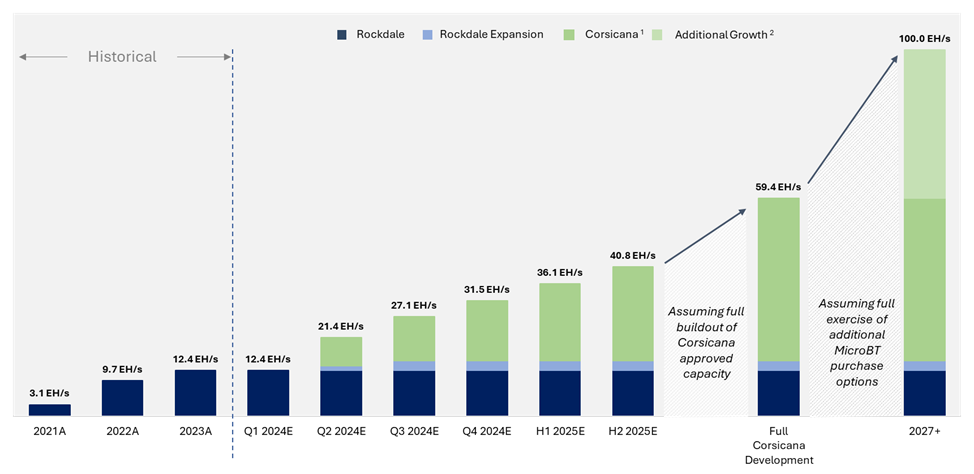

Hash Rate Growth

Riot anticipates achieving a total self-mining hash rate capacity of 31 EH/s by the end of 2024.

On April 18th, Riot announced the successful energization of the Corsicana Facility substation. The Corsicana Facility will have a total capacity of 1 GW when fully developed, at which point it is expected to be the largest known Bitcoin mining facility in the world by developed capacity. The recently energized substation will power the initial 400 MW phase of development of the Corsicana Facility. This initial phase is expected to add 16 EH/s to Riot’s self-mining capacity by the end of 2024. The first batch of miners in the first 100 MW building, Building A1, have been installed and are already hashing, and miners will continue to be deployed in Building A1 until a total capacity of 3.7 EH/s is reached.

As previously disclosed in June 2023, Riot entered into a long-term master purchase agreement with MicroBT, which included an initial order of 33,280 immersion miners for the Corsicana Facility. Effective December 1, 2023, Riot executed a second order under the MicroBT master agreement for an additional 66,560 immersion miners, primarily for the Corsicana Facility. In February 2024, Riot entered into a third order with MicroBT, for 31,500 air-cooled miners for the Rockdale Facility. Approximately 17,000 miners in the order are expected to replace underperforming machines currently operating in the facility, and the deployment of the remaining 14,500 miners will contribute additional hash rate capacity to our self-mining operations at the Rockdale Facility.

Collectively, the three purchase orders will add an anticipated 28 EH/s to Riot’s self-mining capacity. Deployment of these miners intended for the Corsicana Facility has begun and is estimated to be completed by the second half of 2025. Deployment of the miners intended for the Rockdale Facility is expected to begin in Q2 2024 and be completed in Q3 2024.

Upon full deployment in 2025, Riot anticipates a total self-mining hash rate capacity of 41 EH/s.

ATM Offerings

In February 2024, the Company registered an offering under its at-the-market equity offering program, under which it could offer and sell up to

During the three months ended March 31, 2024, the Company received net proceeds of approximately

Subsequent to March 31, 2024, and through April 30, 2024, the Company received net proceeds of approximately

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the world’s leading Bitcoin-driven infrastructure platform.

Our mission is to positively impact the sectors, networks and communities that we touch. We believe that the combination of an innovative spirit and strong community partnership allows the Company to achieve best-in-class execution and create successful outcomes.

Riot is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. The Company has Bitcoin mining operations in central Texas and electrical switchgear engineering and fabrication operations in Denver, Colorado.

For more information, visit www.riotplatforms.com.

Safe Harbor

Statements in this press release that are not historical facts are forward-looking statements that reflect management’s current expectations, assumptions, and estimates of future performance and economic conditions. Such statements rely on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “anticipates,” “believes,” “plans,” “expects,” “intends,” “will,” “potential,” “hope,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements may include, but are not limited to, statements about the Company’s plans, objectives, expectations, and intentions. The risks and uncertainties that could cause actual results to differ from those expressed in forward-looking statements include, but are not limited to: unaudited estimates of Bitcoin production; our future hash rate growth (EH/s); the anticipated benefits, construction schedule, and costs associated with the Corsicana site expansion; our expected schedule of new miner deliveries; the impact of weather events on our operations and results; our ability to successfully deploy new miners; potential negative impacts on our results of Bitcoin production due to the variance in our mining pool rewards; megawatt (“MW”) capacity under development; our potential inability to realize the anticipated benefits from immersion cooling; our ability to access sufficient additional capital for future strategic growth initiatives; the possibility that the integration of acquired businesses may not be successful, or such integration may take longer or be more difficult, time-consuming or costly to accomplish than anticipated; failure to otherwise realize anticipated efficiencies and strategic and financial benefits from our acquisitions; the anticipated impacts of the Bitcoin “halving”; and the impact of COVID-19 on our suppliers in connection with our estimated timelines. Detailed information regarding the factors identified by the Company’s management which they believe may cause actual results to differ materially from those expressed or implied by such forward-looking statements in this press release may be found in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including the risks, uncertainties and other factors discussed under the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as amended, and the other filings the Company makes with the SEC, copies of which may be obtained from the SEC’s website, www.sec.gov. All forward-looking statements included in this press release are made only as of the date of this press release, and the Company disclaims any intention or obligation to update or revise any such forward-looking statements to reflect events or circumstances that subsequently occur, or of which the Company hereafter becomes aware, except as required by law. Persons reading this press release are cautioned not to place undue reliance on such forward-looking statements.

For further information, please contact:

Investor Contact:

Phil McPherson

IR@Riot.Inc

303-794-2000 ext. 110

Media Contact:

Alexis Brock

303-794-2000 ext. 118

PR@Riot.Inc

Non-U.S. GAAP Measures of Financial Performance

In addition to financial measures presented under generally accepted accounting principles in the United States of America (“GAAP”), we consistently evaluate our use of and calculation of non-GAAP financial measures such as “Adjusted EBITDA.” EBITDA is computed as net income before interest, taxes, depreciation, and amortization. Adjusted EBITDA is a financial measure defined as EBITDA, adjusted to eliminate the effects of certain non-cash and/or non-recurring items that do not reflect our ongoing strategic business operations, which management believes results in a performance measurement that represents a key indicator of the Company’s core business operations of Bitcoin mining. The adjustments include fair value adjustments such as derivative power contract adjustments, equity securities value changes, and non-cash stock-based compensation expense, in addition to financing and legacy business income and expense items. We exclude impairments and gains or losses on sales or exchanges of Bitcoin from our calculation of Adjusted EBITDA for all periods presented.

We believe Adjusted EBITDA can be an important financial measure because it allows management, investors, and our board of directors to evaluate and compare our operating results, including our return on capital and operating efficiency from period-to-period by making such adjustments. Additionally, Adjusted EBITDA is used as a performance metric for share-based compensation.

Adjusted EBITDA is provided in addition to, and should not be considered to be a substitute for, or superior to, net income, the most comparable measure under GAAP for Adjusted EBITDA. Further, Adjusted EBITDA should not be considered as an alternative to revenue growth, net income, diluted earnings per share or any other performance measure derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of our liquidity. Adjusted EBITDA has limitations as an analytical tool, and you should not consider such measures either in isolation or as substitutes for analyzing our results as reported under GAAP.

The following table reconciles Adjusted EBITDA to Net income (loss), the most comparable GAAP financial metric:

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2024 | 2023 | |||||||

| Net income (loss) | $ | 211,814 | $ | 18,513 | ||||

| Interest (income) expense | (7,805 | ) | 3,830 | |||||

| Income tax expense (benefit) | (102 | ) | (4,969 | ) | ||||

| Depreciation and amortization | 32,343 | 59,340 | ||||||

| EBITDA | 236,250 | 76,714 | ||||||

| Adjustments: | ||||||||

| Stock-based compensation expense | 32,000 | (2,296 | ) | |||||

| Change in fair value of derivative asset | (20,232 | ) | 5,778 | |||||

| Casualty-related charges (recoveries), net | (2,300 | ) | 1,526 | |||||

| Other (income) expense | (8 | ) | — | |||||

| License fees | (24 | ) | (24 | ) | ||||

| Adjusted EBITDA | $ | 245,686 | $ | 81,698 | ||||

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/655f8c6c-b52d-412e-b93a-9e52a59c3d1c

https://www.globenewswire.com/NewsRoom/AttachmentNg/11431087-d2ec-4229-9a23-1b63282ead4d

FAQ

What was Riot Platforms, Inc.'s total revenue for the first quarter of 2024?

Riot Platforms, Inc. reported total revenue of $79.3 million for the first quarter of 2024.

What is Riot Platforms, Inc.'s stock symbol?

Riot Platforms, Inc.'s stock symbol is RIOT.

How much did Riot Platforms, Inc. earn in net income for the first quarter of 2024?

Riot Platforms, Inc. earned net income of $211.8 million for the first quarter of 2024.

What are Riot Platforms, Inc.'s plans for increasing self-mining hash rate capacity?

Riot Platforms, Inc. plans to increase its self-mining hash rate capacity to 31 EH/s by the end of 2024.